Buod ng kumpanya

| 4e Buod ng Pagsusuri | |

| Itinatag | 2023 |

| Rehistradong Bansa/Rehiyon | Malaysia |

| Regulasyon | Walang regulasyon |

| Mga Instrumento sa Merkado | Digital Assets, Forex, Commodities, Stocks at Indices |

| Demo Account | ✅ |

| Leverage | / |

| Spread | Floating |

| Plataforma ng Pagsusugal | Web, mobile app |

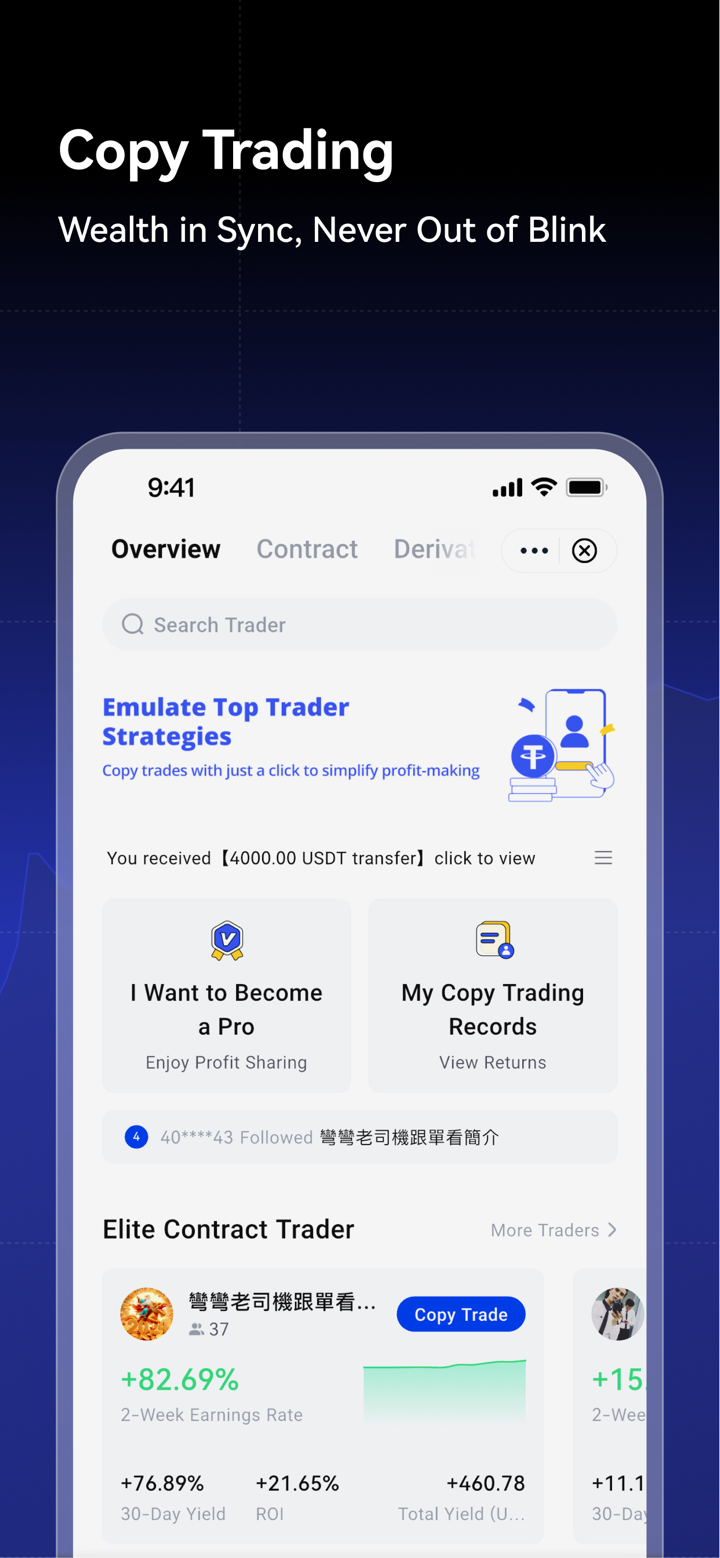

| Copy Trading | ✅ |

| Min Deposit | / |

| Suporta sa Customer | 24/7 live chat |

| X: https://twitter.com/4e_Globalt=pskuEUAmV5h_AGEtle08yw&s=09 | |

| Instagram: https://www.instagram.com/global_4e/ | |

| Youtube: https://www.youtube.com/@4E_Global | |

| Mga Pagsalig sa Rehiyon | Hilagang Korea, Cuba, Syria, Iran, Venezuela, Sudan, Timog Sudan, Crimea, Russia, Lebanon, Iraq, Libya, Estados Unidos, Bangladesh, India at Pakistan |

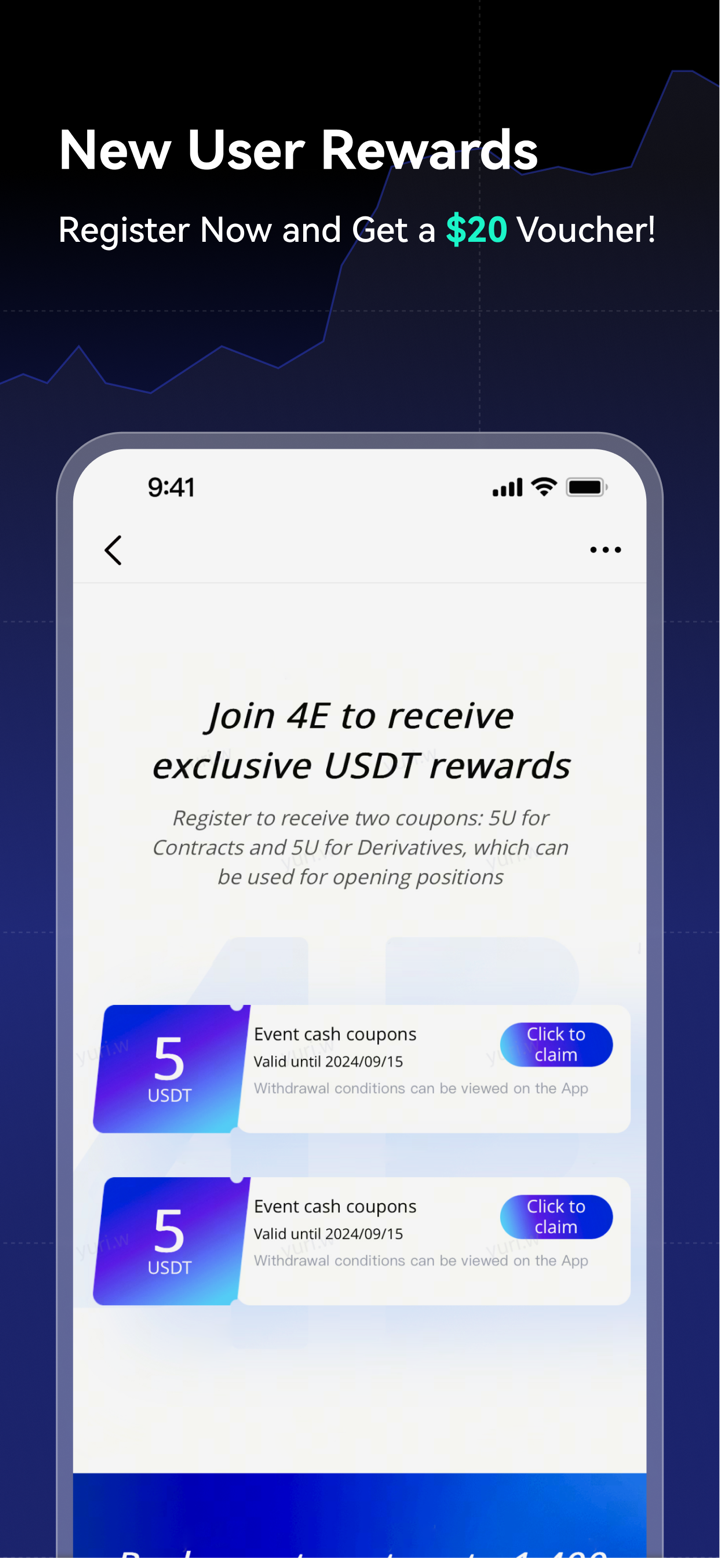

Ang 4e ay isang platform ng pagtutulot ng mga pinansiyal na derivatives na naka-rehistro sa Malaysia noong 2023. Nag-aalok ito ng pagtutulot sa Digital Assets, Forex, Commodities, Stocks at Indices. Gayunpaman, ito ay kasalukuyang nag-ooperate nang walang regulasyon mula sa isang awtoridad sa pinansyal.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Iba't ibang mga pagpipilian sa pagtutulot | Walang regulasyon |

| Available ang mga demo account | Kawalan ng transparensya |

| Copy trading | Mataas na bayad sa hindi aktibo |

| 24/7 live chat na suporta | Walang maaasahang platform ng pagtutulot |

| Limitadong mga pagpipilian sa pagbabayad | |

| Mga pagsalig sa rehiyon |

Tunay ba ang 4e?

Hindi, hindi lehitimong tagapagbigay ng serbisyong pinansyal ang 4e. Hindi kami nakakita ng anumang impormasyon tungkol sa regulasyon nito, kaya't mariing inirerekomenda naming iwasan ang pakikipagtransaksyon sa 4e at sa halip ay pumili ng isang broker na may tamang lisensya at regulasyon.

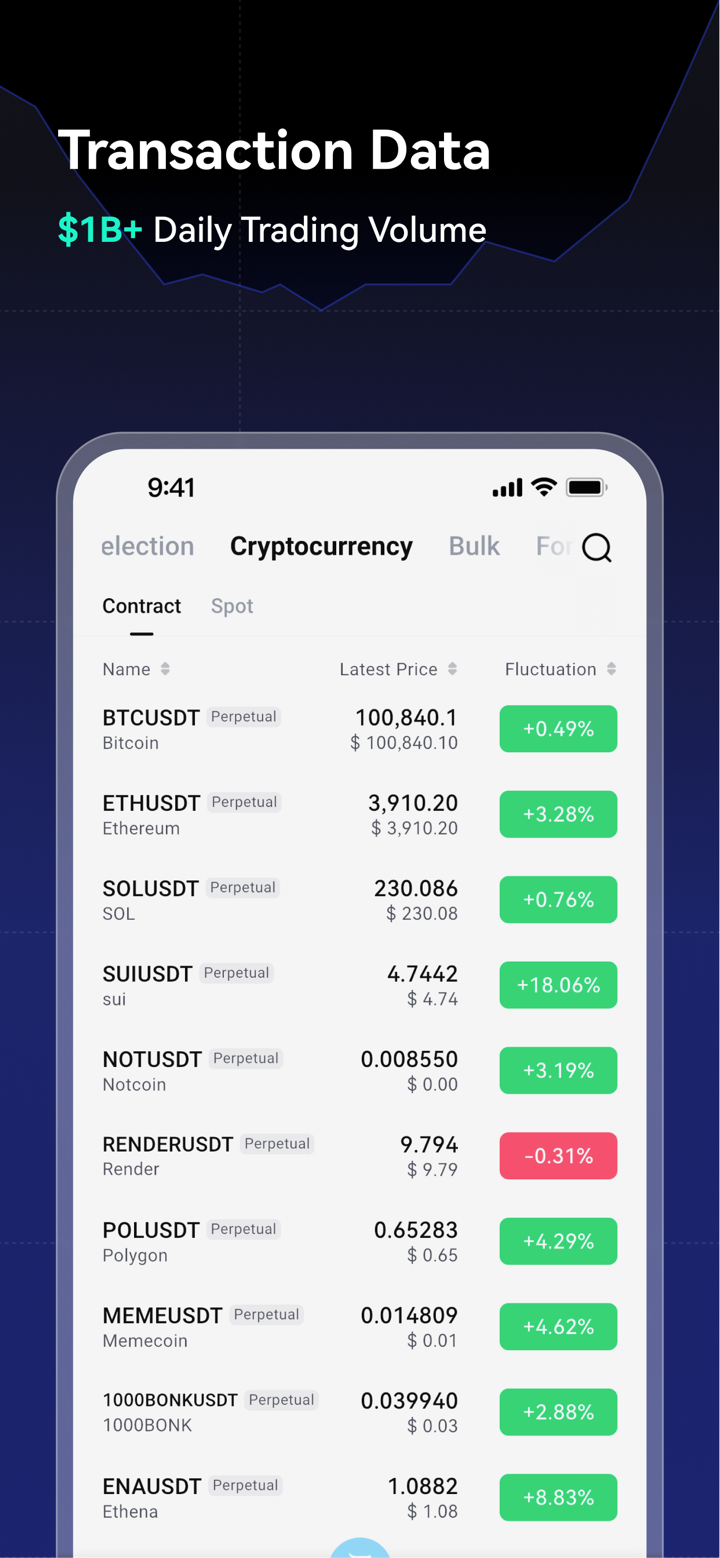

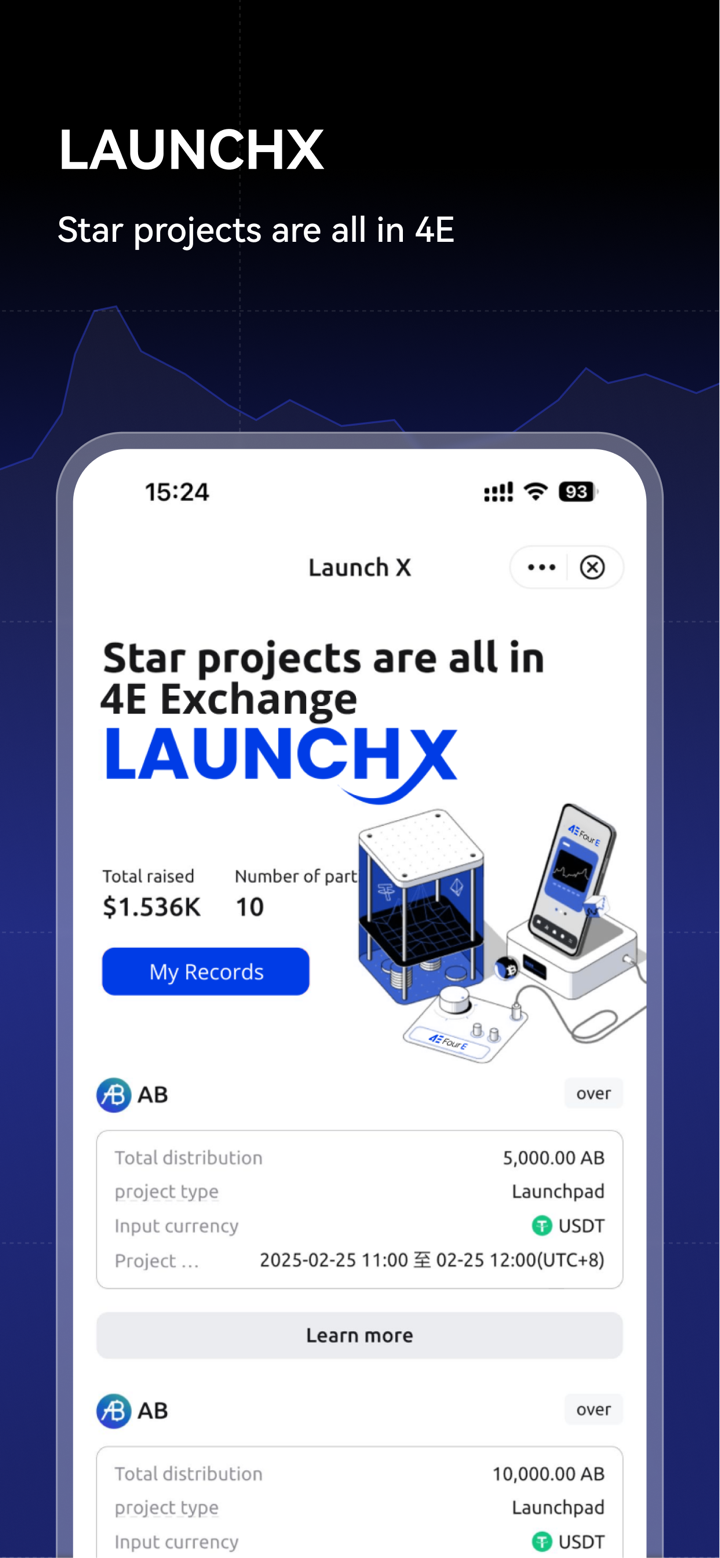

Ano ang Maaari Kong I-trade sa 4e?

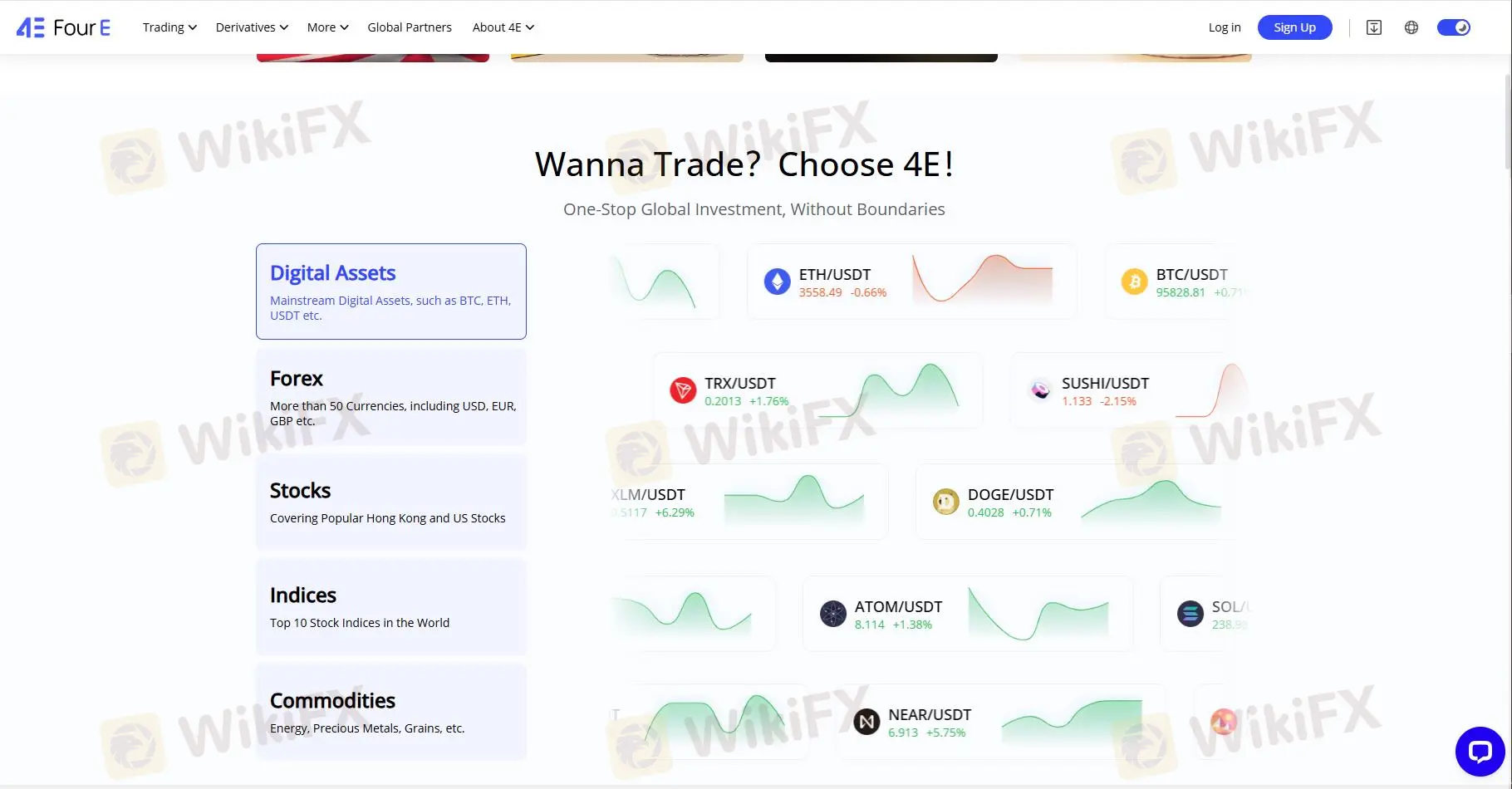

Nag-aalok ang 4e ng iba't ibang mga pagpipilian sa pagtutulot, kasama ang digital assets, forex, commodities at ETFs, stocks at indices.

Digital Assets: Pangunahing Digital Assets, tulad ng BTC, ETH, USDT, atbp.

Forex: Higit sa 50 mga currency, kasama ang USD, EUR, GBP, atbp.

Stocks: Sikat na mga Stock sa Hong Kong at US (AAPL, GOOG, Cocacola, KO, MSFT, TSLA...)

Indices: US30, Japan 225, US 500, US SPX 500, UK 100, US NDAQ 100, Euro 50....

Mga Kalakal: Enerhiya, Mahahalagang Metal, Mga Butil, Pilak, NGAS...

| Mga Instrumento na Maaaring I-Trade | Supported |

| Forex | ✔ |

| Mga Kalakal | ✔ |

| Mga Indeks | ✔ |

| Mga Stock | ✔ |

| Mga Cryptocurrency | ✔ |

| Mga Bond | ❌ |

| Mga Opsyon | ❌ |

| Mga ETF | ❌ |

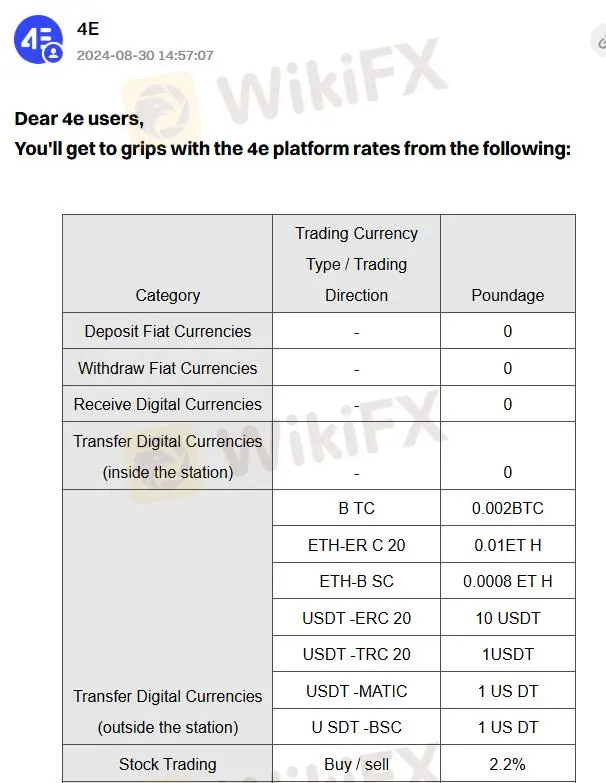

4e Mga Bayarin

4e singilin ang isang tiyak na komisyon para sa digital na pera at stock trading. Maaari mong tingnan ang sumusunod na form para sa mga detalye. Hindi binabanggit ang iba pang uri ng mga instrumento sa pag-trade patungkol sa komisyon.

| Kategorya | Uri ng Pera sa Pag-trade / Direksyon ng Pag-trade | Komisyon |

| Transfer ng Digital na Pera (labas ng istasyon) | BTC | 0.002BTC |

| ETH-ER C 20 | 0.01ETH | |

| ETH-B SC | 0.0008 ETH | |

| USDT-ERC 20 | 10 USDT | |

| USDT-TRC 20 | 1 USDT | |

| USDT-MATIC | 1 USDT | |

| U SDT -BSC | 1 US DT | |

| Pag-trade ng Stock | Bumili / magbenta | 2.2% |

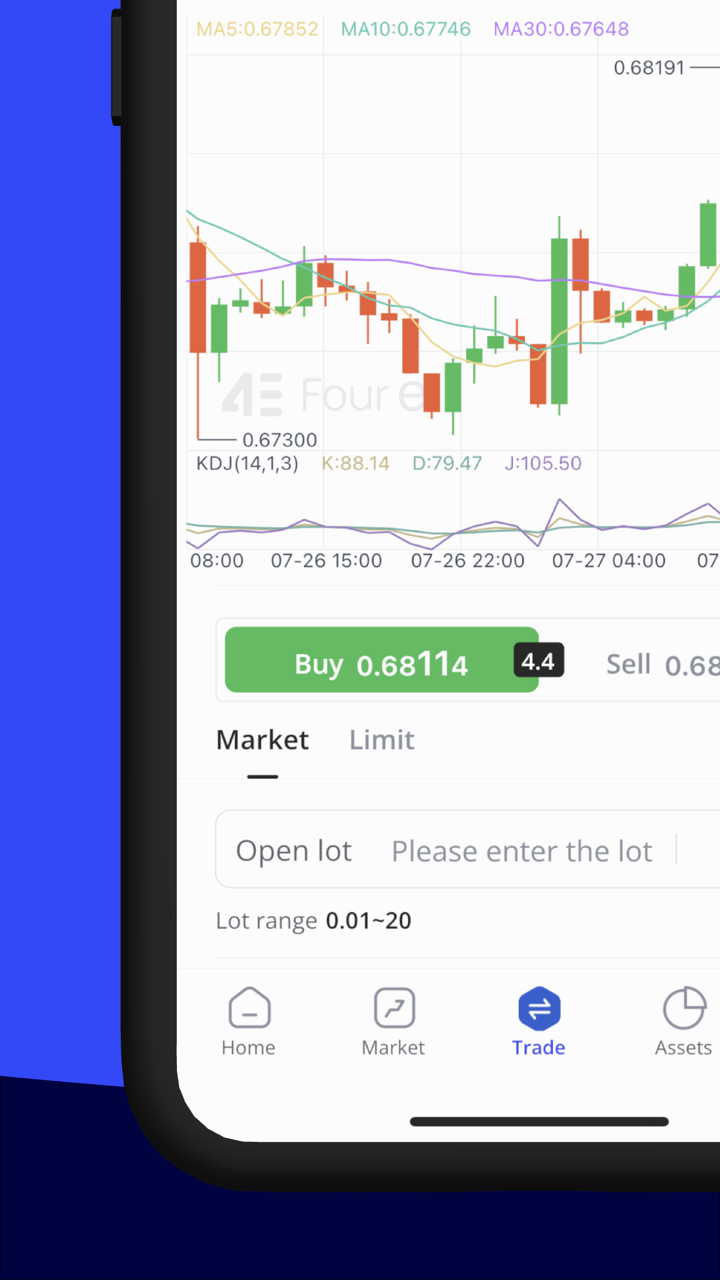

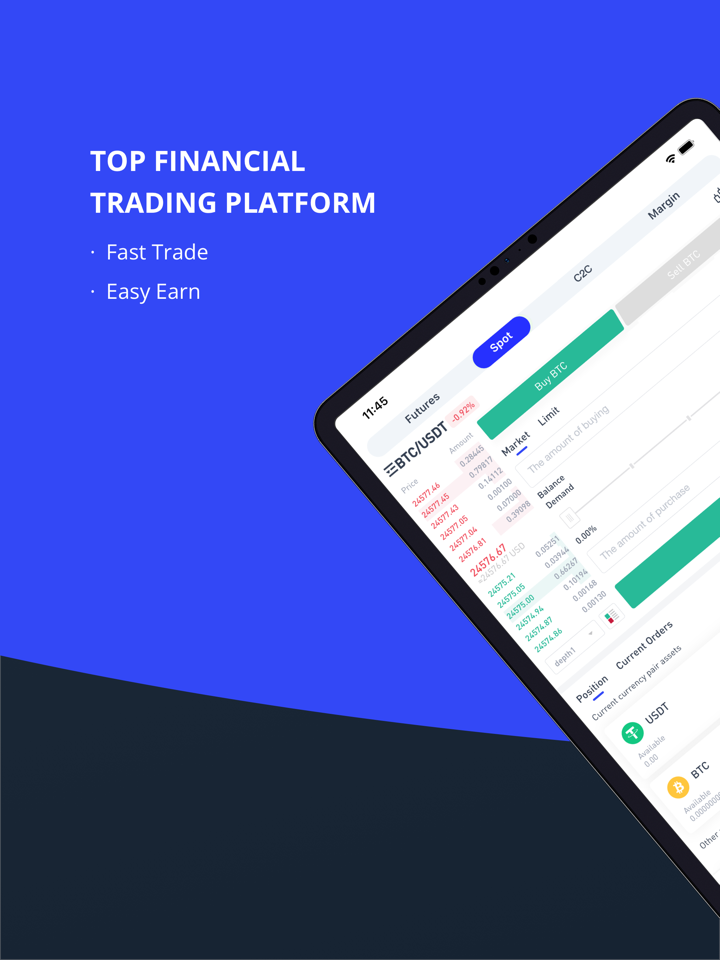

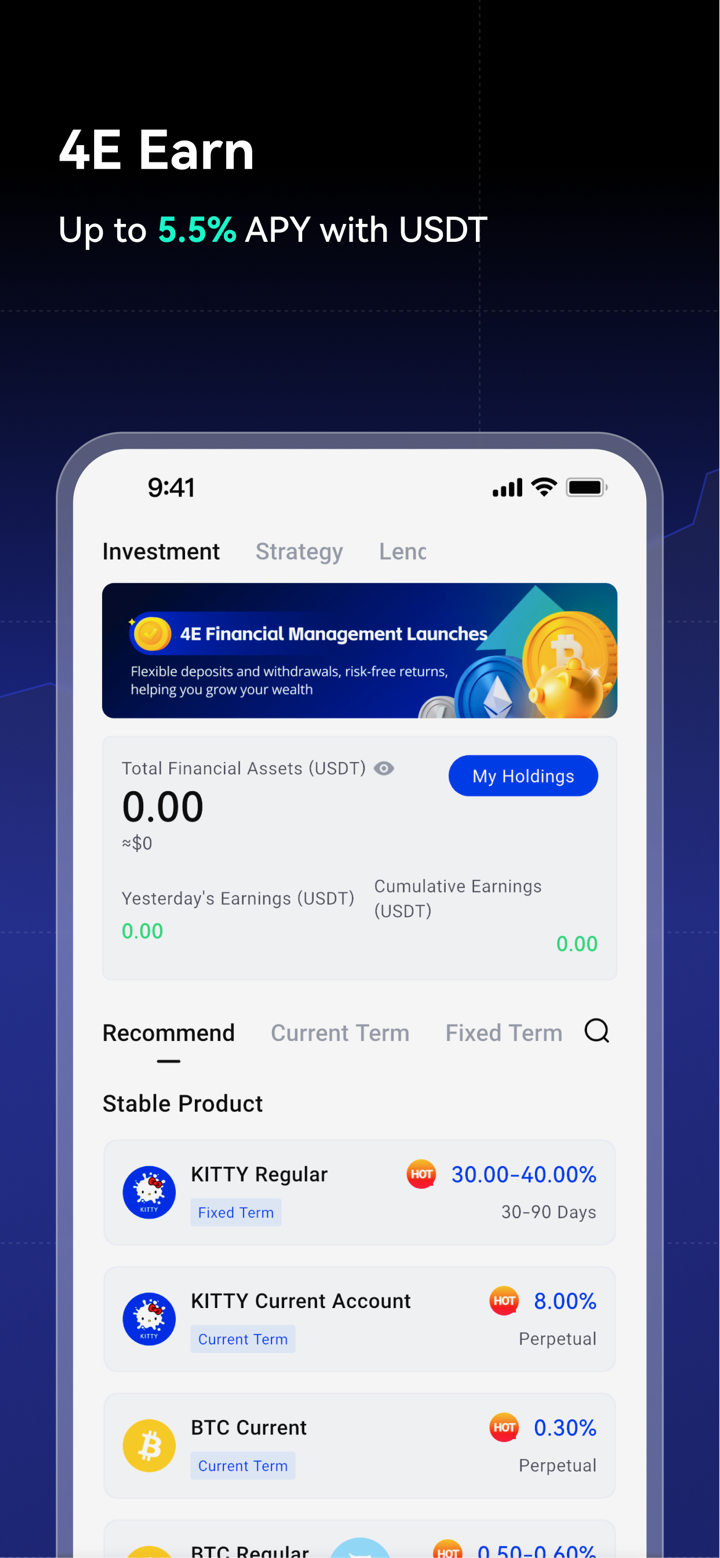

Platforma sa Pag-trade

4e nag-aalok ng sariling-developed na platforma para sa pag-trade, mayroong mga app at tablet na bersyon na available. Ito ay nag-aangkin na nagbibigay sa iyo ng pinakabagong mga trend sa pinansyal. Gayunpaman, kami pa rin ay nagrerekomenda na piliin ang isang reguladong broker na may propesyonal na platforma sa pag-trade tulad ng MT4 o MT5.

| Platforma sa Pag-trade | Supported | Available Devices | Angkop para sa |

| 4e Mobile | ✔ | Web at mobile app | / |

| MT4 | ❌ | / | Mga Beginners |

| MT5 | ❌ | / | Mga Kadalubhasaan na mga trader |

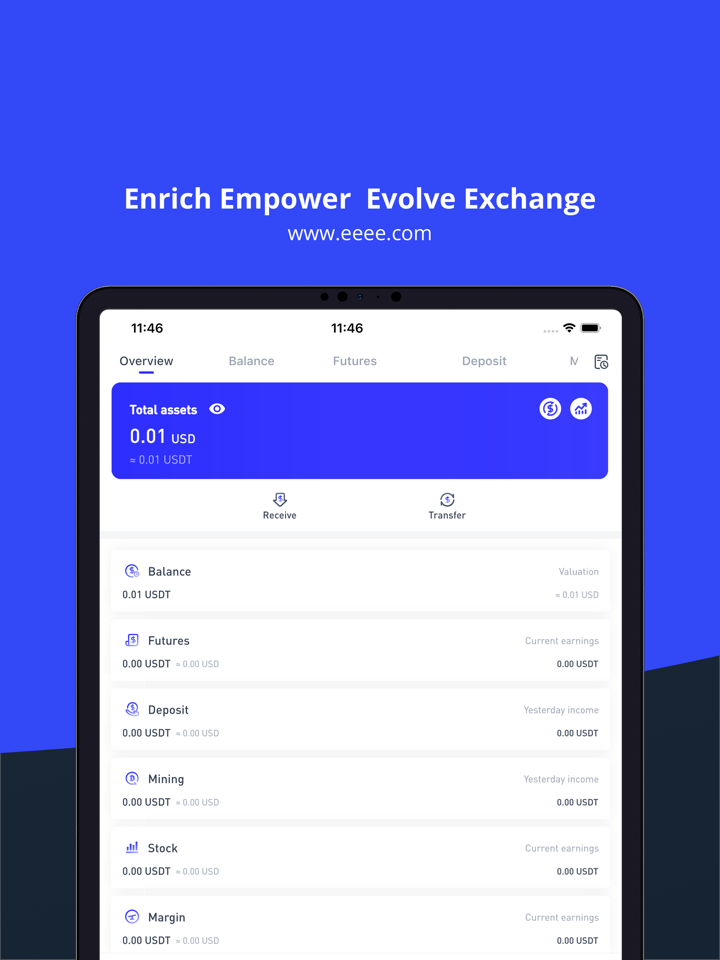

Pagdedeposito at Pagwiwithdraw

Ang 4e ay nagbanggit lamang na maaari kang magdeposito at magwithdraw ng pondo sa pamamagitan ng cryptocurrencies at iba pang paraan, ngunit hindi ipinahayag ang mga tiyak na paraan. Dapat mong tandaan na ang lahat ng transaksyon na ginawa sa pamamagitan ng cryptocurrencies ay hindi maaaring bawiin, na may kasamang mataas na panganib, lalo na kapag nakikipagtransaksyon sa isang hindi reguladong broker tulad ng 4e.