基礎資訊

賽普勒斯

賽普勒斯天眼評分

賽普勒斯

|

10-15年

|

賽普勒斯

|

10-15年

| https://www.tradecapitalmarkets.com/en

官方網址

評分指數

影響力

D

影響力指數 NO.1

烏克蘭 2.66

烏克蘭 2.66單核

1G

40G

1M*ADSL

賽普勒斯

賽普勒斯 tradecapitalmarkets.com

tradecapitalmarkets.com 英國

英國

| TCM 檢討摘要 | |

| 成立年份 | 2019 |

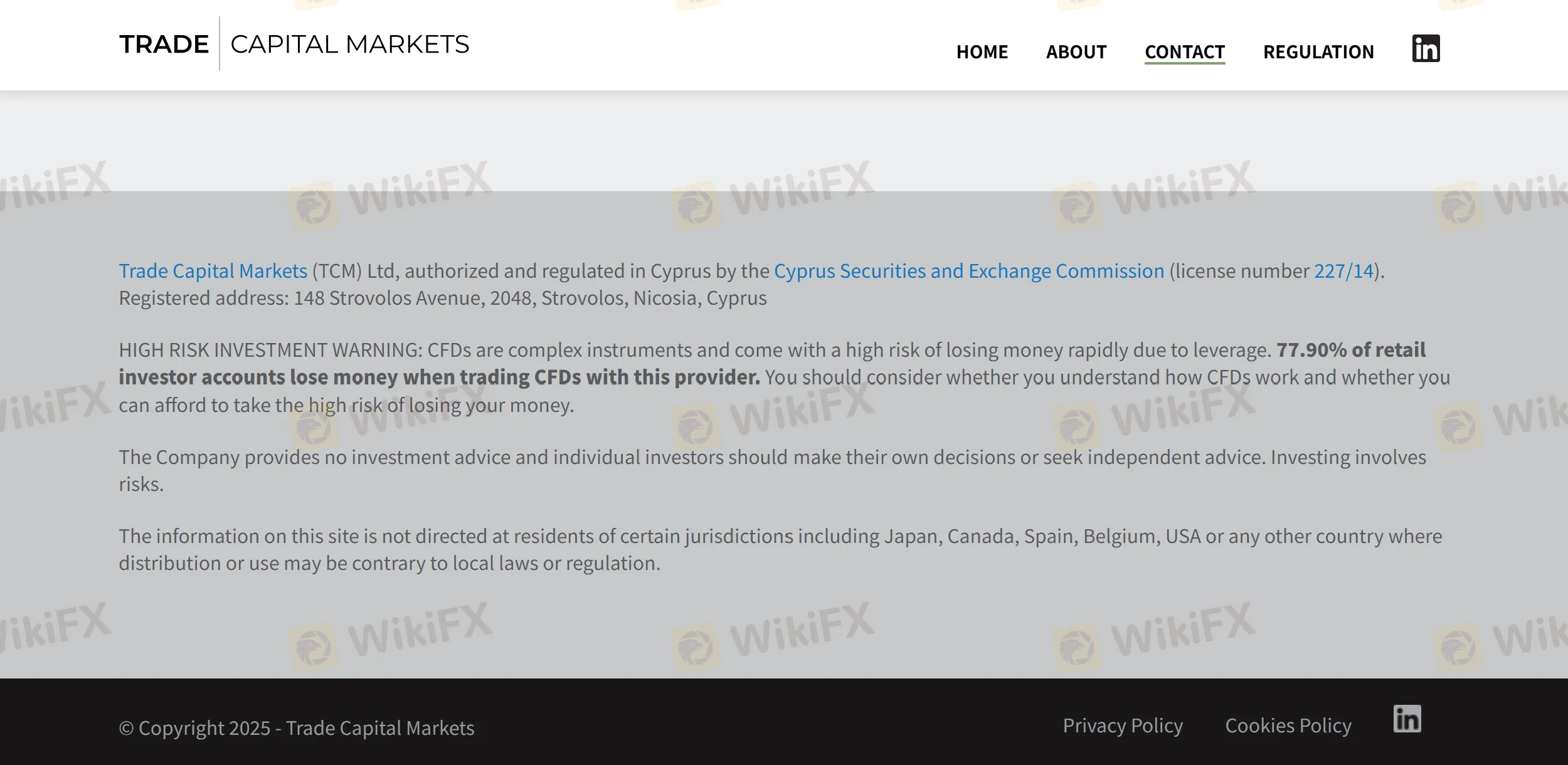

| 註冊國家/地區 | 塞浦路斯 |

| 監管 | CYSEC(受監管),FSCA(可疑副本) |

| 市場工具 | 差價合約(CFDs) |

| 模擬帳戶 | ❌ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | 電話:+357 22 030446 |

| 電郵:info@tradecapitalmarkets.com | |

| 公司地址:148 Strovolos Avenue, 1st floor, CY 2048, 尼科西亞, 塞浦路斯 | |

| 社交媒體:LinkedIn | |

| 區域限制 | 日本、加拿大、西班牙、比利時、美國 |

TCM(Trade Capital Markets)是一家位於塞浦路斯的線上交易平台。TCM 宣稱在差價合約(CFD)交易中提供多種投資產品和服務。該平台已獲塞浦路斯證券交易委員會(CySEC)和金融行為監管局(FSCA)監管,但其FSCA許可證被懷疑是偽造的副本。

| 優點 | 缺點 |

| CYSEC 監管 | 可疑副本 FSCA 許可證 |

| 多種聯絡渠道 | 區域限制 |

| 無模擬帳戶 | |

| 收費結構不清晰 |

TCM在塞浦路斯獲得塞浦路斯證券交易委員會(CySEC,牌照號碼227/14)的授權和監管。與此同時,TCM還持有金融行為監管局(FSCA)的可疑克隆牌照。

| 監管國家 | 監管機構 | 監管狀態 | 受監察實體 | 牌照類型 | 牌照號碼 |

| 塞浦路斯證券交易委員會(CySEC) | 受監管 | Trade Capital Markets(TCM)有限公司 | 市場製造商(MM) | 227/14 |

| 金融行為監管局(FSCA) | 可疑克隆 | TRADE CAPITAL MARKETS(TCM)有限公司 | 金融服務公司 | 47857 |

WikiFX現場調查團隊訪問了TCM在塞浦路斯的地址,我們發現了其實際辦公室。

TCM專注於差價合約(CFD)交易,並聲稱提供各種投資產品和服務,擁有最高質量標準。

Based on my analysis and experience evaluating brokers, I want to be transparent about what I discovered with Trade Capital Markets. Unfortunately, the information regarding specific deposit and withdrawal fees is not clearly outlined in the available context. As a trader, clarity around fee structures is essential, since even minor, unexpected charges can erode trading profits over time. What concerns me is that this lack of disclosure about deposit and withdrawal charges makes it difficult to accurately assess the true cost of trading with this broker. In my own practice, I always look for brokers that provide full transparency about all potential fees, especially regarding moving funds in and out of trading accounts. An unclear fee structure raises yellow flags for me, since it could mean hidden costs or future complications with withdrawing funds. It's notable that some user feedback highlighted issues with withdrawals and trust, signalling another area for caution. Therefore, without explicit confirmation from official or customer-facing resources about their fee policy, I would personally approach funding or withdrawing from Trade Capital Markets with caution. Whenever fee details are ambiguous, I make direct contact with a broker’s official support before committing any funds, ensuring I understand all possible costs and withdrawal conditions. This conservative approach is, in my view, critical for responsible risk management.

From my own experience and careful research into Trade Capital Markets, I have found that this broker does not currently offer a free demo account. For me, demo accounts are a critical tool in evaluating a platform’s trading conditions and risk management tools—especially before committing real funds. The absence of a demo account is a notable downside because it prevents traders like myself from testing the broker’s MT4 platform, order execution, and spreads in a risk-free environment. Moreover, not having access to a demo account raises concerns about transparency. A reputable broker would typically provide this option as a standard practice to help users become comfortable with their systems. Without it, I would exercise caution and recommend that others consider if they are comfortable trading live without any prior experience on the platform. The lack of a demo also makes it difficult to gauge if there are hidden restrictions, such as time limits, as no such option is available in the first place. In my view, a demo account is not just a convenience; it is essential for trust and proper risk assessment. Therefore, this omission is a significant factor to weigh before deciding whether to open an account with Trade Capital Markets.

In my experience as an independent trader, there are certain advantages to trading with Trade Capital Markets, but they come with notable caveats. The first benefit for me is that Trade Capital Markets is regulated by CySEC in Cyprus. While regulatory oversight does not fully guarantee safety, I always consider it a baseline requirement for any broker I use, as it typically entails some degree of client protection and periodic oversight. Another advantage is their offering of the MetaTrader 4 (MT4) platform with a full license. MT4's reliability and widespread adoption are consequential for me as a trader, as it supports robust execution and access to automated trading systems and technical analysis tools. This familiarity provides a measure of confidence and efficiency in managing trades. Lastly, the company’s established operating history—over a decade in the industry—suggests operational stability. For me, longevity sometimes signals that a broker has weathered various market conditions, which I interpret as a cautious sign of resilience. However, I must emphasize that ongoing concerns over suspicious licensing in other jurisdictions and multiple user reports about withdrawal difficulties require very careful risk assessment before committing significant funds. Ultimately, while Trade Capital Markets has attributes I look for in a broker, the benefits only outweigh the risks if your due diligence and risk management protocols are strictly observed.

As someone who takes risk management and cost transparency seriously in my trading, I always investigate brokers’ fee structures thoroughly before opening an account. With Trade Capital Markets, I found that their WikiFX profile does not provide explicit details about inactivity fees or the conditions under which such fees might be charged. For me, this lack of clarity raises important caution flags—especially since an unclear fee structure is expressly noted as a drawback in the available information. From my experience, undefined or hidden inactivity charges can negatively impact long-term profitability, particularly for traders who do not trade continuously or who prefer to hold positions over extended periods. In this case, the absence of clear policy statements about inactivity fees means I cannot confidently determine the exact circumstances in which such charges could apply or the amount that might be deducted from idle accounts. Given the regulatory ambiguity noted with a suspicious clone FSCA license and several withdrawal-related complaints from users, I would strongly recommend contacting Trade Capital Markets directly via their official channels for a written confirmation of all potential account maintenance or inactivity-related costs before proceeding. For me, this is a necessary step to ensure there are no surprises that could compromise my capital or trading flexibility with this broker.

請輸入...

FX8831647032

中國

千万不要受骗千万不要受骗

爆料

+95798

中國

根本就不能提现。要怎么样才可以要回本金。这两个人都害死人了。

爆料

( ・᷅ὢ・᷄ )Amy

中國

擦亮眼睛不要上当了,骗子骗子,我们都是前车之鉴

爆料

xukrat

新西蘭

中醫是個徹頭徹尾的騙子。他們在你入金之前就說平台近乎完美,各種花言巧語騙你,入金之後不理你和你的提現請求。

好評

涛哥33986

西班牙

總的來說,我覺得TCM提供的交易條件非常有吸引力,比如低保證金和高槓桿、MT5、模擬賬戶、各種交易工具……但是監管牌照接口似乎不太靠譜,我決定不要冒這個險。

中評