Perfil de la compañía

| India Advantage Resumen de la reseña | |

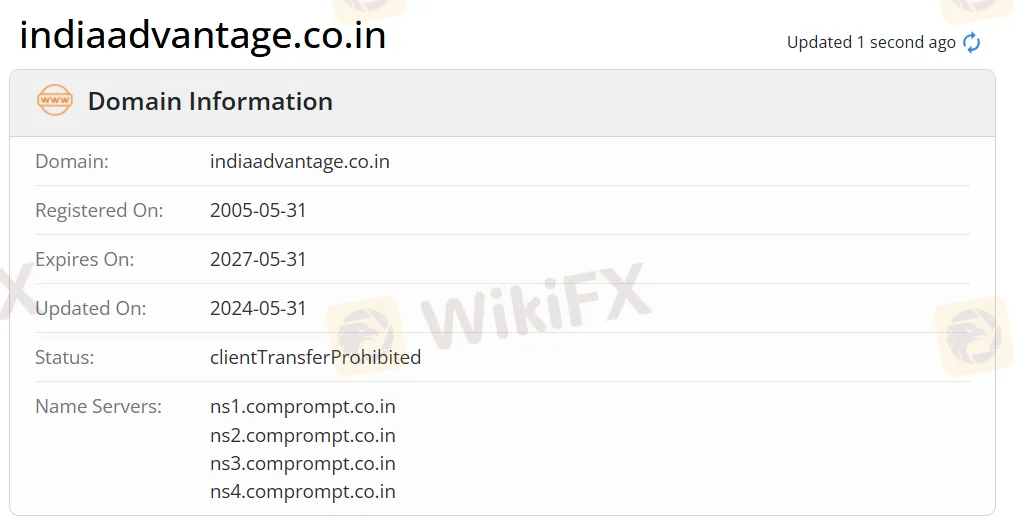

| Establecido | 2005 |

| País/Región Registrada | India |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Acciones, derivados (F&O), divisas, materias primas |

| Cuenta Demo | ❌ |

| Plataforma de Trading | / |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de contacto |

| Tel: +91-022-6616 8800 | |

| Email: contact@indiaadvantage.co.in | |

| Redes sociales: Facebook, LinkedIn, Whatsapp | |

| Dirección: 4th Floor, Om Plaza, Vasanji Lalji Road, Opp. Kandivli Station, Kandivli (West). Mumbai - 400 067 | |

Información de India Advantage

India Advantage es un proveedor de servicios no regulado de corretaje y servicios financieros de primera categoría en la Bolsa de Valores de la India. Ofrece productos y servicios en acciones, derivados (F&O), divisas, materias primas, asesoramiento de inversiones y trading.

Pros y Contras

| Pros | Contras |

| Varios canales de contacto | Sin cuentas demo |

| Varios productos y servicios | Sin plataforma MT4/MT5 |

| Largo tiempo de operación | Falta de regulación |

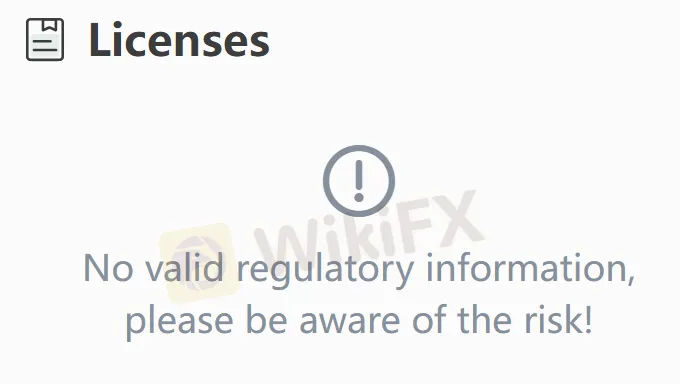

¿Es India Advantage Legítimo?

No. India Advantage actualmente no tiene regulaciones válidas. ¡Por favor, tenga en cuenta el riesgo!

¿Qué puedo comerciar en India Advantage?

| Activos de Trading | Soportado |

| Monedas | ✔ |

| Productos Básicos | ✔ |

| Acciones | ✔ |

| Derivados (F&O) | ✔ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

Tipo de Cuenta

El corredor ofrece cuenta de Trading de Acciones, cuenta de Trading de Productos Básicos, cuenta de Trading de Derivados y cuenta de Trading de Monedas pero los detalles no están definidos.