Profil perusahaan

| Jarden Ringkasan Ulasan | |

| Dibentuk | 1961 |

| Negara/Daerah Terdaftar | Selandia Baru |

| Regulasi | Diatur oleh ASIC (Australia) |

| Instrumen Pasar | Ekuitas, Forex, Komoditas, Futures, Opsi |

| Akun Demo | ❌ |

| Daya Ungkit | / |

| Spread | / |

| Platform Perdagangan | Ranos, Commtrade, Market Trader |

| Deposit Minimum | / |

| Dukungan Pelanggan | Formulir Kontak |

| Tel: +61 2 8077 1300 | |

| Email: info@afca.org.au | |

| Alamat: Level 54 Governor Phillip Tower 1 Farrer Place Sydney NSW 2000 | |

Informasi Jarden

Jarden adalah broker berbasis Selandia Baru yang didirikan pada tahun 1961, diatur oleh ASIC. Menawarkan beragam instrumen pasar, misalnya: Ekuitas, Forex, Komoditas, Futures, dan Opsi.

Pro dan Kontra

| Pro | Kontra |

| Diatur oleh ASIC | Informasi perdagangan terbatas |

| Berbagai aset perdagangan | Tidak ada dukungan MT4 dan MT5 |

| Berbagai saluran kontak | Tidak ada akun demo |

| Kantor fisik terbukti | |

| Waktu operasi panjang |

Apakah Jarden Legal?

Jarden diaturoleh Komisi Sekuritas & Investasi Australia (ASIC), di bawah JARDEN AUSTRALIA PTY LTD, dengan nomor lisensi 000485351.

| Status Regulasi | Diatur Oleh | Institusi Berlisensi | Jenis Lisensi | Nomor Lisensi |

| Diatur | Komisi Sekuritas & Investasi Australia (ASIC) | JARDEN AUSTRALIA PTY LTD | Pembuat Pasar (MM) | 000485351 |

Survei Lapangan WikiFX

Tim survei lapangan WikiFX mengunjungi alamat Jarden di Australia, dan kami menemukan kantornya di lokasi, yang berarti perusahaan ini beroperasi dengan kantor fisik.

Apa yang Bisa Saya Perdagangkan di Jarden?

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| Forex | ✔ |

| Komoditas | ✔ |

| Futures | ✔ |

| Opsi | ✔ |

| Indeks | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| ETF | ❌ |

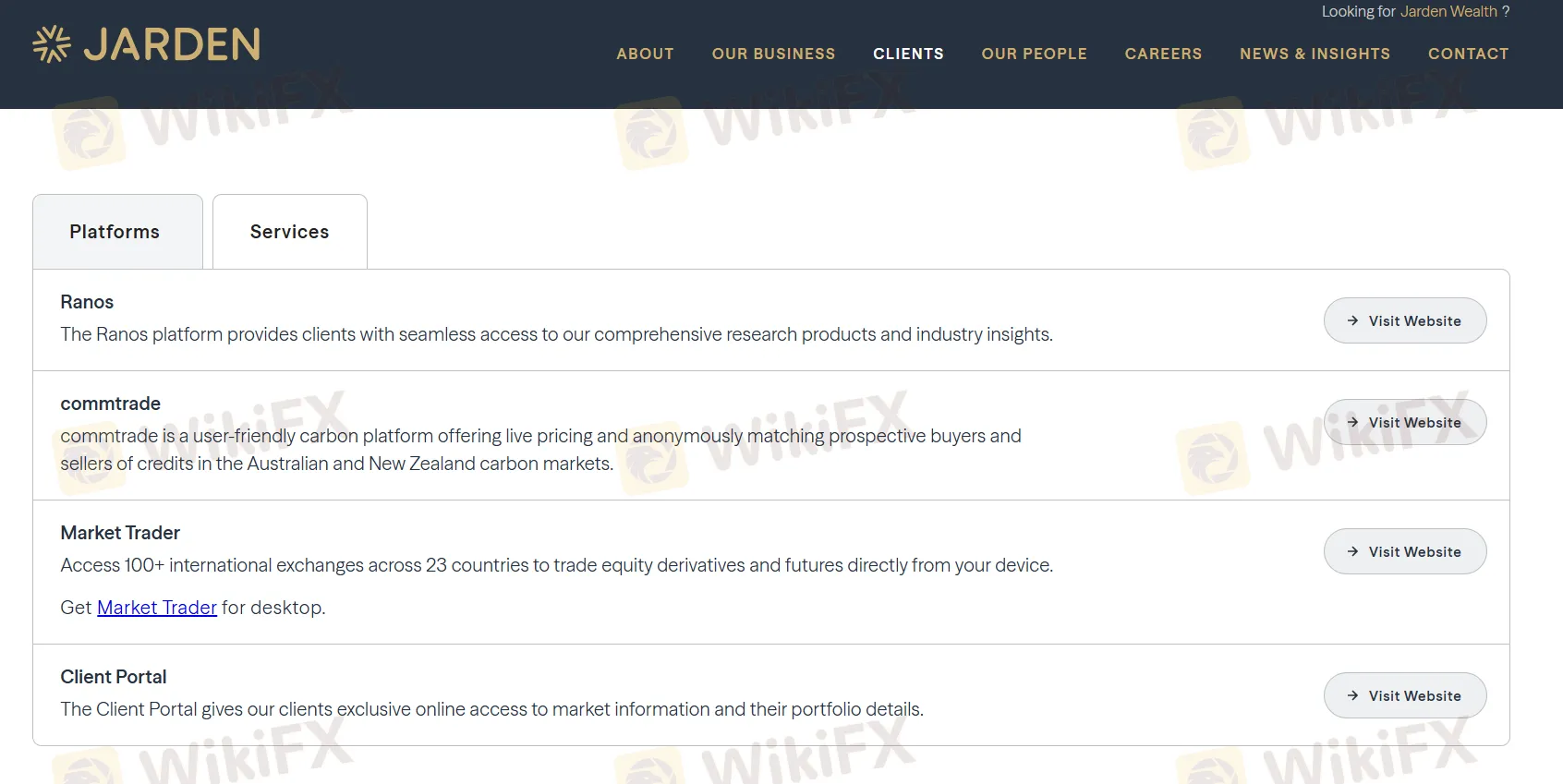

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Ranos | ✔ | Web (berbasis browser) | / |

| Commtrade | ✔ | Web (berbasis browser) | / |

| Market Trader | ✔ | Windows | / |

| MT4 | ❌ | / | Pemula |

| MT5 | ❌ | / | Trader berpengalaman |