Şirket özeti

| PhillipCapital İnceleme Özeti | |

| Kuruluş Yılı | 1975 |

| Kayıtlı Ülke | Singapur |

| Düzenleme | Düzenleme yok |

| Piyasa Araçları | Menkul kıymetler, forex, CFD'ler, fonlar, özel sermaye, sigorta |

| İşlem Platformu | / |

| Müşteri Desteği | Telefon: +65 6531 1555 |

| E-posta: talktophillip@phillip.com.sg | |

| Adres: 250 North Bridge Road, #06-00 Raffles City Tower, Singapur 179101 | |

PhillipCapital Bilgileri

1975 yılında kurulan PhillipCapital, merkez ofisini Singapur'da bulunmaktadır. Varlık kategorileri boyunca geniş bir finansal hizmet yelpazesi sunmasına rağmen MAS, bir aracı olarak kontrol etmemektedir. Kurumsal finanstan menkul kıymetler aracılığına kadar faaliyetleri kapsayan firma, 40.000'den fazla finansal ürünü ve 35 milyar AUM değerinde işlettiğini belirtmektedir.

Artıları ve Eksileri

| Artılar | Eksiler |

| Geniş ürün yelpazesi | Düzenleme yok |

| Uzun işletme geçmişi | Ücretlerle ilgili sınırlı bilgi |

| Yüksek AUM (35 milyar ABD doları üzeri) ve kapsamlı piyasa kapsamı |

PhillipCapital Güvenilir mi?

Singapur'da kayıtlı olmasına rağmen Phillip, Singapur Para Kurumu (MAS) tarafından bir aracı olarak düzenlenmemektedir.

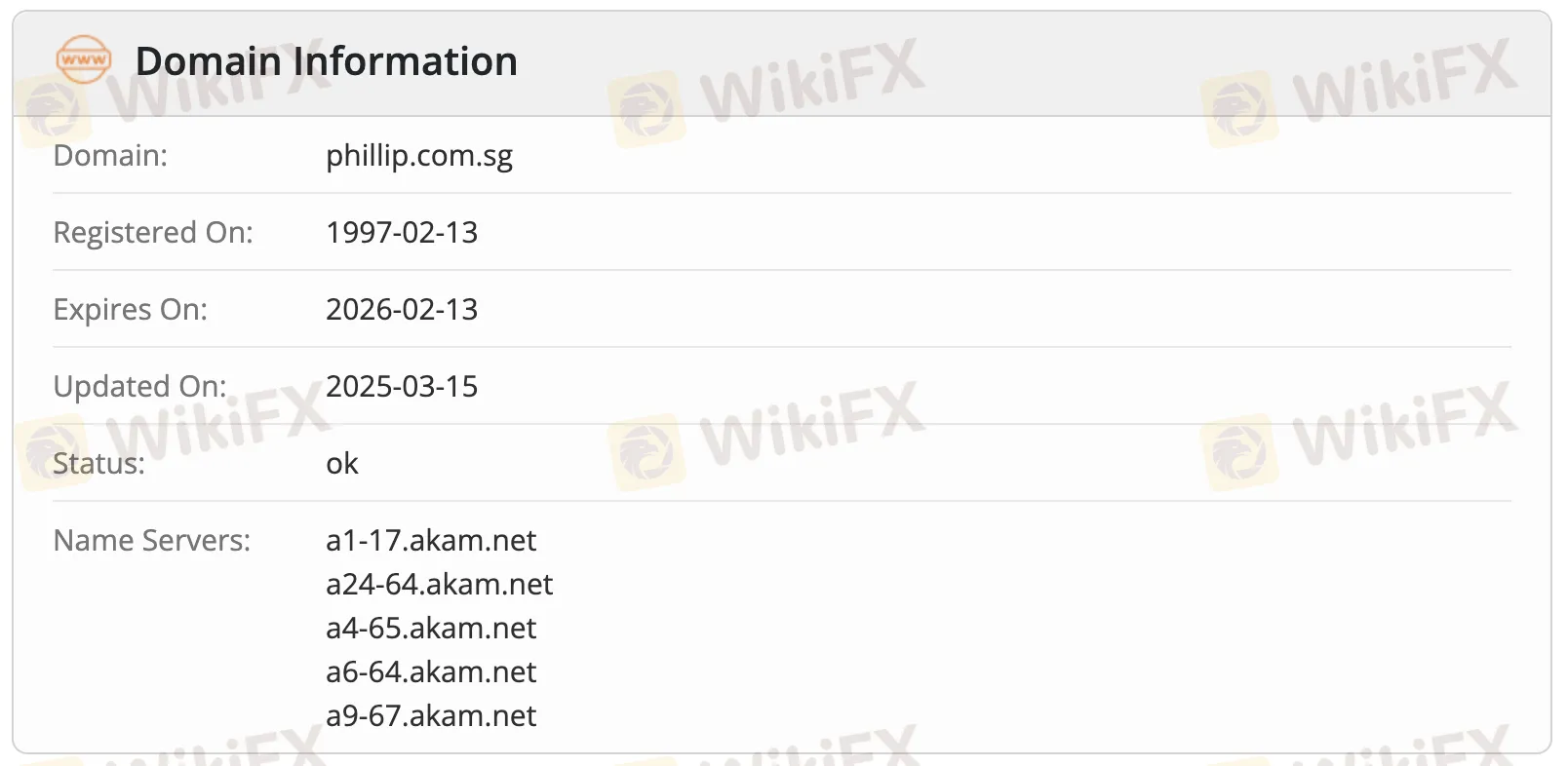

Whois kayıtları, phillip.com.sg alan adının 13 Şubat 1997'de kaydedildiğini ve son olarak 15 Mart 2025'te değiştirildiğini göstermektedir. Şu anda aktif durumda ve 13 Şubat 2026'da süresinin dolacağı planlanmaktadır. Alan adı durumu "ok" olarak belirtilmektedir.

Phillip ile Ne Alım Satım Yapabilirim?

40.000'den fazla finansal ürün ve 35 milyar ABD doları üzeri AUM ile Phillip, menkul kıymetler, para birimleri, CFD'ler, fon yönetimi ve kurumsal finans dahil olmak üzere varlık sınıfları ve sektörler arasında geniş bir finansal hizmet yelpazesi sunmaktadır.

| İşlem Araçları | Desteklenen |

| Menkul Kıymetler | ✔ |

| Forex | ✔ |

| CFD'ler | ✔ |

| Fonlar | ✔ |

| Özel Sermaye | ✔ |

| Sigorta | ✔ |

| Tahviller | ❌ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |