Sanford

1-2年

Could you break down the total trading costs involved when trading indices such as the US100 on RGL?

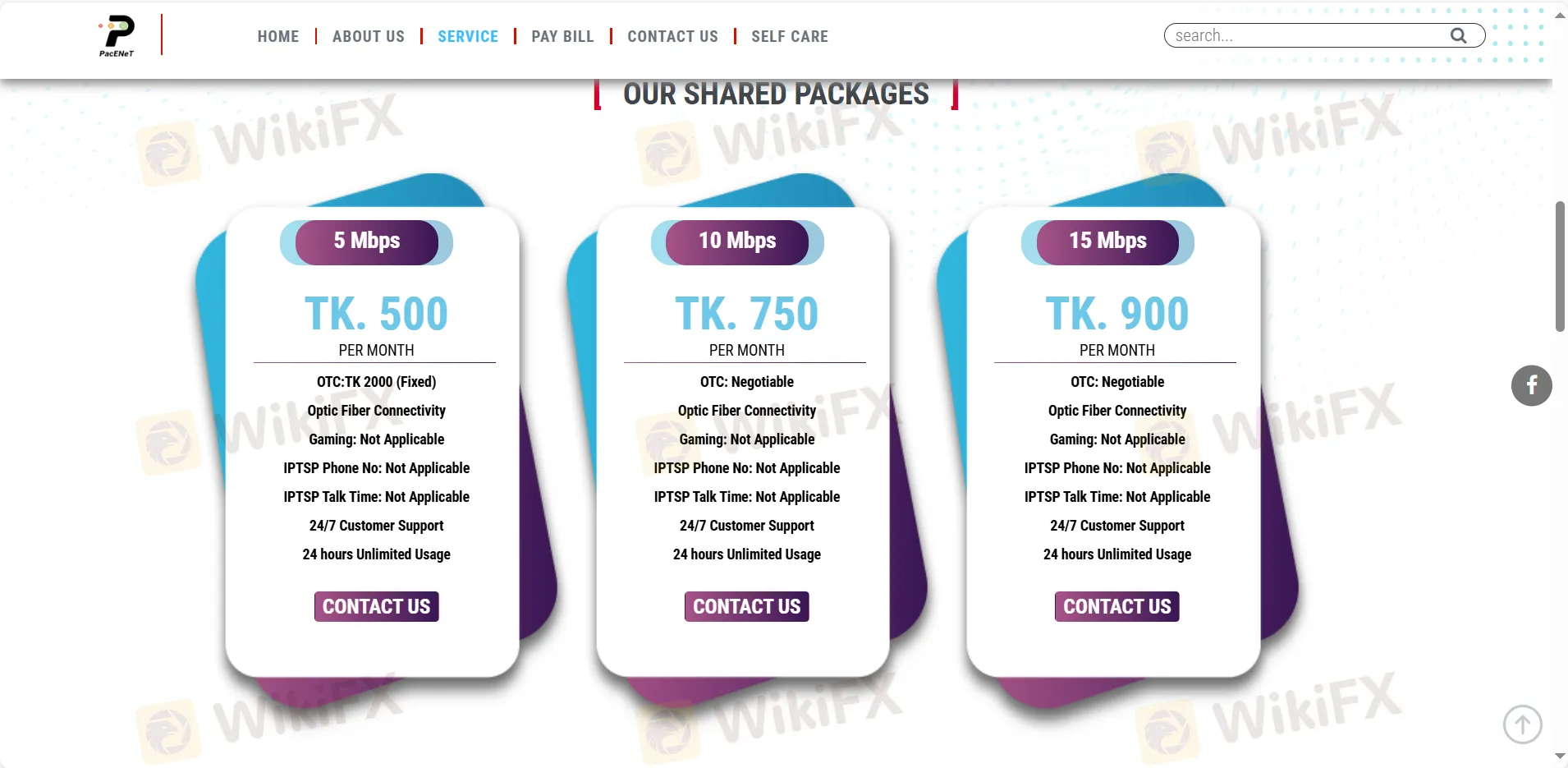

As someone with years of experience trading forex and indices, I approach every new broker with a careful, methodical eye—especially when considering total trading costs, which are critical to long-term profitability. When evaluating RGL for trading indices like the US100, I immediately noticed several red flags that impact any cost assessment. Most importantly, RGL lacks any valid regulatory status and is flagged with high potential risk due to a suspicious scope of business. For me, this lack of regulation means that any published cost structure could be unreliable or subject to sudden changes, without client protection or regulatory recourse.

Digging into the details, I found no transparent breakdown of trading costs for indices such as the US100 on RGL's materials. Unlike established, regulated brokers, RGL does not disclose spreads, commissions, or swap/overnight fees associated with index trading. Without this vital information, it's impossible for a prudent trader to accurately estimate the total transaction costs beforehand. I also noticed that RGL primarily operates as an Internet Service Provider and lists a range of IT services; there is no evidence of a professional trading platform or clear fee policy for financial instrument trading.

Because costs in trading (like spreads and commissions) can significantly affect returns, the absence of clarity or regulatory oversight means I cannot recommend, or even confidently evaluate, the total trading expenses at RGL for an instrument like US100. From my perspective, unless fee transparency and regulatory assurances are established, the risks—including unknown or hidden costs—far outweigh any potential benefits. I would proceed with the utmost caution and advise others to seek out licensed, reputable brokers for index trading.

Broker Issues

Fees and Spreads

Yousef47

1-2年

What is the highest leverage RGL allows for major forex pairs, and how does this leverage differ for other types of assets?

Based on my thorough experience and analysis, I cannot provide a clear answer regarding the highest leverage RGL offers for major forex pairs, as there is a lack of transparent information about its trading conditions, including leverage specifics. From the details available, RGL primarily operates as an unregulated internet service and IT solutions provider rather than a dedicated forex broker. This is a critical point for me because regulation is vital for client protection, especially when considering something as potentially risky as leveraged trading.

I have not found any disclosure of leverage ratios on major forex pairs or for other asset types within RGL’s available resources. This absence of leverage details is concerning for me as a trader, since knowing these parameters is fundamental to managing risk and position sizing. Additionally, without regulation, any stated leverage (had it even been available) would come with significant counterparty risk and less recourse in the event of disputes.

Personally, I would exercise extreme caution with any broker that does not prominently or transparently define its leverage offering—especially for something as standard as major forex pairs. For my own trading, I always prioritize brokers who are open about their leverage structures and who operate under reliable regulatory oversight, ensuring I have appropriate risk control mechanisms in place at all times.

Broker Issues

Leverage

Platform

Account

Instruments

Davis Wu

1-2年

Which types of payment options are available for making deposits and withdrawals with RGL, such as credit cards, PayPal, Skrill, or cryptocurrencies?

In my research and experience as a cautious forex trader, I always prioritize understanding deposit and withdrawal methods, especially when dealing with high-risk or unregulated firms. For RGL, I've noticed that their payment options are fairly traditional. Specifically, they accept payments through MasterCard, Visa, and UnionPay. In addition, they support local mobile transactions via the bKash app, which is popular in Bangladesh. However, I haven’t seen any evidence of support for PayPal, Skrill, or cryptocurrencies.

The lack of mention of popular e-wallets like Skrill or PayPal, and the absence of crypto options, is a limitation for traders who value flexible, borderless transactions. While credit and debit cards do cover standard needs, I urge anyone considering RGL to exercise caution given the absence of regulation and the high potential risk rating highlighted in my research. Without a robust regulatory framework, even basic payment channels might not offer the recourse or reliability I'd demand before making a deposit.

In summary, RGL offers MasterCard, Visa, UnionPay, and bKash for transactions. For me, the lack of regulatory oversight heavily outweighs the convenience of these options, and I recommend extreme caution when evaluating funding any trading activities here.

Broker Issues

Deposit

Withdrawal

Five8

1-2年

How do RGL's swap fees or overnight financing charges stack up against those of other brokers?

Based on my careful assessment of RGL and their publicly available information, I could not find any concrete details regarding their swap fees or overnight financing charges. As an independent trader, understanding these costs is absolutely essential when evaluating a broker, since they can significantly impact the net profitability of holding positions overnight in the forex market. From my experience, regulated and transparent brokers usually make such fee structures clearly available, allowing traders to compare them with industry norms.

However, RGL currently operates without any valid regulatory oversight and there’s a notable lack of detailed information about their trading conditions. In my opinion, this significant lack of transparency presents a real concern. I am particularly cautious with brokers who do not openly disclose essential trading costs, as this can lead to unexpected charges and erodes trust. Personally, I prefer to trade with brokers who are clear about all costs—including swap fees—so I can accurately factor them into my strategies.

Given RGL’s absence of regulatory status and the absence of explicit disclosure regarding overnight financing, I would exercise considerable caution. Without verifiable information, it is impossible for me to properly compare their swap fees against other, more established and transparent brokers. For my own trading, I consider access to full fee information a non-negotiable prerequisite for trust and risk management.

Broker Issues

Fees and Spreads