회사 소개

| India Advantage 리뷰 요약 | |

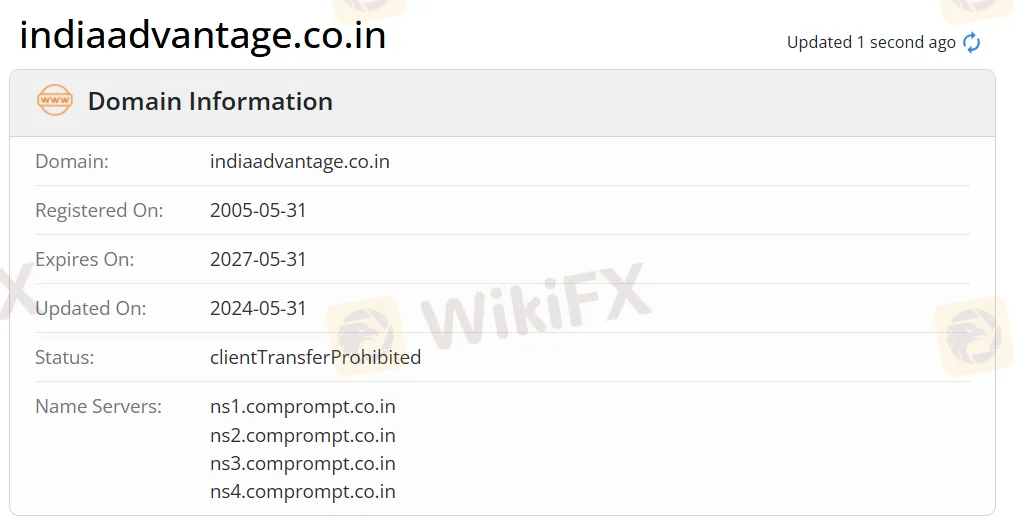

| 설립 연도 | 2005 |

| 등록 국가/지역 | 인도 |

| 규제 | 규제 없음 |

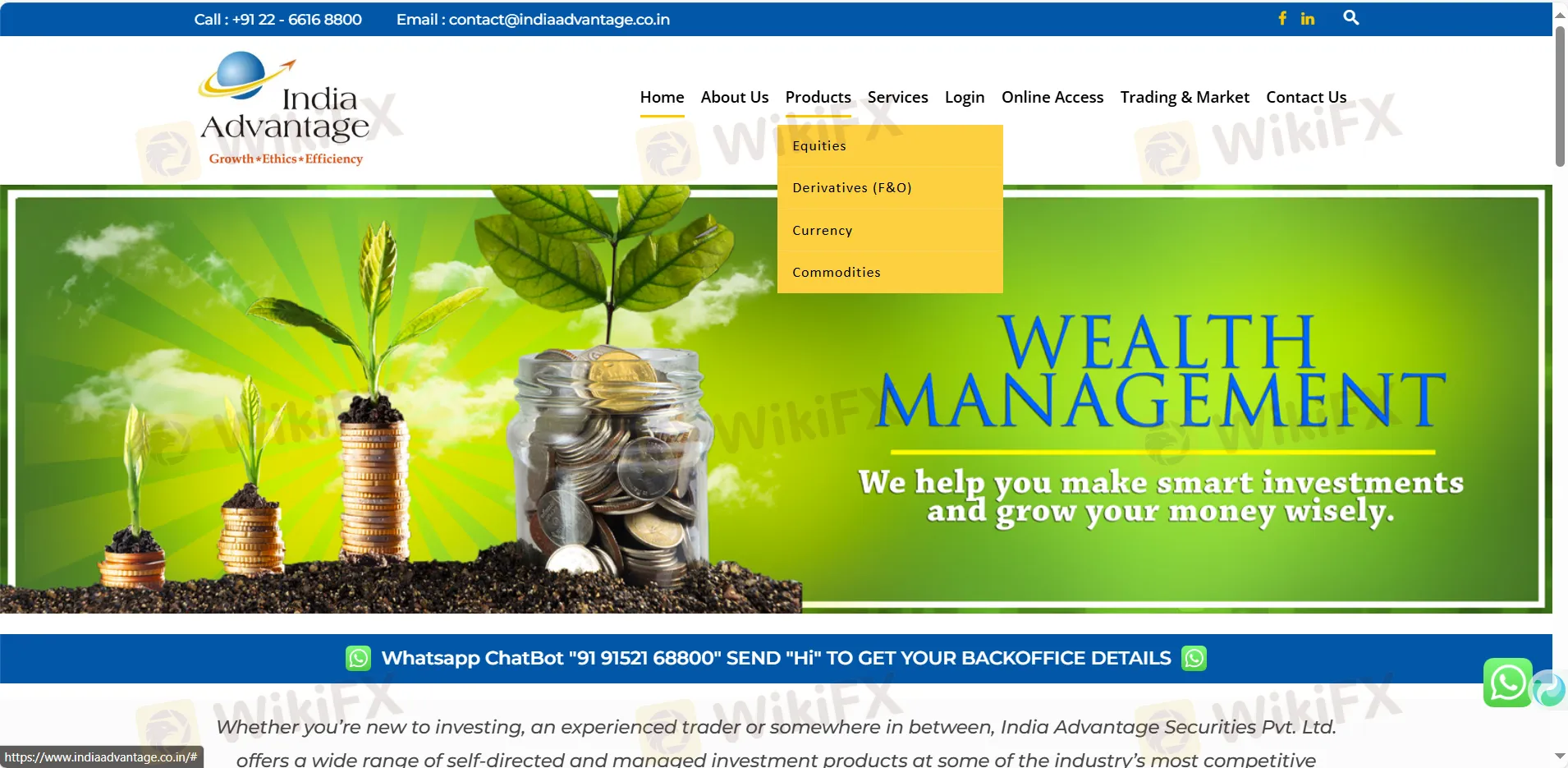

| 시장 상품 | 주식, 파생상품 (선물 및 옵션), 통화, 상품 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: +91-022-6616 8800 | |

| 이메일: contact@indiaadvantage.co.in | |

| 소셜 미디어: Facebook, LinkedIn, Whatsapp | |

| 주소: 4th Floor, Om Plaza, Vasanji Lalji Road, Opp. Kandivli Station, Kandivli (West). Mumbai - 400 067 | |

India Advantage 정보

India Advantage은 인도 주식 시장에서 프리미어 중개업 및 금융 서비스의 규제되지 않은 공급 업체입니다. 주식, 파생상품 (선물 및 옵션), 통화, 상품, 투자 자문 및 거래에 대한 제품 및 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 다양한 연락 수단 | 데모 계정 없음 |

| 다양한 제품 및 서비스 | MT4/MT5 플랫폼 없음 |

| 운영 시간이 길다 | 규제 부족 |

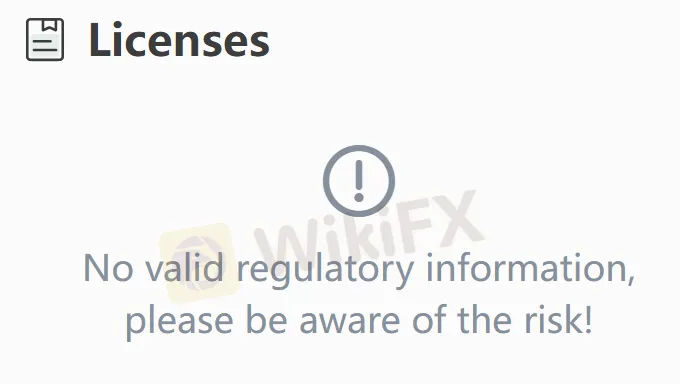

India Advantage 신뢰할 만한가요?

No. India Advantage 현재 유효한 규정이 없습니다. 리스크를 인식해주십시오!

India Advantage에서 무엇을 거래할 수 있나요?

| 거래 자산 | 지원됨 |

| 통화 | ✔ |

| 상품 | ✔ |

| 주식 | ✔ |

| 파생상품 (선물 및 옵션) | ✔ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

계정 유형

브로커는 주식 거래 계정, 상품 거래 계정, 파생상품 거래 계정 및 통화 거래 계정을 제공하지만 세부 내용은 정의되지 않았습니다.