Présentation de l'entreprise

| PhillipCapital Résumé de l'examen | |

| Fondé | 1975 |

| Pays d'enregistrement | Singapour |

| Régulation | Pas de régulation |

| Instruments de marché | Titres, forex, CFD, fonds, actions privées, assurance |

| Plateforme de trading | / |

| Support client | Téléphone : +65 6531 1555 |

| Email : talktophillip@phillip.com.sg | |

| Adresse : 250 North Bridge Road, #06-00 Raffles City Tower, Singapour 179101 | |

Informations sur PhillipCapital

Fondée en 1975, PhillipCapital a son siège principal à Singapour. Bien qu'elle propose une large gamme de services financiers dans différentes catégories d'actifs, la MAS ne la contrôle pas en tant que courtier. Couvrant des activités allant de la finance d'entreprise à la courtage de titres, la société affirme gérer plus de 40 000 produits financiers et 35 milliards de dollars d'actifs sous gestion.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Large gamme de produits de trading | Pas de régulation |

| Longue histoire opérationnelle | Informations limitées sur les frais |

| Gros actifs sous gestion (35+ milliards de dollars US) et une couverture de marché étendue |

PhillipCapital est-il légitime ?

Bien que Phillip soit enregistré à Singapour, il n'est pas réglementé en tant que courtier par l'Autorité Monétaire de Singapour (MAS).

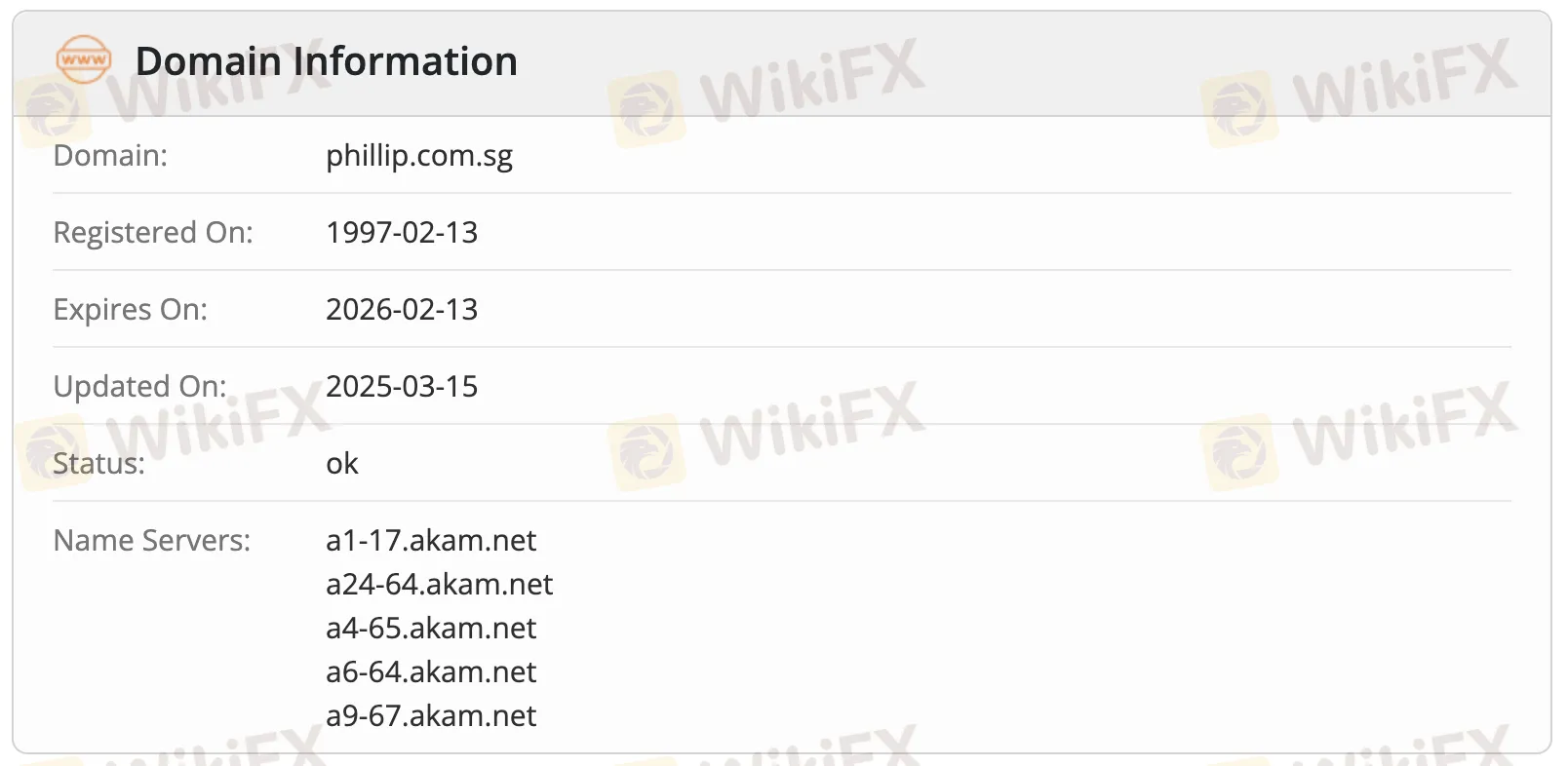

Les enregistrements Whois montrent que le domaine phillip.com.sg a été enregistré le 13 février 1997 et modifié pour la dernière fois le 15 mars 2025. Il est actuellement actif et est prévu d'expirer le 13 février 2026. Le statut du domaine indique "ok".

Que puis-je trader avec Phillip ?

Avec plus de 40 000 produits financiers et plus de 35 milliards de dollars US d'actifs sous gestion, Phillip propose un large éventail de services financiers dans différentes classes d'actifs et secteurs, y compris les titres, les devises, les CFD, la gestion de fonds et la finance d'entreprise.

| Instruments de trading | Pris en charge |

| Titres | ✔ |

| Forex | ✔ |

| CFD | ✔ |

| Fonds | ✔ |

| Actions privées | ✔ |

| Assurance | ✔ |

| Obligations | ❌ |

| Options | ❌ |

| ETF | ❌ |