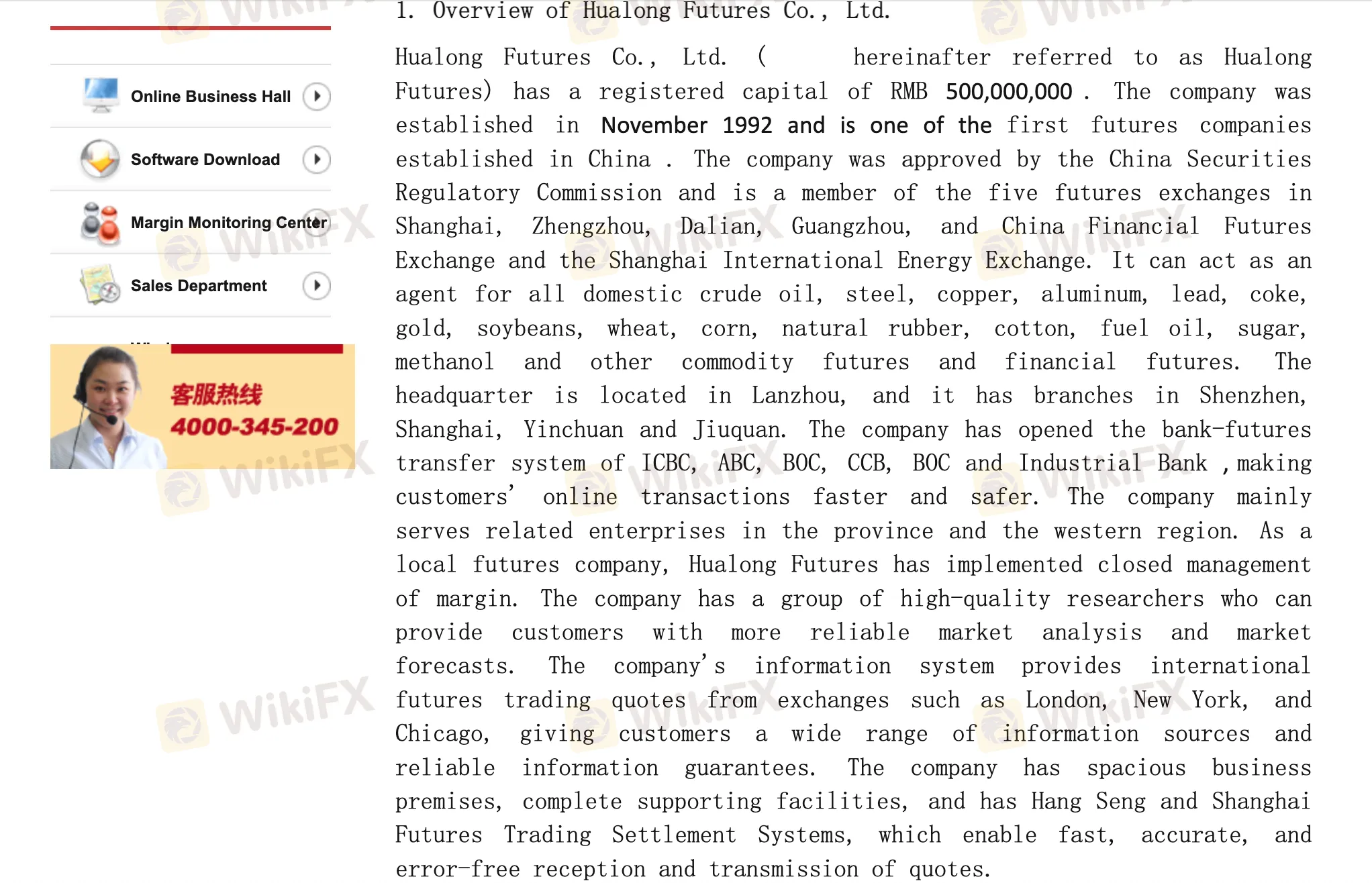

Présentation de l'entreprise

| CHINA DRAGON Résumé de l'examen | |

| Fondé | 2019 |

| Pays/Région Enregistré | Chine |

| Régulation | CFFE (Réglementé) |

| Instrument de Marché | Futures |

| Compte de Démo | ✅ |

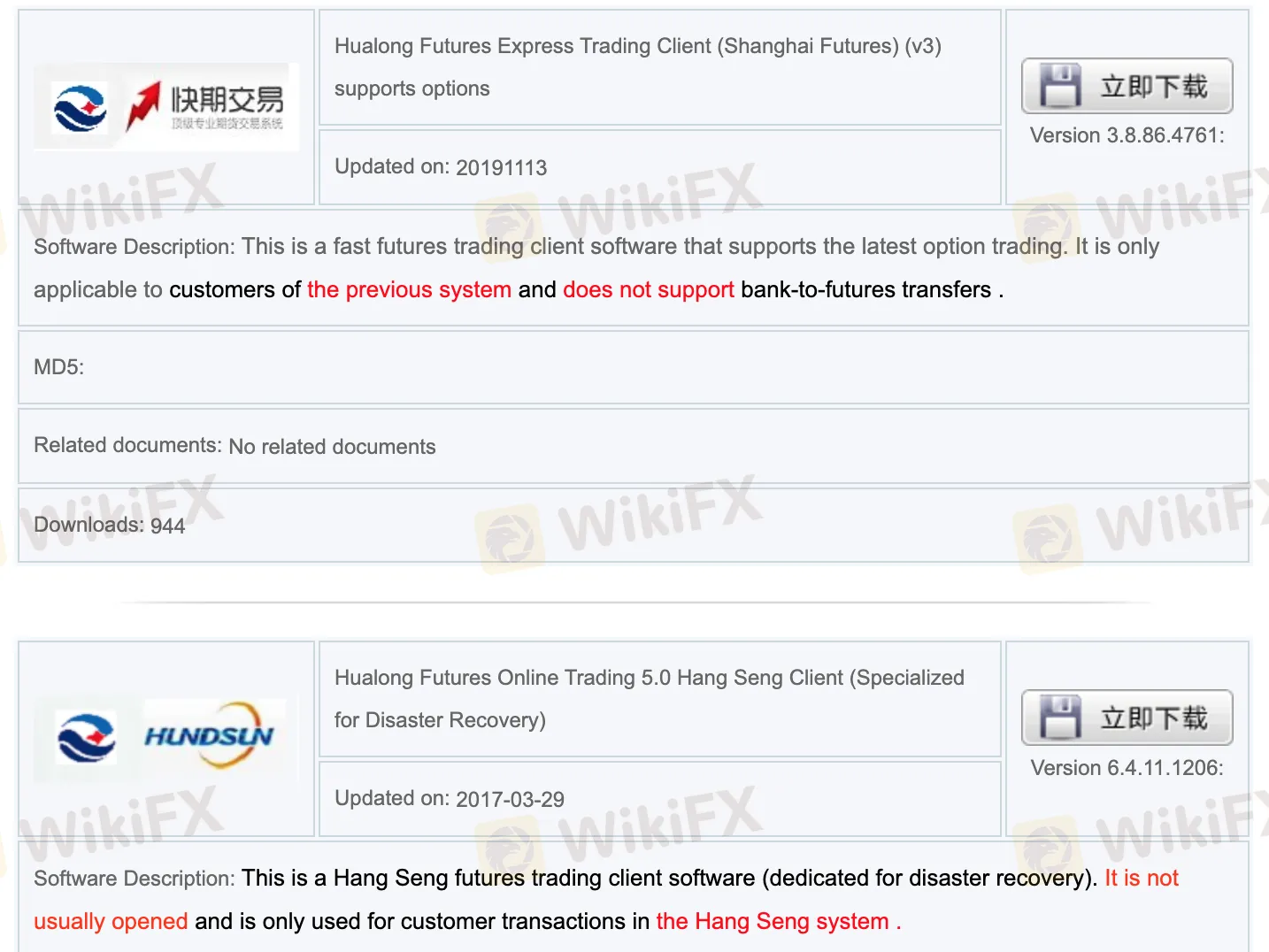

| Plateforme de Trading | Logiciel de Trading Hualong Futures-Boyi Cloud, Logiciel de Trading Hualong Futures-Yingshun Cloud Version HD (wh6), Client de Trading en Ligne Hualong Futures UF2.0 Hang Seng, Édition Hualong Zhixin Hang Seng, Édition Hualong Futures Boyi, Client de Trading Express Hualong Futures (Dernière Période), Client de Trading Express Hualong Futures (Shanghai Futures) (v3) prend en charge les options, Client de Trading en Ligne Hualong Futures 5.0 Hang Seng (Spécialisé pour la Récupération en Cas de Catastrophe), Logiciel de Trading Hualong Futures-Yingshun Cloud Version IPV6, Version Android du Logiciel de Trading Hualong Futures Boyi, Version IOS du Logiciel de Trading Hualong Futures Boyi, Version Android de Hualong Zhixin Hang Seng, Version IOS de Hualong Zhixin Hang Seng, Application Mobile Wenhua Finance, etc. |

| Support Client | Tél : 0931-8894644; 0931-8894283 |

| FAX:0931-8894198 | |

| Email : hlqh@hlqhgs.com | |

Informations sur CHINA DRAGON

CHINA DRAGON est un courtier réglementé, proposant le trading sur les contrats à terme sur différentes plateformes de trading.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Diverses plateformes de trading | Types limités de produits de trading |

| Comptes de démonstration | Frais de marge facturés |

| Bien réglementé | Options de paiement limitées |

| Divers canaux de support client |

CHINA DRAGON est-il Légitime ?

Oui. CHINA DRAGON est autorisé par la CFFEX à fournir des services.

| Pays Réglementé | Régulateur | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| Bourse des Contrats à Terme Financiers de Chine | Réglementé | 华龙期货股份有限公司 | Licence de Contrats à Terme | 0279 |

Sur quoi puis-je trader sur CHINA DRAGON ?

CHINA DRAGON propose le trading sur les contrats à terme.

| Instruments négociables | Pris en charge |

| Contrats à terme | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptos | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Type de compte

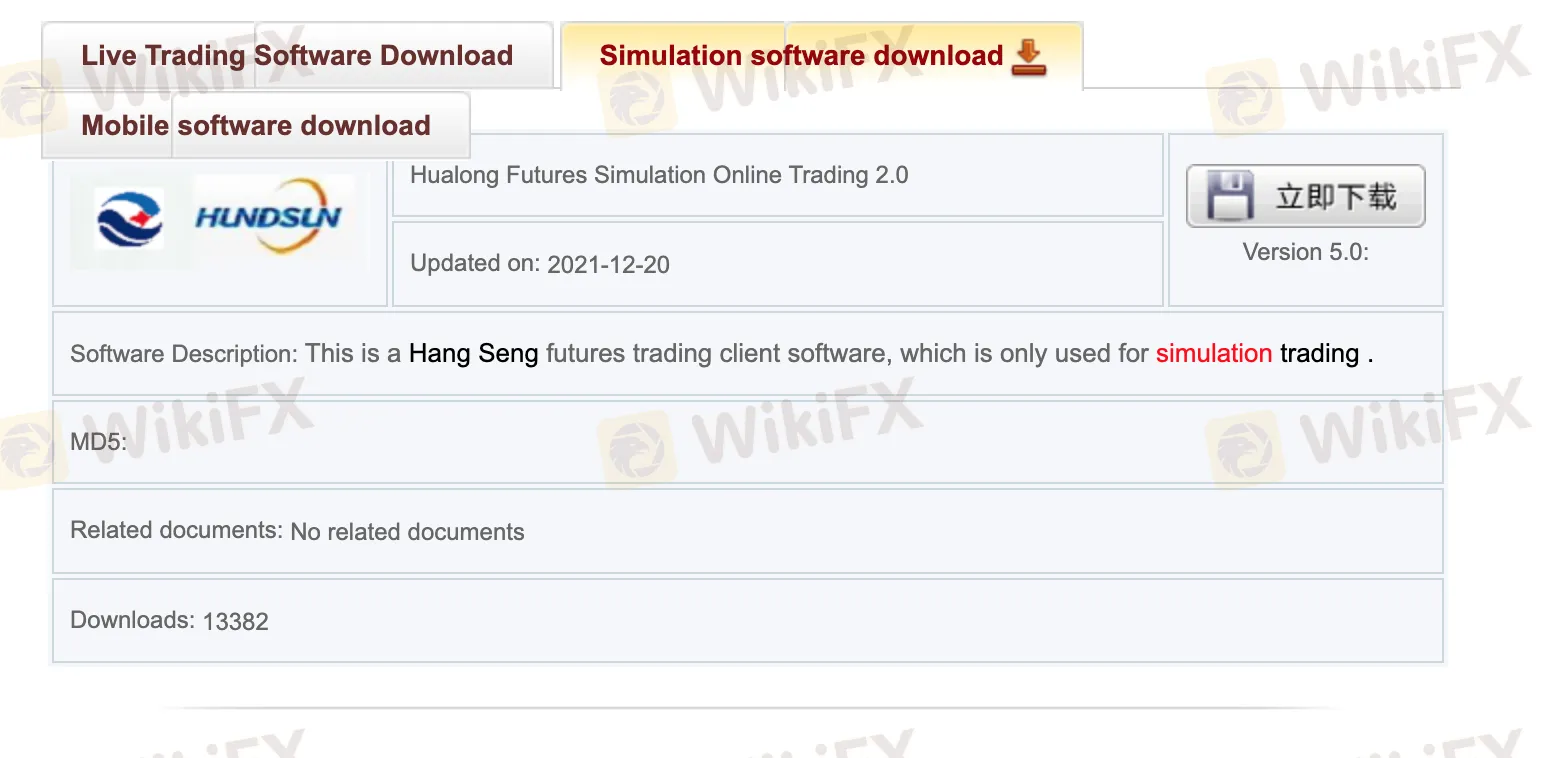

Le courtier n'a pas clairement indiqué les types de compte qu'il propose. Les clients peuvent télécharger un logiciel de simulation pour ouvrir des comptes de démonstration.

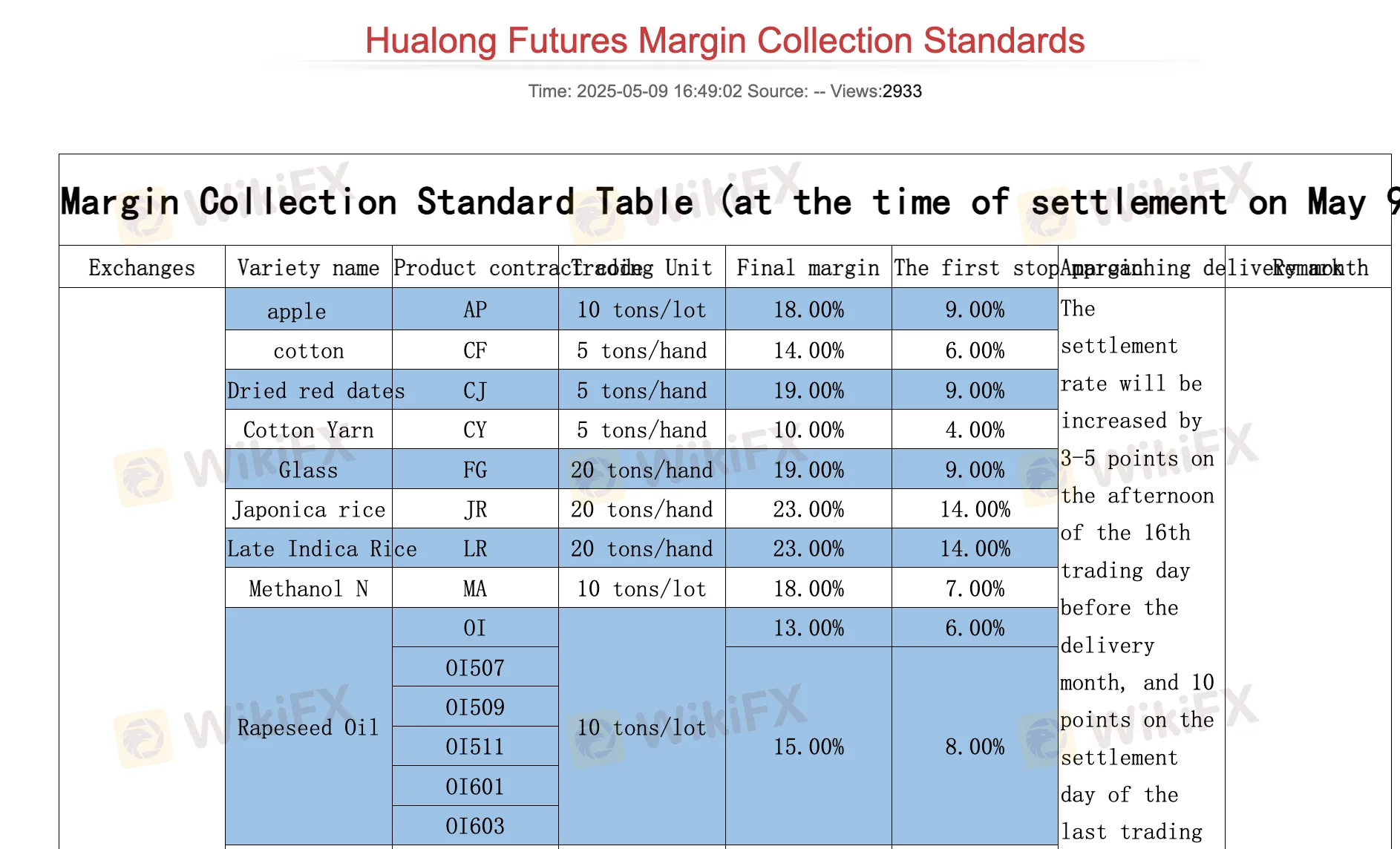

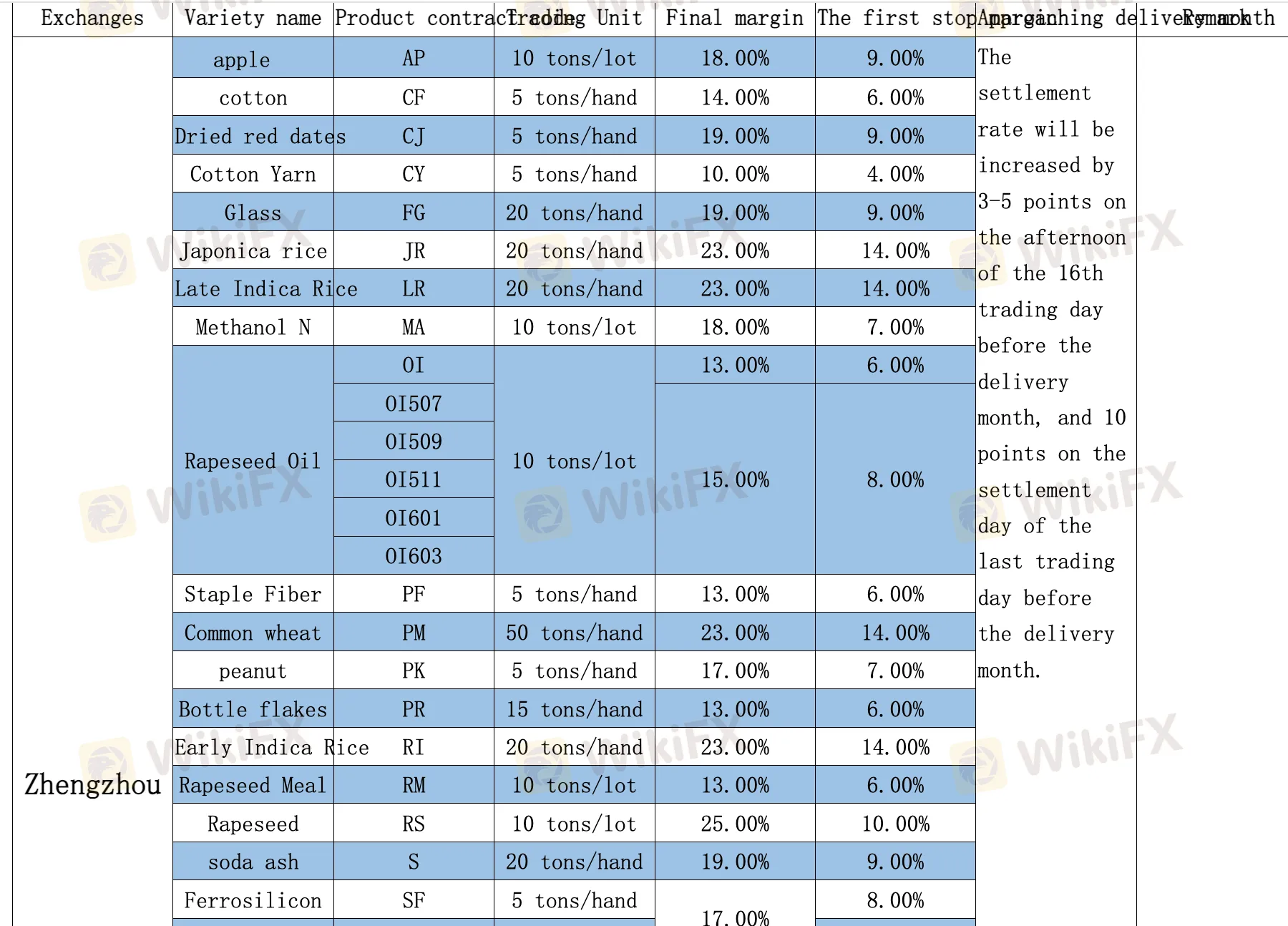

Frais CHINA DRAGON

Le courtier exige des frais de marge pour différents instruments de trading.

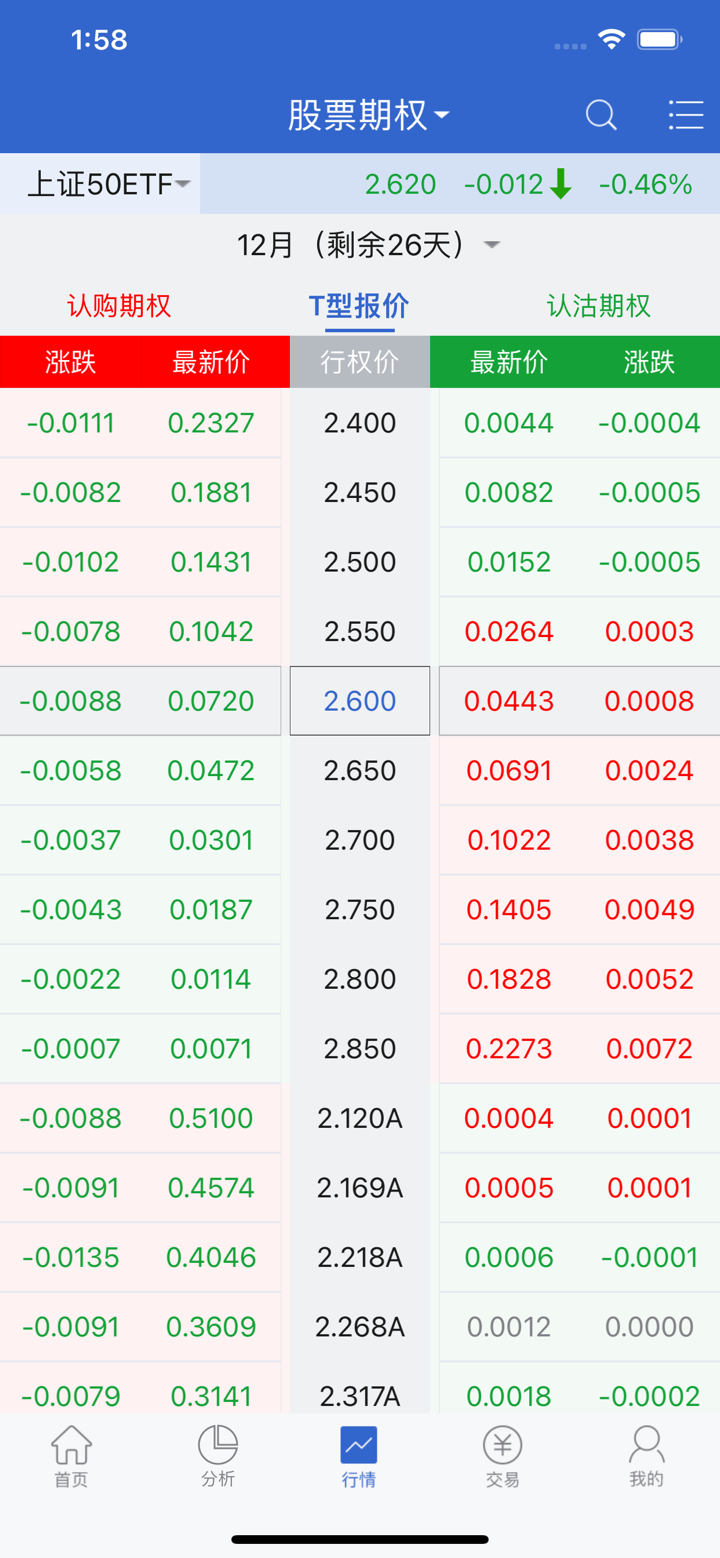

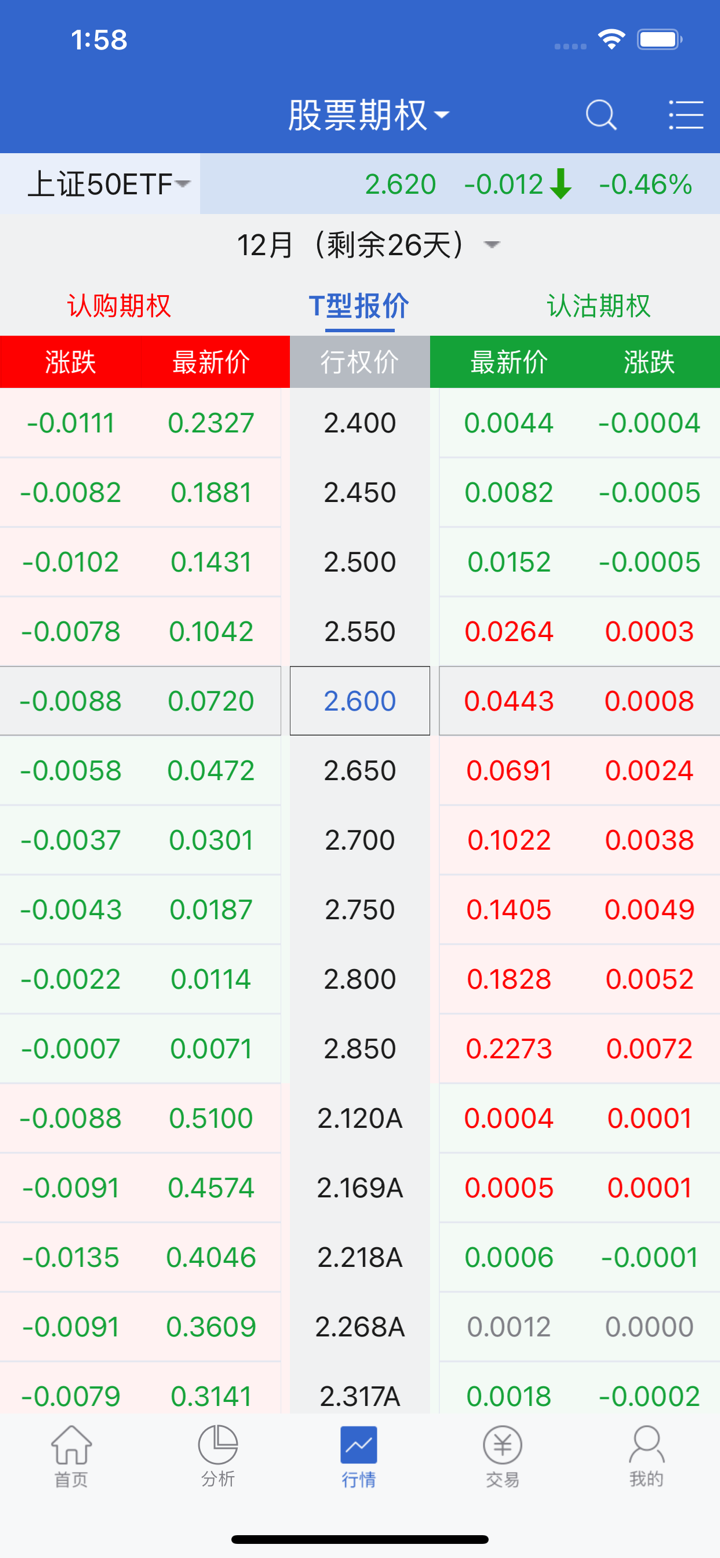

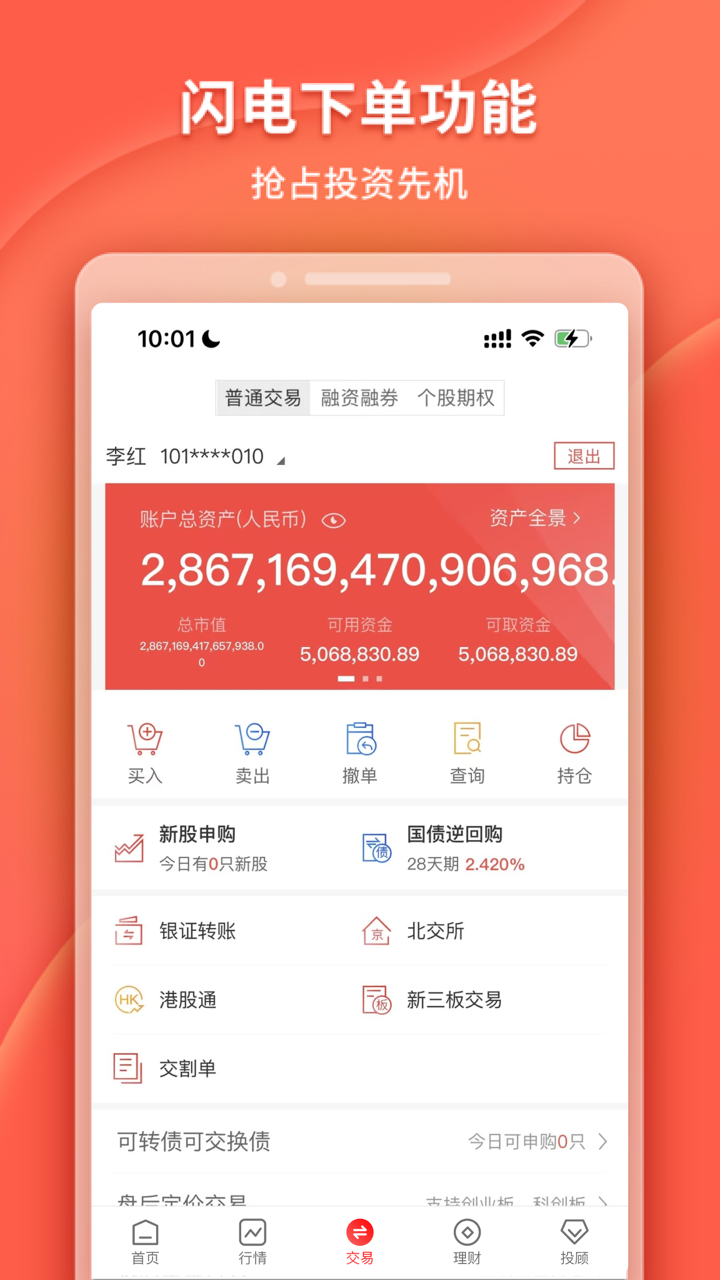

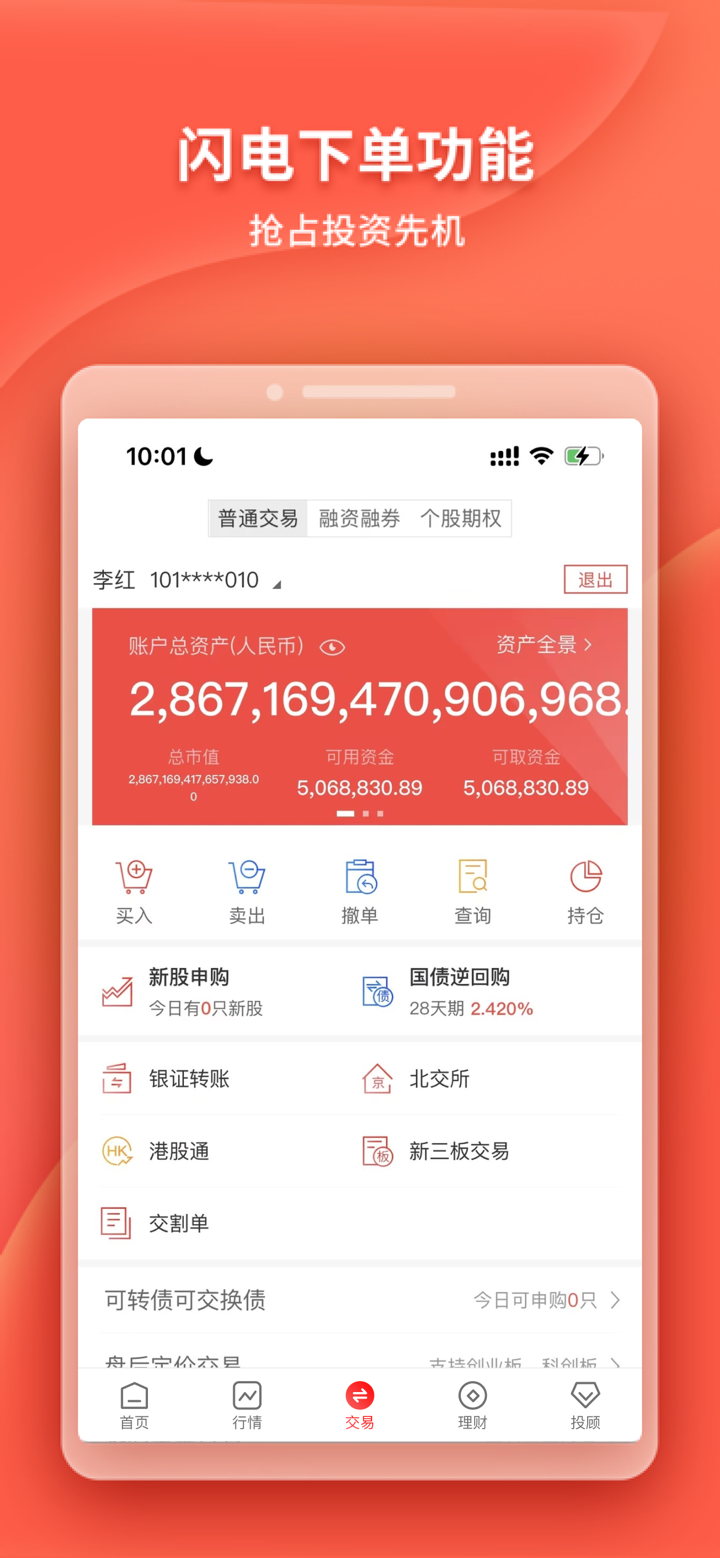

Plateforme de trading

Le courtier propose différentes plateformes de trading, y compris le logiciel de trading Hualong Futures-Boyi Cloud Market, le logiciel de trading Hualong Futures-Yingshun Cloud Market HD Version (wh6), Hualong Futures Online Trading UF2.0 Hang Seng Client, Hualong Zhixin Hang Seng Edition, Hualong Futures Boyi Edition, Hualong Futures Express Trading Client (Last Period), Hualong Futures Express Trading Client (Shanghai Futures) (v3) prend en charge les options, Hualong Futures Online Trading 5.0 Hang Seng Client (Spécialisé pour la récupération après sinistre), Hualong Futures-Yingshun Cloud Market Trading Software-IPV6 Version, Hualong Futures Boyi Version (Version Android), Hualong Futures Boyi Version (Version IOS), Hualong Zhixin Hang Seng version (Version Android), Hualong Zhixin Hang Seng version (Version IOS) et l'application mobile Wenhua Finance.

Appareils disponibles : bureau et mobile (IOS, Android).

Dépôt et retrait

Le courtier accepte les paiements via virement bancaire. Aucun montant minimum de dépôt ou de retrait n'est défini et aucun frais n'est spécifié.

Lors du retrait de fonds par transfert de contrats à terme sur l'argent, si les clients n'ont pas de positions, ils peuvent retirer la totalité du montant, mais le profit de la journée ne peut pas être transféré. Si les clients ont des transactions ou des positions le même jour, ils peuvent transférer 70% des fonds disponibles à chaque fois et peuvent effectuer 5 retraits consécutifs.