Profil perusahaan

| 4e Ringkasan Ulasan | |

| Dibentuk | 2023 |

| Negara/Daerah Terdaftar | Malaysia |

| Regulasi | Tidak Diatur |

| Instrumen Pasar | Aset Digital, Forex, Komoditas, Saham, dan Indeks |

| Akun Demo | ✅ |

| Leverage | / |

| Spread | Mengambang |

| Platform Trading | Web, aplikasi seluler |

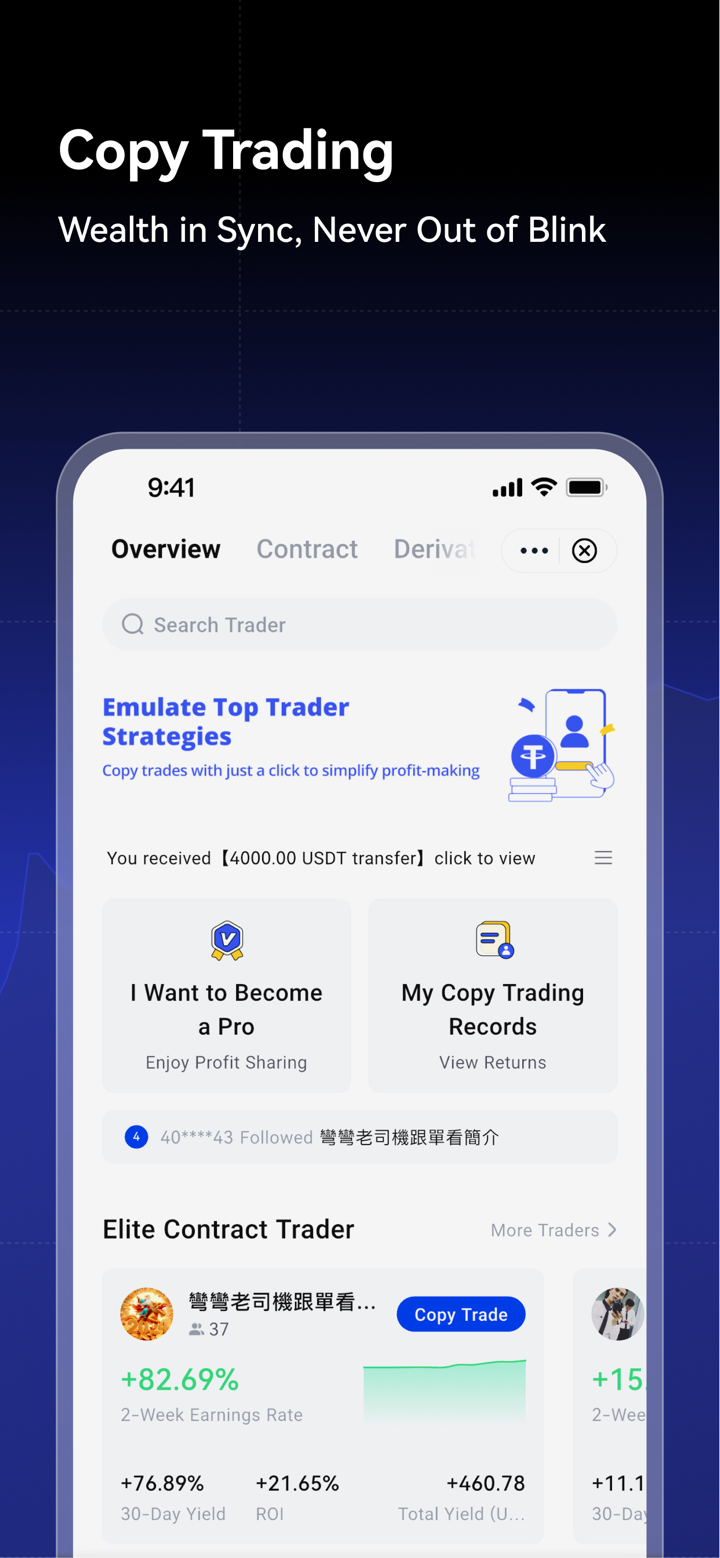

| Copy Trading | ✅ |

| Deposit Minimum | / |

| Dukungan Pelanggan | Chat langsung 24/7 |

| X: https://twitter.com/4e_Globalt=pskuEUAmV5h_AGEtle08yw&s=09 | |

| Instagram: https://www.instagram.com/global_4e/ | |

| Youtube: https://www.youtube.com/@4E_Global | |

| Pembatasan Regional | Korea Utara, Kuba, Suriah, Iran, Venezuela, Sudan, Sudan Selatan, Crimea, Rusia, Lebanon, Irak, Libya, Amerika Serikat, Bangladesh, India, dan Pakistan |

4e adalah platform perdagangan derivatif keuangan yang terdaftar di Malaysia pada tahun 2023. Ia menawarkan perdagangan Aset Digital, Forex, Komoditas, Saham, dan Indeks. Namun, saat ini ia beroperasi tanpa pengawasan regulasi dari otoritas keuangan.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berbagai pilihan perdagangan | Tidak ada regulasi |

| Tersedia akun demo | Kurangnya transparansi |

| Copy trading | Biaya tidak aktif tinggi |

| Dukungan chat langsung 24/7 | Tidak ada platform perdagangan yang dapat diandalkan |

| Opsi pembayaran terbatas | |

| Pembatasan regional |

Apakah 4e Legal?

Tidak, 4e bukan penyedia layanan keuangan yang sah. Kami tidak menemukan informasi mengenai regulasinya, oleh karena itu, kami sangat menyarankan untuk menghindari berurusan dengan 4e dan memilih broker yang memiliki lisensi dan diatur dengan baik.

Apa yang Dapat Saya Perdagangkan di 4e?

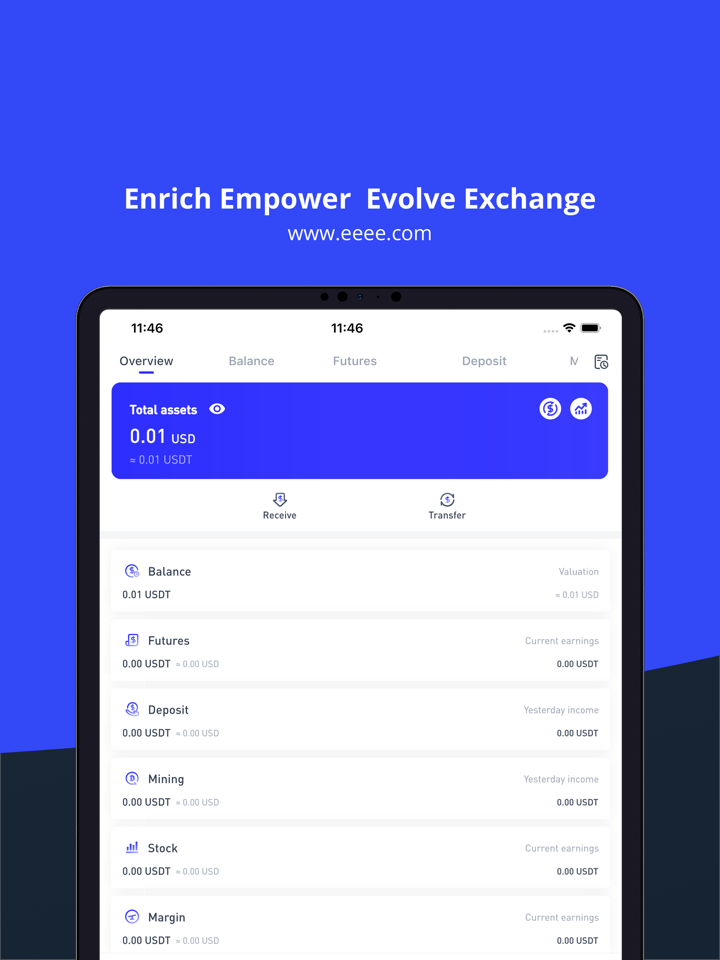

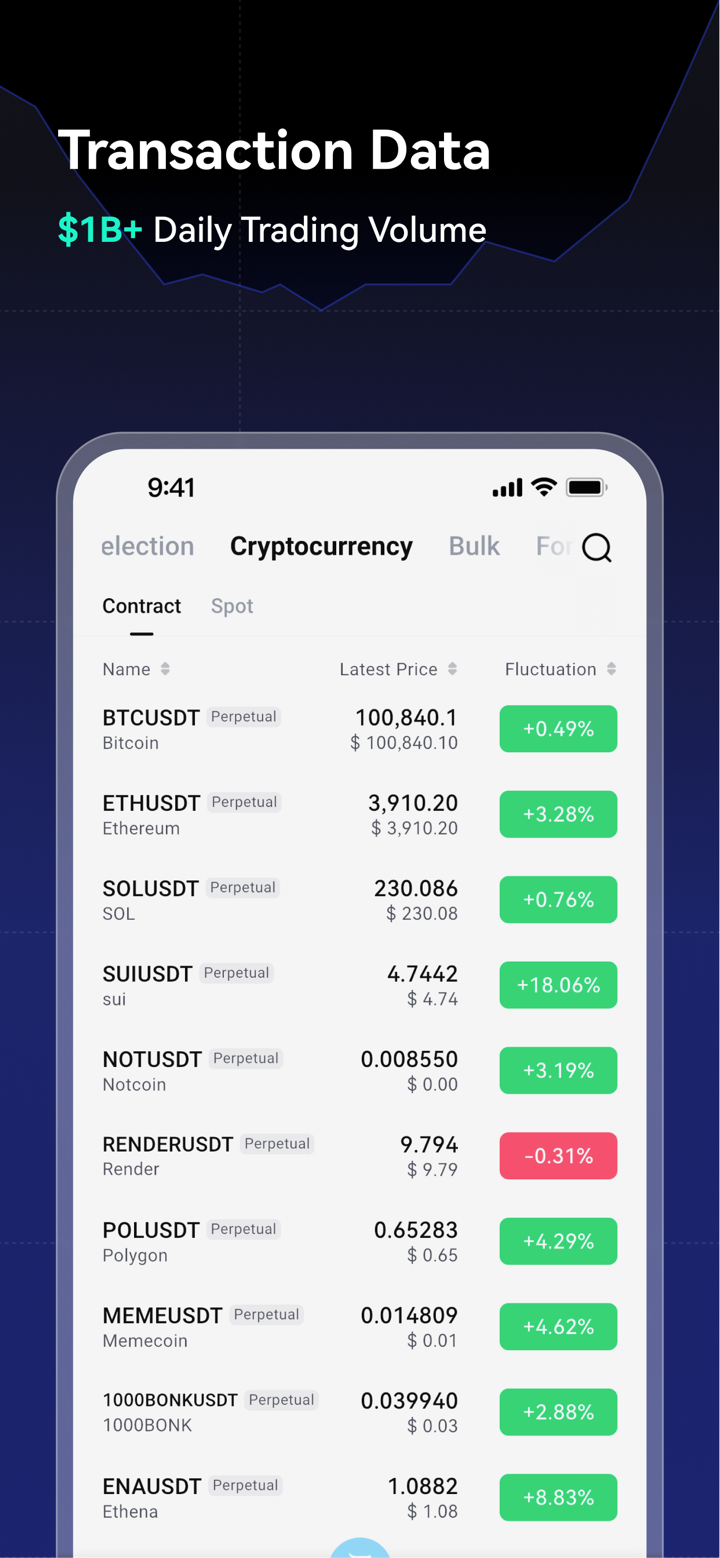

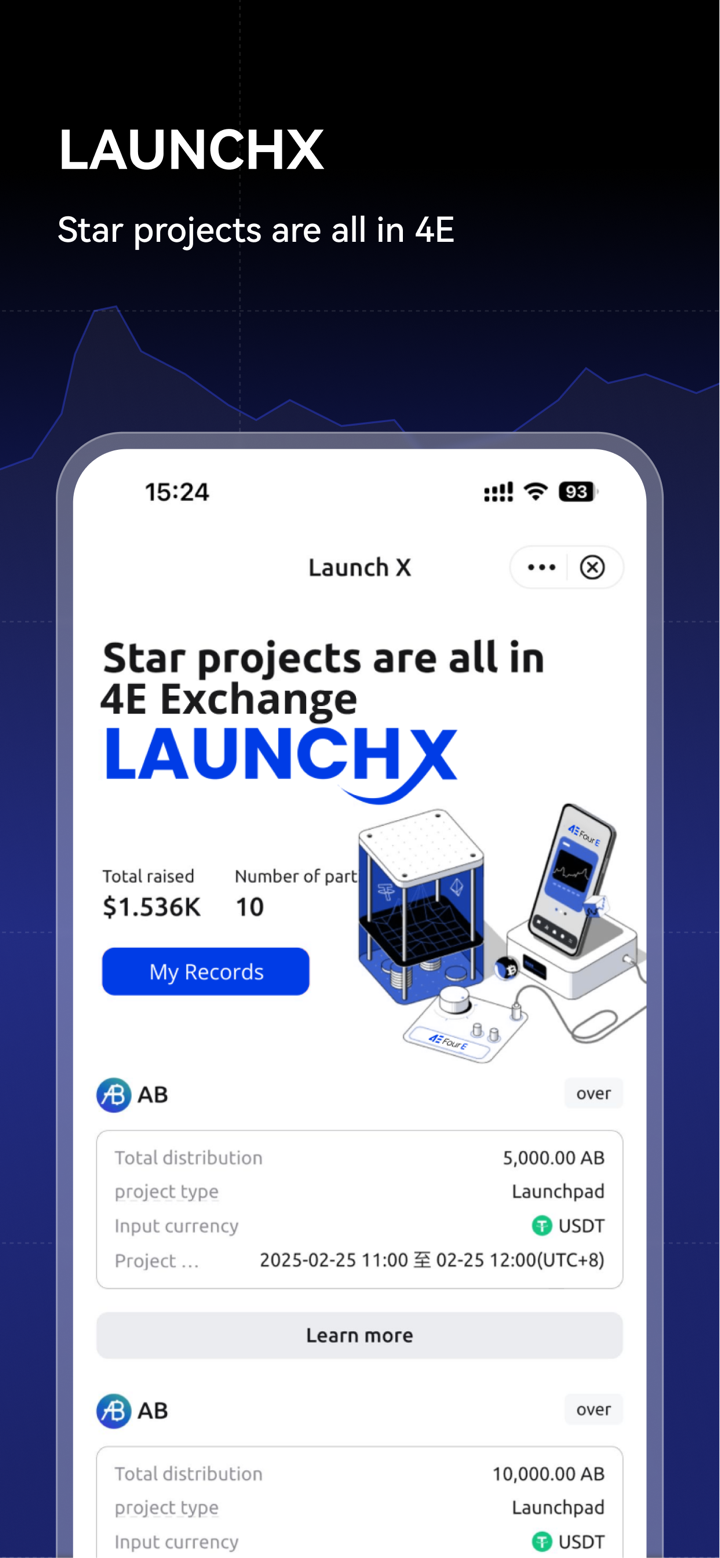

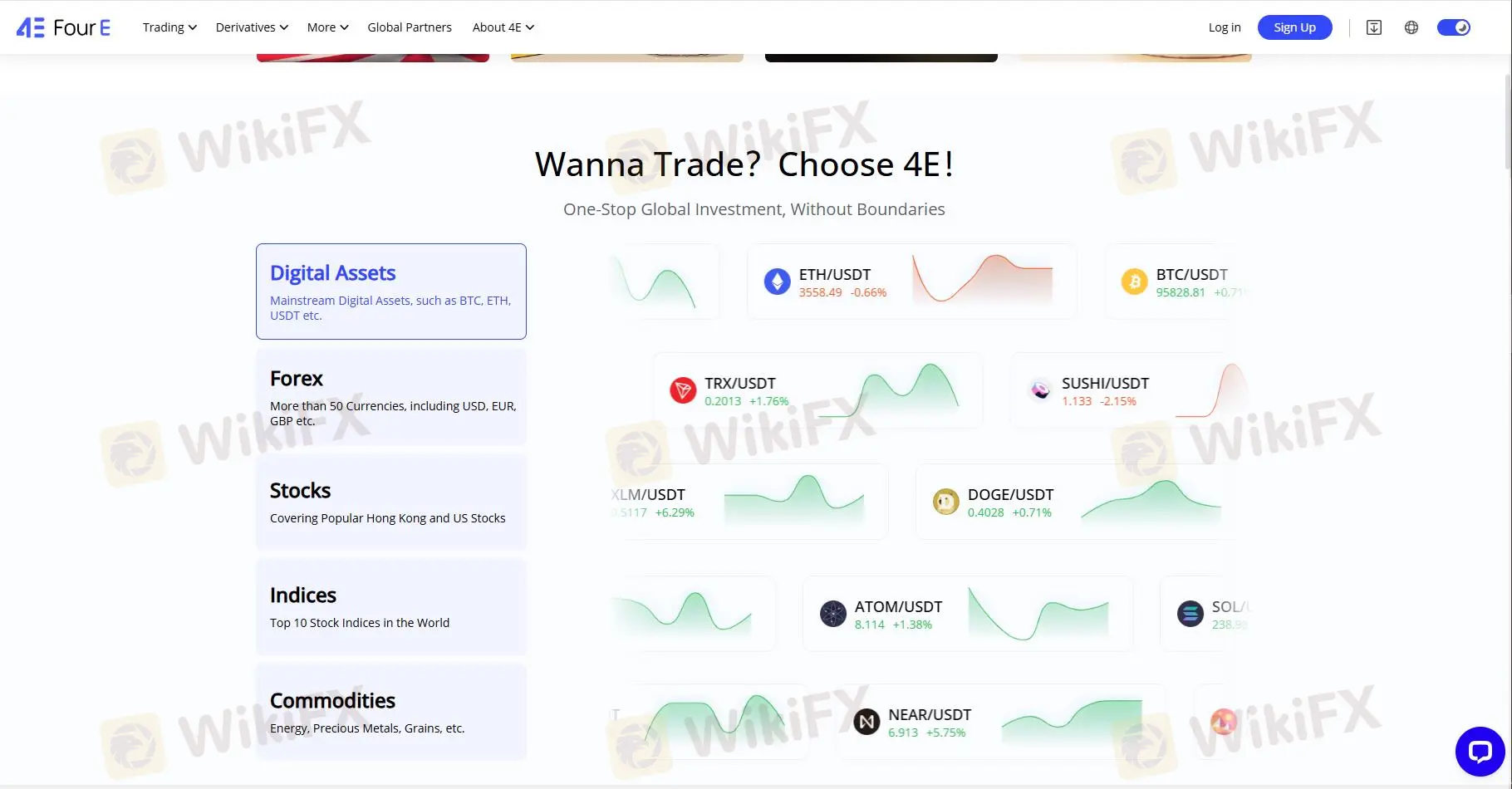

4e menawarkan berbagai pilihan perdagangan, termasuk aset digital, forex, komoditas, dan ETF, saham, dan indeks.

Aset Digital: Aset Digital Utama, seperti BTC, ETH, USDT, dll.

Forex: Lebih dari 50 mata uang, termasuk USD, EUR, GBP, dll.

Saham: Saham Populer Hong Kong dan AS (AAPL, GOOG, Cocacola, KO, MSFT, TSLA...)

Indeks: US30, Jepang 225, US 500, US SPX 500, UK 100, US NDAQ 100, Euro 50....

Komoditas: Energi, Logam Mulia, Bijian, Perak, NGAS...

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Forex | ✔ |

| Komoditas | ✔ |

| Indeks | ✔ |

| Saham | ✔ |

| Kriptocurrency | ✔ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

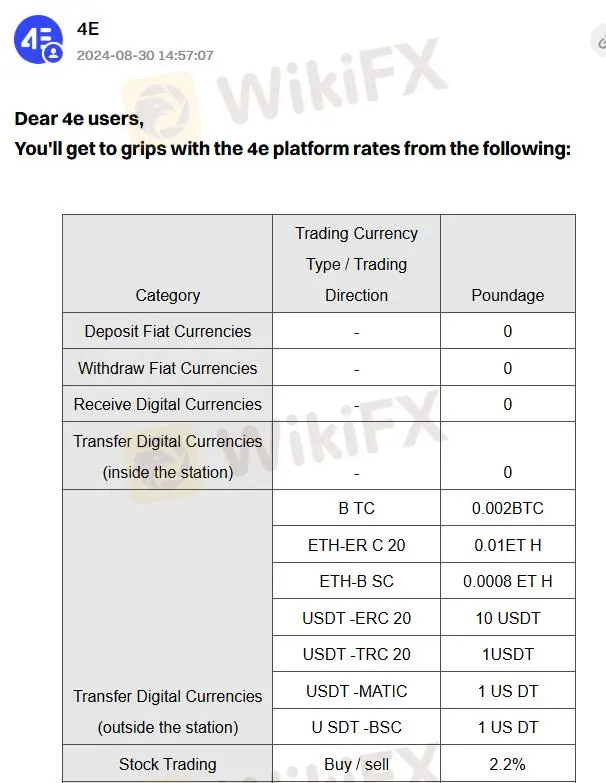

4e Biaya

4e mengenakan komisi tertentu untuk perdagangan mata uang digital dan saham. Anda dapat merujuk ke formulir berikut untuk rincian. Jenis instrumen perdagangan lainnya tidak disebutkan mengenai komisi.

| Kategori | Jenis Mata Uang Perdagangan/Arah Perdagangan | Komisi |

| Transfer Mata Uang Digital (di luar stasiun) | BTC | 0.002BTC |

| ETH-ER C 20 | 0.01ETH | |

| ETH-B SC | 0.0008 ETH | |

| USDT-ERC 20 | 10 USDT | |

| USDT-TRC 20 | 1 USDT | |

| USDT-MATIC | 1 USDT | |

| U SDT -BSC | 1 US DT | |

| Perdagangan Saham | Beli / jual | 2.2% |

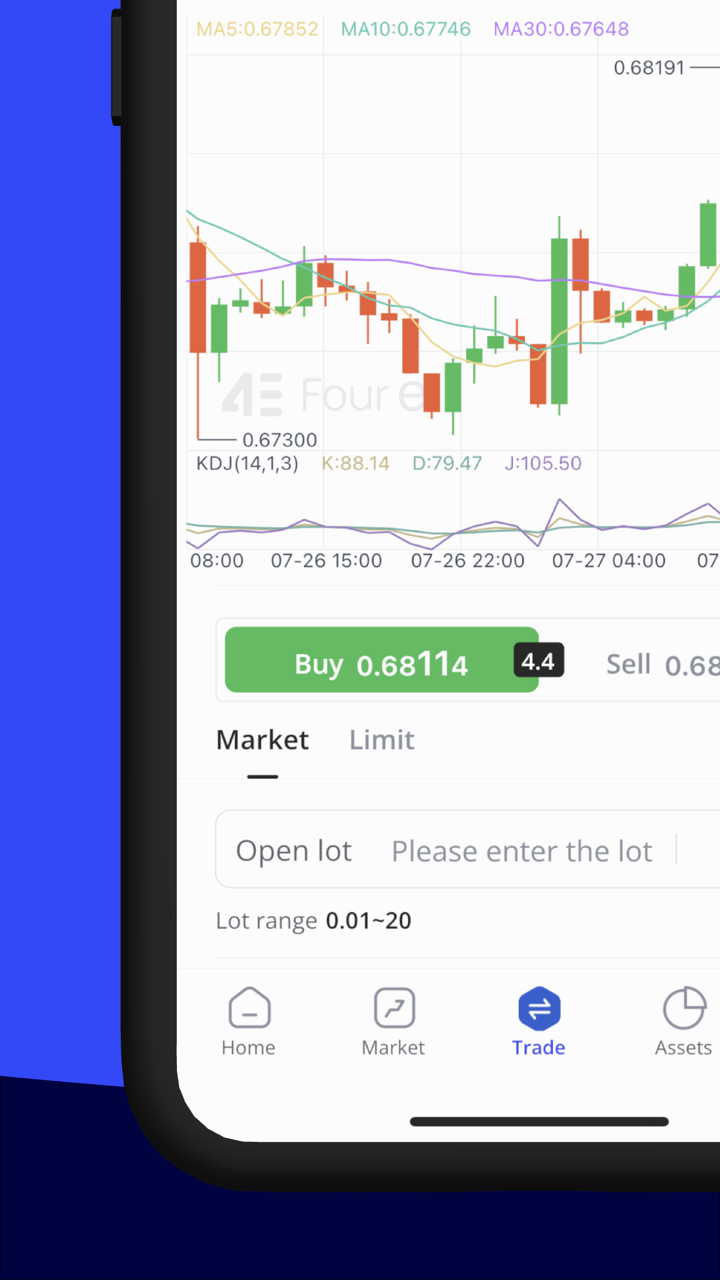

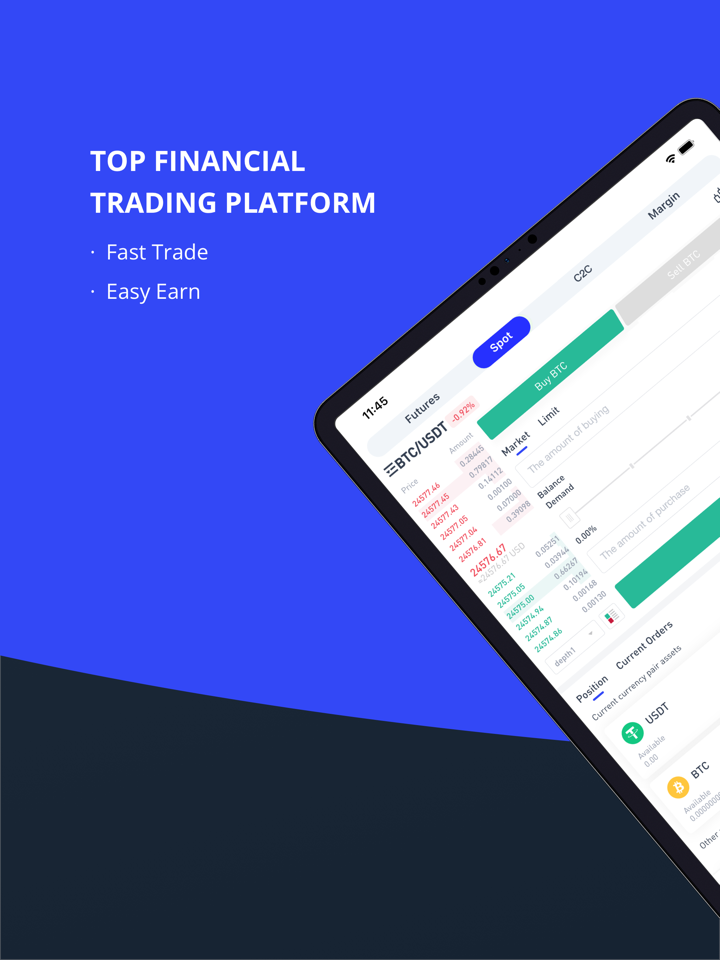

Platform Perdagangan

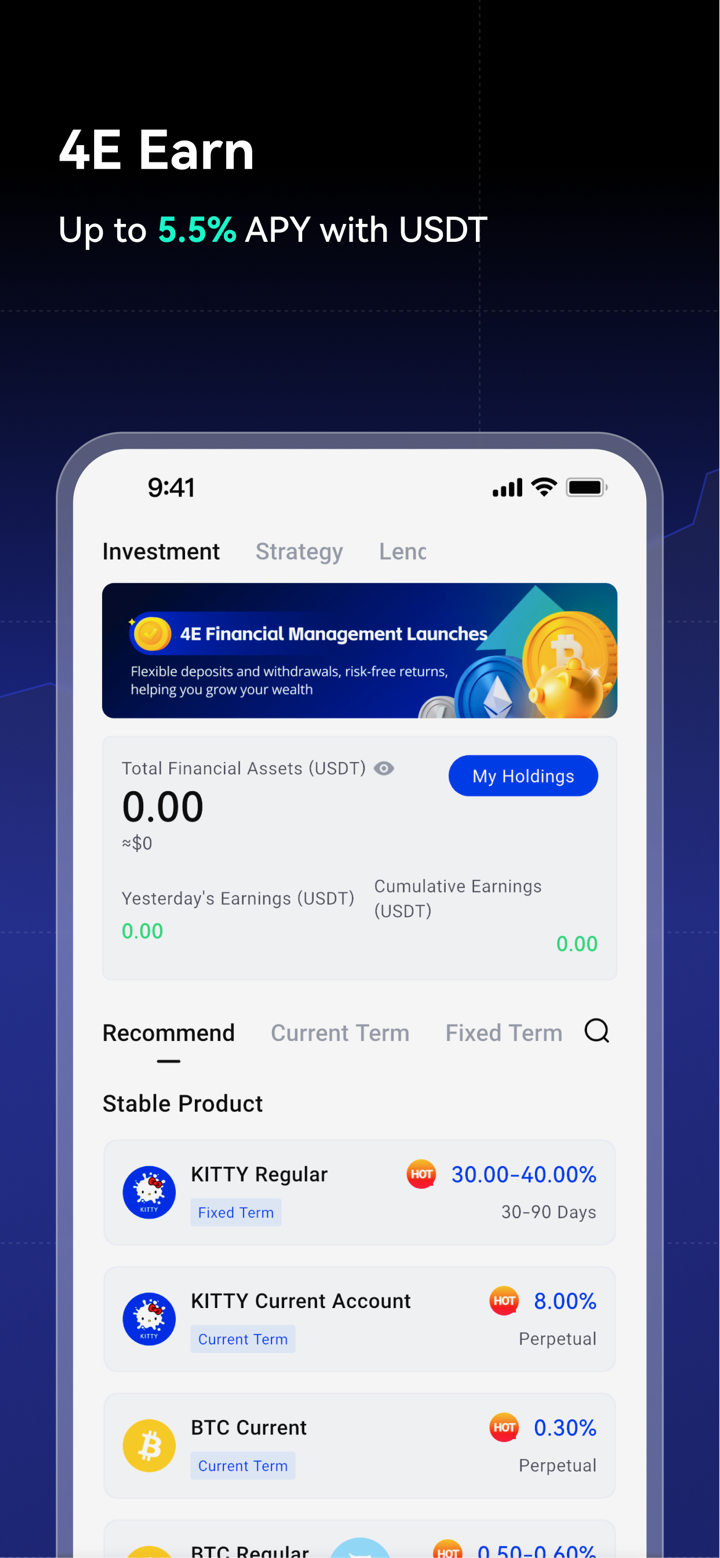

4e menawarkan platform yang dikembangkan sendiri untuk perdagangan, dengan versi aplikasi dan tablet yang tersedia. Ia mengklaim menyediakan Anda dengan tren keuangan terbaru. Namun, kami tetap merekomendasikan memilih broker yang diatur dengan platform perdagangan profesional seperti MT4 atau MT5.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| 4e Mobile | ✔ | Web dan aplikasi mobile | / |

| MT4 | ❌ | / | Pemula |

| MT5 | ❌ | / | Trader berpengalaman |

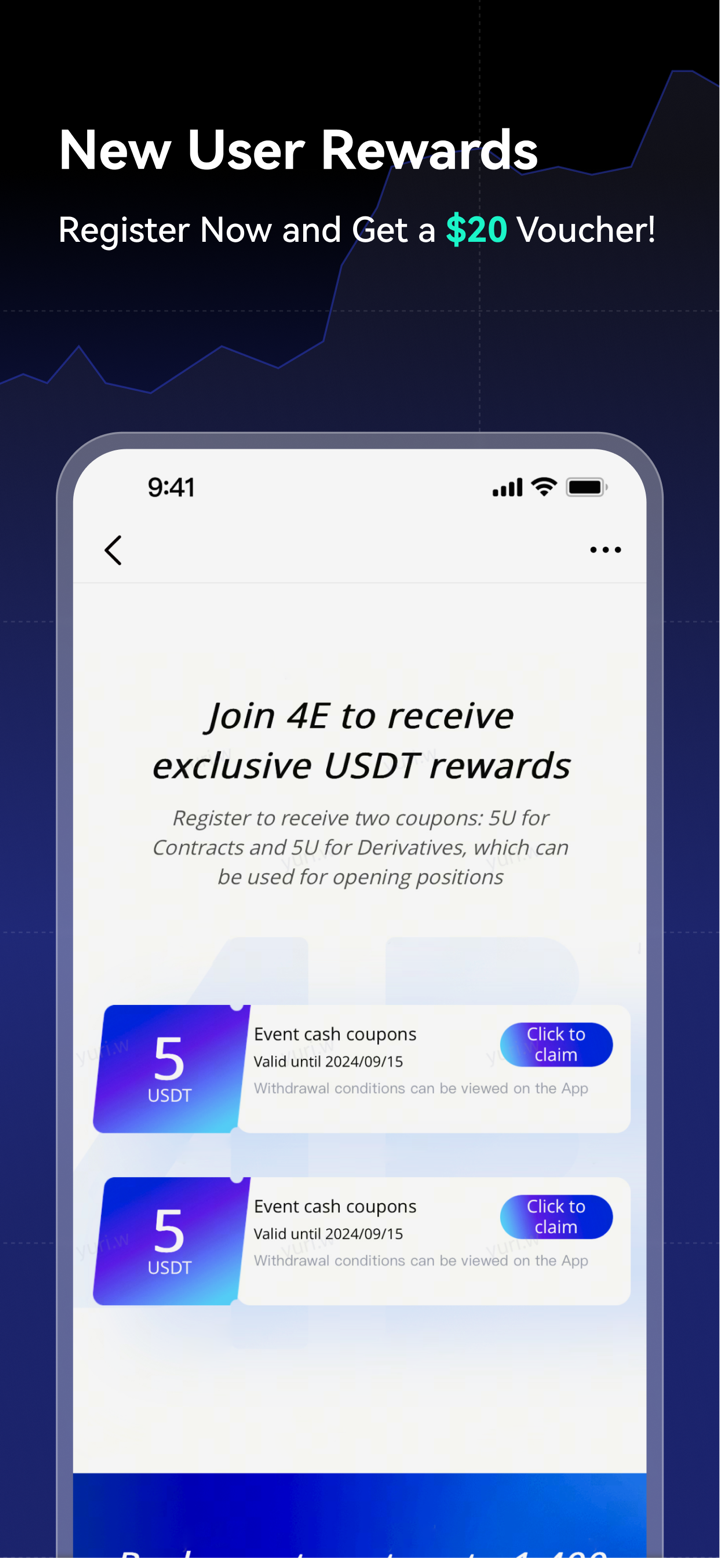

Deposit dan Penarikan

4e hanya menyebutkan bahwa Anda dapat melakukan deposit dan penarikan dana melalui cryptocurrencies dan metode lainnya, tetapi cara-cara spesifik tidak diungkapkan. Anda harus memperhatikan bahwa semua transaksi yang dilakukan melalui cryptocurrencies tidak dapat dibatalkan, yang melibatkan risiko tinggi, terutama saat berurusan dengan broker yang tidak diatur seperti 4e.