Profil perusahaan

| Vita Markets Ringkasan Ulasan | |

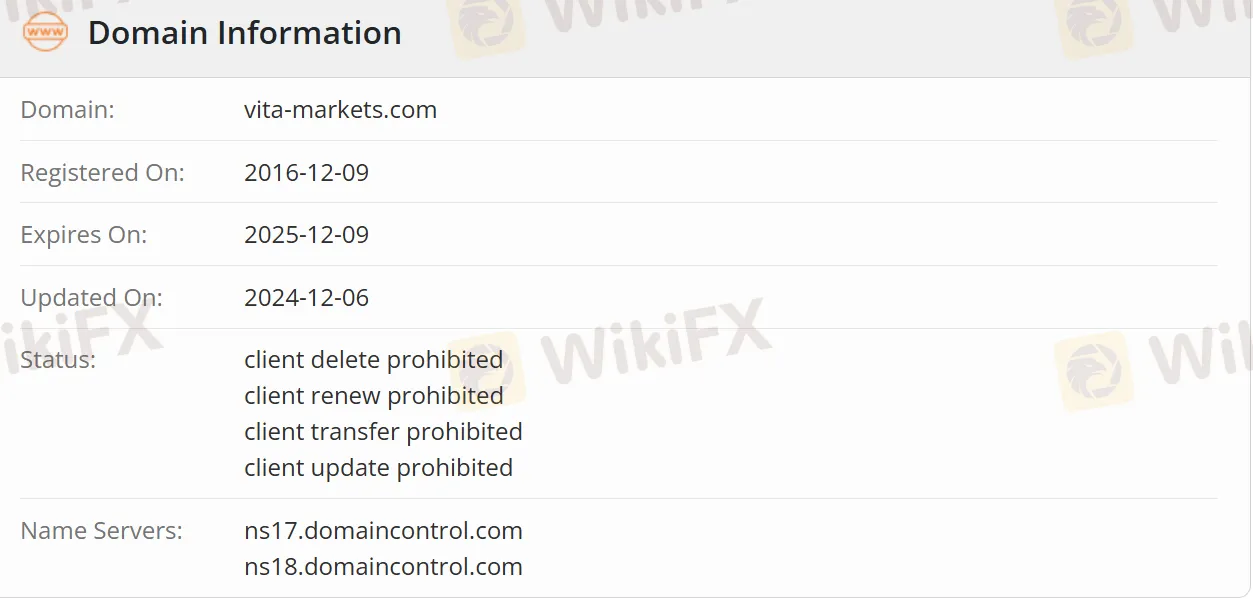

| Dibentuk | 2016-12-09 |

| Negara/Daerah Terdaftar | Siprus |

| Regulasi | Teregulasi |

| Dukungan Pelanggan | +357 25311407/+357 25377104 |

| Email: info@vita-markets.com | |

| Alamat Bisnis Telepon: 3095, Siprus, Limasol, Pindarou 14 Alamat Hukum: 3020, Siprus, Limasol, Aiolou & Panagioti Diomidous 9 | |

Vita Markets Informasi

VM Vita Markets menyediakan layanan investasi untuk klien perorangan dan korporat. VM Vita Markets Ltd adalah Cyprus Investment Firm (CIF) yang diotorisasi dan diatur oleh Cyprus Securities and Exchange Commission (CySEC), dengan nomor lisensi CIF 373/19.

Pro dan Kontra

| Pro | Kontra |

| Teregulasi | Informasi terbatas |

| Layanan investasi disediakan |

Apakah Vita Markets Legal?

Perusahaan ini memiliki lisensi CIF (373/19) yang dikeluarkan oleh CySEC, dan merupakan lembaga keuangan yang terdaftar secara legal yang mematuhi persyaratan regulasi UE seperti anti pencucian uang dan perlindungan investor. Disarankan untuk memprioritaskan pialang dengan operasi yang stabil dan informasi yang transparan. Untuk informasi lebih lanjut, Anda dapat memverifikasi status regulasi perusahaan melalui situs web resmi CySEC.

Dam0nG

Amerika Serikat

Aplikasi yang cukup bagus. Saya baru mulai berinvestasi. Bagi saya, aplikasi ini mudah dinavigasi. Dukungan bekerja selama jam kerja bursa, tapi saya rasa mereka berjanji pada akhirnya akan tersedia 24/7. Hampir tidak ada batasan pada setoran minimum, jadi Anda hanya dapat memiliki $1 dan berdagang. Persyaratannya cukup bisa diterima. Selain itu, bahkan ada sesuatu untuk dibaca, mereka memposting banyak analisis menarik di sini "Saya baru mulai berinvestasi. Bagi saya, aplikasi ini mudah dinavigasi. Dukungan bekerja selama jam kerja bursa, tapi saya rasa mereka menjanjikannya pada akhirnya akan tersedia 24/7. Hampir tidak ada batasan pada deposit minimum, sehingga Anda hanya dapat memiliki $1 dan berdagang. Persyaratannya cukup dapat diterima. Selain itu, bahkan ada sesuatu untuk dibaca, mereka memposting banyak analisis menarik di sini

Baik

László

Hungaria

Aplikasi yang sangat bagus sepenuhnya diterjemahkan ke dalam bahasa Hungaria. Saya pikir ini adalah alat sederhana untuk investor pemula. Yang paling saya sukai adalah mereka memberi saya stok gratis setelah saya membuka akun dengan $80

Baik

Byte_investor

Rusia

Broker yang bagus dengan aplikasi yang sangat bagus dan dukungan yang ramah. Tidak banyak ide untuk diinvestasikan, tetapi semuanya dari Pasar AS, itulah yang saya cari.

Baik

Alvin4423

Siprus

Solusi perdagangan hebat bagi mereka yang baru memulai perjalanan investasi mereka. Proses orientasi yang sederhana dan cepat, navigasi yang mudah, akses ke saham berkinerja terbaik, eksekusi cepat, dan komisi yang masuk akal.

Baik