Perfil de la compañía

| Victory Securities Resumen de la reseña | |

| Fundado | 1971 |

| País/Región registrado | Hong Kong |

| Regulación | SFC |

| Servicios | Gestión de patrimonio, Mercado de capitales, Activos virtuales, Gestión de activos, Seguros, Servicios de corretaje y Plan de propiedad de acciones para empleados (ESOP) |

| Plataforma de negociación | VictoryX, VictorySecurities (Acciones), VIC TOKEN y Negociación de valores (Escritorio) |

| Soporte al cliente | Teléfono: +852 2523 1709, +86 147 1501 7408, +852 5498 9438 |

| Fax: +852 2810 7616 | |

| Correo electrónico: cs@victorysec.com.hk | |

| Dirección: 11/F, Yardley Commercial Building, 3 Connaught Road West, Sheung Wan, Hong Kong | |

| Formulario de contacto, redes sociales | |

Fundada en 1971, Victory Securities es un corredor con licencia regulado por SFC en Hong Kong. Ofrece una variedad de servicios como Gestión de patrimonio, Mercado de capitales, Activos virtuales, Gestión de activos, Seguros, Servicios de corretaje y Plan de propiedad de acciones para empleados (ESOP) a través de múltiples plataformas de negociación como VictoryX, VictorySecurities (Acciones), VIC TOKEN y Negociación de valores (Escritorio).

Pros y contras

| Pros | Contras |

| Regulado por SFC | Estructura de tarifas compleja |

| Diversos canales de contacto | Sin soporte de chat en vivo |

| Amplia gama de servicios | |

| Diversos tipos de cuentas | |

| Múltiples plataformas |

¿Es Victory Securities legítimo?

| País regulado | Autoridad reguladora | Entidad regulada | Tipo de licencia | Número de licencia |

| La Comisión de Valores y Futuros (SFC) | Victory Securities Company Limited | Operaciones de contratos de futuros | ABN091 |

Servicios

Victory Securities ofrece servicios financieros tradicionales como Gestión de patrimonio, Mercado de capitales, Activos virtuales, Gestión de activos, Seguros, Servicios de corretaje y Plan de propiedad de acciones para empleados (ESOP).

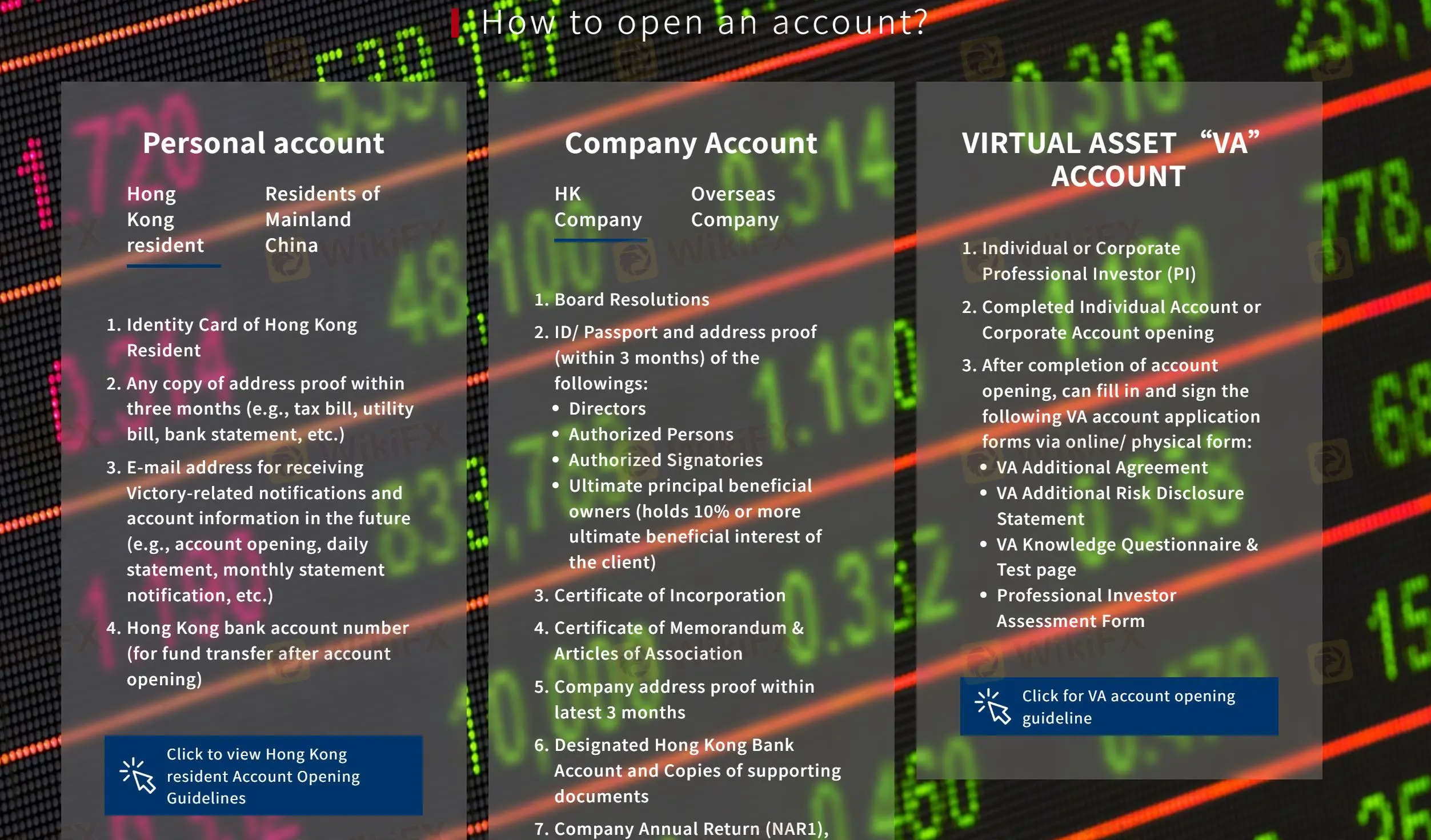

Tipo de cuenta

Victory Securities ofrece tres tipos de cuentas para los usuarios.

Cuenta personal es adecuada para inversores individuales residentes en Hong Kong o China continental.

Cuenta de empresa está diseñada para entidades corporativas, tanto empresas de Hong Kong como extranjeras.

Cuenta de Activos Virtuales (VA) está disponible para inversores profesionales individuales o corporativos que ya hayan abierto una cuenta personal o de empresa.

Victory Securities ofrece dos formas de abrir una cuenta en línea utilizando la aplicación móvil "VictoryX" y abrir una cuenta por correo.

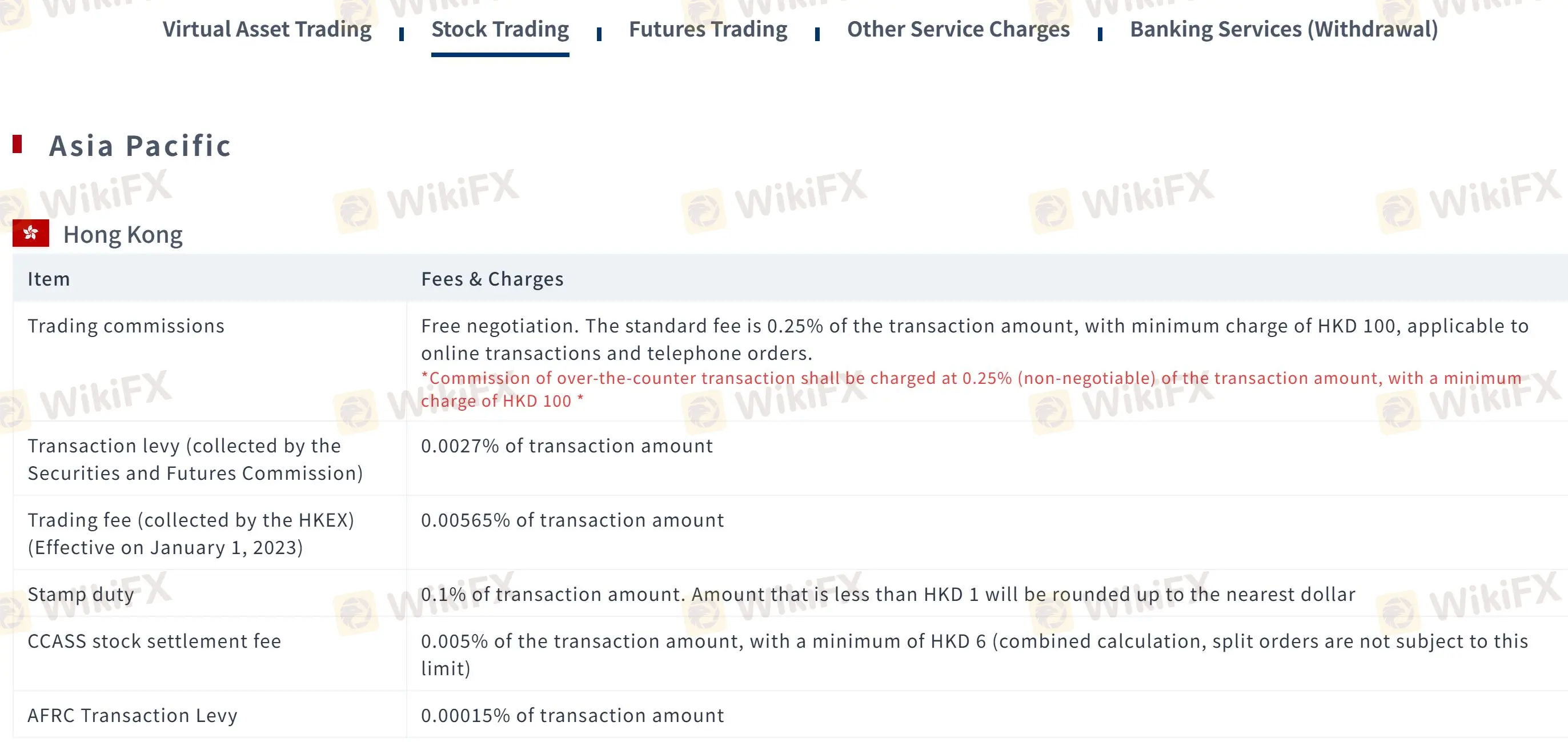

Tarifas

Tarifas de negociación

La cantidad específica de comisión de Victory Securities depende del mercado, producto y tipo de transacción. Por ejemplo, la comisión para operar acciones suele ser del 0,25% al 0,45% del monto de la transacción, y la tarifa mínima varía según la región.

| Producto | Comisión | Cargo mínimo |

| Acciones de Hong Kong | 0,25% (negociable) | HKD 100 |

| China (Shanghai/Shenzhen Connect) | 0,25% | RMB 100 |

| Acciones de Japón | 0,30% (en línea), 0,40% (teléfono) | JPY 3.500 |

| Acciones de Singapur | 0,25% | USD 40 |

| Acciones de Taiwán | 0,30% | NT$600 |

| Acciones de Australia | 0,35% | AUD 50 |

| Acciones de Corea del Sur | 0,30% | KRW 20.000 |

| Acciones de Estados Unidos | 0,25% | USD 15 |

Tarifas no relacionadas con la negociación

Existen tarifas adicionales asociadas a sus servicios. Estas tarifas cubren diversos aspectos de la gestión de cuentas, acciones corporativas y tipos de transacciones específicas. Algunos ejemplos comunes incluyen impuestos y gravámenes de transacción, tarifas de compensación, tarifas de custodia y otras tarifas de servicio.

| Categoría de tarifa | Monto |

| Impuesto de transacción | 0,0027% del monto de la transacción |

| Tarifa de negociación | 0,00565% del monto de la transacción |

| Impuesto de timbre | 0,1% del monto de la transacción (redondeado) |

| Tarifa de liquidación de acciones CCASS | 0,005% del monto de la transacción (mínimo HKD 6) |

| Impuesto de transacción AFRC | 0,00015% del monto de la transacción |

Para obtener más información, consulte el siguiente sitio web: https://www.victorysec.com.hk/en/help/fee

Plataforma de Trading

| Plataforma de Trading | Adecuado para |

| VictoryX | Inversores individuales que buscan una plataforma de trading completa y fácil de usar con funciones avanzadas. |

| Victory Securities (Stock) | Inversores individuales interesados principalmente en el trading de acciones. |

| VIC TOKEN | Inversores interesados en el trading de criptomonedas. |

| Securities Trading (Desktop) | Inversores individuales que prefieren una plataforma de trading basada en escritorio. |

Depósito y Retiro

Depósito

| Opción de Depósito | Depósito Mínimo | Comisión | Tiempo de Procesamiento |

| Transferencia Bancaria (en línea y fuera de línea) | / | / | El horario límite en días laborables es a las 4:45 pm. Los certificados de transferencia presentados después de este horario se procesarán el segundo día laborable. |

Retiro

| Opción de Retiro | Retiro Mínimo | Comisión | Tiempo de Procesamiento |

| Transferencia Bancaria (en línea y fuera de línea) | $0 | El primer retiro diario es gratuito, y los retiros posteriores son de HKD$500 cada uno. | Las solicitudes presentadas antes de las 12:00 del mediodía se procesarán el mismo día. |

| Las solicitudes presentadas después de las 12:00 del mediodía se programarán para su procesamiento al siguiente día laborable. | |||

| Transferencia Telegráfica/Transferencia Interbancaria | $0 | HKD/RMB: El primer retiro diario es de $/RMB$300, y los retiros posteriores son de $/RMB$800 cada uno; | Las solicitudes presentadas antes de las 12:00 del mediodía se procesarán el mismo día. |

| USD: El primer retiro diario es de US$25, y los retiros posteriores son de US$100 cada uno. | Las solicitudes presentadas después de las 12:00 del mediodía se programarán para su procesamiento al siguiente día laborable. |