Buod ng kumpanya

| India Advantage Buod ng Pagsusuri | |

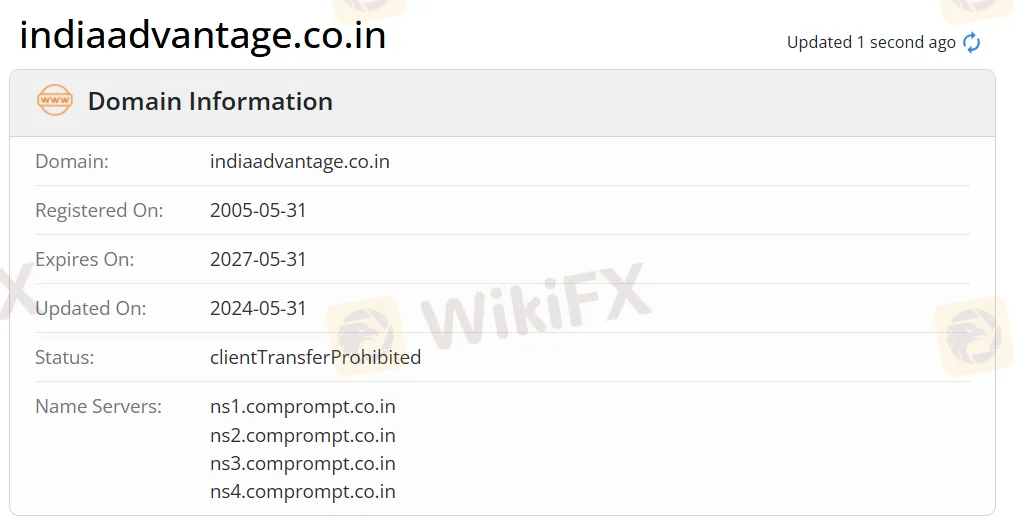

| Itinatag | 2005 |

| Rehistradong Bansa/Rehiyon | India |

| Regulasyon | Walang regulasyon |

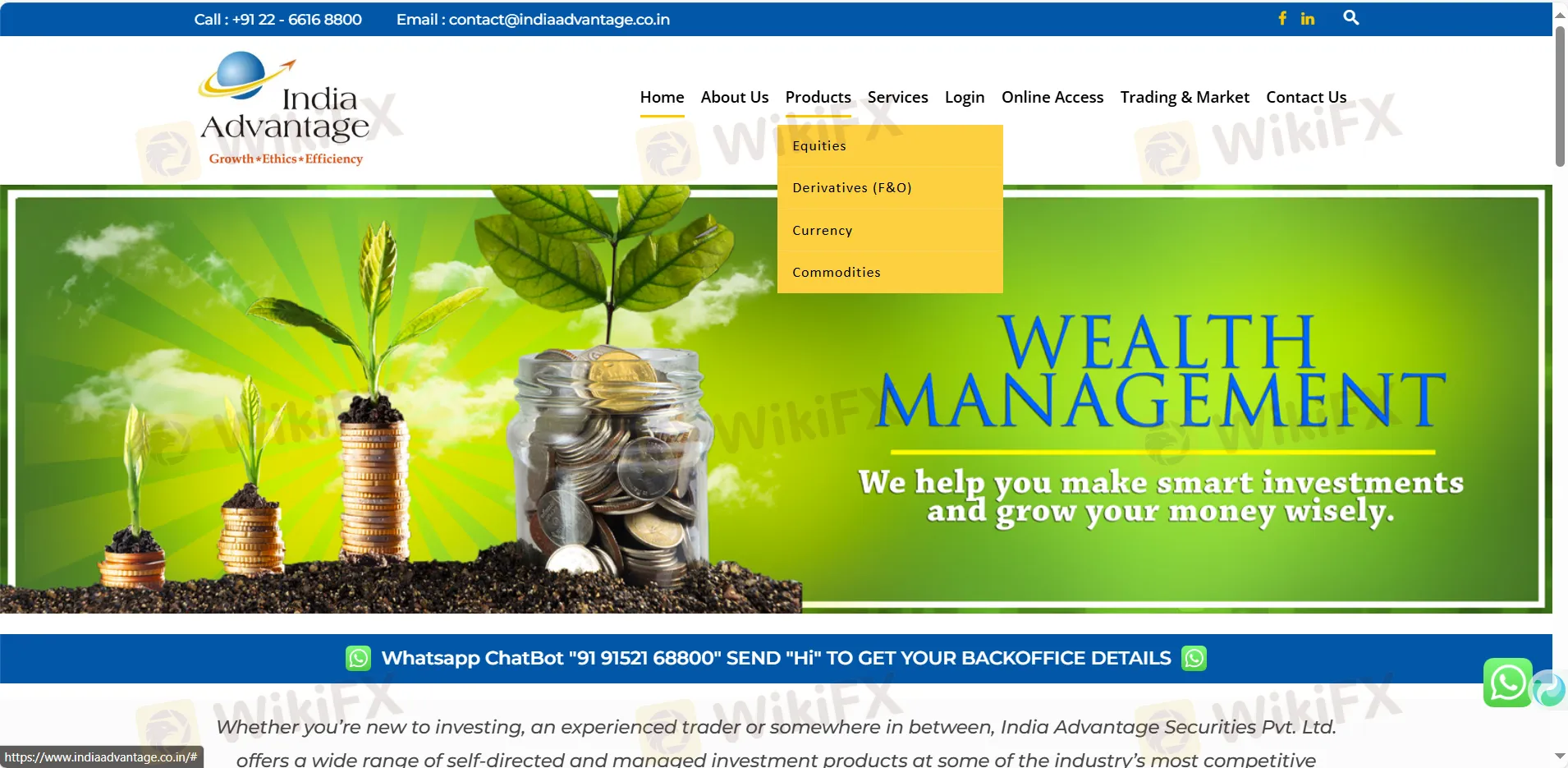

| Mga Instrumento sa Merkado | Mga Ekityes, derivatives (F&O), currencies, commodities |

| Demo Account | ❌ |

| Platform ng Paggawa ng Kalakalan | / |

| Minimum na Deposito | / |

| Suporta sa Kustomer | Form ng Pakikipag-ugnayan |

| Tel: +91-022-6616 8800 | |

| Email: contact@indiaadvantage.co.in | |

| Sosyal na midya: Facebook, LinkedIn, Whatsapp | |

| Address: 4th Floor, Om Plaza, Vasanji Lalji Road, Opp. Kandivli Station, Kandivli (West). Mumbai - 400 067 | |

Impormasyon Tungkol sa India Advantage

Ang India Advantage ay isang hindi nairegulahang tagapagbigay ng pangunahing brokerage at serbisyong pinansyal sa India Stock Exchange. Nag-aalok ito ng mga produkto at serbisyo sa mga ekwiti, derivatives (F&O), currency, commodities, investment advisory at trading.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Walang demo accounts |

| Iba't ibang mga produkto at serbisyo | Walang platapormang MT4/MT5 |

| Mahabang oras ng operasyon | Kawalan ng regulasyon |

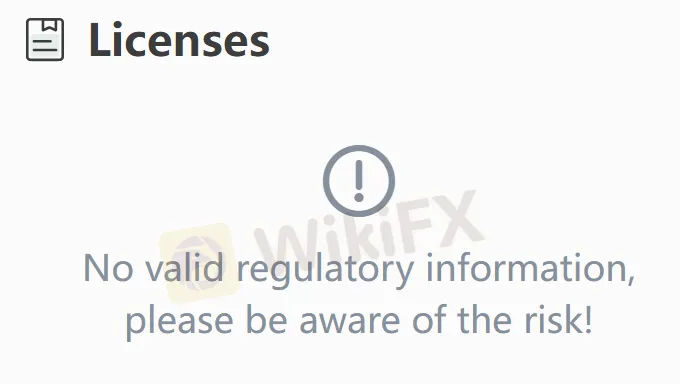

Tunay ba ang India Advantage?

Walang. India Advantage kasalukuyang walang walang bisaing regulasyon. Mangyaring maging maingat sa panganib!

Ano ang Maaari Kong I-trade sa India Advantage?

| Mga Asset sa Paghahalaga | Sinusugpo |

| Mga Pera | ✔ |

| Mga Kalakal | ✔ |

| Mga Ekwiti | ✔ |

| Mga Deribatibo (F&O) | ✔ |

| Mga Indise | ❌ |

| Mga Stock | ❌ |

| Mga Cryptocurrency | ❌ |

| Mga Obligasyon | ❌ |

| Mga Opsyon | ❌ |

| Mga ETF | ❌ |

Uri ng Account

Ang broker ay nagbibigay ng Equity Trading account, Commodities Trading account, Derivatives Trading account at Currency Trading account ngunit hindi pa itinatukoy ang mga detalye.