Présentation de l'entreprise

| SHENGDA FUTURES Résumé de l'examen | |

| Fondé | 2010 |

| Pays/Région enregistré | Chine |

| Régulation | CFFEX |

| Instrument de marché | Futures |

| Compte de démonstration | ✅ |

| Plateforme de trading | Shengda Futures CTP Express Client v2, Shengda Futures CTP Express Client v3, Shengda Futures CTP Infinite Easy Production System, Pyramid Decision Trading System (CTP), etc. |

| Support client | |

| Tél : 400-826-3131 | |

| Email : sdqh@sdfutures.com.cn | |

| Code postal : 311201 | |

| Fax : 0571-28289393 | |

| Adresse : Salle 2201, Unité 2, et Salle 801, Unité 1, Centre Guojin, N° 259, Route Pinglan, Rue Ningwei, District de Xiaoshan, Hangzhou, Zhejiang | |

Informations sur SHENGDA FUTURES

SHENGDA FUTURES est un fournisseur de services réglementé de premier plan en courtage et services financiers, fondé en Chine en 2010. Il propose des produits et services pour l'or, l'argent et le platine, les contrats à terme sur l'indice des prix des actions (SPIF), le caoutchouc naturel (RU), le fioul (FU), le polyéthylène basse densité linéaire LLDPE (L), le chlorure de polyvinyle PVC (V), le coke (J), l'acide téréphtalique purifié PTA (TA), le méthanol (MA), etc.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Comptes de démonstration | Frais divers facturés |

| Temps d'opération long | |

| Divers canaux de contact | |

| Bien réglementé | |

| Multiples plateformes de trading |

SHENGDA FUTURES est-il légitime ?

Oui. SHENGDA FUTURES est agréé par la China Financial Futures Exchange (CFFEX) pour offrir des services. Son numéro de licence est 0256. La CFFEX, créée avec l'approbation du Conseil d'État de la République populaire de Chine et de la Commission de régulation des valeurs mobilières de Chine (CSRC), est une bourse incorporée spécialisée dans la fourniture de services de trading et de compensation pour les contrats à terme financiers, les options et autres dérivés.

| Pays Réglementé | Régulateur | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| China Financial Futures Exchange (CFFEX) | Réglementé | 盛达期货有限公司 | Licence de Contrats à Terme | 0256 |

Que Puis-je Trader sur SHENGDA FUTURES?

| Instruments de Trading | Pris en Charge |

| Contrats à Terme | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptos | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

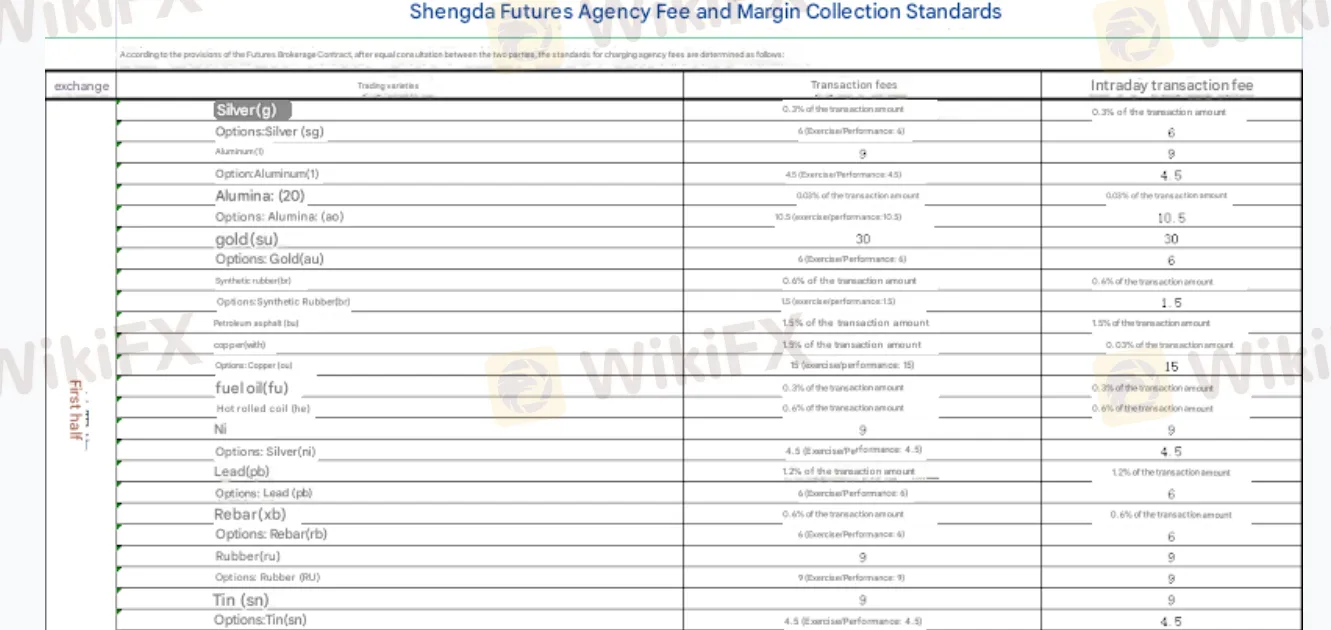

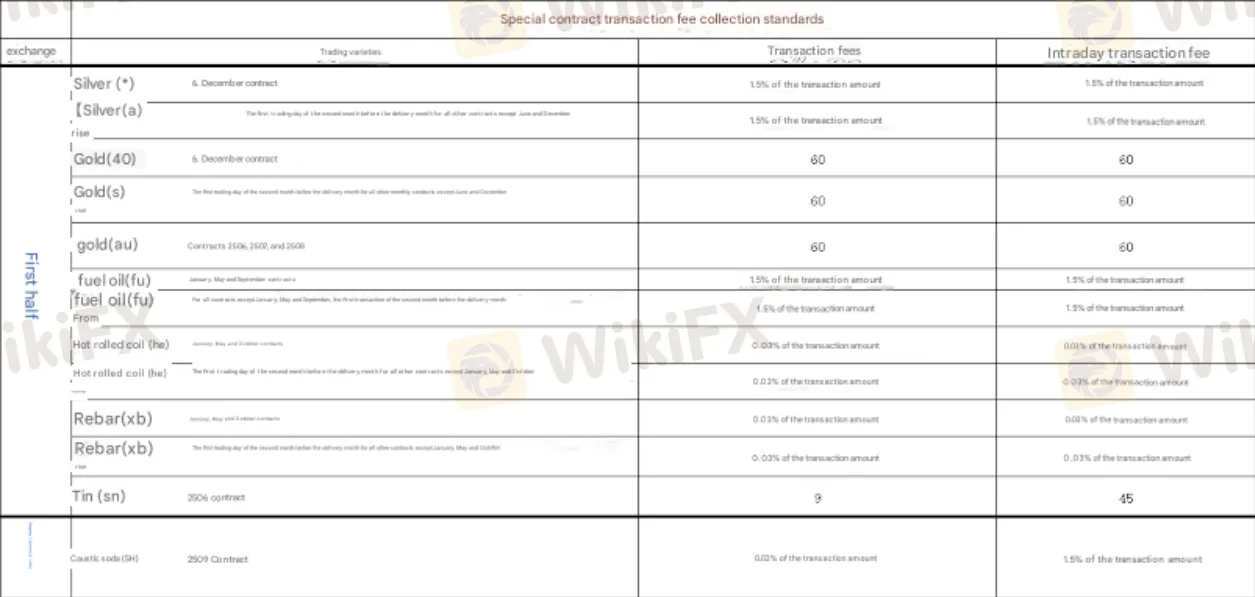

Frais SHENGDA FUTURES

Les commissions facturées par différentes succursales pour différents produits de base et différentes formes de contrat sont différentes, veuillez visiter le site officiel pour plus de détails (l'image est traduite par Google, pas très claire, veuillez visiter le site officiel pour plus de détails).

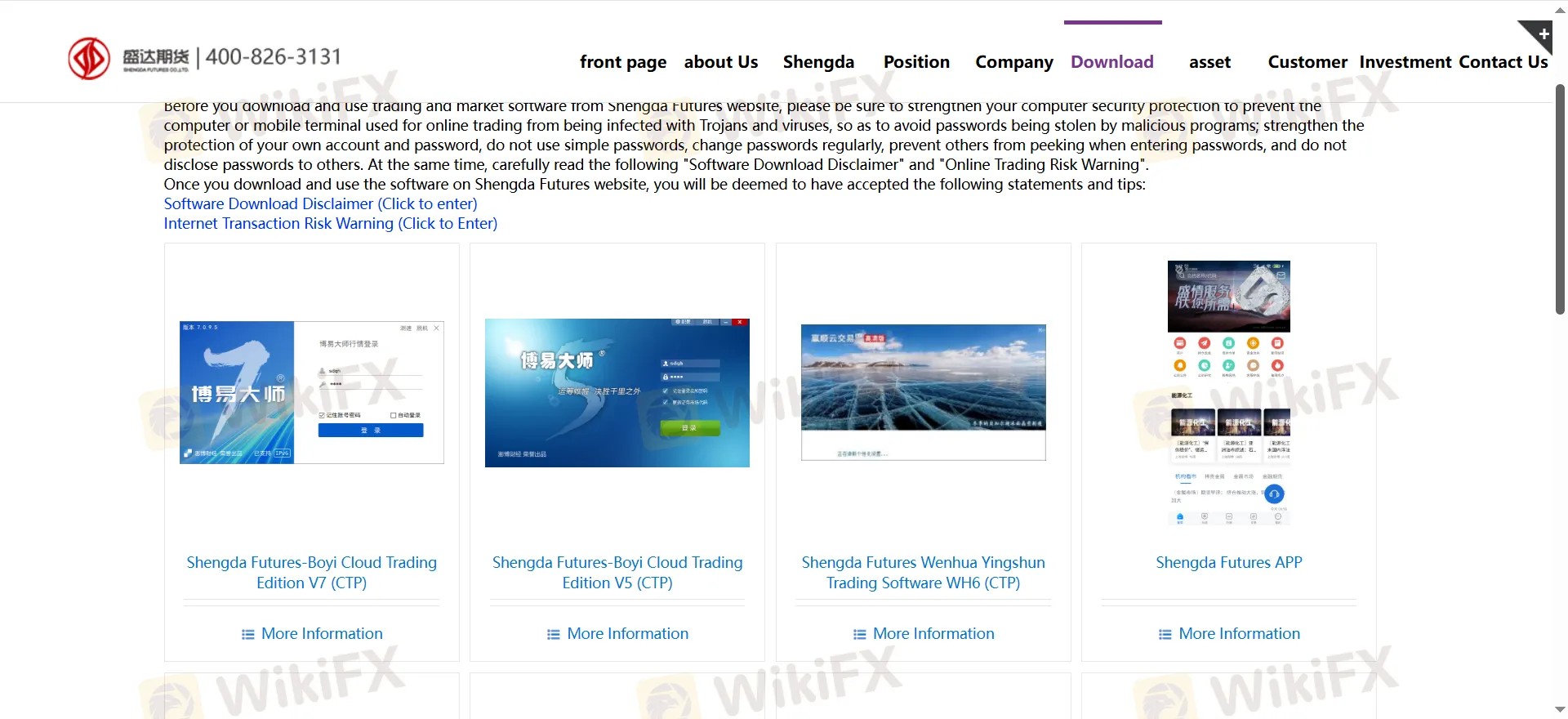

Plateforme de Trading

| Plateforme de Trading | Pris en charge | Appareils Disponibles |

| Shengda Futures CTP Express Client v2 | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures CTP Express Client v3 | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures CTP Infinite Easy Production System | ✔ | PC, ordinateur portable, tablette |

| Pyramid Decision Trading System (CTP) | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures-Boyi Cloud Trading Edition V7 (CTP) | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures-Boyi Cloud Trading Edition V5 (CTP) | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures Wenhua Yingshun Trading Software WH6 (CTP) | ✔ | PC, ordinateur portable, tablette |

| Trading Pioneer Ultimate (CTP) | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures Boyi Master 5CTP Demo Version | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures CTP Option Simulation System | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures CTP Infinite Options Simulation System | ✔ | PC, ordinateur portable, tablette |

| Shengda Futures APP | ✔ | Mobile |

Dépôt et Retrait

SHENGDA FUTURES accepte les paiements effectués par carte de crédit, carte de débit et virement bancaire.

Dépôt : Il n'y a pas de restrictions sur le nombre de dépôts, le montant minimum de dépôt et le montant maximum de dépôt.

Retrait: Pour les exigences de retrait telles que le retrait unique et la limite de retrait totale pour la journée, le nombre de retraits par jour et les fonds garantis, veuillez vous référer au site officiel du courtier.

Horaire de dépôt et de retrait au guichet : du lundi au vendredi : 8h30-16h00.

Les fonds arriveront généralement dans les 24 heures.