公司简介

| 致富评论摘要 | |

| 成立时间 | 1979年 |

| 注册国家/地区 | 香港 |

| 监管 | 受监管 |

| 市场工具 | 证券期货 |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | Chief Deal |

| 最低存款 | / |

| 客户支持 | 电子邮件:cs@chiefgroup.com.hk |

| 社交媒体:Facebook,Linkedin,Youtube,Whatsapp,Wechat | |

致富 信息

致富成立于1979年,总部位于香港。目前受香港证监会监管,主要提供证券和期货交易,并拥有自己的交易平台。

优点和缺点

| 优点 | 缺点 |

| 受香港证监会监管 | 不支持MT4/5 |

| 不提供模拟账户 |

致富 是否合法?

| 监管国家/地区 |  |

| 监管机构 | 香港证监会 |

| 监管实体 | Chief Commodities Limited |

| 许可证类型 | 期货合约交易 |

| 许可证号码 | AAZ607 |

| 当前状态 | 受监管 |

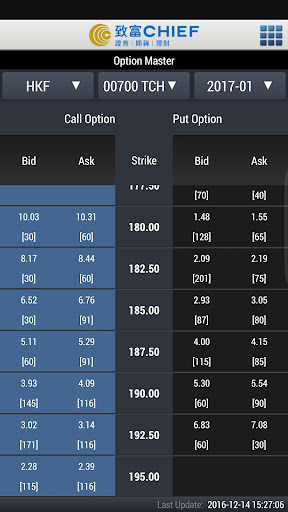

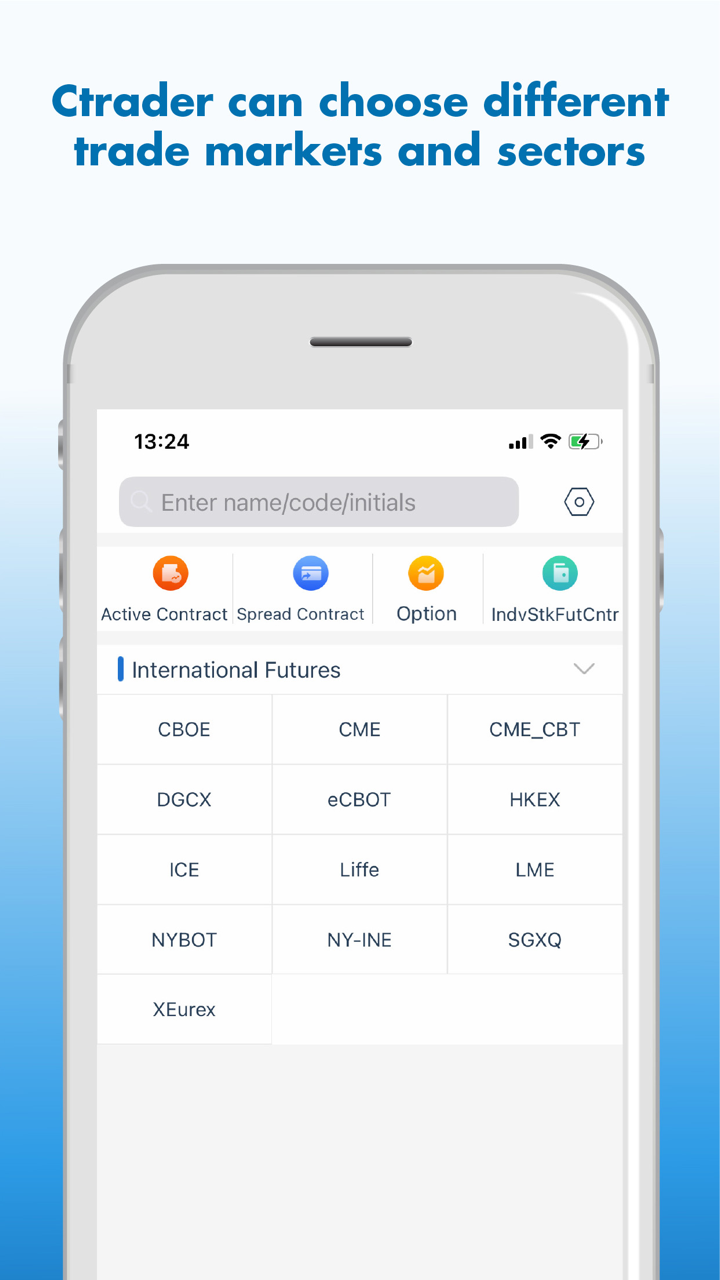

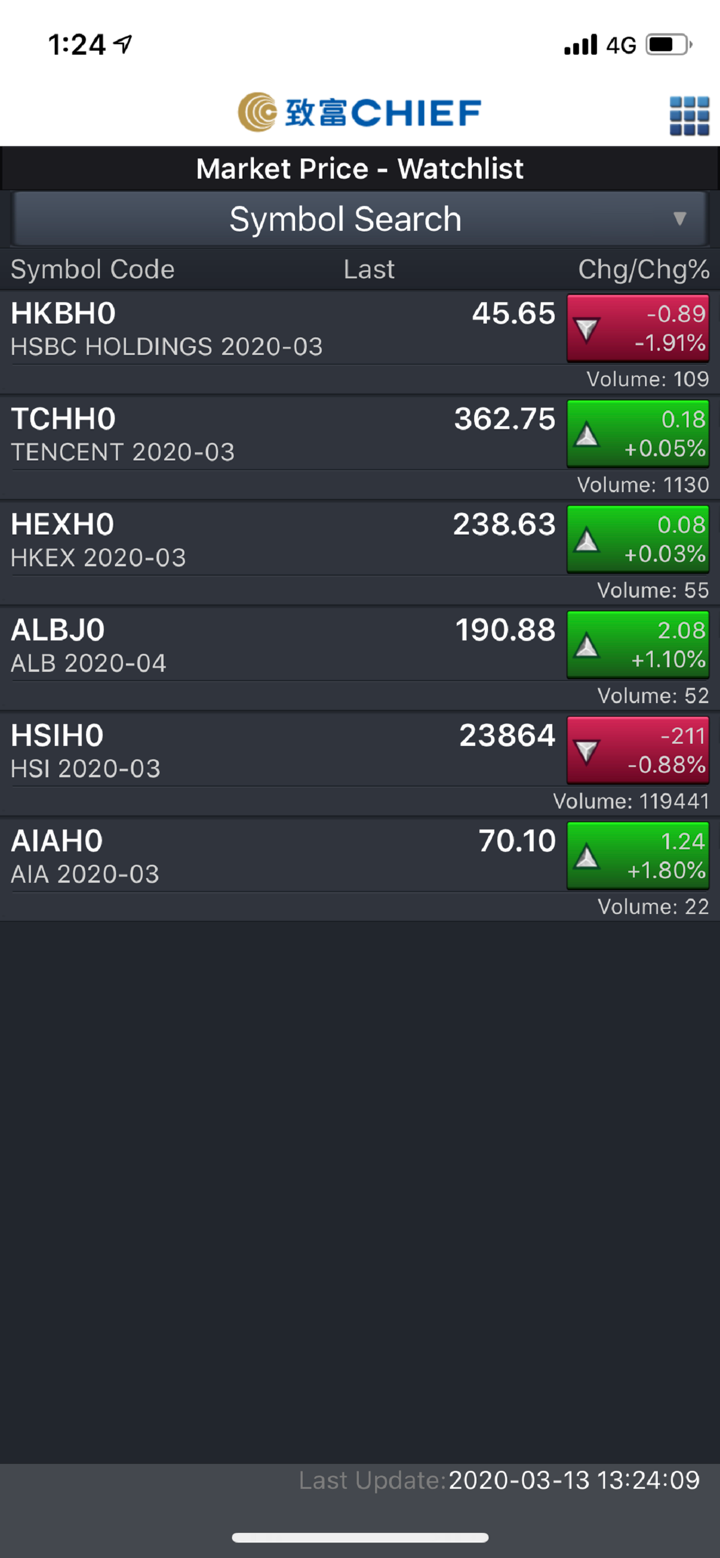

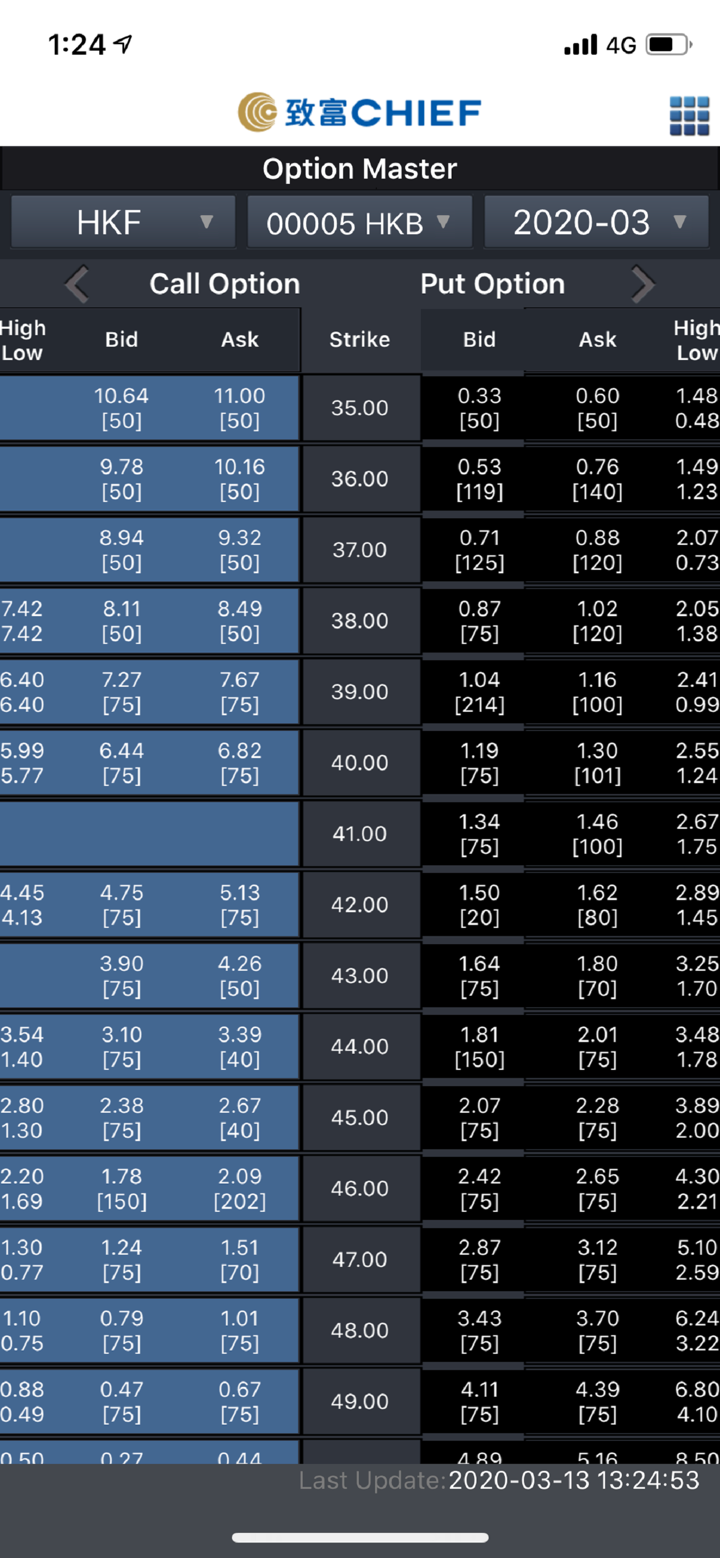

致富 可以交易什么?

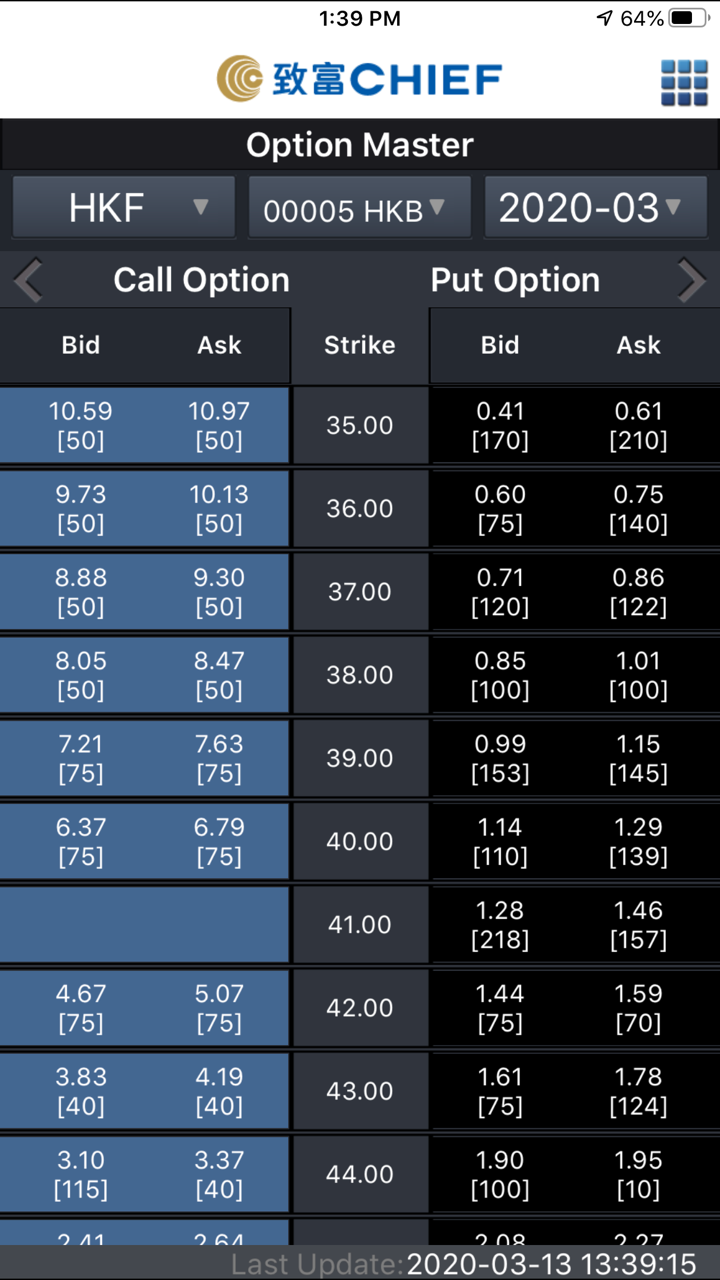

致富 支持证券和期货交易。

| 可交易工具 | 支持 |

| 证券 | ✔ |

| 期货 | ✔ |

| 外汇 | ❌ |

| 贵金属和大宗商品 | ❌ |

| 指数 | ❌ |

| 债券 | ❌ |

| ETF | ❌ |

账户类型

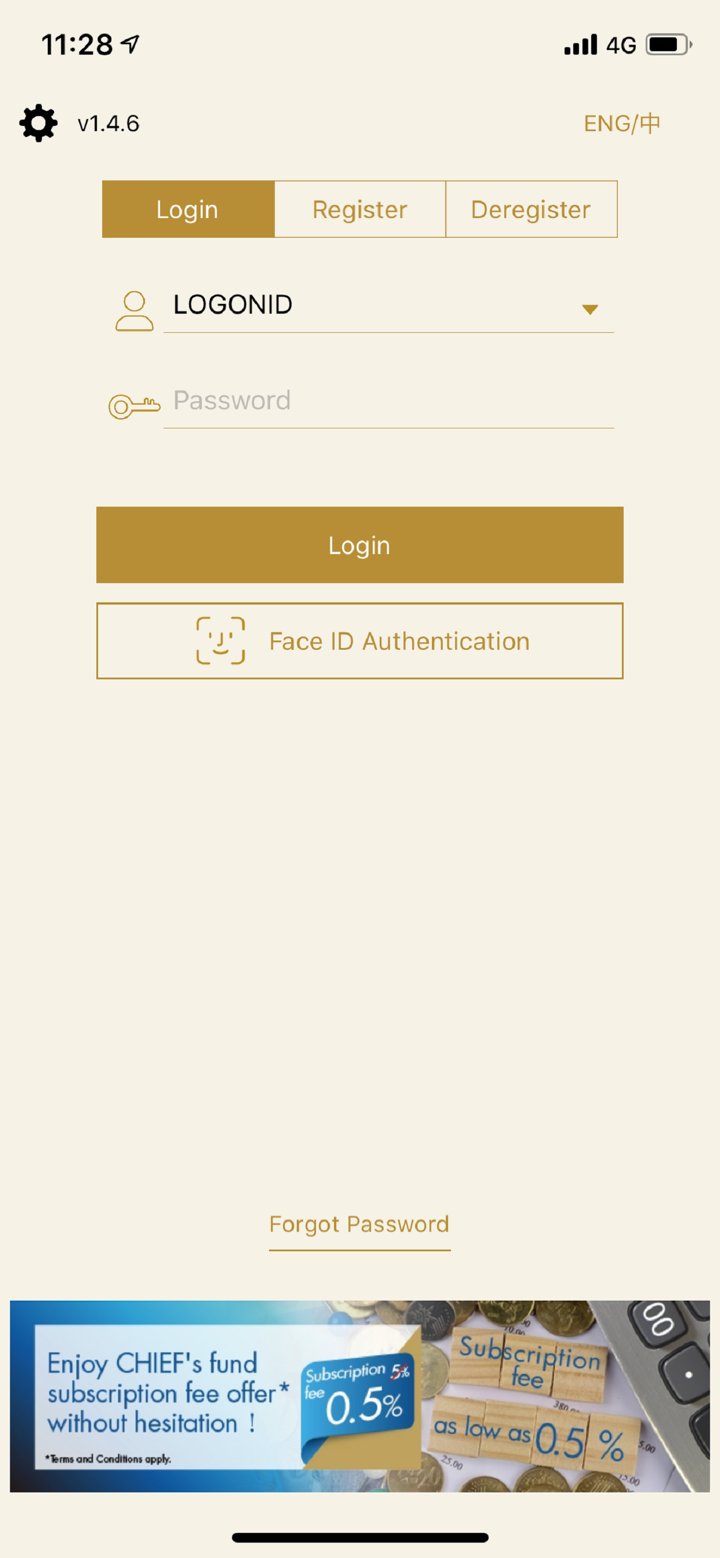

致富未提供账户信息。但支持的开户方式有“远程开户通”预约、亲临和邮寄开户。您可以参考:https://www.chiefgroup.com.hk/hk/account?apply=e-account

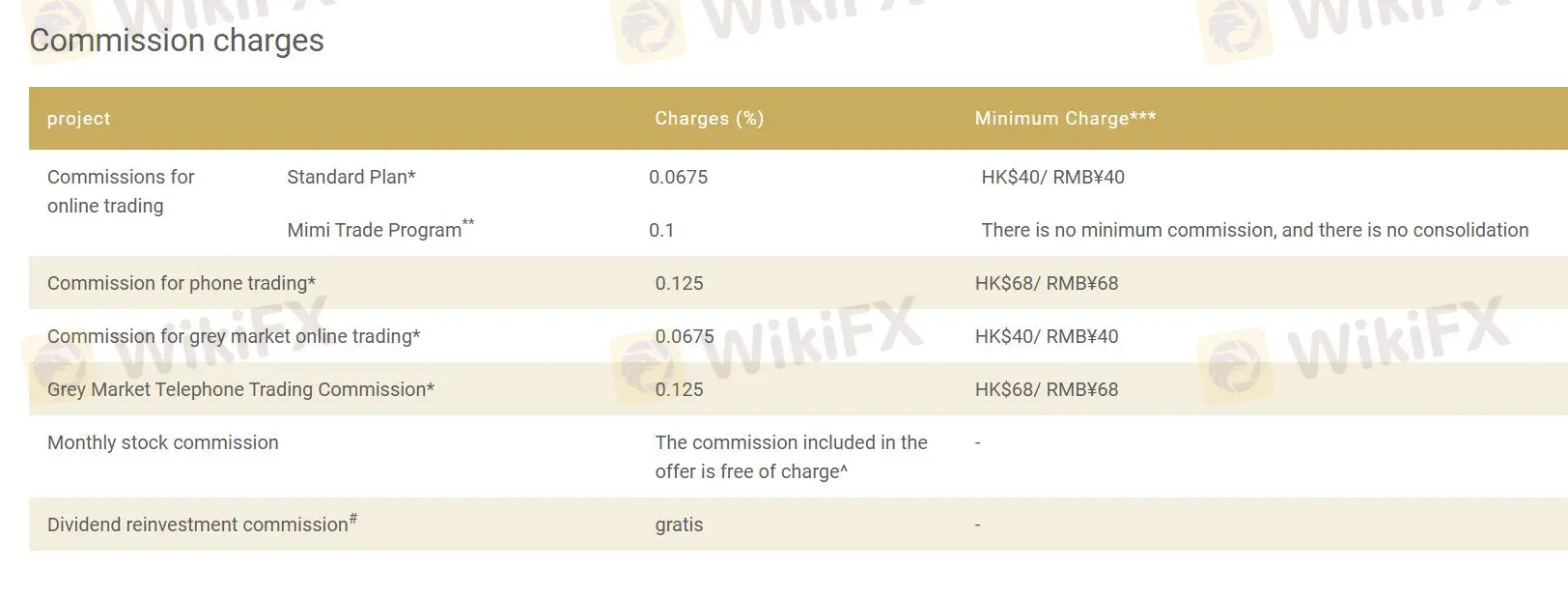

致富费用

致富支持部分免佣金的项目,项目的佣金率不超过0.2%。最低费用范围从HK $40至HK $68和RMB ¥40至RMB ¥68。

| 项目 | 费用(%) | 最低费用**** |

| 佣金在线交易 | ||

| 标准计划* | 0.0675 | HK$40 / RMB¥40 |

| 迷你交易计划** | 0.1 | 无最低佣金,无合并 |

| 电话交易佣金* | 0.125 | HK$68 / RMB¥68 |

| 灰市在线交易佣金* | 0.0675 | HK$40 / RMB¥40 |

| 灰市电话交易佣金* | 0.125 | HK$68 / RMB¥68 |

| 月度股票佣金 | 报价中包含的佣金免费* | - |

| 股息再投资佣金# | 免费 | - |

交易平台

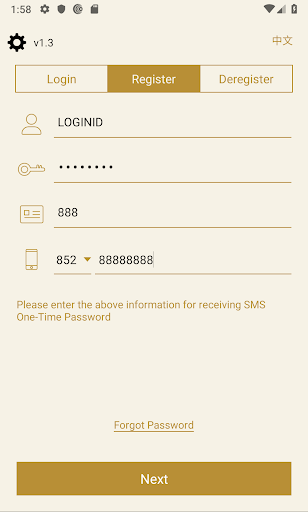

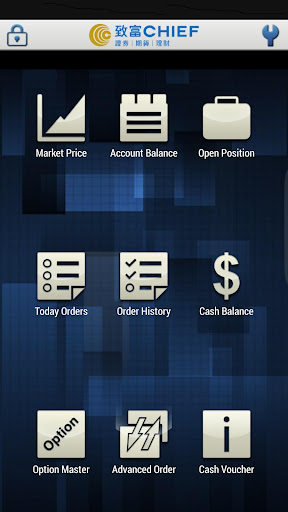

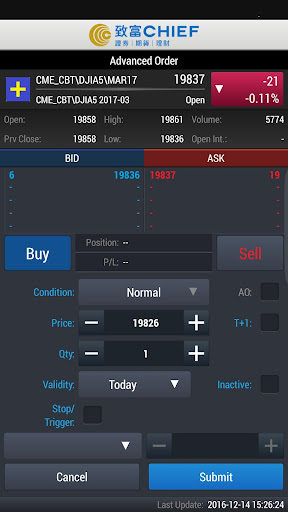

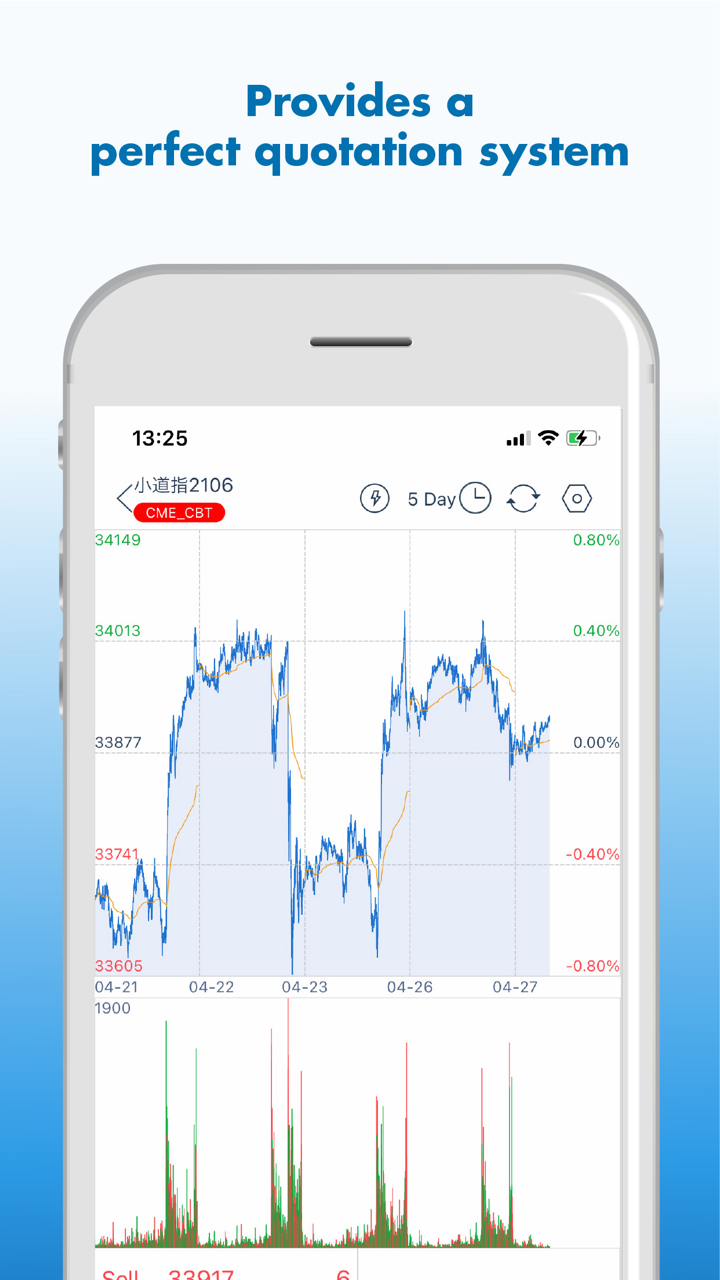

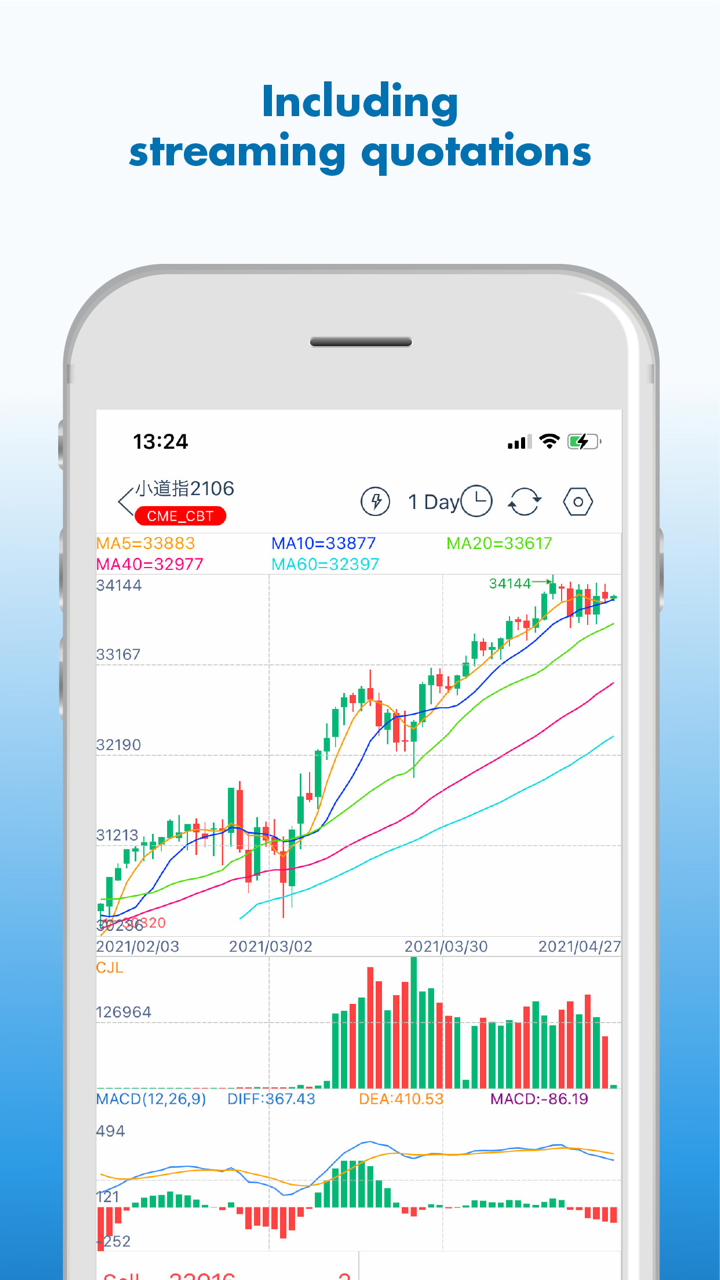

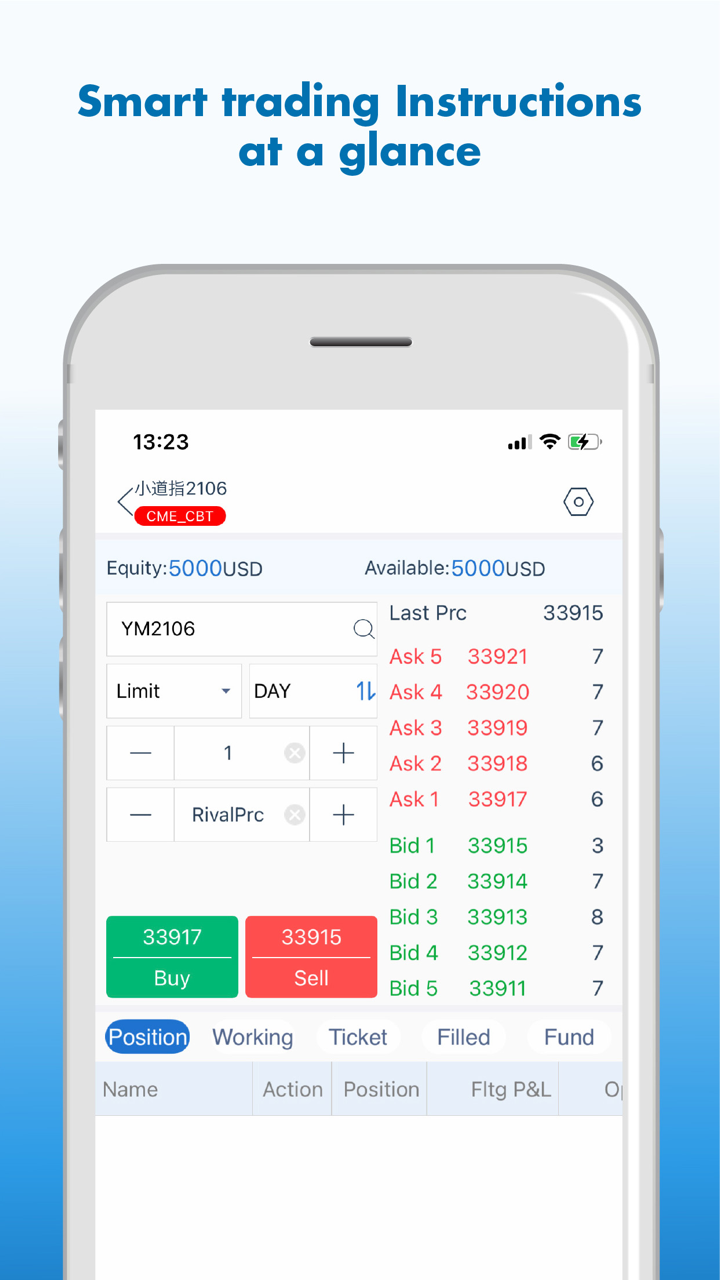

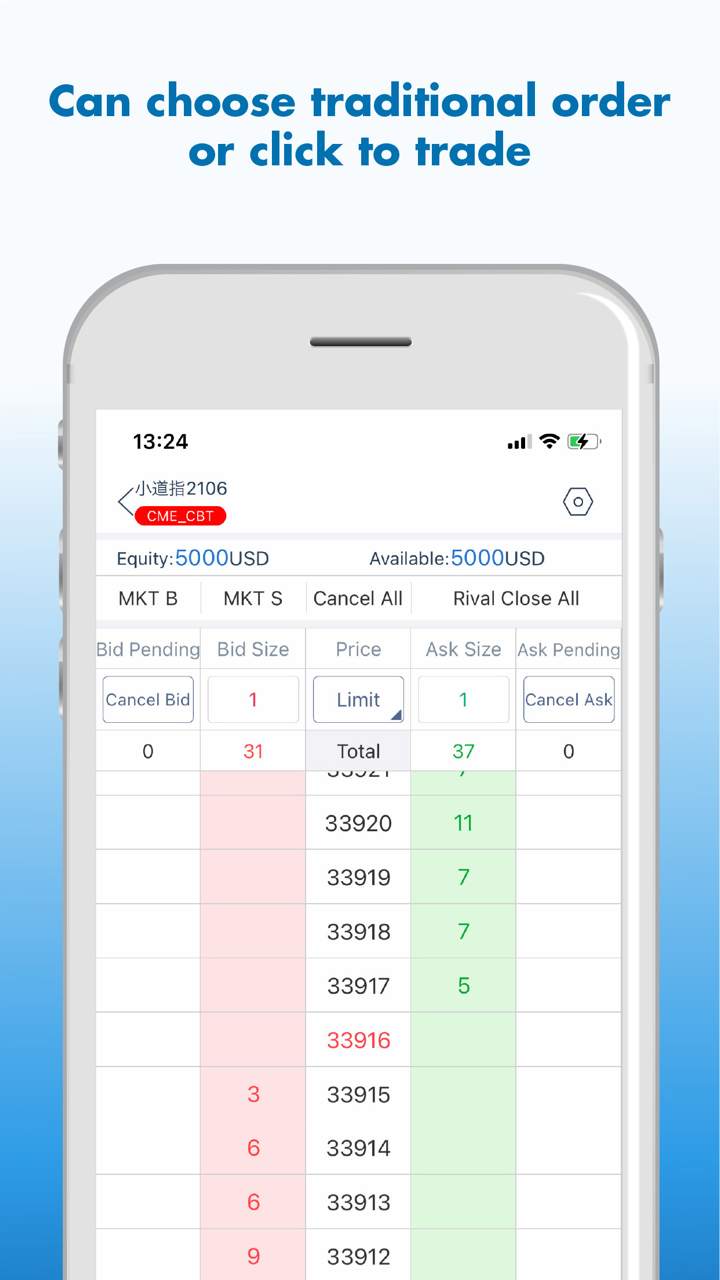

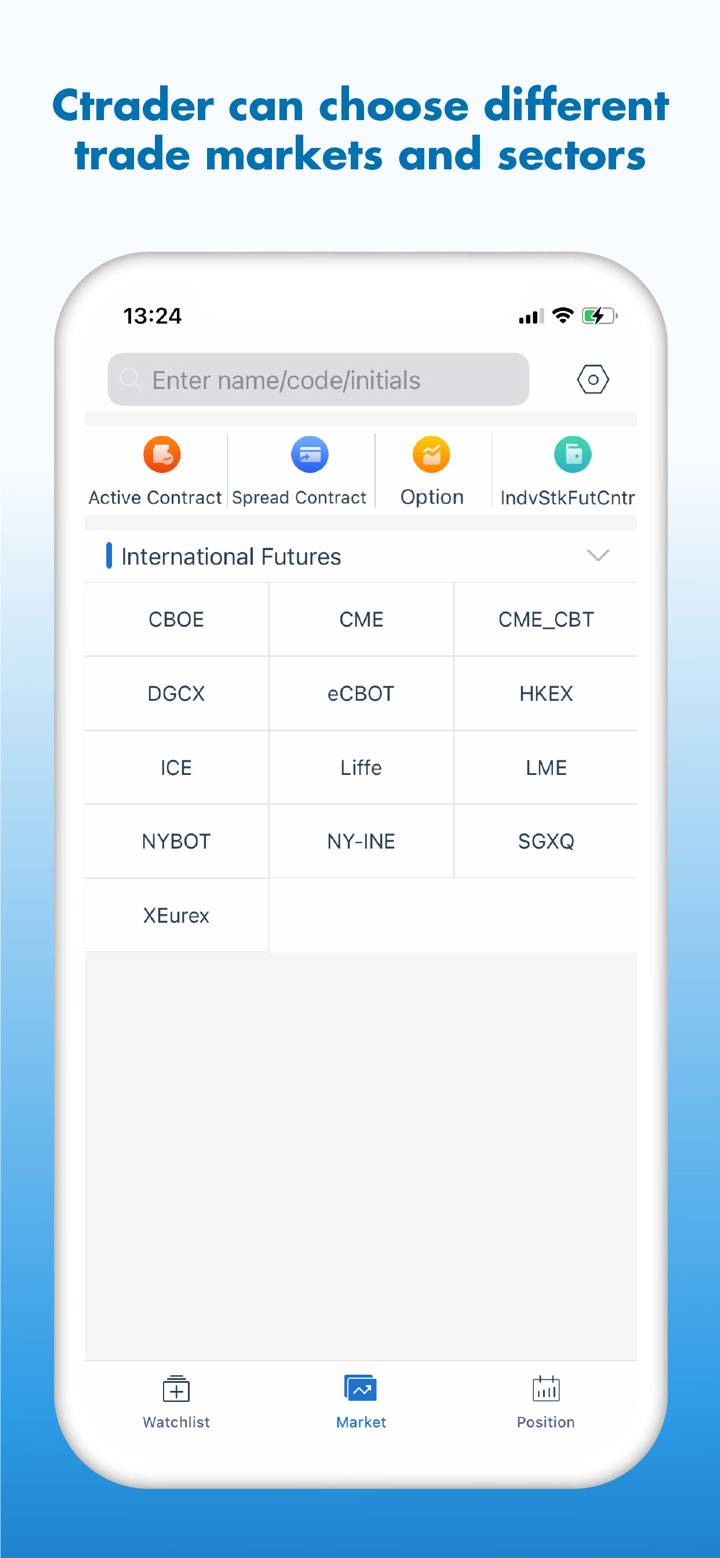

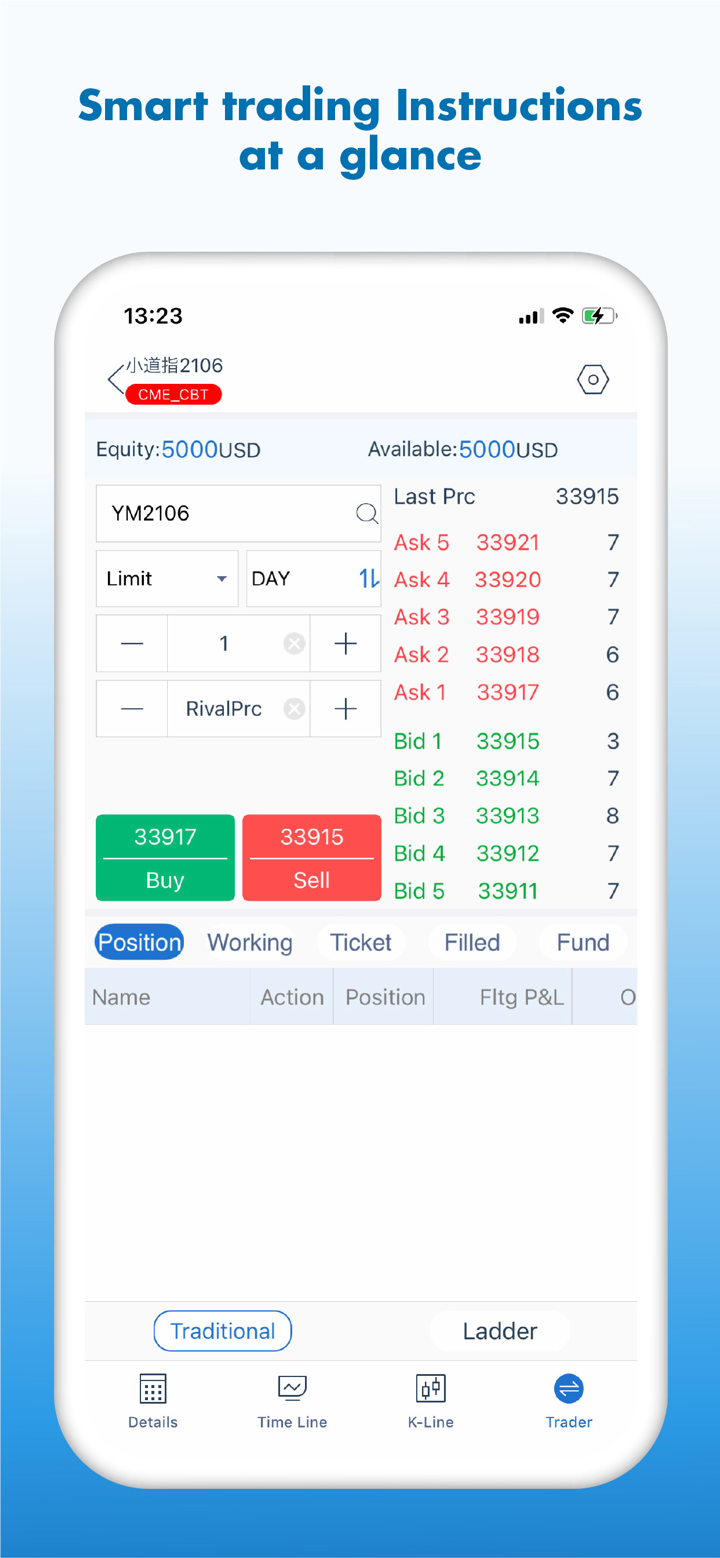

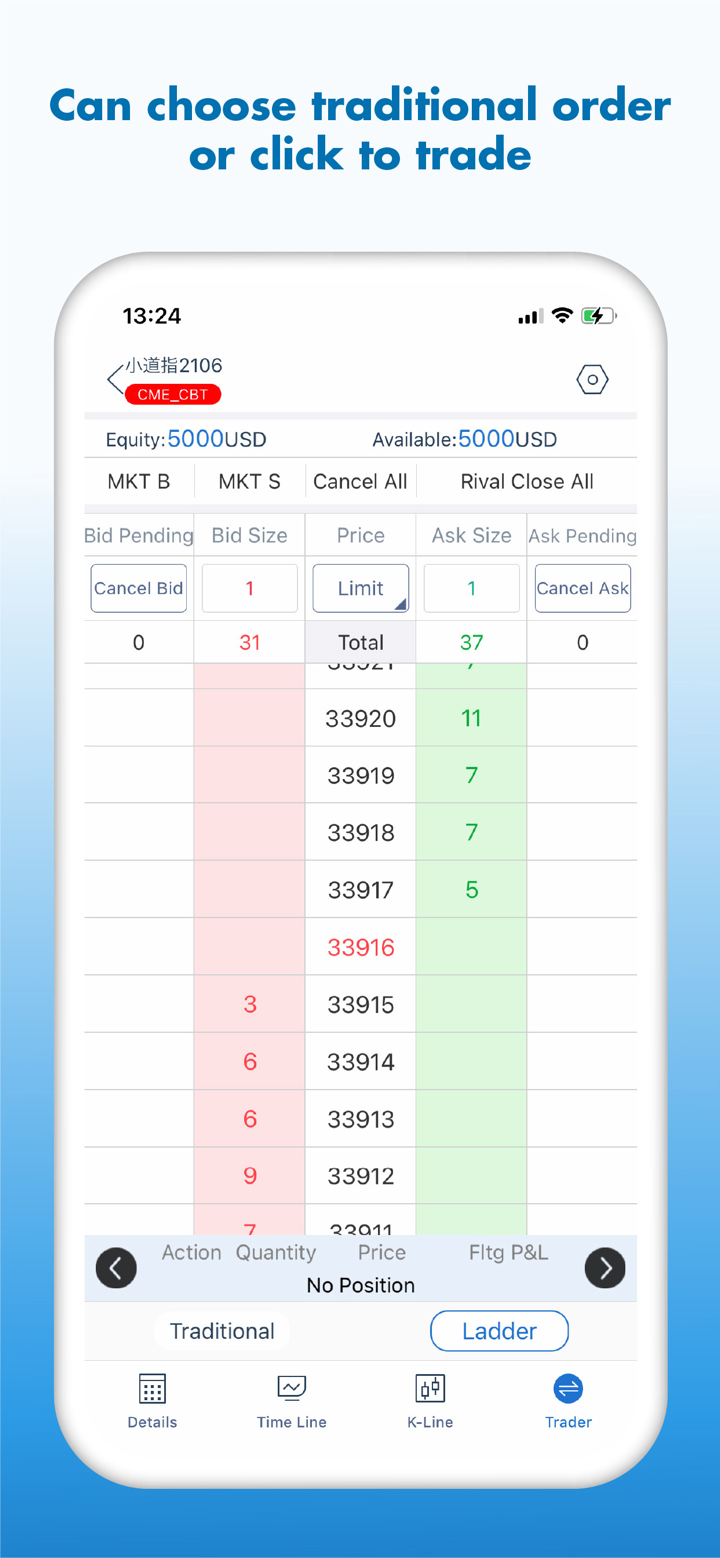

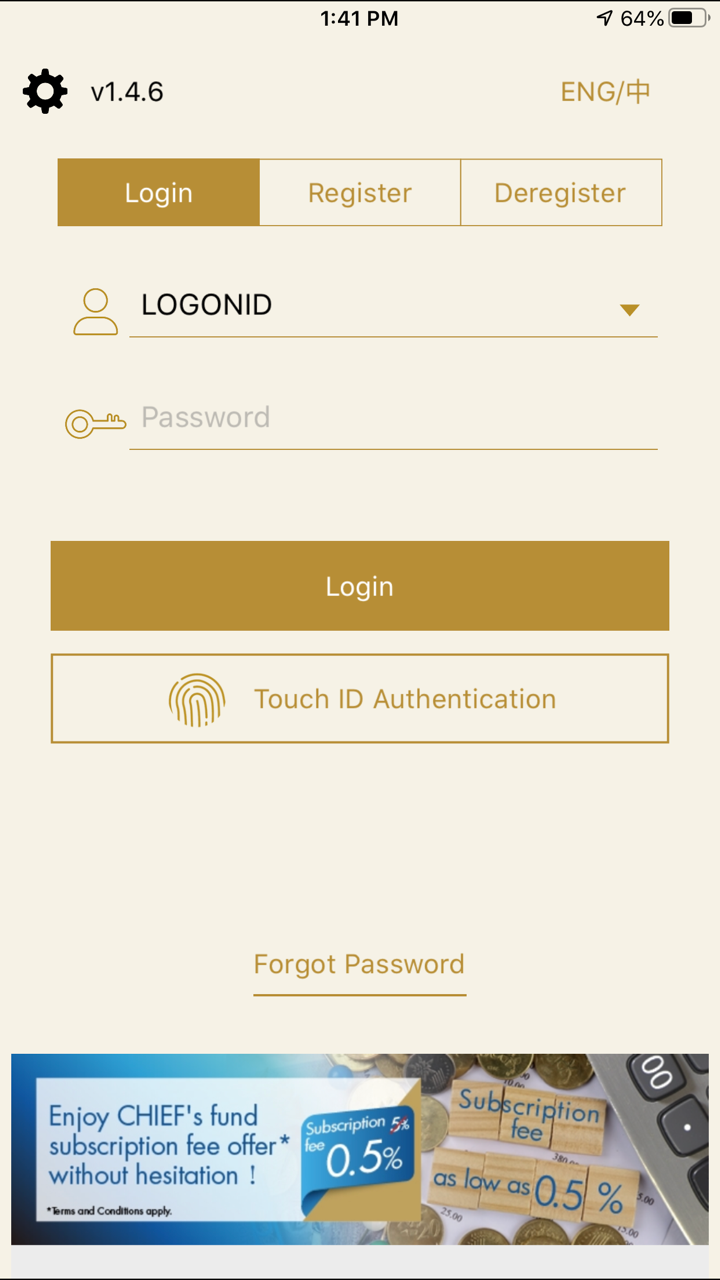

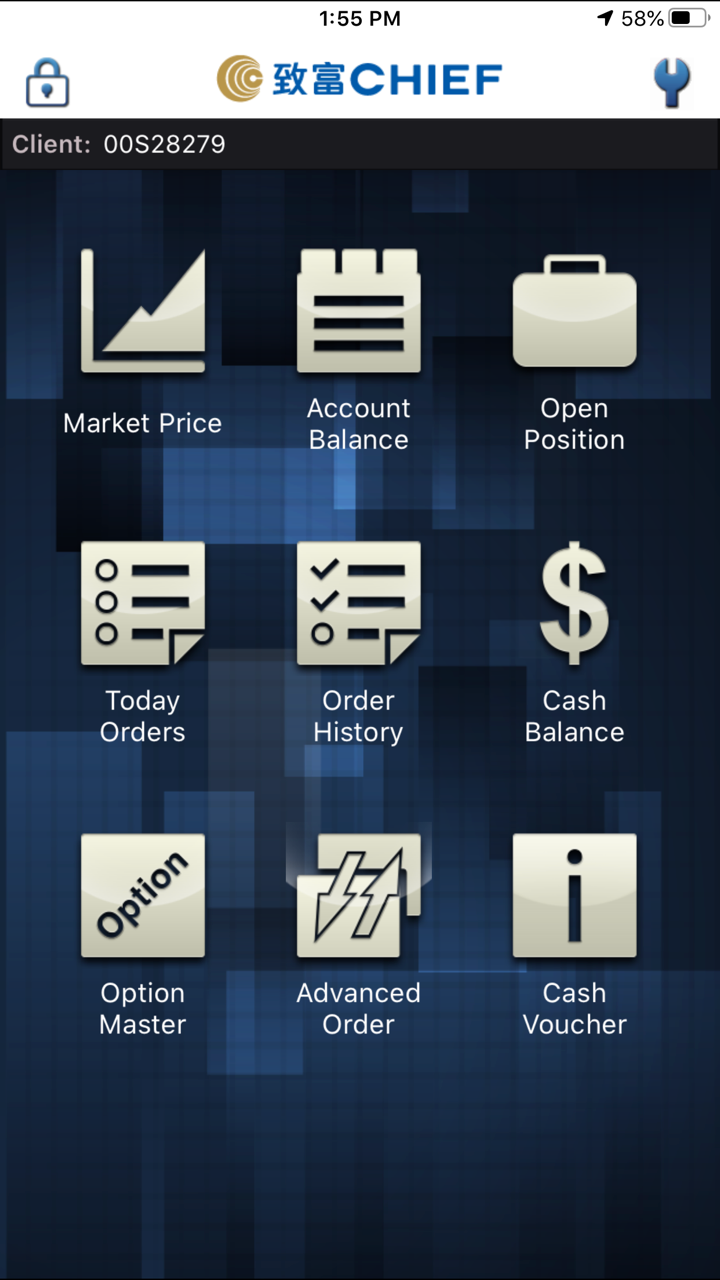

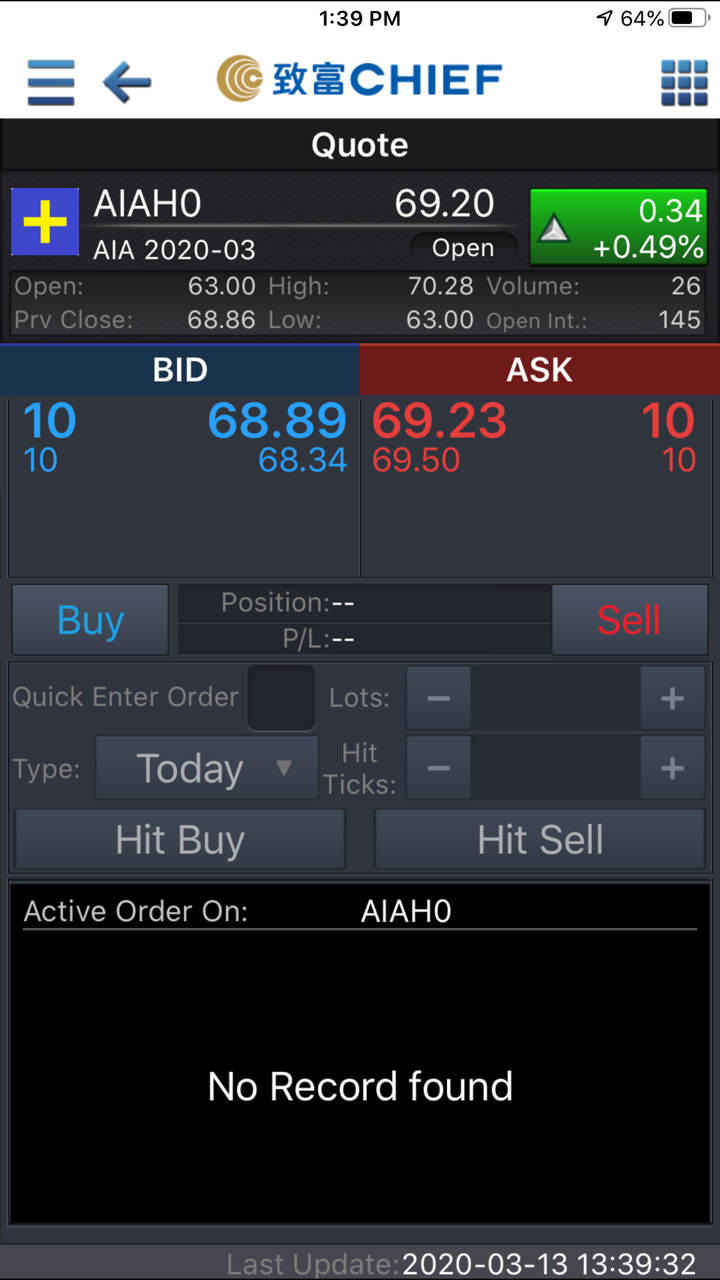

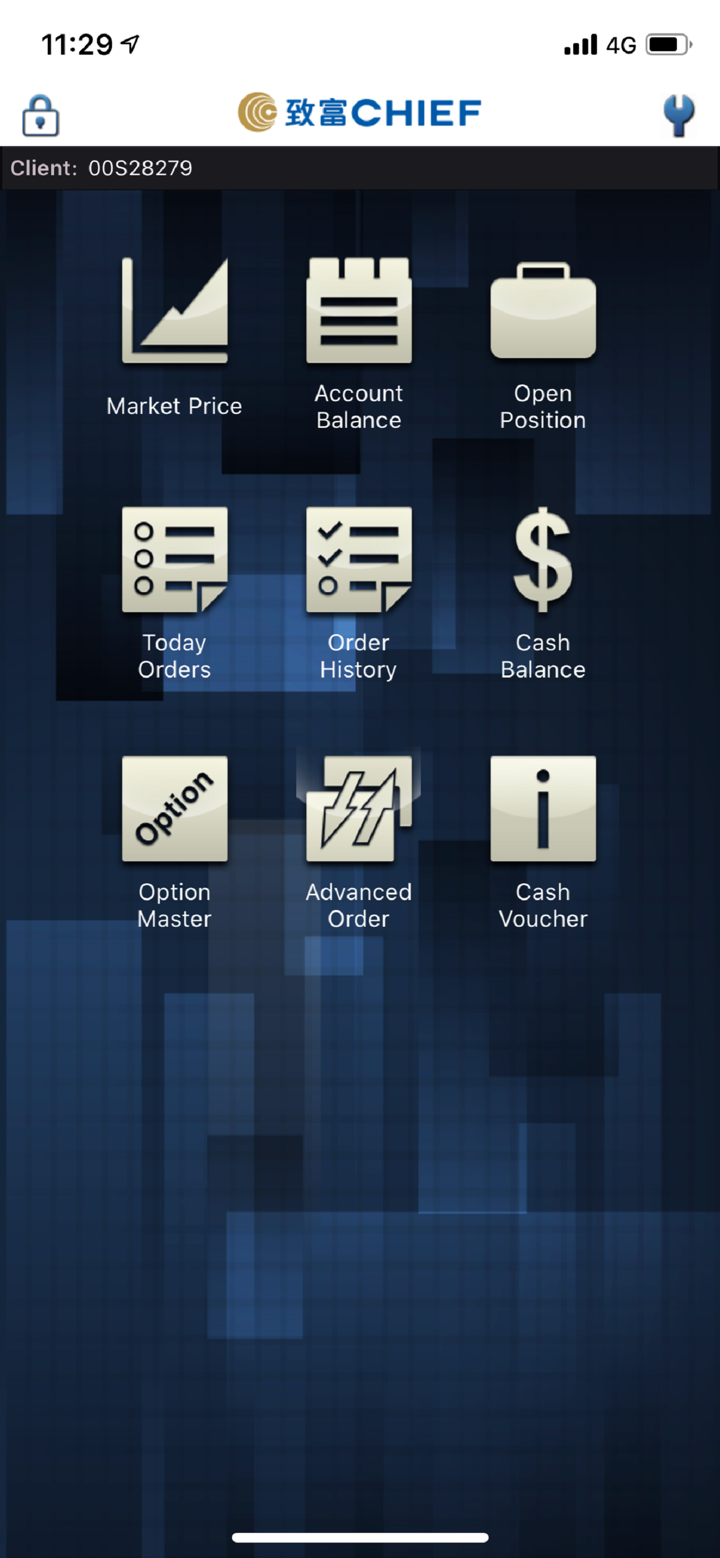

致富提供自己的平台Chief Deal,可在移动设备上使用。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| Chief Deal | ✔ | 移动设备 | 所有交易者 |

| MT4 | ❌ | ||

| MT5 | ❌ |

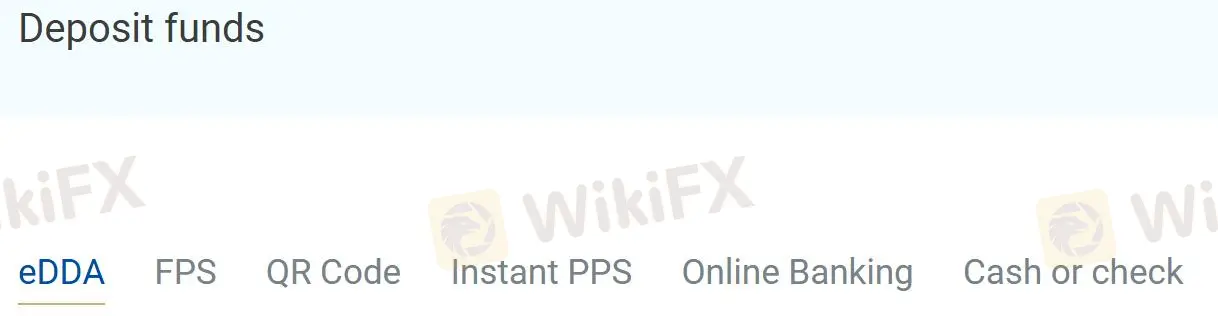

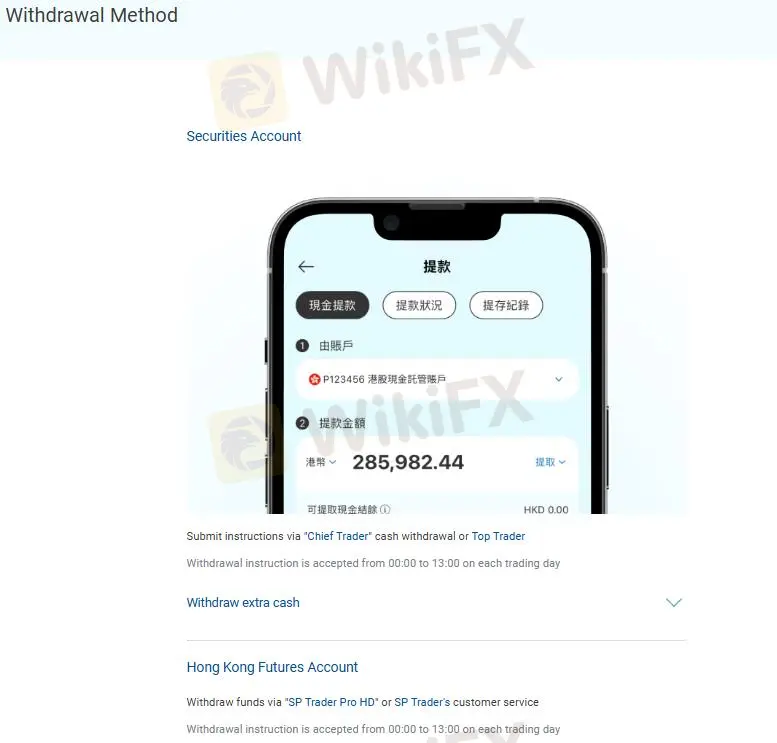

存款和取款

致富提供6种存款方式:eDDA、FPS、QR码、即时PPS、网上银行、现金或支票。

取款需要通过“Chief Trader”现金提款或Top Trader提交指示,或通过“SP Trader Pro HD”或SP Trader的客户服务提取资金。