회사 소개

| Victory Securities 리뷰 요약 | |

| 설립 | 1971년 |

| 등록 국가/지역 | 홍콩 |

| 규제 | SFC |

| 서비스 | 재산 관리, 자본 시장, 가상 자산, 자산 관리, 보험, 중개 서비스 및 종업원 주식 소유 계획 (ESOP) |

| 거래 플랫폼 | VictoryX, VictorySecurities (주식), VIC TOKEN 및 Securities Trading (데스크톱) |

| 고객 지원 | 전화: +852 2523 1709, +86 147 1501 7408, +852 5498 9438 |

| 팩스: +852 2810 7616 | |

| 이메일: cs@victorysec.com.hk | |

| 주소: 홍콩 성완 콘나우트로 서부 야드리 상업 건물 11층 | |

| 문의 양식, 소셜 미디어 | |

Victory Securities은 1971년에 설립된 홍콩의 SFC 규제를 받는 라이선스 브로커입니다. VictoryX, VictorySecurities (주식), VIC TOKEN 및 Securities Trading (데스크톱)과 같은 다양한 거래 플랫폼을 통해 재산 관리, 자본 시장, 가상 자산, 자산 관리, 보험, 중개 서비스 및 종업원 주식 소유 계획 (ESOP)과 같은 다양한 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| SFC 규제 | 복잡한 수수료 구조 |

| 다양한 연락처 채널 | 라이브 채팅 지원 없음 |

| 다양한 서비스 범위 | |

| 다양한 계정 유형 | |

| 다양한 플랫폼 |

Victory Securities이 신뢰할 수 있는가요?

| 규제 국가 | 규제 기관 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 증권선물위원회 (SFC) | Victory Securities 회사 유한 공사 | 선물 계약 거래 | ABN091 |

서비스

Victory Securities은 재산 관리, 자본 시장, 가상 자산, 자산 관리, 보험, 중개 서비스 및 종업원 주식 소유 계획 (ESOP)과 같은 전통적인 금융 서비스를 제공합니다.

계정 유형

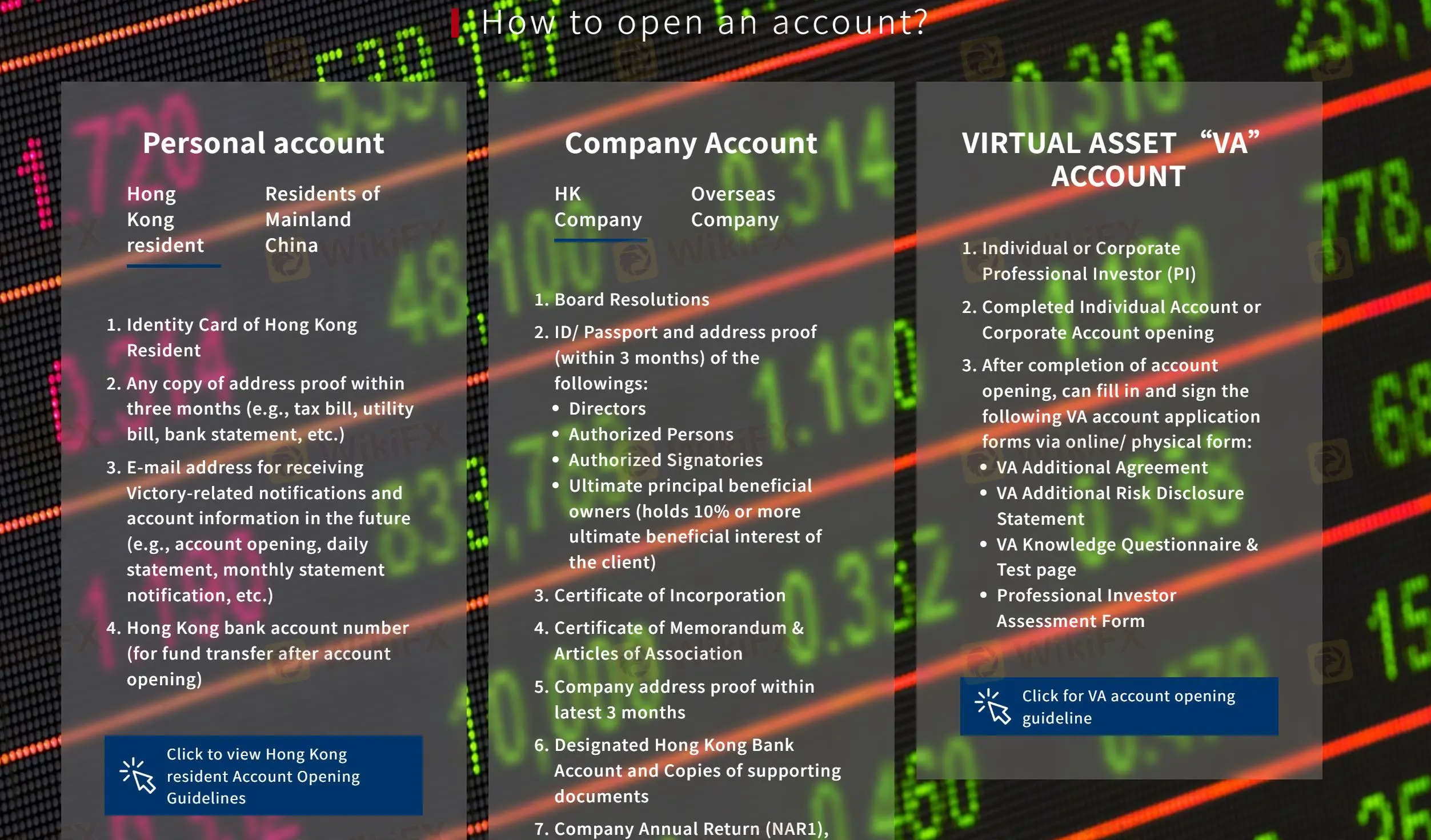

Victory Securities은 사용자를 위해 세 가지 계정 유형을 제공합니다.

개인 계정은 홍콩 또는 중국 본토에 거주하는 개인 투자자에게 적합합니다.

회사 계정은 홍콩 및 해외 기업을 위해 설계되었습니다.

Virtual Asset (VA) Account는 이미 개인 또는 회사 계정을 개설한 개인 또는 기업 전문 투자자에게 제공됩니다.

Victory Securities은 온라인으로 계정을 개설하는 "VictoryX" 모바일 앱을 사용하거나 우편으로 계정을 개설하는 두 가지 방법을 제공합니다.

수수료

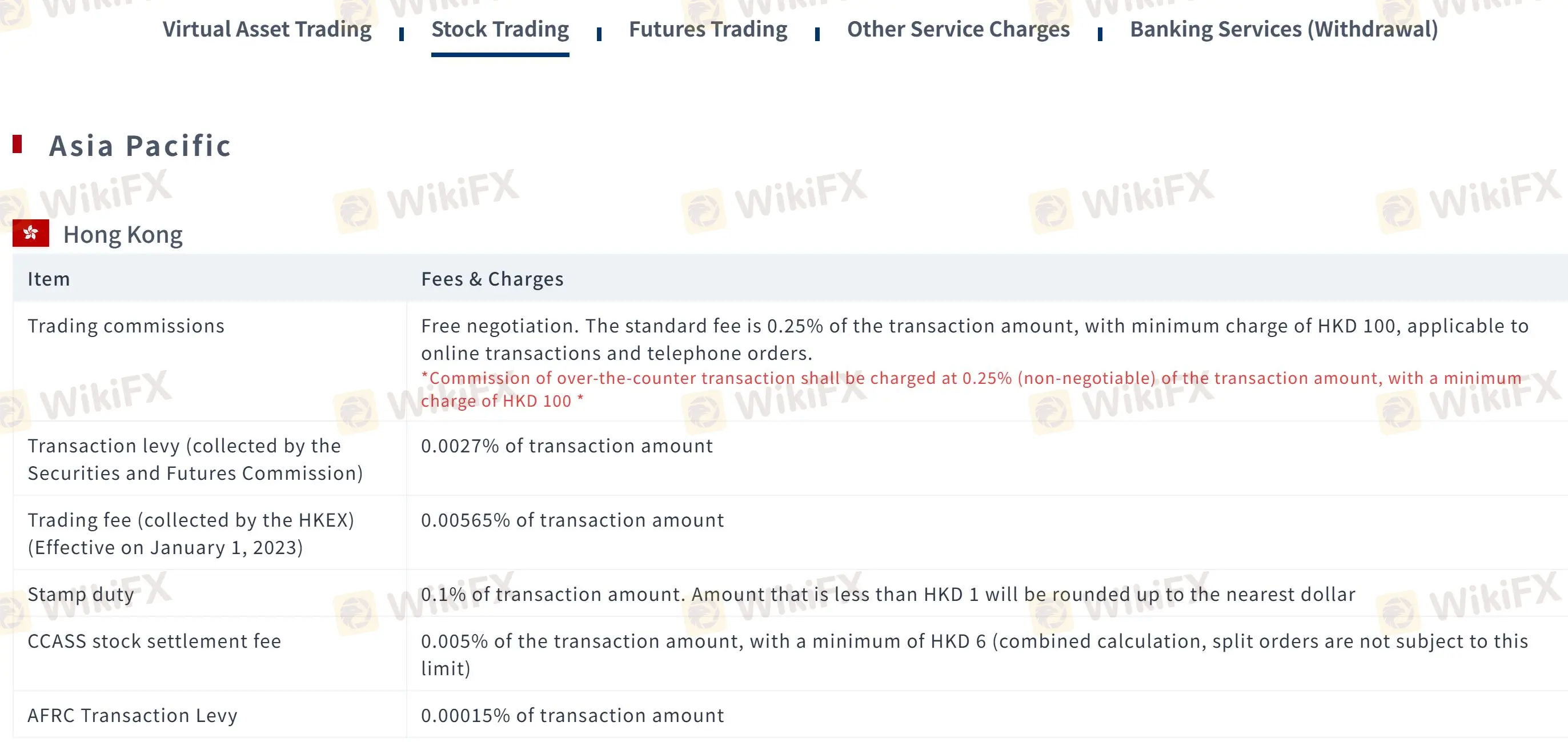

거래 수수료

Victory Securities의 수수료는 시장, 상품 및 거래 유형에 따라 달라집니다. 예를 들어, 주식 거래의 수수료는 일반적으로 거래 금액의 0.25%에서 0.45%이며, 최소 수수료는 지역에 따라 다릅니다.

| 상품 | 수수료 | 최소 요금 |

| 홍콩 주식 | 0.25% (협의 가능) | HKD 100 |

| 중국 (상하이/심천 커넥트) | 0.25% | RMB 100 |

| 일본 주식 | 0.30% (온라인), 0.40% (전화) | JPY 3,500 |

| 싱가포르 주식 | 0.25% | USD 40 |

| 대만 주식 | 0.30% | NT$600 |

| 호주 주식 | 0.35% | AUD 50 |

| 한국 주식 | 0.30% | KRW 20,000 |

| 미국 주식 | 0.25% | USD 15 |

비거래 수수료

서비스에는 추가 수수료가 있습니다. 이러한 수수료는 계정 관리, 기업 행동 및 특정 거래 유형과 관련된 다양한 측면을 포함합니다. 일반적인 예로는 거래 세금, 정산 수수료, 보관 수수료 및 기타 서비스 수수료가 있습니다.

| 수수료 범주 | 금액 |

| 거래 세금 | 거래 금액의 0.0027% |

| 거래 수수료 | 거래 금액의 0.00565% |

| 스탬프 세금 | 거래 금액의 0.1% (올림) |

| CCASS 주식 정산 수수료 | 거래 금액의 0.005% (최소 HKD 6) |

| AFRC 거래 세금 | 거래 금액의 0.00015% |

더 많은 정보는 다음 웹 사이트를 참조하십시오: https://www.victorysec.com.hk/en/help/fee

거래 플랫폼

| 거래 플랫폼 | 적합한 대상 |

| VictoryX | 종합적이고 사용자 친화적인 고급 기능을 갖춘 거래 플랫폼을 찾는 개인 투자자. |

| Victory Securities (주식) | 개인 투자자 중 주식 거래에 주로 관심이 있는 사람들. |

| VIC TOKEN | 암호화폐 거래에 관심이 있는 투자자들. |

| 증권 거래 (데스크탑) | 데스크탑 기반 거래 플랫폼을 선호하는 개인 투자자들. |

입출금

입금

| 입금 옵션 | 최소 입금액 | 수수료 | 처리 시간 |

| 은행 송금 (온라인 및 오프라인) | / | / | 근무일의 마감 시간은 오후 4시 45분입니다. 이 시간 이후에 제출된 송금증은 다음 근무일에 처리됩니다. |

출금

| 출금 옵션 | 최소 출금액 | 수수료 | 처리 시간 |

| 은행 송금 (온라인 및 오프라인) | $0 | 첫 출금은 무료이며, 이후 출금은 HKD$500씩 부과됩니다. | 정오 12시 이전에 신청한 경우, 당일 처리됩니다. |

| 정오 12시 이후에 신청한 경우, 다음 근무일에 처리됩니다. | |||

| 전신 송금/은행 간 송금 | $0 | HKD/RMB: 첫 출금은 $/RMB$300이며, 이후 출금은 $/RMB$800씩 부과됩니다; | 정오 12시 이전에 신청한 경우, 당일 처리됩니다. |

| USD: 첫 출금은 US$25이며, 이후 출금은 US$100씩 부과됩니다. | 정오 12시 이후에 신청한 경우, 다음 근무일에 처리됩니다. |