Perfil de la compañía

| RGL Resumen de la revisión | |

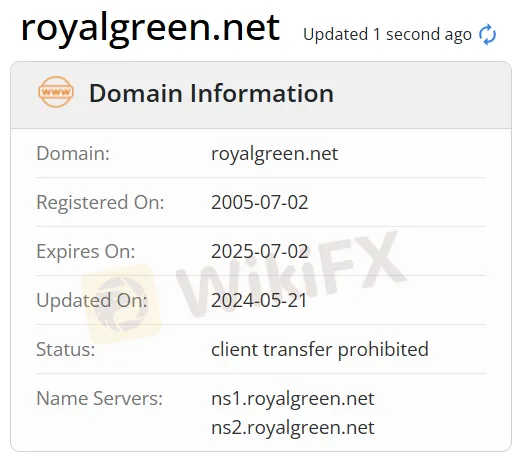

| Establecido | 2005 |

| País/Región Registrada | Bangladesh |

| Regulación | Sin regulación |

| Servicios | Nube Privada, Nube Pública, Servidor Virtual Privado, IaaS, PaaS, SaaS, Firewall como Servicio, Router como Servicio, Protección DDoS como Servicio (Solución F5), Backup como Servicio, DR como Servicio, LB como Servicio, Elástico, Cómputo como Servicio, Servidor Dedicado como Servicio, Seguridad de Datos- Integrada, Encriptación de Datos, Contenedores como Servicio, WAF como Servicio- WAP (Solución F5), Conectividad a Internet Dedicada, Conectividad de Datos a Nivel Nacional, Soluciones de IP Telefónica y IPPBX, Servicios de TI Administrados, Servicios y Soluciones en la Nube, Registro de Dominios y Alojamiento Web, Servicios y Soluciones de Correo, Soluciones de Software |

| Plataforma de Trading | bKash |

| Soporte al Cliente | Soporte 24/7, formulario de contacto |

| Tel: +880 9603-111999; +88-09603-777777 | |

| Email: sales@royalgreen.net; support@pacecloud.com | |

| Dirección: Royal Green Ltd, 114 Motijheel C/A, Nivel-9,11,12,17,18 Dhaka-1000 | |

| Redes sociales: Facebook, X, YouTube, LinkedIn | |

Información de RGL

RGL es un Proveedor de Servicios de Internet no regulado, fundado en Bangladesh en 2005. Ofrece productos y servicios de Nube Privada, Nube Pública, Servidor Virtual Privado, Infraestructura como Servicio (IaaS), Plataforma como Servicio (PaaS), Software como Servicio (SaaS), Firewall como Servicio, Router como Servicio, Protección DDoS como Servicio (Solución F5), Backup como Servicio, DR como Servicio, LB como Servicio, Elástico, Cómputo como Servicio, Servidor Dedicado como Servicio, Seguridad de Datos- Integrada, Encriptación de Datos, Contenedores como Servicio, WAF como Servicio- WAP (Solución F5), Conectividad a Internet Dedicada, Conectividad de Datos a Nivel Nacional, Soluciones de IP Telefónica y IPPBX, Servicios de TI Administrados, Servicios y Soluciones en la Nube, Registro de Dominios y Alojamiento Web, Servicios y Soluciones de Correo, Soluciones de Software.

Pros y Contras

| Pros | Contras |

| Tiempo de operación prolongado | Sitio web inaccesible (parcial) |

| Varios canales de contacto | Falta de regulación |

| Varios servicios | Falta de transparencia |

| Opciones de pago diversas | Cargos aplicados |

¿Es RGL Legítimo?

No. RGL actualmente no tiene regulaciones válidas. ¡Por favor, tenga en cuenta el riesgo!

Servicios de RGL

| Servicios | Soportado |

| Nube Privada, Pública | ✔ |

| Servidor Virtual Privado | ✔ |

| Infraestructura como Servicio (IaaS) | ✔ |

| Plataforma como Servicio (PaaS) | ✔ |

| Software como Servicio (SaaS) | ✔ |

| Firewall como Servicio | ✔ |

| Router como Servicio | ✔ |

| Protección contra DDoS como Servicio (Solución F5) | ✔ |

| Backup como Servicio | ✔ |

| DR como Servicio | ✔ |

| LB como Servicio | ✔ |

| Elástico | ✔ |

| Cómputo como Servicio | ✔ |

| Servidor Dedicado como Servicio | ✔ |

| Seguridad de Datos- Integrada | ✔ |

| Cifrado de Datos | ✔ |

| Contenedores como Servicio | ✔ |

| WAF como Servicio- WAP (Solución F5) | ✔ |

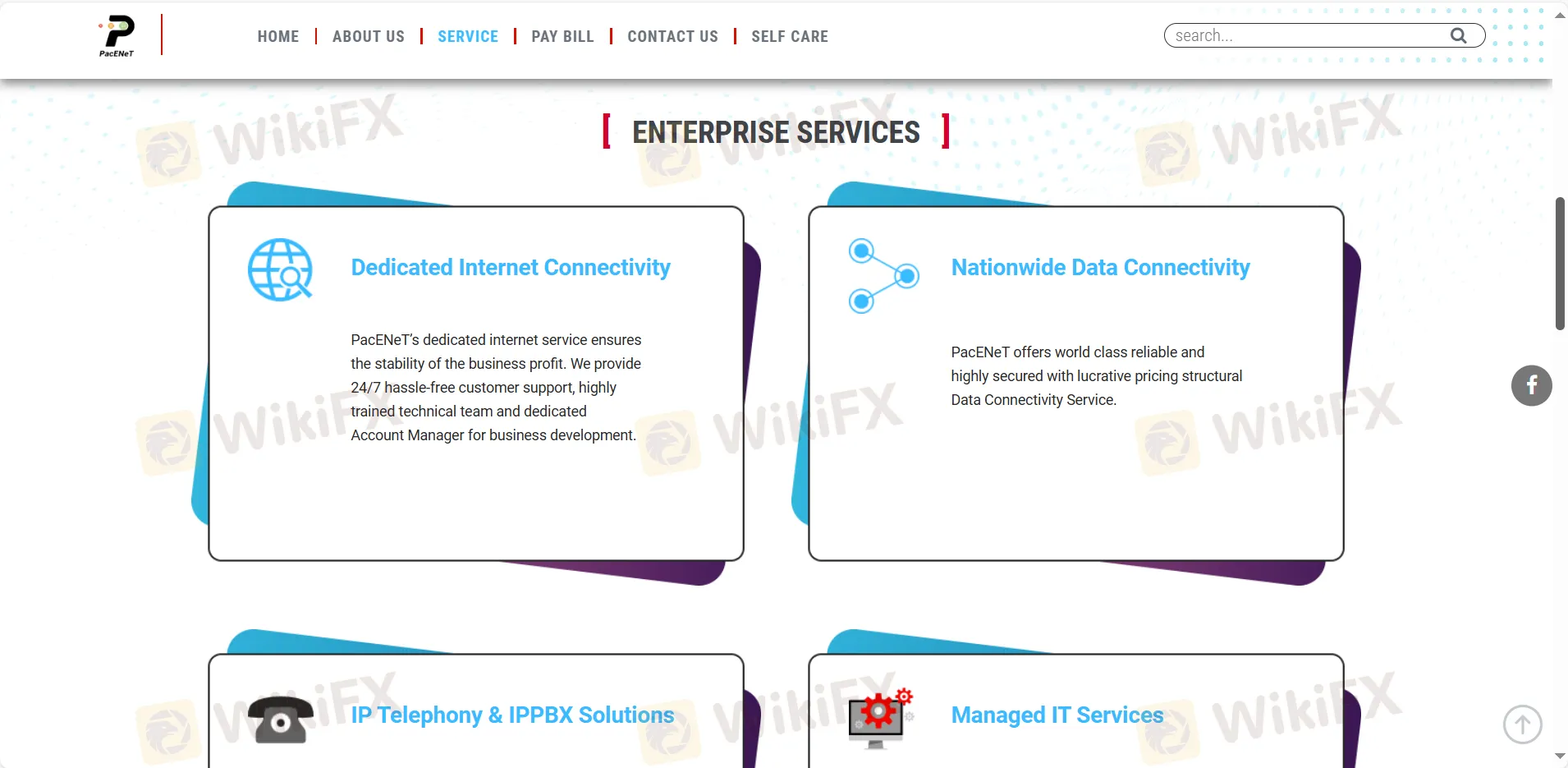

| Conectividad a Internet Dedicada | ✔ |

| Conectividad de Datos a Nivel Nacional | ✔ |

| Telefonía IP y Soluciones IPPBX | ✔ |

| Servicios de TI Administrados | ✔ |

| Servicios y Soluciones en la Nube | ✔ |

| Registro de Dominio y Alojamiento Web | ✔ |

| Servicios y Soluciones de Correo | ✔ |

| Soluciones de Software | ✔ |

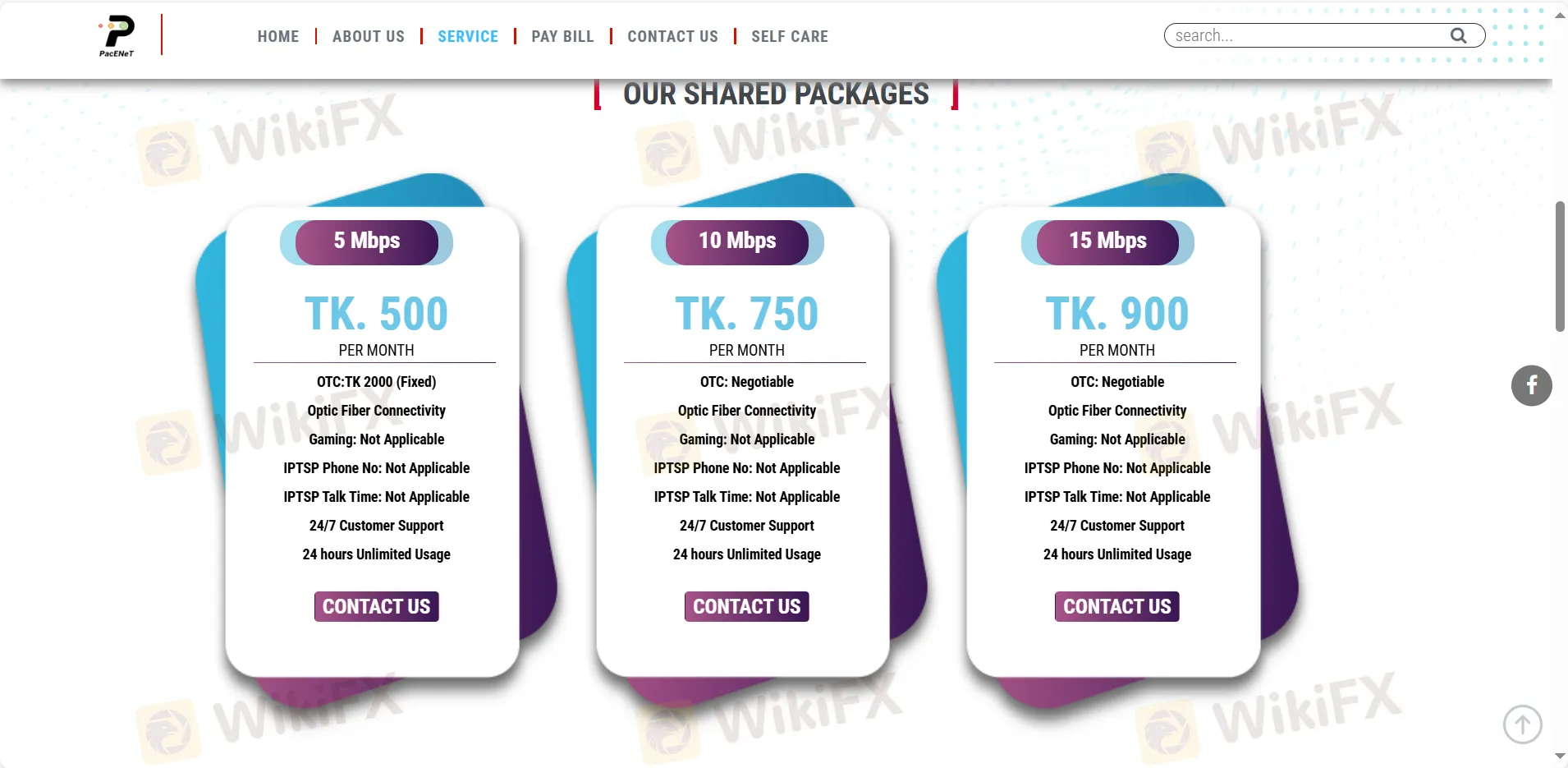

Tarifas de RGL

| Tipo | Tarifas |

| 5 Mbps | TK. 500 por mes |

| 10 Mbps | TK. 750 por mes |

| 15 Mbps | TK. 900 por mes |

| 20 Mbps | TK. 1050 por mes |

| 30 Mbps | TK. 1550 por mes |

| 40 Mbps | TK. 1950 por mes |

| 50 Mbps | TK. 2450 por mes |

| 75 Mbps | TK. 3400 por mes |

| 100 Mbps | TK. 4500 por mes |

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles |

| Aplicación bKash | ✔ | Móvil |

Depósito y Retiro

El proveedor de servicios de Internet acepta pagos realizados a través de Master, Visa, UnionPay y otros métodos. No se ha definido un monto mínimo de retiro y no se especifican tarifas ni cargos.