Profil perusahaan

| NORDEARingkasan Ulasan | |

| Dibentuk | 2000 |

| Negara/Daerah Terdaftar | Denmark |

| Regulasi | Tidak Diatur |

| Layanan | Pinjaman dan kredit, tabungan dan investasi, asuransi, perbankan pribadi, layanan digital, pembiayaan, perdagangan luar negeri, perbankan korporat, manajemen kas, perbankan investasi, bisnis internasional |

| Dukungan Pelanggan | Telepon: +45 7033 3333; +45 7033 4444 |

| Media Sosial: LinkedIn, Facebook, Threads, YouTube | |

| Alamat: Denmark, Finlandia, Norwegia, Swedia | |

Informasi NORDEA

Didirikan pada tahun 2000 dan terdaftar di Denmark, NORDEA menyediakan layanan keuangan yang beragam untuk individu, bisnis, dan lembaga besar, termasuk perbankan harian, layanan digital, perbankan investasi, dan produk pasar modal. Meskipun perusahaan ini memiliki berbagai saluran layanan pelanggan seperti telepon dan media sosial, tidak diatur dan kurang informasi rinci tentang proses deposito dan penarikan serta struktur biaya. Pelanggan perlu berhati-hati saat menggunakan dana mereka.

Pro & Kontra

| Pro | Kontra |

| Berbagai layanan perbankan | Tidak diatur |

| Berbagai saluran dukungan pelanggan | Struktur biaya yang tidak jelas |

| Sejarah operasi panjang |

Apakah NORDEA Legal?

NORDEA tidak diatur, dan pelanggan harus berhati-hati saat melakukan perdagangan.

Layanan

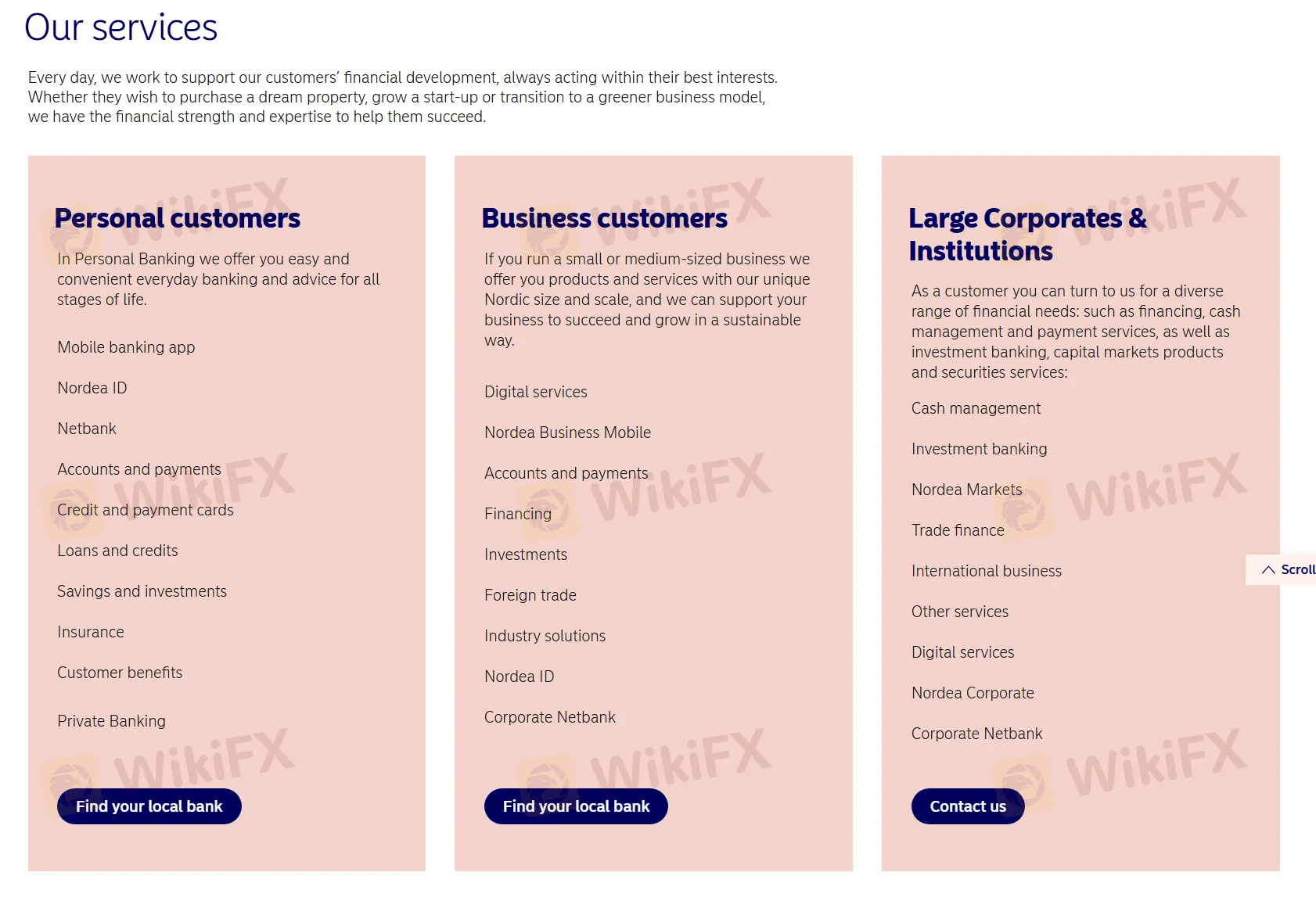

NORDEA menyediakan layanan kepada pelanggan pribadi, pelanggan bisnis, dan perusahaan besar dan lembaga, termasuk:

Pelanggan Pribadi: Untuk pelanggan individu, menawarkan layanan perbankan harian yang nyaman, termasuk aplikasi perbankan seluler, manajemen akun, layanan pembayaran, kartu kredit, pinjaman, tabungan dan investasi, asuransi, manfaat pelanggan, dan layanan perbankan pribadi.

Pelanggan Bisnis: Untuk usaha kecil dan menengah, menawarkan layanan digital, perbankan seluler, manajemen akun, pembiayaan, investasi, perdagangan internasional, solusi industri, dan layanan lainnya untuk mendukung pengembangan bisnis yang berkelanjutan.

Large Corporates & Institusi: Untuk perusahaan besar dan institusi, menawarkan layanan keuangan komprehensif termasuk manajemen kas, perbankan investasi, produk pasar modal, layanan sekuritas, perdagangan internasional, layanan lainnya, dan layanan digital.

| Jenis Pelanggan | Layanan yang Ditawarkan |

| Pelanggan Perorangan | Aplikasi perbankan seluler |

| Nordea ID | |

| Netbank | |

| Akun dan pembayaran | |

| Kartu kredit dan pembayaran | |

| Pinjaman dan kredit | |

| Tabungan dan investasi | |

| Asuransi | |

| Manfaat pelanggan | |

| Perbankan Swasta | |

| Pelanggan Bisnis | Layanan digital |

| Nordea Business Mobile | |

| Akun dan pembayaran | |

| Pembiayaan | |

| Nordea Business Mobile | |

| Perdagangan luar negeri | |

| Solusi industri | |

| Nordea ID | |

| Netbank Korporat | |

| Perusahaan Besar & Institusi | Manajemen kas |

| Perbankan investasi | |

| Pasar Nordea | |

| Pembiayaan perdagangan | |

| Usaha internasional | |

| Layanan lainnya | |

| Layanan digital | |

| Nordea Korporat | |

| Netbank Korporat |