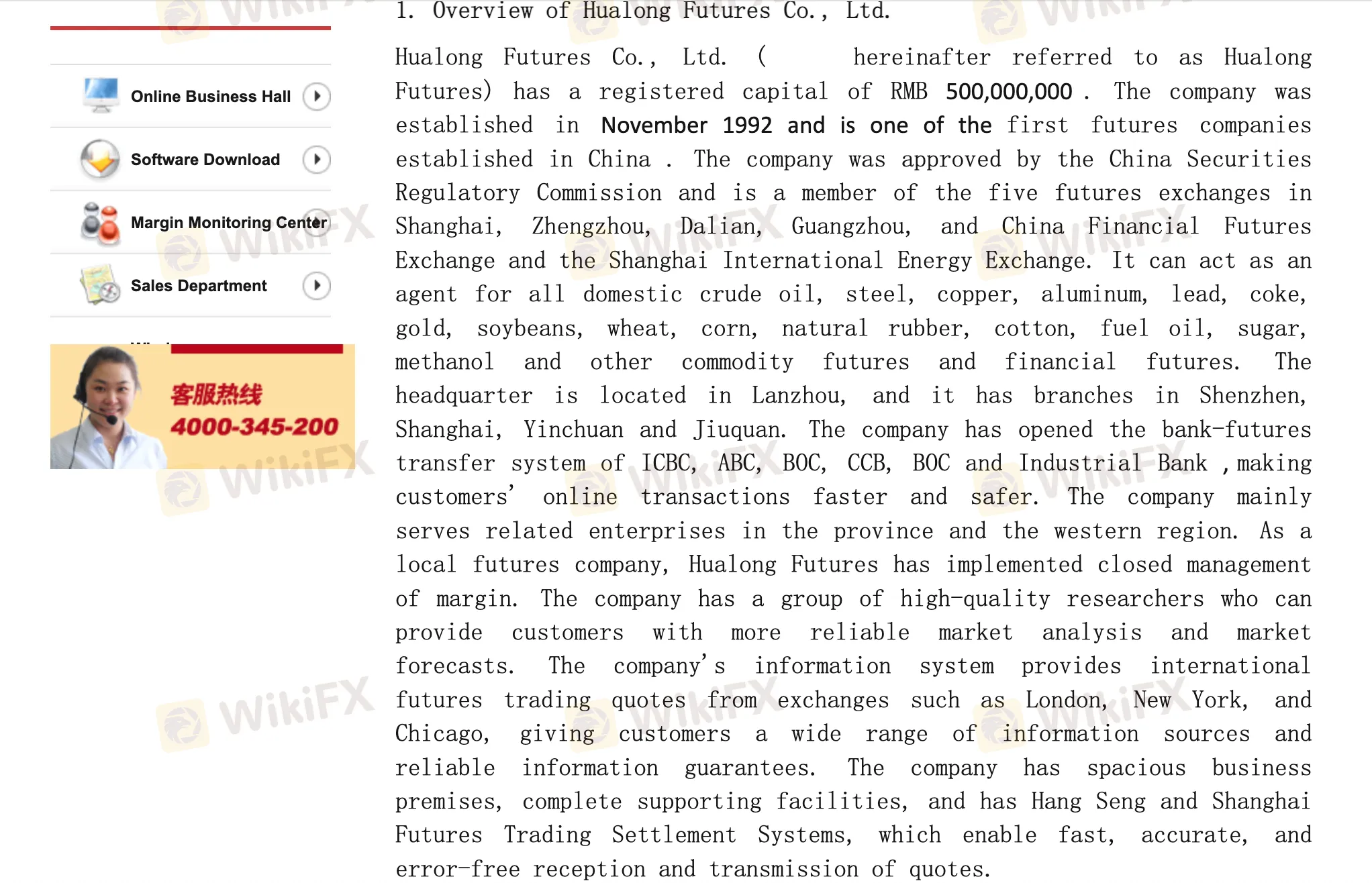

Описание компании

| CHINA DRAGON Обзор | |

| Основано | 2019 |

| Страна/Регион регистрации | Китай |

| Регуляция | CFFE (Регулируется) |

| Инструменты рынка | Фьючерсы |

| Демо-счет | ✅ |

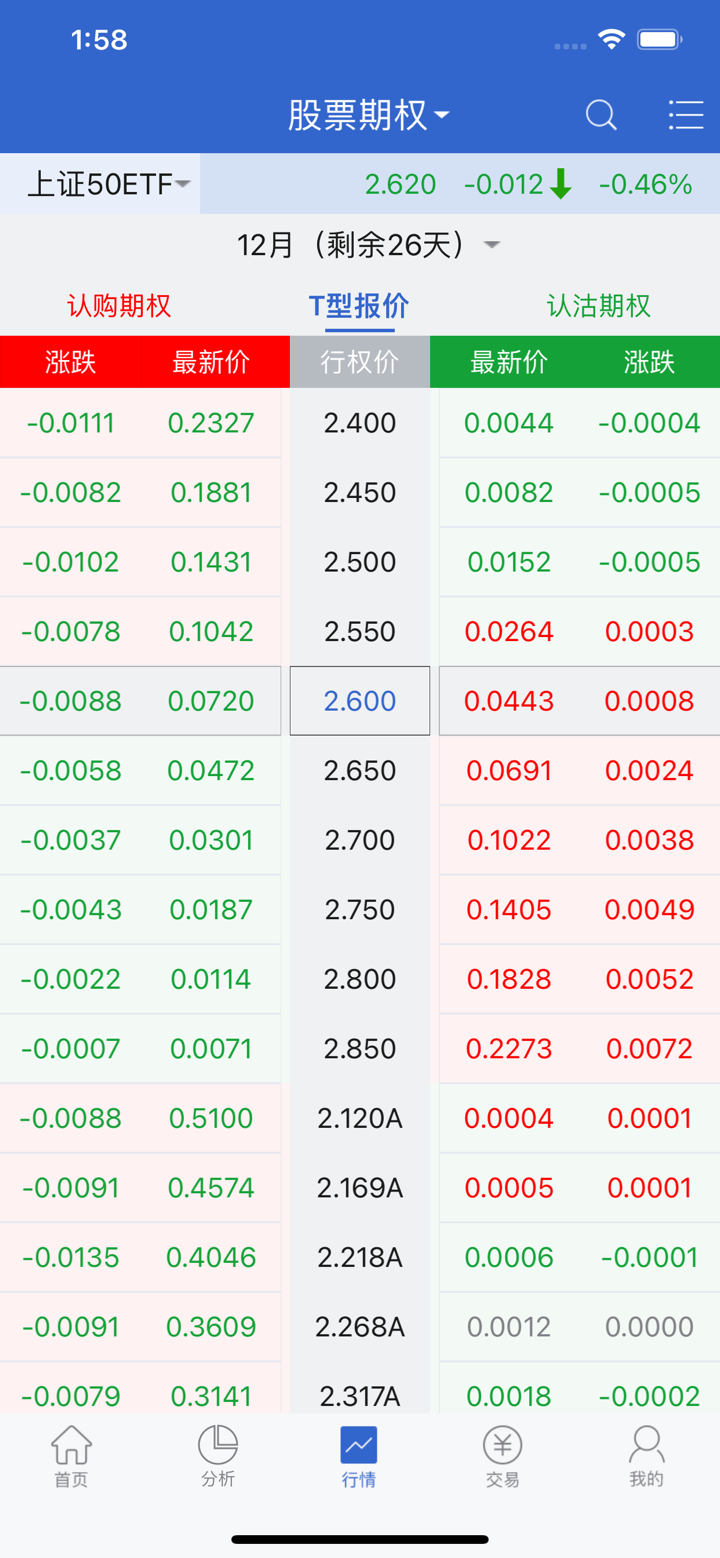

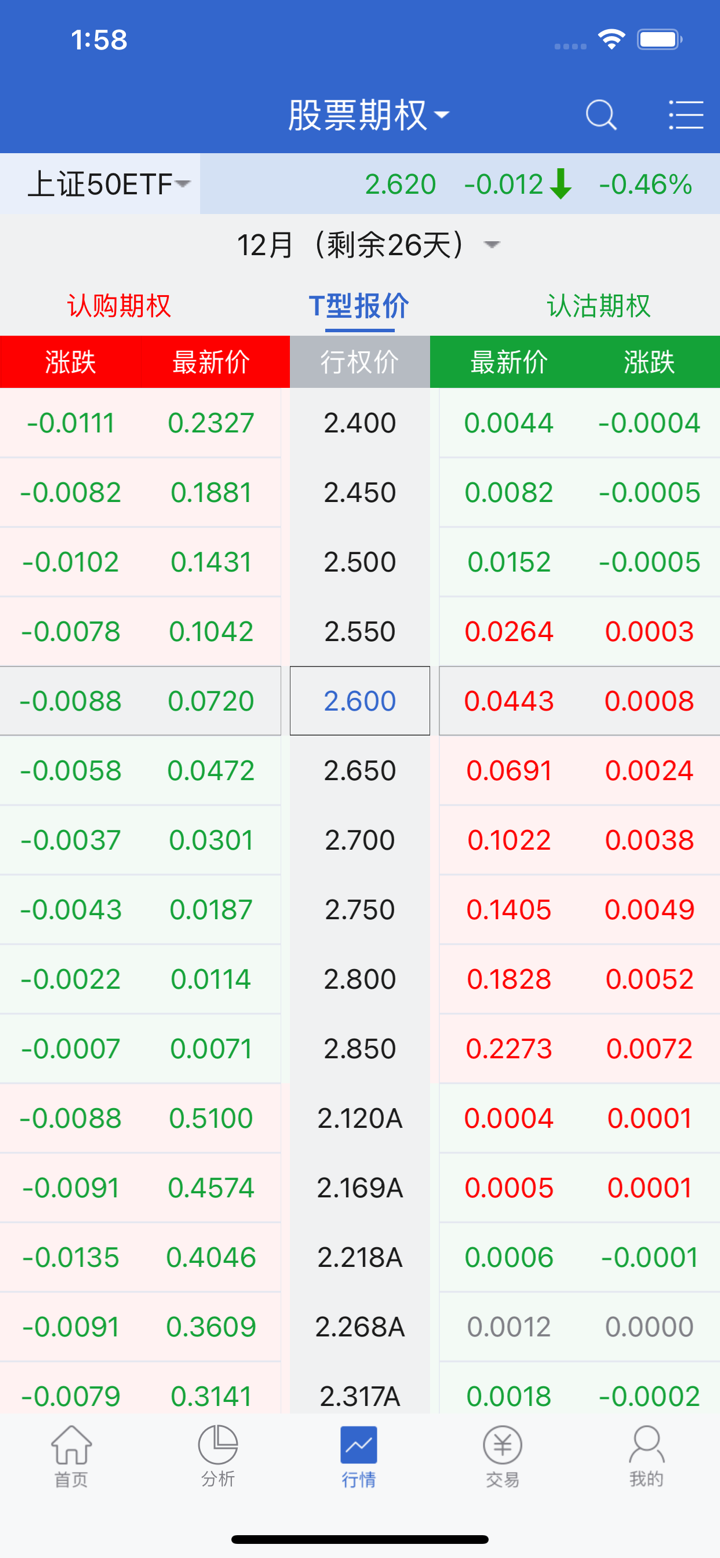

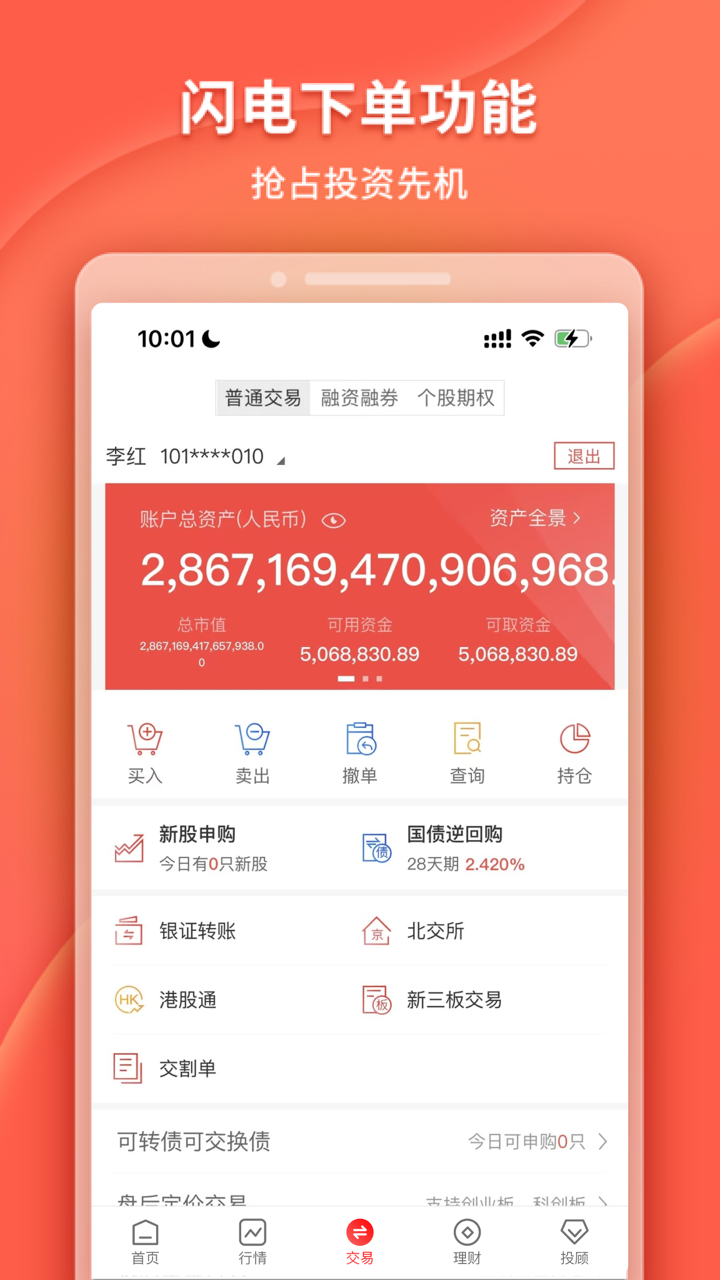

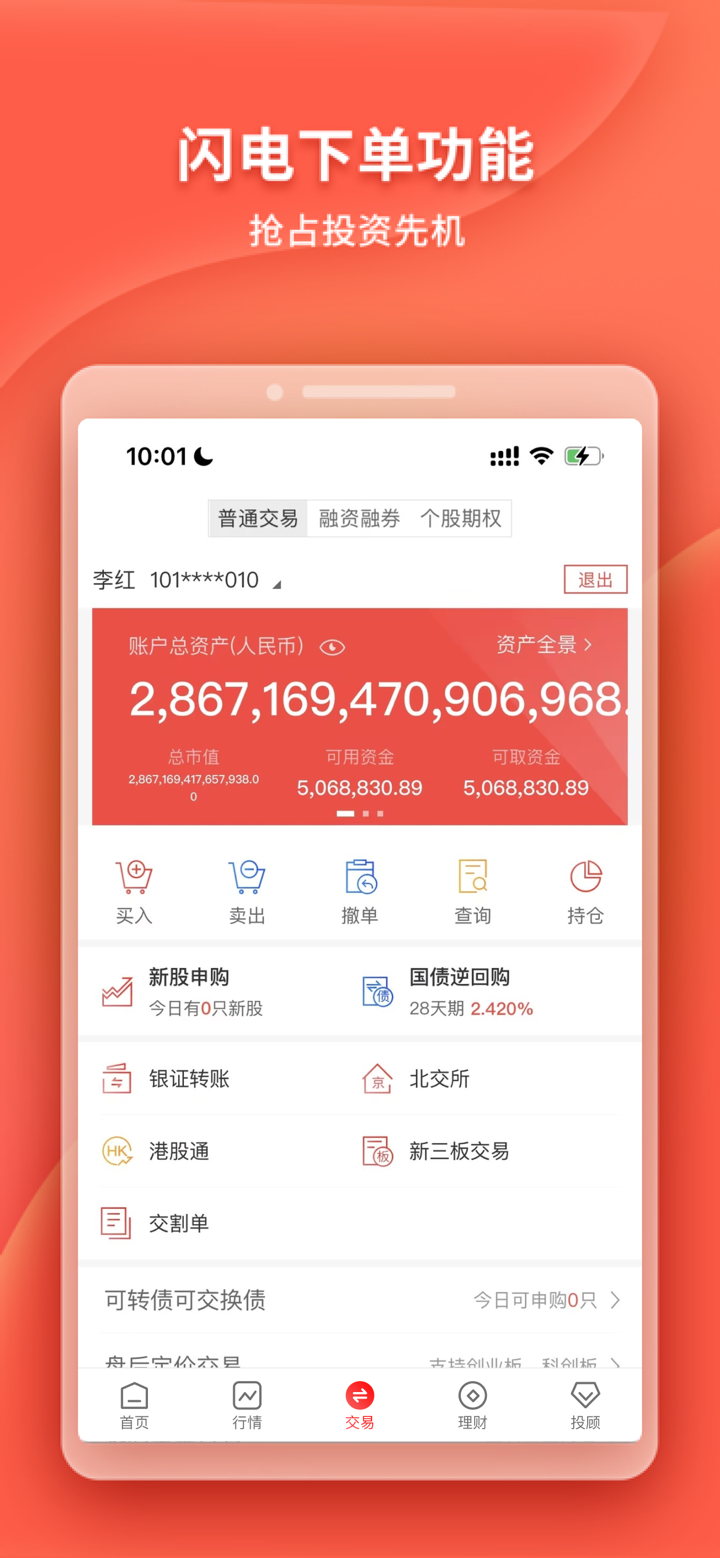

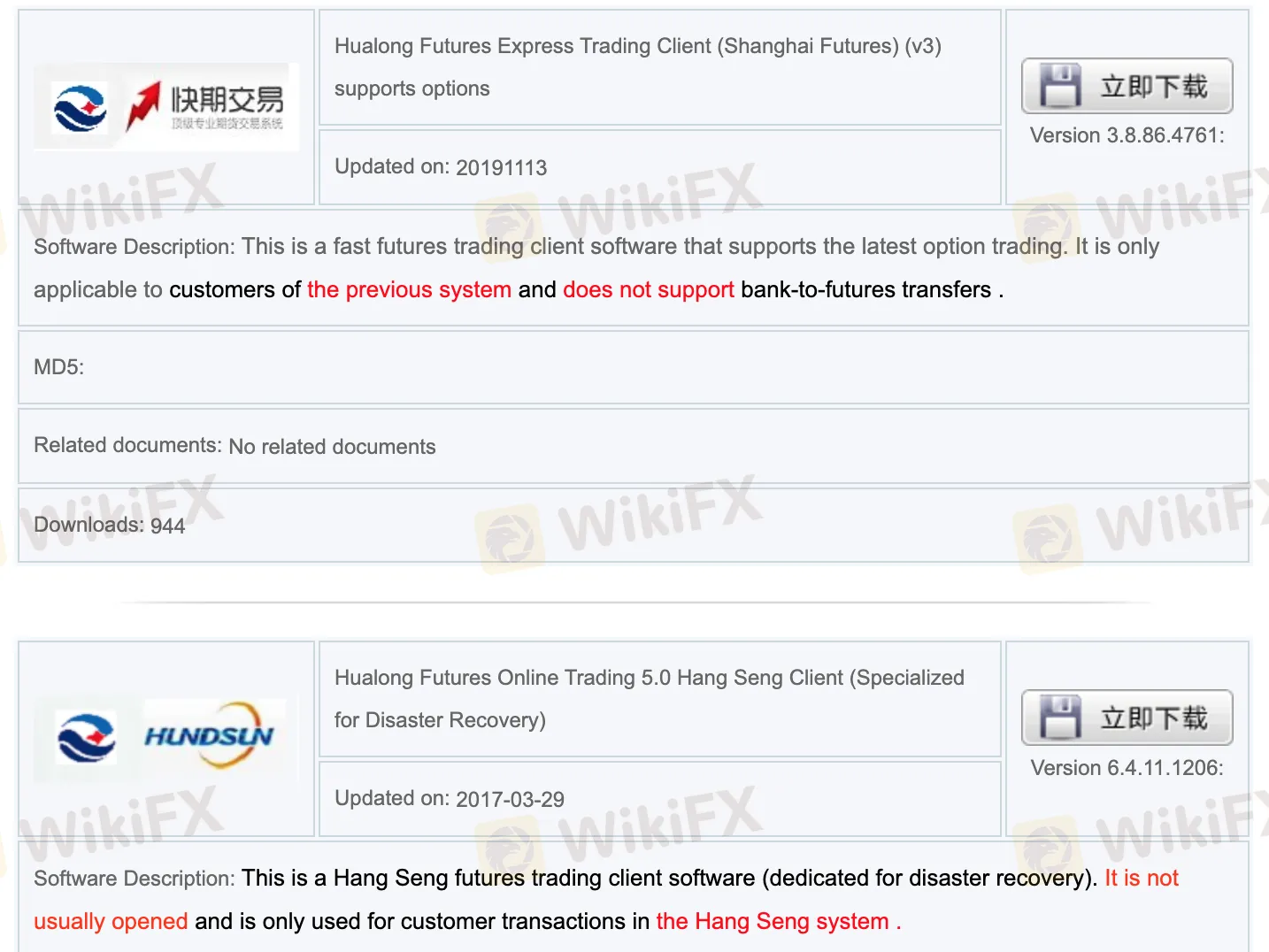

| Торговые платформы | Hualong Futures-Boyi Облачное программное обеспечение для торговли на рынке, Hualong Futures-Yingshun Облачное программное обеспечение для торговли на рынке HD-версия (wh6), Hualong Futures Онлайн-торговля UF2.0 Клиент Hang Seng, Hualong Zhixin Hang Seng Edition, Hualong Futures Boyi Edition, Hualong Futures Express Trading Client (Последний период), Hualong Futures Express Trading Client (Шанхайские фьючерсы) (v3) поддерживает опционы, Hualong Futures Онлайн-торговля 5.0 Клиент Hang Seng (Специализирован для восстановления после катастрофы), Hualong Futures-Yingshun Облачное программное обеспечение для торговли на рынке-версия IPV6, Hualong Futures Boyi Version (Версия для Android), Hualong Futures Boyi Version (Версия для IOS), Hualong Zhixin Hang Seng version (Версия для Android), Hualong Zhixin Hang Seng version (Версия для IOS), Мобильное приложение Wenhua Finance и др. |

| Поддержка клиентов | Тел: 0931-8894644; 0931-8894283 |

| Факс: 0931-8894198 | |

| Эл. почта: hlqh@hlqhgs.com | |

Информация о CHINA DRAGON

CHINA DRAGON - это регулируемый брокер, предлагающий торговлю фьючерсами на различных торговых платформах.

Плюсы и минусы

| Плюсы | Минусы |

| Разнообразные торговые платформы | Ограниченный выбор торговых продуктов |

| Демо-счета | Взимание маржинальных комиссий |

| Хорошо регулируется | Ограниченные варианты оплаты |

| Различные каналы поддержки клиентов |

CHINA DRAGON Легально?

Да. CHINA DRAGON лицензирован CFFEX для предоставления услуг.

| Страна регулирования | Регулятор | Текущий статус | Регулируемая сущность | Тип лицензии | Номер лицензии |

| Китайская финансовая фьючерсная биржа | Регулируется | 华龙期货股份有限公司 | Лицензия на фьючерсы | 0279 |

На что я могу торговать на CHINA DRAGON?

CHINA DRAGON предлагает торговлю фьючерсами.

| Торгуемые инструменты | Поддерживается |

| Фьючерсы | ✔ |

| Форекс | ❌ |

| Товары | ❌ |

| Индексы | ❌ |

| Акции | ❌ |

| Криптовалюты | ❌ |

| Облигации | ❌ |

| Опционы | ❌ |

| ETF | ❌ |

Тип счета

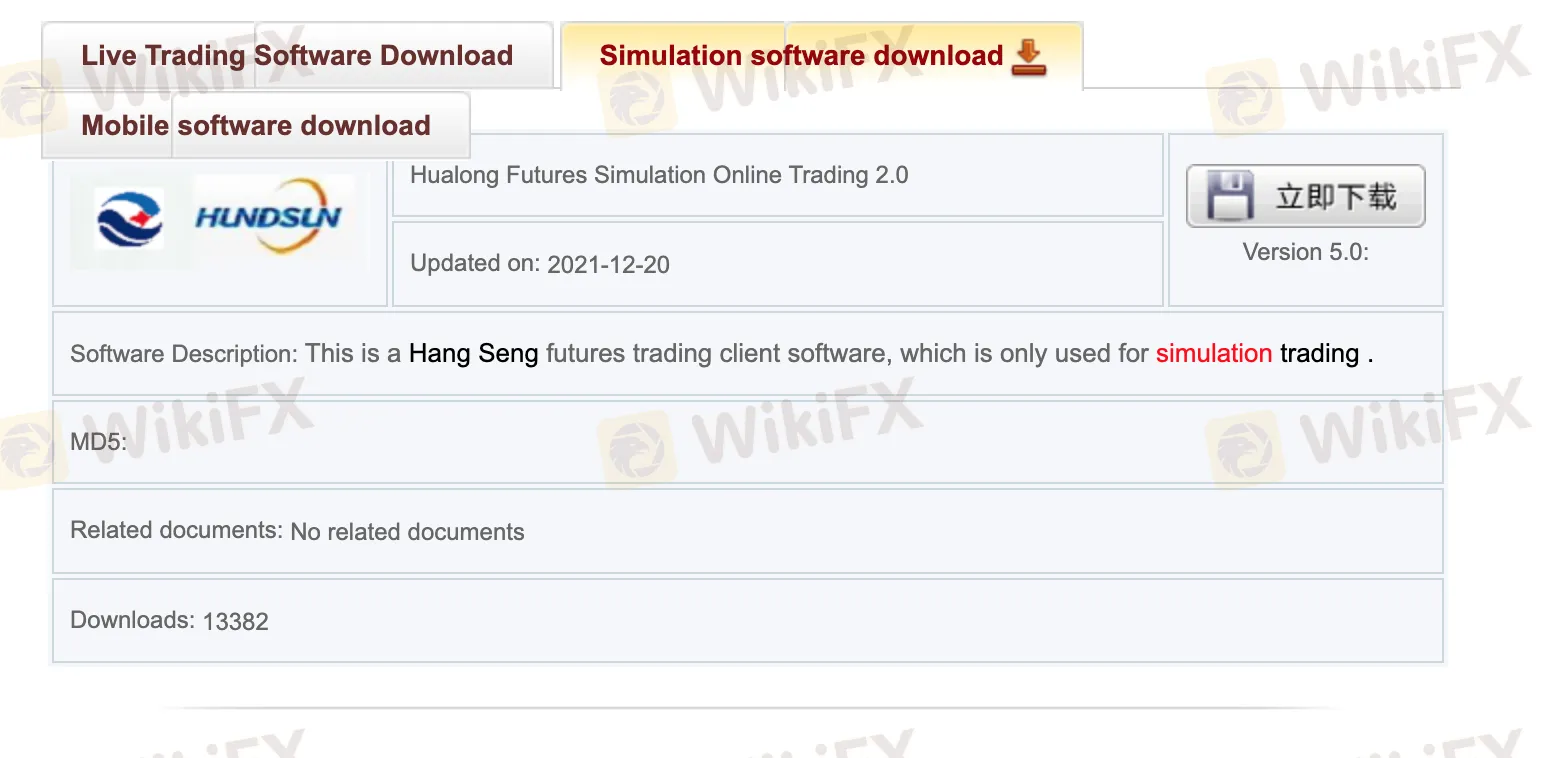

Брокер не четко указал типы счетов, которые предлагает. Клиенты могут скачать программное обеспечение для моделирования, чтобы открыть демо-счета.

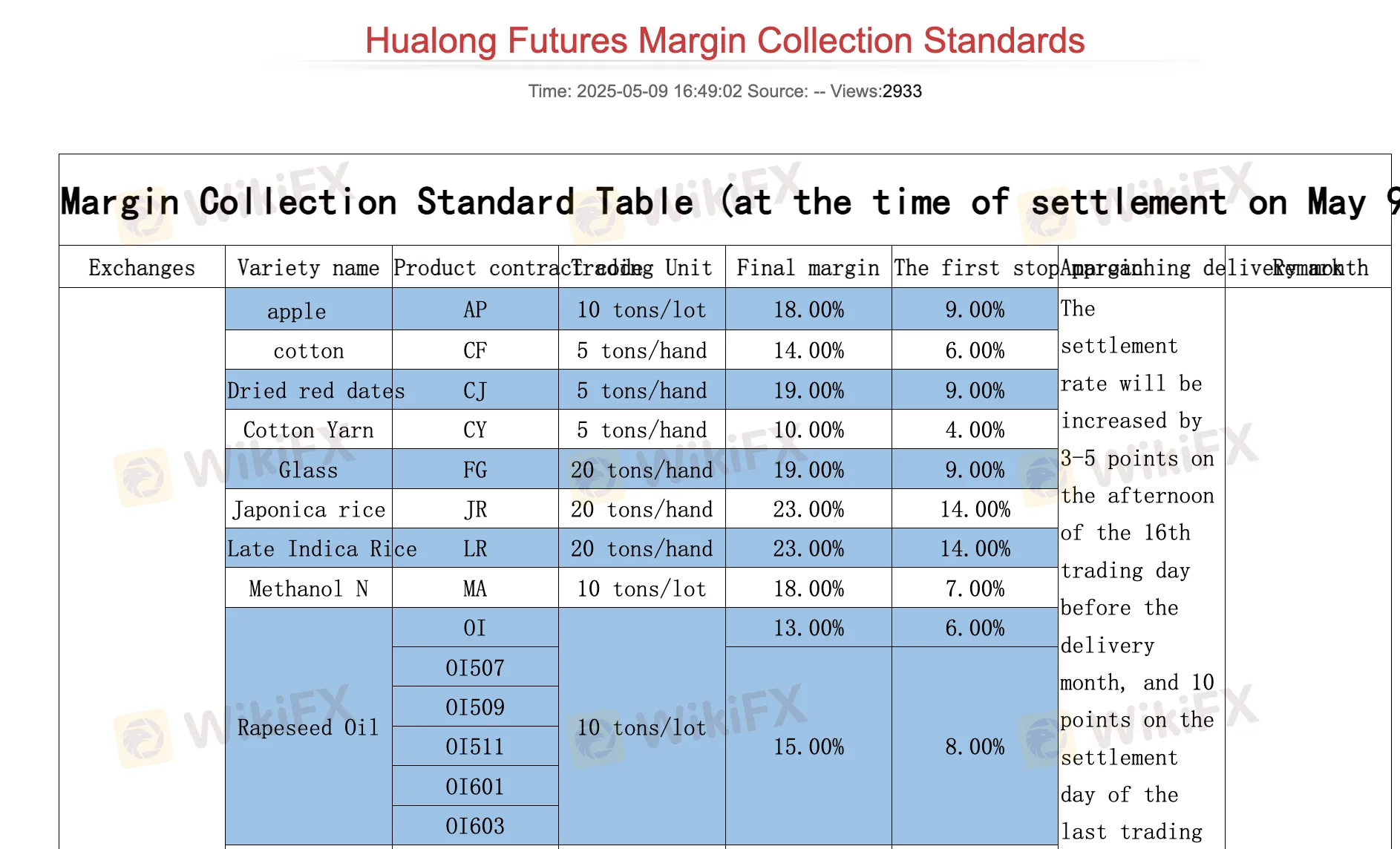

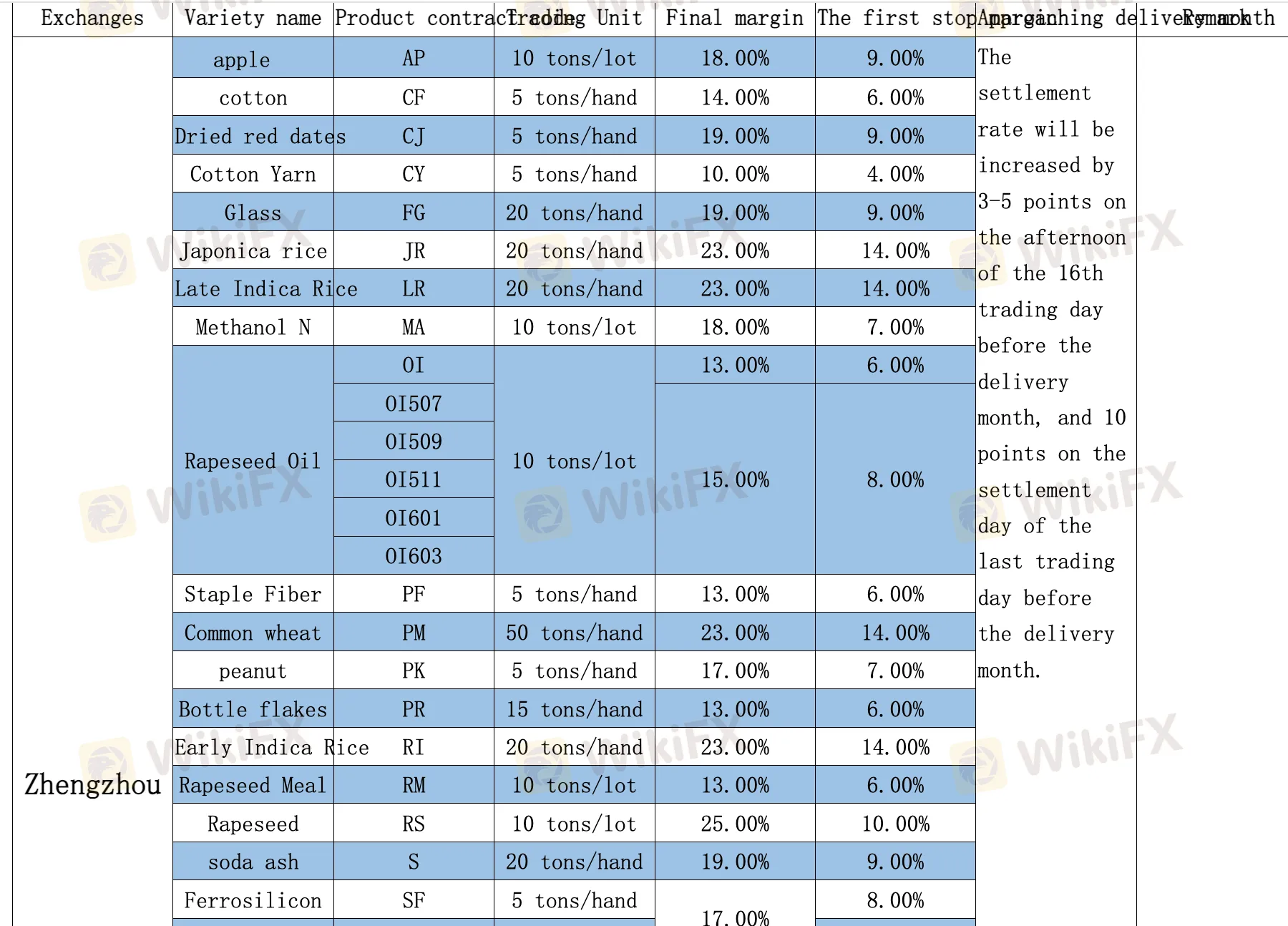

Комиссии CHINA DRAGON

Брокер взимает маржинальные сборы за различные торговые инструменты.

Торговая платформа

Брокер предоставляет различные торговые платформы, включая Hualong Futures-Boyi Cloud Market Trading Software, Hualong Futures-Yingshun Cloud Market Trading Software HD Version (wh6), Hualong Futures Online Trading UF2.0 Hang Seng Client, Hualong Zhixin Hang Seng Edition, Hualong Futures Boyi Edition, Hualong Futures Express Trading Client (Last Period), Hualong Futures Express Trading Client (Shanghai Futures) (v3) поддерживает опционы, Hualong Futures Online Trading 5.0 Hang Seng Client (специализирован для восстановления после катастрофы), Hualong Futures-Yingshun Cloud Market Trading Software-IPV6 Version, Hualong Futures Boyi Version (Android Version), Hualong Futures Boyi Version (IOS Version), Hualong Zhixin Hang Seng version (Android version), Hualong Zhixin Hang Seng version (IOS version) и Wenhua Finance Mobile App.

Доступные устройства: настольные и мобильные (IOS, Android).

Депозит и вывод средств

Брокер принимает платежи через банковский перевод. Минимальная сумма депозита или вывода не определена, и комиссии или сборы не указаны.

При выводе средств через перевод серебряных фьючерсов, если у клиентов нет позиций, они могут вывести полную сумму, но прибыль за день не может быть выведена. Если у клиентов есть сделки или позиции в тот же день, они могут переводить 70% доступных средств каждый раз и совершать вывод 5 раз подряд.