Présentation de l'entreprise

| NORDEARésumé de l'examen | |

| Fondé | 2000 |

| Pays/Région d'enregistrement | Danemark |

| Régulation | Pas de régulation |

| Services | Prêts et crédits, épargne et investissements, assurance, banque privée, services numériques, financement, commerce extérieur, banque d'entreprise, gestion de trésorerie, banque d'investissement, affaires internationales |

| Support Client | Téléphone : +45 7033 3333; +45 7033 4444 |

| Réseaux sociaux : LinkedIn, Facebook, Threads, YouTube | |

| Adresse : Danemark, Finlande, Norvège, Suède | |

NORDEA Informations

Fondé en 2000 et enregistré au Danemark, NORDEA propose des services financiers diversifiés pour les particuliers, les entreprises et les grandes institutions, comprenant la banque au quotidien, les services numériques, la banque d'investissement et les produits du marché financier. Bien que la société dispose de plusieurs canaux de service client tels que le téléphone et les réseaux sociaux, elle n'est pas réglementée et manque d'informations détaillées sur les processus de dépôt et de retrait ainsi que sur les structures tarifaires. Les clients doivent faire preuve de prudence lors de l'utilisation de leurs fonds.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Multiples services bancaires | Pas de régulation |

| Divers canaux de support client | Structure tarifaire peu claire |

| Longue histoire d'opération |

NORDEA Est-il Légitime ?

NORDEA n'est pas réglementé, et les clients doivent faire preuve de prudence lorsqu'ils tradent.

Services

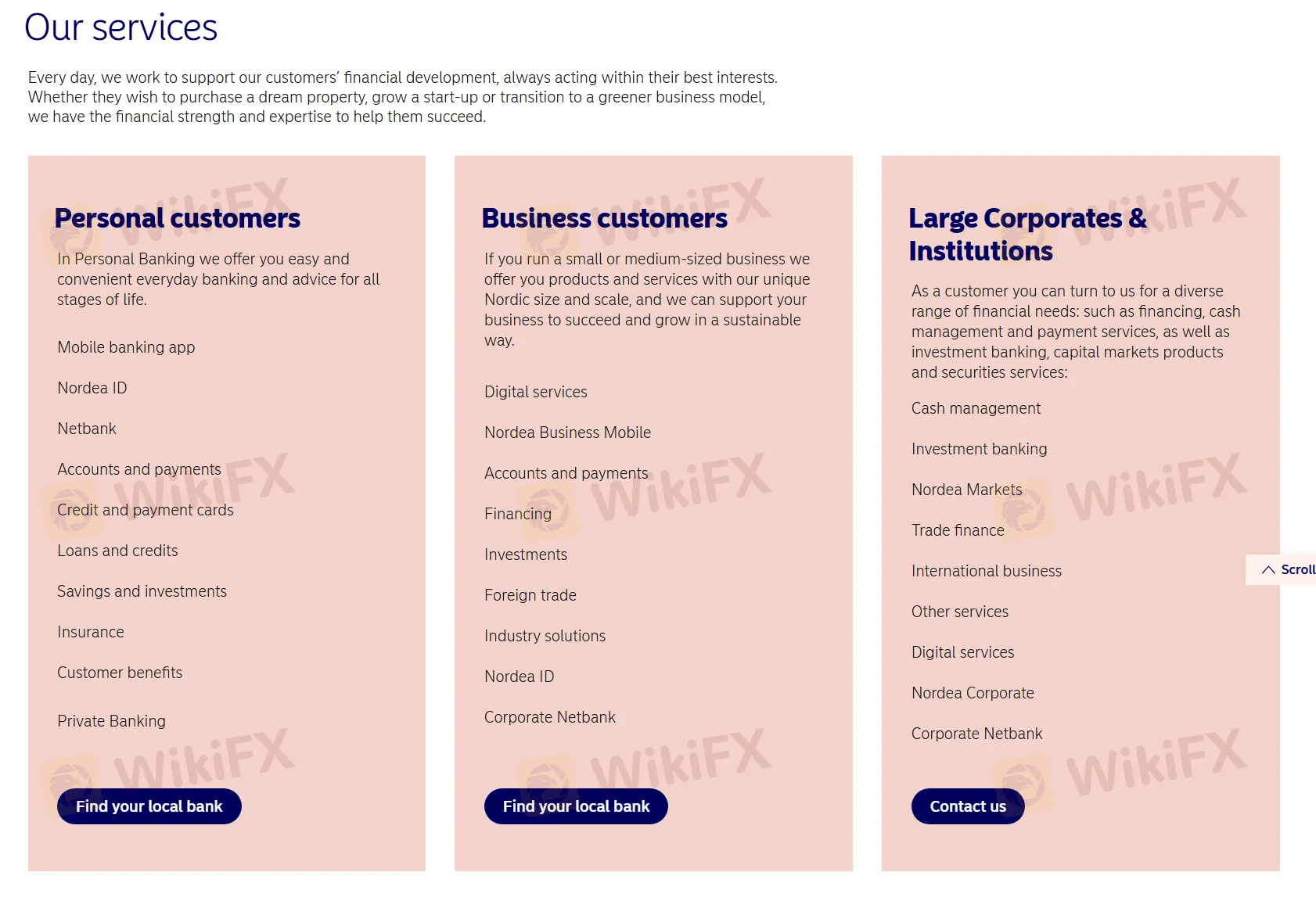

NORDEA propose des services aux clients particuliers, aux entreprises et aux grandes corporations et institutions, incluant :

Clients Particuliers : Pour les clients individuels, il offre une banque au quotidien pratique et des services financiers, incluant des applications de banque mobile, gestion de compte, services de paiement, cartes de crédit, prêts, épargne et investissement, assurance, avantages clients, et services de banque privée.

Clients Entreprises : Pour les petites et moyennes entreprises, il propose des services numériques, banque mobile, gestion de compte, financement, investissement, commerce international, solutions sectorielles, et d'autres services pour soutenir le développement commercial durable.

Grandes entreprises et institutions : Pour les grandes entreprises et institutions, il offre des services financiers complets comprenant la gestion de trésorerie, la banque d'investissement, les produits du marché des capitaux, les services de titres, le commerce international, d'autres services et des services numériques.

| Type de client | Services offerts |

| Clients particuliers | Application de banque mobile |

| Identifiant Nordea | |

| Netbank | |

| Comptes et paiements | |

| Cartes de crédit et de paiement | |

| Prêts et crédits | |

| Épargne et investissements | |

| Assurance | |

| Avantages clients | |

| Banque privée | |

| Clients professionnels | Services numériques |

| Mobile professionnel Nordea | |

| Comptes et paiements | |

| Financement | |

| Mobile professionnel Nordea | |

| Commerce extérieur | |

| Solutions sectorielles | |

| Identifiant Nordea | |

| Netbank d'entreprise | |

| Grandes entreprises et institutions | Gestion de trésorerie |

| Banque d'investissement | |

| Marchés Nordea | |

| Financement du commerce | |

| Commerce international | |

| Autres services | |

| Services numériques | |

| Entreprise Nordea | |

| Netbank d'entreprise |