Informations sur DGCX

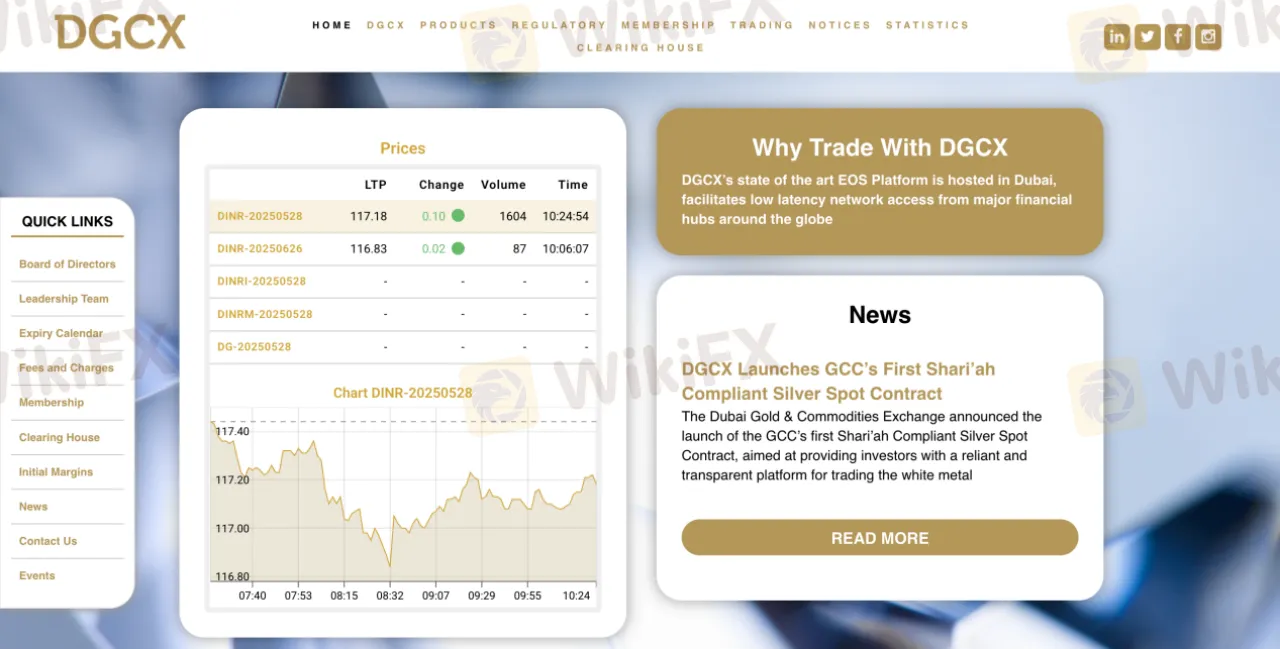

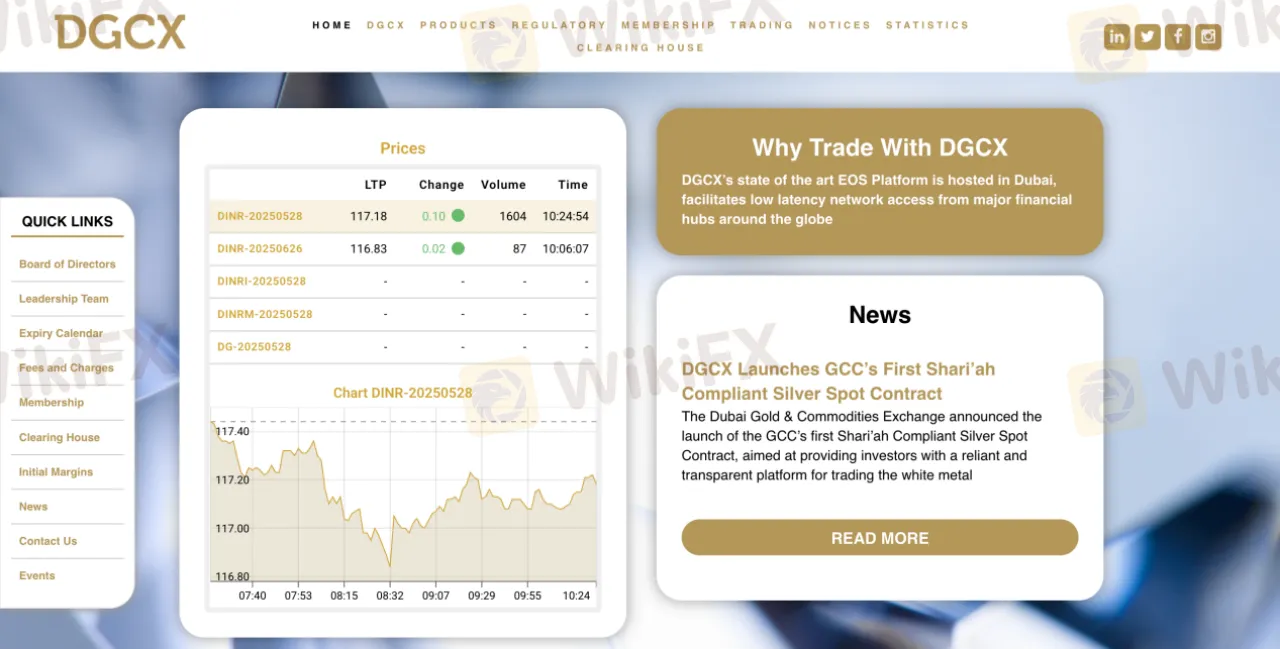

DGCX est une bourse de produits dérivés basée aux Émirats arabes unis, fondée en 2005, offrant des transactions sur contrats à terme dans les domaines des devises, des métaux, des hydrocarbures et des actions. Elle opère sur une plateforme institutionnelle robuste (Cinnober par Nasdaq), mais est principalement accessible aux membres et n'est pas conviviale pour les particuliers.

Avantages et Inconvénients

DGCX est-il Légitime ?

DGCX (Dubai Gold & Commodities Exchange) est basé à Dubaï et opère sous la supervision du Dubai Multi Commodities Centre (DMCC). Cependant, il ne détient pas de licence délivrée par l'un des principaux régulateurs financiers internationaux tels que la FCA (Royaume-Uni), l'ASIC (Australie) ou la NFA (États-Unis).

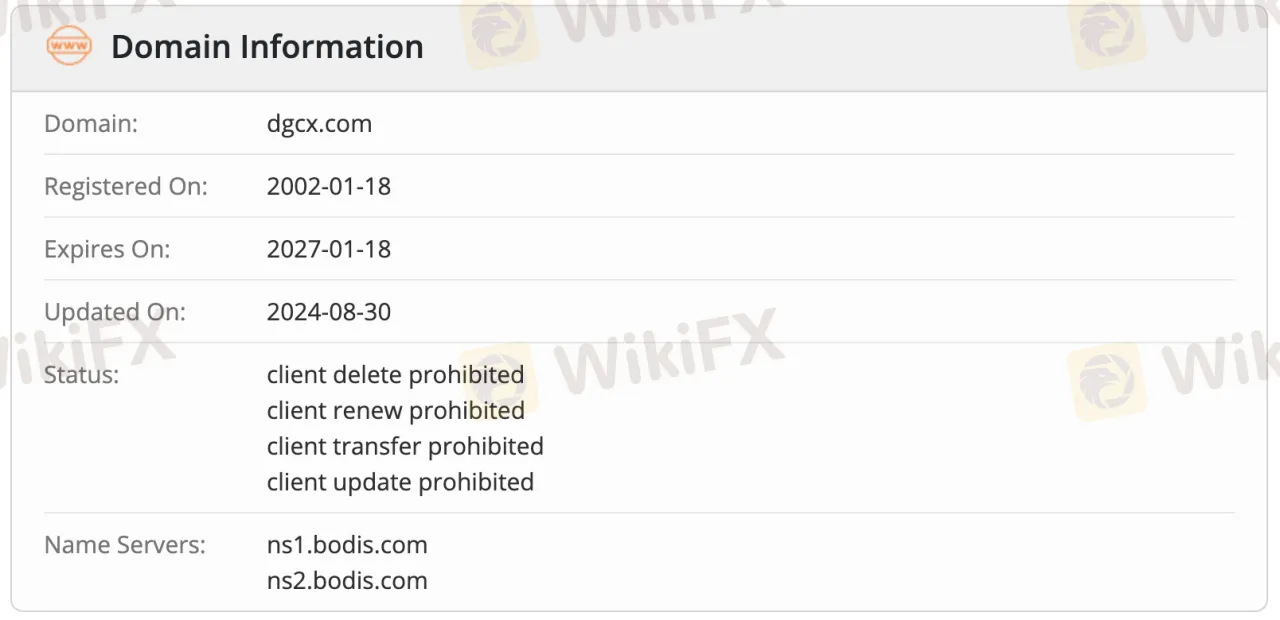

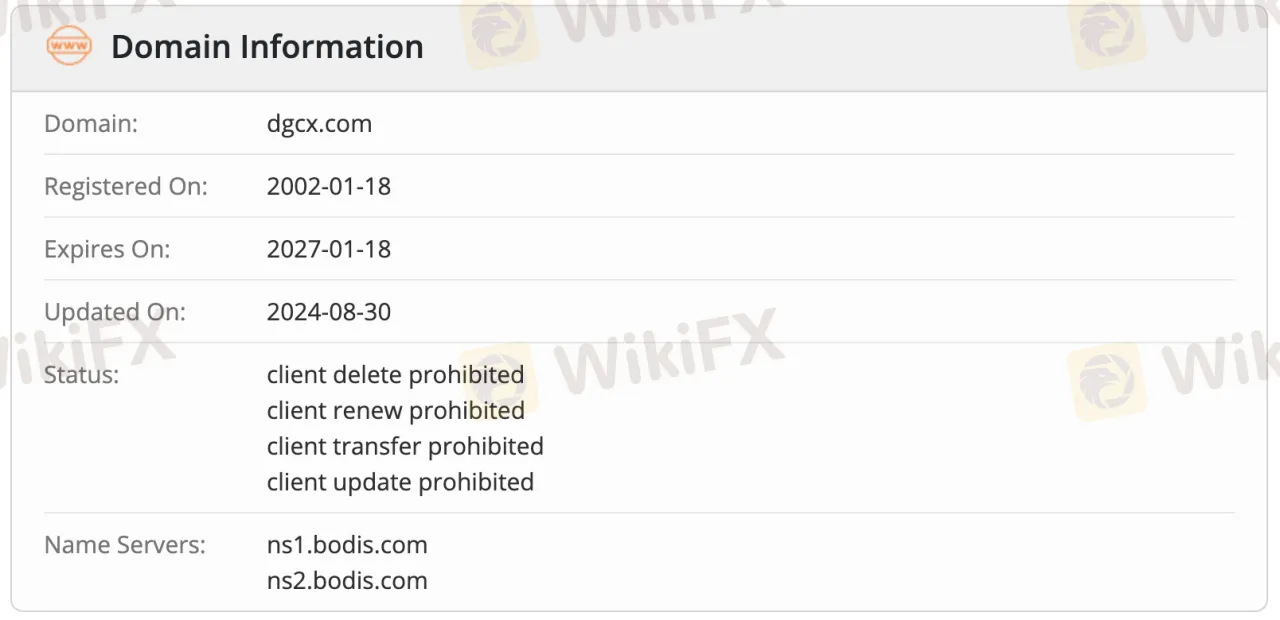

Le domaine dgcx.com a été enregistré le 18 janvier 2002 et expirera le 18 janvier 2027. Il a été mis à jour pour la dernière fois le 30 août 2024. Le domaine est actuellement dans un état verrouillé qui empêche la suppression, le renouvellement, le transfert ou les mises à jour. Ses serveurs de noms sont répertoriés sous Bodis, ce qui suggère que le site pourrait être en parking ou inactif.

Que Puis-je Trader sur DGCX ?

DGCX propose un total de 4 types de produits, comprenant une variété de paires de devises, des contrats à terme sur les métaux, des contrats d'hydrocarbures et des instruments liés aux actions.

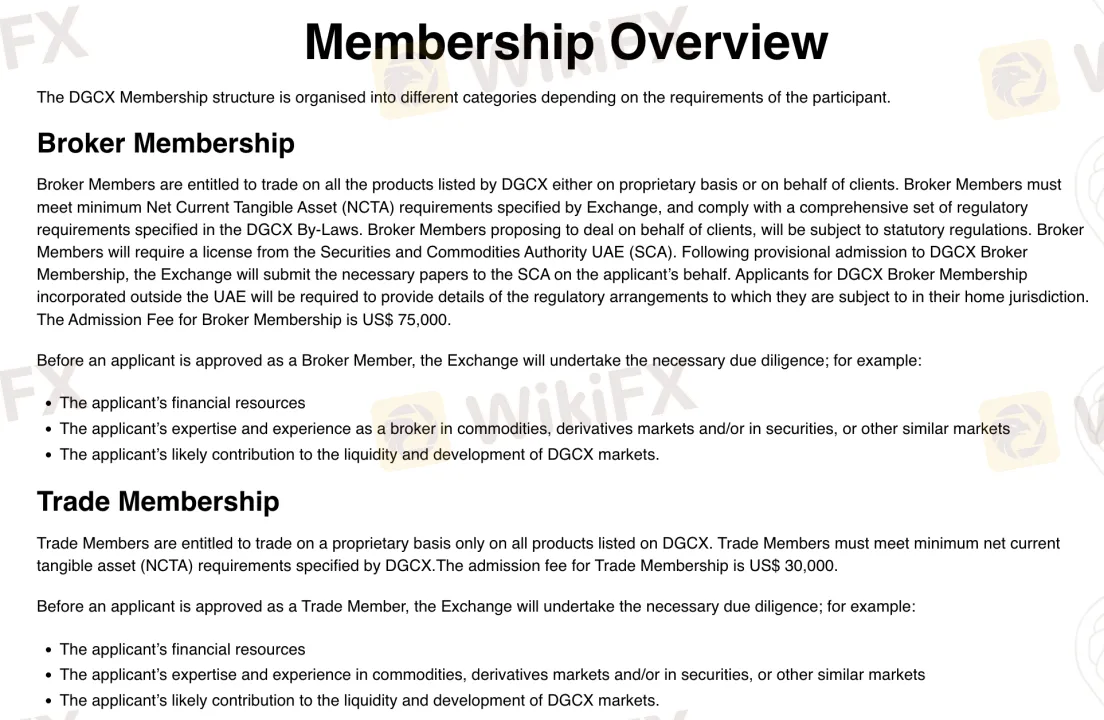

Adhésion

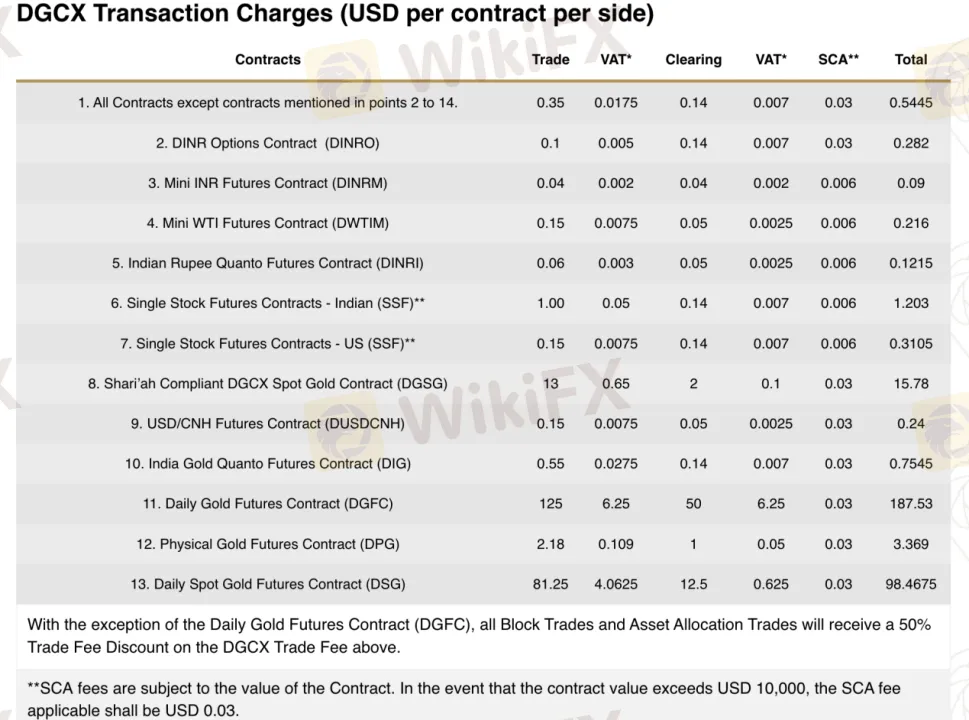

Frais DGCX

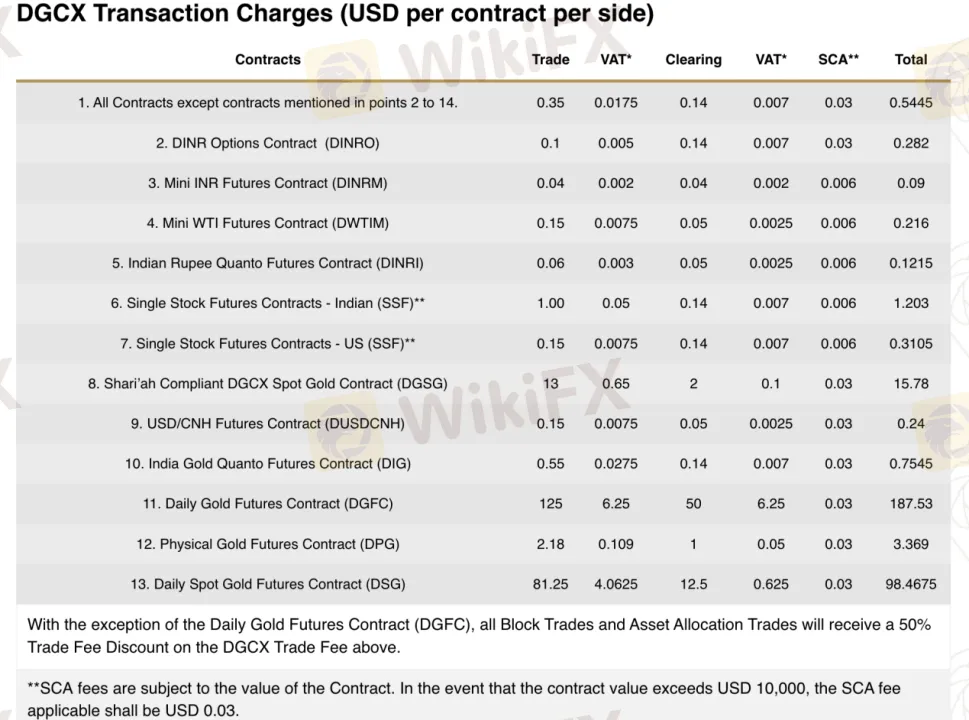

Les frais de trading de DGCX sont élevés par rapport aux courtiers de détail typiques, notamment pour les métaux précieux. Cela est attendu car DGCX fonctionne comme une bourse à terme de niveau institutionnel plutôt que comme un courtier CFD de détail. DGCX facture des frais fixes par contrat et par côté. Ces frais varient en fonction du produit.

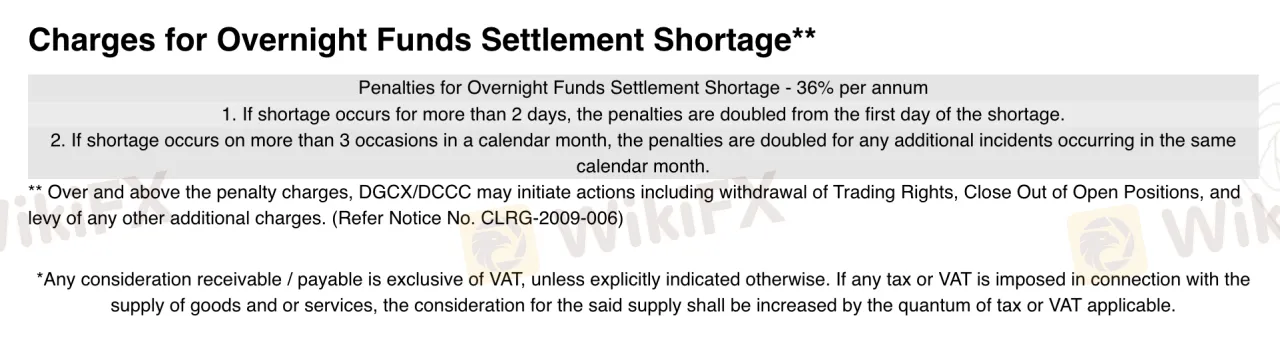

Taux de swap

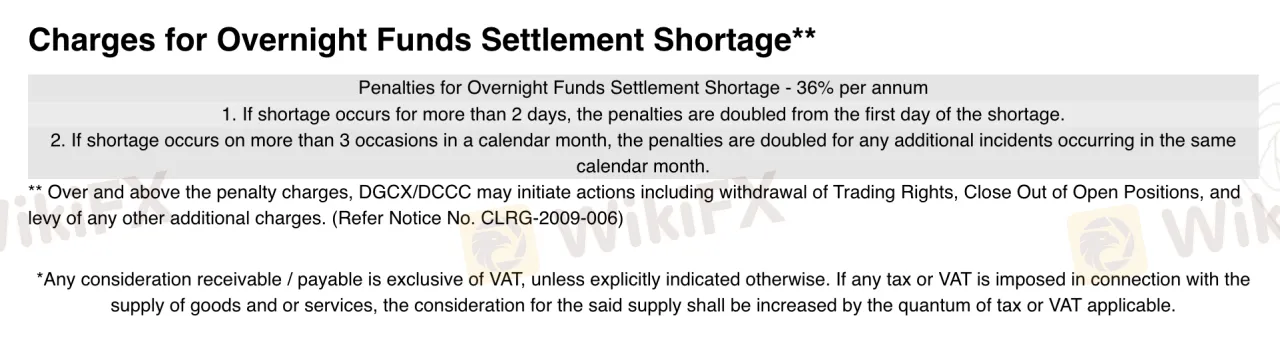

DGCX n'applique pas les taux de swap traditionnels comme le font les courtiers CFD grand public. Au lieu de cela, il facture une pénalité pour les pénuries de règlement de fonds de nuit à un taux de 36% par an.

Plateforme de trading