회사 소개

| IFC 리뷰 요약 | |

| 설립 | 1978년 |

| 등록 국가/지역 | 요르단 |

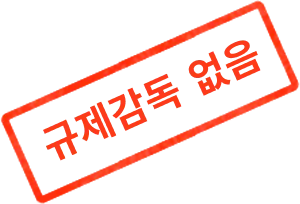

| 규제 | 규제 없음 |

| 시장 기구 | 금융 중개 - 현금 거래, 마진 금융, 금융 중개, 온라인 거래 |

| 데모 계정 | 사용 가능 |

| 고객 지원 | 전화:+962 6 5621786 이메일:info@ifc.com.jo |

IFC 정보

1978년에 설립된 국제 금융 센터(IFC)는 요르단에 본사를 두고 금융 중개, 현금 거래, 마진 금융, 금융 중개 및 온라인 거래를 포함한 다양한 금융 서비스를 제공합니다.

회사는 데모 계정을 제공하여 잠재적인 고객이 거래 플랫폼에 익숙해질 수 있도록 도와줍니다. 고객 지원은 +962 6 5621786으로 전화하거나 info@ifc.com.jo로 이메일로 문의할 수 있습니다.

장단점

| 장점 | 단점 |

| 데모 계정 이용 가능 | 규제 부족 |

IFC이 신뢰할 만한가요?

IFC은 현재 어떠한 규제 기관에도 규제되지 않았습니다.

IFC에서 무엇을 거래할 수 있나요?

IFC은 금융 중개(현금 거래), 마진 금융 서비스 및 스팟 거래에 특화되어 있습니다.

| 거래 가능한 기구 | 지원 여부 |

| 금융 중개 | ✔ |

| 마진 금융 | ✔ |

| 스팟 거래 | ✔ |

| 암호화폐 | ❌ |

| 선물 | ❌ |

| 채권 | ❌ |