Дмитрий

1-2年

Does CHINA DRAGON apply any fees when you deposit or withdraw funds?

As an experienced trader, I’ve learned to pay particular attention to the costs associated with funding and withdrawing from broker accounts, as these can significantly affect my overall trading returns and ease of access to my capital. With CHINA DRAGON, my review is shaped by the available facts regarding their policies.

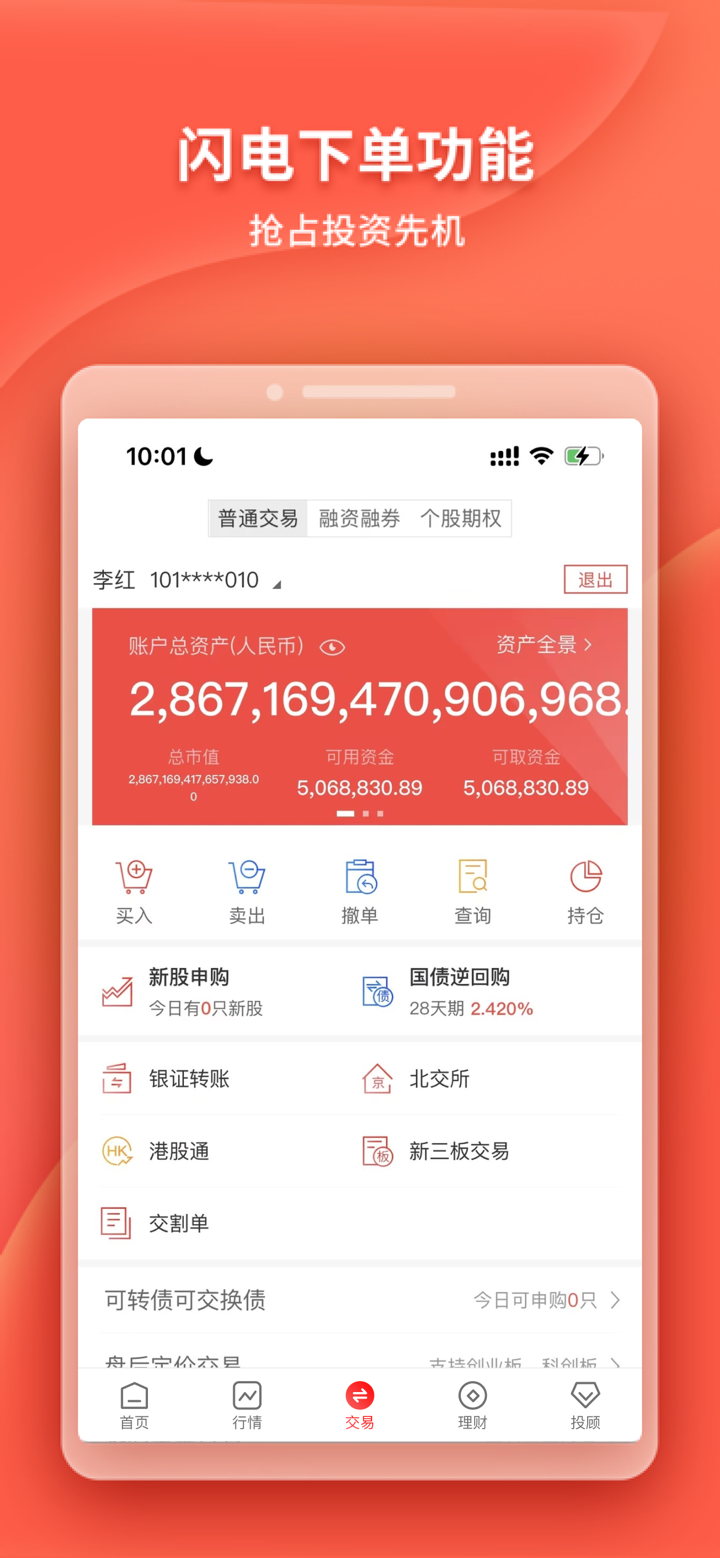

Based on my research, CHINA DRAGON accepts payments via bank wire, which is a standard method among regulated Chinese futures brokers. However, as of this writing, I could not find any explicit mention of deposit or withdrawal fees set by the broker itself. There is also no specified minimum amount for deposits or withdrawals. That said, the absence of a stated fee does not necessarily guarantee that funding is entirely free—the bank involved in the wire process might still charge independent handling fees, which is a variable outside the broker’s direct control.

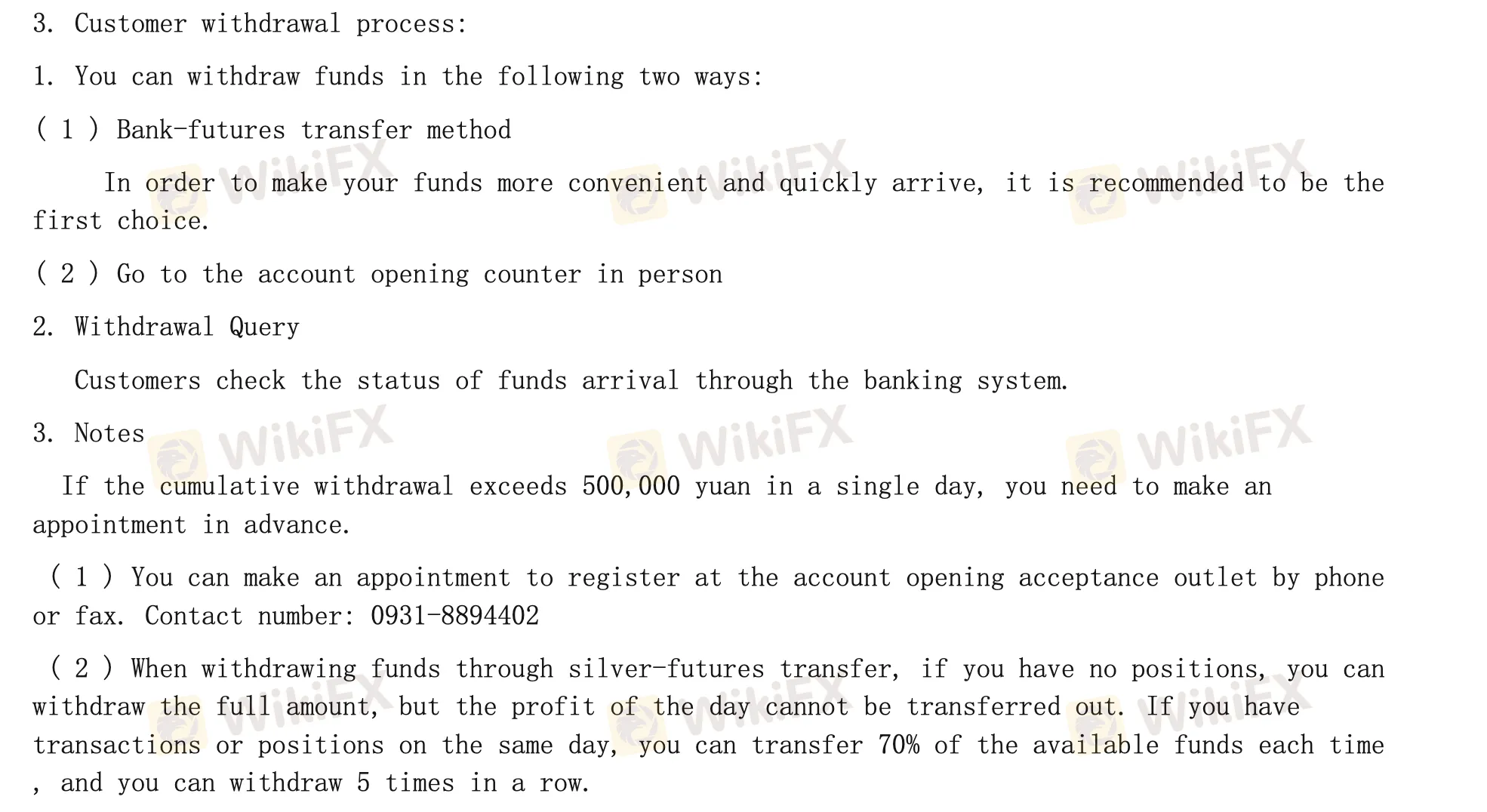

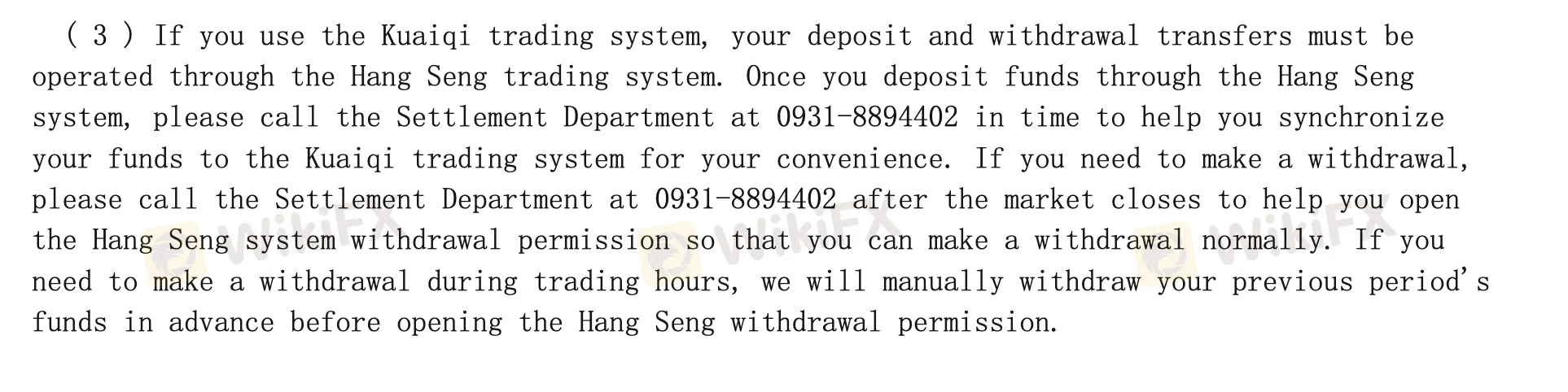

Regarding withdrawals, CHINA DRAGON has a structured policy: If I have no open positions, I can withdraw the full available amount, except for profits made on the current trading day. If I have trades or open positions, only up to 70% of available funds can be withdrawn at once, and the operation can be repeated up to five times. This restriction appears intended to manage intra-day liquidity and risk.

Ultimately, while no broker-side deposit or withdrawal charges are evident, I would exercise due diligence by confirming with both the broker and my bank to fully understand any possible costs. For any trader, ensuring transparent access to funds and clarity on all related charges is a non-negotiable priority, irrespective of the broker's regulatory standing or local licensing.

Broker Issues

CHINA DRAGON FUTURES 华龙期货 Deposit

Withdrawal

Rpy Sundram

1-2年

What is the usual timeframe for a withdrawal from CHINA DRAGON to reach a bank account or e-wallet?

From my experience evaluating CHINA DRAGON and other similar brokers, transparency around withdrawal timeframes is crucial for building trust. What stands out with CHINA DRAGON is that they only support bank wire withdrawals, with no options for e-wallets. The withdrawal process itself appears to be somewhat restrictive, particularly due to their policy: if I have no open positions, I can withdraw the full balance except for same-day profits. However, with active trades, I am permitted to withdraw up to 70% of available funds per transaction and repeat this process up to five times consecutively.

Unfortunately, CHINA DRAGON does not publicly specify the average processing or arrival time for withdrawals to a bank account. In my wider trading experience across regulated Chinese futures brokers, bank wire withdrawals often take anywhere from one to several business days, depending on the time of request and banking intermediaries involved. Due to these uncertainties and certain limitations outlined, I would exercise caution and assume that funds might require multiple business days to reflect in my bank account. Personally, I always ensure to keep trading and withdrawal records and maintain realistic expectations with brokers that offer minimal public detail regarding transfer speed. Overall, CHINA DRAGON’s approach to withdrawals emphasizes risk controls, but lacks the upfront clarity I generally prefer as a trader.

Broker Issues

CHINA DRAGON FUTURES 华龙期货 Deposit

Withdrawal

Razzie87

1-2年

Is CHINA DRAGON overseen by any financial regulators, and if so, which authorities are responsible for its regulation?

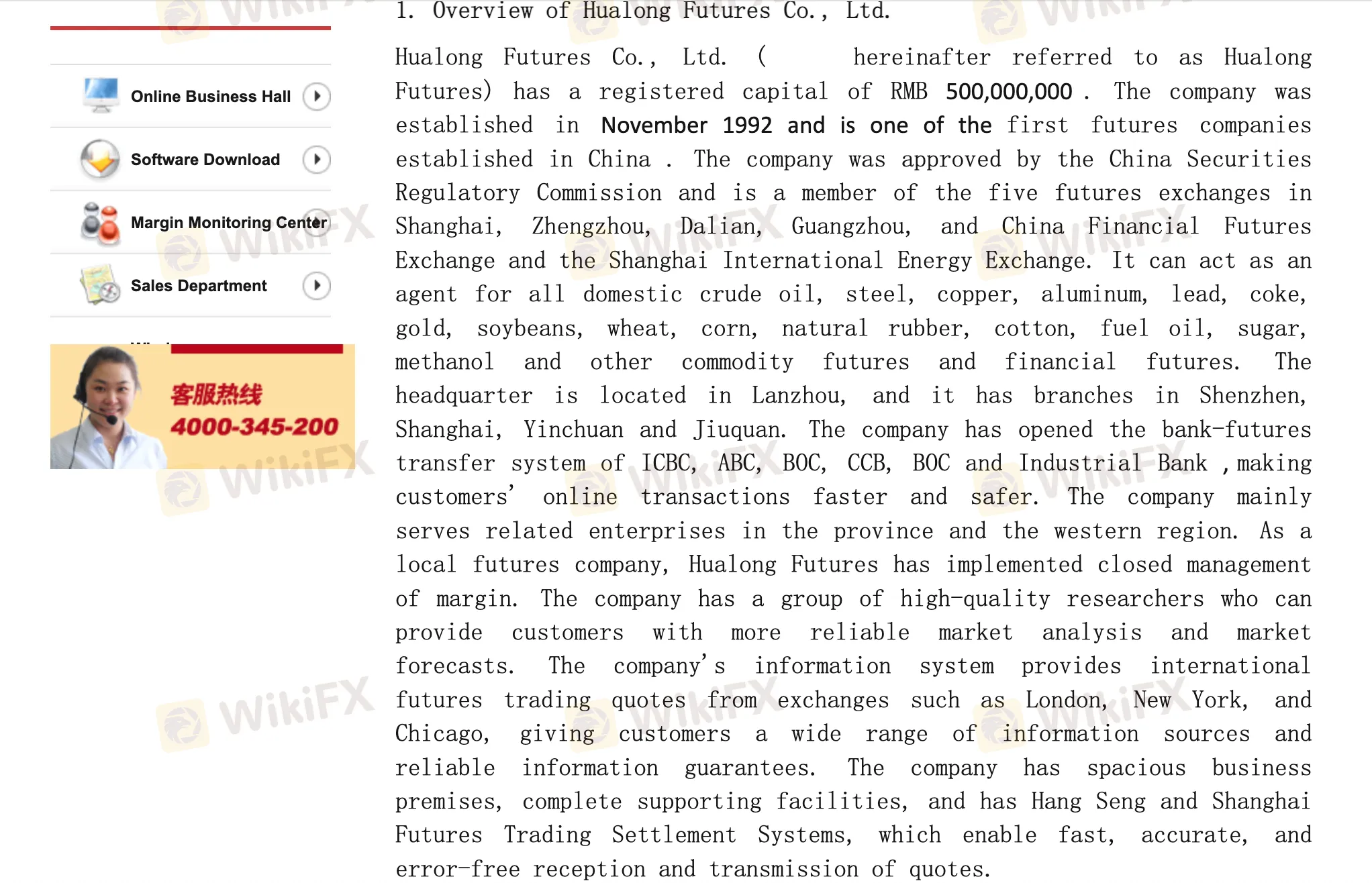

As an independent trader who values due diligence, regulatory oversight is always the first criterion I examine before even considering a new broker. In the case of CHINA DRAGON, I verified that the broker is indeed overseen by a financial regulator—specifically, the China Financial Futures Exchange (CFFEX). Their license is associated with 华龙期货股份有限公司 and is clearly designated as a Futures License (No. 0279). For me, the presence of formal regulation under CFFEX provides a greater sense of basic market integrity, as it signifies that the broker is subject to ongoing review and operational standards mandated by a government-recognized institution.

That said, it's important to be cautious and not assume all regulatory environments are equal globally. My experience has taught me that, while CFFEX regulation does require compliance with core practices in China's domestic futures market, it might not offer the same investor protection mechanisms found in some Western jurisdictions. Still, after researching, I've found that the review scores surrounding CHINA DRAGON’s risk management and business operations are generally positive, reflecting a mature internal system.

Ultimately, while I appreciate that CHINA DRAGON is not operating unregulated and does hold a credible domestic futures license, I would recommend that traders fully evaluate their individual risk appetite and consider the nuances of regional regulatory frameworks before committing significant capital. For me, the presence of CFFEX regulation is reassuring, but I always proceed methodically, understanding both the advantages and inherent limitations.

Broker Issues

CHINA DRAGON FUTURES 华龙期货 Regulation

Thobani Dlalda

1-2年

Which documents do I usually need to provide to process my initial withdrawal with CHINA DRAGON?

In my experience trading with regulated brokers like CHINA DRAGON, the initial withdrawal process typically requires a basic set of identification documents. Since CHINA DRAGON is licensed by the China Financial Futures Exchange and operates under Chinese regulations, I approach the withdrawal process with a cautious mindset and make sure my documents are in order. For the first withdrawal, I generally prepare a government-issued photo ID (such as a passport or identity card) and proof of address, like a recent utility bill or bank statement, to satisfy standard anti-money laundering checks. Given that depositing and withdrawing are only available through bank wire transfers at CHINA DRAGON, the bank account details I use must exactly match the name on my trading account for compliance reasons.

I've learned never to take shortcuts here—providing clear and up-to-date documentation not only prevents delays but also protects my funds. Although CHINA DRAGON’s website does not specify exhaustive requirements for every withdrawal scenario, from what I know of regulated futures brokers, preparing these core documents in advance is fundamental. Verification standards can also change based on local regulations or specific client circumstances, so I make it a point to check directly with their customer support using their published phone or email channels if I’m ever unsure. This cautious, systematic approach helps reduce the risk of any disruptions or surprises when withdrawing my capital.

Broker Issues

CHINA DRAGON FUTURES 华龙期货 Withdrawal

Deposit