Perfil de la compañía

| NORDEAResumen de la reseña | |

| Establecido | 2000 |

| País/Región registrado | Dinamarca |

| Regulación | Sin regulación |

| Servicios | Préstamos y créditos, ahorros e inversiones, seguros, banca privada, servicios digitales, financiamiento, comercio exterior, banca corporativa, gestión de efectivo, banca de inversión, negocios internacionales |

| Atención al cliente | Teléfono: +45 7033 3333; +45 7033 4444 |

| Redes sociales: LinkedIn, Facebook, Threads, YouTube | |

| Dirección: Dinamarca, Finlandia, Noruega, Suecia | |

Información de NORDEA

Fundada en 2000 y registrada en Dinamarca, NORDEA ofrece servicios financieros diversificados para individuos, empresas y grandes instituciones, que incluyen banca diaria, servicios digitales, banca de inversión y productos del mercado de capitales. Aunque la empresa cuenta con múltiples canales de atención al cliente como teléfono y redes sociales, no está regulada y carece de información detallada sobre los procesos de depósito y retiro, así como de la estructura de tarifas. Los clientes deben tener precaución al utilizar sus fondos.

Pros y contras

| Pros | Contras |

| Múltiples servicios bancarios | Sin regulación |

| Varios canales de atención al cliente | Estructura de tarifas poco clara |

| Larga historia de operación |

¿Es NORDEA legítimo?

NORDEA no está regulado, por lo que los clientes deben tener precaución al operar.

Servicios

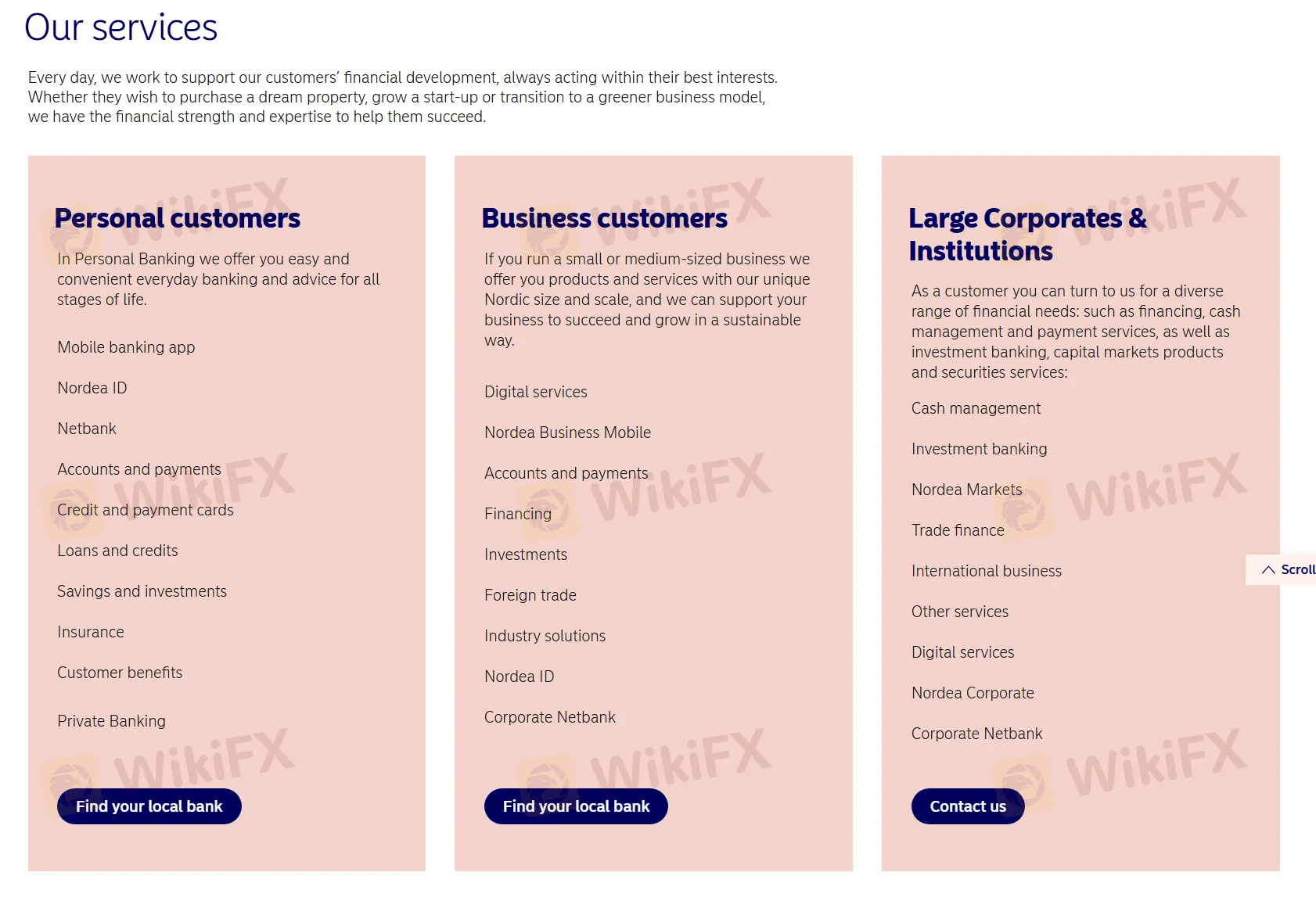

NORDEA ofrece servicios a clientes personales, empresariales y grandes corporaciones e instituciones, que incluyen:

Clientes personales: Para clientes individuales, ofrece banca diaria conveniente y servicios financieros, que incluyen aplicaciones de banca móvil, gestión de cuentas, servicios de pago, tarjetas de crédito, préstamos, ahorros e inversiones, seguros, beneficios para el cliente y servicios de banca privada.

Clientes empresariales: Para pequeñas y medianas empresas, ofrece servicios digitales, banca móvil, gestión de cuentas, financiamiento, inversión, comercio internacional, soluciones industriales y otros servicios para apoyar el desarrollo empresarial sostenible.

Grandes Empresas e Instituciones: Para grandes corporaciones e instituciones, ofrece servicios financieros integrales que incluyen gestión de efectivo, banca de inversión, productos del mercado de capitales, servicios de valores, comercio internacional, otros servicios y servicios digitales.

| Tipo de Cliente | Servicios Ofrecidos |

| Clientes Personales | Aplicación de banca móvil |

| Nordea ID | |

| Netbank | |

| Cuentas y pagos | |

| Tarjetas de crédito y débito | |

| Préstamos y créditos | |

| Ahorros e inversiones | |

| Seguros | |

| Beneficios para el cliente | |

| Banca Privada | |

| Clientes Empresariales | Servicios digitales |

| Nordea Business Mobile | |

| Cuentas y pagos | |

| Financiamiento | |

| Nordea Business Mobile | |

| Comercio exterior | |

| Soluciones para la industria | |

| Nordea ID | |

| Corporate Netbank | |

| Grandes Empresas e Instituciones | Gestión de efectivo |

| Banca de inversión | |

| Mercados de Nordea | |

| Financiamiento del comercio | |

| Negocios internacionales | |

| Otros servicios | |

| Servicios digitales | |

| Nordea Corporate | |

| Corporate Netbank |