Buod ng kumpanya

| XP Investimentos Buod ng Pagsusuri | |

| Nakarehistro Noong | 5-10 taon |

| Nakarehistrong Bansa/Rehiyon | Brazil |

| Regulasyon | Hindi Regulado |

| Mga Produkto at Serbisyo | Mga produkto ng fixed income, futures, stocks, investment funds, real estate funds (FIIs), COE, IPO, private pension plans, at life insurance |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

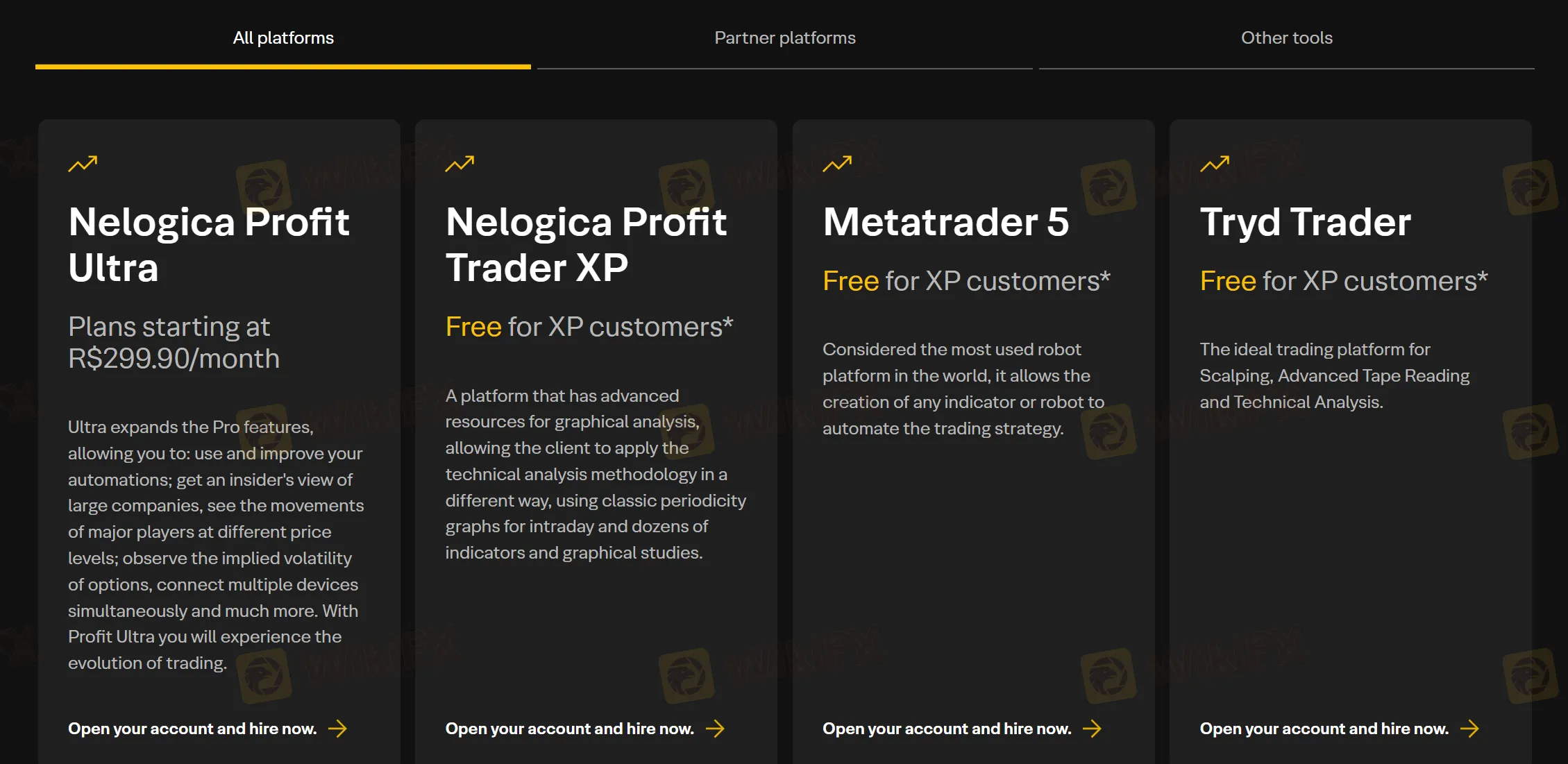

| Plataforma ng Paggagalaw | Nelogica Profit Ultra, Metatrader 5, Tryd Trader, at Nelogica Profit Trader XP |

| Min Deposit | / |

| Suporta sa Customer | WhatsApp: +55 11 4935-2720 |

| 0800-772-02020800-000-0078 | |

| oficios@xpi.com.br (Ombudsman) | |

XP Investimentos Impormasyon

Ang XP Investimentos ay isang komprehensibong plataporma ng serbisyong pinansiyal na hindi lamang nag-aalok ng malawak na hanay ng mga produkto at serbisyo sa pamumuhunan kundi nagbibigay din ng mga kumportableng at maaasahang karanasan sa pamumuhunan para sa indibidwal at korporasyong kliyente. Sa mga produkto, ito ay sumasaklaw sa iba't ibang uri ng asset classes, mula sa tradisyonal na pamumuhunan sa stock at bond hanggang sa mga bagong lumalabas na futures at investment funds. Sa mga serbisyo, ito ay naglunsad ng mga digital na serbisyong account para sa korporasyong kliyente.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Maraming produkto at serbisyo | Hindi Regulado |

| Mababang threshold para sa XP Empresas | Mga bayad sa internasyonal na procurement (0.5% - 1%) |

| XP Visa Infinite Card na may permanenteng annual fee waiver | |

| MT5 na available |

Tunay ba ang XP Investimentos?

Ang XP Investimentos ay nag-operate sa merkado ng pinansyal sa loob ng maraming taon, ngunit hindi ito regulado. Laging pinapayuhan ang mga mangangalakal na pumili ng mga kumpanyang pang-invest na may opisyal na lisensya sa pinansyal at regulasyon.

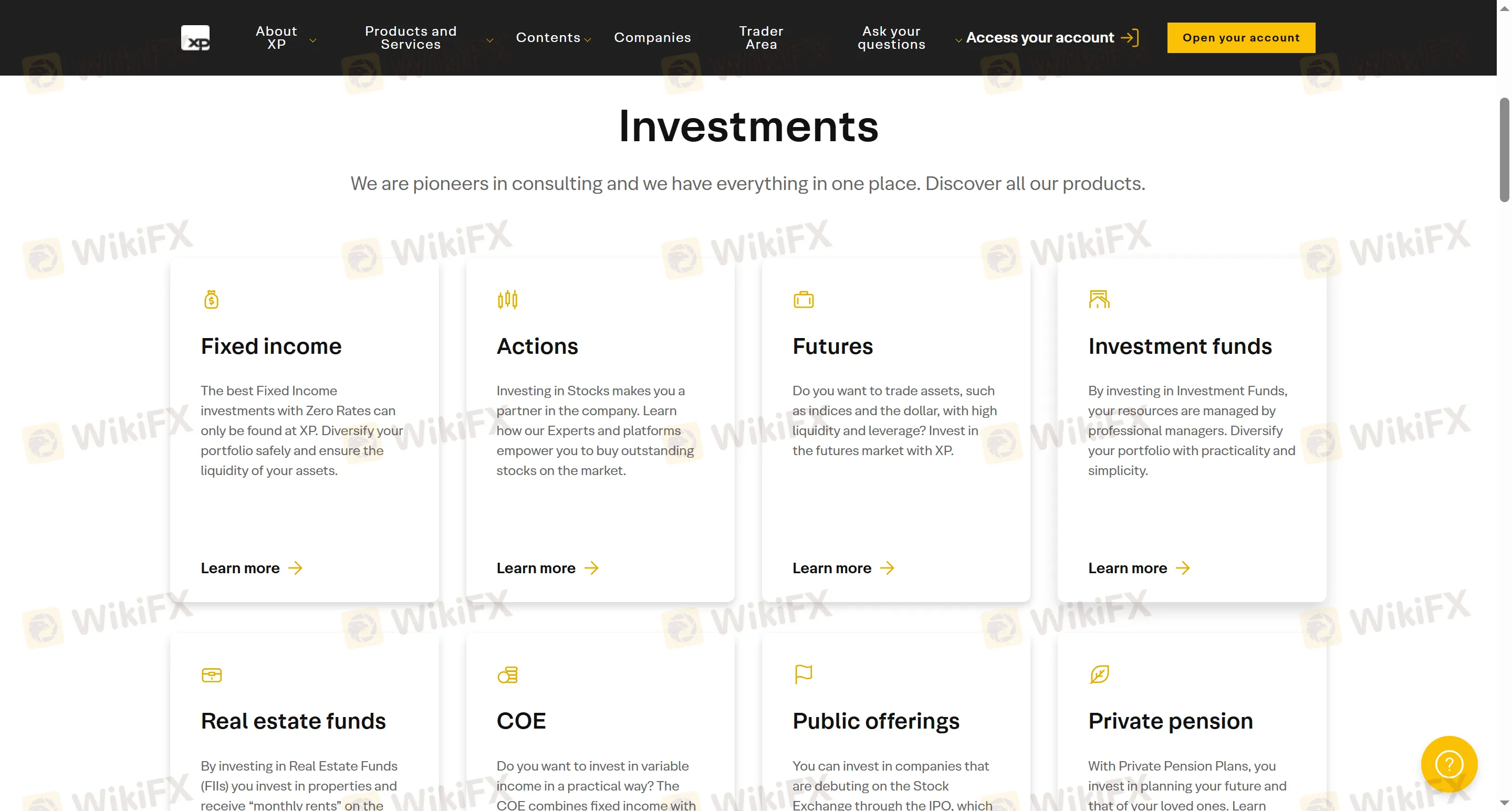

Ano ang Mga Produkto at Serbisyo na Iniaalok ng XP Investimentos?

Sa XP Investimentos, maaari kang mag-trade ng iba't ibang uri ng mga ari-arian at serbisyo, kabilang ang mga produkto ng fixed income, mga stock, futures, investment funds, real estate funds (FIIs), at iba pang mga produkto ng investment tulad ng COE (pinagsasama ang fixed income at variable income), public offering stocks (IPO), pribadong plano ng pensyon, life insurance, at iba pa.

| Mga Produkto at Serbisyo | Supported |

| Mga produkto ng fixed income | ✔ |

| Futures | ✔ |

| Stocks | ✔ |

| Mga investment funds | ✔ |

| Mga real estate funds (FIIs) | ✔ |

| COE | ✔ |

| IPO | ✔ |

| Pribadong mga plano ng pensyon | ✔ |

| Life insurance | ✔ |

Uri ng Account

Sa pamamagitan ng mga investment account sa XP Investimentos, maaaring mamuhunan ang mga trader sa mga fixed-income at variable income applications. Sa pamamagitan ng digital accounts, maaaring asikasuhin ng mga users ang araw-araw na transaksyon tulad ng pagbabayad ng mga bill, pagpapadala at pagtanggap ng PIX at TED transfers, at pagtanggap ng sahod.

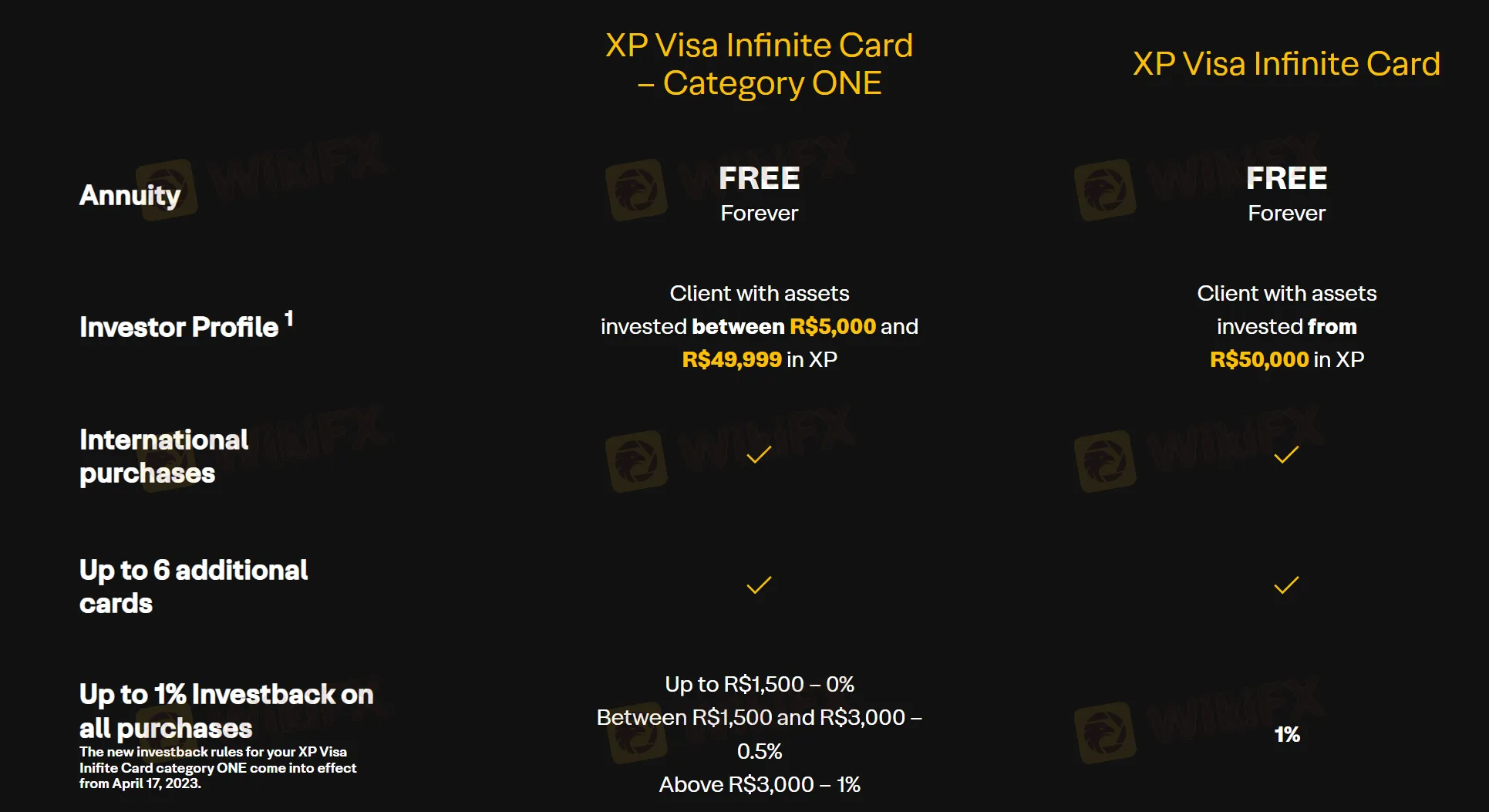

Mga Bayarin sa XP Investimentos

Ang XP Visa Infinite Card - Category One at ang XP Visa Infinite Card parehong nag-aalok ng libreng taunang bayad, at maaaring makatanggap ang mga customer ng investment rebate na hanggang 1% sa lahat ng kanilang mga pagbili. Para sa XP Visa Infinite Card - Category One, ang mga rate ng investment rebate ay ang mga sumusunod: 0% para sa mga pagbili na hindi lalampas sa R$1,500; 0.5% para sa mga pagbili na nasa pagitan ng R$1,500 at R$3,000; 1% para sa mga pagbili na higit sa R$3,000.

Plataforma ng Trading

Nag-aalok ang XP Investimentos ng Nelogica Profit Ultra na nagsisimula sa isang buwanang bayad na R$299.90, pati na rin ang mga globally widely used trading platforms na Metatrader 5, Tryd Trader, at Nelogica Profit Trader XP.

| Plataforma ng Trading | Supported |

| Nelogica Profit Ultra | ✔ |

| Metatrader 5 | ✔ |

| Tryd Trader | ✔ |

| Nelogica Profit Trader XP | ✔ |