회사 소개

| FlexTrade리뷰 요약 | |

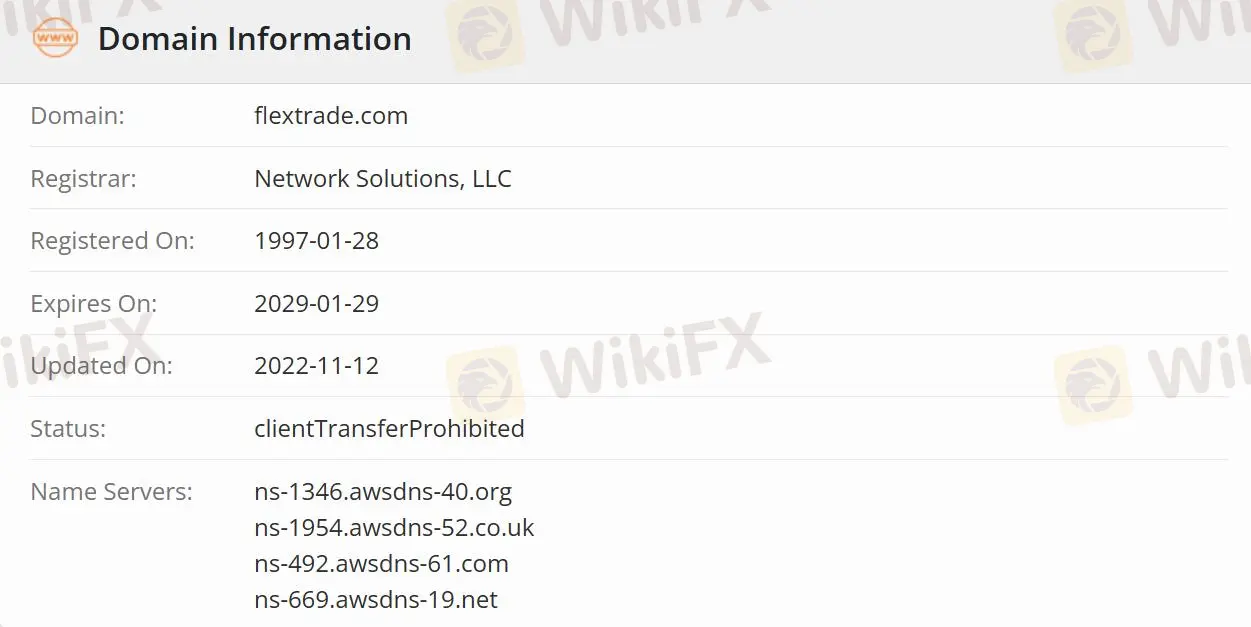

| 설립일 | 1997-01-28 |

| 등록 국가/지역 | 미국 |

| 규제 | 규제되지 않음 |

| 서비스 | 자산 관리자/헤지 펀드/하이터치/거래/마켓 메이킹/로우터치 트레이딩/프로그램 트레이딩/파생상품 트레이딩/외부 위탁 트레이딩/소매 트레이딩 |

| 고객 지원 | 사무실 전화: +1 516 627 8993/+1 516 304 3655/+44 20 3757 9310/+33 1 59 03 15 77/+65 6965 2100/+91 20 6724 5023/+852 3579 2200/+61 2 8103 4043 |

| 판매 이메일: sales@flextrade.com | |

FlexTrade 정보

미국에 등록된 FlexTrade Systems는 주식, 채권, 외환, 선물 및 옵션을 위한 다중 자산 거래 및 주문 관리 시스템을 비롯한 다양한 거래 기술 서비스를 제공합니다. 45개 국가의 소중한 고객을 섬기고 있습니다.

FlexTrade 신뢰할 수 있나요?

FlexTrade은(는) 규제되지 않음으로 규제된 중개인보다 안전하지 않습니다.

FlexTrade의 제품 및 솔루션은 무엇인가요?

FlexTrade은(는) 매수자를 위해 자산 관리자, 헤지 펀드 및 주권 자산/연금 기금 서비스를 제공하며, 판매자를 위해 하이터치 트레이딩/마켓 메이킹, 로우터치 트레이딩, 프로그램 트레이딩, 파생상품 트레이딩, 외부 위탁 트레이딩 및 소매 트레이딩 서비스를 제공합니다.

고객이 선택할 수 있는 거래 제품은 FIexTRADER EMS, FIexONE OEM, 금융 자금 조달, FlexFX, Flex Options, Flex Futures 및 FlexOMS입니다.