कंपनी का सारांश

| CHIEFसमीक्षा सारांश | |

| स्थापित | 1979 |

| पंजीकृत देश/क्षेत्र | हांगकांग |

| नियामक | नियमित |

| बाजार उपकरण | सुरक्षा और भविष्य विपणन |

| डेमो खाता | ❌ |

| लीवरेज | / |

| स्प्रेड | / |

| ट्रेडिंग प्लेटफॉर्म | चीफ डील |

| न्यूनतम जमा | / |

| ग्राहक सहायता | ईमेल: cs@chiefgroup.com.hk |

| सोशल मीडिया: फेसबुक, लिंक्डइन, यूट्यूब, व्हाट्सएप, वीचैट | |

CHIEF जानकारी

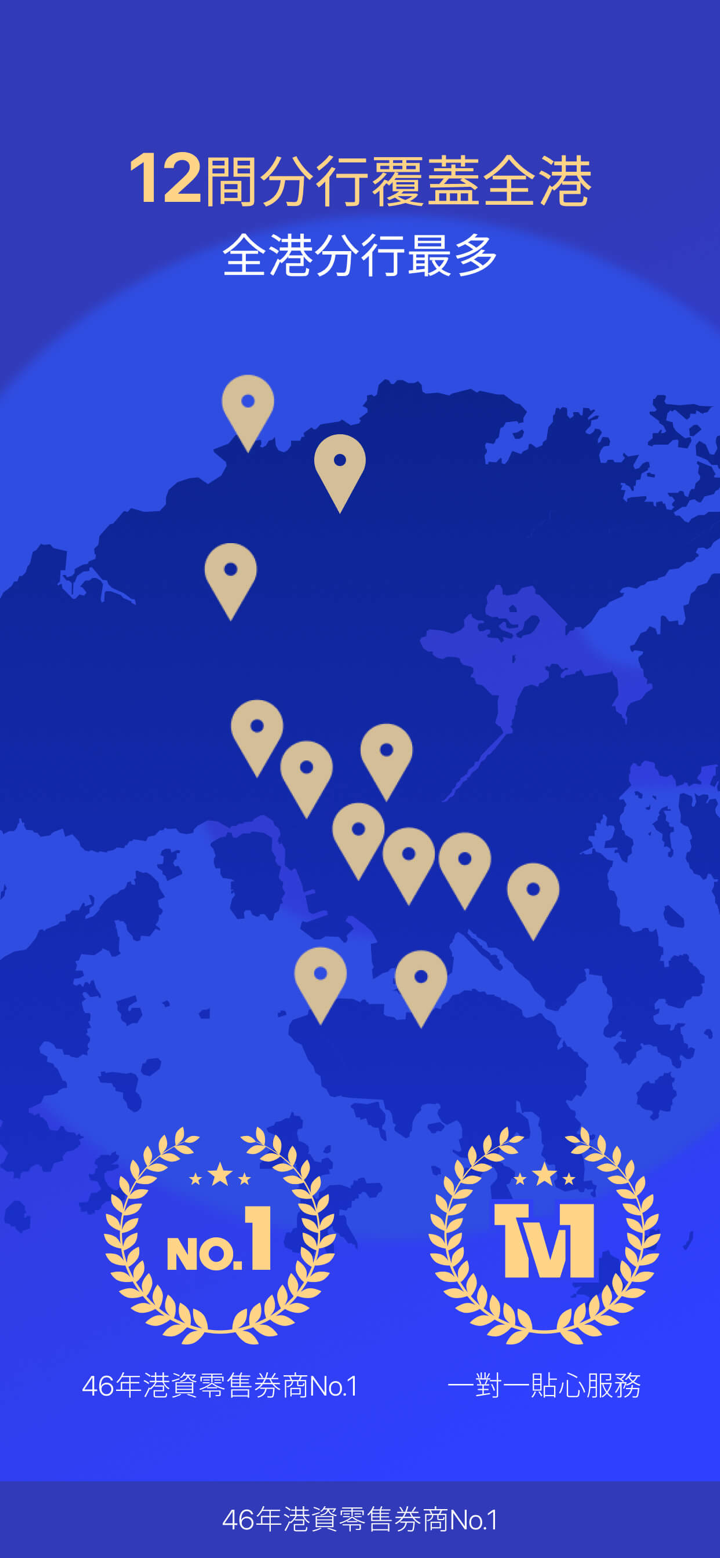

CHIEF, 1979 में हांगकांग में स्थापित की गई है। वर्तमान में यह एसएफसी द्वारा नियामित है, मुख्य रूप से सुरक्षा और भविष्य विपणन प्रदान करता है, और इसका अपना ट्रेडिंग प्लेटफॉर्म है।

लाभ और हानि

| लाभ | हानि |

| एसएफसी द्वारा नियामित | एमटी4/5 का समर्थन नहीं है |

| डेमो खाताएं उपलब्ध नहीं हैं |

CHIEF क्या विधित है?

| पंजीकृत देश/क्षेत्र |  |

| नियामक प्राधिकरण | एसएफसी |

| नियामित संस्था | चीफ कमोडिटीज लिमिटेड |

| लाइसेंस प्रकार | भविष्य अनुबंधों में व्यापार करना |

| लाइसेंस नंबर | AAZ607 |

| वर्तमान स्थिति | नियामित |

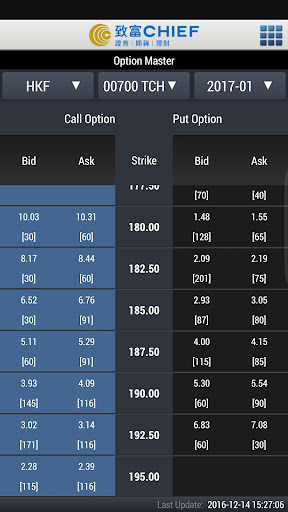

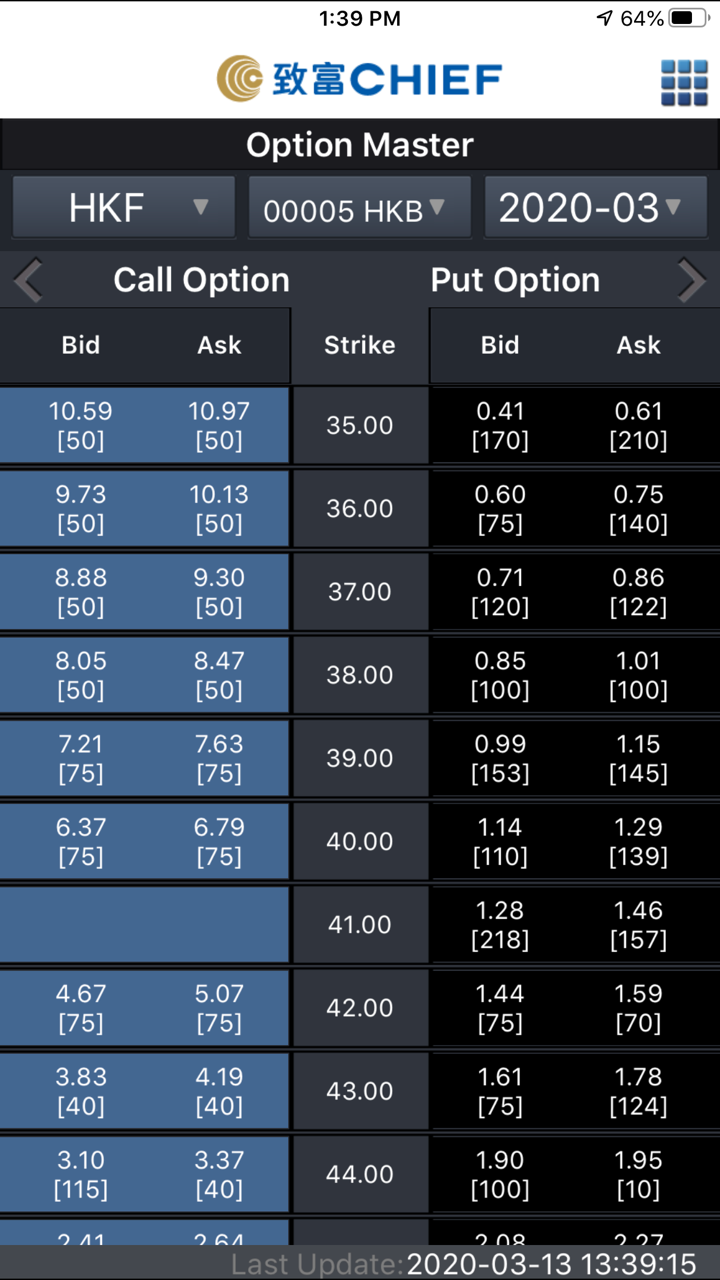

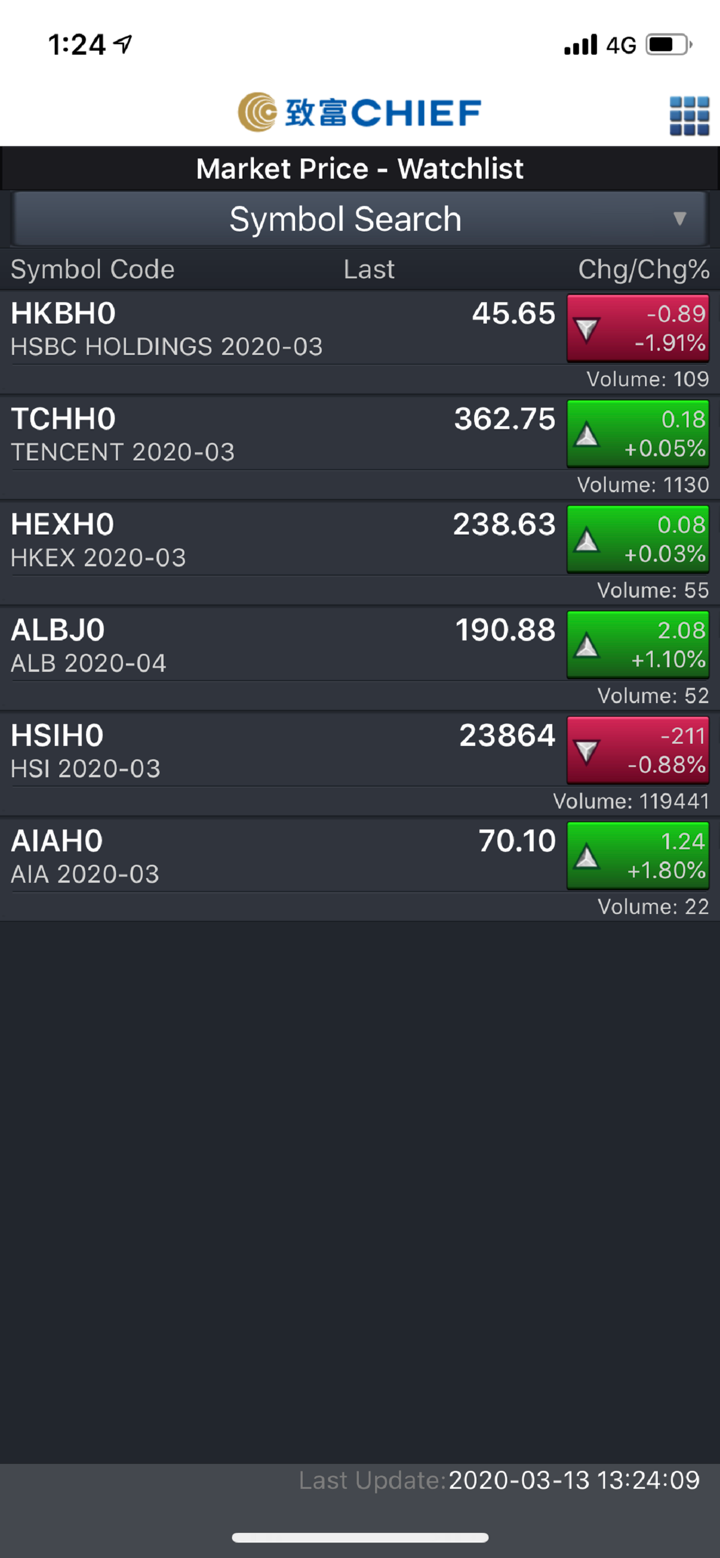

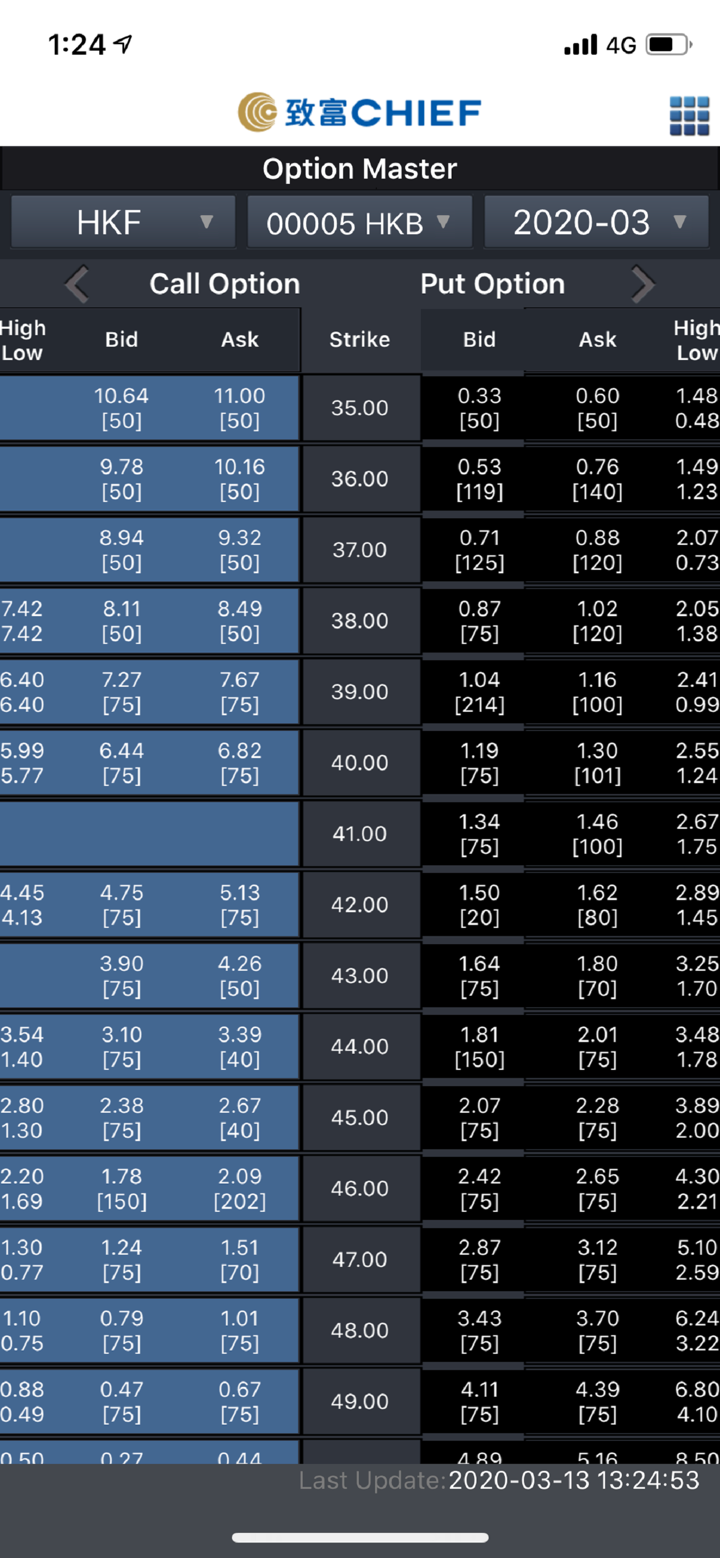

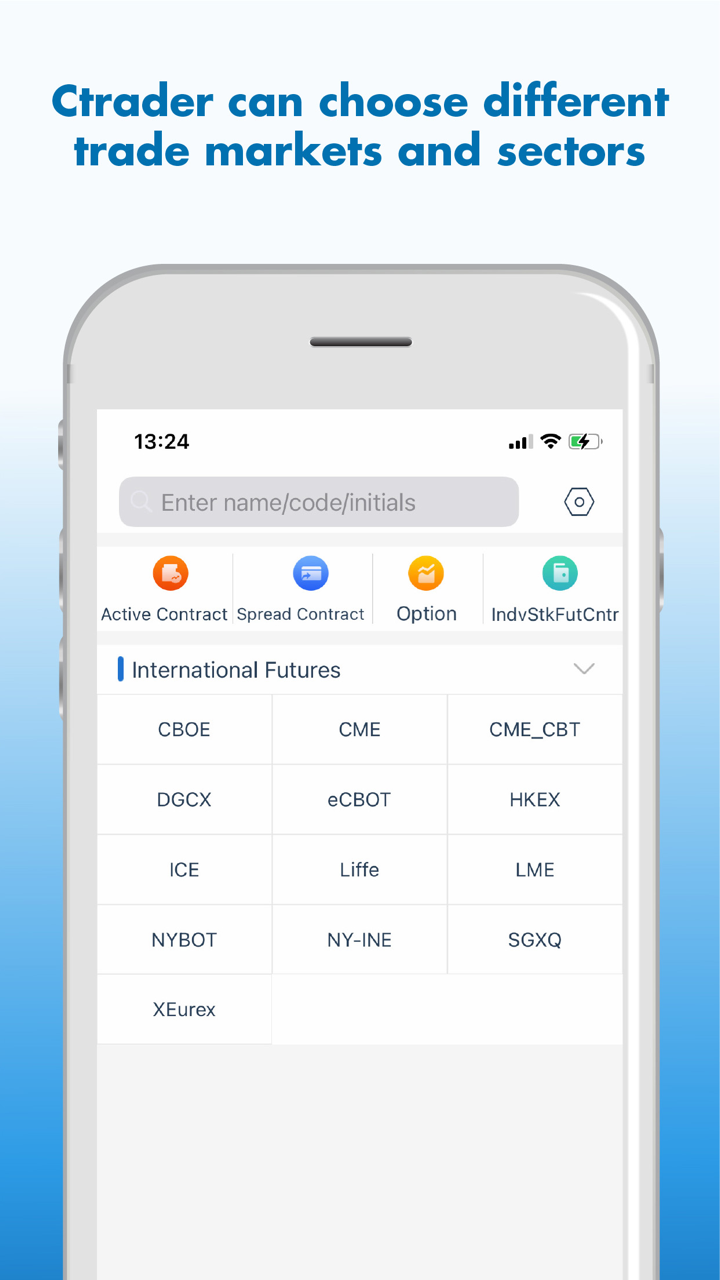

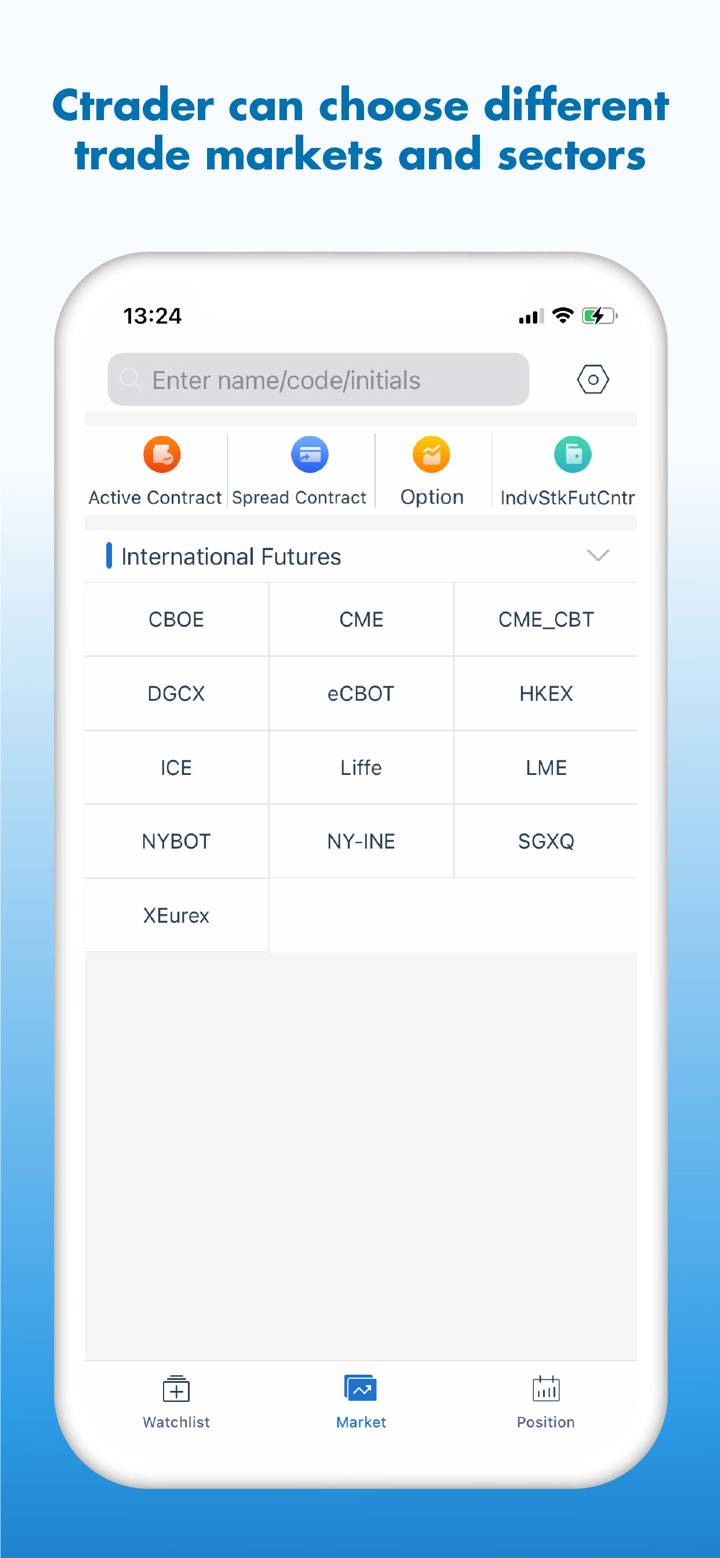

CHIEF पर मैं क्या ट्रेड कर सकता हूँ?

CHIEF आपको सुरक्षा और भविष्य विपणन में सहायता प्रदान करता है।

| व्यापार्य उपकरण | समर्थित |

| सुरक्षा | ✔ |

| भविष्य | ✔ |

| विदेशी मुद्रा | ❌ |

| महंगे धातु और कमोडिटीज | ❌ |

| सूचकांक | ❌ |

| बंध | ❌ |

| ईटीएफ | ❌ |

खाता प्रकार

CHIEF ने खाता जानकारी प्रदान नहीं की। हालांकि, समर्थित खाता खोलने के तरीके "दूरस्थ खाता खोलने पास" अपॉइंटमेंट, व्यक्तिगत और मेल खाता खोलने हैं। आप इस पर देख सकते हैं: https://www.chiefgroup.com.hk/hk/account?apply=e-account

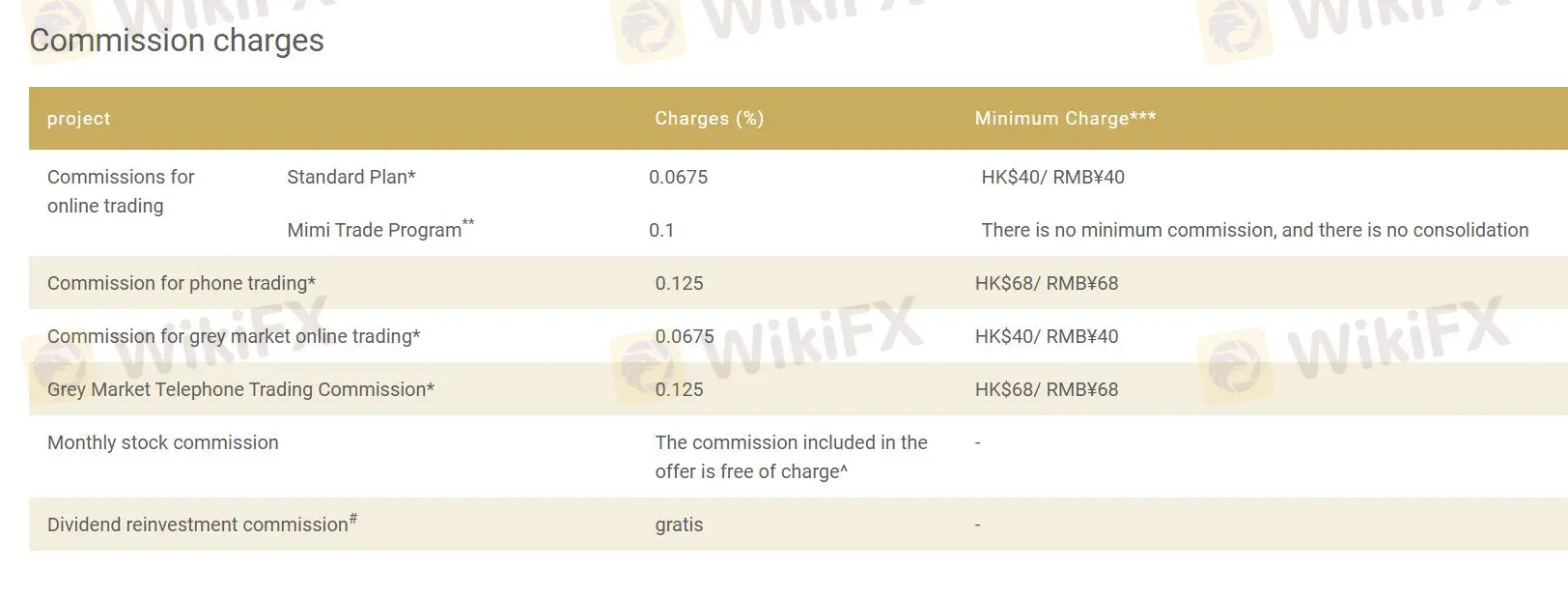

CHIEF शुल्क

CHIEF कुछ परियोजनाओं को कमीशन मुक्त भी समर्थन करता है, और परियोजना की कमीशन दर 0.2% से अधिक नहीं होती है। न्यूनतम शुल्क HK $40 से HK $68 और RMB ¥40 से RMB ¥68 तक होता है।

| परियोजना | शुल्क (%) | न्यूनतम शुल्क**** |

| ऑनलाइन ट्रेडिंग के लिए कमीशन | ||

| मानक योजना* | 0.0675 | HK$40 / RMB¥40 |

| मिमी ट्रेड प्रोग्राम** | 0.1 | कोई न्यूनतम कमीशन, कोई संयोजन नहीं |

| फोन ट्रेडिंग के लिए कमीशन* | 0.125 | HK$68 / RMB¥68 |

| ग्रे मार्केट ऑनलाइन ट्रेडिंग के लिए कमीशन* | 0.0675 | HK$40 / RMB¥40 |

| ग्रे मार्केट टेलीफोन ट्रेडिंग कमीशन* | 0.125 | HK$68 / RMB¥68 |

| मासिक स्टॉक कमीशन | प्रस्ताव में शामिल कमीशन मुक्त है* | - |

| डिविडेंड पुनर्निवेशन कमीशन# | मुफ्त | - |

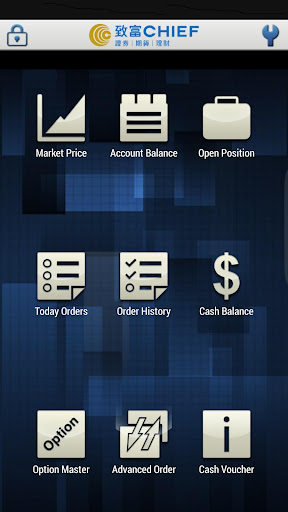

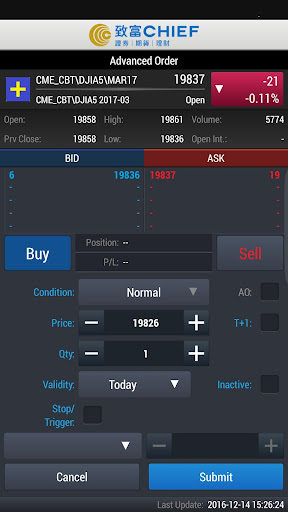

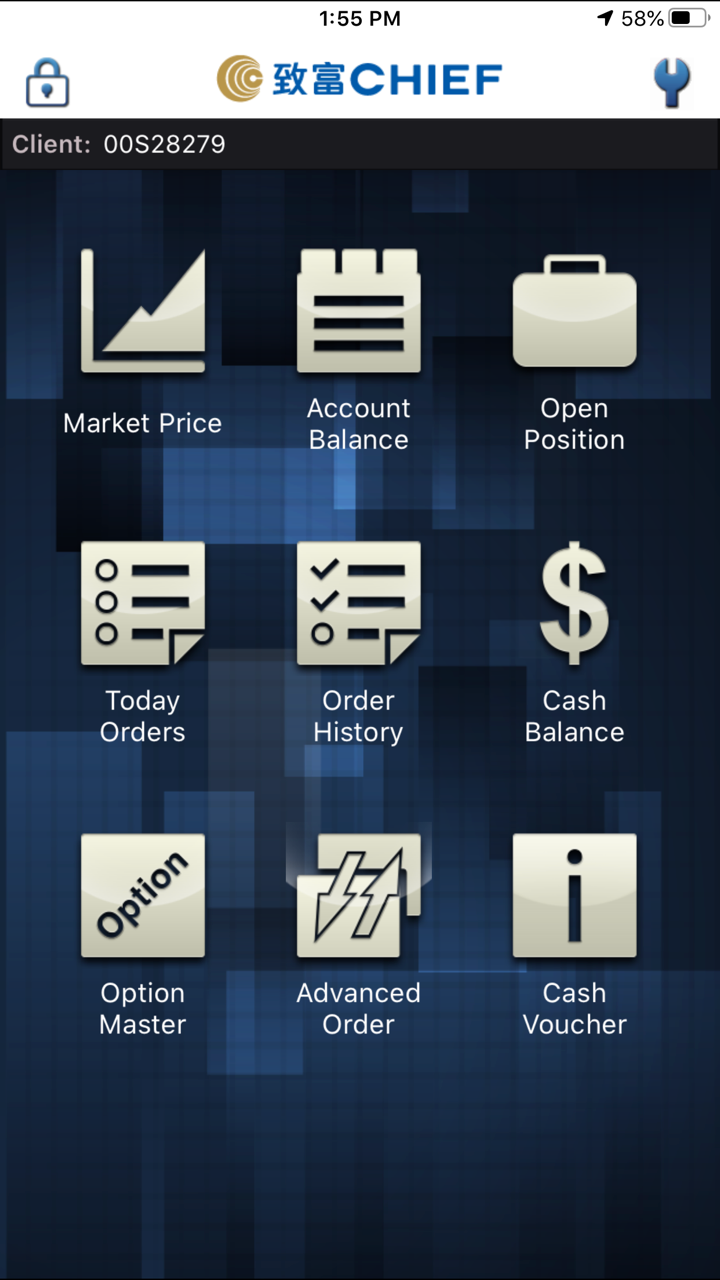

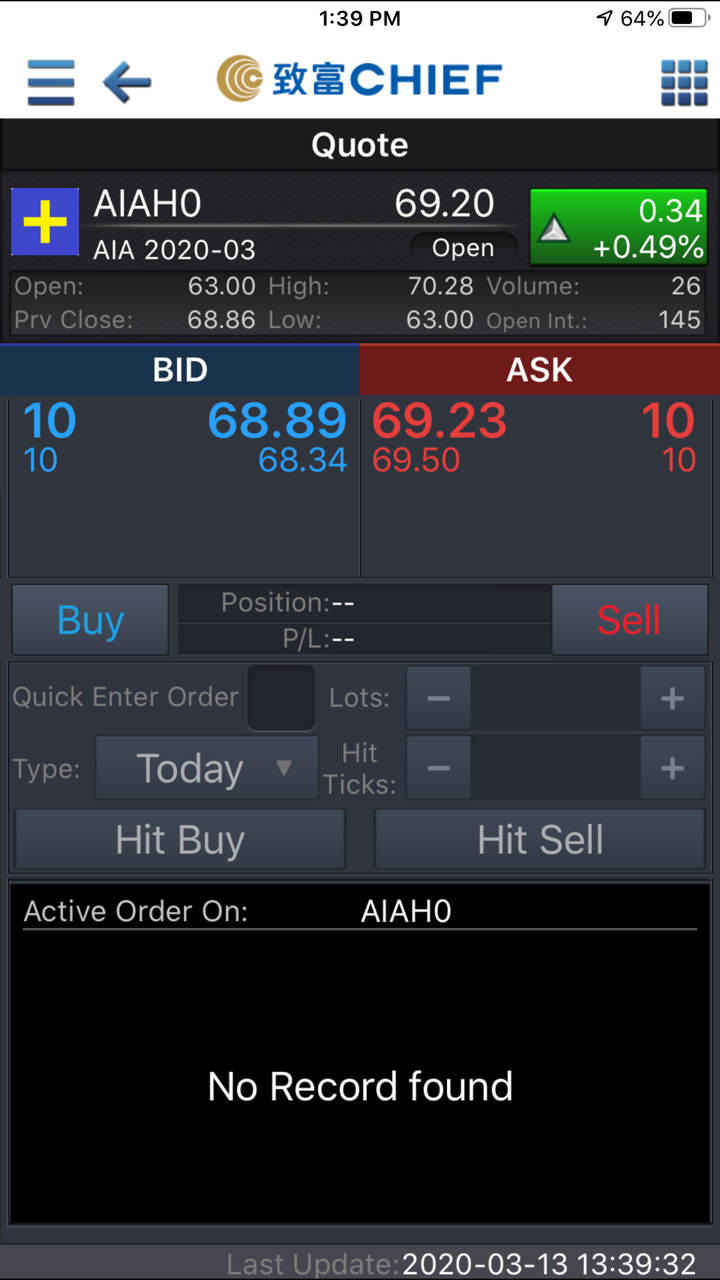

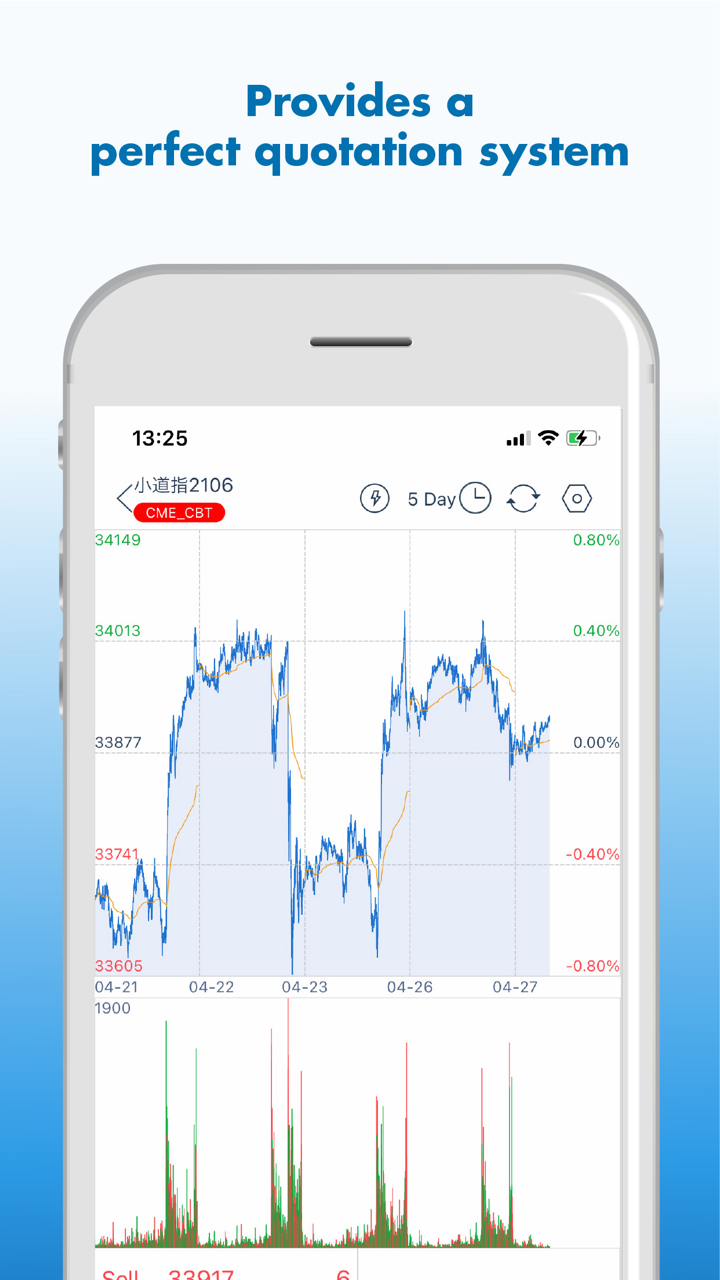

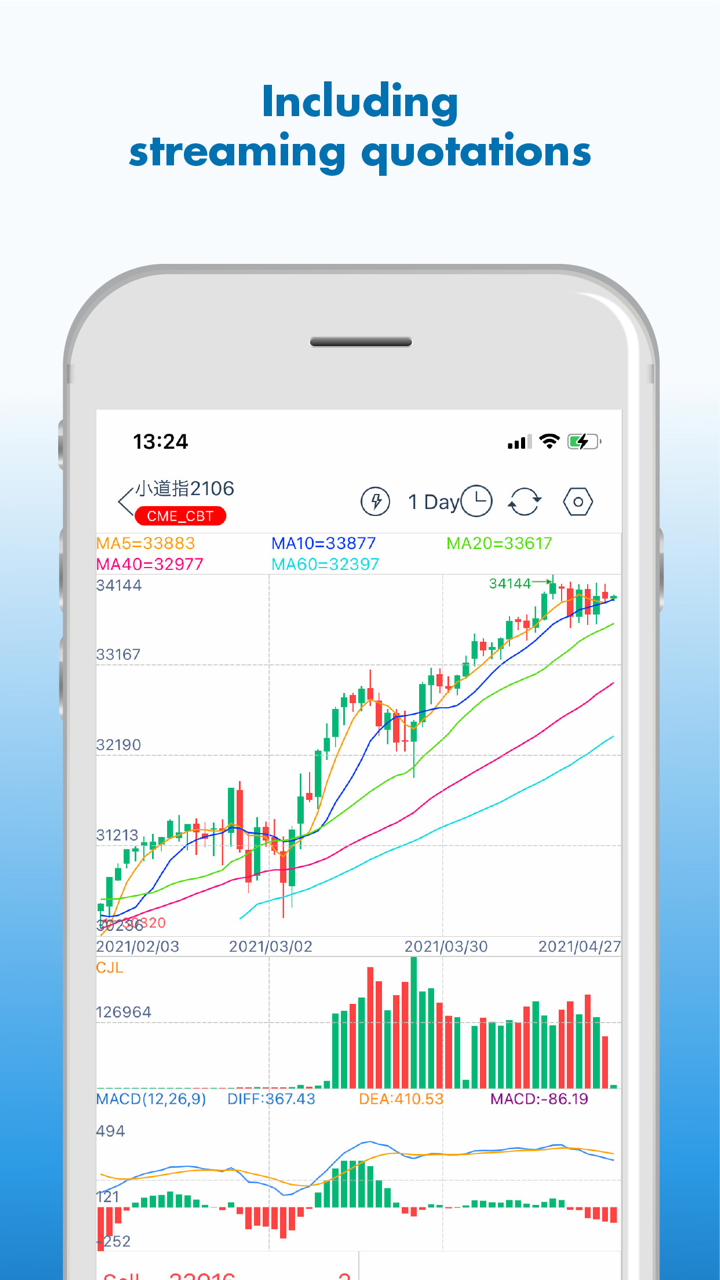

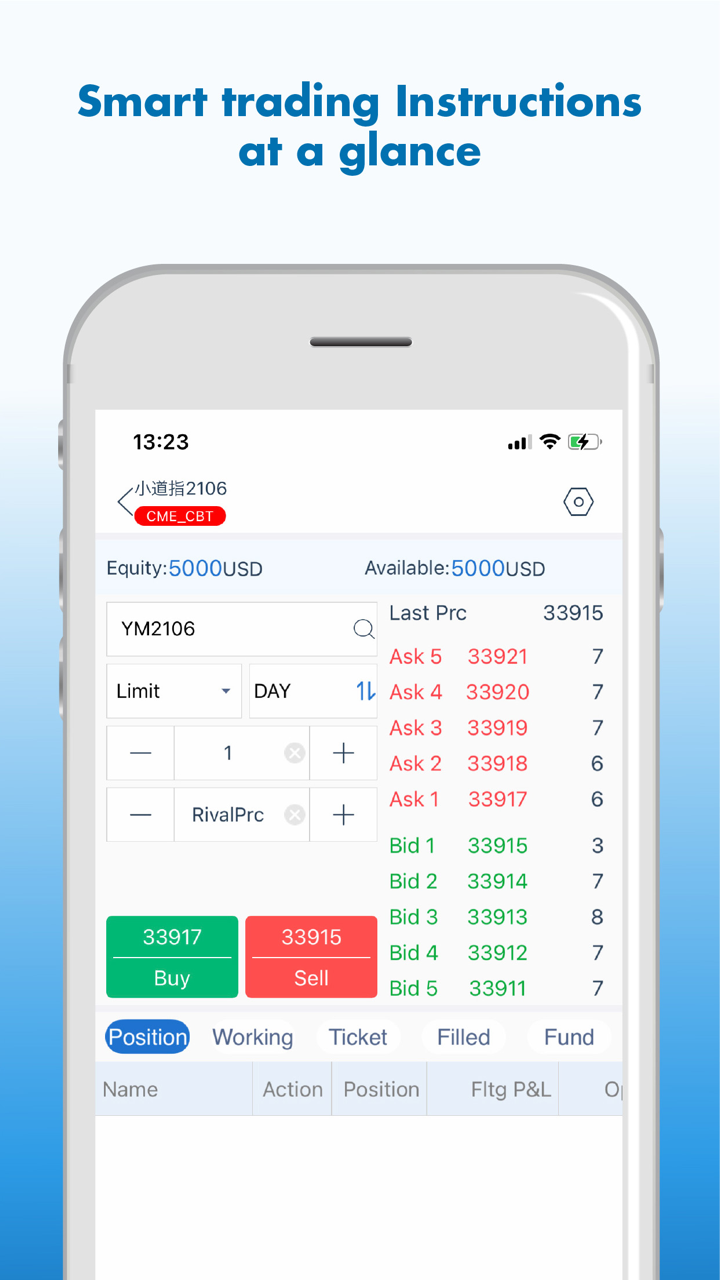

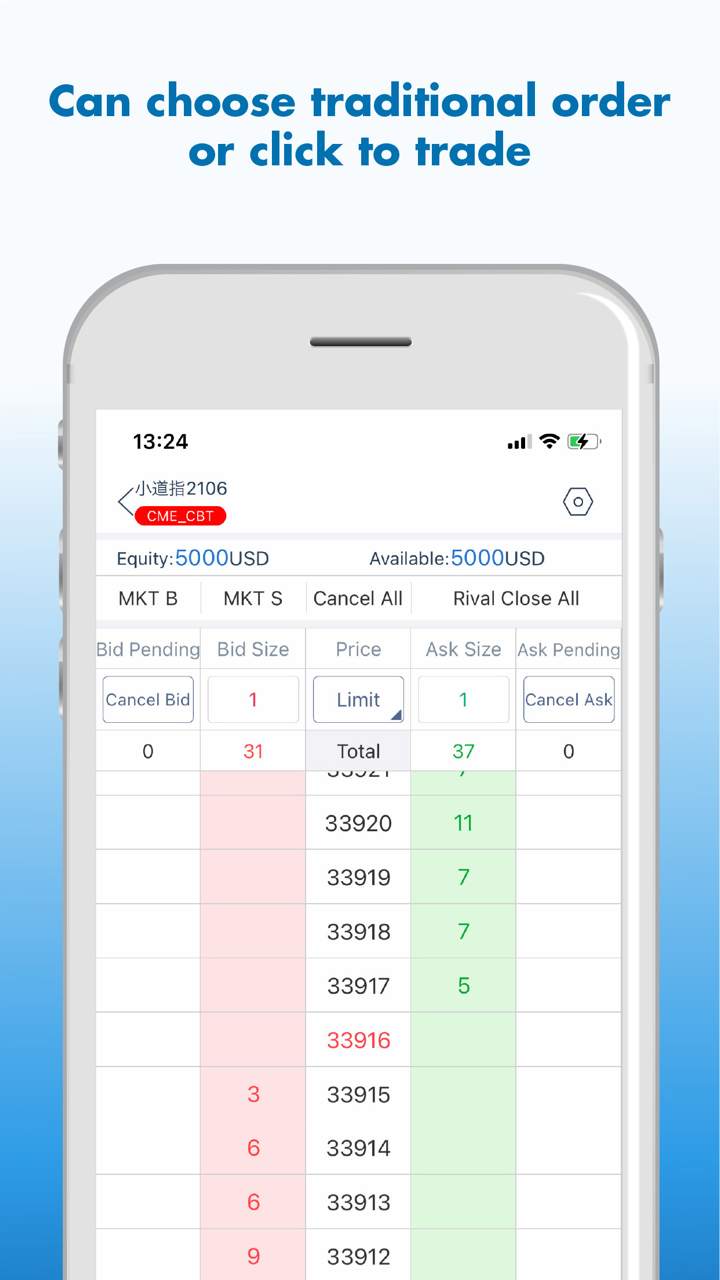

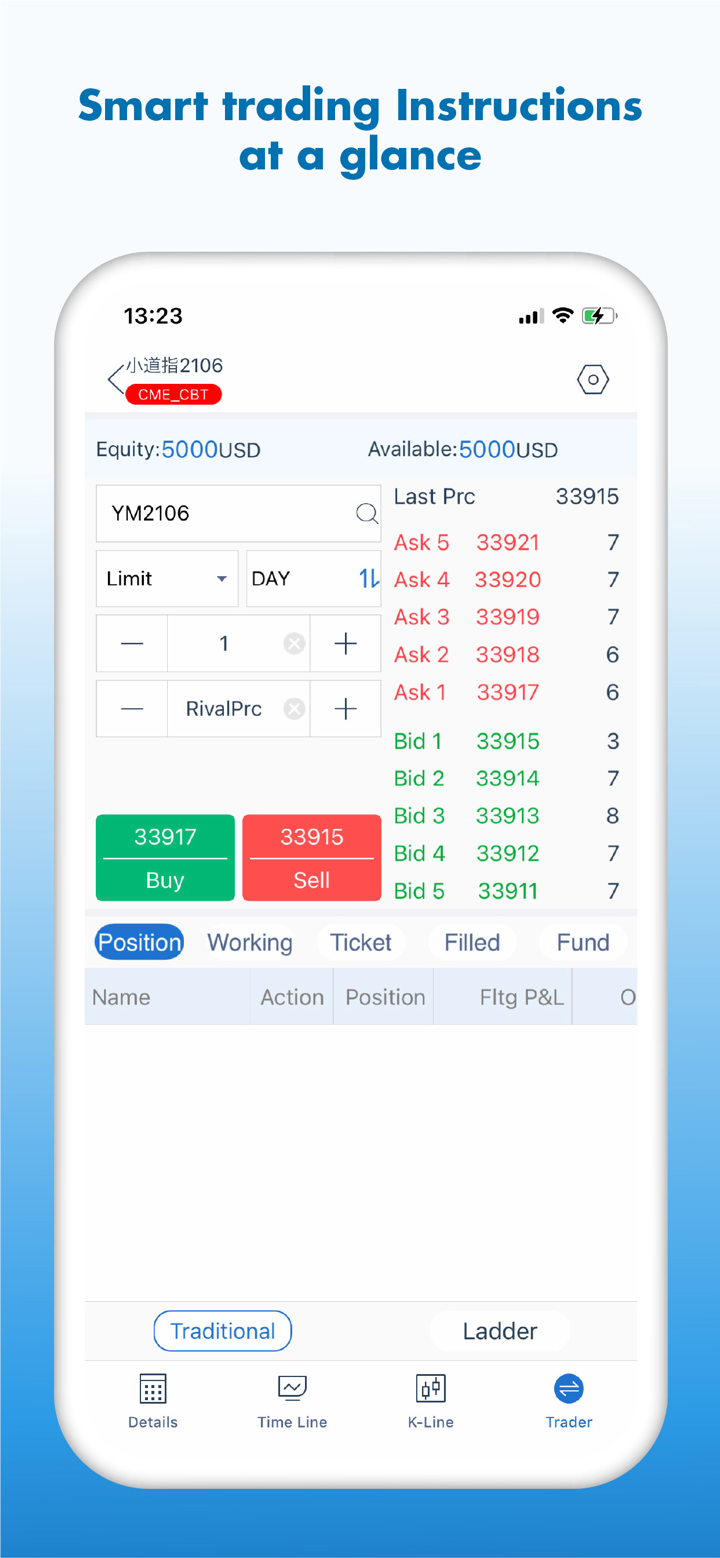

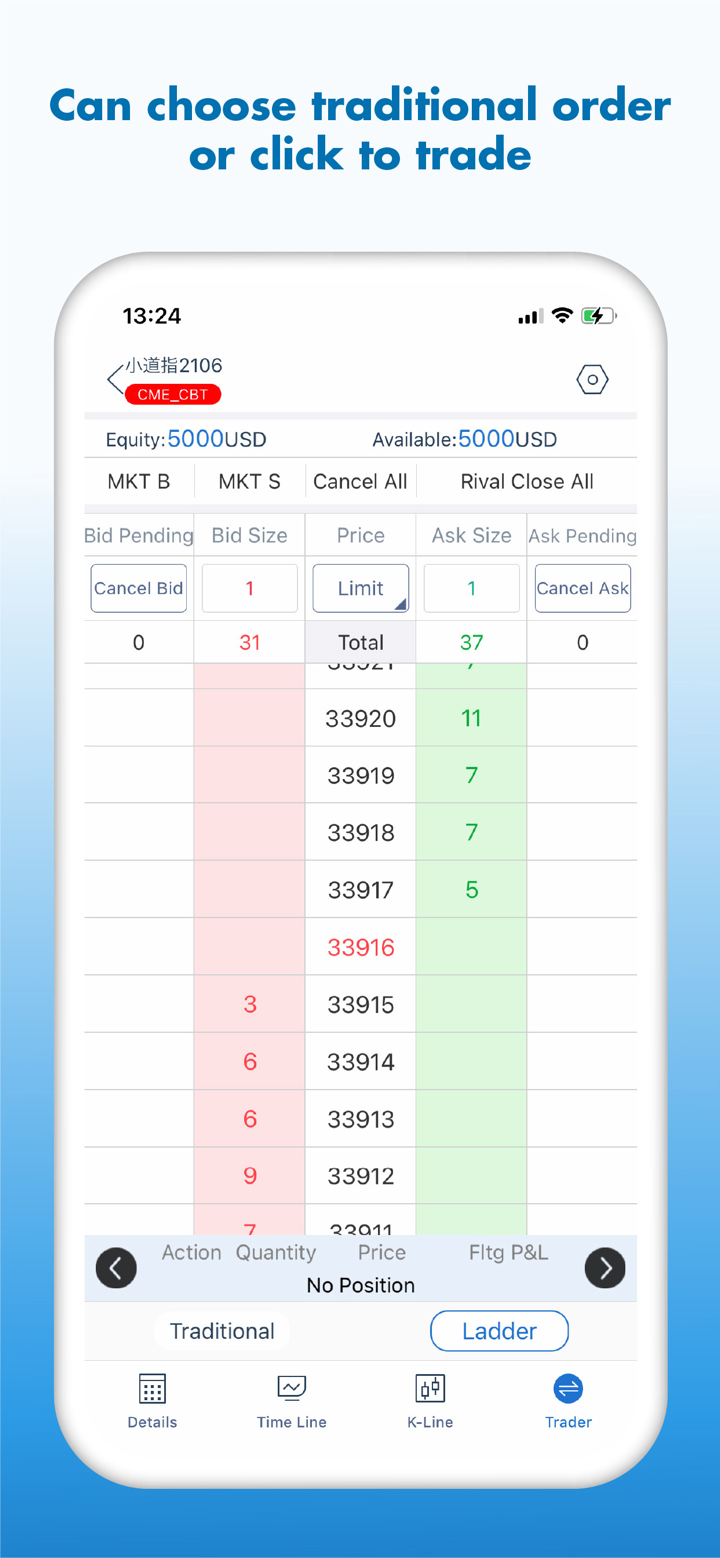

ट्रेडिंग प्लेटफॉर्म

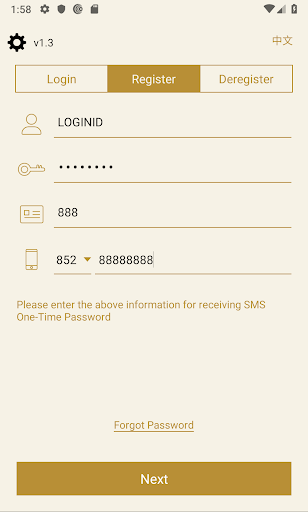

CHIEF अपने खुद के प्लेटफॉर्म Chief Deal का उपयोग मोबाइल पर कर सकता है।

| ट्रेडिंग प्लेटफॉर्म | समर्थित | उपलब्ध उपकरण | के लिए उपयुक्त |

| Chief Deal | ✔ | मोबाइल | सभी ट्रेडर्स |

| MT4 | ❌ | ||

| MT5 | ❌ |

जमा और निकासी

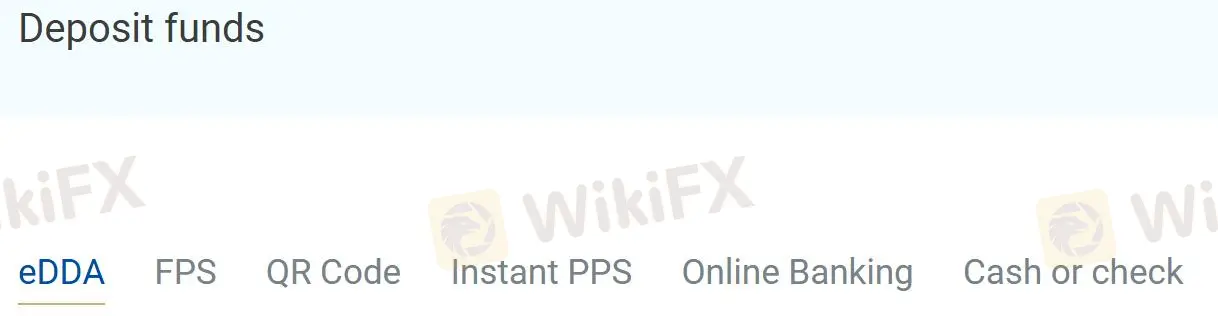

CHIEF 6 जमा विधियाँ प्रदान करता है: eDDA, FPS, QR कोड, तत्काल PPS, ऑनलाइन बैंकिंग, नकद या चेक।

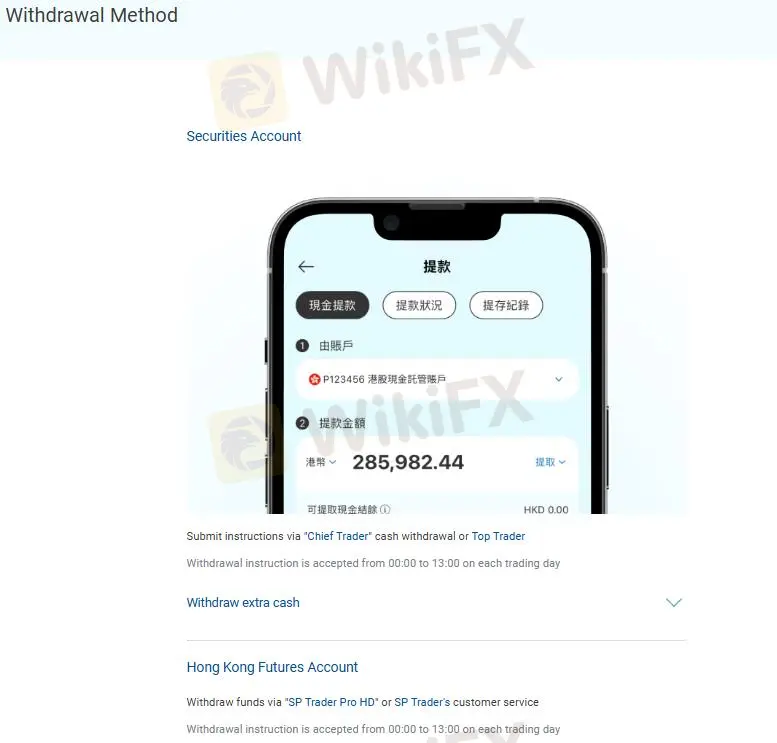

निकासी के लिए निर्देश प्रस्तुत करने की आवश्यकता होती है विनिर्देशों के माध्यम से "Chief Trader" नकद निकासी या Top Trader, या "SP Trader Pro HD" या SP Trader की ग्राहक सेवा के माध्यम से निधि निकासी।