Présentation de l'entreprise

| TCM Résumé de l'examen | |

| Fondé | 2019 |

| Pays/Région Enregistré | Chypre |

| Régulation | CYSEC (Réglementé), FSCA (Clone Suspect) |

| Instruments de Marché | CFDs |

| Compte de Démo | ❌ |

| Effet de Levier | / |

| Spread | / |

| Plateforme de Trading | / |

| Dépôt Minimum | / |

| Support Client | Téléphone : +357 22 030446 |

| Email : info@tradecapitalmarkets.com | |

| Adresse de l'Entreprise : 148 Strovolos Avenue, 1er étage, CY 2048, Nicosie, Chypre | |

| Réseaux Sociaux : LinkedIn | |

| Restrictions Régionales | Japon, Canada, Espagne, Belgique, les États-Unis |

Informations sur TCM

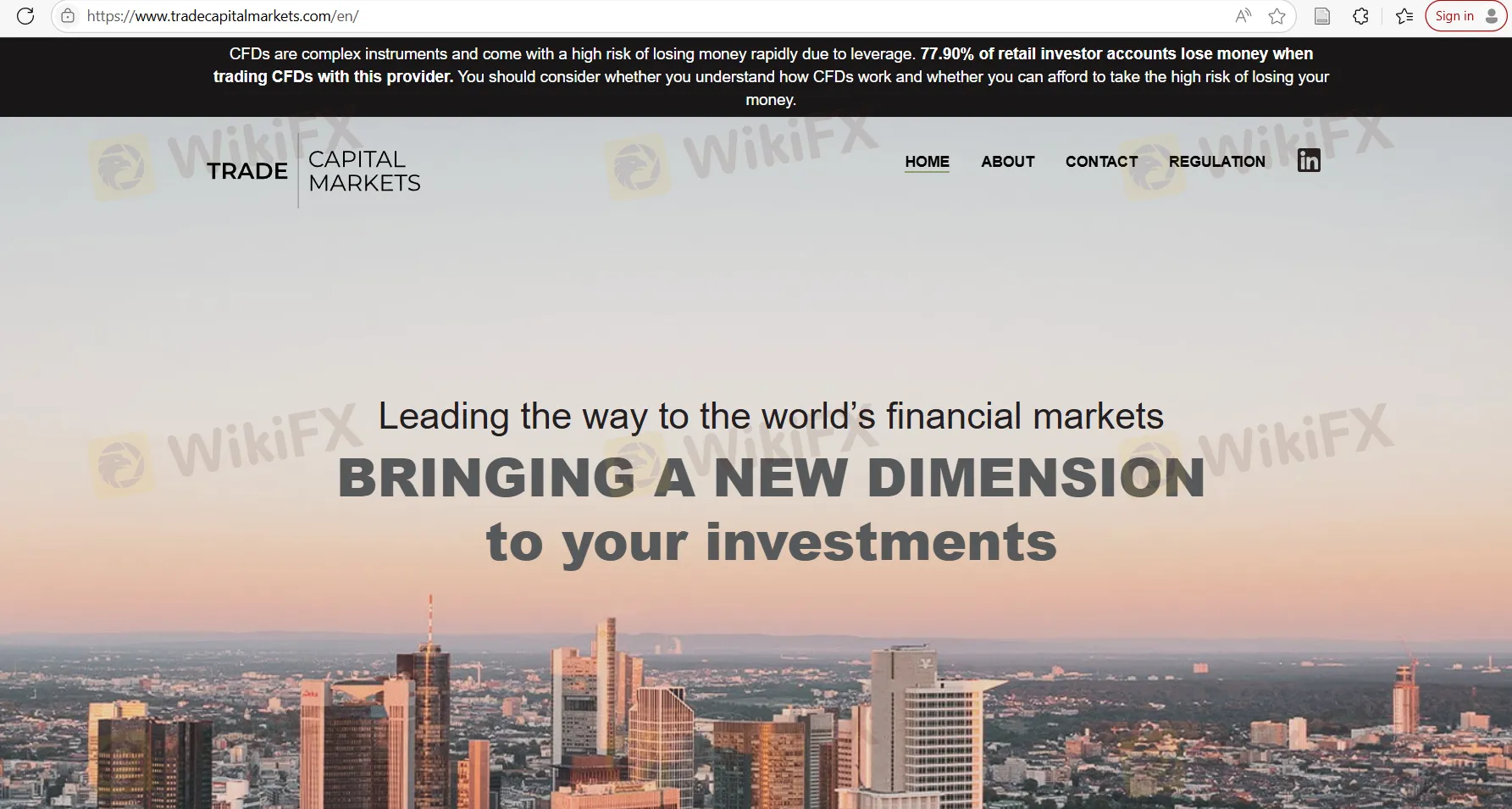

TCM (Trade Capital Markets) est une plateforme de trading en ligne basée à Chypre. TCM affirme fournir une large gamme de produits d'investissement et de services dans le trading de CFD. Cette plateforme est réglementée par la Commission des Valeurs Mobilières et des Changes de Chypre (CySEC) et l'Autorité de Conduite du Secteur Financier (FSCA), mais sa licence FSCA est suspectée d'être un clone frauduleux.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par CYSEC | Licence FSCA Clone Suspecte |

| Multiples canaux de contact | Restrictions Régionales |

| Comptes de démo non disponibles | |

| Structure de frais peu claire |

TCM Est-il Légitime ?

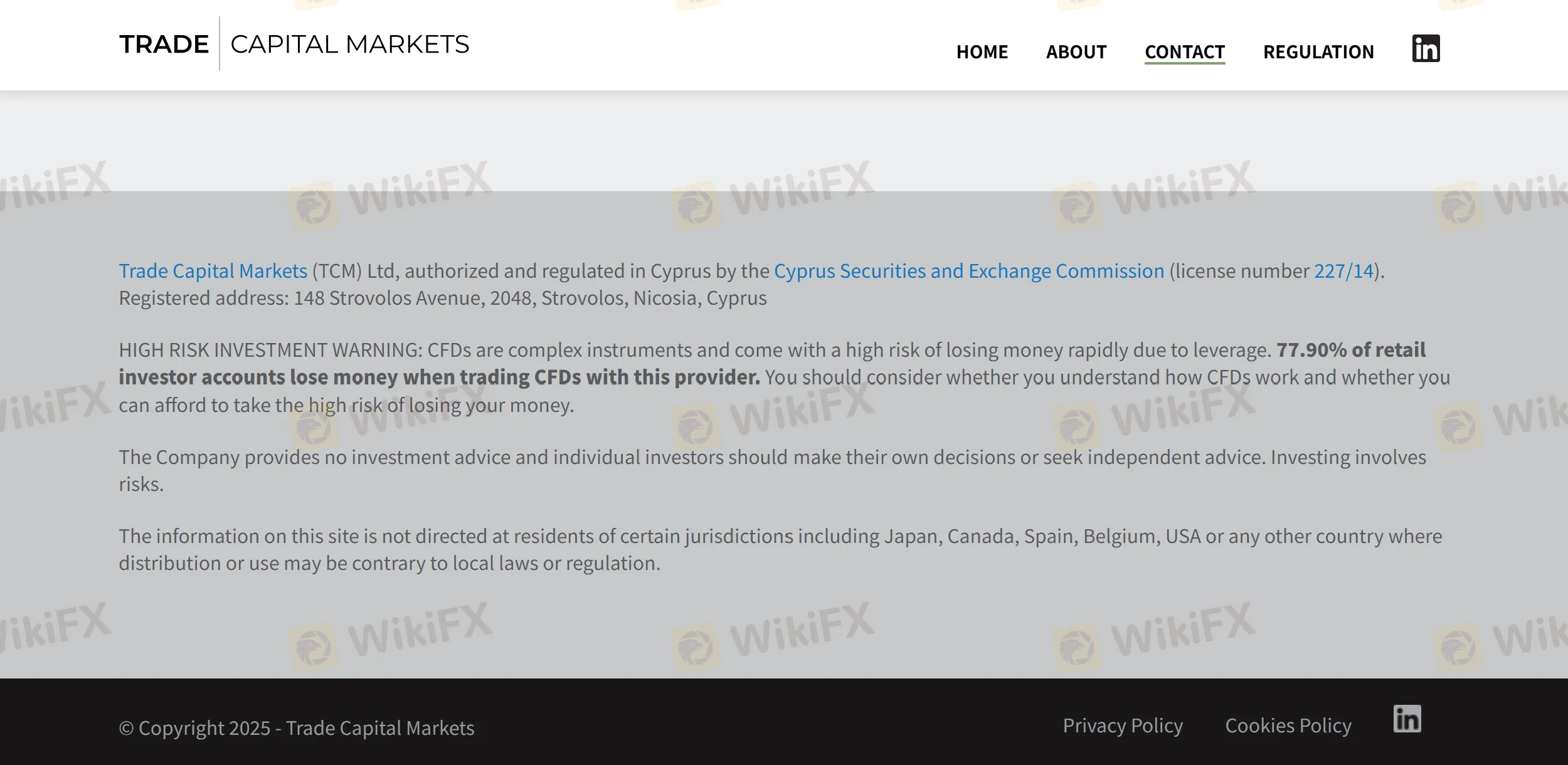

TCM est autorisé et réglementé à Chypre par la Commission des valeurs mobilières et des changes de Chypre (CySEC, numéro de licence 227/14). En attendant, TCM détient une licence de clone suspecte de la Financial Sector Conduct Authority (FSCA).

| Pays Réglementé | Autorité de Régulation | Statut Réglementaire | Entité Réglementée | Type de Licence | Numéro de Licence |

| Commission des valeurs mobilières et des changes de Chypre (CySEC) | Réglementé | Trade Capital Markets (TCM) Ltd | Teneur de Marché (MM) | 227/14 |

| Financial Sector Conduct Authority (FSCA) | Clone Suspect | TRADE CAPITAL MARKETS (TCM) LTD | Service Financier d'Entreprise | 47857 |

Enquête sur le Terrain WikiFX

L'équipe d'enquête sur le terrain de WikiFX a visité l'adresse de TCM à Chypre et nous avons trouvé son bureau physique sur place.

Que Puis-je Trader sur TCM?

TCM se spécialise dans le trading de CFD et prétend offrir une large gamme de produits d'investissement et de services de la plus haute qualité.

FX8831647032

Hong Kong

Ne soyez pas trompé

Divulgation

+95798

Hong Kong

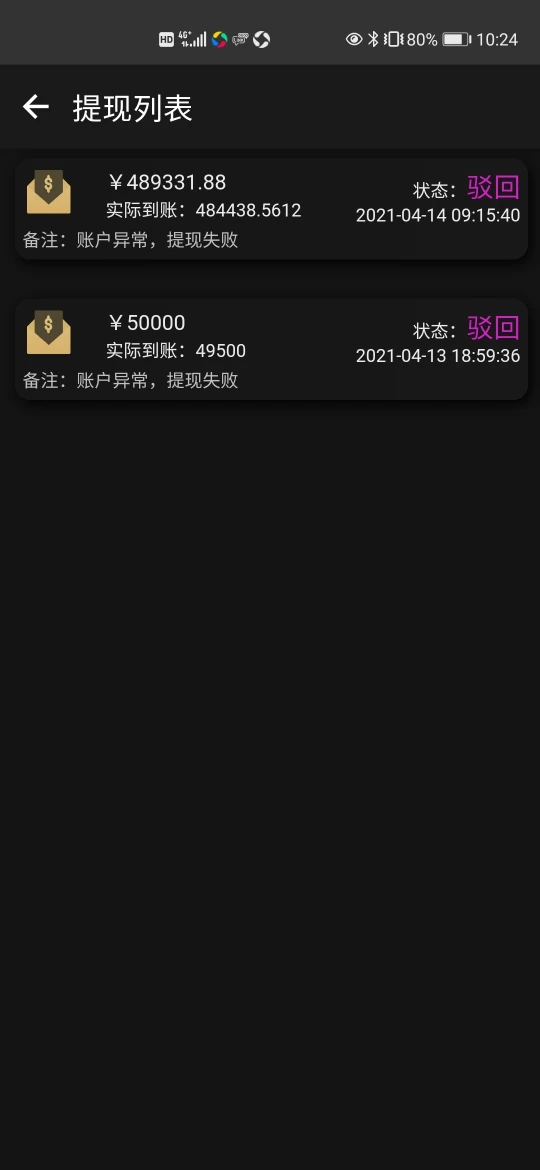

Impossible de retirer des fonds du tout. Comment puis-je obtenir mon principal. Ces deux personnes nous trompent.

Divulgation

( ・᷅ὢ・᷄ )Amy

Hong Kong

Polissez vos yeux et ne vous laissez pas tromper par la fraude. Vous devriez prendre un avertissement de notre part

Divulgation

xukrat

Nouvelle Zélande

TCM est un menteur complet. Ils disent que la plateforme est presque parfaite avant que vous ne déposiez, utilisent toutes sortes de mots pour vous tromper et vous ignorent, vous et votre demande de retrait après votre dépôt.

Positifs

涛哥33986

L'Espagne

D'une manière générale, je pense que les conditions de trading fournies par TCM sont très attrayantes, telles que des marges faibles et un effet de levier élevé, MT5, un compte de démonstration, une variété d'instruments de trading... Mais l'interface de licence réglementaire ne semble pas très fiable, j'ai décidé de ne pas ne prends pas ce risque.

Neutre