Resumo da empresa

| 4e Resumo da Revisão | |

| Fundado | 2023 |

| País/Região Registrado | Malásia |

| Regulação | Não regulamentado |

| Instrumentos de Mercado | Ativos Digitais, Forex, Commodities, Ações e Índices |

| Conta Demonstração | ✅ |

| Alavancagem | / |

| Spread | Flutuante |

| Plataforma de Negociação | Web, aplicativo móvel |

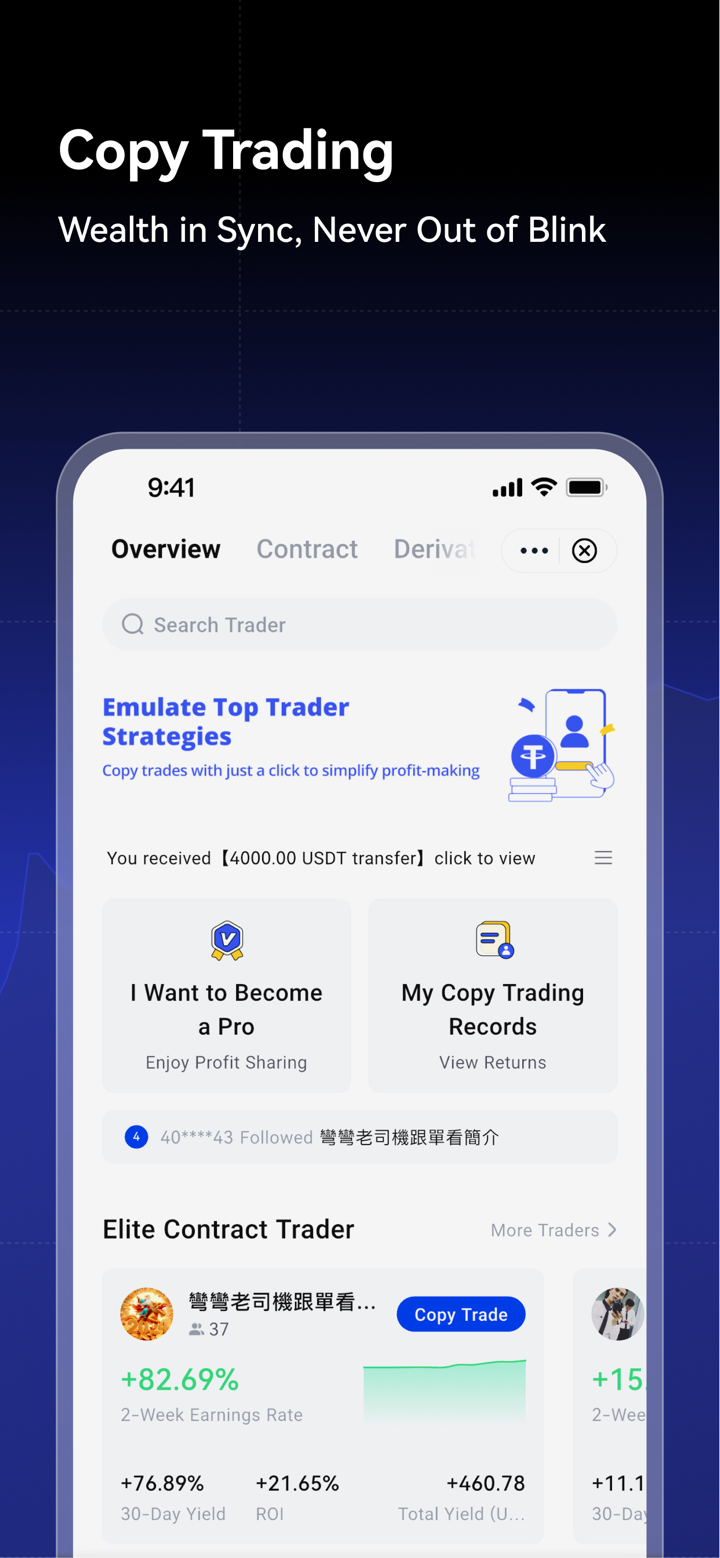

| Cópia de Negociação | ✅ |

| Depósito Mínimo | / |

| Suporte ao Cliente | Chat ao vivo 24/7 |

| X: https://twitter.com/4e_Globalt=pskuEUAmV5h_AGEtle08yw&s=09 | |

| Instagram: https://www.instagram.com/global_4e/ | |

| Youtube: https://www.youtube.com/@4E_Global | |

| Restrições Regionais | Coreia do Norte, Cuba, Síria, Irã, Venezuela, Sudão, Sudão do Sul, Crimeia, Rússia, Líbano, Iraque, Líbia, Estados Unidos, Bangladesh, Índia e Paquistão |

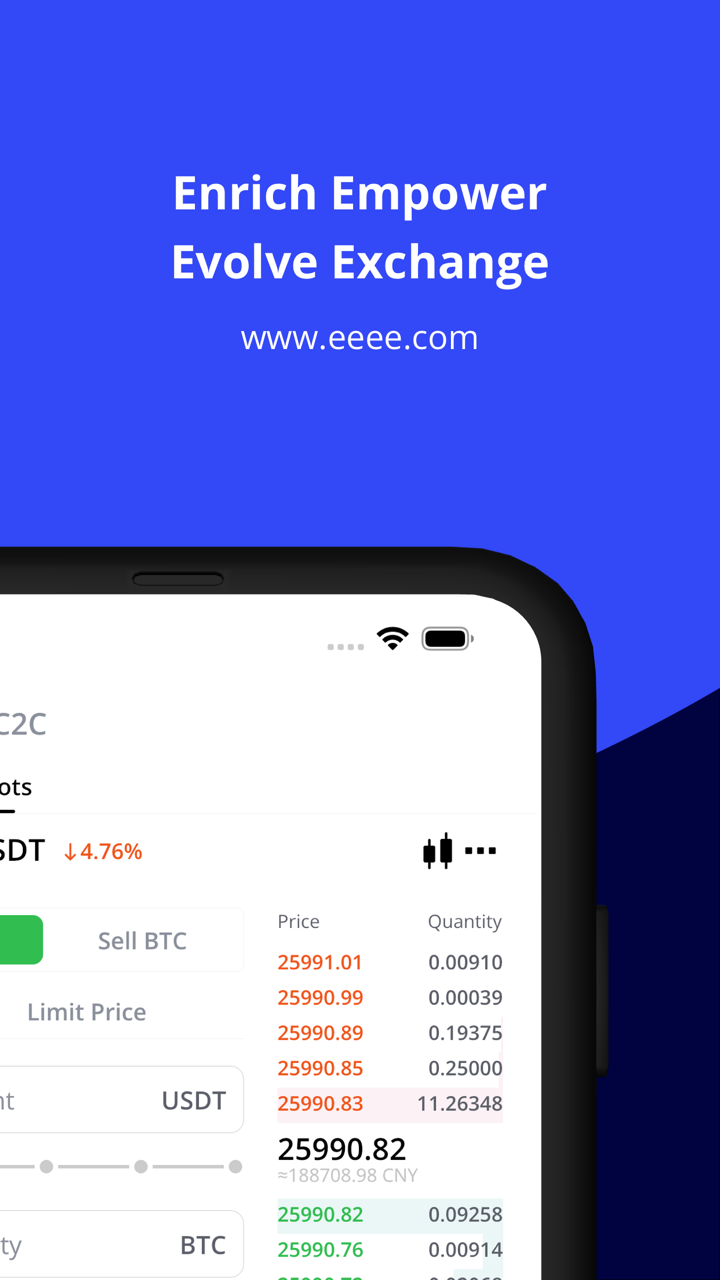

4e é uma plataforma de negociação de derivativos financeiros registrada na Malásia em 2023. Ela oferece negociação de Ativos Digitais, Forex, Commodities, Ações e Índices. No entanto, atualmente opera sem supervisão regulatória de uma autoridade financeira.

Prós e Contras

| Prós | Contras |

| Várias opções de negociação | Sem regulação |

| Contas de demonstração disponíveis | Falta de transparência |

| Cópia de negociação | Taxa de inatividade alta |

| Suporte de chat ao vivo 24/7 | Nenhuma plataforma de negociação confiável |

| Opções de pagamento limitadas | |

| Restrições regionais |

4e é Legítimo?

Não, 4e não é um provedor de serviços financeiros legítimo. Não encontramos nenhuma informação sobre sua regulação e, portanto, recomendamos fortemente evitar lidar com 4e e, em vez disso, escolher uma corretora devidamente licenciada e regulamentada.

O que posso negociar no 4e?

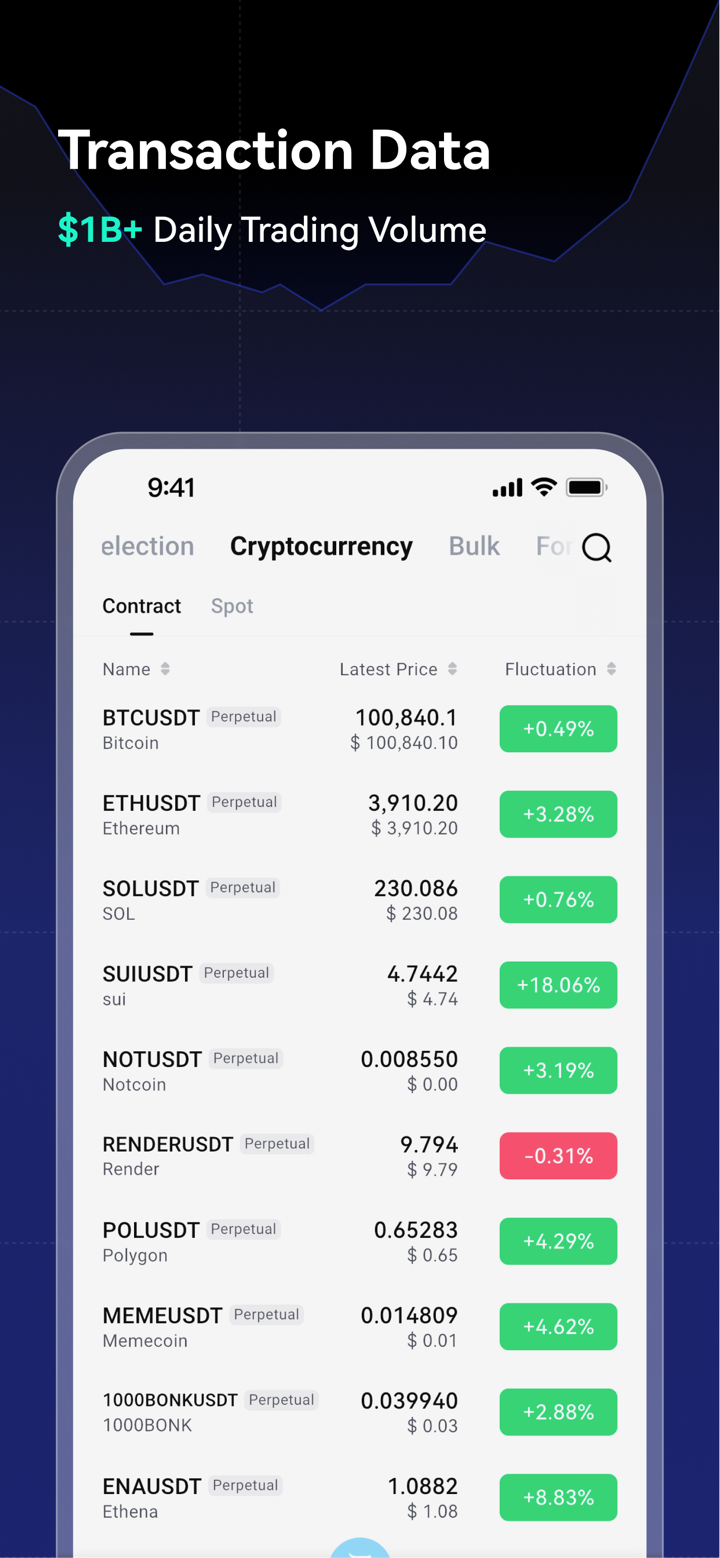

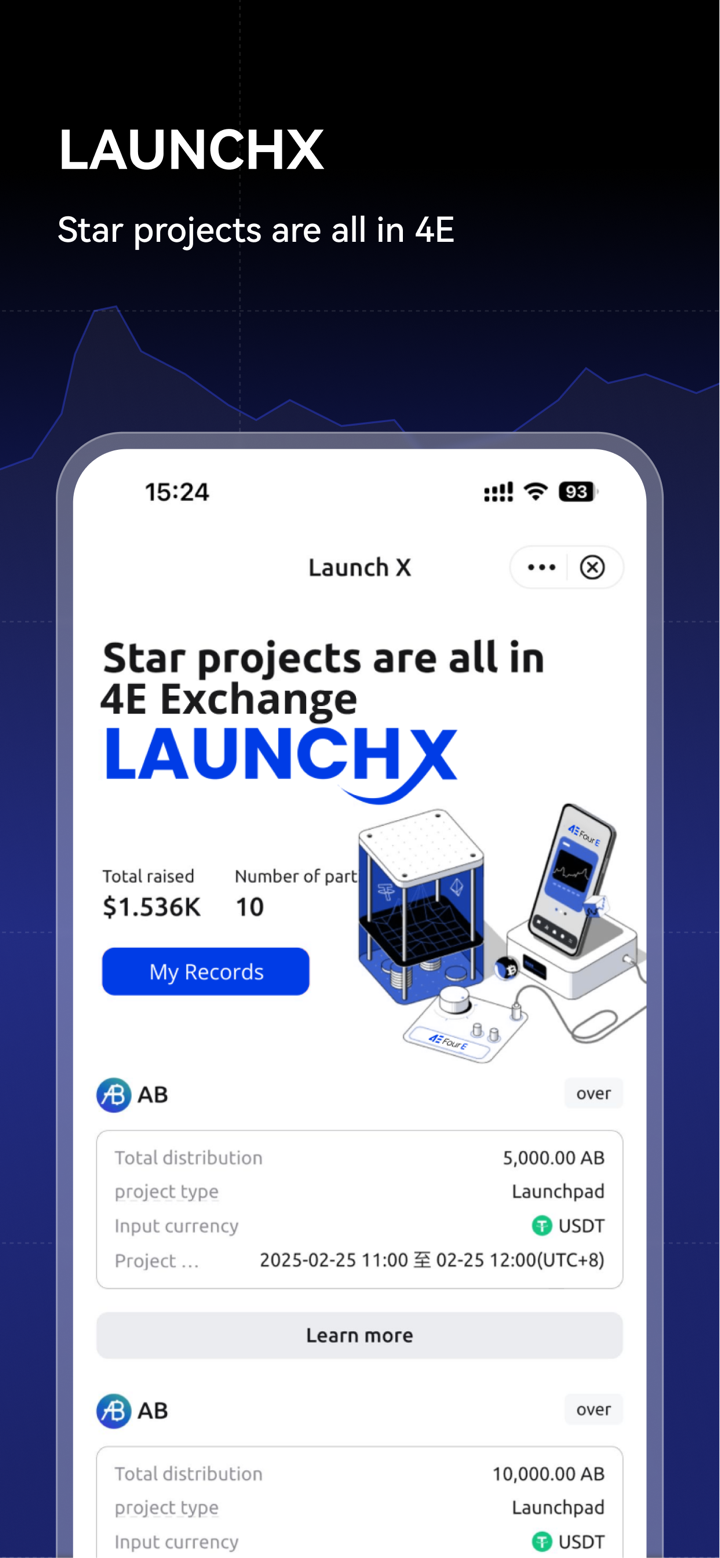

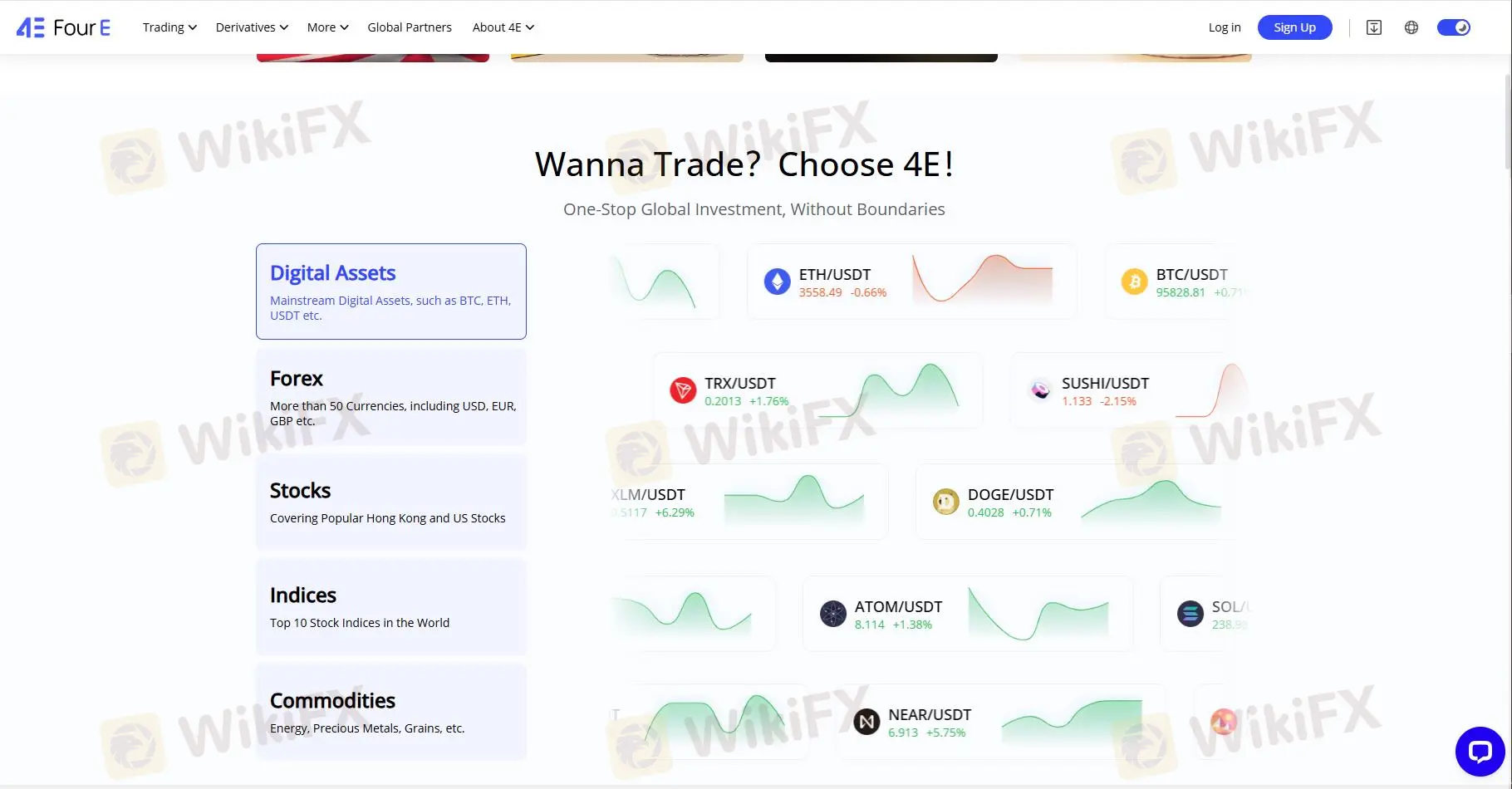

4e oferece várias opções de negociação, incluindo ativos digitais, forex, commodities e ETFs, ações e índices.

Ativos Digitais: Ativos Digitais principais, como BTC, ETH, USDT etc.

Forex: Mais de 50 moedas, incluindo USD, EUR, GBP etc.

Ações: Ações populares de Hong Kong e EUA (AAPL, GOOG, Cocacola, KO, MSFT, TSLA...)

Índices: US30, Japão 225, US 500, US SPX 500, UK 100, US NDAQ 100, Euro 50....

Commodities: Energia, Metais Preciosos, Grãos, Prata, NGAS...

| Instrumentos Negociáveis | Suportado |

| Forex | ✔ |

| Commodities | ✔ |

| Índices | ✔ |

| Ações | ✔ |

| Criptomoedas | ✔ |

| Títulos | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

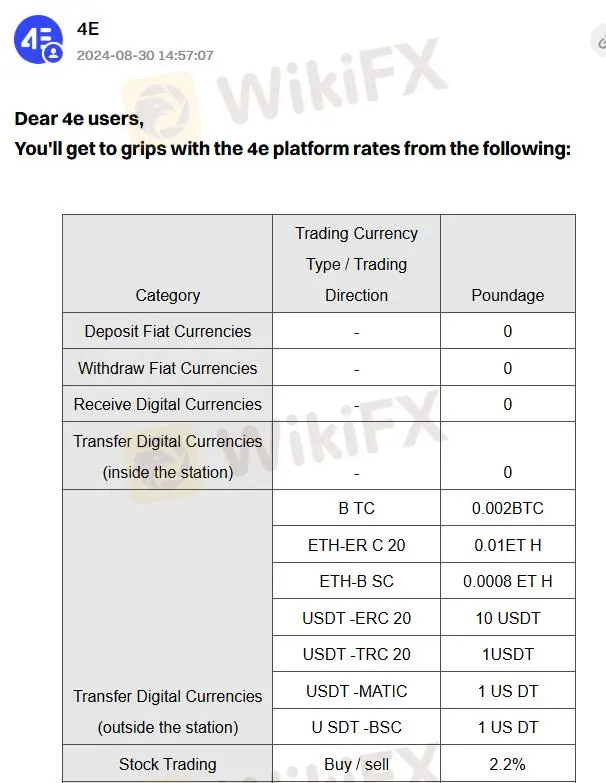

4e Taxas

4e cobra uma certa comissão para negociação de moedas digitais e ações. Você pode consultar o formulário a seguir para obter detalhes. Outros tipos de instrumentos de negociação não são mencionados em relação à comissão.

| Categoria | Tipo de Moeda de Negociação/Direção de Negociação | Comissão |

| Transferência de Moedas Digitais (fora da plataforma) | BTC | 0.002BTC |

| ETH-ER C 20 | 0.01ETH | |

| ETH-B SC | 0.0008 ETH | |

| USDT-ERC 20 | 10 USDT | |

| USDT-TRC 20 | 1 USDT | |

| USDT-MATIC | 1 USDT | |

| U SDT -BSC | 1 US DT | |

| Negociação de Ações | Compra / venda | 2.2% |

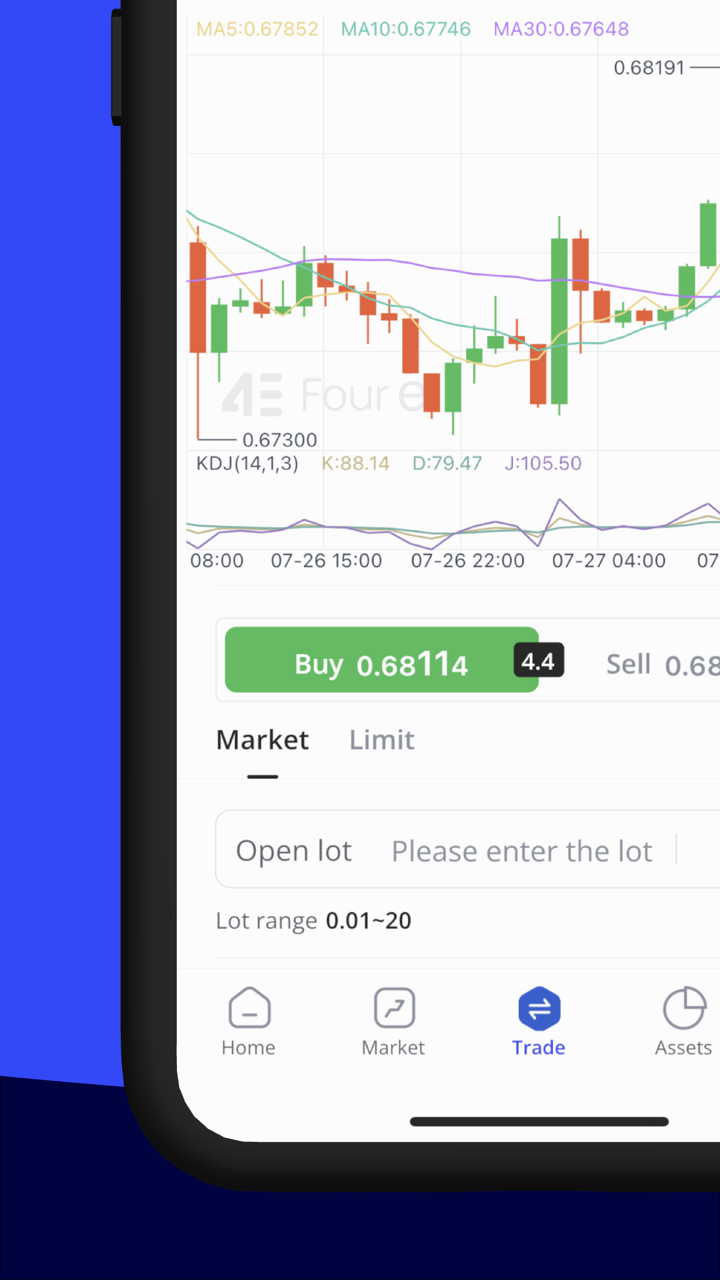

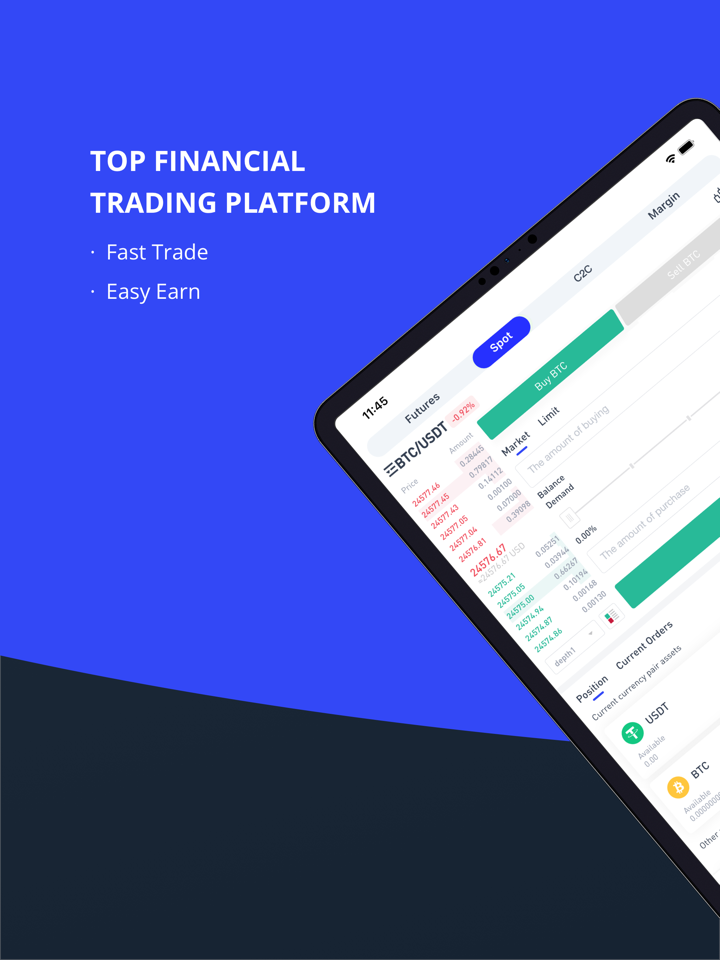

Plataforma de Negociação

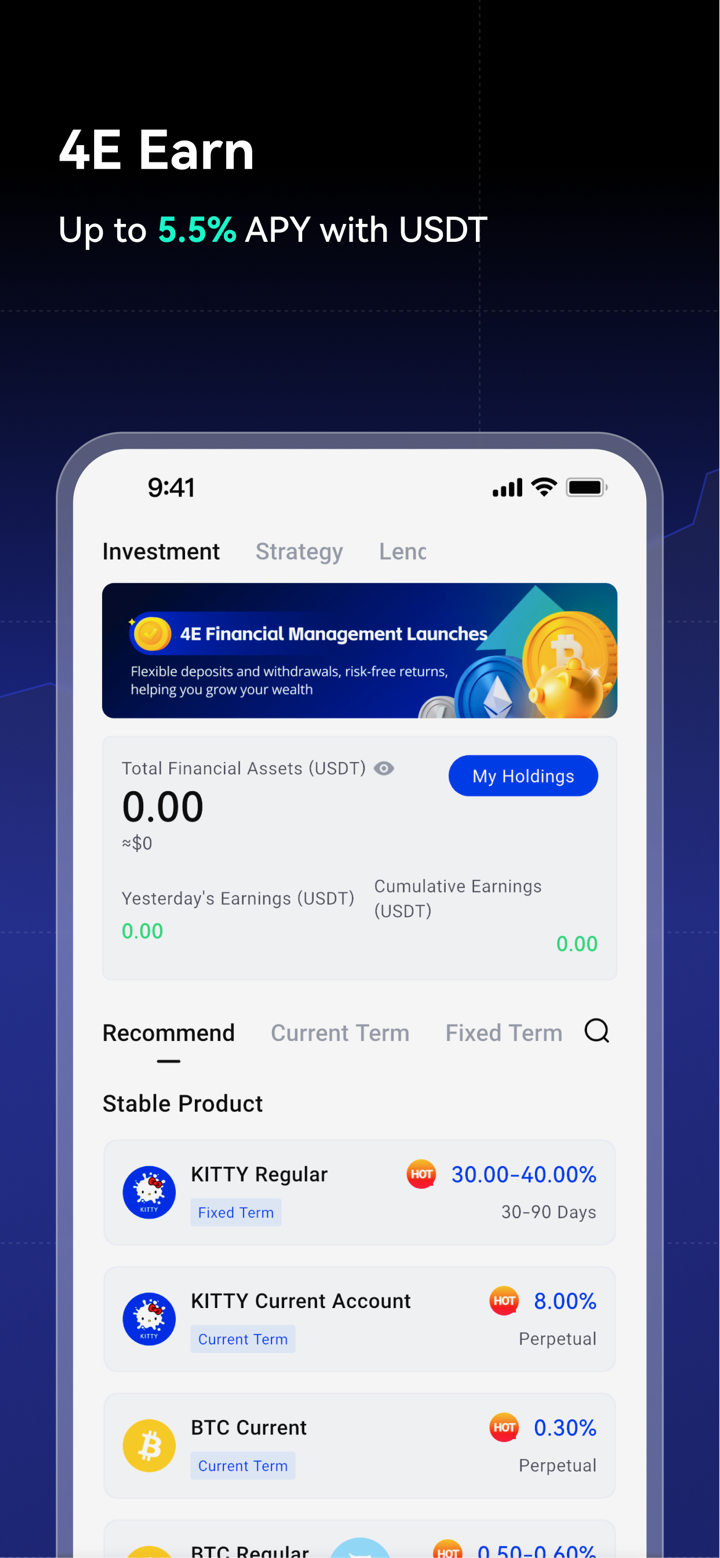

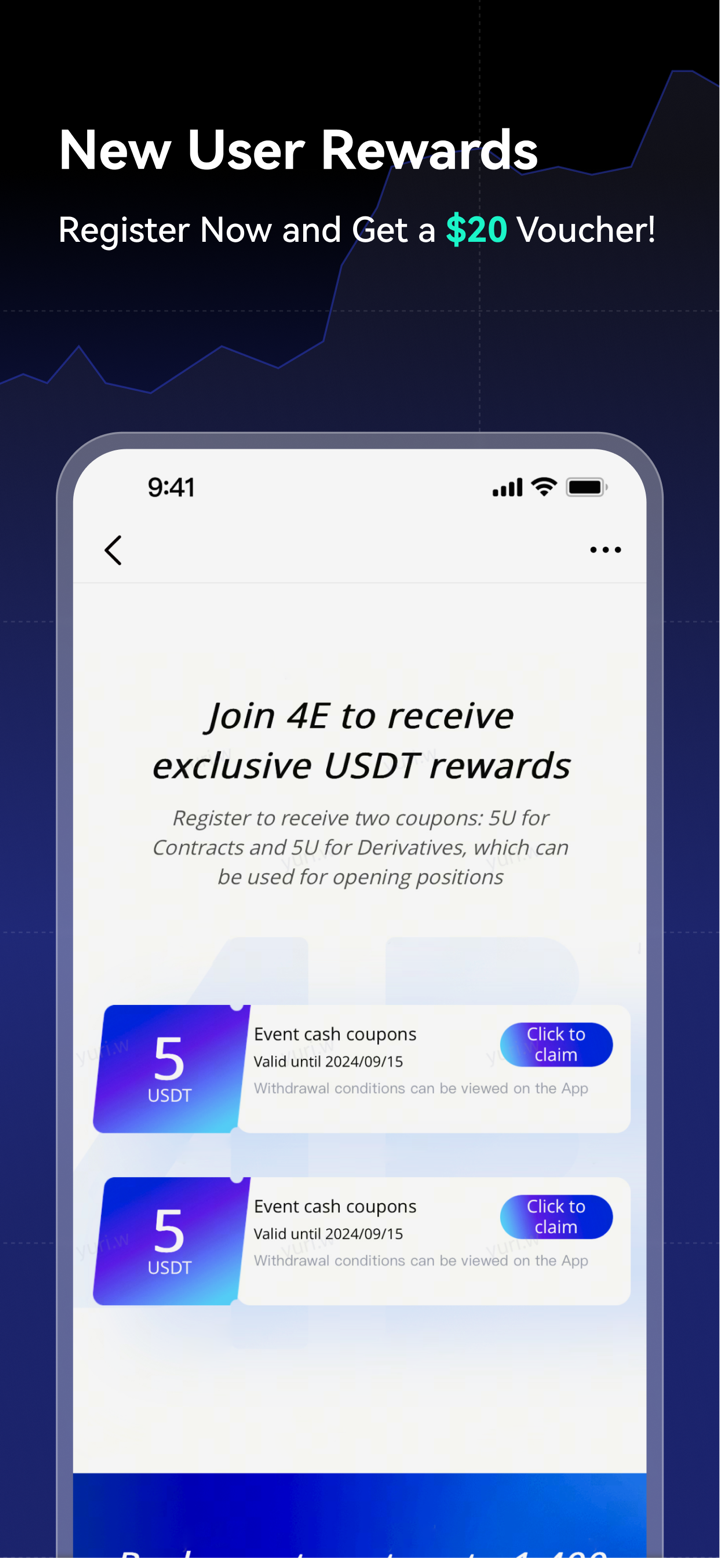

4e oferece uma plataforma desenvolvida internamente para negociação, com versões de aplicativo e tablet disponíveis. Alega fornecer as últimas tendências financeiras. No entanto, ainda recomendamos escolher uma corretora regulamentada com uma plataforma de negociação profissional como MT4 ou MT5.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| 4e Mobile | ✔ | Web e aplicativo móvel | / |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |

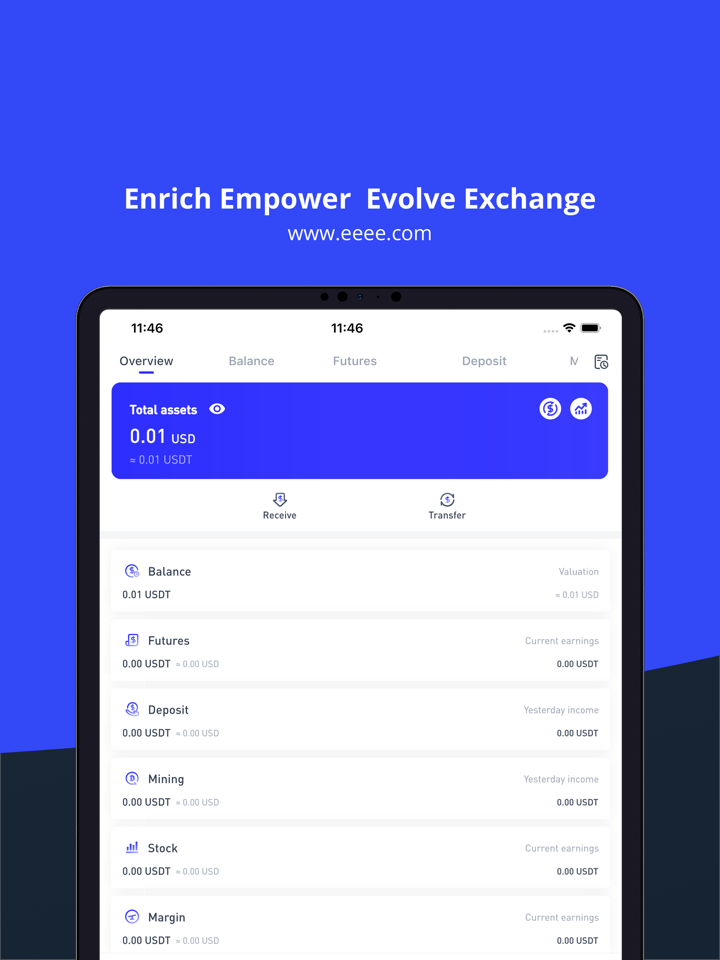

Depósito e Retirada

4e menciona apenas que você pode depositar e sacar fundos através de criptomoedas e outros métodos, mas as formas específicas não são divulgadas. Você deve observar que todas as transações feitas através de criptomoedas são irrevogáveis, o que acarreta altos riscos, especialmente ao lidar com um corretor não regulamentado como 4e.