Buod ng kumpanya

| Victory Securities Buod ng Pagsusuri | |

| Itinatag | 1971 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | SFC |

| Mga Serbisyo | Pamamahala ng Kayamanan, Pamilihan ng Kapital, Virtual na Asset, Pamamahala ng Asset, Seguro, Serbisyong Brokerage, at Employee Stock Ownership Plan (ESOP) |

| Platform ng Pagkalakalan | VictoryX, VictorySecurities (Stock), VIC TOKEN, at Securities Trading (Desktop) |

| Suporta sa Customer | Telepono: +852 2523 1709, +86 147 1501 7408, +852 5498 9438 |

| Fax: +852 2810 7616 | |

| Email: cs@victorysec.com.hk | |

| Address: 11/F, Yardley Commercial Building, 3 Connaught Road West, Sheung Wan, Hong Kong | |

| Contact form, social media | |

Itinatag noong 1971, ang Victory Securities ay isang lisensyadong broker na sinusugan ng SFC sa Hong Kong. Nag-aalok ito ng iba't ibang mga serbisyo tulad ng Pamamahala ng Kayamanan, Pamilihan ng Kapital, Virtual na Asset, Pamamahala ng Asset, Seguro, Serbisyong Brokerage, at Employee Stock Ownership Plan (ESOP) sa pamamagitan ng maraming mga plataporma ng pagkalakalan tulad ng VictoryX, VictorySecurities (Stock), VIC TOKEN, at Securities Trading (Desktop).

Mga Kalamangan at Disadvantage

| Mga Kalamangan | Mga Disadvantage |

| Sinusugan ng SFC | Komplikadong istraktura ng bayad |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Walang live chat support |

| Malawak na hanay ng mga serbisyo | |

| Iba't ibang uri ng account | |

| Maramihang mga plataporma |

Totoo ba ang Victory Securities?

| Rehistradong Bansa | Rehistradong Pangasiwaan | Rehistradong Entidad | Uri ng Lisensya | Numero ng Lisensya |

| Ang Securities and Futures Commission (SFC) | Victory Securities Company Limited | Pagsasangla sa mga kontrata ng hinaharap | ABN091 |

Mga Serbisyo

Nagbibigay ang Victory Securities ng tradisyunal na mga serbisyo sa pananalapi tulad ng Pamamahala ng Kayamanan, Pamilihan ng Kapital, Virtual na Asset, Pamamahala ng Asset, Seguro, Serbisyong Brokerage, at Employee Stock Ownership Plan (ESOP).

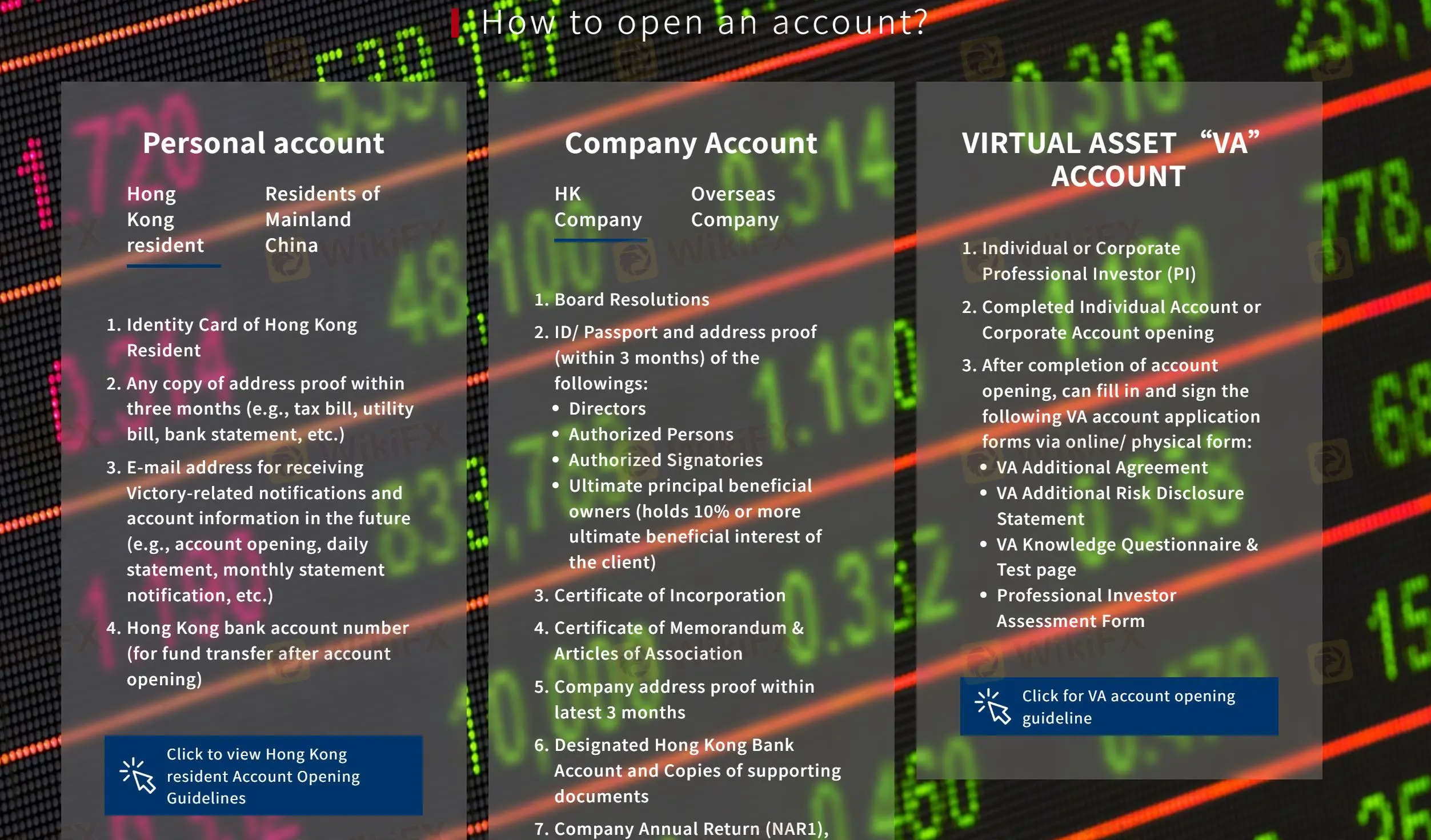

Uri ng Account

Nagbibigay ang Victory Securities ng tatlong uri ng account para sa mga gumagamit.

Ang Personal Account ay angkop para sa mga indibidwal na mamumuhunan na naninirahan sa Hong Kong o Mainland China.

Ang Company Account ay dinisenyo para sa mga korporasyong entidad, parehong Hong Kong at mga kompanya sa ibang bansa.

Virtual Asset (VA) Account ay available sa mga indibidwal o korporasyong propesyonal na mga mamumuhunan na mayroon nang bukas na personal o kumpanya account.

Victory Securities ay nagbibigay ng dalawang paraan upang magbukas ng account online gamit ang "VictoryX" mobile app at magbukas ng account sa pamamagitan ng koreo.

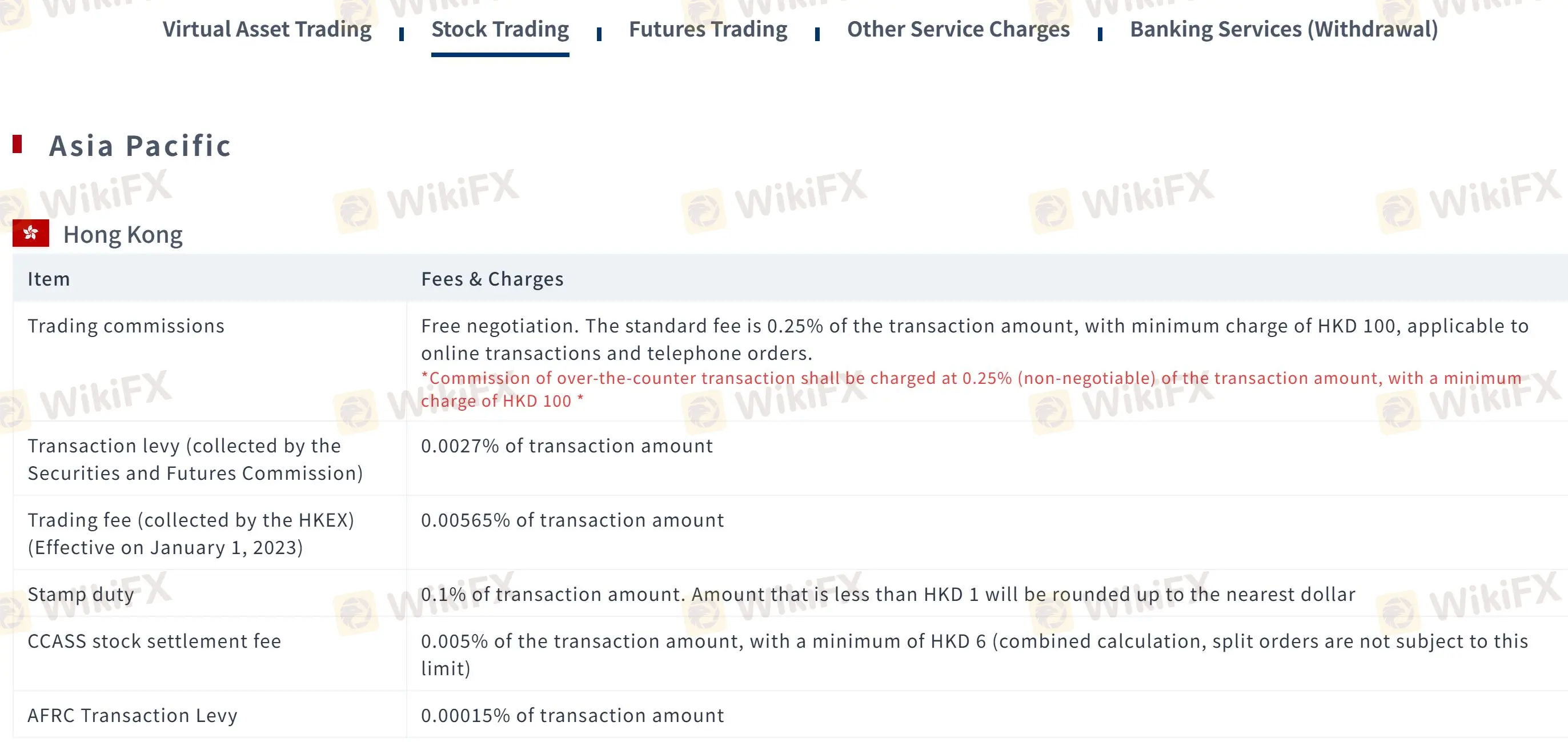

Mga Bayarin

Mga Bayarin sa Pagkalakal

Ang tiyak na halaga ng komisyon ng Victory Securities ay depende sa merkado, produkto, at uri ng transaksyon. Halimbawa, ang komisyon para sa pagkalakal ng mga stock ay karaniwang 0.25% hanggang 0.45% ng halaga ng transaksyon, at ang minimum na bayad ay nag-iiba mula rehiyon sa rehiyon.

| Produkto | Komisyon | Minimum na Bayad |

| Hong Kong Stocks | 0.25% (maaaring tawaran) | HKD 100 |

| China (Shanghai/Shenzhen Connect) | 0.25% | RMB 100 |

| Japan Stocks | 0.30% (online), 0.40% (telephone) | JPY 3,500 |

| Singapore Stocks | 0.25% | USD 40 |

| Taiwan Stocks | 0.30% | NT$600 |

| Australia Stocks | 0.35% | AUD 50 |

| South Korea Stocks | 0.30% | KRW 20,000 |

| US Stocks | 0.25% | USD 15 |

Mga Bayaring Hindi Tungkol sa Pagkalakal

Mayroong karagdagang bayarin na kaugnay ng kanilang mga serbisyo. Ang mga bayaring ito ay sumasakop sa iba't ibang aspeto ng pamamahala ng account, mga korporasyon na aksyon, at partikular na uri ng transaksyon. Ilan sa mga karaniwang halimbawa ay kasama ang Transaction levies at mga buwis, mga bayad sa paglilinaw, mga bayad sa pangangalaga, at iba pang mga bayad sa serbisyo.

| Kategorya ng Bayad | Halaga |

| Transaction Levy | 0.0027% ng halaga ng transaksyon |

| Trading Fee | 0.00565% ng halaga ng transaksyon |

| Stamp Duty | 0.1% ng halaga ng transaksyon (pinalalaki) |

| CCASS Stock Settlement Fee | 0.005% ng halaga ng transaksyon (minimum na HKD 6) |

| AFRC Transaction Levy | 0.00015% ng halaga ng transaksyon |

Para sa karagdagang impormasyon, mangyaring tingnan ang sumusunod na website: https://www.victorysec.com.hk/en/help/fee

Plataforma ng Pagtitinda

| Plataforma ng Pagtitinda | Angkop para sa |

| VictoryX | Mga indibidwal na naghahanap ng isang komprehensibo at madaling gamiting plataforma ng pagtitinda na may mga advanced na tampok. |

| Victory Securities (Stock) | Mga indibidwal na pangunahing interesado sa pagtitinda ng mga stock. |

| VIC TOKEN | Mga mamumuhunan na interesado sa pagtitinda ng mga cryptocurrency. |

| Securities Trading (Desktop) | Mga indibidwal na mamumuhunan na mas gusto ang desktop-based na plataforma ng pagtitinda. |

Pag-iimbak at Pagwiwithdraw

Deposit

| Deposit Option | MinDeposit | Bayad | Oras ng Proseso |

| Bank Transfer (online and offline) | / | / | Ang cut-off time sa mga araw ng trabaho ay 4:45 pm. Ang sertipiko ng paglipat na isinumite pagkatapos ng oras na ito ay ipo-proseso sa ikalawang araw ng trabaho. |

Withdrawal

| Withdrawal Option | MinWithdrawal | Bayad | Oras ng Proseso |

| Bank Transfer (online and offline) | $0 | Ang unang withdrawal sa bawat araw ay libre, at ang mga sumunod na withdrawal ay HKD$500 bawat isa. | Ang mga aplikasyon na isinumite bago ang 12:00 ng tanghali ay ipo-proseso sa parehong araw. |

| Ang mga aplikasyon na isinumite pagkatapos ng 12:00 ng tanghali ay ipo-proseso sa susunod na araw ng trabaho. | |||

| Telegraphic Transfer/Interbank Transfer | $0 | HKD/RMB: Ang unang withdrawal sa bawat araw ay $/RMB$300, at ang mga sumunod na withdrawal ay $/RMB$800 bawat isa; | Ang mga aplikasyon na isinumite bago ang 12:00 ng tanghali ay ipo-proseso sa parehong araw. |

| USD: Ang unang withdrawal sa bawat araw ay US$25, at ang mga sumunod na withdrawal ay US$100 bawat isa. | Ang mga aplikasyon na isinumite pagkatapos ng 12:00 ng tanghali ay ipo-proseso sa susunod na araw ng trabaho. |