Riepilogo dell'azienda

avviso di rischio

Il trading online comporta rischi significativi e potresti perdere tutto il capitale investito. Non è adatto a tutti i trader o investitori. Assicurati di aver compreso i rischi coinvolti e tieni presente che le informazioni contenute in questo articolo sono solo per informazioni generali.

Informazioni di base e regolamenti

cinagalassia · China Galaxy , nome e cognome China Galaxy International Financial Holdings Limited , è un fornitore di servizi finanziari costituito a Hong Kong nel febbraio 2011, che afferma di fornire vari prodotti e servizi finanziari ai propri clienti. ecco la homepage del sito ufficiale del broker:

per quanto riguarda la situazione normativa, chinagalaxy · China Galaxy è soggetto alla normale supervisione della negoziazione di contratti future da parte della commissione di regolamentazione dei titoli di Hong Kong. ecco perché il suo stato normativo su wikifx è elencato come "regolatorio" con un punteggio elevato di 6,96/10.

Scopo commerciale

cinagalassia · China Galaxy pubblicizza un'ampia gamma di attività, tra cui azioni, futures e opzioni, gestione patrimoniale, obbligazioni, fondi comuni di investimento, prodotti strutturati, assicurazioni e altro ancora.

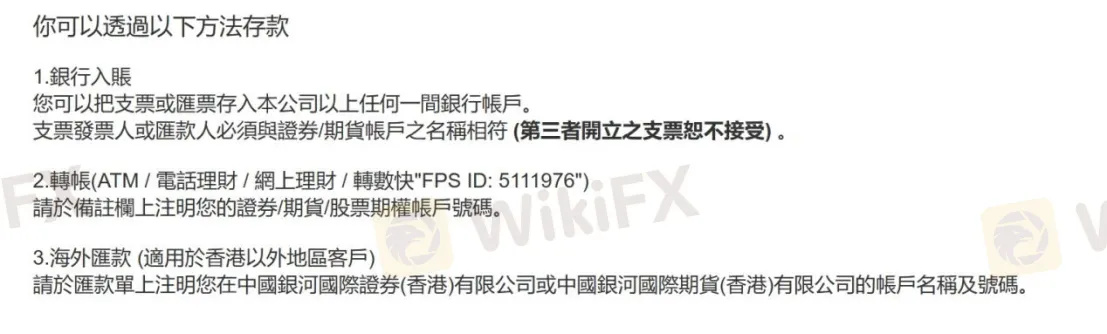

deposito e prelievo

cinagalassia · China Galaxy sono supportati tre metodi di deposito, vale a dire deposito bancario, trasferimento (atm / banca telefonica / banca online / fps "fps id: 5111976") e rimessa all'estero (applicabile ai clienti al di fuori di Hong Kong). per i dettagli, fare riferimento allo screenshot qui sotto.

Servizio Clienti

Telefono: 852 3698-6888, 400 866 8833;

E-mail: enquiry@chinastock.com.hk;

Social media: WeChat;

Indirizzo: 20th Floor, Wing On Center, 111 Connaught Road Central, Sheung Wan, Hong Kong; Stanza 3601, COSCO Tower, 183 Queen's Road Central, Hong Kong; 8° piano, edificio Mei Mei, 683-685 Nathan Road, Mong Kok, Hong Kong.

Vantaggi e svantaggi

| vantaggio | discordanza |

| • Regolamentato | • Insufficiente trasparenza delle informazioni |

| • Ampia gamma di affari | |

| • Nessun deposito iniziale minimo |

problema comune

| Domanda 1: | cinagalassia · China Galaxy è regolamentato? |

| UN 1: | cinagalassia · China Galaxy è soggetto alla normale supervisione della negoziazione di contratti future da parte della commissione di regolamentazione dei titoli di Hong Kong. |

| Domanda 2: | cinagalassia · China Galaxy qual è la soglia di deposito? |

| UN 2: | Non è previsto alcun costo minimo di apertura. |

| Domanda 3: | cinagalassia · China Galaxy è amichevole per i neofiti? |

| UN 3: | Non è previsto alcun costo minimo di apertura. Anche la regolamentazione di questo broker è molto buona e nel complesso è una buona scelta. |

1g h jv f f f

Hong Kong

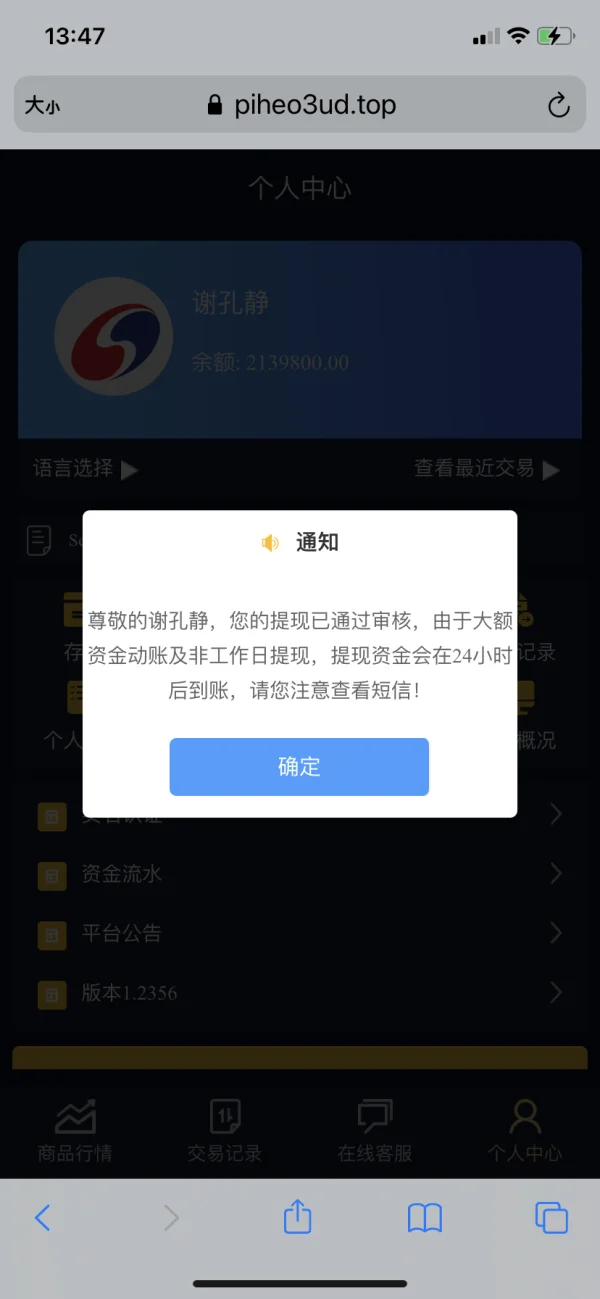

La piattaforma Black

Esposizione

建雷

Hong Kong

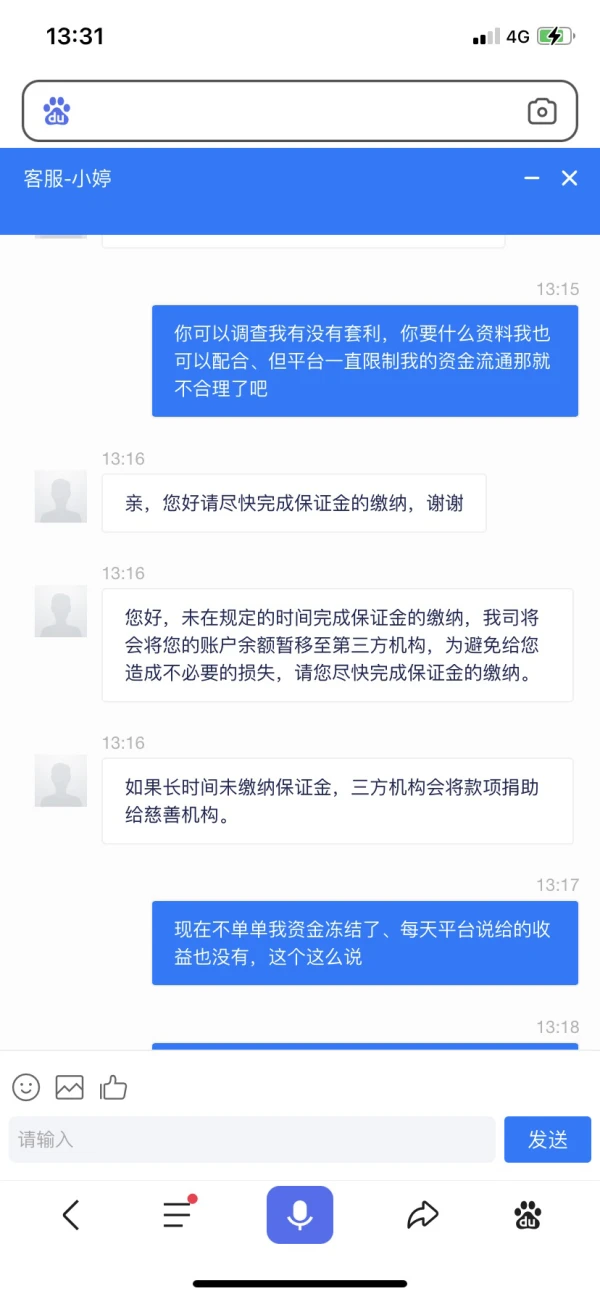

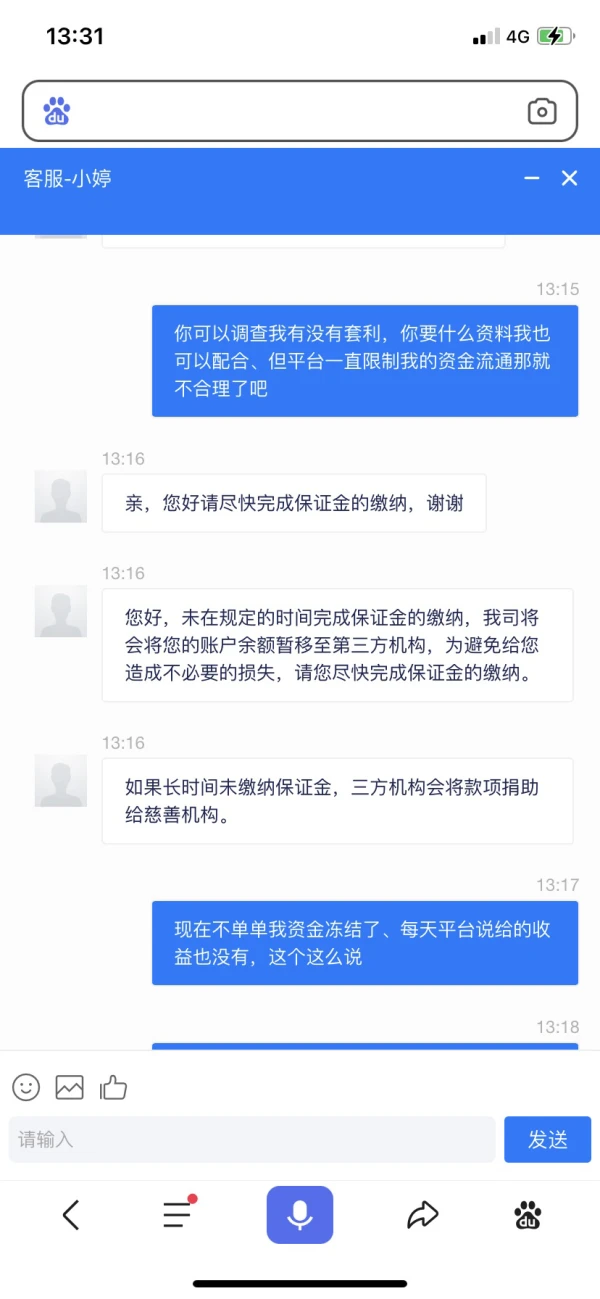

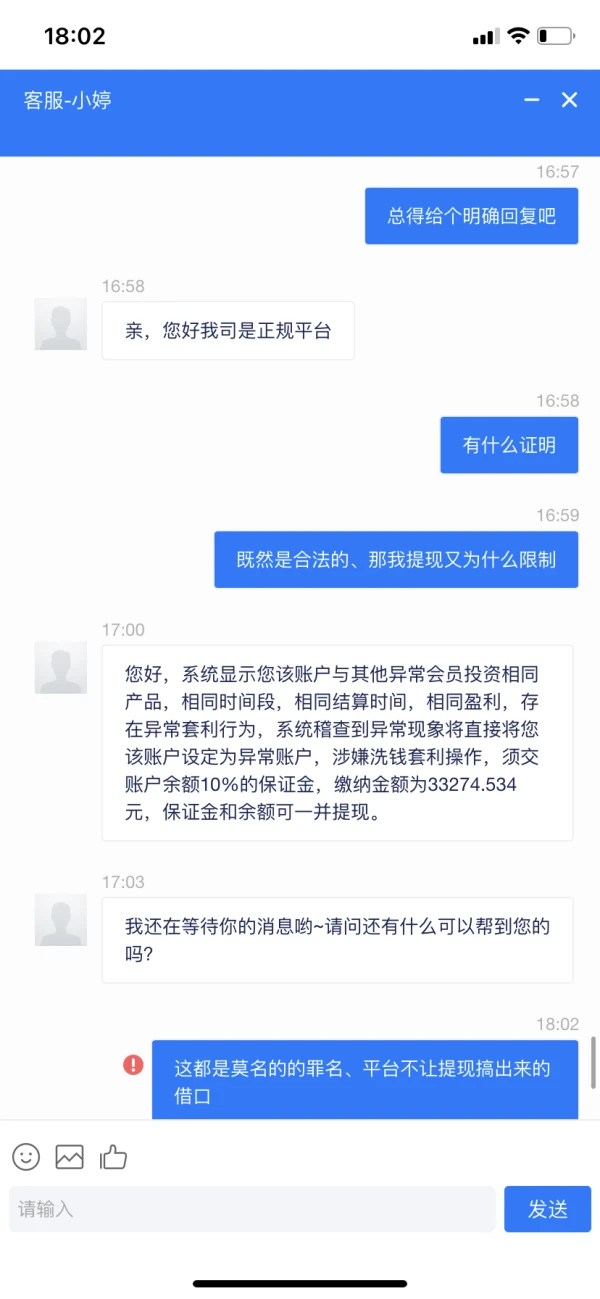

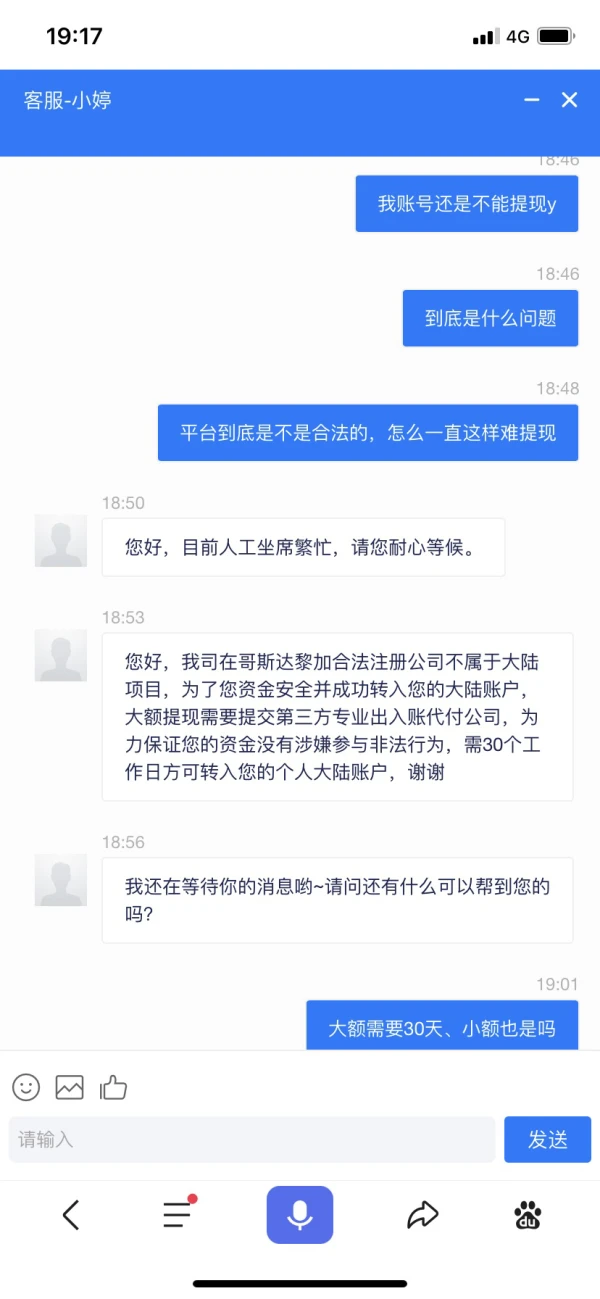

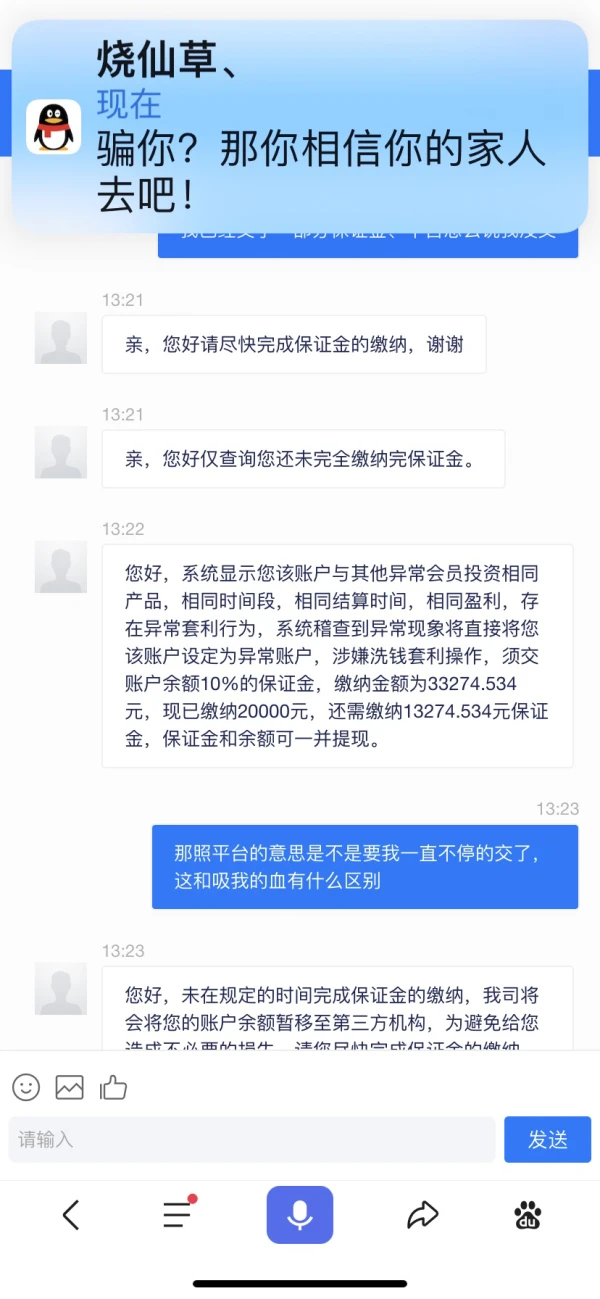

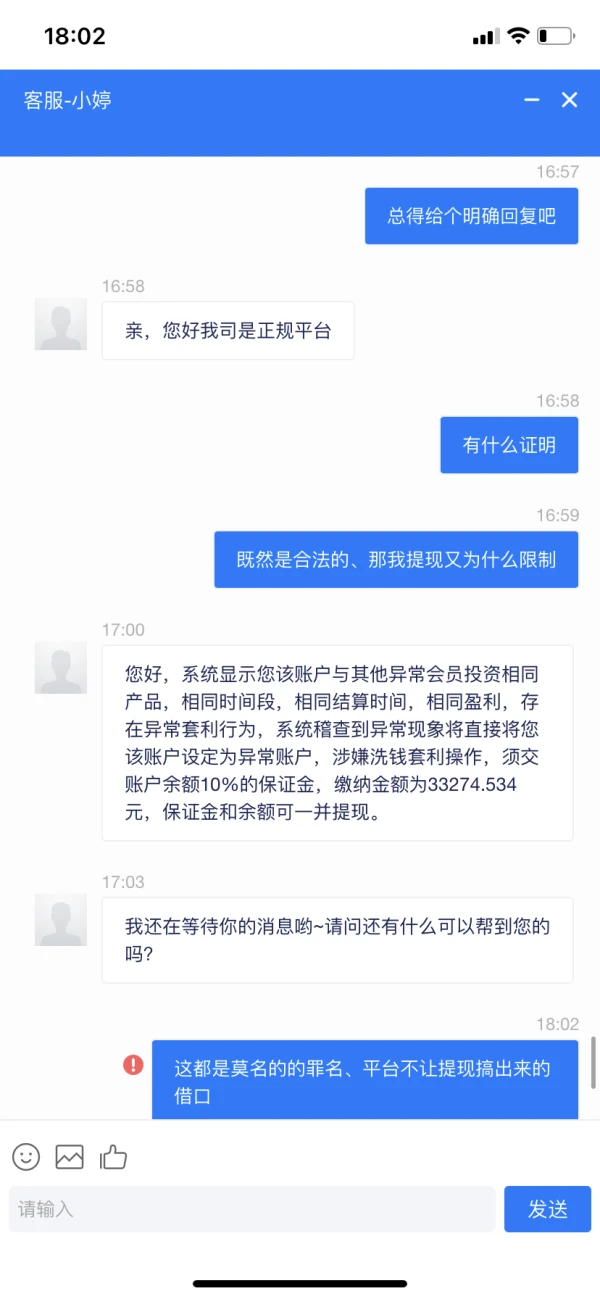

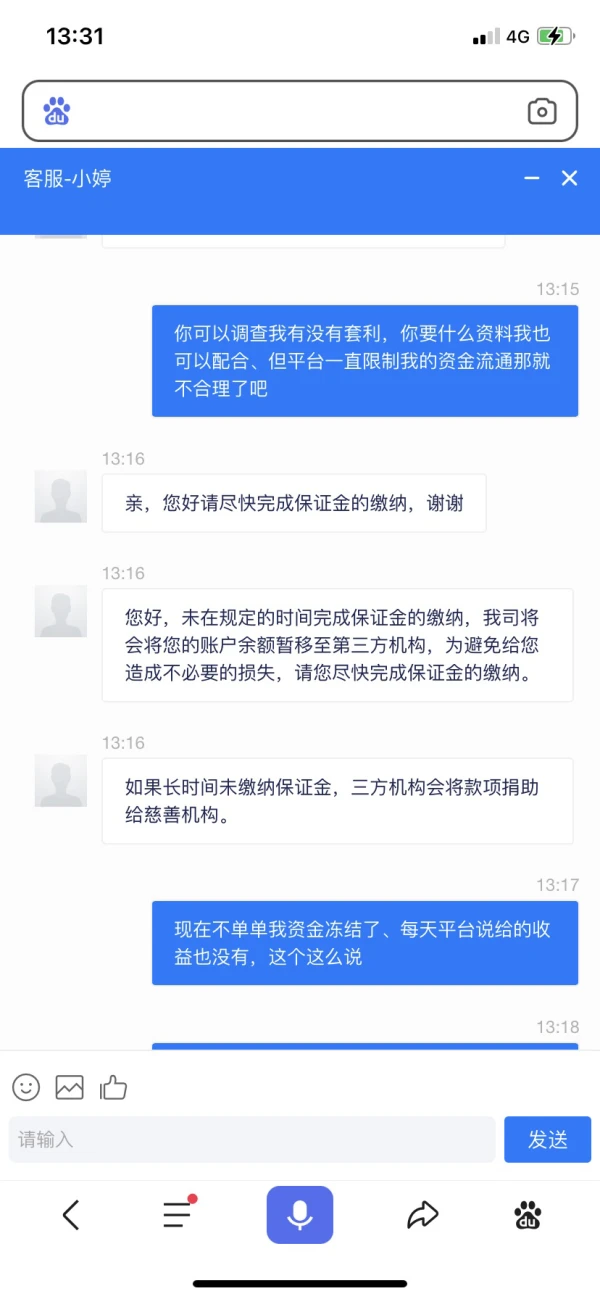

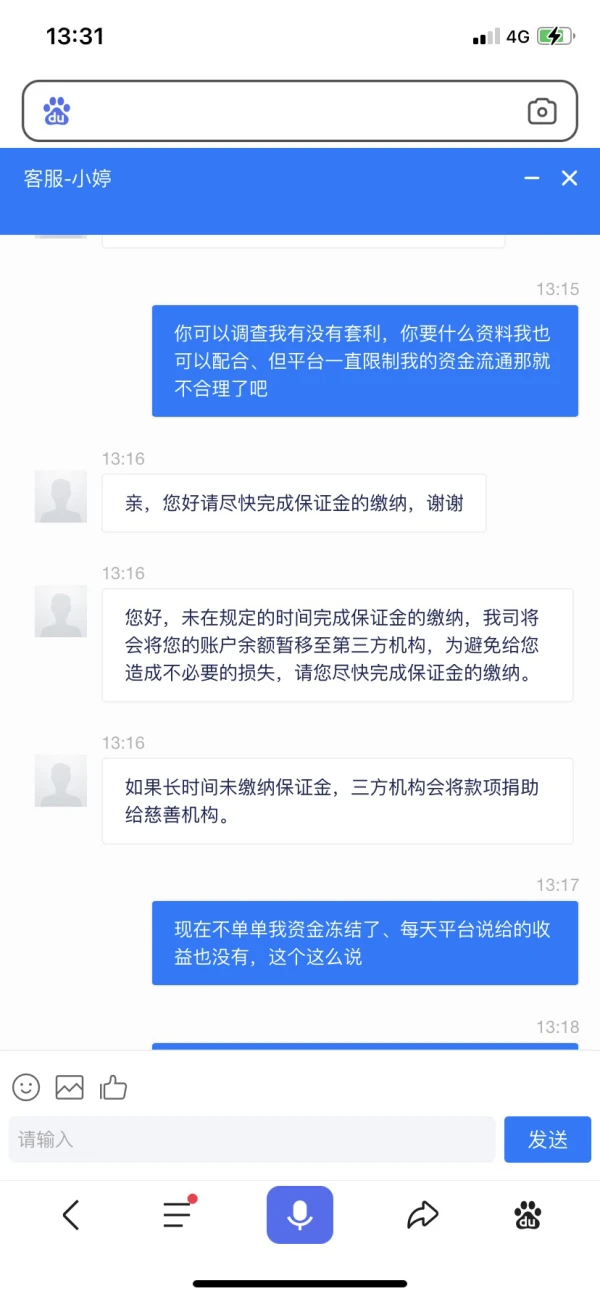

La domanda di witdhrawal è stata rifiutata per molte ragioni. Per favore presta attenzione.

Esposizione

徊眸

Hong Kong

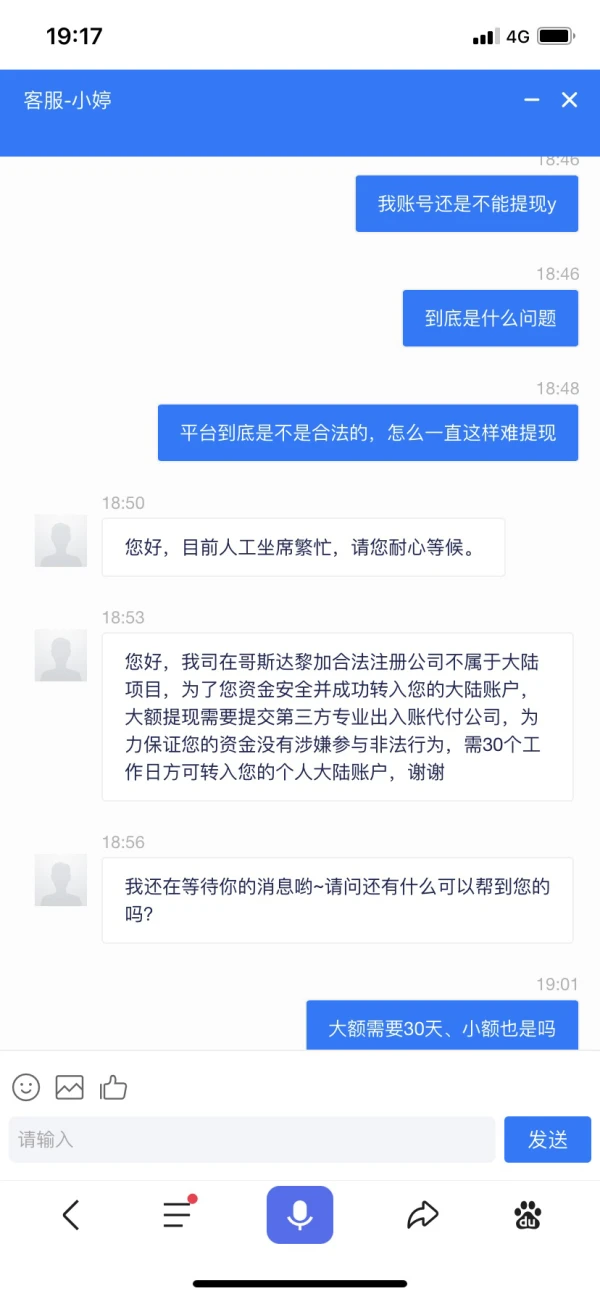

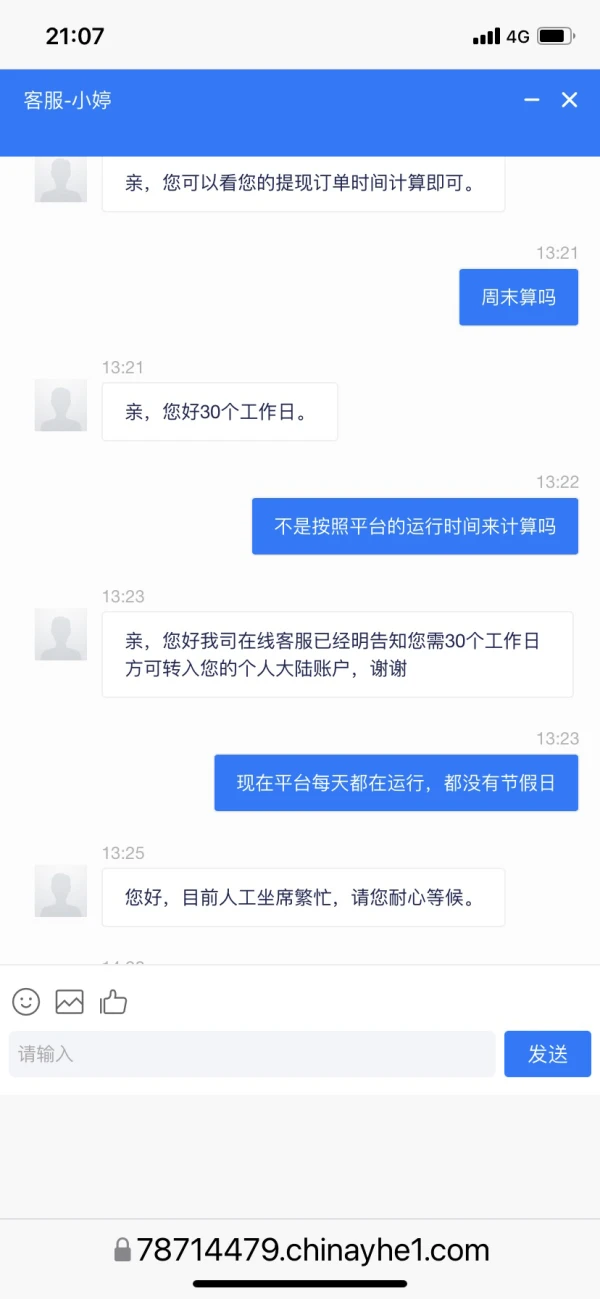

Il servizio clienti continua a utilizzare diverse scuse per non ritirarsi. Chiedo qual è il problema, ma non possono indicarlo. Sto solo cercando scuse.

Esposizione

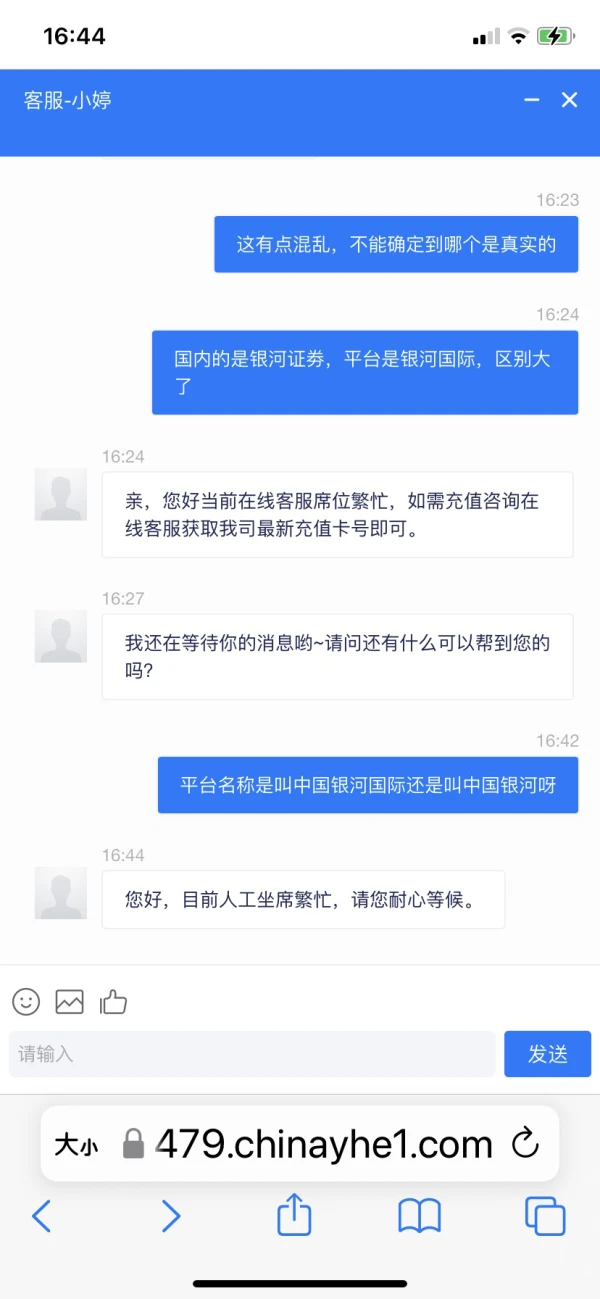

徊眸

Hong Kong

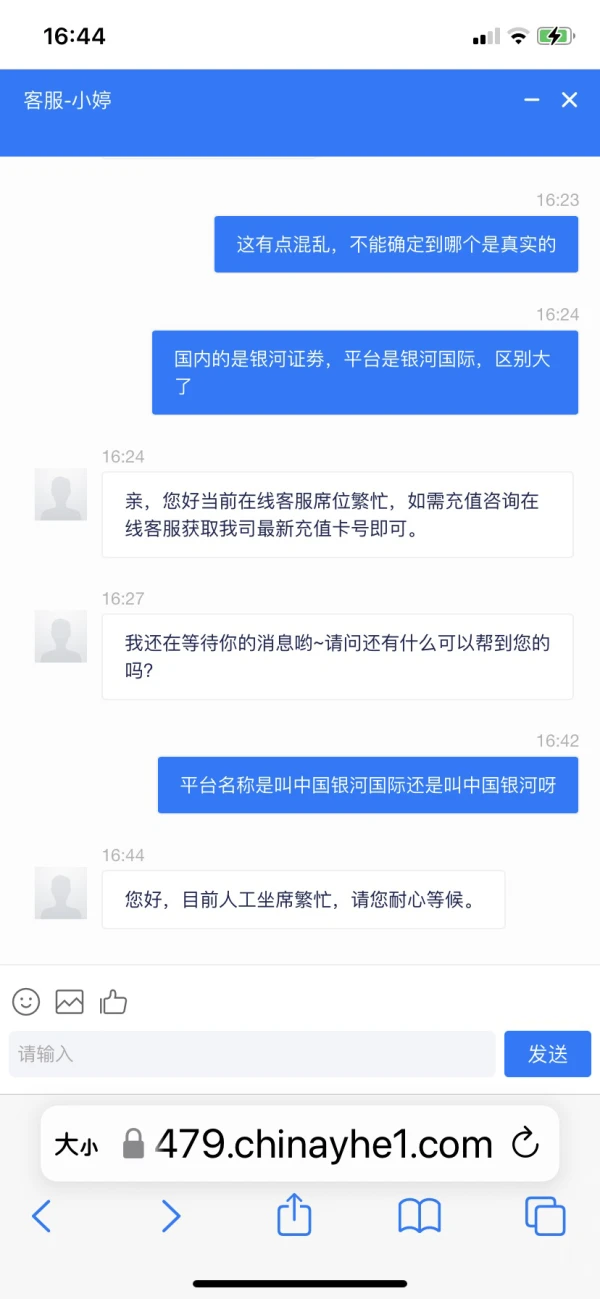

Il servizio clienti non si è ritirato utilizzando diverse scuse, non so se si tratti di una piattaforma legittima o di una piattaforma clone fraudolenta. Il sito Web è https://78714479.chinayhe1.com/index/login/login/token/d6b70b5b8eef4ceef2e2765b7f46dd9b.html

Esposizione

FX1433857007

Hong Kong

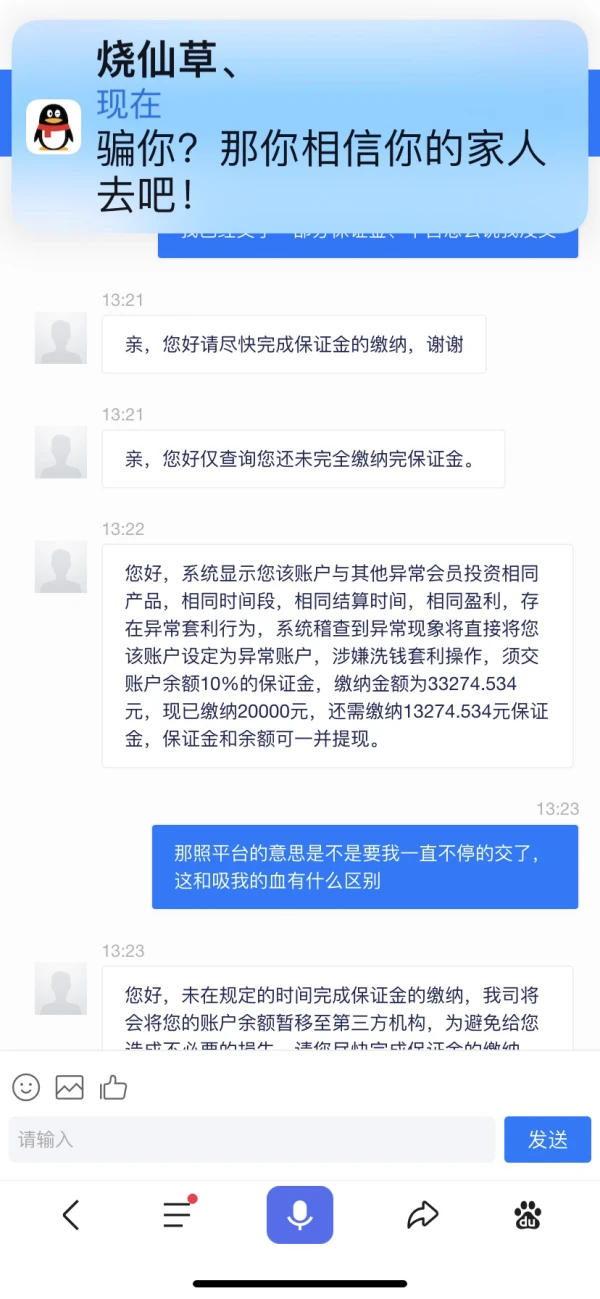

前些日子,从手机上认识了一个人,说是做外汇的。我咨询了一些事,让后做了几单,当时挺好,到了第六单就暴仓了35000元,后来他说不要急,包赔。 经过他们商量给我打到外汇帐上17500元,让我再加17500元,商量后也跟进,让后做单35000元,后这单完成,但不能提现,说要再下一单,才能提现,但我没跟。到现在帐面上还在93400元,但不敢提现。 还有跟我联系的人,以把我拉黑。谢!

Esposizione