Perfil de la compañía

| XP Investimentos Resumen de la revisión | |

| Registrado en | 5-10 años |

| País/Región de registro | Brasil |

| Regulación | No regulado |

| Productos y Servicios | Productos de renta fija, Futuros, Acciones, Fondos de inversión, Fondos inmobiliarios (FIIs), COE, IPO, Planes de pensiones privados y Seguros de vida |

| Cuenta Demo | ✅ |

| Apalancamiento | / |

| Spread | / |

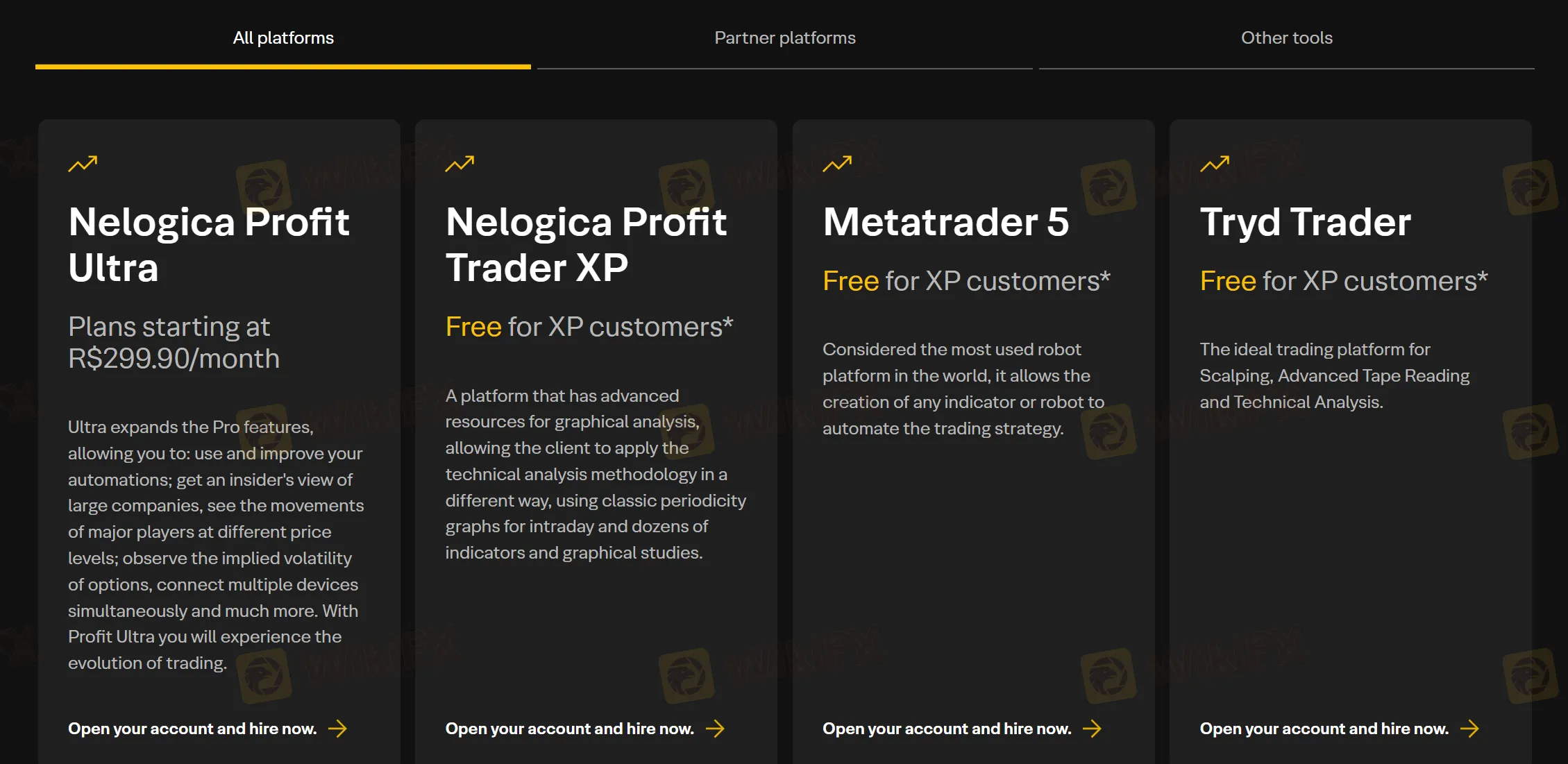

| Plataforma de Trading | Nelogica Profit Ultra, Metatrader 5, Tryd Trader y Nelogica Profit Trader XP |

| Depósito Mínimo | / |

| Soporte al Cliente | WhatsApp: +55 11 4935-2720 |

| 0800-772-02020800-000-0078 | |

| oficios@xpi.com.br (Defensor del Cliente) | |

Información sobre XP Investimentos

XP Investimentos es una plataforma integral de servicios financieros que no solo ofrece una amplia gama de productos y servicios de inversión, sino que también brinda experiencias de inversión convenientes y eficientes para clientes individuales y corporativos. En cuanto a productos, abarca diversas clases de activos, desde inversiones tradicionales en acciones y bonos hasta futuros emergentes y fondos de inversión. En cuanto a servicios, ha lanzado servicios de cuenta digital para clientes corporativos.

Pros y Contras

| Pros | Contras |

| Múltiples productos y servicios | No regulado |

| Bajo umbral para XP Empresas | Tarifas internacionales de adquisición (0.5% - 1%) |

| Tarjeta XP Visa Infinite con exención permanente de tarifa anual | |

| Disponible MT5 |

¿Es XP Investimentos Legítimo?

XP Investimentos ha operado en el mercado financiero durante muchos años, pero no está regulado. Siempre se aconseja a los traders que elijan firmas de inversión con licencias financieras formales y regulación.

¿Qué Productos y Servicios Ofrece XP Investimentos?

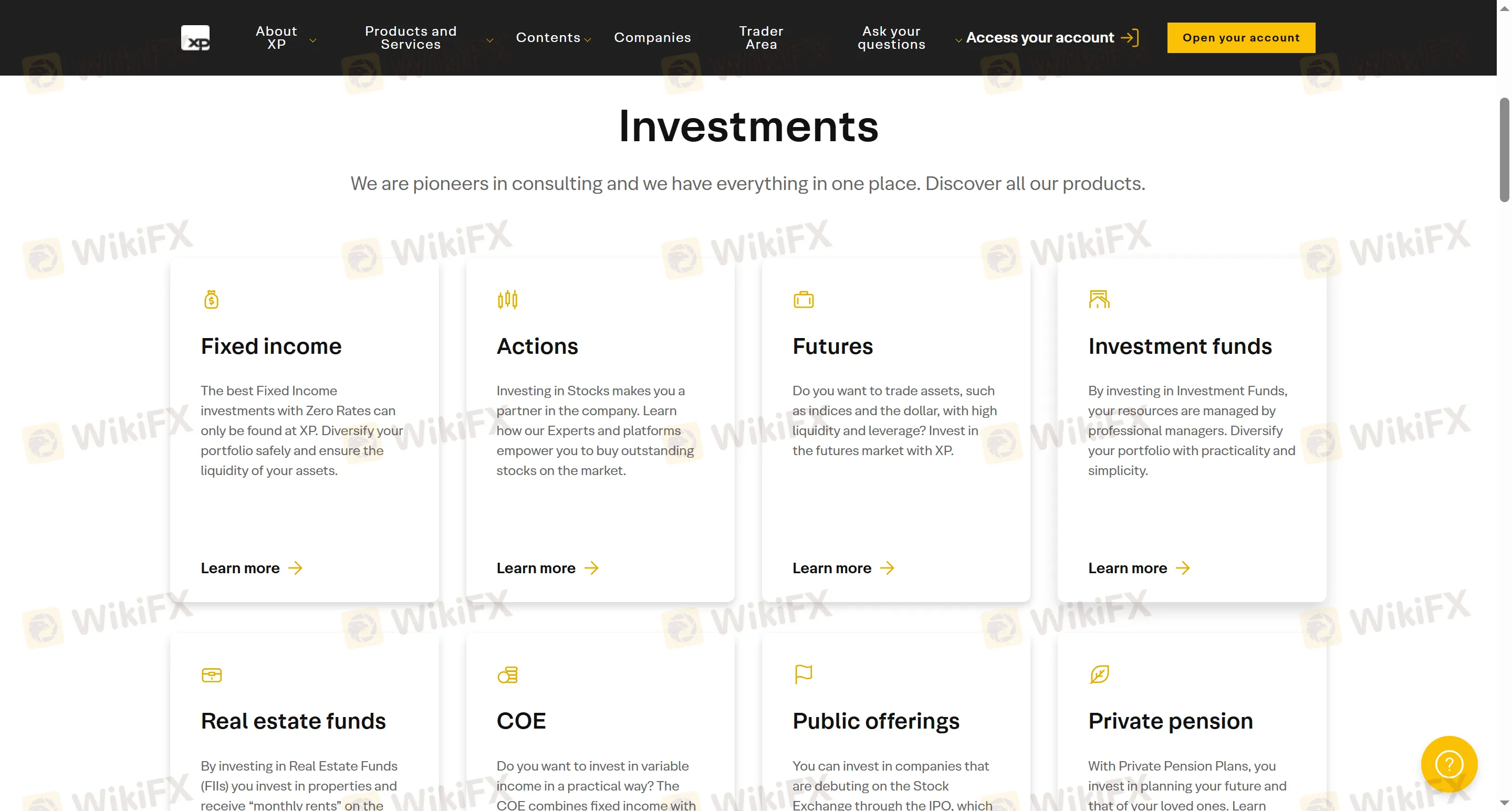

En XP Investimentos, puedes comerciar con múltiples tipos de activos y servicios, incluyendo productos de renta fija, acciones, futuros, fondos de inversión, fondos inmobiliarios (FIIs) y otros productos de inversión como COE (combinando renta fija e renta variable), acciones de oferta pública (IPO), planes de pensiones privados, seguros de vida, etc.

| Productos y Servicios | Soportado |

| Productos de renta fija | ✔ |

| Futuros | ✔ |

| Acciones | ✔ |

| Fondos de inversión | ✔ |

| Fondos inmobiliarios (FIIs) | ✔ |

| COE | ✔ |

| IPO | ✔ |

| Planes de pensiones privados | ✔ |

| Seguros de vida | ✔ |

Tipo de Cuenta

A través de cuentas de inversión en XP Investimentos, los traders pueden invertir en aplicaciones de renta fija y renta variable. Con cuentas digitales, los usuarios pueden manejar transacciones diarias como pagar facturas, enviar y recibir transferencias PIX y TED, y recibir salarios.

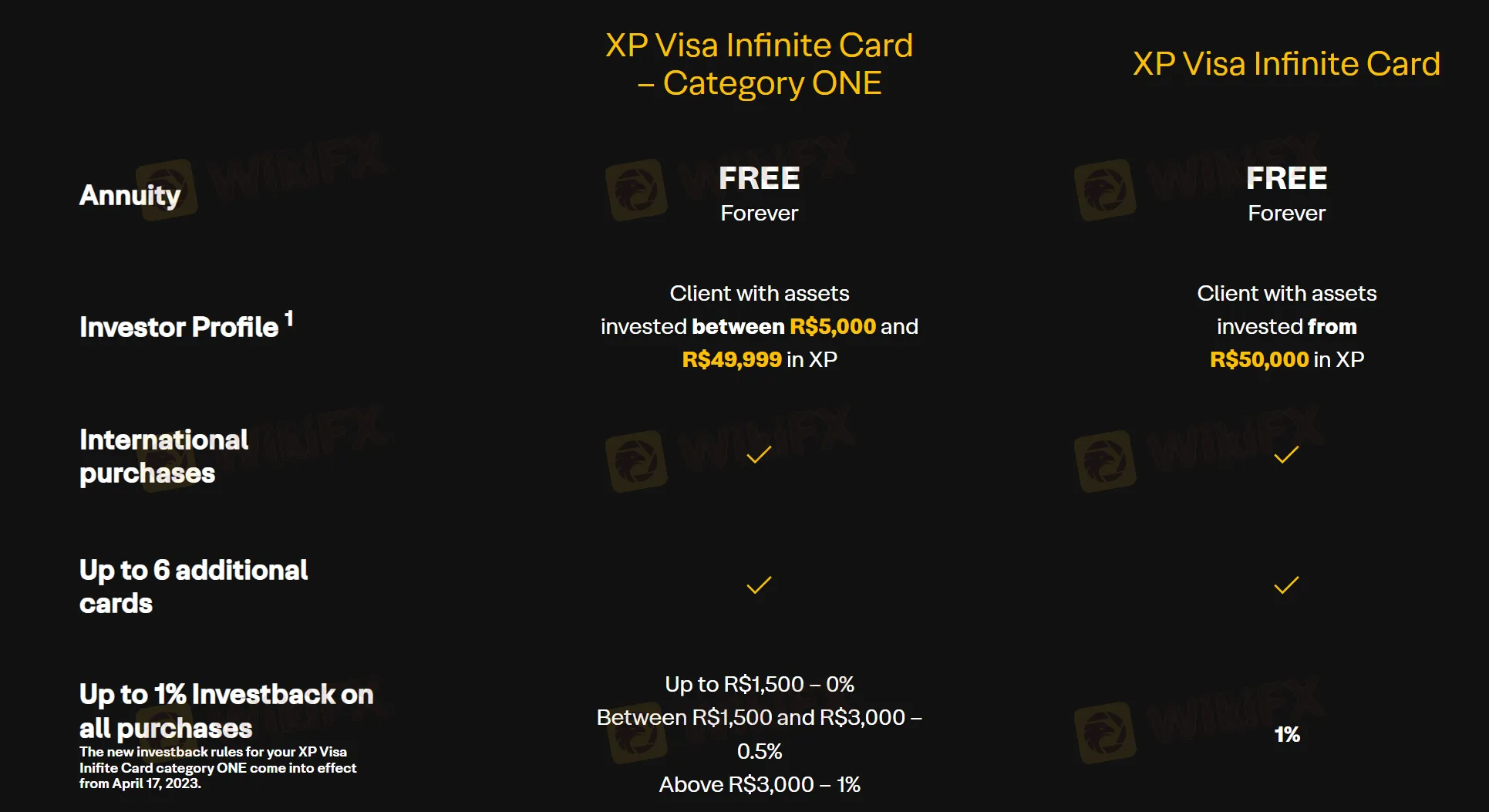

Tarifas de XP Investimentos

La Tarjeta XP Visa Infinite - Categoría Uno y la Tarjeta XP Visa Infinite ofrecen ambas tarifas anuales gratuitas, y los clientes pueden recibir un reembolso de inversión de hasta el 1% en todas las compras. Para la Tarjeta XP Visa Infinite - Categoría Uno, las tasas de reembolso de inversión son las siguientes: 0% para compras inferiores a R$1,500; 0.5% para compras entre R$1,500 y R$3,000; 1% para compras superiores a R$3,000.

Plataforma de Trading

XP Investimentos ofrece Nelogica Profit Ultra a partir de una tarifa mensual de R$299.90, así como las plataformas de trading ampliamente utilizadas a nivel mundial Metatrader 5, Tryd Trader y Nelogica Profit Trader XP.

| Plataforma de Trading | Soportado |

| Nelogica Profit Ultra | ✔ |

| Metatrader 5 | ✔ |

| Tryd Trader | ✔ |

| Nelogica Profit Trader XP | ✔ |