Unternehmensprofil

| CHIEFÜberprüfungszusammenfassung | |

| Gegründet | 1979 |

| Registriertes Land/Region | Hongkong |

| Regulierung | Reguliert |

| Marktinstrumente | WertpapiereFutures |

| Demokonto | ❌ |

| Hebelwirkung | / |

| Spread | / |

| Handelsplattform | Chief Deal |

| Mindesteinzahlung | / |

| Kundensupport | E-Mail: cs@chiefgroup.com.hk |

| Soziale Medien: Facebook, Linkedin, Youtube, Whatsapp, Wechat | |

CHIEF Informationen

CHIEF, gegründet in Hongkong im Jahr 1979. Es wird derzeit von der SFC reguliert, bietet hauptsächlich Wertpapier- und Futures-Handel an und verfügt über eine eigene Handelsplattform.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert durch die SFC | MT4/5 wird nicht unterstützt |

| Demo-Konten sind nicht verfügbar |

Ist CHIEF legitim?

| Reguliertes Land/Region |  |

| Regulierungsbehörde | SFC |

| Reguliertes Unternehmen | Chief Commodities Limited |

| Lizenztyp | Handel mit Futures-Kontrakten |

| Lizenznummer | AAZ607 |

| Aktueller Status | Reguliert |

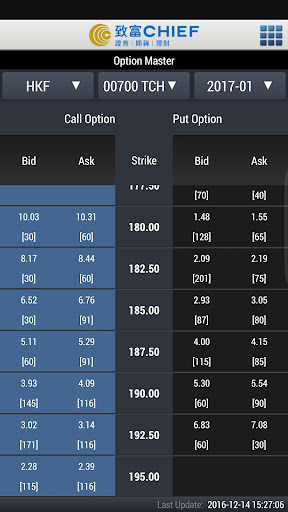

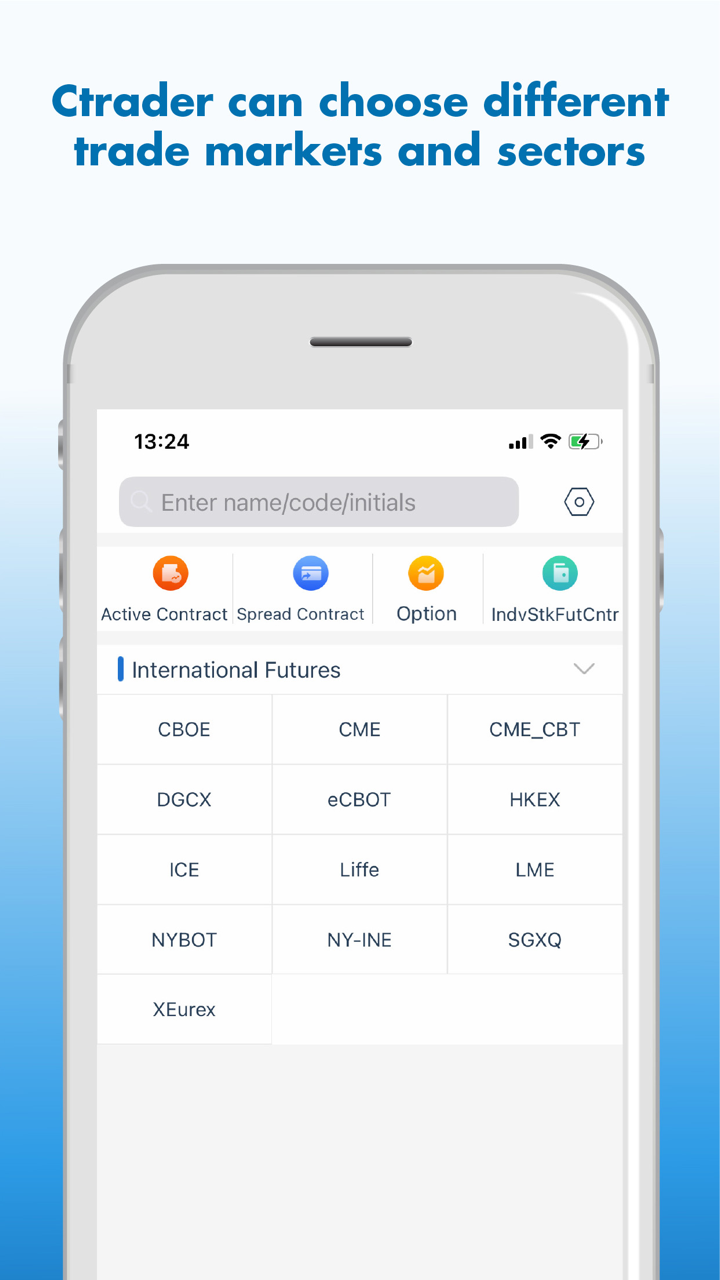

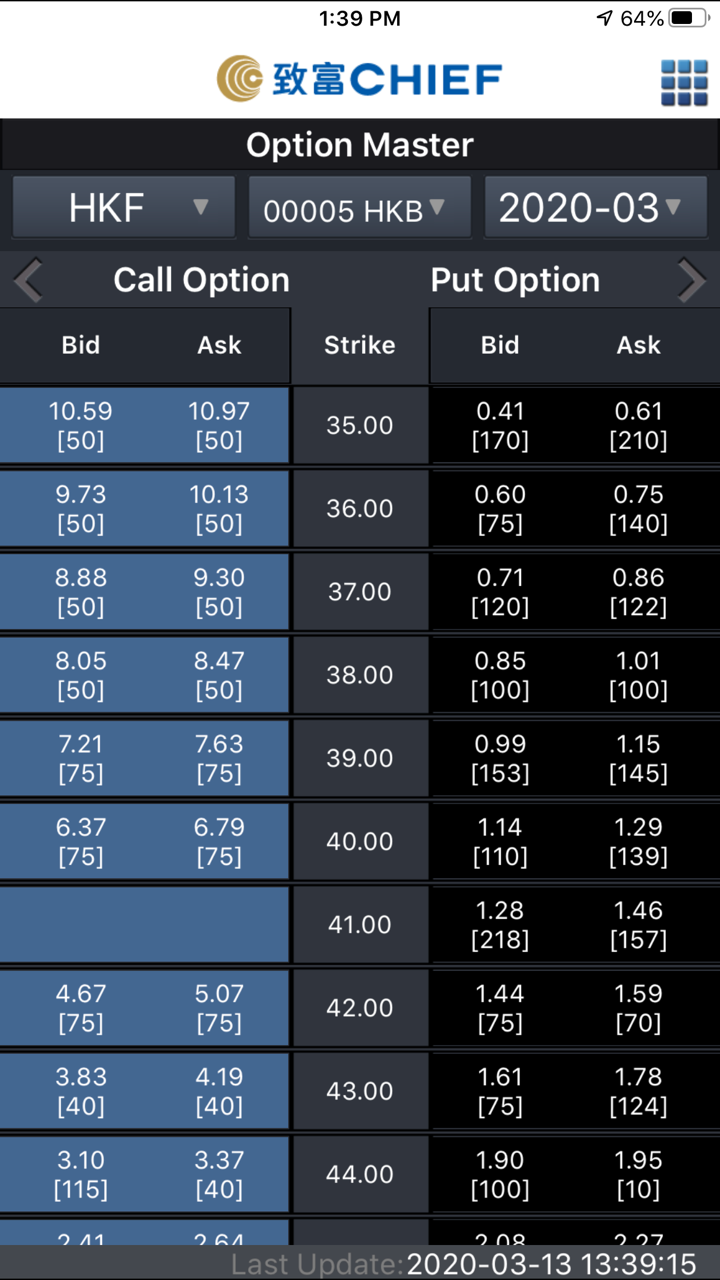

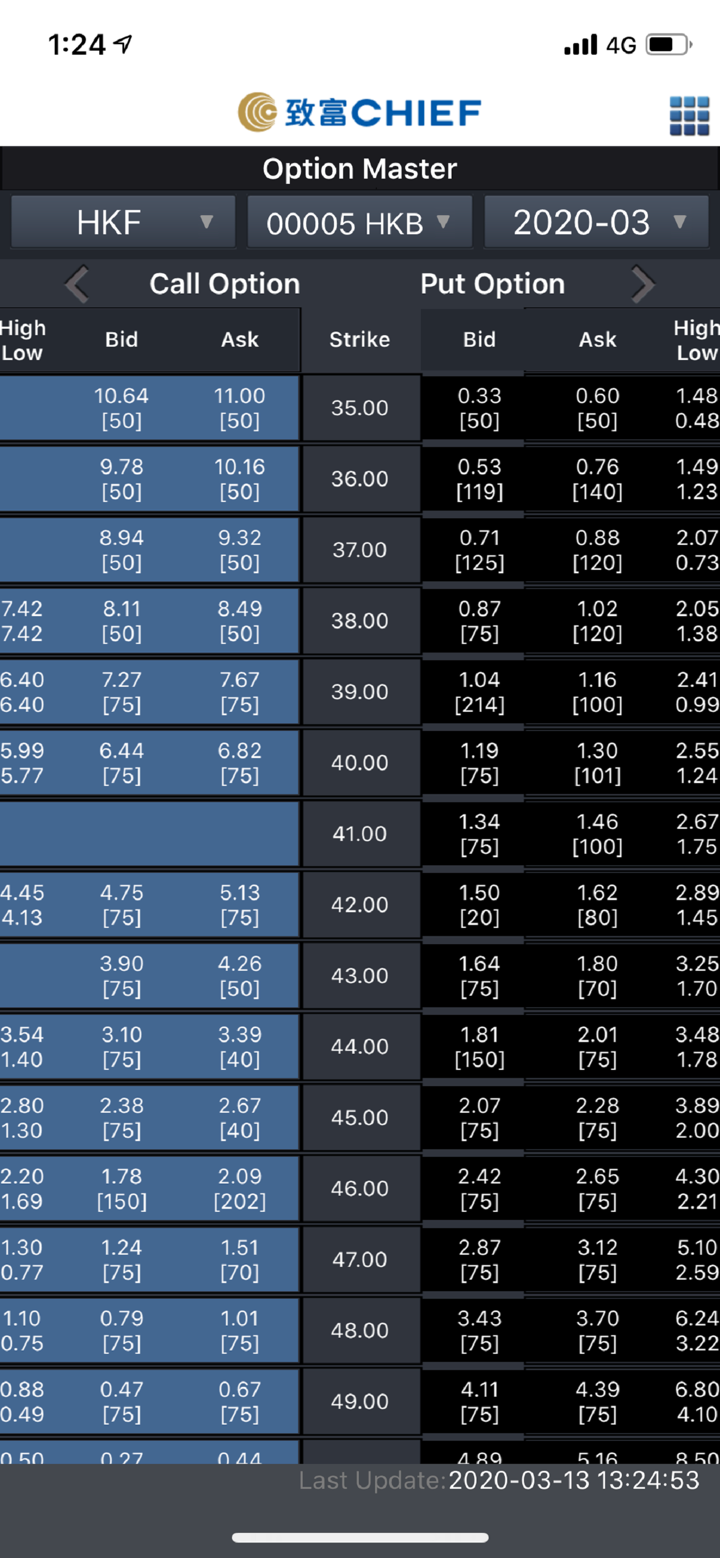

Was kann ich bei CHIEF handeln?

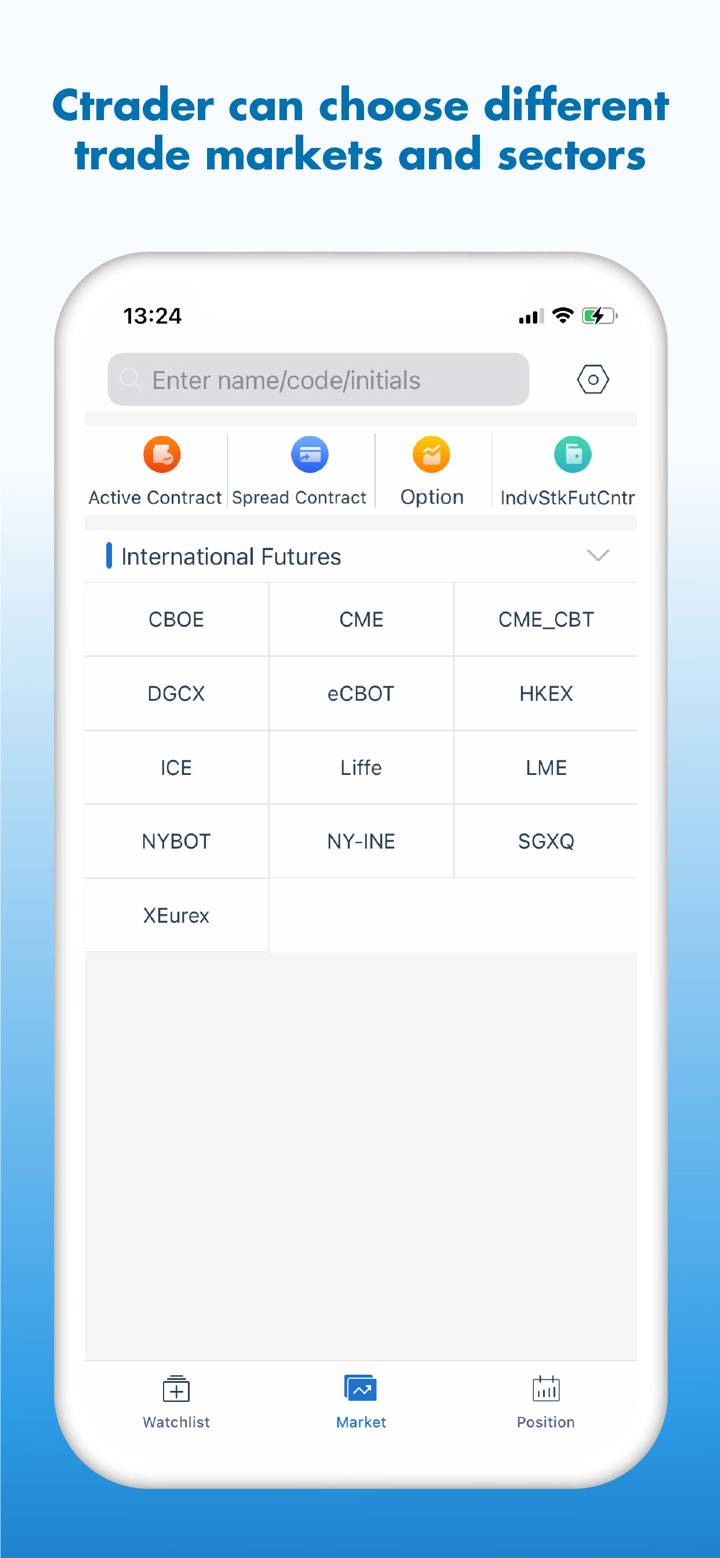

CHIEF unterstützt Sie beim Wertpapier- und Futures-Handel.

| Handelbare Instrumente | Unterstützt |

| Wertpapiere | ✔ |

| Futures | ✔ |

| Devisen | ❌ |

| Edelmetalle & Rohstoffe | ❌ |

| Indizes | ❌ |

| Anleihen | ❌ |

| ETF | ❌ |

Kontotypen

CHIEF hat keine Kontoinformationen bereitgestellt. Die unterstützten Methoden zur Kontoeröffnung sind jedoch "Remote-Kontoeröffnungspass" Termine, persönliche Kontoeröffnung und Kontoeröffnung per Post. Sie können sich hierzu informieren: https://www.chiefgroup.com.hk/hk/account?apply=e-account

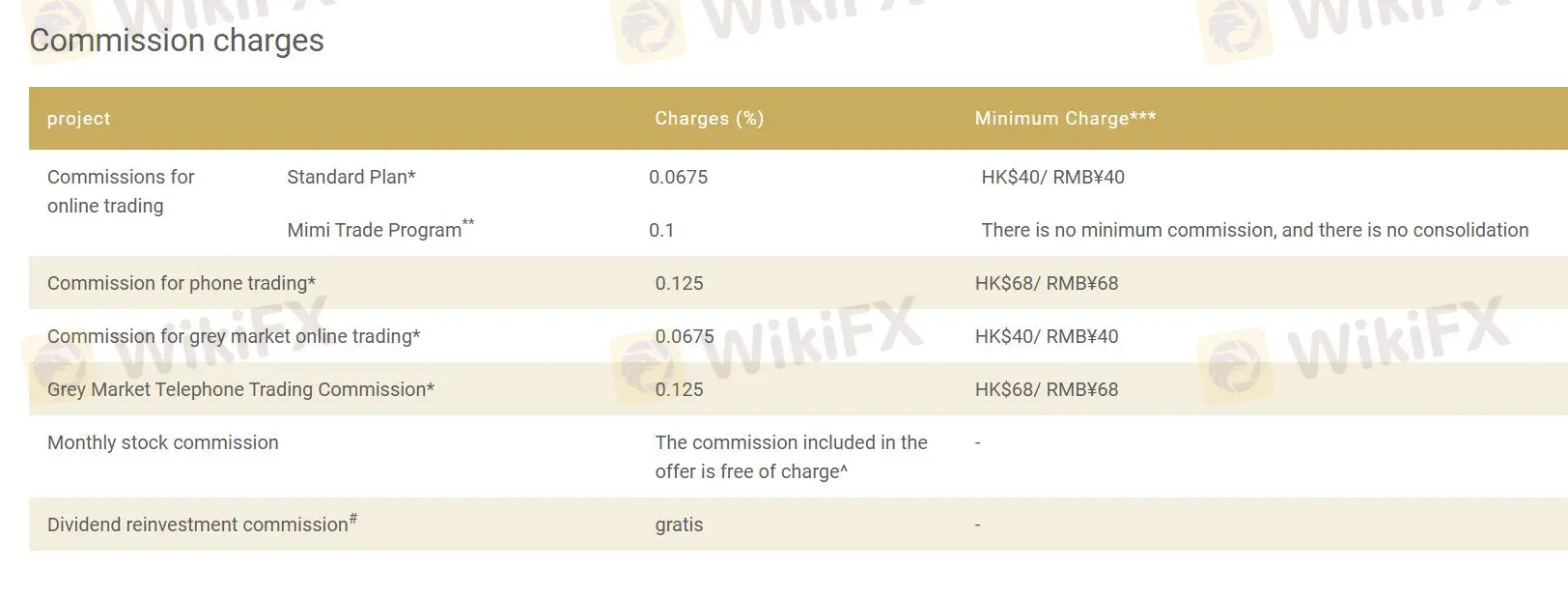

CHIEF Gebühren

CHIEF unterstützt einige Projekte ohne Provision, und der Provisionssatz des Projekts beträgt höchstens 0,2%. Die Mindestgebühr liegt zwischen HK $40 und HK $68 und RMB ¥40 und RMB ¥68.

| Projekt | Gebühren (%) | Mindestgebühr**** |

| Provisionen für den Online-Handel | ||

| Standardplan* | 0,0675 | HK$40 / RMB¥40 |

| Mimi Trade Programm** | 0,1 | Keine Mindestprovision, keine Konsolidierung |

| Provision für den Telefonhandel* | 0,125 | HK$68 / RMB¥68 |

| Provision für den Graumarkt-Online-Handel* | 0,0675 | HK$40 / RMB¥40 |

| Graumarkt-Telefonhandelsprovision* | 0,125 | HK$68 / RMB¥68 |

| Monatliche Aktienprovision | Die in dem Angebot enthaltene Provision ist kostenlos* | - |

| Dividenden-Wiederanlageprovision# | gratis | - |

Handelsplattform

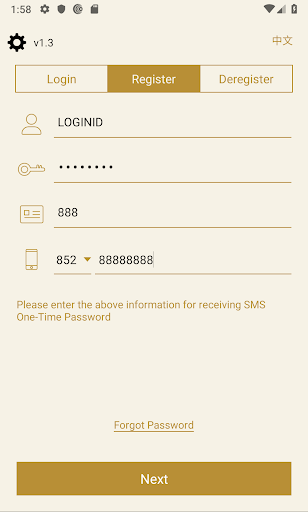

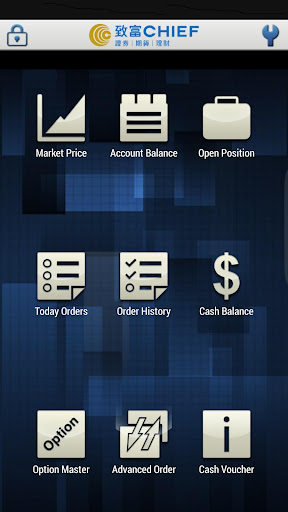

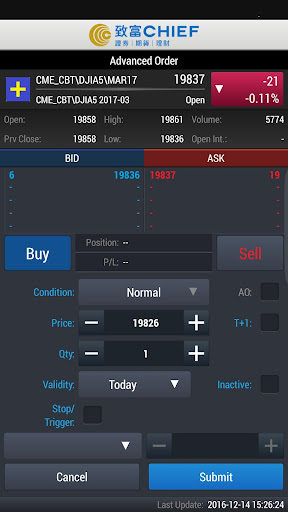

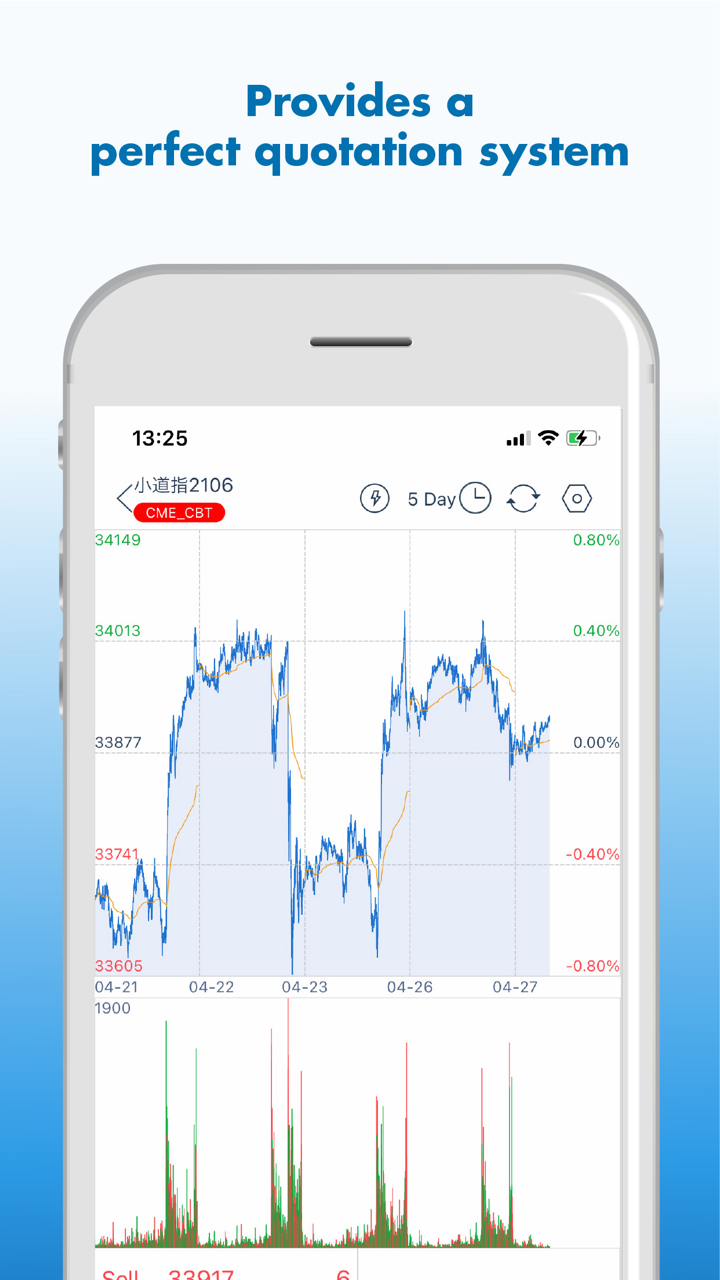

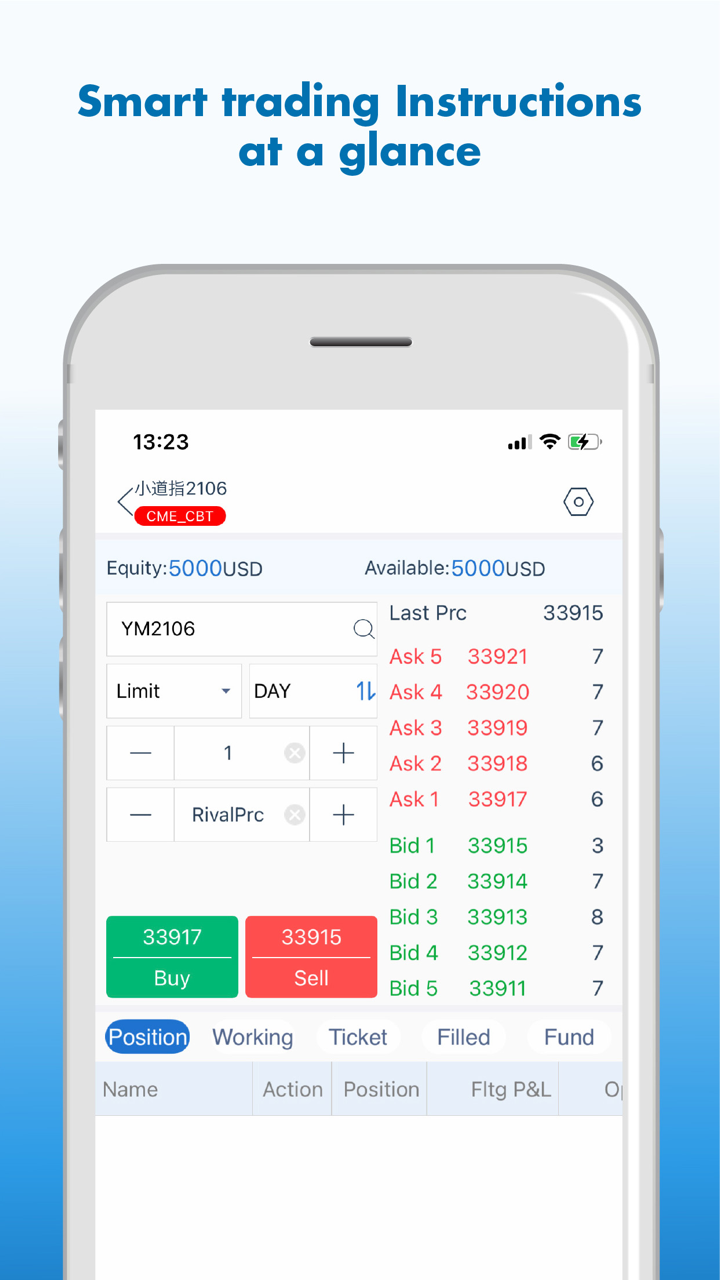

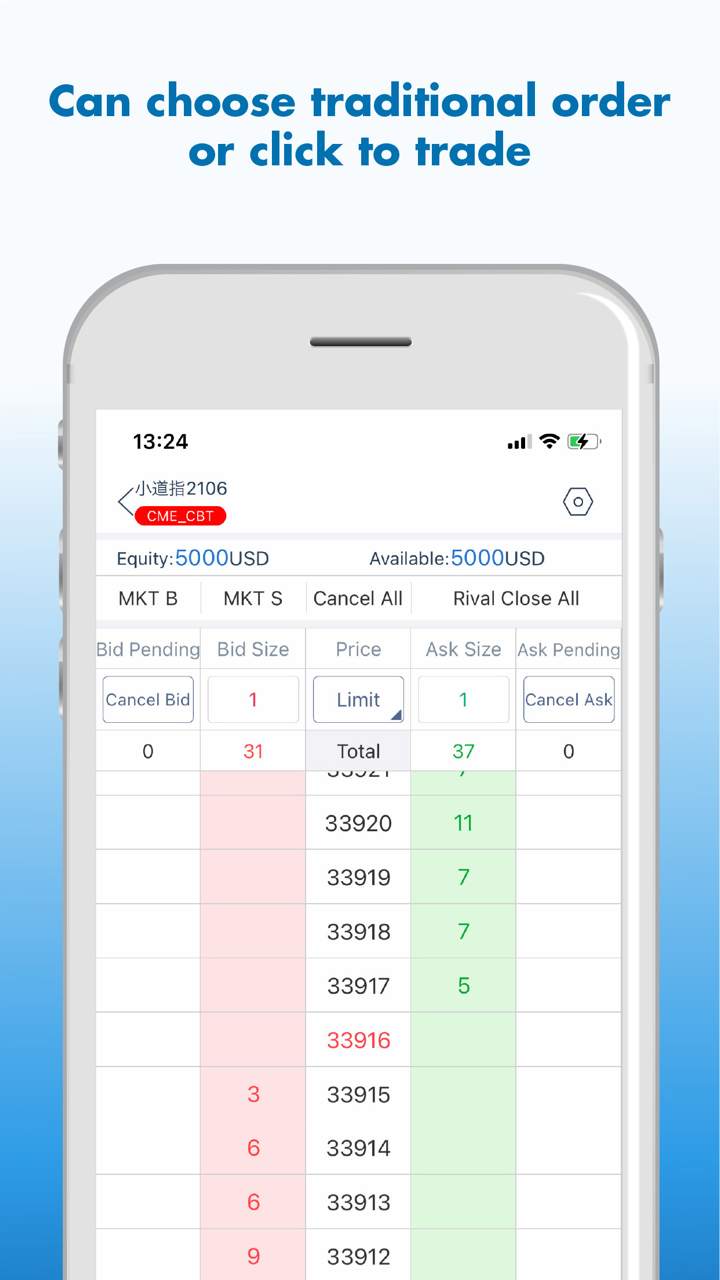

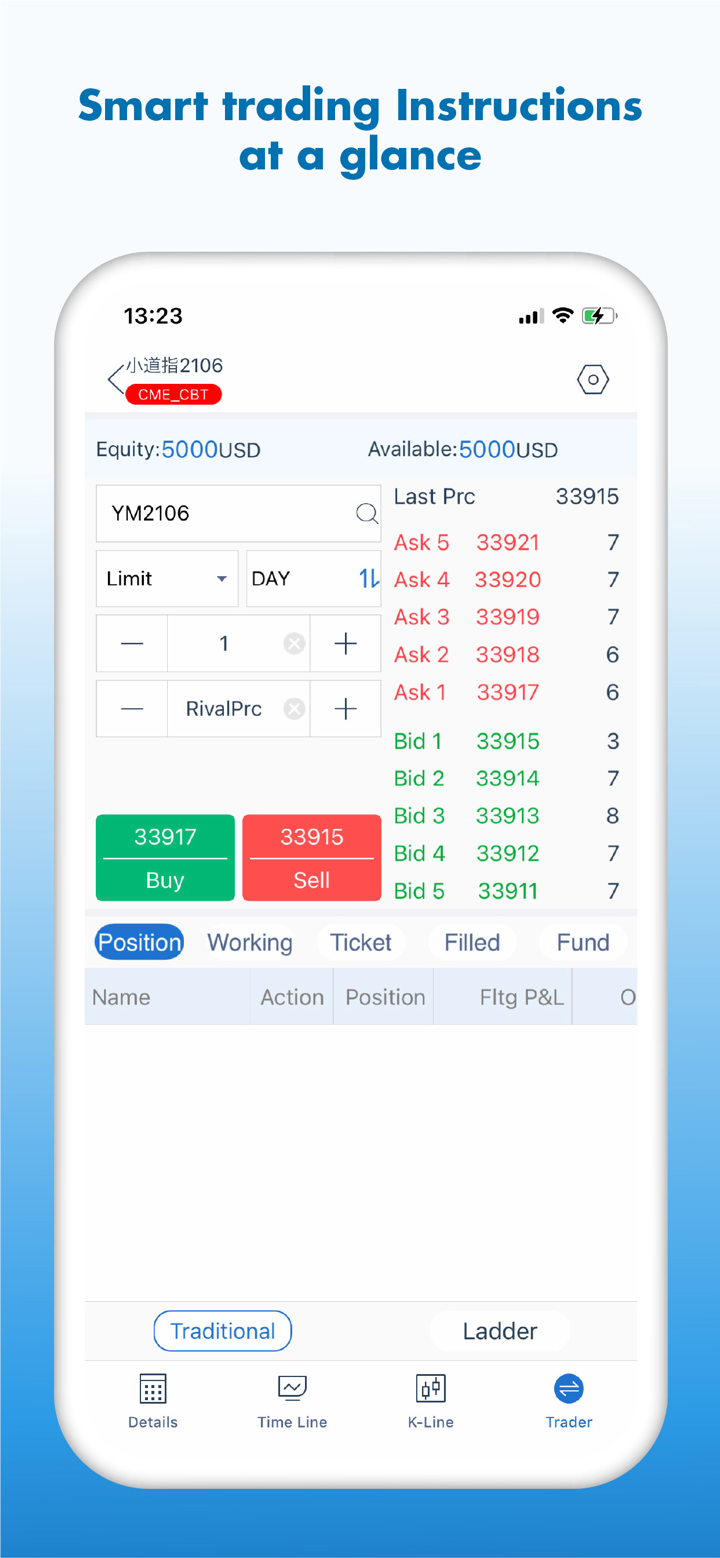

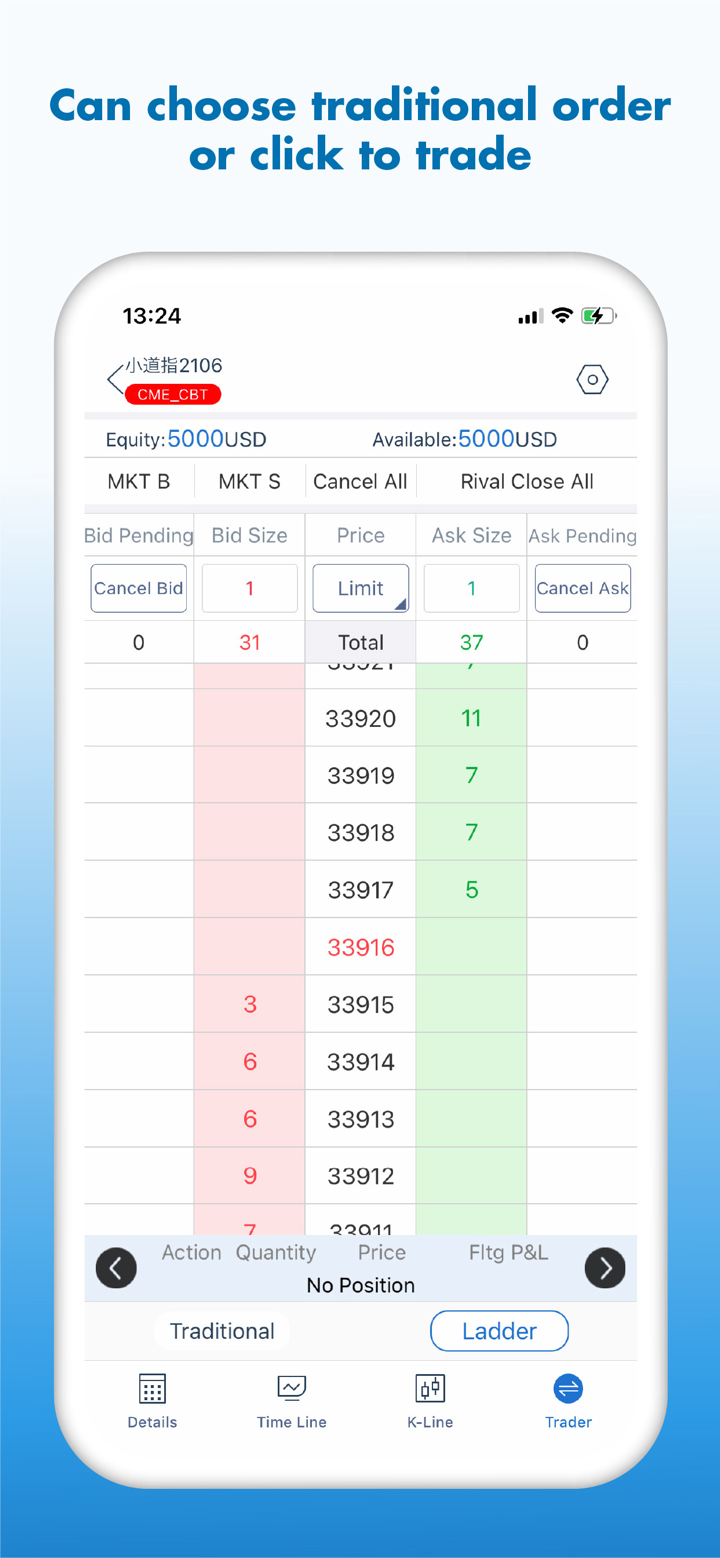

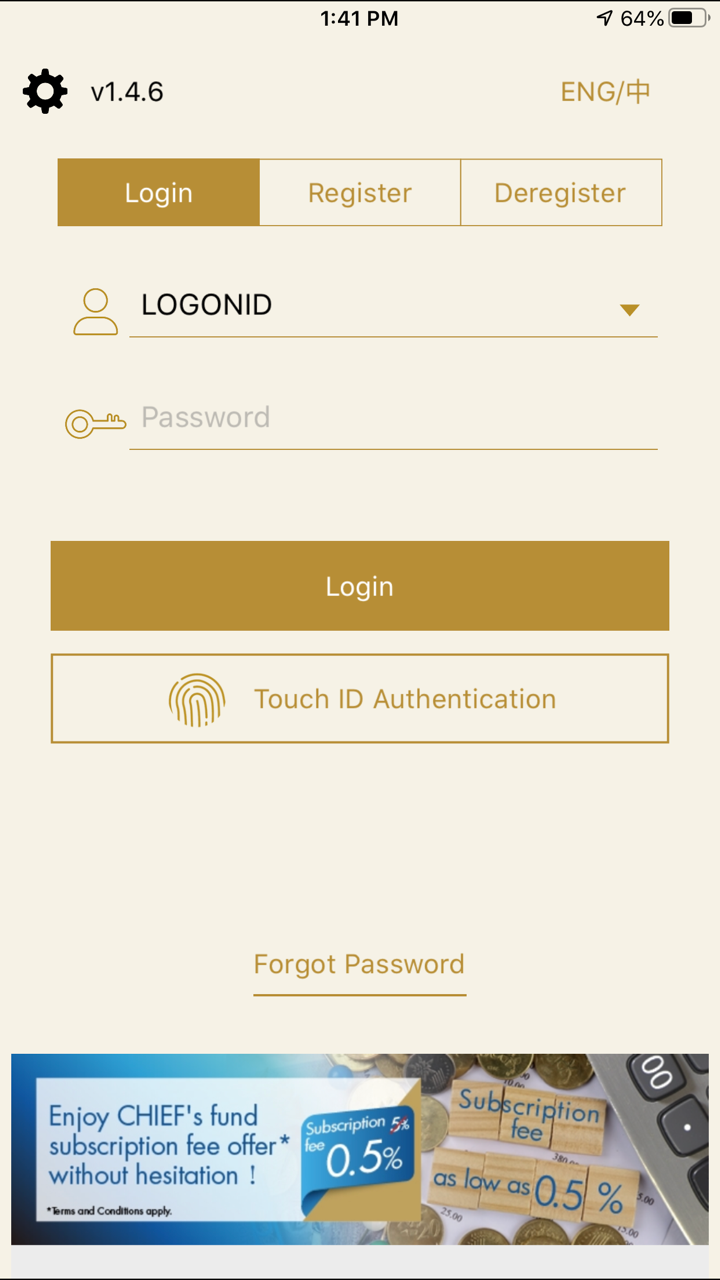

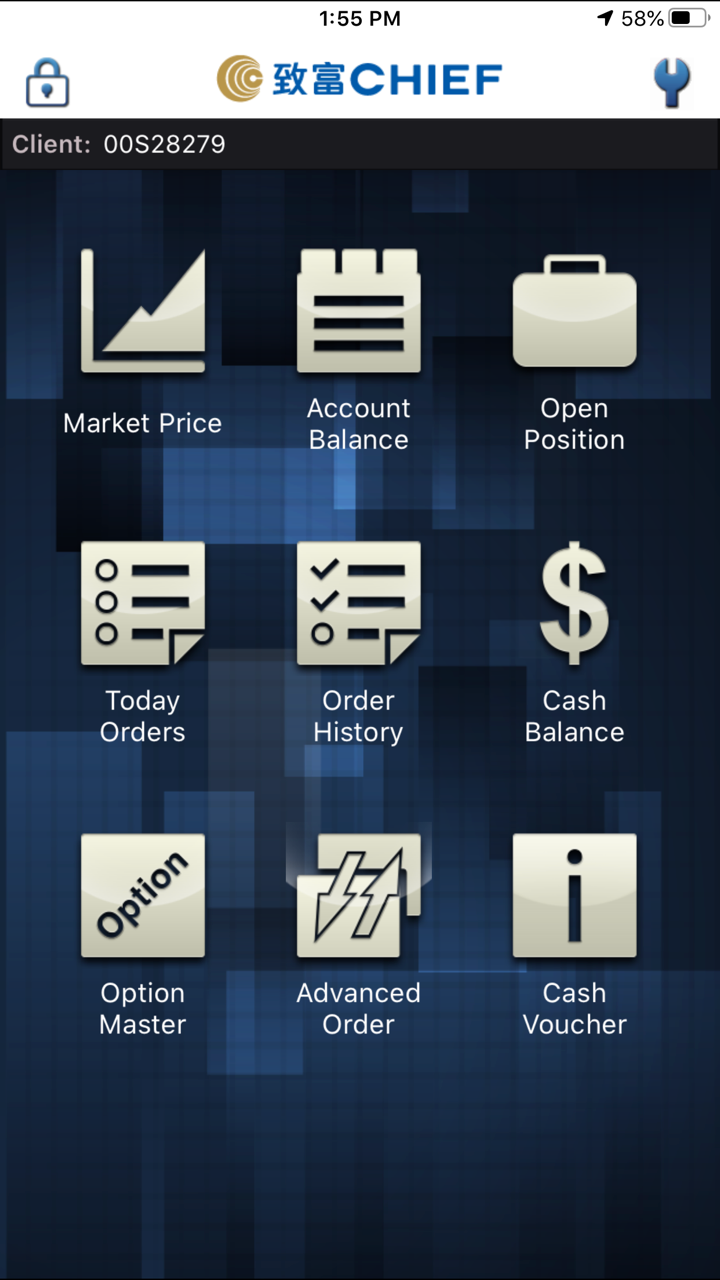

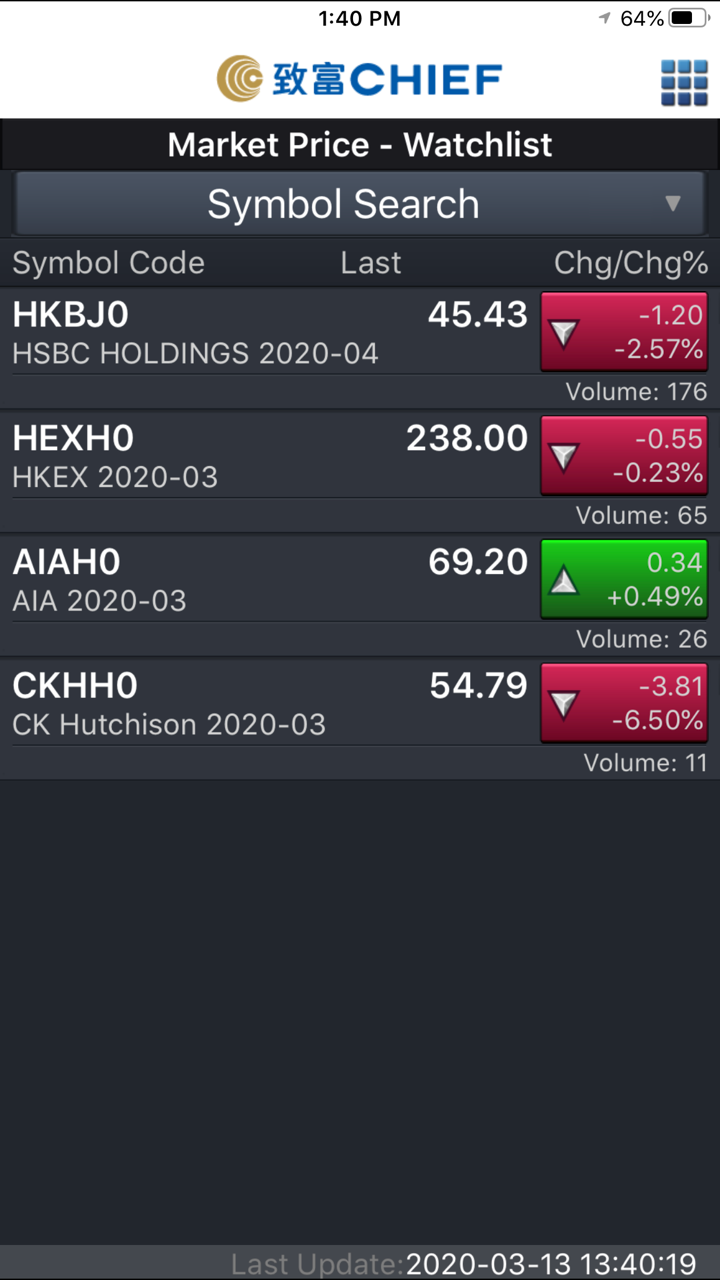

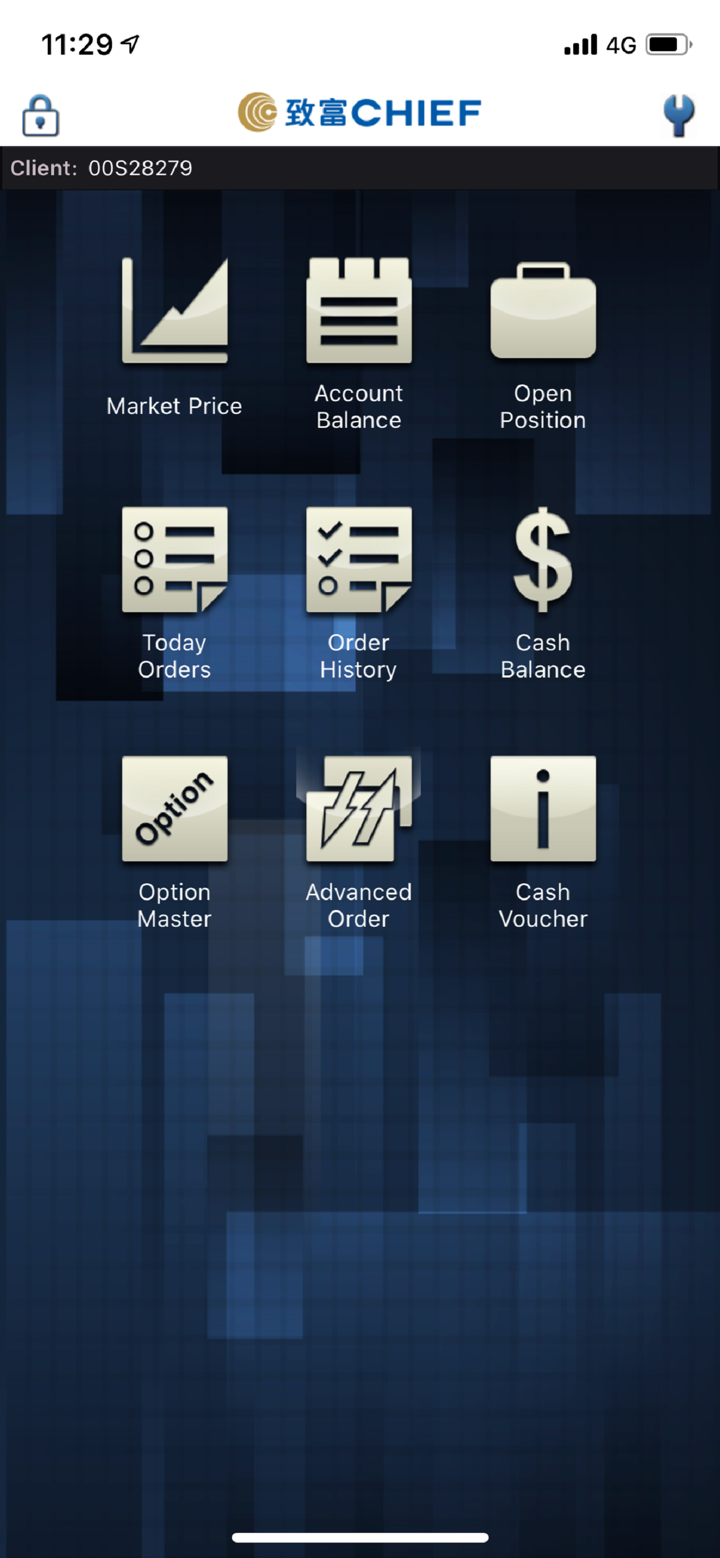

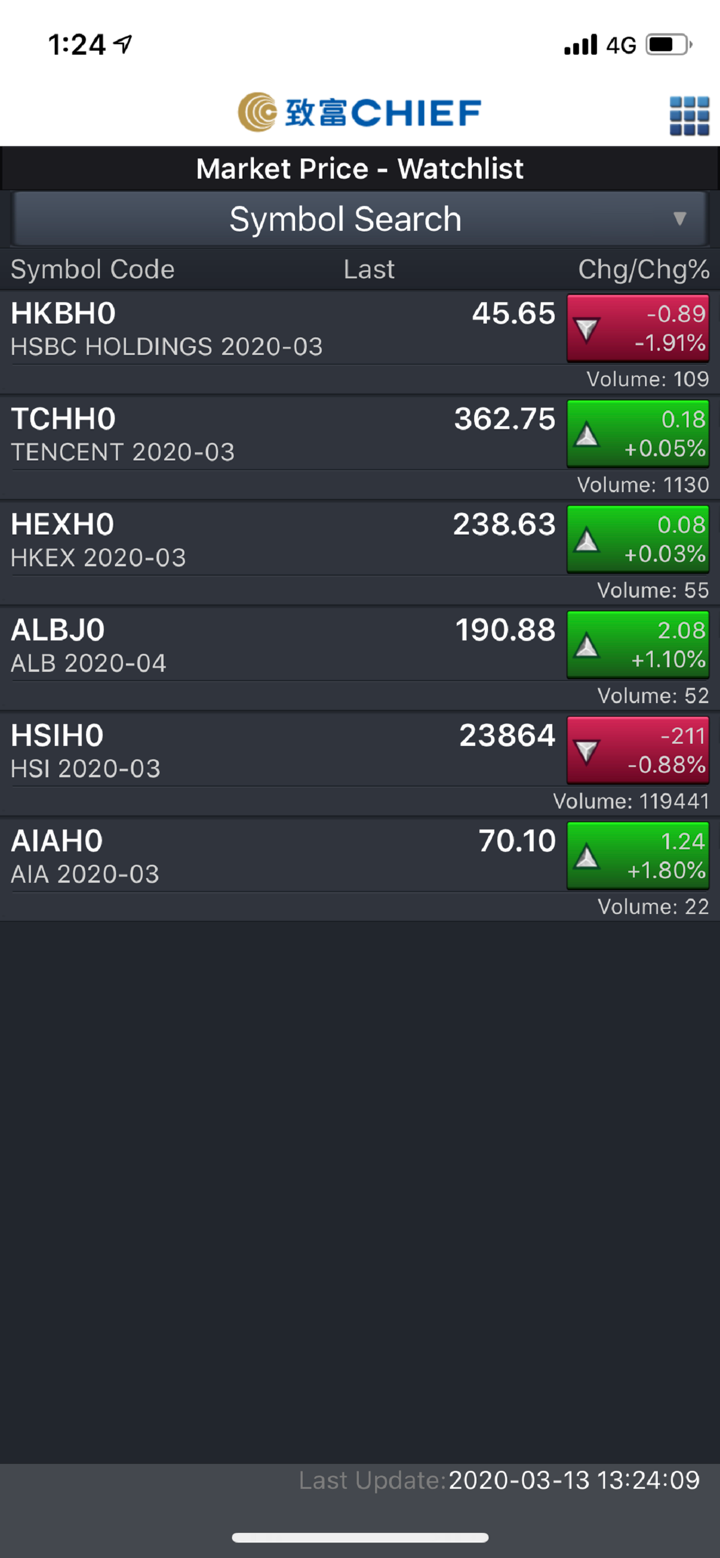

CHIEF bietet seine eigene Plattform Chief Deal an, die auf Mobilgeräten verwendet werden kann.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Chief Deal | ✔ | Mobilgeräte | Alle Trader |

| MT4 | ❌ | ||

| MT5 | ❌ |

Ein- und Auszahlung

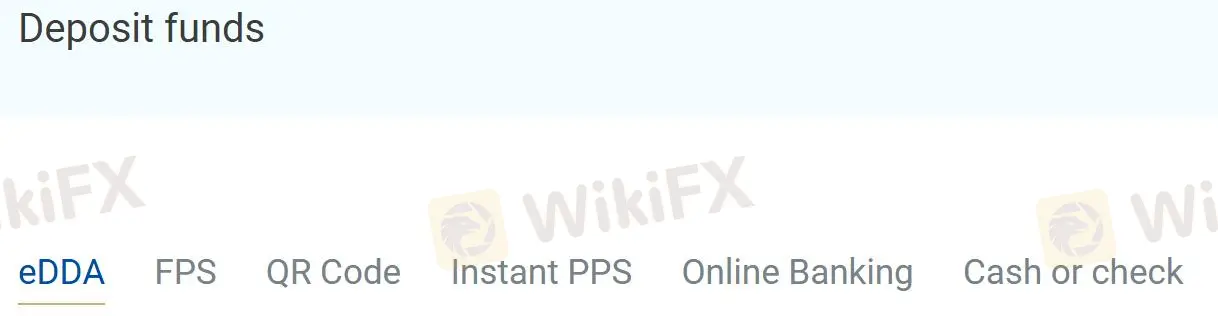

CHIEF bietet 6 Einzahlungsmethoden an: eDDA, FPS, QR-Code, Instant PPS, Online-Banking, Bargeld oder Scheck.

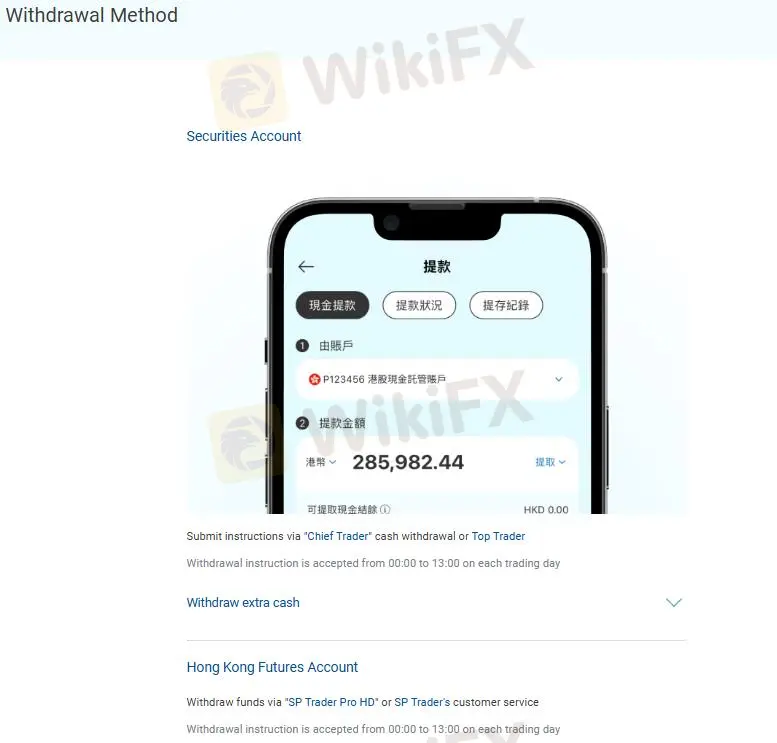

Auszahlungen müssen über "Chief Trader" Bargeldabhebung oder Top Trader Anweisungen eingereicht werden, oder über "SP Trader Pro HD" oder den Kundenservice von SP Trader Gelder abheben.