公司簡介

| India Advantage 評論摘要 | |

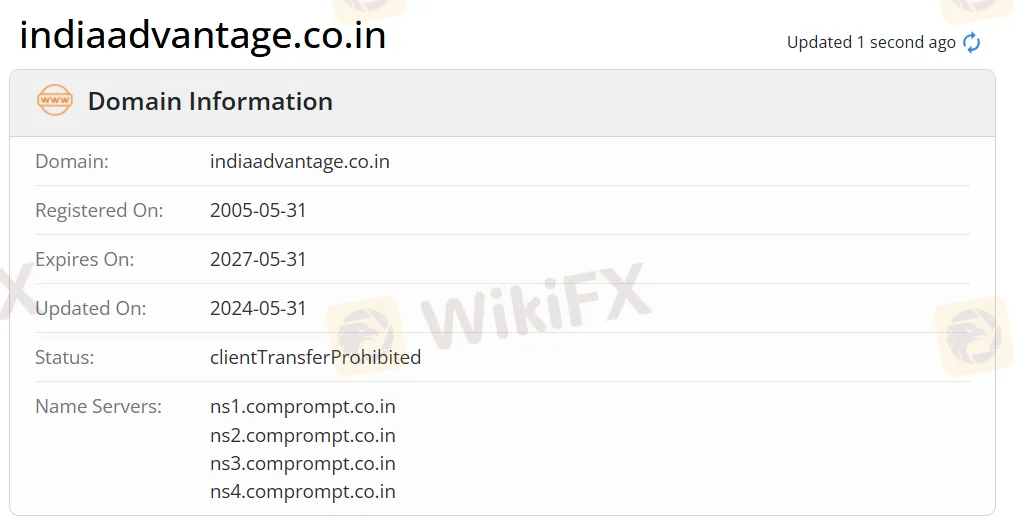

| 成立年份 | 2005 |

| 註冊國家/地區 | 印度 |

| 監管 | 無監管 |

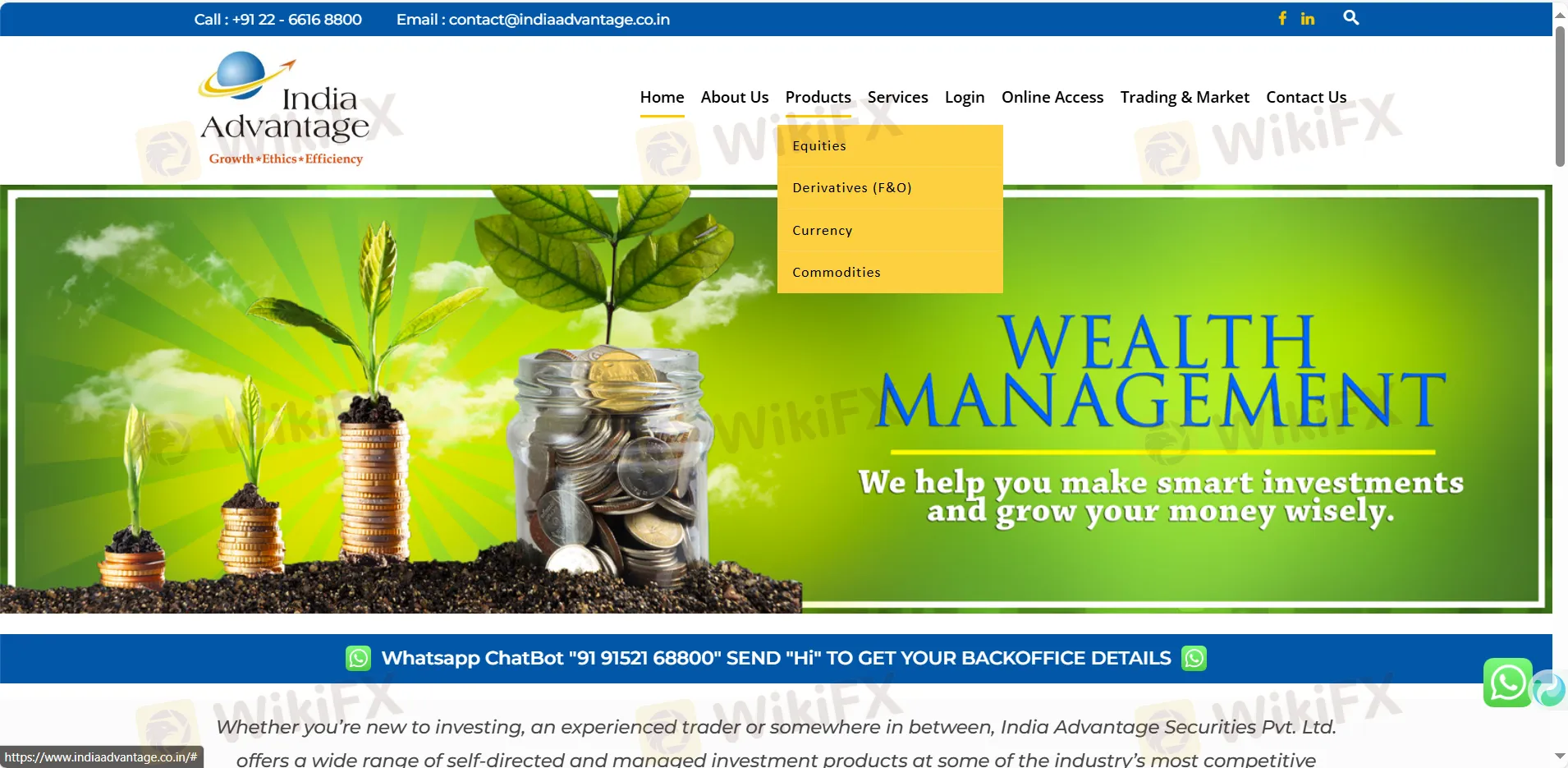

| 市場工具 | 股票、衍生品(F&O)、貨幣、商品 |

| 模擬帳戶 | ❌ |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:+91-022-6616 8800 | |

| 電郵:contact@indiaadvantage.co.in | |

| 社交媒體:Facebook、LinkedIn、Whatsapp | |

| 地址:4th Floor, Om Plaza, Vasanji Lalji Road, Opp. Kandivli Station, Kandivli (West). Mumbai - 400 067 | |

India Advantage 資訊

India Advantage 是印度證券交易所的一家未受監管的頂級經紀和金融服務提供商。它提供股票、衍生品(F&O)、貨幣、商品、投資諮詢和交易產品和服務。

優缺點

| 優點 | 缺點 |

| 多種聯絡途徑 | 沒有模擬帳戶 |

| 多樣化產品和服務 | 沒有MT4/MT5平台 |

| 長時間運作 | 缺乏監管 |

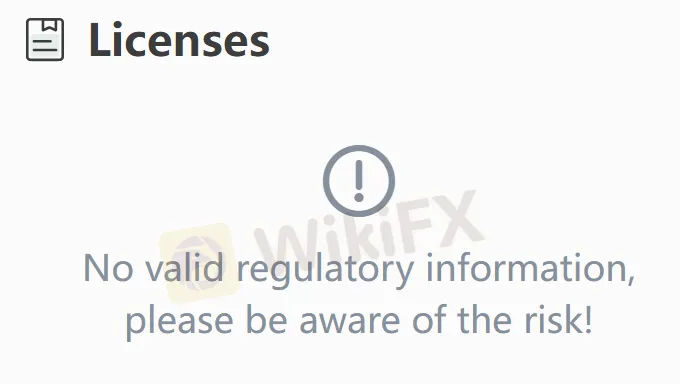

India Advantage 是否合法?

編號 India Advantage 目前 沒有有效的監管。請注意風險!

我可以在 India Advantage 交易什麼?

| 交易資產 | 支援 |

| 貨幣 | ✔ |

| 商品 | ✔ |

| 股票 | ✔ |

| 衍生品 (期貨及選擇權) | ✔ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETF | ❌ |

帳戶類型

該經紀商提供 股票交易帳戶、商品交易帳戶、衍生品交易帳戶和貨幣交易帳戶,但詳細資料尚未確定。