Buod ng kumpanya

| CHIEF Buod ng Pagsusuri | |

| Itinatag | 1979 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | Regulated |

| Mga Instrumento sa Merkado | SecuritiesFutures |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Plataporma ng Pagkalakalan | Chief Deal |

| Min Deposit | / |

| Customer Support | Email: cs@chiefgroup.com.hk |

| Social Media: Facebook, Linkedin, Youtube, Whatsapp, Wechat | |

Impormasyon ng CHIEF

CHIEF, itinatag sa Hong Kong noong 1979. Sa kasalukuyan ito ay regulado ng SFC, pangunahing nagbibigay ng serbisyo sa securities at futures trading, at may sariling plataporma ng pagkalakalan.

Mga Kalamangan at Disadvantage

| Kalamangan | Disadvantage |

| Regulado ng SFC | Hindi sinusuportahan ang MT4/5 |

| Hindi available ang demo account |

Tunay ba ang CHIEF?

| Rehistradong Bansa/Rehiyon |  |

| Otoridad ng Regulasyon | SFC |

| Reguladong Entidad | Chief Commodities Limited |

| Uri ng Lisensya | Pagsasangkot sa mga kontrata ng futures |

| Numero ng Lisensya | AAZ607 |

| Kasalukuyang Katayuan | Regulated |

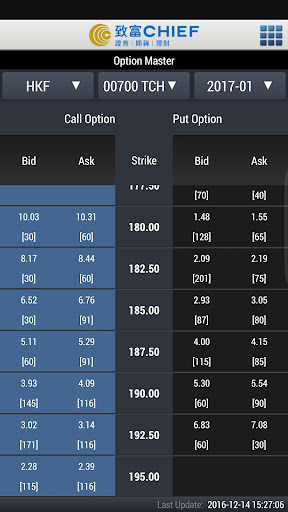

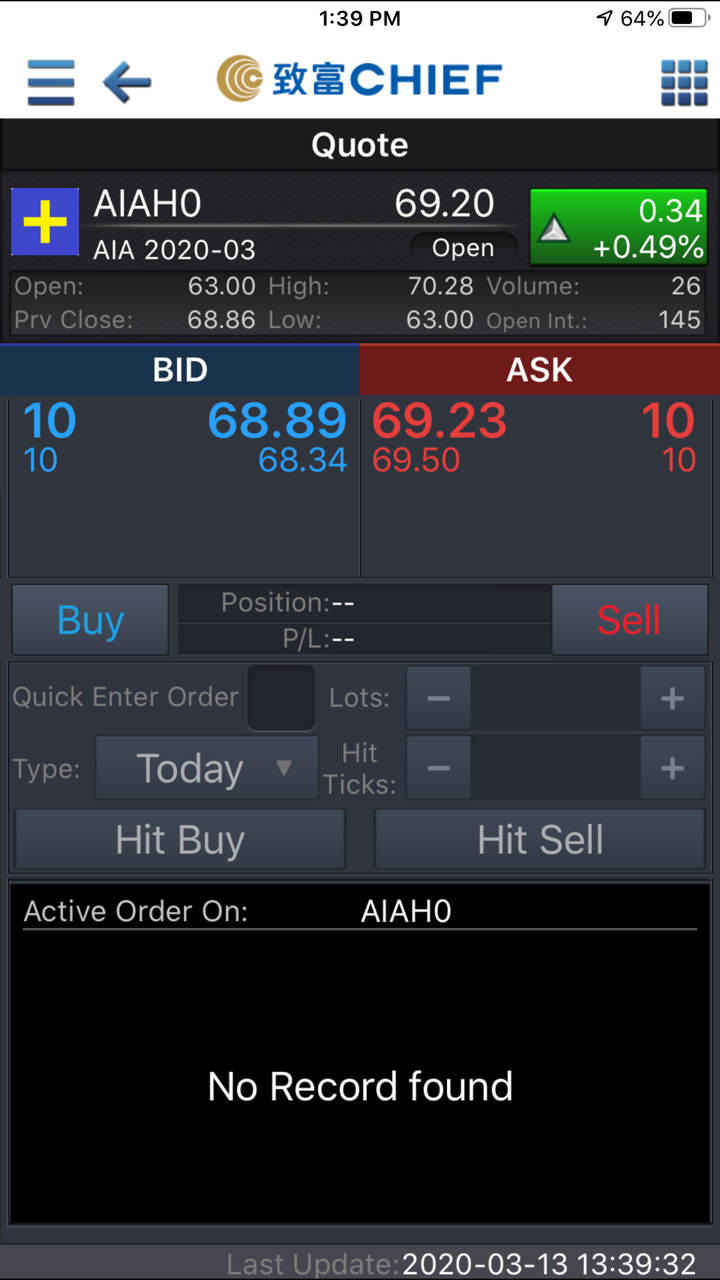

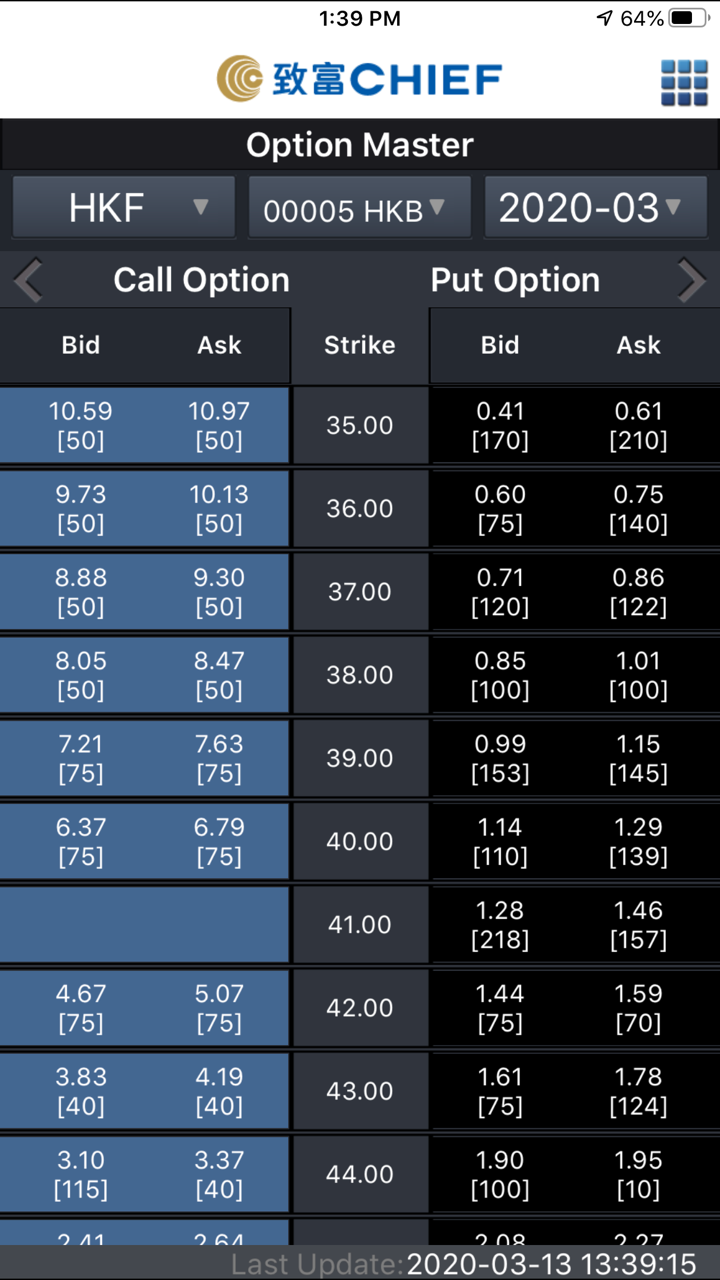

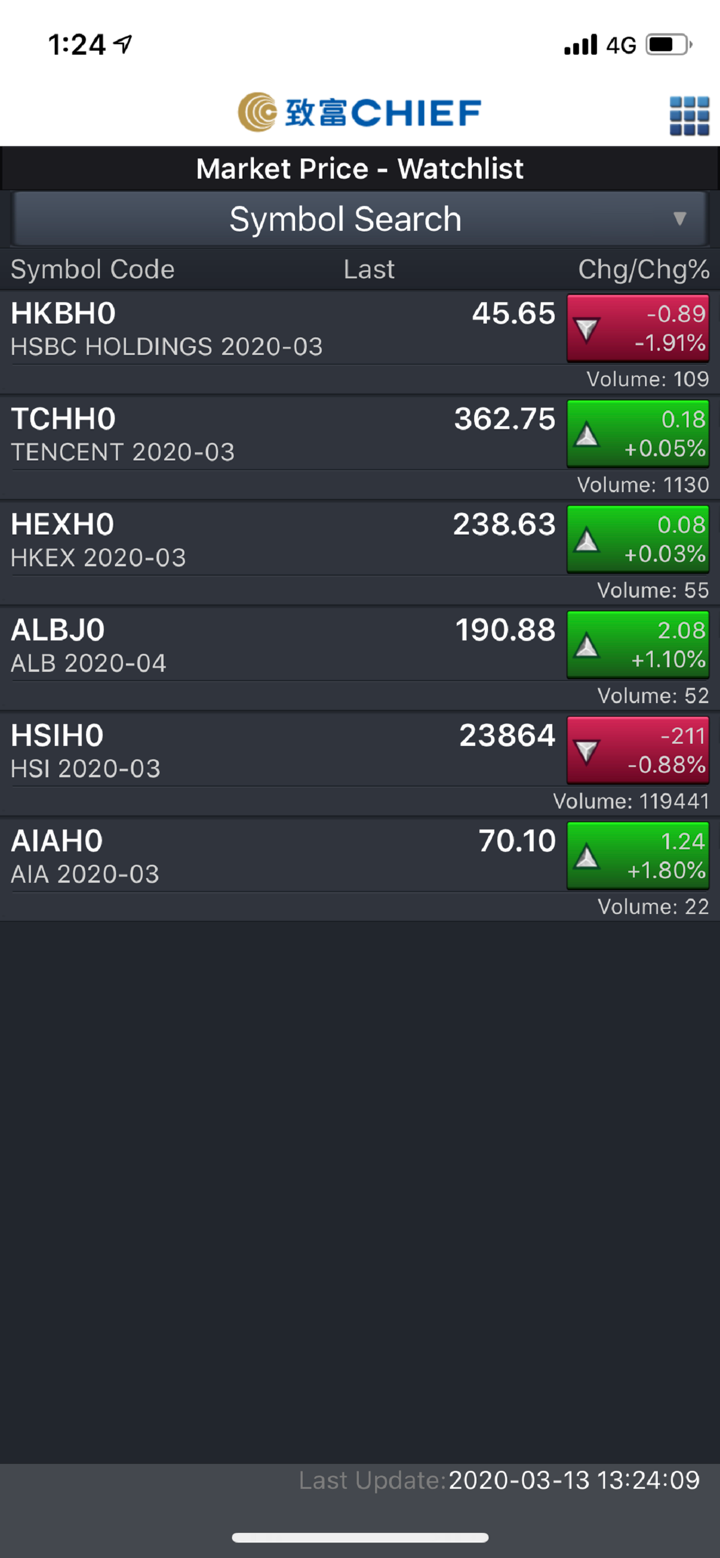

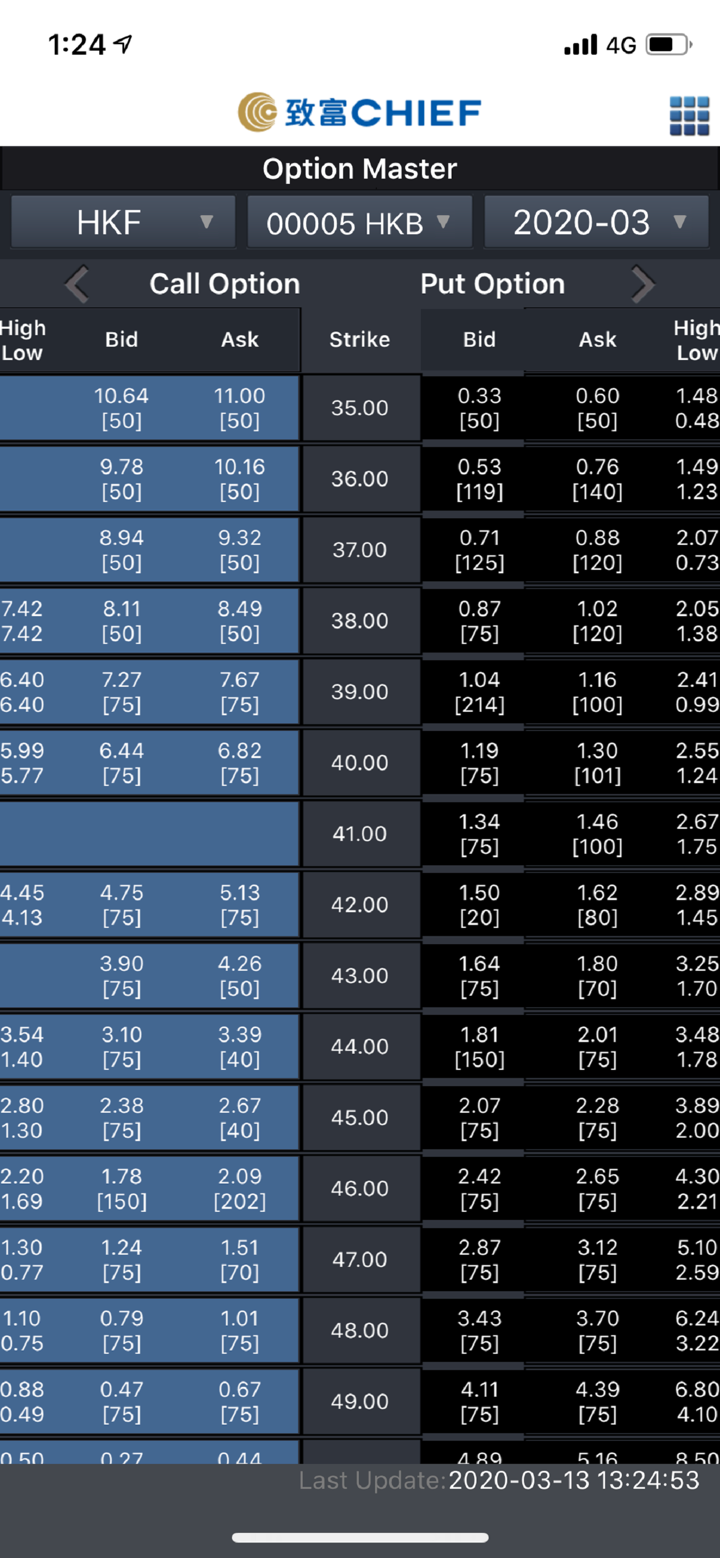

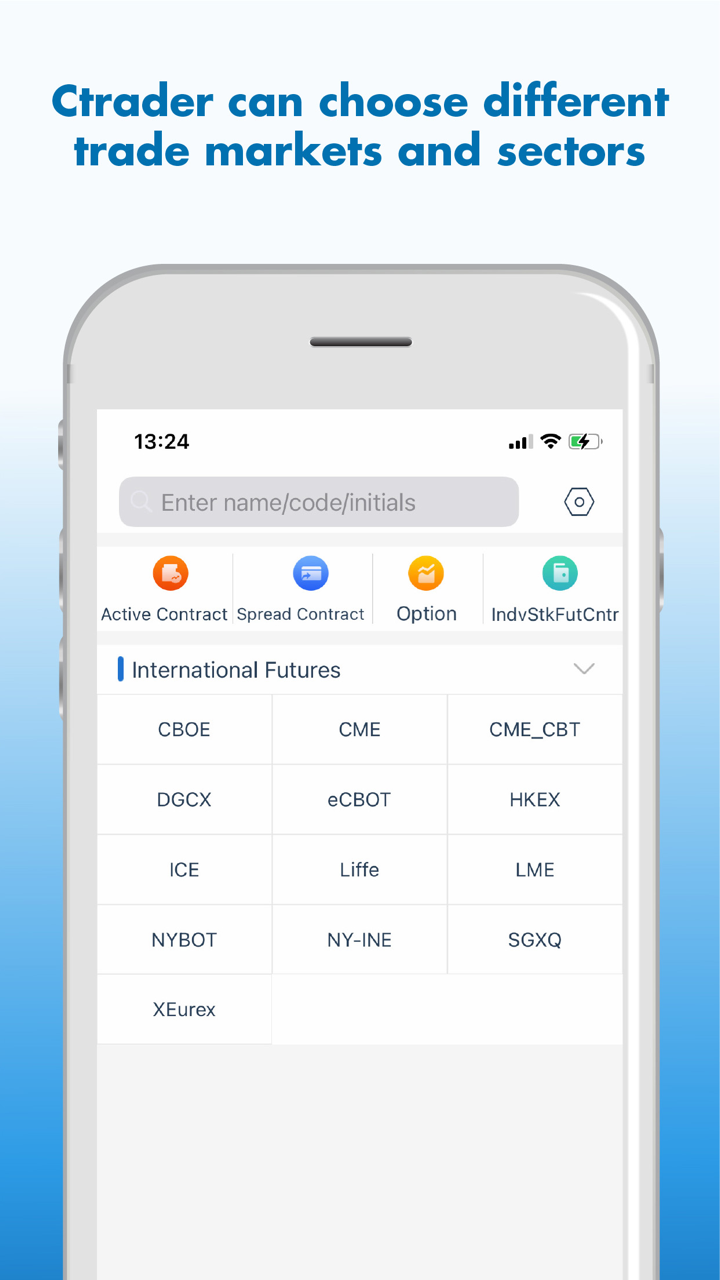

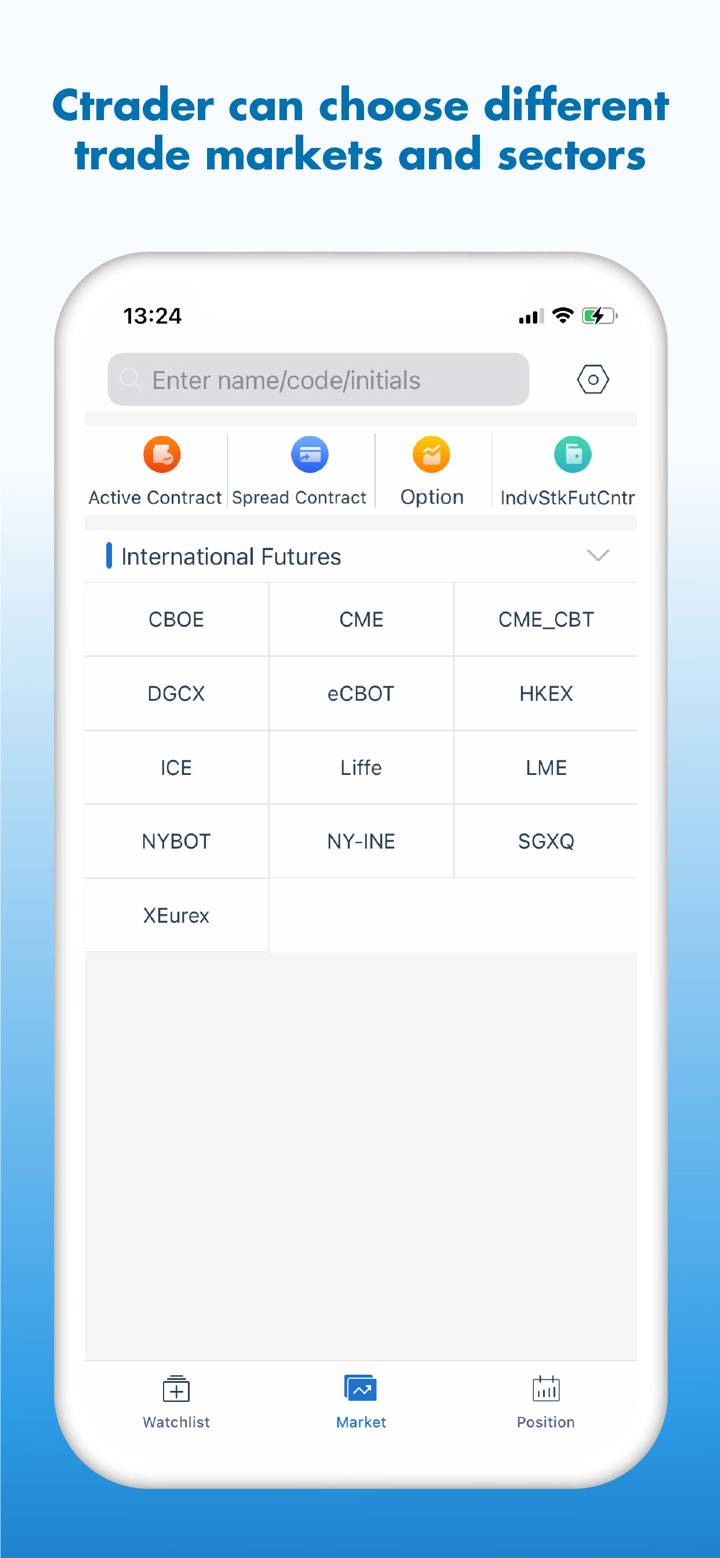

Ano ang Maaari Kong Ikalakal sa CHIEF?

Sinusuportahan ka ng CHIEF sa securities at futures trading.

| Mga Ikalakal na Instrumento | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Precious metals & Commodities | ❌ |

| Indices | ❌ |

| Bonds | ❌ |

| ETF | ❌ |

Uri ng Account

CHIEF hindi nagbigay ng impormasyon ng account. Gayunpaman, ang mga suportadong paraan ng pagbubukas ng account ay "remote account opening pass" appointments, personal na pagbubukas ng account at pagbubukas ng account sa pamamagitan ng mail. Maaari kang mag-refer sa: https://www.chiefgroup.com.hk/hk/account?apply=e-account

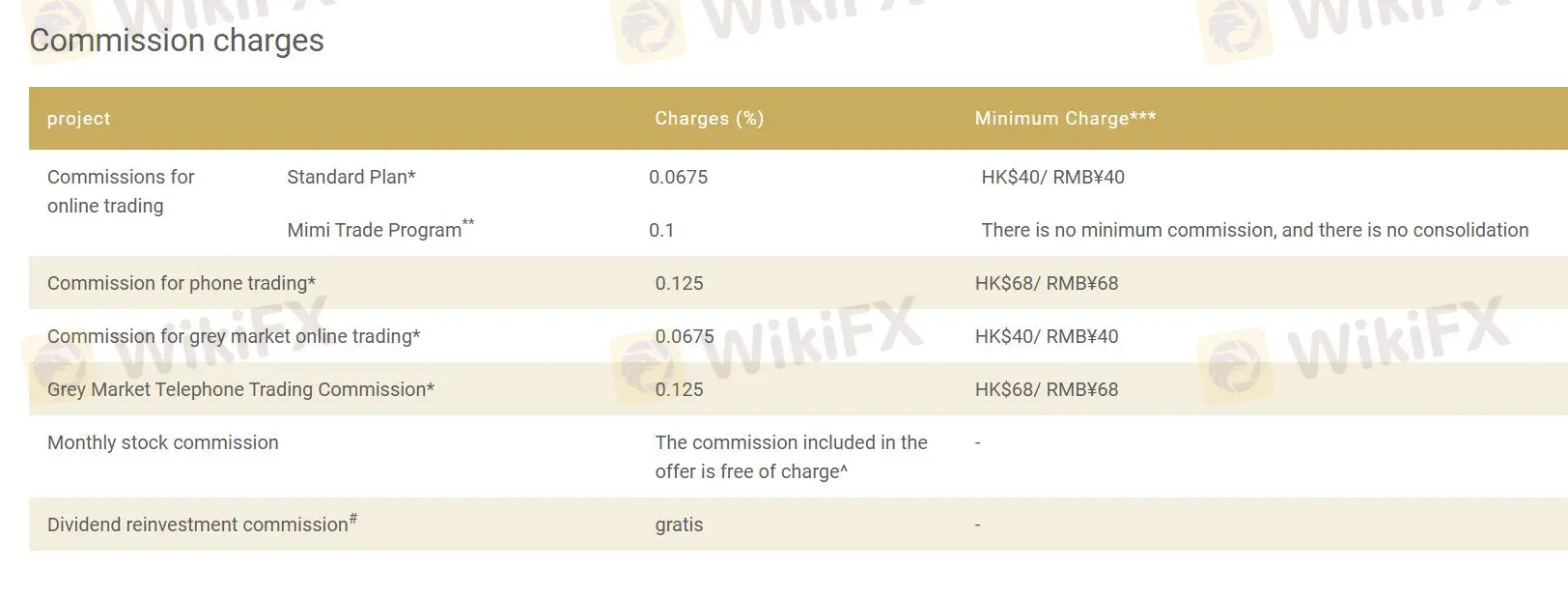

CHIEF Fees

CHIEF suportado ang ilang proyekto na walang komisyon, at ang rate ng komisyon ng proyekto ay hindi hihigit sa 0.2%. Ang minimum na bayad ay nasa HK $40 hanggang HK $68 at RMB ¥40 hanggang RMB ¥68.

| Proyekto | Mga Bayad (%) | Minimum na Bayad**** |

| Komisyon para sa online trading | ||

| Standard Plan* | 0.0675 | HK$40 / RMB¥40 |

| Mimi Trade Program** | 0.1 | Walang minimum na komisyon, walang consolidation |

| Komisyon para sa phone trading* | 0.125 | HK$68 / RMB¥68 |

| Komisyon para sa grey market online trading* | 0.0675 | HK$40 / RMB¥40 |

| Grey Market Telephone Trading Commission* | 0.125 | HK$68 / RMB¥68 |

| Buwanang stock commission | Ang komisyon na kasama sa alok ay libre* | - |

| Dividend reinvestment commission# | gratis | - |

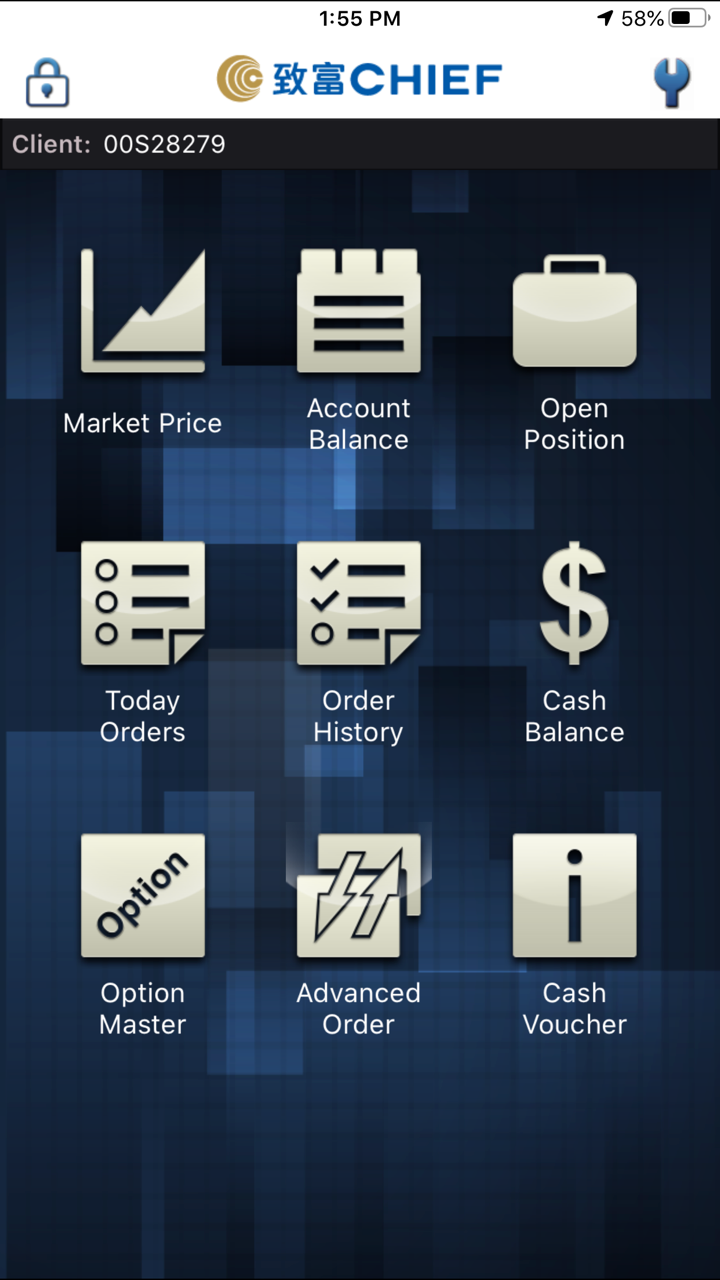

Trading Platform

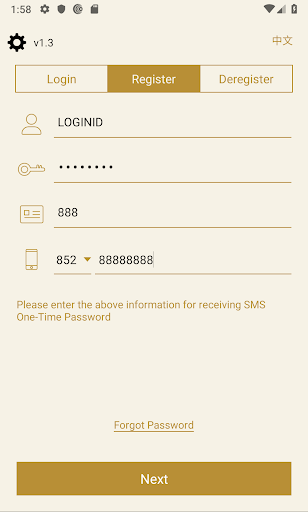

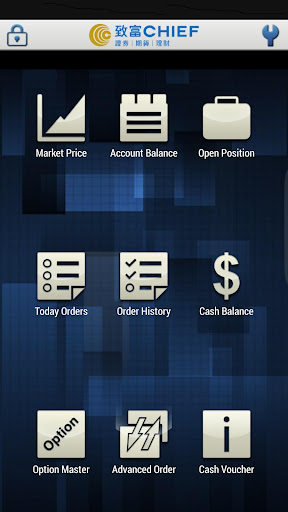

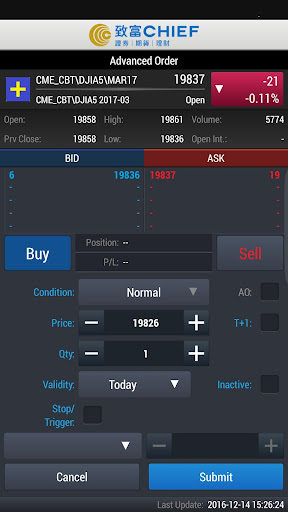

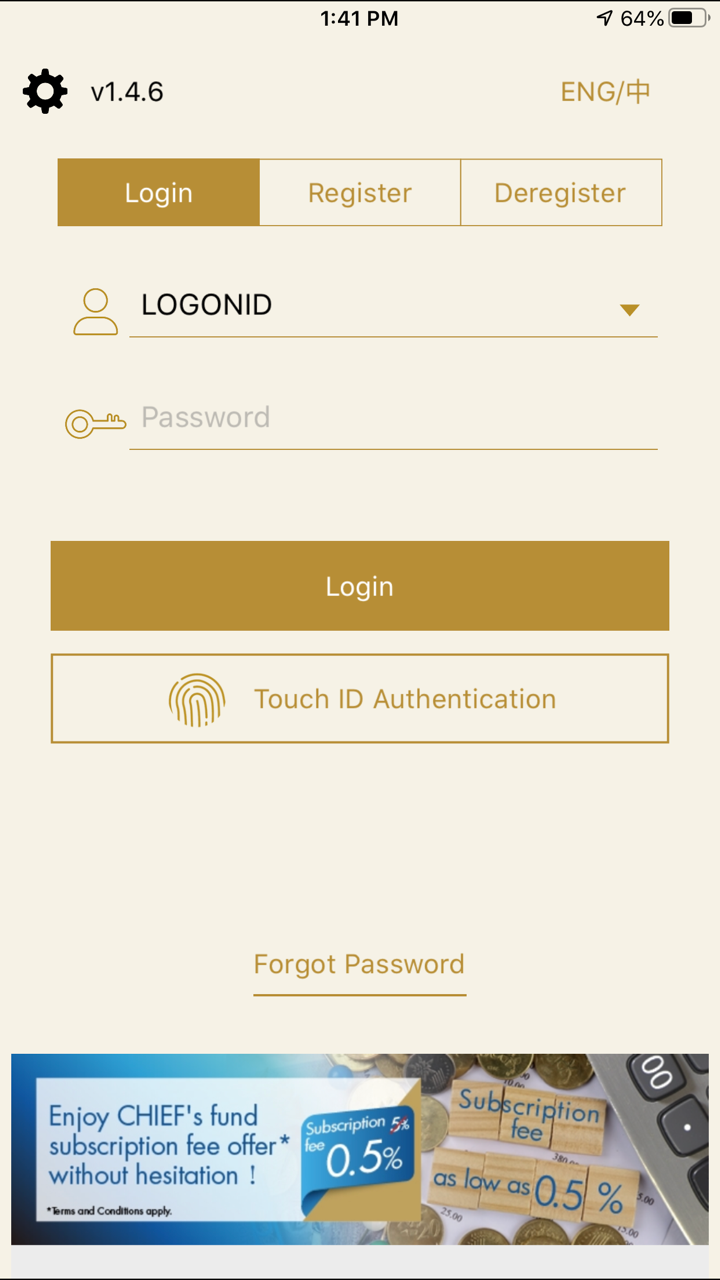

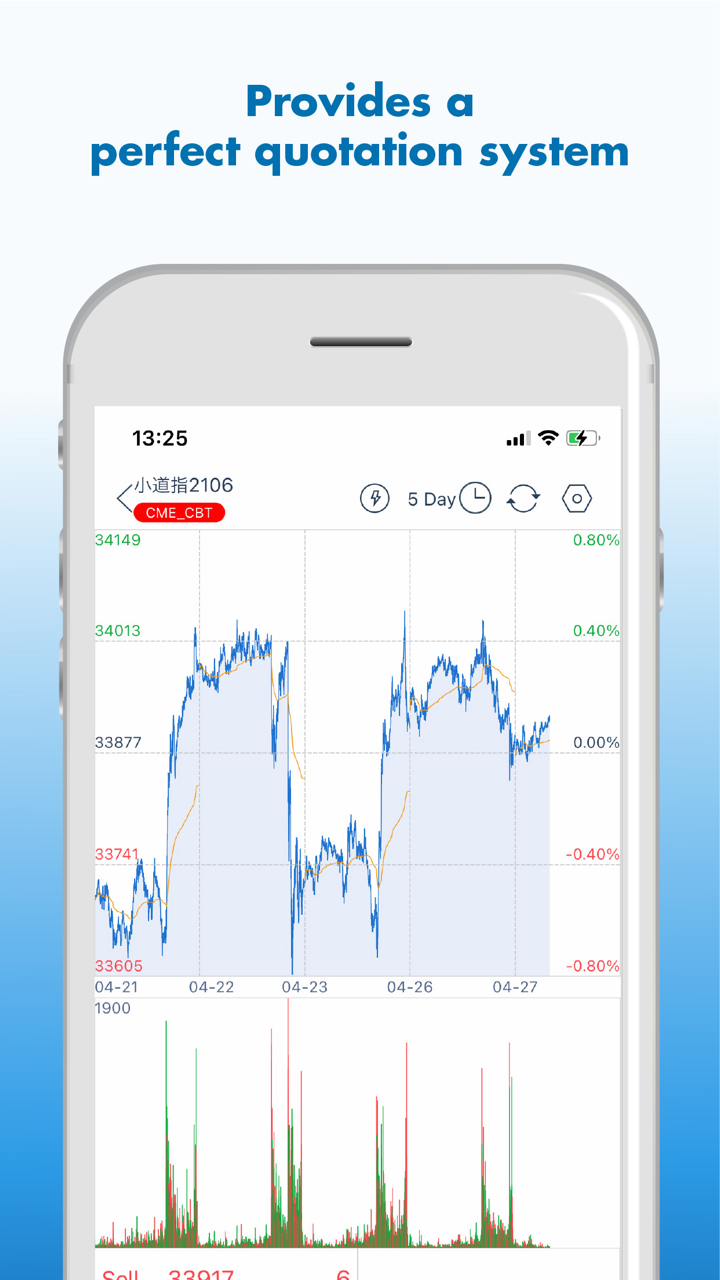

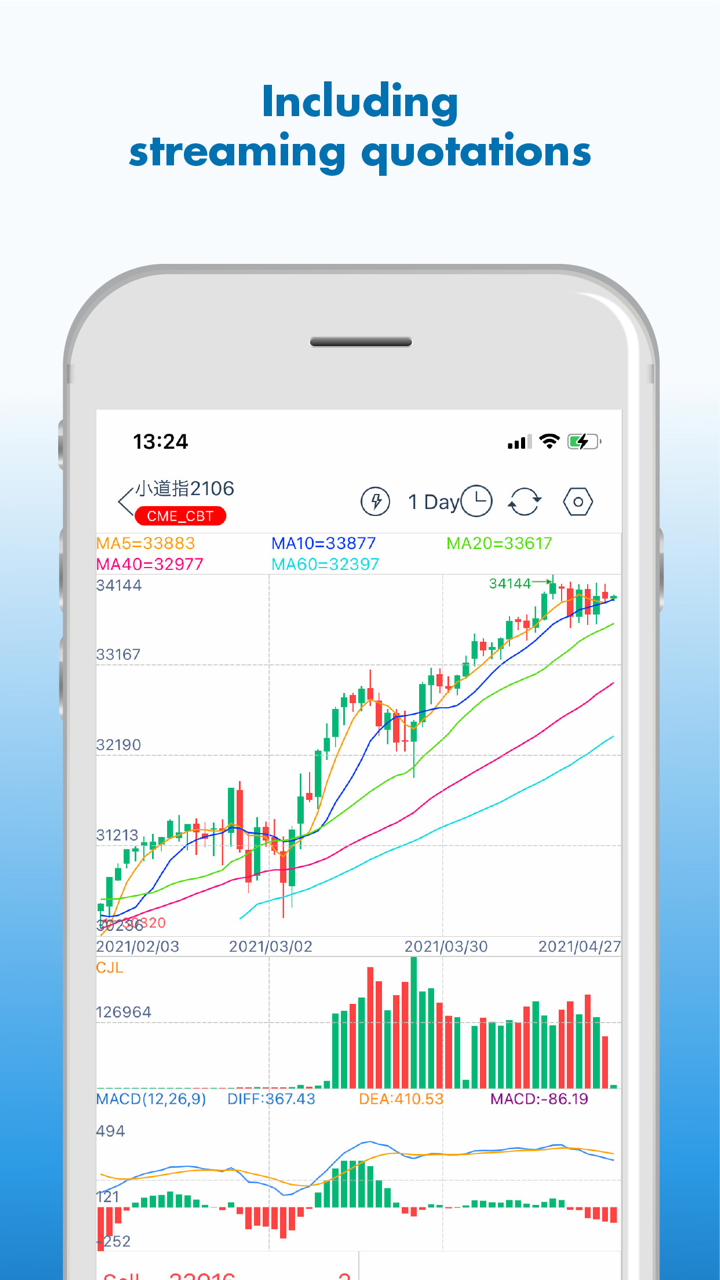

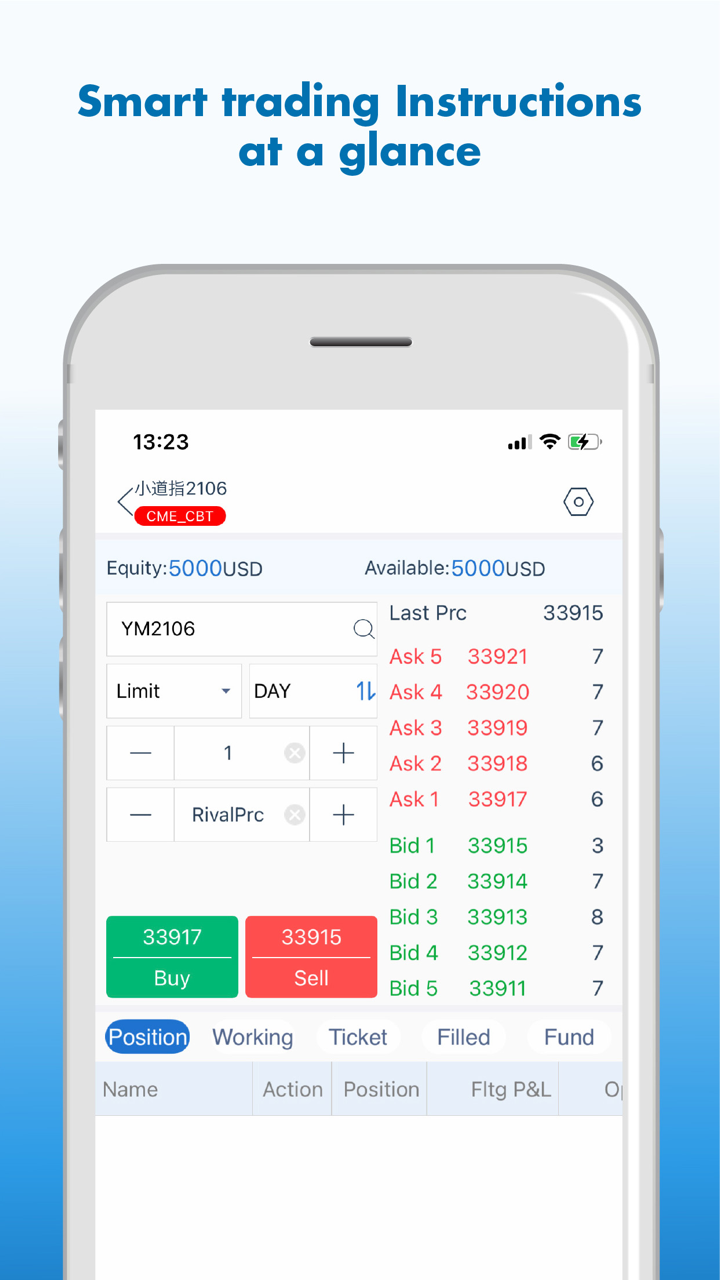

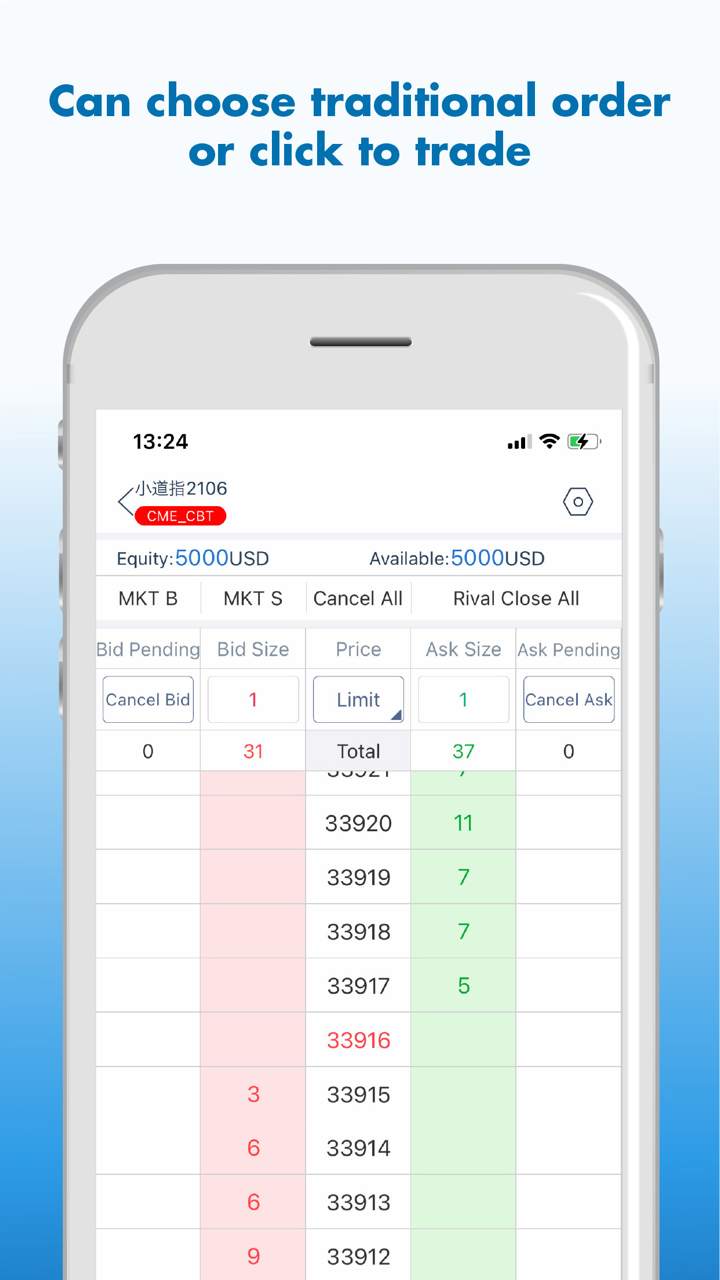

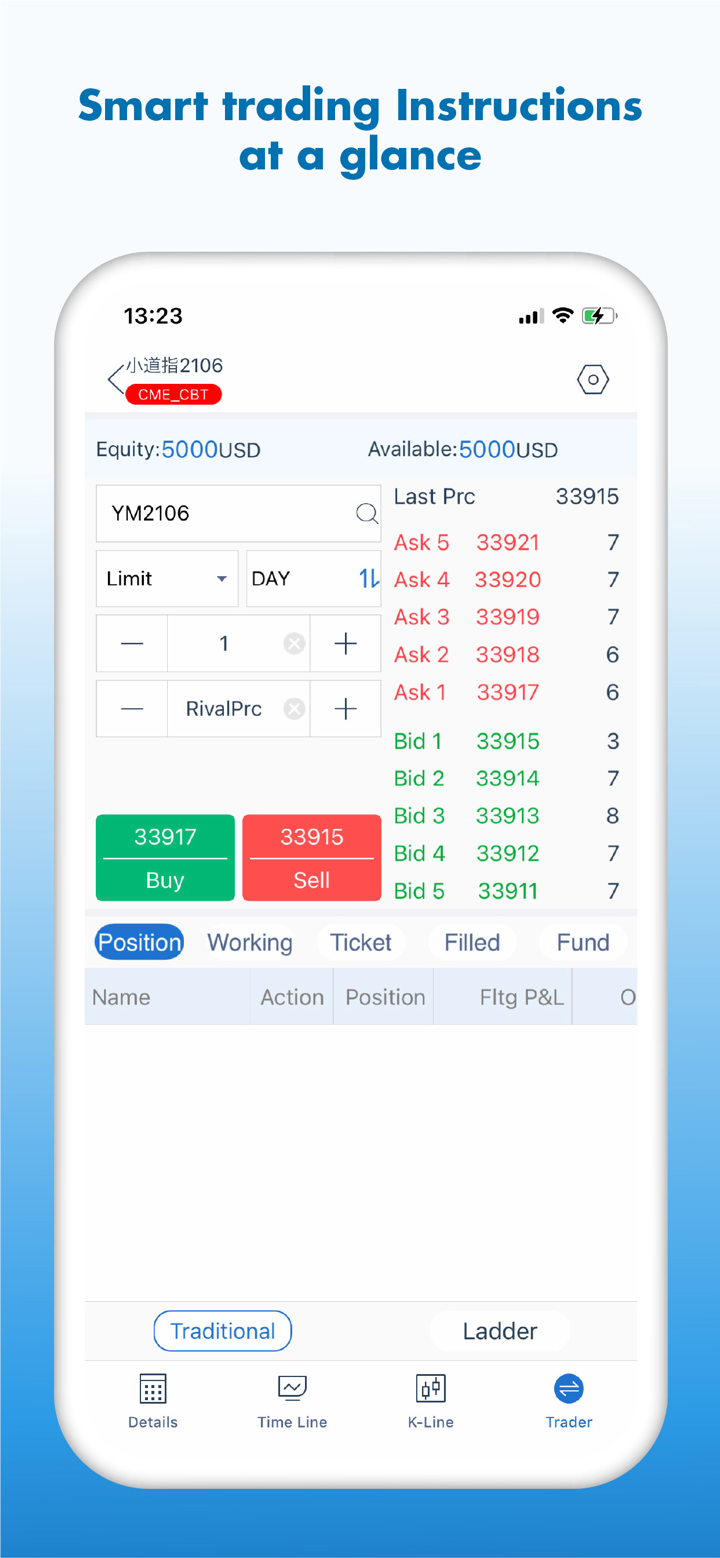

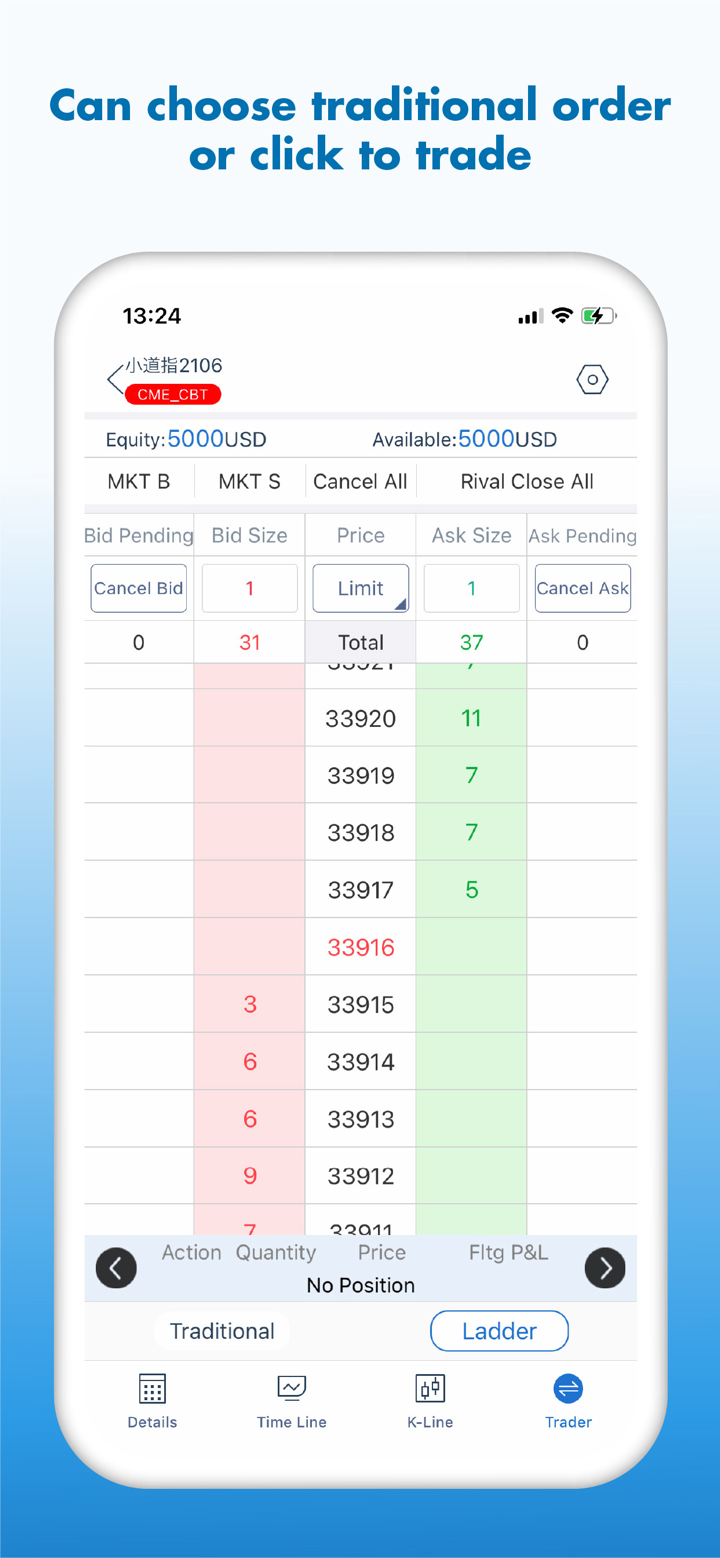

CHIEF nag-aalok ng sariling platform na Chief Deal, na maaaring gamitin sa mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| Chief Deal | ✔ | Mobile | Lahat ng mga trader |

| MT4 | ❌ | ||

| MT5 | ❌ |

Deposit and Withdrawal

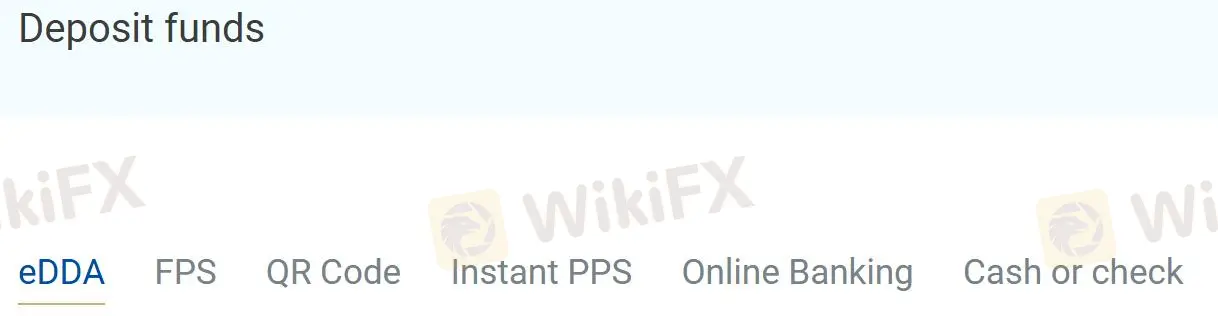

CHIEF nag-aalok ng 6 na paraan ng pagdedeposito: eDDA, FPS, QR Code, Instant PPS, Online Banking, Cash or check.

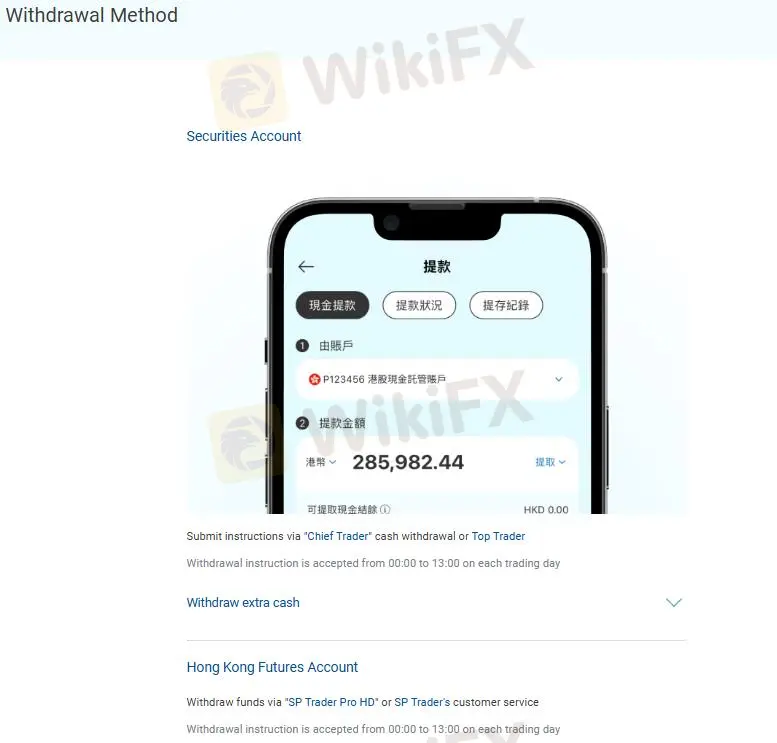

Ang mga withdrawal ay kailangang magsumite ng mga tagubilin sa pamamagitan ng "Chief Trader" cash withdrawal o Top Trader, o mag-withdraw ng pondo sa pamamagitan ng "SP Trader Pro HD" o serbisyo ng SP Trader.