Informasi Dasar

Brasil

Brasil

Skor

Brasil

|

5-10 tahun

|

Brasil

|

5-10 tahun

| https://www.xpi.com.br/

Website

Peringkat indeks

MT4/5

Lisensi Penuh

XPMT5-PRD

Pengaruh

AA

Indeks pengaruh NO.1

Brasil 9.37

Brasil 9.37

Identifikasi MT4/5

Lisensi Penuh

Brasil

BrasilPengaruh

AA

Indeks pengaruh NO.1

Brasil 9.37

Brasil 9.37 Lisensi

LisensiTidak ada informasi regulasi yang valid, harap waspada!

Brasil

Brasil

Trader MT4/5 utama formal akan memiliki layanan sistem suara dan dukungan teknis tindak lanjut. Secara umum, bisnis dan teknologi mereka relatif matang dan kemampuan pengendalian risiko mereka kuat

xpi.com.br

xpi.com.br Amerika Serikat

Amerika Serikat| XP Investimentos Ringkasan Ulasan | |

| Teregistrasi Pada | 5-10 tahun |

| Negara/Daerah Terdaftar | Brasil |

| Regulasi | Tidak Diatur |

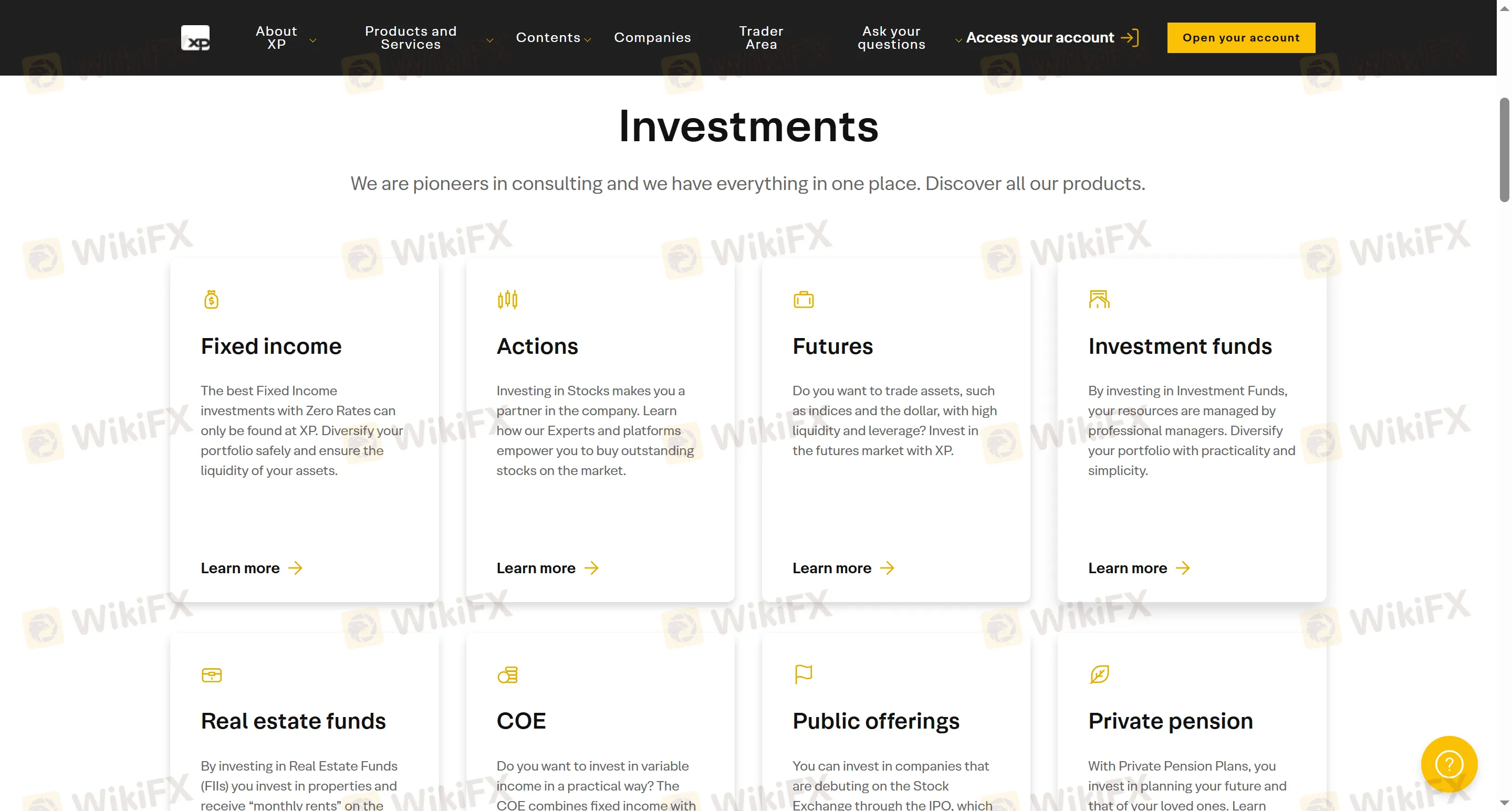

| Produk dan Layanan | Produk pendapatan tetap, Futures, Saham, Dana investasi, Dana real estat (FIIs), COE, IPO, Rencana pensiun pribadi, dan Asuransi jiwa |

| Akun Demo | ✅ |

| Daya Ungkit | / |

| Spread | / |

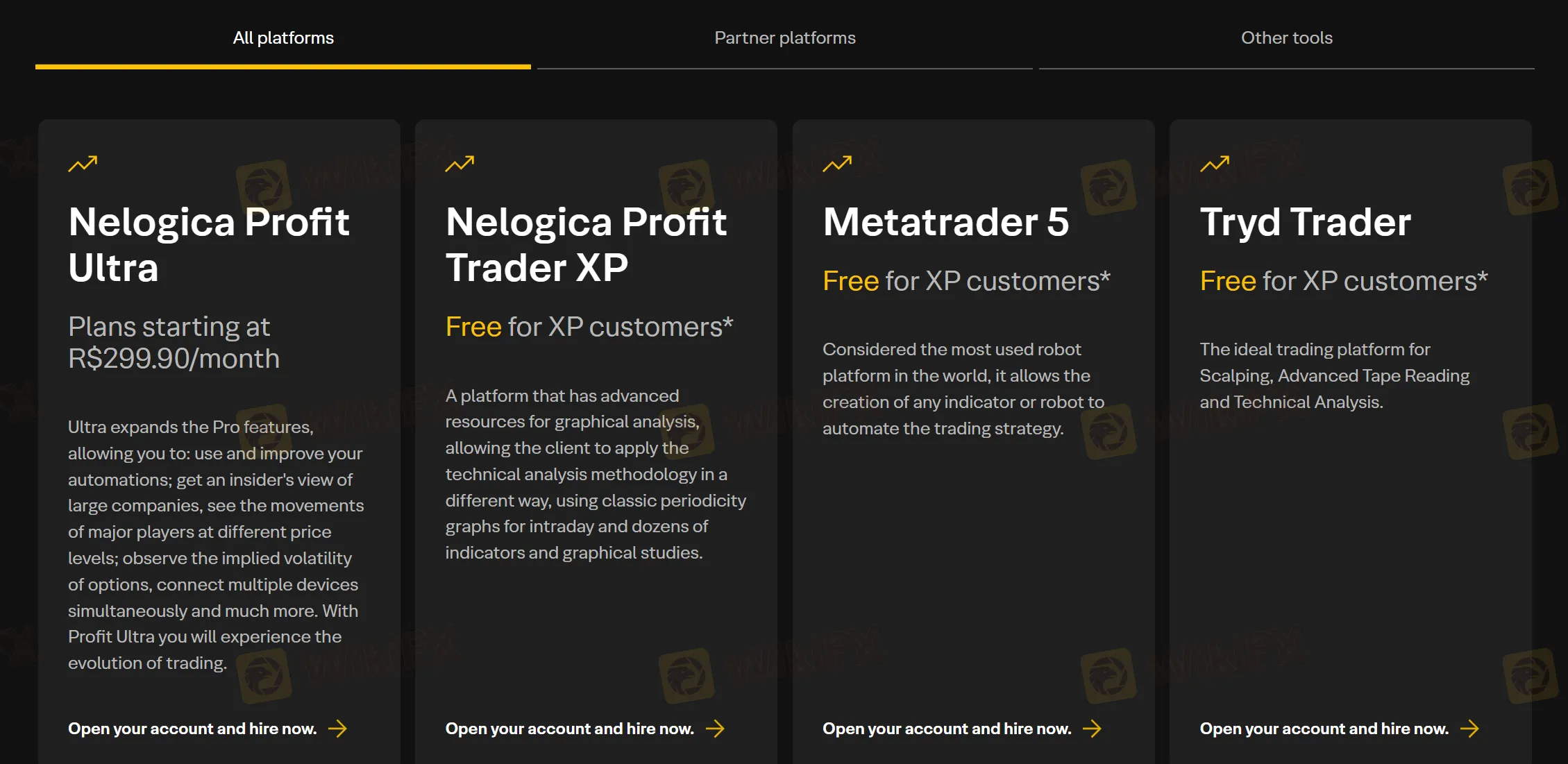

| Platform Perdagangan | Nelogica Profit Ultra, Metatrader 5, Tryd Trader, dan Nelogica Profit Trader XP |

| Deposit Minimum | / |

| Dukungan Pelanggan | WhatsApp: +55 11 4935-2720 |

| 0800-772-02020800-000-0078 | |

| oficios@xpi.com.br (Ombudsman) | |

XP Investimentos adalah platform layanan keuangan komprehensif yang tidak hanya menawarkan beragam produk dan layanan investasi tetapi juga memberikan pengalaman investasi yang nyaman dan efisien bagi klien perorangan dan korporat. Dalam hal produk, platform ini mencakup berbagai kelas aset, mulai dari investasi saham dan obligasi tradisional hingga futures dan dana investasi yang sedang berkembang. Dalam hal layanan, telah diluncurkan layanan akun digital untuk klien korporat.

| Kelebihan | Kekurangan |

| Beragam produk dan layanan | Tidak Diatur |

| Ambang batas rendah untuk XP Empresas | Biaya pengadaan internasional (0,5% - 1%) |

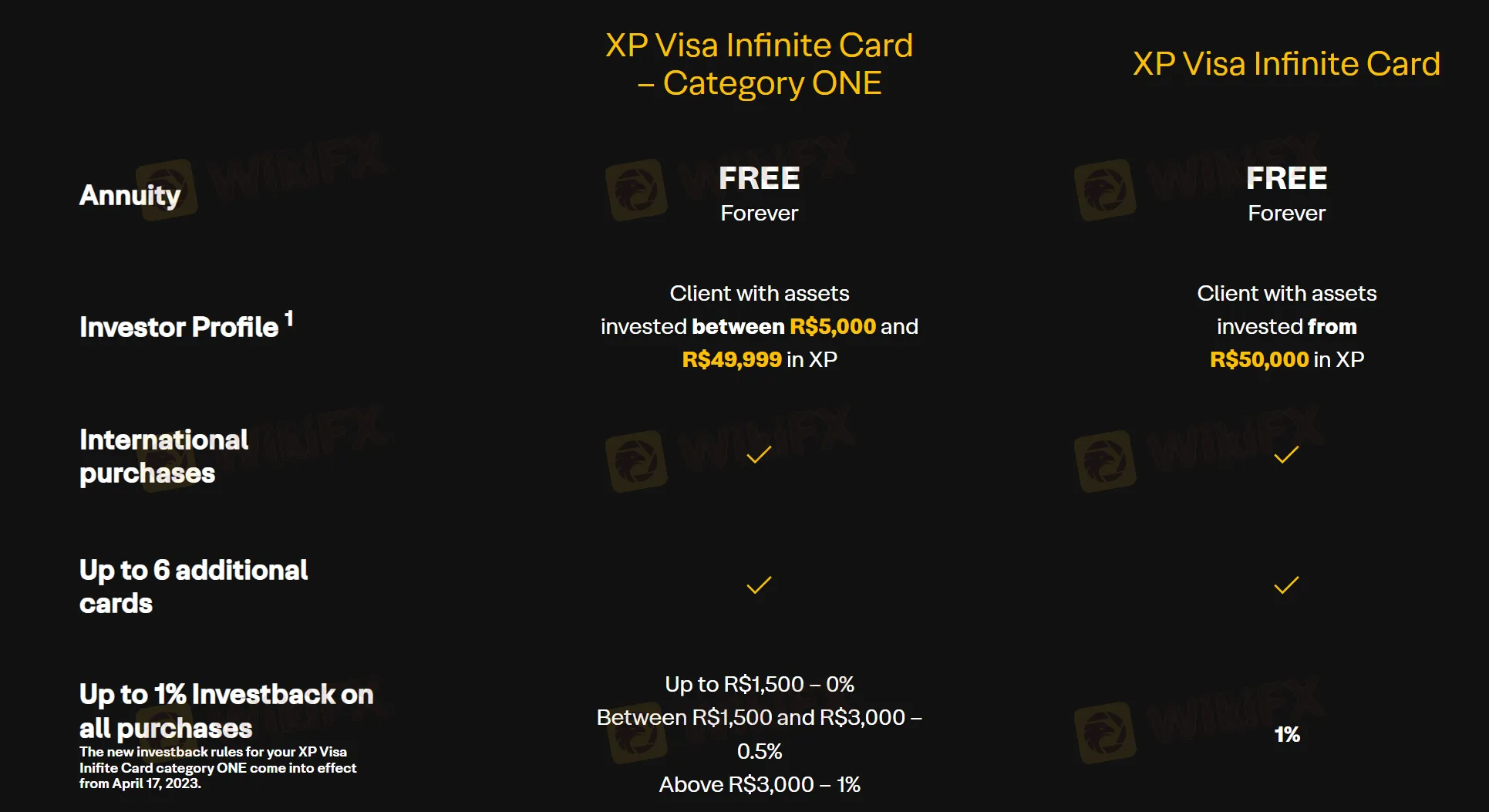

| Kartu XP Visa Infinite dengan pembebasan biaya tahunan permanen | |

| MT5 tersedia |

XP Investimentos telah beroperasi di pasar keuangan selama bertahun-tahun, namun tidak diatur. Para trader selalu disarankan untuk memilih perusahaan investasi dengan lisensi keuangan resmi dan regulasi.

Di XP Investimentos, Anda dapat melakukan perdagangan berbagai jenis aset dan layanan, termasuk produk pendapatan tetap, saham, futures, dana investasi, dana real estat (FIIs), dan produk investasi lainnya seperti COE (gabungan pendapatan tetap dan variabel), saham penawaran umum (IPO), rencana pensiun pribadi, asuransi jiwa, dll.

| Produk dan Layanan | Didukung |

| Produk pendapatan tetap | ✔ |

| Futures | ✔ |

| Saham | ✔ |

| Dana investasi | ✔ |

| Dana real estat (FIIs) | ✔ |

| COE | ✔ |

| IPO | ✔ |

| Rencana pensiun pribadi | ✔ |

| Asuransi jiwa | ✔ |

Melalui akun investasi di XP Investimentos, para trader dapat berinvestasi dalam aplikasi pendapatan tetap dan variabel. Dengan akun digital, pengguna dapat mengelola transaksi harian seperti membayar tagihan, mengirim dan menerima transfer PIX dan TED, serta menerima gaji.

Kartu XP Visa Infinite - Kategori Satu dan Kartu XP Visa Infinite keduanya menawarkan biaya tahunan gratis, dan pelanggan dapat menerima diskon investasi hingga 1% untuk semua pembelian. Untuk Kartu XP Visa Infinite - Kategori Satu, tarif diskon investasi adalah sebagai berikut: 0% untuk pembelian di bawah R$1.500; 0,5% untuk pembelian antara R$1.500 dan R$3.000; 1% untuk pembelian di atas R$3.000.

XP Investimentos menawarkan Nelogica Profit Ultra mulai dari biaya bulanan R$299,90, serta platform perdagangan yang banyak digunakan secara global seperti Metatrader 5, Tryd Trader, dan Nelogica Profit Trader XP.

| Platform Perdagangan | Didukung |

| Nelogica Profit Ultra | ✔ |

| Metatrader 5 | ✔ |

| Tryd Trader | ✔ |

| Nelogica Profit Trader XP | ✔ |

In my experience as a trader, evaluating XP Investimentos for potential risks requires careful scrutiny. What immediately stands out for me is the broker's lack of proper regulation. Despite operating in the financial markets for several years, XP Investimentos remains unregulated, which fundamentally means there are no formal oversight authorities ensuring client fund protection or monitoring their operational transparency. This alone significantly raises my level of caution since, without appropriate regulatory frameworks, recourse in the case of disputes or malpractice can be severely limited. Another concern is the “suspicious regulatory license” flag, which prompts me to question the reliability and safety of trading activities with them. While they do offer a full MetaTrader 5 license and access to reputable trading platforms, I remind myself that good technology doesn’t substitute for clear legal safeguards. I also noticed certain fee structures, like international procurement fees ranging from 0.5% to 1%, which could impact trading costs, especially for cross-border activities. Although the broker touts a broad product range and some appealing features, such as investment rebates via their Visa Infinite Card, these benefits do not compensate for the absence of regulation. For me, a key risk is that clients are inherently exposed to greater financial vulnerabilities and, therefore, must practice a higher degree of due diligence. In summary, the unregulated status and ambiguous regulatory signals present the most critical downsides that, for me, outweigh the platform’s broader service offerings.

Based on my research and experience with brokers, including a close review of XP Investimentos, I was unable to find clear or explicit information regarding specific deposit or withdrawal fees charged by XP Investimentos in the provided context. This lack of transparency immediately raises a concern for me as a trader who prioritizes understanding all costs associated with moving funds in and out of a brokerage account. While XP Investimentos is known for a broad selection of services and even offers certain fee waivers for its Visa Infinite card, there is no detailed mention of charges related to account funding or withdrawals. From a risk management perspective, especially with XP Investimentos being an unregulated entity and flagged for high potential risk, I believe it is essential to approach with caution. In my view, before opening an account or transferring any funds, it would be wise for prospective clients to contact XP Investimentos directly, request written clarification on any potential deposit or withdrawal fees, and evaluate how this may impact overall trading costs. For me, clear and accessible fee information is a cornerstone of trustworthiness—its absence is a factor I weigh heavily when considering any broker.

As an experienced trader who has reviewed and closely examined XP Investimentos, I can confirm that this broker provides access to a notably broad range of financial instruments, catering primarily to the Brazilian market. In my direct experience and observation, XP Investimentos stands out for its offering of traditional asset classes: traders can invest in fixed income products, stocks, futures, investment funds, and real estate funds (FIIs). These allow for a variety of strategies, from conservative allocation in bonds to more speculative plays in the equity and futures markets. Additionally, the firm provides access to structured products like COEs, which combine fixed and variable returns, as well as opportunities to participate in IPOs. Further, they offer private pension plans and life insurance, which, while not trading instruments in the conventional sense, may appeal to those looking for long-term financial planning. However, I must note what is not supported: there is no mention of access to forex pairs, commodities, indices, or cryptocurrencies within their product suite. For me, this absence significantly narrows the broker’s suitability for globally minded traders or those eager to access diverse asset classes beyond Brazil’s main listed products. In summary, XP Investimentos is geared toward investors and traders focused on the Brazilian market, rather than those seeking comprehensive exposure to international forex, commodities, or crypto trading. This is an important factor I consider when evaluating any brokerage's fit for my trading objectives.

As an independent forex trader who’s worked with a variety of brokers, it’s always my priority to verify core details like minimum deposit requirements before funding any live trading account. In my thorough review of XP Investimentos, I found that their public materials, as summarized above, do not specify a clear minimum deposit amount for opening a standard live trading account. This absence of transparent information immediately stands out for me, especially when compared to international brokers that disclose clear entry thresholds. From my experience, a reputable broker usually makes such foundational information visible up front, as it’s a critical part of financial planning and risk management for any trader. The lack of stated minimum deposit does not necessarily mean there is no minimum – instead, it could reflect policy flexibility or perhaps a focus on higher-net-worth accounts, but in either case, I would treat the situation cautiously. I would not proceed with deposits or larger financial commitments without direct and official confirmation from XP Investimentos about their minimum deposit conditions. For me, this level of conservatism is necessary—especially since, in this case, the broker is not regulated by a recognized authority, which only increases the need for extra due diligence. I always recommend reaching out directly to their customer support and getting explicit, up-to-date information before committing funds. This approach is essential for safeguarding both my capital and my peace of mind as a trader.

Silakan masukan...

TOP

TOP

Chrome

Plugin Chrome

Pertanyaan Regulasi Pialang Forex Global

Jelajahi situs web broker forex dan kenali broker resmi dan penipu secara akurat

Pasang sekarang