Unternehmensprofil

| XP Investimentos Überprüfungszusammenfassung | |

| Registriert am | 5-10 Jahre |

| Registriertes Land/Region | Brasilien |

| Regulierung | Unreguliert |

| Produkte und Dienstleistungen | Festverzinsliche Produkte, Futures, Aktien, Investmentfonds, Immobilienfonds (FIIs), COE, IPO, private Rentenpläne und Lebensversicherungen |

| Demokonto | ✅ |

| Hebel | / |

| Spread | / |

| Handelsplattform | Nelogica Profit Ultra, Metatrader 5, Tryd Trader und Nelogica Profit Trader XP |

| Mindesteinzahlung | / |

| Kundensupport | WhatsApp: +55 11 4935-2720 |

| 0800-772-02020800-000-0078 | |

| oficios@xpi.com.br (Ombudsmann) | |

XP Investimentos Informationen

XP Investimentos ist eine umfassende Finanzdienstleistungsplattform, die nicht nur eine breite Palette von Anlageprodukten und -dienstleistungen anbietet, sondern auch bequeme und effiziente Anlageerfahrungen für Einzel- und Firmenkunden bietet. In Bezug auf Produkte deckt es verschiedene Anlageklassen ab, von traditionellen Aktien- und Anleiheinvestitionen bis hin zu aufstrebenden Futures und Investmentfonds. In Bezug auf Dienstleistungen hat es digitale Kontendienste für Firmenkunden eingeführt.

Vor- und Nachteile

| Vorteile | Nachteile |

| Vielfältige Produkte und Dienstleistungen | Unreguliert |

| Niedrige Schwelle für XP Empresas | Internationale Beschaffungsgebühren (0,5% - 1%) |

| XP Visa Infinite Card mit dauerhafter jährlicher Gebührenbefreiung | |

| MT5 verfügbar |

Ist XP Investimentos legitim?

XP Investimentos ist seit vielen Jahren im Finanzmarkt tätig, aber sie ist nicht reguliert. Händlern wird immer geraten, Anlagefirmen mit formellen Finanzlizenzen und Regulierungen zu wählen.

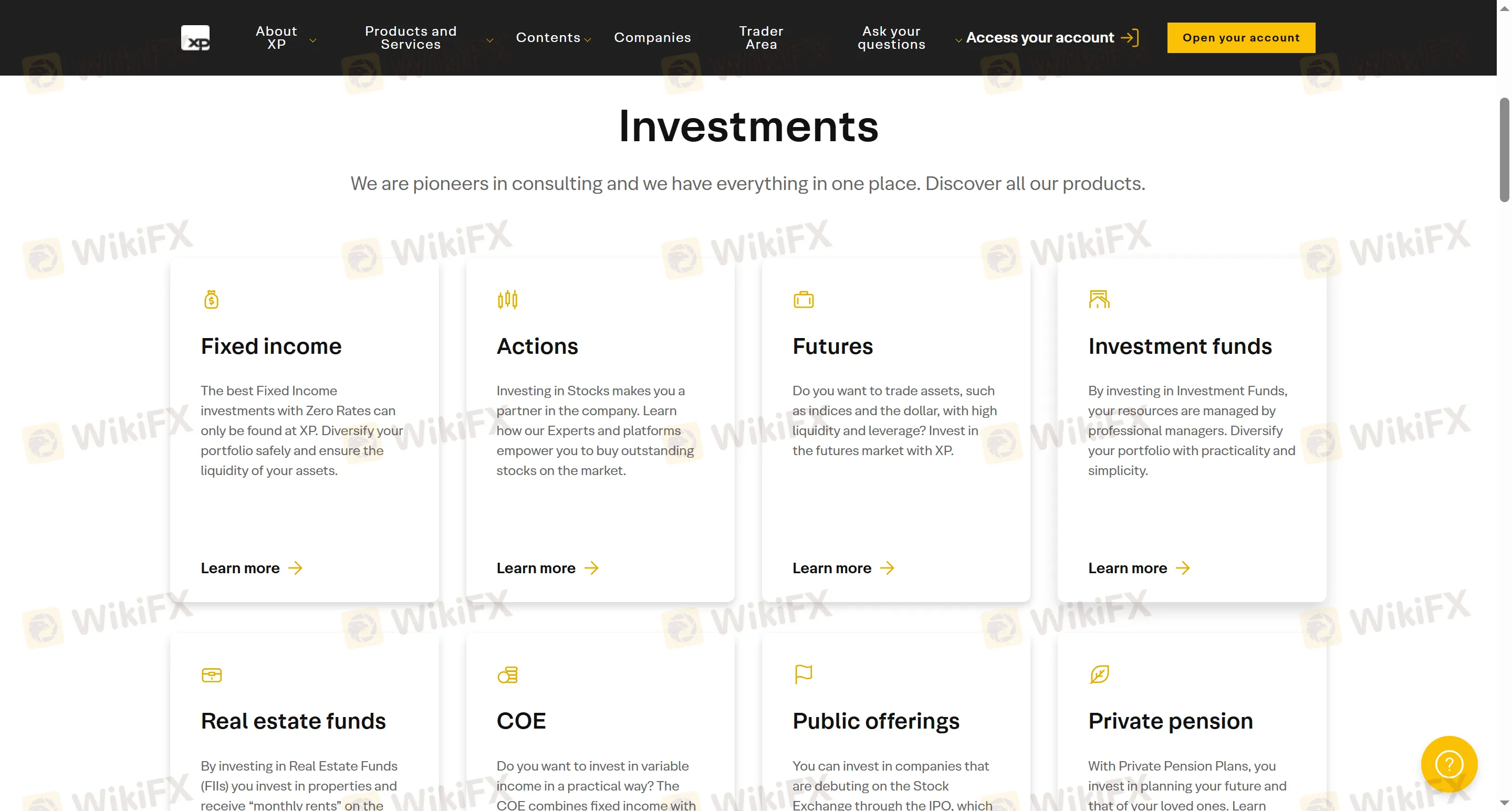

Welche Produkte und Dienstleistungen bietet XP Investimentos an?

Bei XP Investimentos können Sie mit verschiedenen Arten von Vermögenswerten und Dienstleistungen handeln, darunter Festzinsprodukte, Aktien, Futures, Investmentfonds, Immobilienfonds (FIIs) und andere Anlageprodukte wie COE (Kombination aus Festzins und variablen Einkommen), öffentlich angebotene Aktien (IPO), private Rentenpläne, Lebensversicherungen usw.

| Produkte und Dienstleistungen | Unterstützt |

| Festzinsprodukte | ✔ |

| Futures | ✔ |

| Aktien | ✔ |

| Investmentfonds | ✔ |

| Immobilienfonds (FIIs) | ✔ |

| COE | ✔ |

| IPO | ✔ |

| Private Rentenpläne | ✔ |

| Lebensversicherung | ✔ |

Kontotyp

Durch Anlagekonten bei XP Investimentos können Trader in Festzins- und variablen Einkommensanwendungen investieren. Mit digitalen Konten können Benutzer tägliche Transaktionen wie Rechnungen bezahlen, PIX- und TED-Überweisungen senden und empfangen sowie Gehälter erhalten.

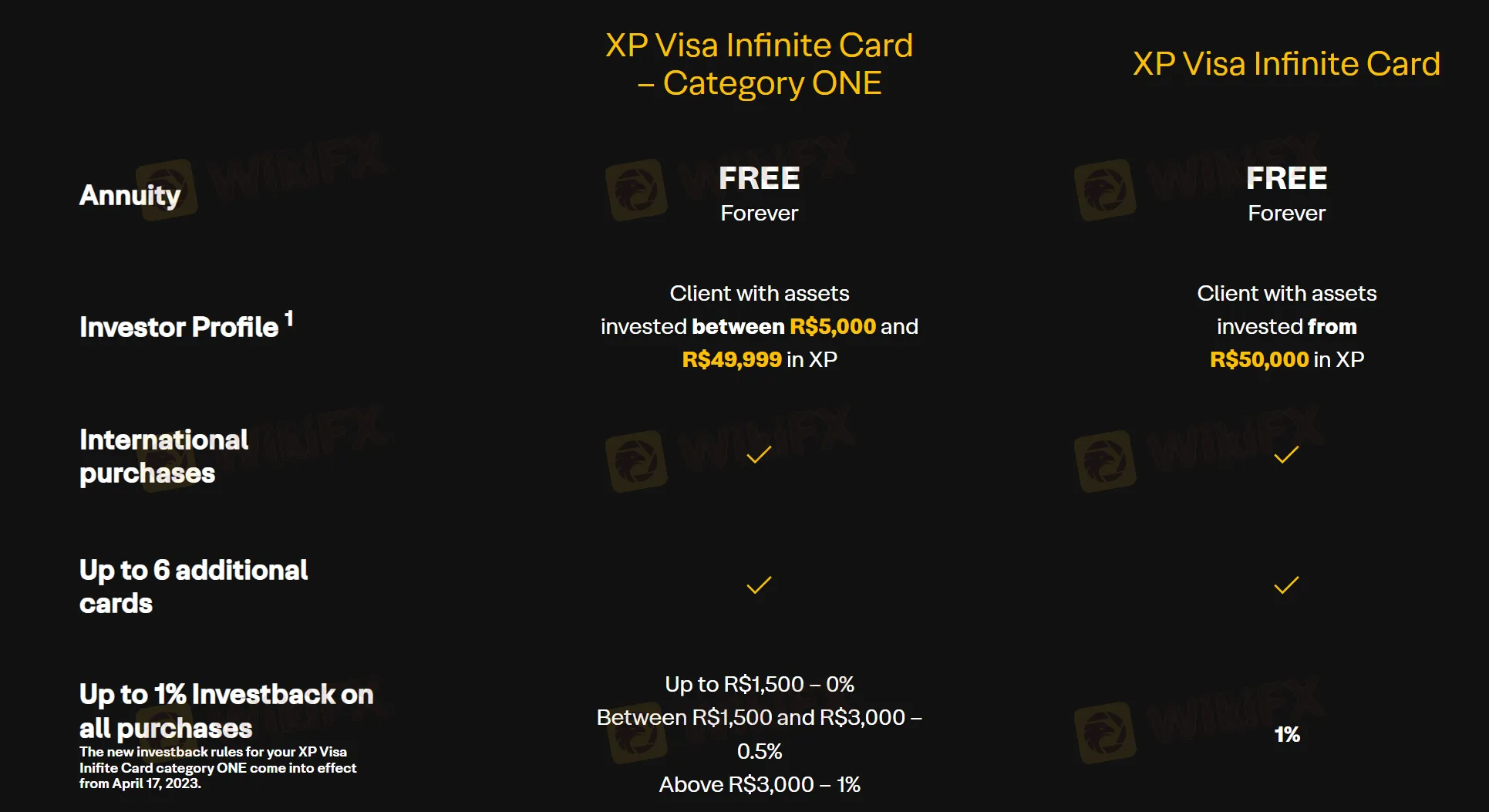

XP Investimentos Gebühren

Die XP Visa Infinite Card - Kategorie Eins und die XP Visa Infinite Card bieten beide kostenlose Jahresgebühren, und Kunden können auf alle Einkäufe einen Investitionsrabatt von bis zu 1% erhalten. Für die XP Visa Infinite Card - Kategorie Eins gelten folgende Investitionsrabattraten: 0% für Einkäufe unter R$1.500; 0,5% für Einkäufe zwischen R$1.500 und R$3.000; 1% für Einkäufe über R$3.000.

Handelsplattform

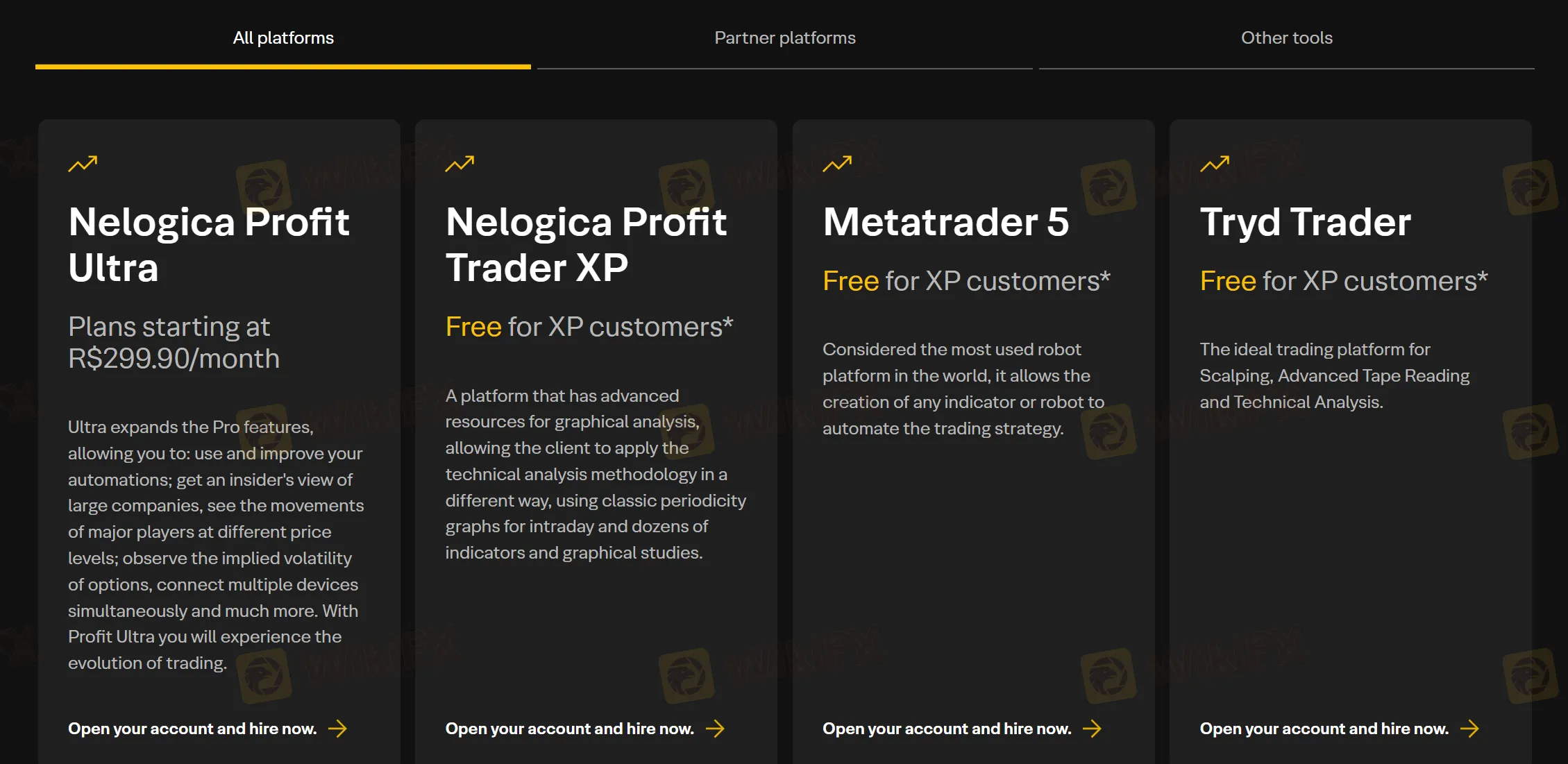

XP Investimentos bietet Nelogica Profit Ultra ab einer monatlichen Gebühr von R$299,90 an, sowie die weltweit weit verbreiteten Handelsplattformen Metatrader 5, Tryd Trader und Nelogica Profit Trader XP.

| Handelsplattform | Unterstützt |

| Nelogica Profit Ultra | ✔ |

| Metatrader 5 | ✔ |

| Tryd Trader | ✔ |

| Nelogica Profit Trader XP | ✔ |