Solotim

1-2年

Which deposit and withdrawal options are available at Victory Securities, such as credit cards, PayPal, Skrill, or cryptocurrencies?

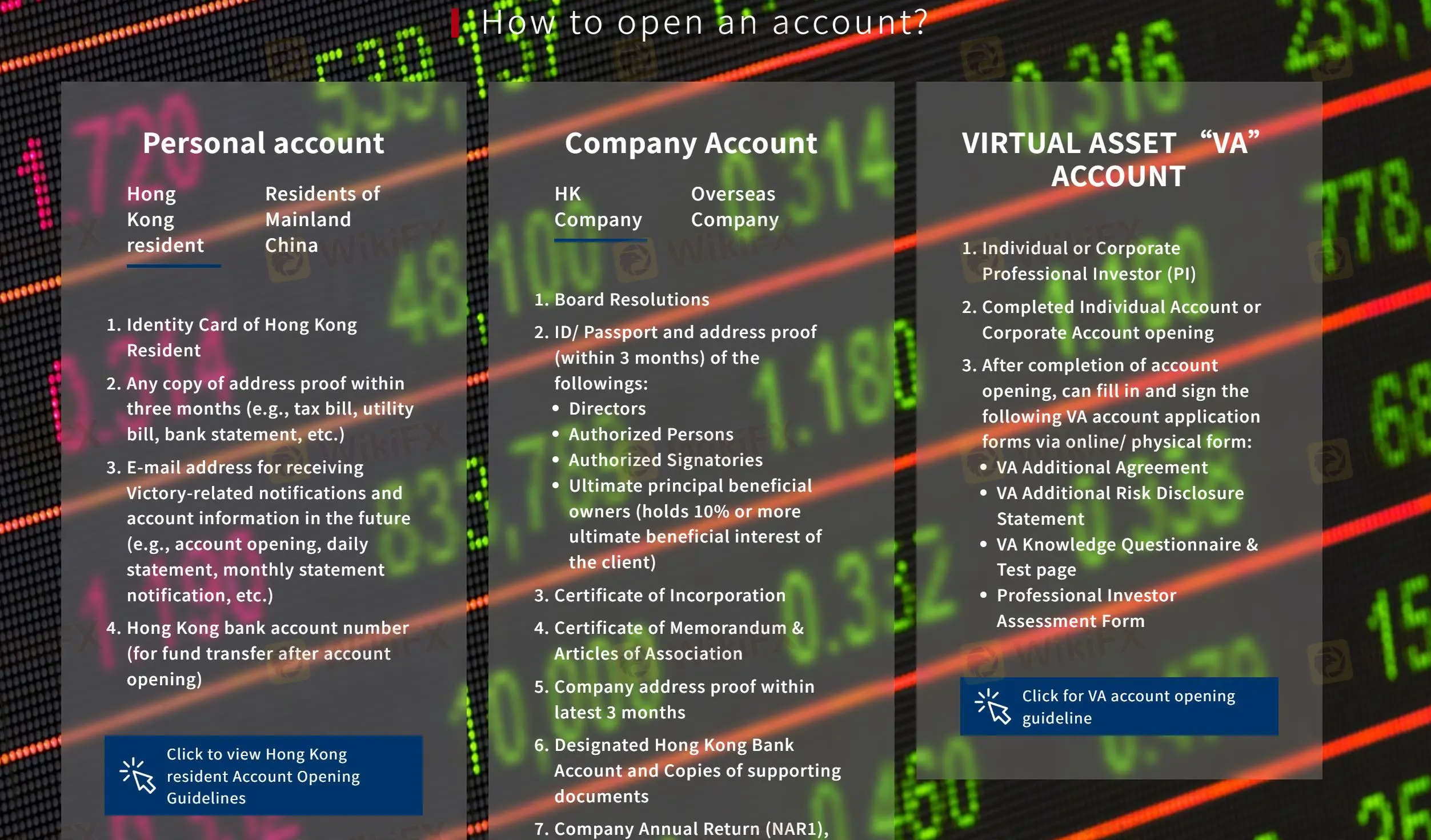

In my personal experience with Victory Securities, I've found that their deposit and withdrawal methods are conventional and mainly bank-oriented. The options available revolve primarily around bank transfers—both online and offline. There is no indication of support for credit cards, PayPal, Skrill, or direct cryptocurrency payments for either deposits or withdrawals. All funding and withdrawal transactions go through standard banking channels, which, for me, underscores their focus on regulatory compliance and the traditional securities landscape in Hong Kong.

When I deposit funds, I use bank transfer, and I've observed there's generally no minimum deposit requirement or fee for this method. For withdrawals, the first bank transfer each day is processed free of charge, but subsequent transactions will incur a notable fee. Processing times are reasonable for standard bank transfers, though applications made late in the day will typically be handled on the following business day. For foreign currency accounts, telegraphic transfer options are available, but again, these are routed entirely through banks. This conservative approach to funding methods means that the platform may not be the best fit for traders seeking the convenience or anonymity of alternative payment systems, but it delivers peace of mind knowing that all processes adhere strictly to regulatory standards.

Broker Issues

Deposit

Withdrawal

marcustan

1-2年

From your review of available feedback and your own assessment, how legitimate do you consider Victory Securities to be?

Based on my experience and close review of Victory Securities, I find it to be a legitimate broker, though not without some necessary cautions. The fact that Victory Securities is regulated by the Securities and Futures Commission (SFC) in Hong Kong stands out as one of the strongest assurances for me. Regulatory oversight in an established jurisdiction like Hong Kong offers a degree of accountability and investor protection that I personally value, particularly in a market as opaque as forex or multi-asset brokerage.

Victory Securities’ long operational history—dating back over 20 years—suggests a track record that newcomers simply cannot match. For me as a trader focused on risk management, such longevity often indicates stable operations and an ability to navigate various market cycles and regulatory changes. Their range of services is broad, with offerings like wealth management, asset management, brokerage, and even virtual asset (cryptocurrency) trading. This level of diversification can be attractive, although I try to remember that breadth doesn’t always equal depth in every asset class.

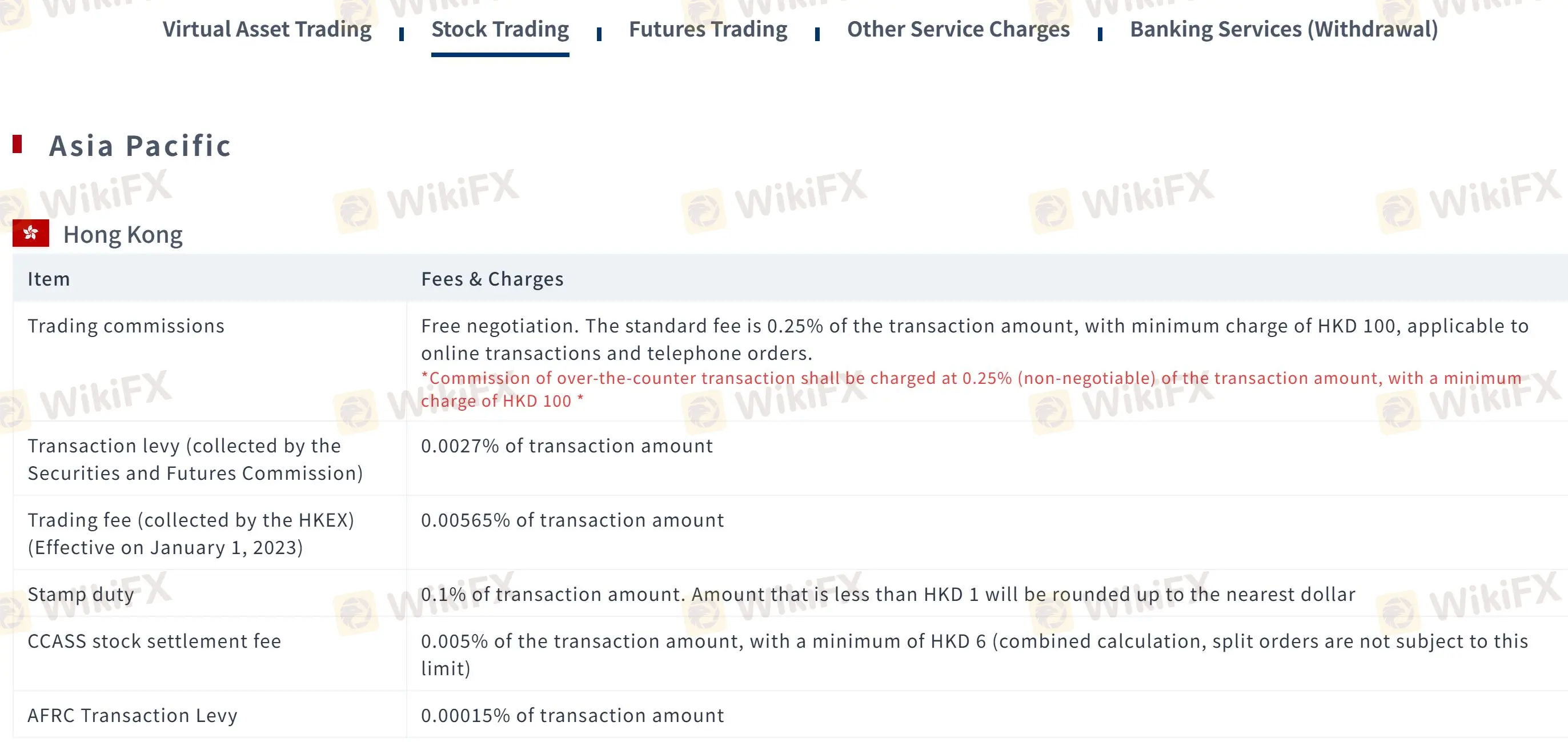

However, there are some areas that warrant careful attention. The broker has a “suspicious scope of business” remark flagged, which, for a cautious trader like me, signals the need for extra diligence—especially before engaging in more complex or less transparent products. Their fee structure also feels complex, and while the published commissions and non-trading fees are standard for Hong Kong, the details can add up quickly. I never overlook fee transparency, as high or hidden costs can erode returns over time.

Customer support appears to be accessible via several channels, but there is no live chat, which for me makes urgent issue resolution less efficient. While Victory Securities clears many of my basic trust checks—long history, established regulatory license, operational transparency—I always advocate for a prudent, incremental approach: test services with modest amounts and verify withdrawal processes in advance.

In summary, I view Victory Securities as a legitimate and reputable broker by Hong Kong’s regulatory standards, but I personally approach with measured caution, mindful of the need to understand both costs and the full scope of their services before deeper engagement.

Ashraf20

1-2年

Does Victory Securities apply any fees when you deposit or withdraw funds?

In my own experience, Victory Securities stands out for its transparency regarding deposit and withdrawal fees, but it is crucial to pay close attention to the details as their policy varies by method and currency. When I deposit funds via bank transfer—whether online or offline—there isn't a specified minimum deposit, nor is there an explicit fee charged for the deposit itself. This straightforward structure helps with planning, though the actual processing time depends on the time of day the transfer certificate is submitted.

Withdrawals, however, require more scrutiny. For bank transfers, the first withdrawal each day is generally free of charge, which is useful for both active and occasional traders. However, if I make additional withdrawals on the same day, a significant fee applies—HKD 500 for each subsequent withdrawal. When withdrawing via telegraphic or interbank transfer, there are tiered costs depending on the currency: the daily first withdrawal in Hong Kong dollars or renminbi costs HKD/RMB 300, with additional withdrawals at HKD/RMB 800 each. For US dollars, the first withdrawal of the day is US$25, and additional withdrawals cost US$100 each.

My assessment is that while these fees are not among the lowest I’ve encountered, the clarity and predictability are advantageous. For me, managing my withdrawal schedule carefully is key to minimizing extra costs, as frequent withdrawals can add up quickly. This underscores the importance, in my view, of thoroughly understanding fee schedules and integrating them into your trading routine before committing significant funds.

Broker Issues

Deposit

Withdrawal

TJensen

1-2年

In what ways does the regulatory status of Victory Securities help safeguard my funds?

In my experience as a trader, the regulatory status of Victory Securities under the Securities and Futures Commission (SFC) of Hong Kong is a crucial factor in assessing the safety of my funds. The SFC is recognized as a stringent financial authority, imposing rigorous requirements on licensed brokers regarding client fund segregation, financial reporting, and operational transparency. This means that, unlike unregulated or loosely regulated entities, Victory Securities must adhere to standards designed to minimize risks such as misuse of client monies or insolvency issues.

For me, knowing that Victory Securities has been regulated for over two decades offers a layer of reassurance. Regulatory oversight subjects the broker to regular audits and requires the firm to comply with anti-money laundering laws, risk management protocols, and ongoing capital adequacy requirements. These processes make it less likely that the broker could engage in fraudulent or negligent practices without detection.

However, while regulation doesn’t eliminate all risks—market losses and operational issues can still occur—it significantly reduces the likelihood of severe misconduct or systemic failure. In summary, the SFC regulation provides important structural safeguards and transparency, helping me feel more confident that my funds are handled with a baseline of professional accountability and legal protection. I believe that prioritizing brokers with credible regulatory oversight is always a prudent step in responsible trading.