公司简介

| 4e 评论摘要 | |

| 成立时间 | 2023 |

| 注册国家/地区 | 马来西亚 |

| 监管 | 未受监管 |

| 市场工具 | 数字资产、外汇、商品、股票和指数 |

| 模拟账户 | ✅ |

| 杠杆 | / |

| 点差 | 浮动 |

| 交易平台 | Web、移动应用 |

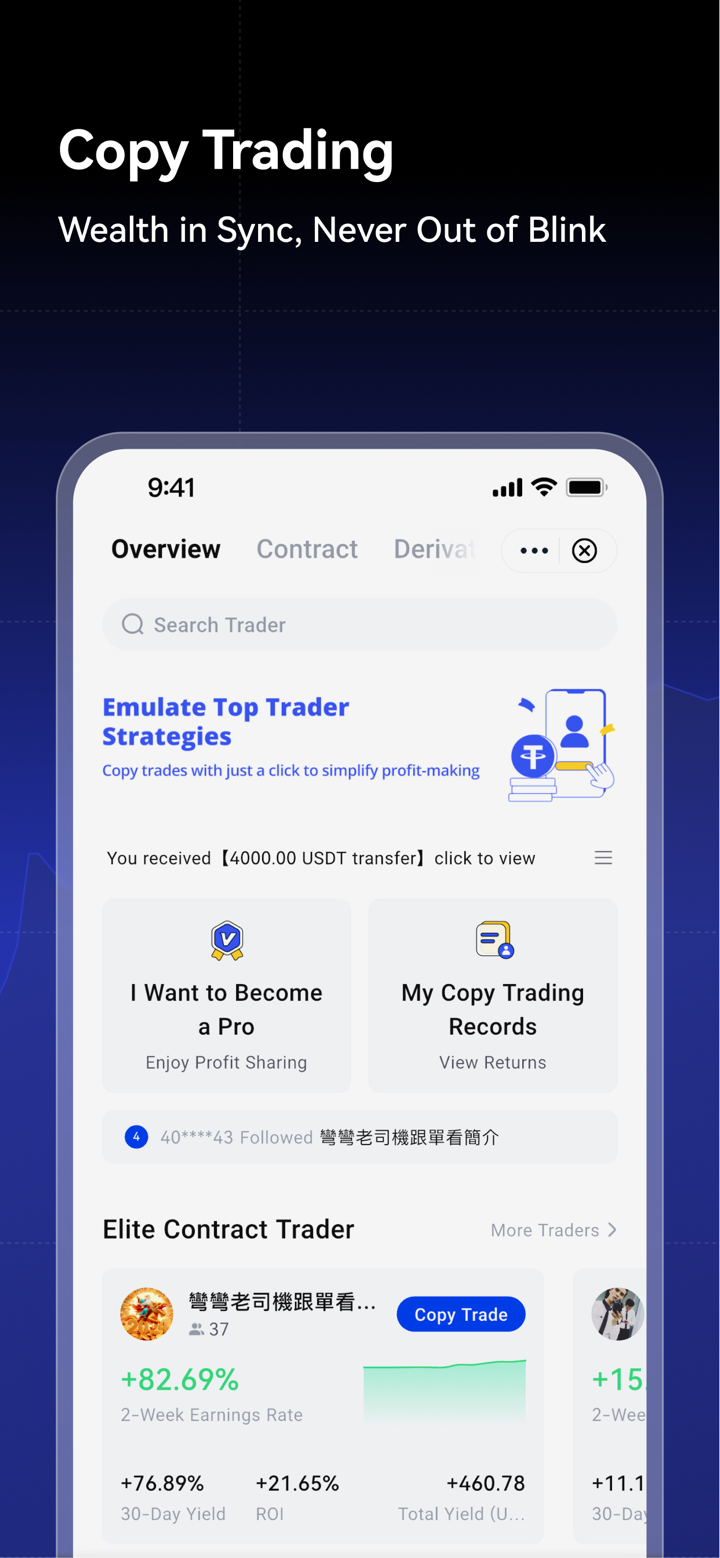

| 复制交易 | ✅ |

| 最低存款 | / |

| 客户支持 | 24/7在线聊天 |

| X: https://twitter.com/4e_Globalt=pskuEUAmV5h_AGEtle08yw&s=09 | |

| Instagram: https://www.instagram.com/global_4e/ | |

| Youtube: https://www.youtube.com/@4E_Global | |

| 地区限制 | 朝鲜、古巴、叙利亚、伊朗、委内瑞拉、苏丹、南苏丹、克里米亚、俄罗斯、黎巴嫩、伊拉克、利比亚、美国、孟加拉国、印度和巴基斯坦 |

4e 是一家于2023年在马来西亚注册的金融衍生品交易平台。它提供数字资产、外汇、商品、股票和指数的交易。然而,目前它在金融机构的监管下没有进行运营。

优点和缺点

| 优点 | 缺点 |

| 多种交易选择 | 无监管 |

| 提供模拟账户 | 缺乏透明度 |

| 复制交易 | 高不活跃费用 |

| 24/7在线聊天支持 | 没有可靠的交易平台 |

| 有限的支付选项 | |

| 地区限制 |

4e 是否合法?

不,4e 不是合法的金融服务提供商。我们没有找到关于它的监管信息,因此我们强烈建议避免与4e交易,而是选择一个拥有适当许可和监管的经纪人。

4e 上可以交易什么?

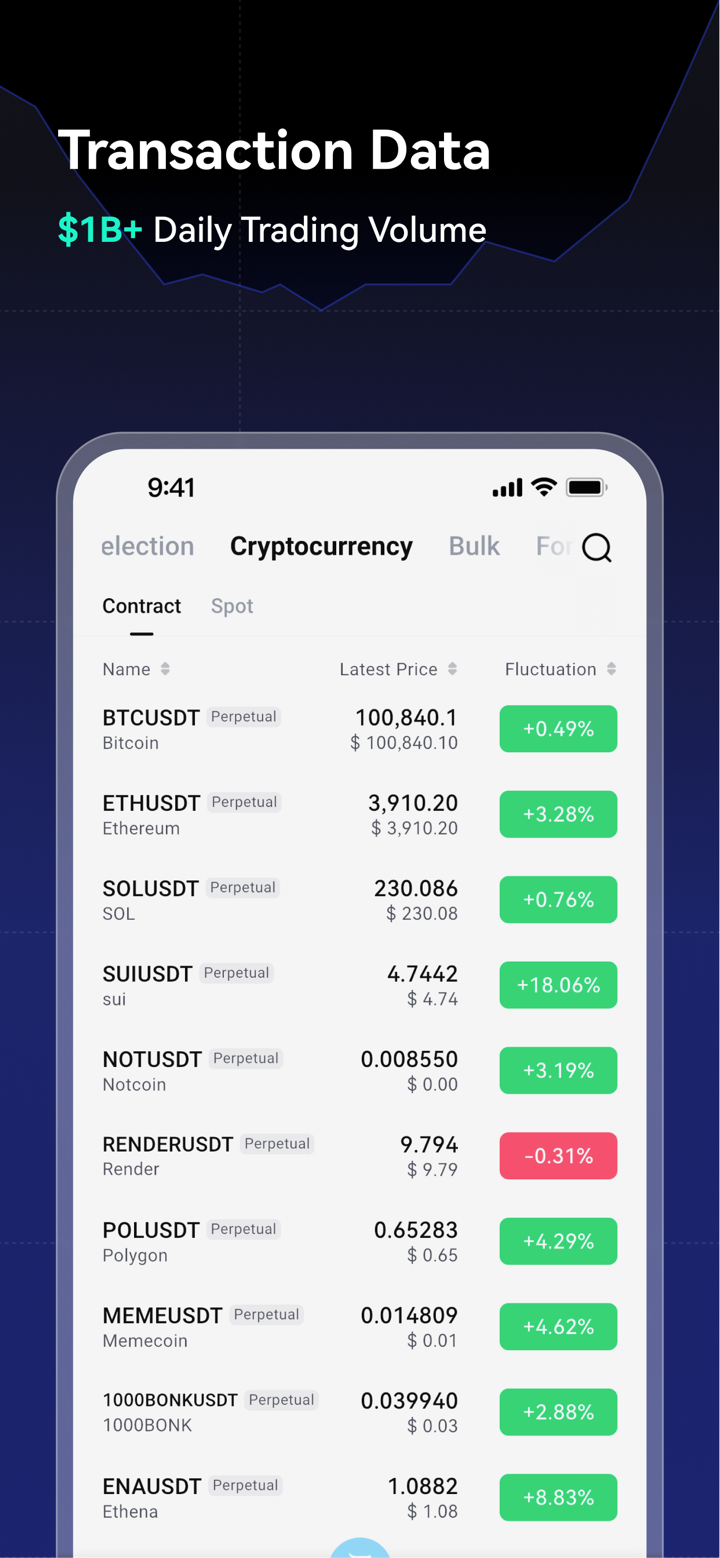

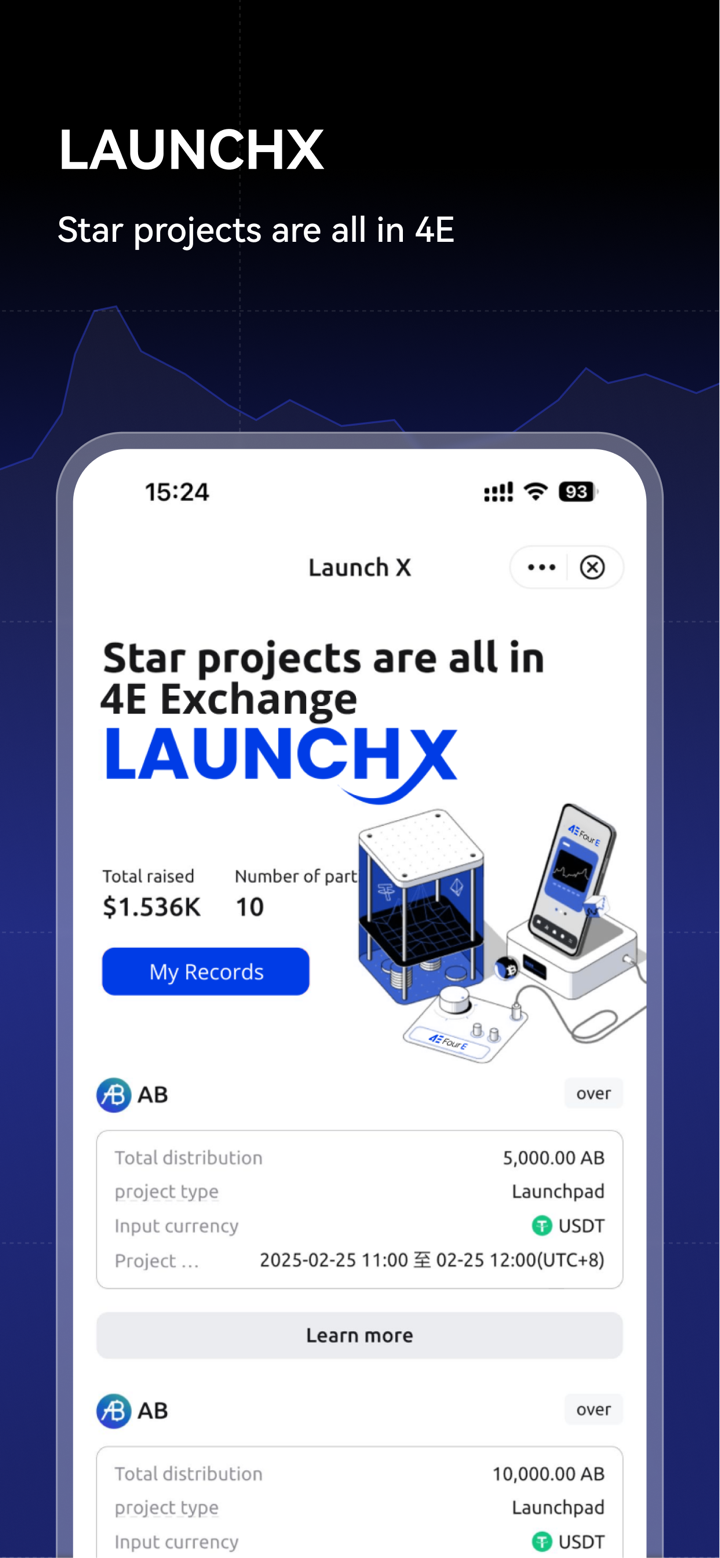

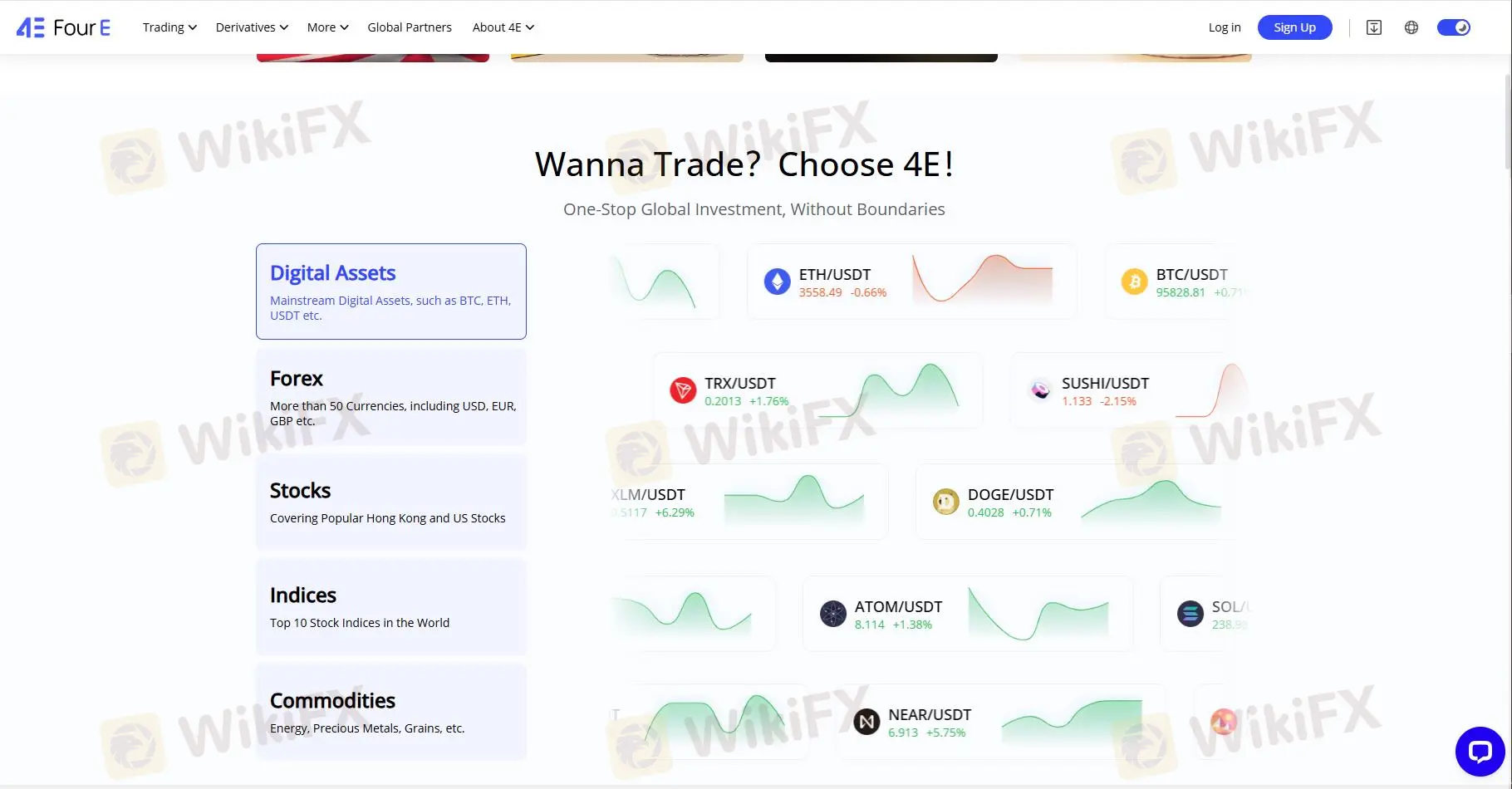

4e 提供多种交易选择,包括数字资产、外汇、商品和ETF、股票和指数。

数字资产:主流数字资产,如BTC、ETH、USDT等。

外汇:超过50种货币,包括美元、欧元、英镑等。

股票:热门的香港和美国股票(AAPL、GOOG、Cocacola、KO、MSFT、TSLA...)

指数:美国30、日本225、美国500、美国SPX 500、英国100、美国纳斯达克100、欧元50等。

大宗商品:能源、贵金属、谷物、白银、天然气...

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 大宗商品 | ✔ |

| 指数 | ✔ |

| 股票 | ✔ |

| 加密货币 | ✔ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

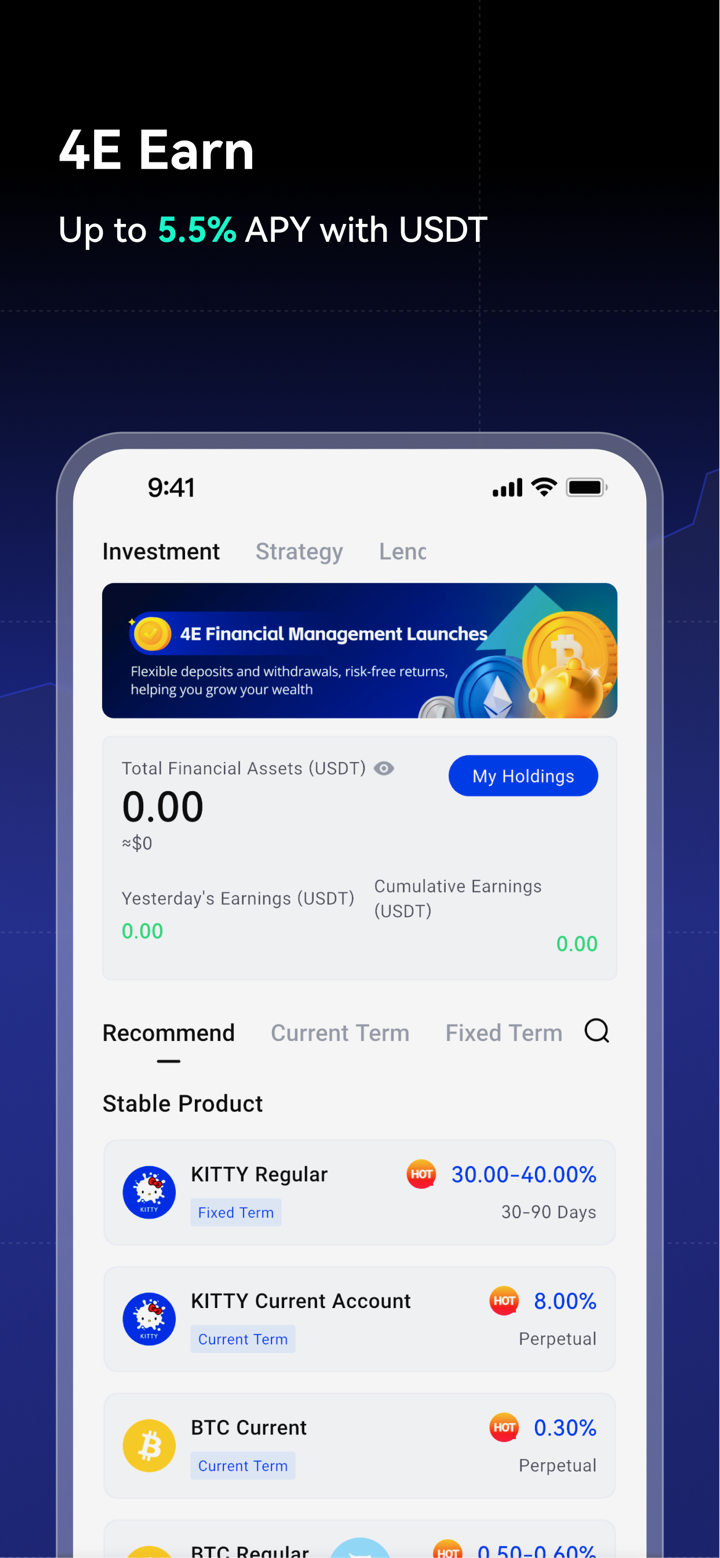

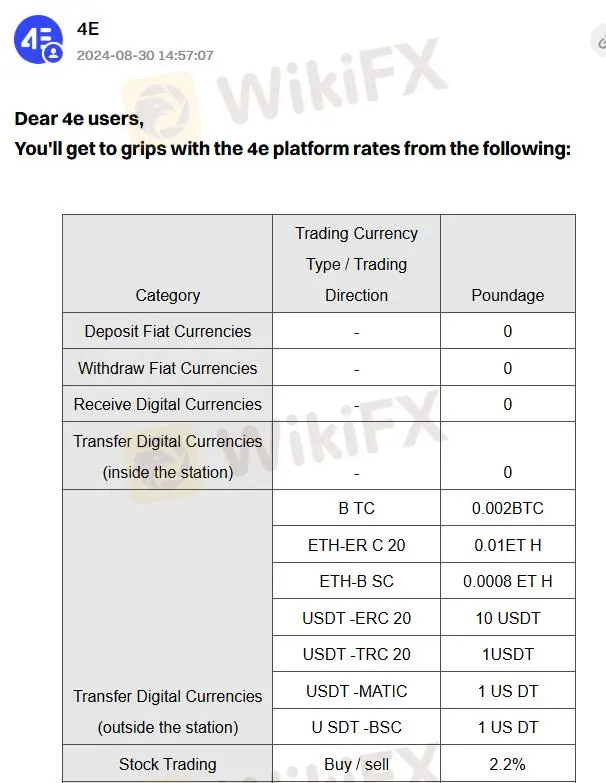

4e费用

4e对数字货币和股票交易收取一定的佣金。您可以参考下表了解详情。其他类型的交易工具关于佣金的信息未提及。

| 类别 | 交易货币类型/交易方向 | 佣金 |

| 转账数字货币(站外) | BTC | 0.002BTC |

| ETH-ERC20 | 0.01ETH | |

| ETH-BSC | 0.0008ETH | |

| USDT-ERC20 | 10USDT | |

| USDT-TRC20 | 1USDT | |

| USDT-MATIC | 1USDT | |

| USDT-BSC | 1USDT | |

| 股票交易 | 买入/卖出 | 2.2% |

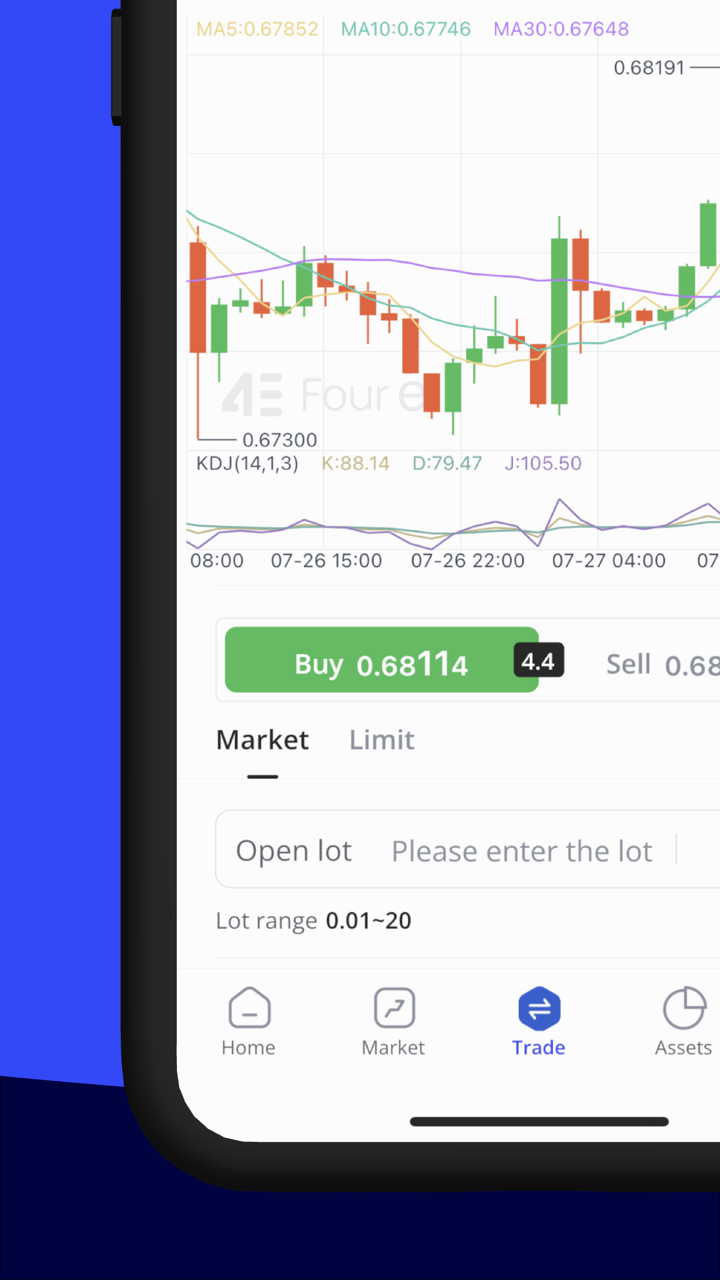

交易平台

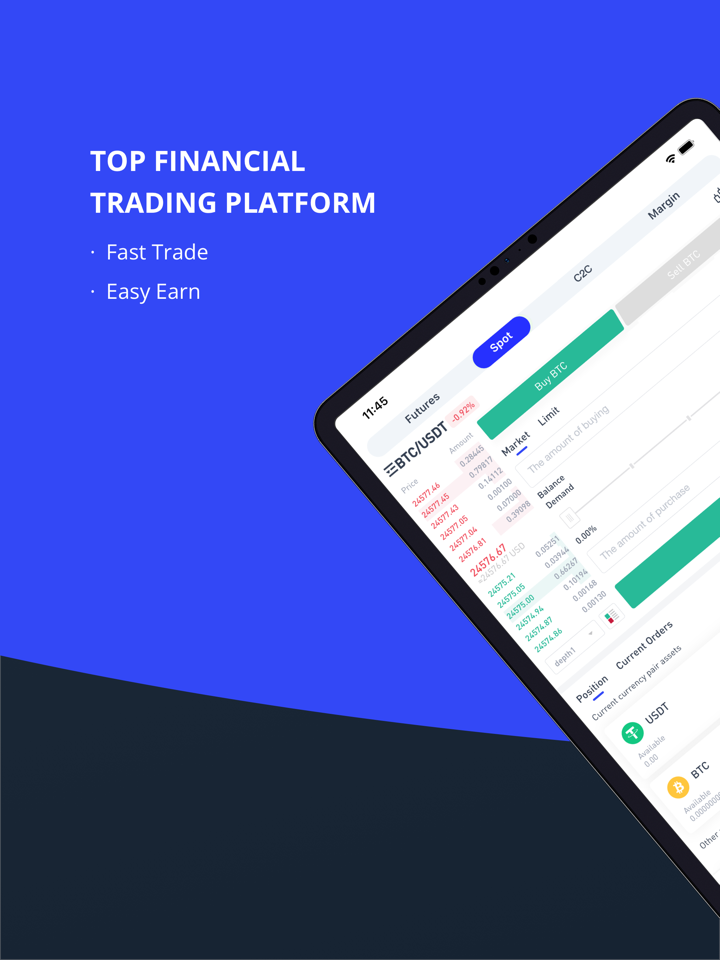

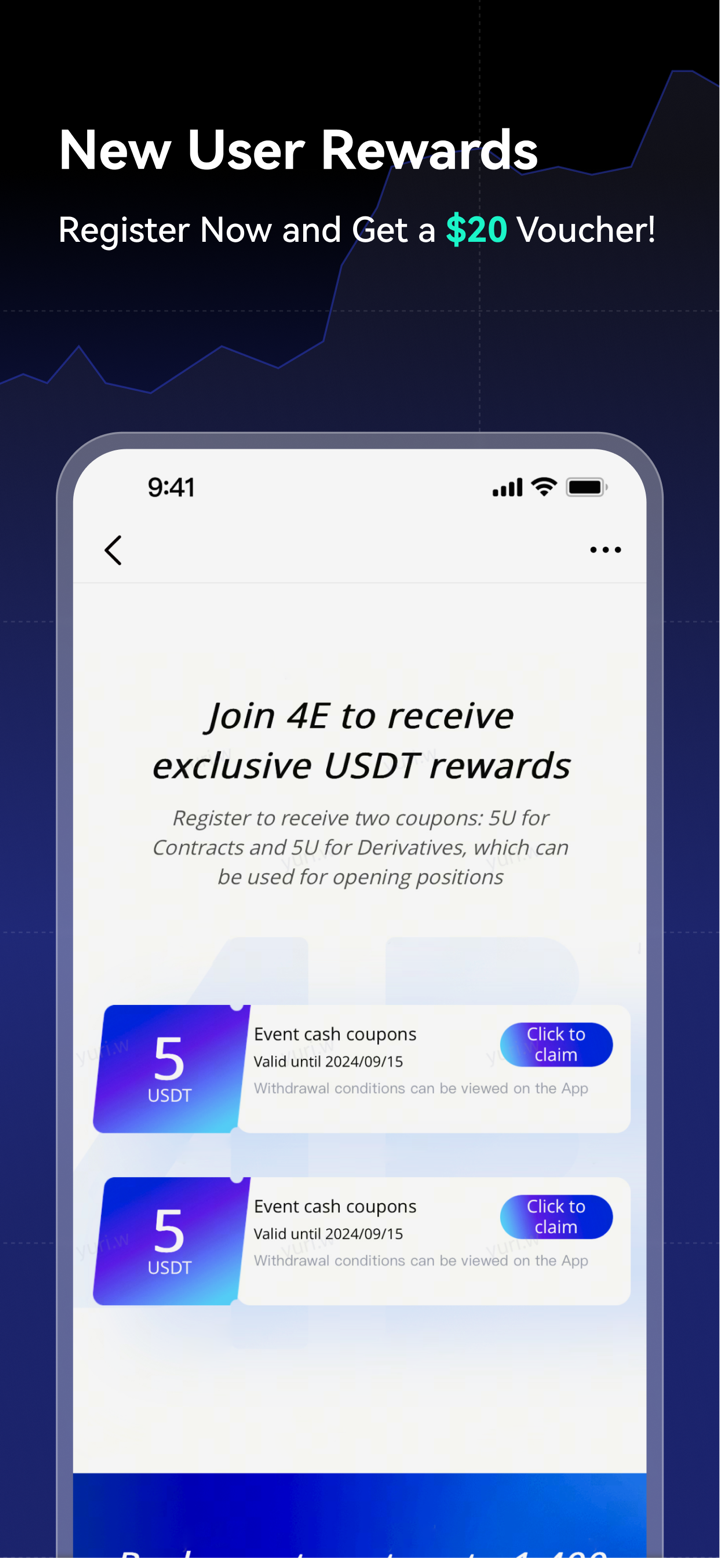

4e提供了自主开发的交易平台,同时提供应用程序和平板电脑版本。它声称为您提供最新的金融趋势。然而,我们仍然建议选择一个受监管的经纪商,使用专业的交易平台,如MT4或MT5。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| 4e移动版 | ✔ | Web和移动应用 | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | / | 有经验的交易者 |

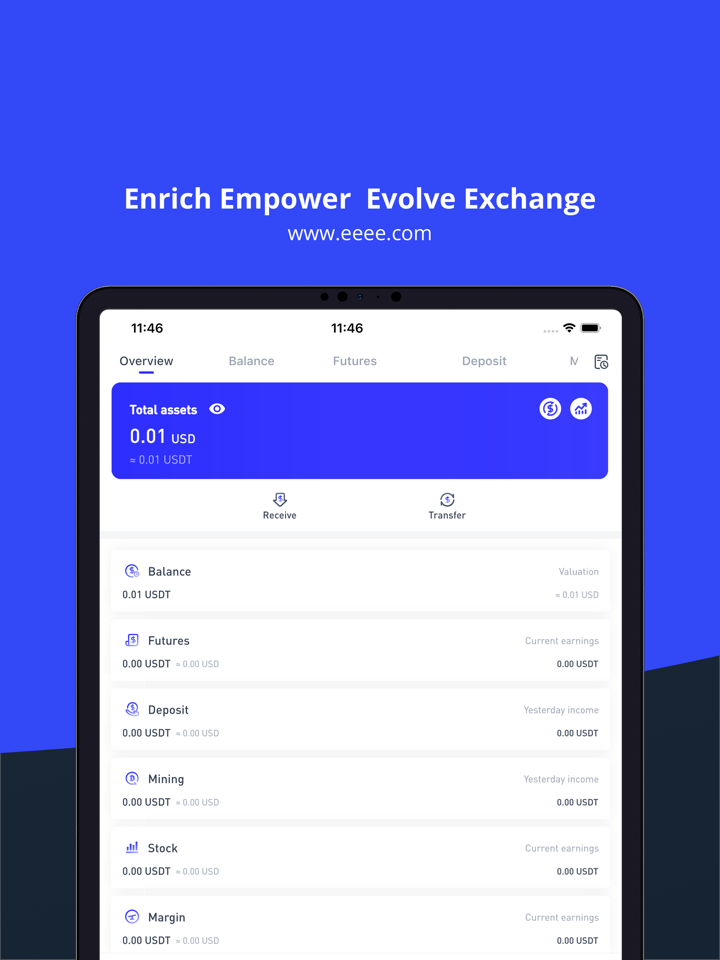

存款和取款

4e只是提到您可以通过加密货币和其他方式存款和取款,但具体的方式没有透露。您应该注意,通过加密货币进行的所有交易都是不可撤销的,这带来了很高的风险,尤其是在与像4e这样的无监管经纪人打交道时。