Unternehmensprofil

| PhillipCapital Überprüfungszusammenfassung | |

| Gegründet | 1975 |

| Registriertes Land | Singapur |

| Regulierung | Keine Regulierung |

| Marktinstrumente | Wertpapiere, Devisen, CFDs, Fonds, Private Equity, Versicherungen |

| Handelsplattform | / |

| Kundenbetreuung | Telefon: +65 6531 1555 |

| E-Mail: talktophillip@phillip.com.sg | |

| Adresse: 250 North Bridge Road, #06-00 Raffles City Tower, Singapur 179101 | |

PhillipCapital Informationen

1975 gegründet, hat PhillipCapital seinen Hauptsitz in Singapur. Obwohl es eine breite Palette von Finanzdienstleistungen über Vermögenskategorien hinweg anbietet, wird es nicht als Broker von der MAS kontrolliert. Das Unternehmen gibt an, mehr als 40.000 Finanzprodukte und 35 Milliarden US-Dollar an verwaltetem Vermögen zu betreiben.

Vor- und Nachteile

| Vorteile | Nachteile |

| Breites Spektrum an Handelsprodukten | Keine Regulierung |

| Lange Betriebsgeschichte | Begrenzte Informationen zu Gebühren |

| Großes verwaltetes Vermögen (35+ Milliarden US-Dollar) und umfassende Marktabdeckung |

Ist PhillipCapital legitim?

Obwohl Phillip in Singapur registriert ist, wird es nicht als Broker von der Monetary Authority of Singapore (MAS) reguliert.

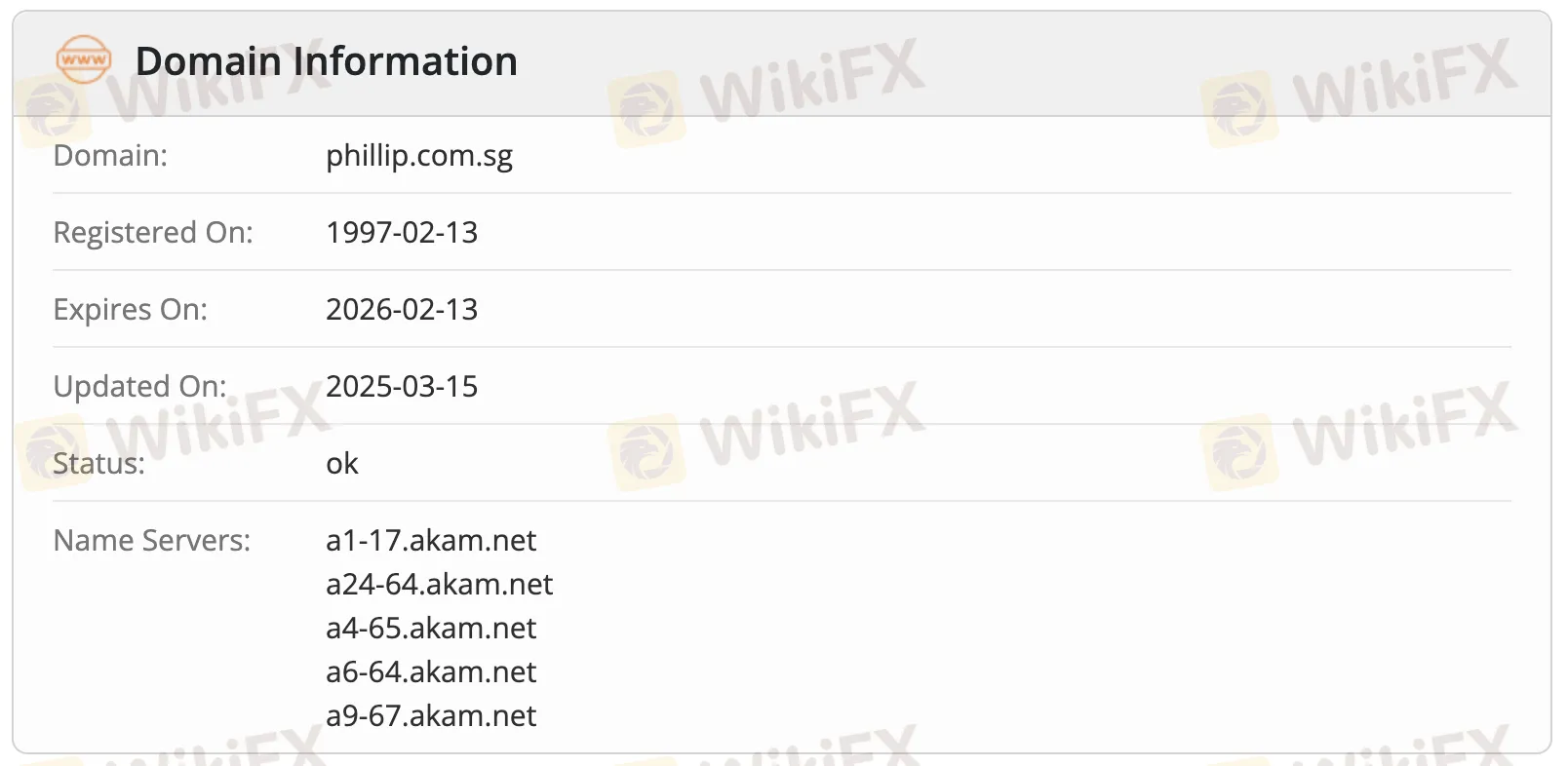

Whois-Aufzeichnungen zeigen, dass die Domain phillip.com.sg am 13. Februar 1997 registriert und zuletzt am 15. März 2025 geändert wurde. Sie ist jetzt aktiv und soll am 13. Februar 2026 ablaufen. Der Domainstatus lautet "ok".

Was kann ich bei PhillipCapital handeln?

Mit mehr als 40.000 Finanzprodukten und einem verwalteten Vermögen von über 35 Milliarden US-Dollar bietet Phillip ein breites Spektrum an Finanzdienstleistungen über Vermögensklassen und Sektoren hinweg, einschließlich Wertpapiere, Währungen, CFDs, Fondsmanagement und Unternehmensfinanzierung.

| Handelsinstrumente | Unterstützt |

| Wertpapiere | ✔ |

| Devisen | ✔ |

| CFDs | ✔ |

| Fonds | ✔ |

| Private Equity | ✔ |

| Versicherung | ✔ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |