Unternehmensprofil

| RGL Überprüfungszusammenfassung | |

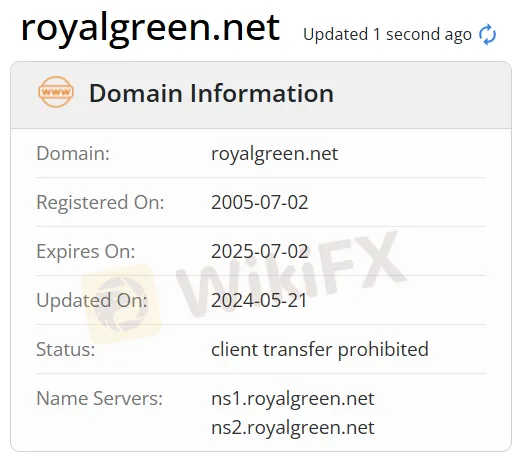

| Gegründet | 2005 |

| Registriertes Land/Region | Bangladesch |

| Regulierung | Keine Regulierung |

| Dienstleistungen | Private, Public Cloud, Virtual Private Server, IaaS, PaaS, SaaS, Firewall as a Service, Router as a Service, DDoS Protection as a Service (F5 Solution), Backup as a Service, DR as a Service, LB as a Service, Elastic, Compute as a Service, Bare Metal as a Service, Data Security- Embedded, Data Encryption, Containers-as-a-Service, WAF as a Service- WAP (F5 Solution), Dedicated Internet Connectivity, Nationwide Data Connectivity, IP Telephony & IPPBX Solutions, Managed IT Services, Cloud Services & Solutions, Domain Registration & Web Hosting, Mail Service & Solutions, Software Solutions |

| Handelsplattform | bKash |

| Kundenbetreuung | 24/7 Support, Kontaktformular |

| Tel: +880 9603-111999; +88-09603-777777 | |

| E-Mail: sales@royalgreen.net; support@pacecloud.com | |

| Adresse: Royal Green Ltd, 114 Motijheel C/A, Level-9,11,12,17,18 Dhaka-1000 | |

| Soziale Medien: Facebook, X, YouTube, LinkedIn | |

RGL Informationen

RGL ist ein unregulierter Internetdienstanbieter, der 2005 in Bangladesch gegründet wurde. Er bietet Produkte und Dienstleistungen für Private, Public Cloud, Virtual Private Server, Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Firewall as a Service, Router as a Service, DDoS Protection as a Service (F5 Solution), Backup as a Service, DR as a Service, LB as a Service, Elastic, Compute as a Service, Bare Metal as a Service, Data Security- Embedded, Data Encryption, Containers-as-a-Service, WAF as a Service- WAP (F5 Solution), Dedicated Internet Connectivity, Nationwide Data Connectivity, IP Telephony & IPPBX Solutions, Managed IT Services, Cloud Services & Solutions, Domain Registration & Web Hosting, Mail Service & Solutions, Software Solutions.

Vor- und Nachteile

| Vorteile | Nachteile |

| Lange Betriebszeit | Nicht erreichbare Website (teilweise) |

| Verschiedene Kontaktmöglichkeiten | Fehlende Regulierung |

| Verschiedene Dienstleistungen | Fehlende Transparenz |

| Vielfältige Zahlungsoptionen | Gebühren werden erhoben |

Ist RGL legitim?

Nr. RGL hat derzeit keine gültigen Vorschriften. Bitte beachten Sie das Risiko!

RGL Dienstleistungen

| Dienstleistungen | Unterstützt |

| Private, Public Cloud | ✔ |

| Virtual Private Server | ✔ |

| Infrastruktur als Dienstleistung (IaaS) | ✔ |

| Plattform als Dienstleistung (PaaS) | ✔ |

| Software als Dienstleistung (SaaS) | ✔ |

| Firewall als Dienstleistung | ✔ |

| Router als Dienstleistung | ✔ |

| DDoS-Schutz als Dienstleistung (F5-Lösung) | ✔ |

| Backup als Dienstleistung | ✔ |

| DR als Dienstleistung | ✔ |

| LB als Dienstleistung | ✔ |

| Elastisch | ✔ |

| Bereitstellung als Dienstleistung | ✔ |

| Bare Metal als Dienstleistung | ✔ |

| Datensicherheit-Embedded | ✔ |

| Datenverschlüsselung | ✔ |

| Container als Dienstleistung | ✔ |

| WAF als Dienstleistung- WAP (F5-Lösung) | ✔ |

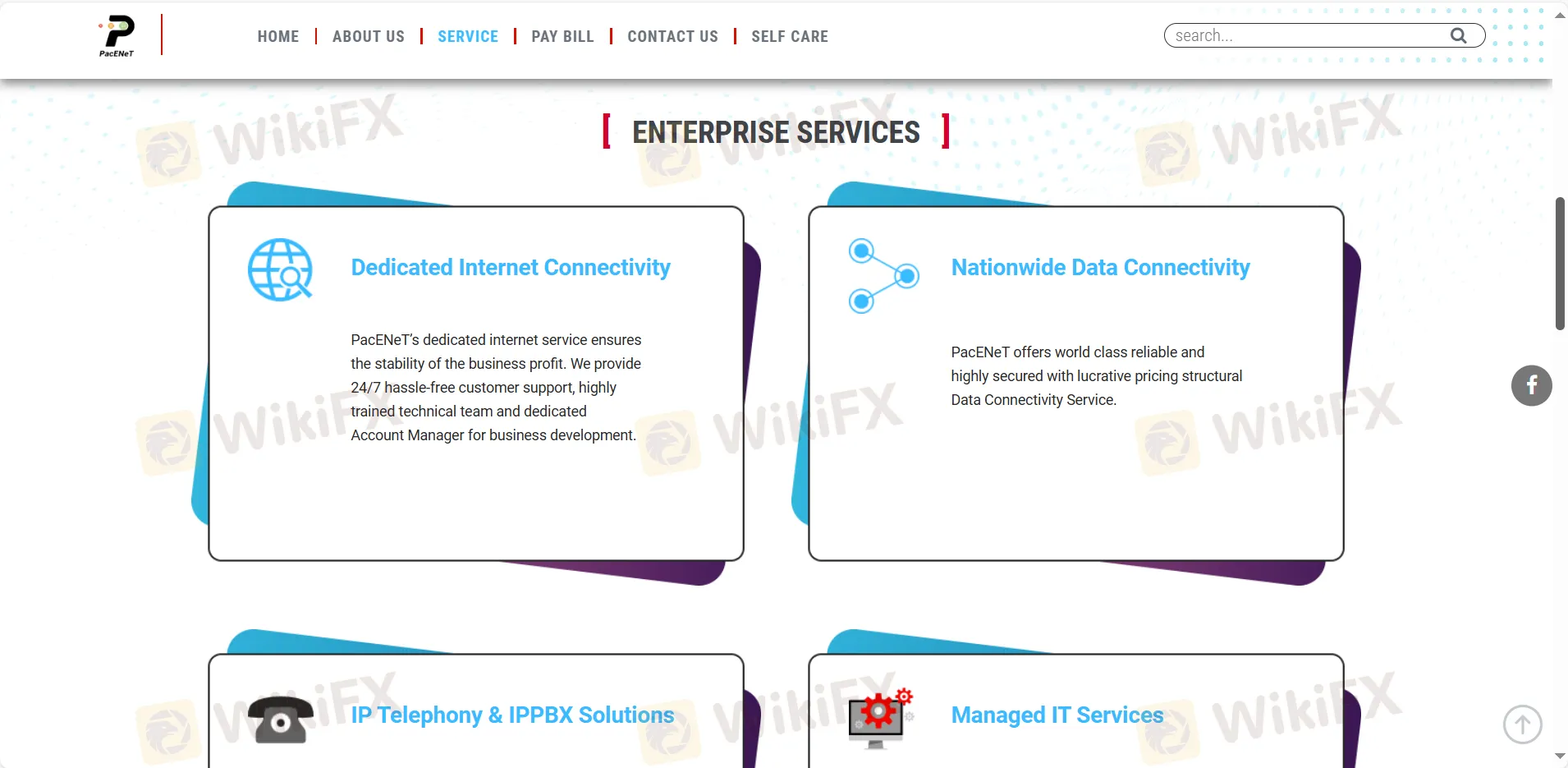

| Dedizierte Internetverbindung | ✔ |

| Nationale Datenverbindung | ✔ |

| IP-Telefonie & IPPBX-Lösungen | ✔ |

| Verwaltete IT-Dienstleistungen | ✔ |

| Cloud-Services & Lösungen | ✔ |

| Domainregistrierung & Webhosting | ✔ |

| Mail-Service & Lösungen | ✔ |

| Softwarelösungen | ✔ |

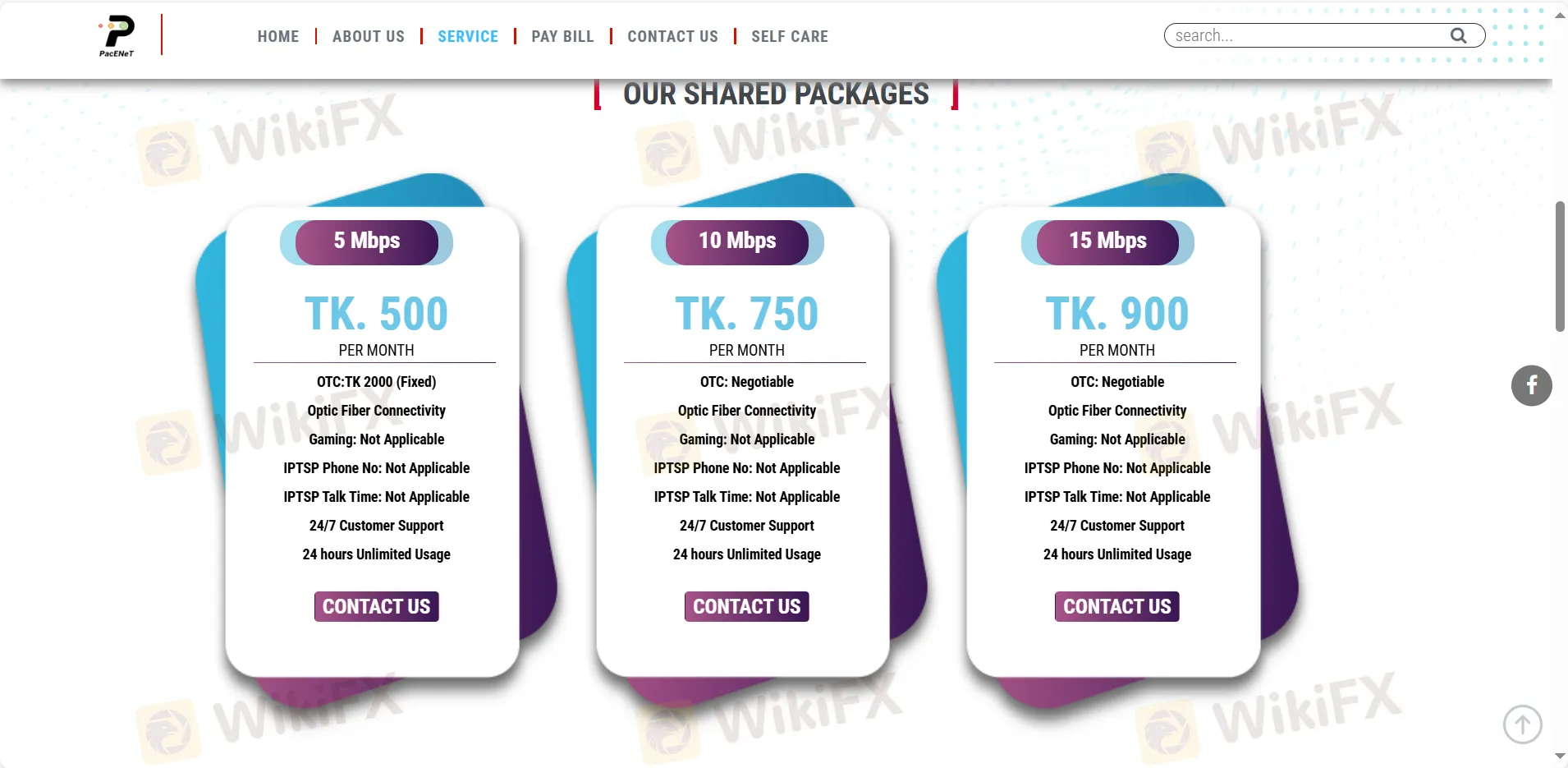

RGL Gebühren

| Typ | Gebühren |

| 5 Mbps | TK. 500 pro Monat |

| 10 Mbps | TK. 750 pro Monat |

| 15 Mbps | TK. 900 pro Monat |

| 20 Mbps | TK. 1050 pro Monat |

| 30 Mbps | TK. 1550 pro Monat |

| 40 Mbps | TK. 1950 pro Monat |

| 50 Mbps | TK. 2450 pro Monat |

| 75 Mbps | TK. 3400 pro Monat |

| 100 Mbps | TK. 4500 pro Monat |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte |

| bKash-App | ✔ | Mobil |

Ein- und Auszahlung

Der Internetdienstanbieter akzeptiert Zahlungen per Master, Visa, UnionPay und so weiter. Es ist kein Mindestauszahlungsbetrag festgelegt und es sind keine Gebühren oder Kosten angegeben.