Informasi Dasar

Hong Kong

Hong Kong

Skor

Hong Kong

|

5-10 tahun

|

Hong Kong

|

5-10 tahun

| http://www.amtdgroup.com/

Website

Peringkat indeks

Pengaruh

C

Indeks pengaruh NO.1

Taiwan 3.23

Taiwan 3.23 Lisensi

LisensiLembaga berlisensi:oOo Securities (HK) Group Limited

Nomor lisensi pengaturan:AJH488

Hong Kong

Hong Kong amtdgroup.com

amtdgroup.com amtd.com.hk

amtd.com.hk VIP tidak diaktifkan.

VIP tidak diaktifkan.

| AMTD Ringkasan Ulasan | |

| Dibentuk | 1997 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | SFC (Tidak Diverifikasi) |

| Layanan | Solusi digital, media dan budaya, pendidikan dan pelatihan, aset premium |

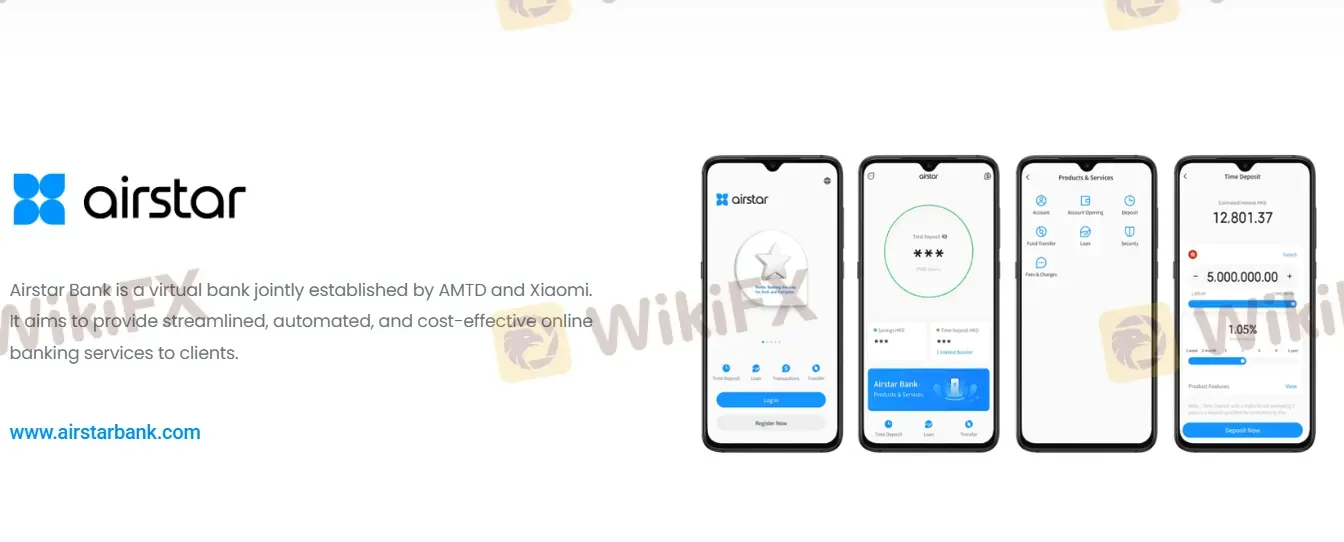

| Platform/APP | airstar APP |

| Dukungan Pelanggan | Email: enquiry@amtdinc.com |

| Media sosial: Facebook, LinkedIn, YouTube, X | |

AMTD didirikan pada tahun 1997 dan terdaftar di Hong Kong, diatur oleh Komisi Sekuritas dan Berjangka Hong Kong (SFC). Menawarkan berbagai layanan termasuk solusi digital, layanan bisnis satu atap, media dan hiburan, serta pendidikan dan pelatihan. Namun, status regulasinya saat ini belum diverifikasi.

| Pro | Kontra |

| Sejarah panjang | Regulasi SFC tidak diverifikasi |

| Berbagai layanan yang ditawarkan | Struktur biaya yang tidak jelas |

| Tidak ada saluran kontak langsung | |

| Tidak ada alamat fisik |

AMTD diatur oleh Komisi Sekuritas dan Berjangka Hong Kong (SFC), namun status regulasinya saat ini belum diverifikasi. Entitas berlisensi adalah oOo Securities (HK) Group Limited, yang memegang lisensi Dealing in Securities dengan nomor lisensi AJH488.

Tim survei lapangan WikiFX mengunjungi alamat AMTD di Hong Kong, dan kami menemukan bahwa AMTD tidak memiliki kehadiran fisik di alamat tersebut.

AMTD menawarkan empat layanan, termasuk Layanan Solusi Digital, Layanan Bisnis Satu Atap, Media dan Hiburan, dan Pendidikan, Pelatihan, Aset Premium, dan Hospitality.

| Platform/APP | Didukung | Perangkat Tersedia |

| airstar App | ✔ | iOS, Android |

From my personal experience evaluating brokers, I found that AMTD currently offers the airstar App as its trading platform, compatible with both iOS and Android devices. Notably, there is no mention of support for popular trading platforms such as MT4, MT5, or cTrader. For me as a trader, this is an important consideration because these industry-standard platforms provide powerful charting, automated trading, and a robust community of users, which can be crucial for both strategy and confidence. The absence of MT4, MT5, or cTrader means that traders interested in algorithmic trading or wanting to use custom indicators might find AMTD's offering limiting. Personally, I depend heavily on access to credible, widely vetted trading technology to ensure the reliability and security of my trading activities. Additionally, I noticed that there are concerns regarding AMTD’s regulatory status and the lack of a clear physical presence, which gives me pause and makes me even more cautious about relying on a proprietary platform I am unfamiliar with. Overall, while AMTD does provide the airstar App, this falls short of the versatility and transparency that established platforms like MT4 or MT5 offer. I would urge traders to approach with caution and carefully weigh the limitations of AMTD’s platform offering before making any decision involving real funds.

Based on my careful review of the available background regarding AMTD, I did not find clear or reliable details about which payment methods—if any—allow for instant withdrawals. In my own trading journey, I prioritize brokers with transparent and trustworthy withdrawal processes because timely access to funds is essential for risk management and peace of mind. However, AMTD’s profile raises several red flags for me: its regulatory status is listed as unverified, and WikiFX even noted concerns about the broker’s physical presence and legitimacy. Additionally, a published user experience specifically referenced being unable to withdraw funds, while other platforms did permit withdrawals. A lack of transparency around payment systems and withdrawal times heightens my concern, especially in the absence of a physical office and with contact channels limited to an email address. For me, the inability to verify instant withdrawal options—in combination with questioned regulatory status and past user complaints—means I would exercise extreme caution and not assume that instant withdrawals, or even timely withdrawals of any kind, are reliably supported by AMTD. Proper due diligence and direct, up-to-date confirmation from the broker itself would be necessary before ever considering financial involvement.

Based on my personal due diligence and experience as a forex trader, I approach brokers like AMTD with significant caution, particularly when evaluating regulatory oversight. While AMTD claims to be registered in Hong Kong and refers to the Hong Kong Securities and Futures Commission (SFC) as its regulator, the current regulatory status is explicitly marked as "unverified." For me, this is a material red flag. The broker’s association with oOo Securities (HK) Group Limited, holding a Dealing in Securities license (AJH488), might initially seem reassuring. However, without up-to-date, independently verifiable confirmation from the SFC, I am unable to classify AMTD as genuinely licensed or supervised in a way that would meet my own risk management standards. Furthermore, given repeated warnings about the suspicious regulatory license and potential risks, as well as a reported lack of physical presence at the claimed address, my confidence in the broker’s regulatory standing is significantly undermined. In my trading career, I have found it essential to prioritize brokers whose regulatory status is clearly confirmed and transparent, as this directly impacts the safety of my funds and recourse options. In summary, I cannot assert that AMTD is licensed or properly supervised by any financial regulator at this time, and I strongly recommend careful, independent verification before proceeding with any engagement.

Drawing from my experience navigating a broad spectrum of forex brokers, undisclosed fees are a significant concern, especially with firms that have limited regulatory clarity. For AMTD, what stands out to me immediately is the “unclear fee structure” highlighted in their profile. This lack of transparency raises a red flag in itself, as trust in any broker hinges on knowing exactly what charges may crop up when depositing or withdrawing funds. In my thorough review of the available information, I was unable to find specific details regarding AMTD’s policies on deposit or withdrawal fees. Compounding this uncertainty, the broker’s regulatory status is described as “unverified,” and there are indicators of “high potential risk” and “suspicious regulatory license.” Furthermore, the absence of concrete customer service channels and reports of at least one withdrawal complaint suggest that users should be extremely cautious. When I consider these factors with my experience, I would not assume any fee structure to be favorable or straightforward here. If a broker is unable or unwilling to clearly disclose their fees, it is prudent from both a risk management and capital preservation perspective to approach with skepticism. For me, unless AMTD clearly outlines all related charges directly on its platform or in its client agreements, I would proceed under the assumption that undisclosed fees are a possibility and would avoid making deposits until I received written clarification from the company.

Silakan masukan...

TOP

TOP

Chrome

Plugin Chrome

Pertanyaan Regulasi Pialang Forex Global

Jelajahi situs web broker forex dan kenali broker resmi dan penipu secara akurat

Pasang sekarang