Présentation de l'entreprise

| Hicend Résumé de l'examen | |

| Fondé | 2008 |

| Pays/Région Enregistré | Chine |

| Régulation | CFFE (Réglementé) |

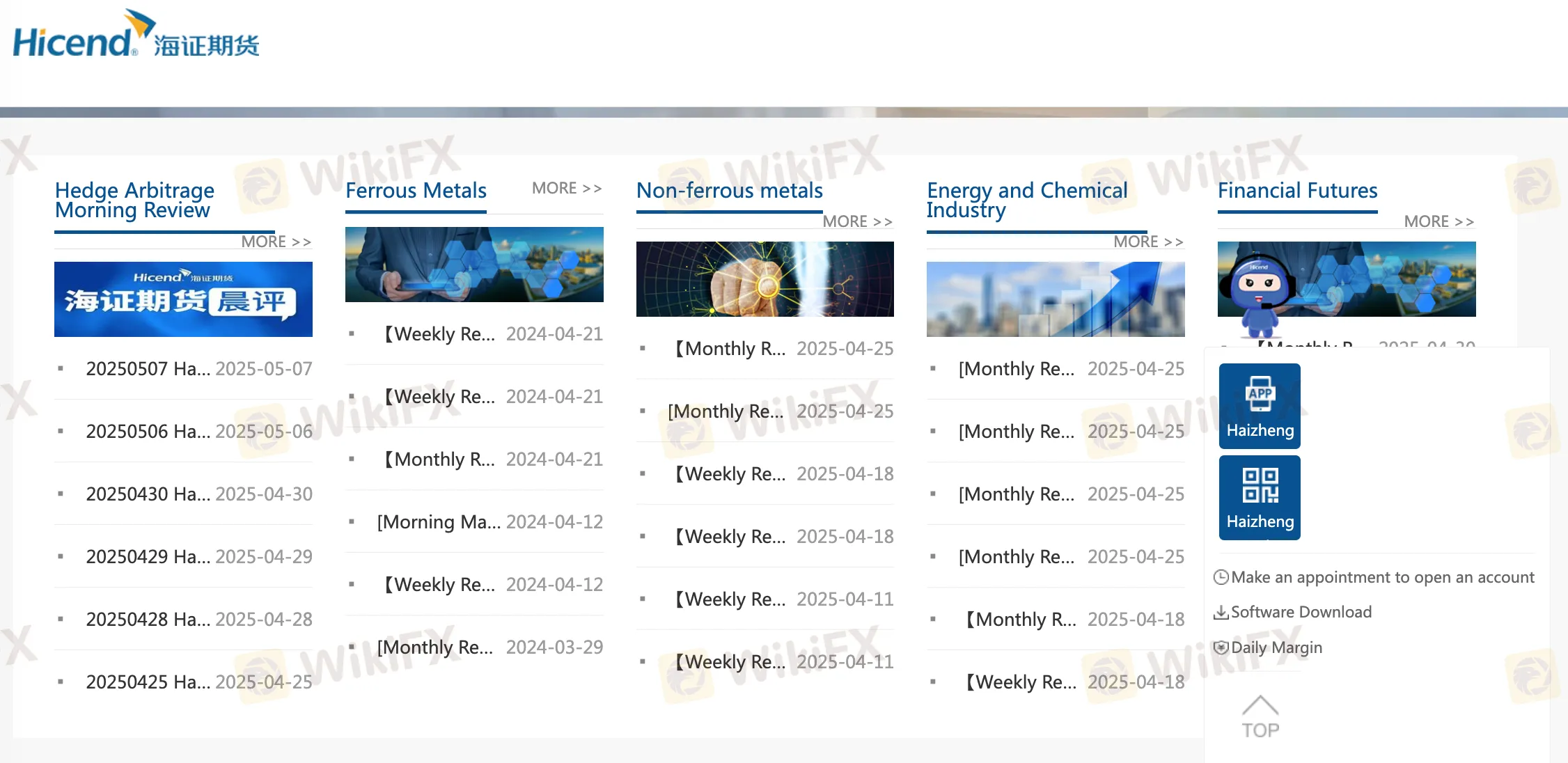

| Instruments de Marché | Futures, métaux, énergie et produits chimiques |

| Compte de Démo | ❌ |

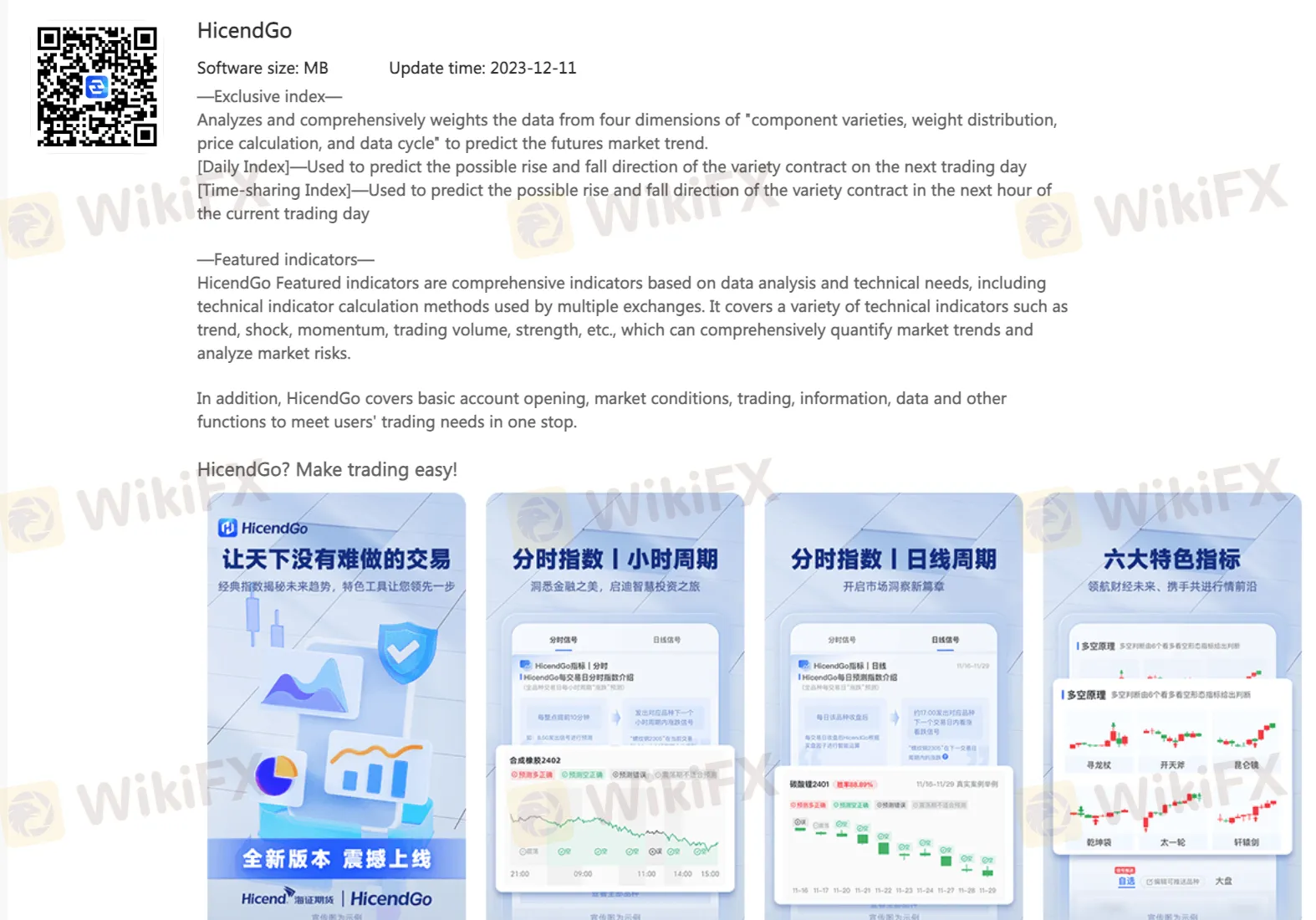

| Plateforme de Trading | Fast Trading Terminal V2, Unlimited Easy Client, Esunny Client 8.5, Esunny Client 8.3, Sui Xin Yi (pour la compétition en temps réel uniquement), Lightning King, HicendGo, Shanghai Securities and Futures, HSI Futures, Mandarin Travel, Pocket Precious Metals, Yixing APP, Quick Issue APP, Dalian Financial News, Quhe APP |

| Support Client | Chat en direct |

| Tél : 400-880-8998 ; 021-60169066/9058 | |

| Email : hzqh@hicend.com.cn | |

Informations sur Hicend

Hicend est un courtier réglementé, offrant des transactions sur les contrats à terme, les métaux, l'énergie et les produits chimiques sur différentes plateformes de trading.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Diverses plateformes de trading | Pas de comptes de démonstration |

| Bien réglementé | Frais d'application et de traitement facturés |

| Divers canaux de support client | |

| Longue durée d'exploitation | |

| Support de chat en direct |

Hicend est-il Légitime ?

Oui. Hicend est autorisé par le CFFEX à fournir des services.

| Pays Réglementé | Régulateur | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| Bourse des contrats à terme financiers de Chine | Réglementé | Hicend有限公司 | Licence de Futures | 0155 |

Sur Quoi Puis-je Trader sur Hicend ?

Hicend propose le trading sur les contrats à terme, les métaux, l'énergie et les produits chimiques.

| Instruments négociables | Pris en charge |

| Métaux | ✔ |

| Énergie et produits chimiques | ✔ |

| Contrats à terme | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptos | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Type de compte

Hicend n'a pas clairement indiqué les types de compte qu'il propose. Les clients peuvent trader sur cinq grandes bourses à terme avec un seul compte.

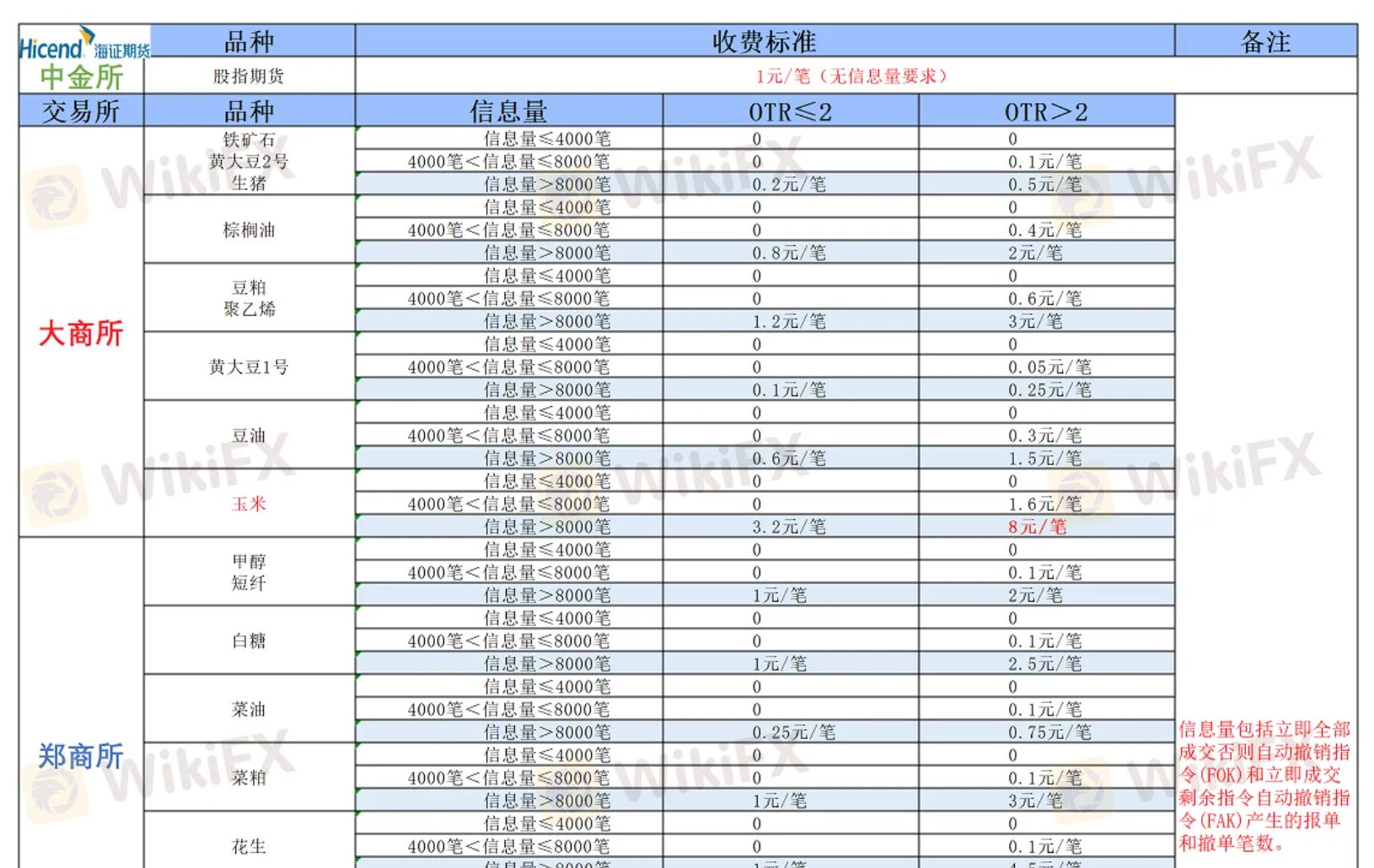

Frais de Hicend

Hicend exige des frais de demande et des frais de gestion lors des transactions.

Plateforme de trading

Hicend propose différentes plateformes de trading, y compris Fast Trading Terminal V2, Unlimited Easy Client, Esunny Client 8.5, Esunny Client 8.3, Sui Xin Yi (pour la compétition en temps réel uniquement), Lightning King, HicendGo, Shanghai Securities and Futures, HSI Futures, Mandarin Travel, Pocket Precious Metals, Yixing APP, Quick Issue APP, Dalian Financial News et Quhe APP.

Appareils disponibles : bureau et mobile.