Resumo da empresa

| DGCX Resumo da Revisão | |

| Fundação | 2005 |

| País/Região Registrada | Emirados Árabes Unidos |

| Regulação | Sem regulação |

| Instrumentos de Mercado | Moedas, Ações, Hidrocarbonetos, Metais |

| Conta Demonstrativa | / |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | Cinnober (por Nasdaq) via FIX API |

| Depósito Mínimo | / |

| Suporte ao Cliente | Tel: +971 4361 1600 |

| Email: info@dgcx.ae | |

Informações sobre DGCX

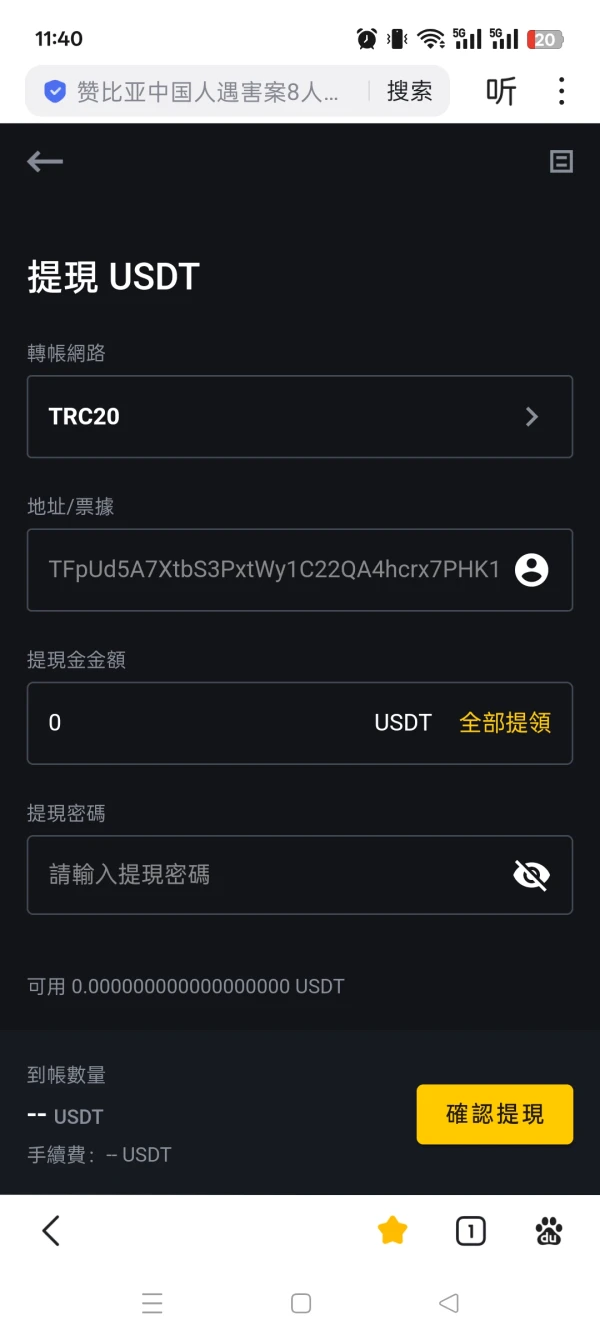

DGCX é uma bolsa de derivativos com sede nos Emirados Árabes Unidos, fundada em 2005, oferecendo negociação de contratos futuros em moedas, metais, hidrocarbonetos e ações. Opera em uma plataforma institucional robusta (Cinnober por Nasdaq), mas é principalmente acessível para membros e não é amigável para o varejo.

Prós e Contras

| Prós | Contras |

| Ampla variedade de instrumentos futuros | Sem regulação |

| Tabela de taxas transparente | Altas taxas de negociação e associação |

| Presença regional forte nos mercados do Oriente Médio | Informações limitadas sobre condições de negociação |

DGCX é Legítimo?

DGCX (Dubai Gold & Commodities Exchange) está sediado em Dubai e opera sob a supervisão do Dubai Multi Commodities Centre (DMCC). No entanto, não possui licença de nenhum dos principais reguladores financeiros internacionais, como a FCA (Reino Unido), ASIC (Austrália) ou NFA (EUA).

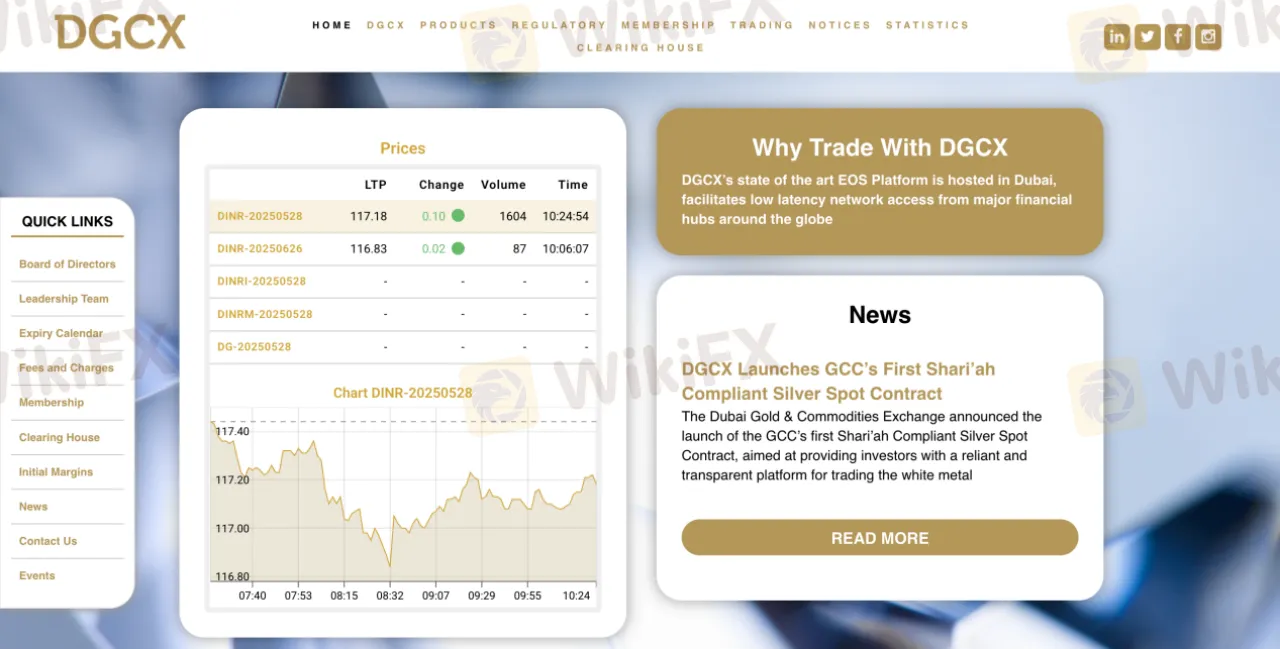

O domínio dgcx.com foi registrado em 18 de janeiro de 2002 e expirará em 18 de janeiro de 2027. Foi atualizado pela última vez em 30 de agosto de 2024. O domínio está atualmente em um estado bloqueado que impede exclusão, renovação, transferência ou atualizações. Seus servidores de nome estão listados sob Bodis, o que sugere que o site pode estar estacionado ou inativo.

O Que Posso Negociar na DGCX?

DGCX oferece um total de 4 tipos de produtos, que incluem uma variedade de pares de moedas, futuros de metais, contratos de hidrocarbonetos e instrumentos relacionados a ações.

| Instrumentos Negociáveis | Suportado |

| Moedas | ✔ |

| Ações | ✔ |

| Hidrocarbonetos | ✔ |

| Metais | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

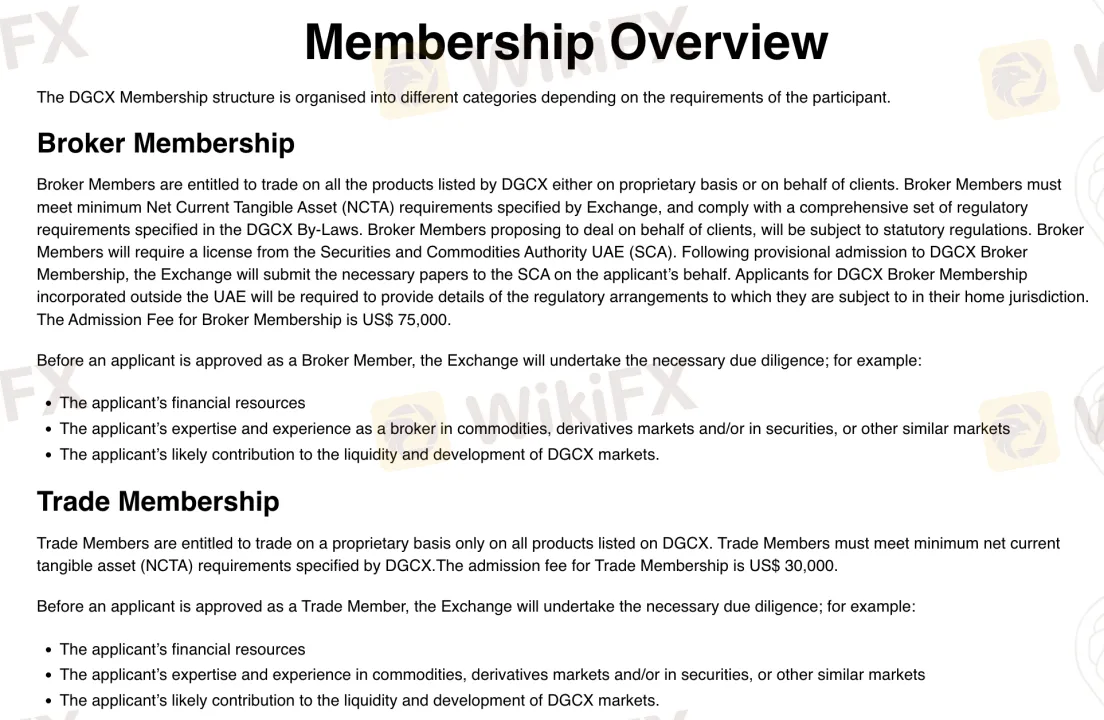

Associação

| Associação | Taxa de Inscrição | Recurso | Adequado para |

| Associação de Corretor | $75,000 | Negociar em nome de clientes; requer licença SCA | Corretores licenciados, empresas financeiras |

| Associação de Negociação | $30,000 | Negociar apenas para conta própria | Traders institucionais ou proprietários |

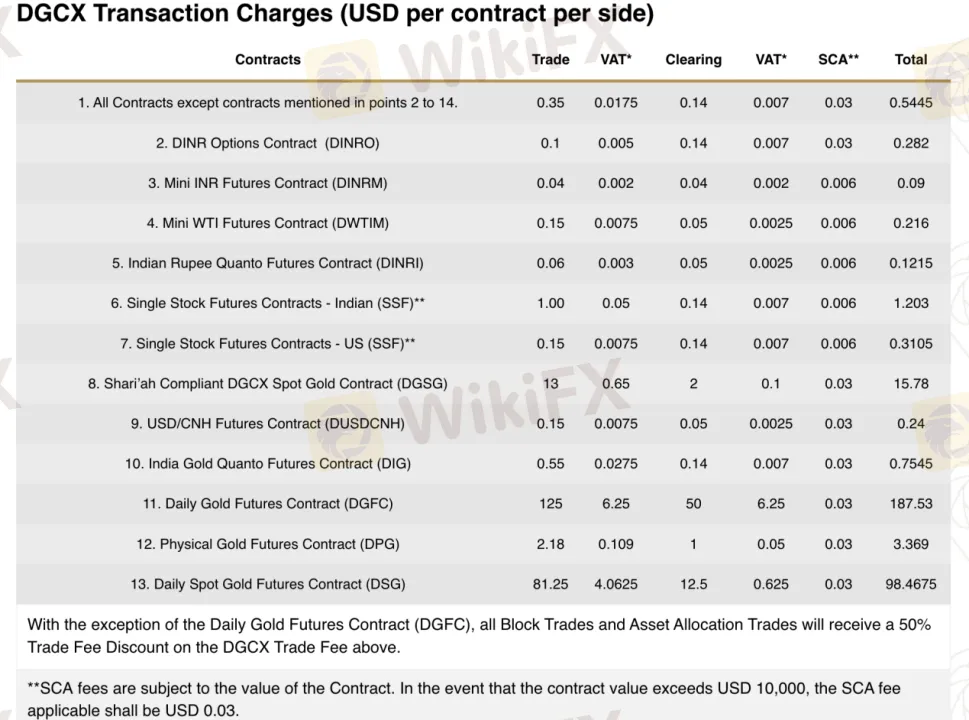

Taxas DGCX

As taxas de negociação do DGCX são altas em comparação com corretores de varejo típicos, especialmente para metais preciosos. Isso é esperado, já que o DGCX opera como uma bolsa de futuros de nível institucional, em vez de um corretor de CFD de varejo. O DGCX cobra taxas fixas por contrato por lado. Essas taxas variam por produto.

| Contrato | Taxa de Negociação | Taxa de Compensação | Total (Excl. VAT/SCA) |

| Contrato Futuro Diário de Ouro (DGFC) | $125.00 | $50.00 | $175.00 |

| Contrato Futuro Mini INR (DINRM) | $0.04 | $0.04 | $0.08 |

| Contrato Futuro USD/CNH (DUSDCNH) | $0.15 | $0.05 | $0.20 |

| Contrato Futuro de Ações Individuais - Indiano (SSF) | $1.00 | $0.14 | $1.14 |

| Contrato de Ouro Spot Shariah (DGSG) | $13.00 | $2.00 | $15.00 |

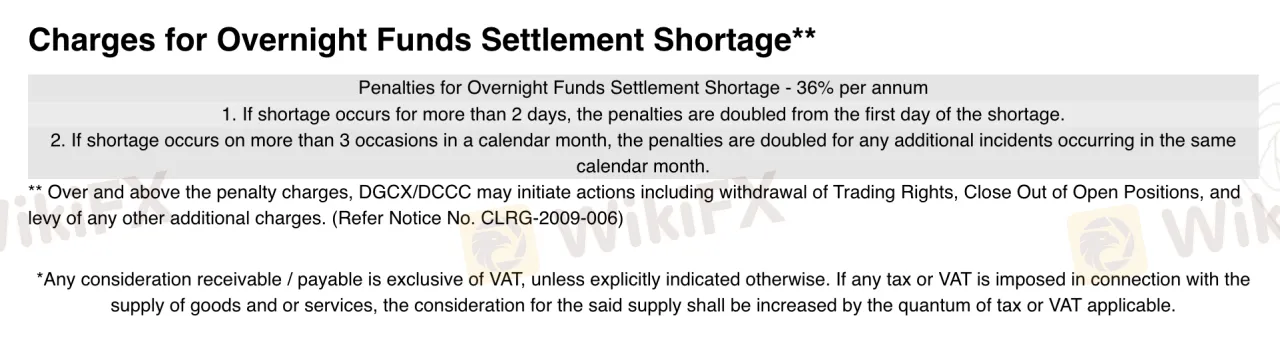

Taxas de Swap

DGCX não aplica taxas de swap tradicionais como as usadas por corretores de CFD de varejo. Em vez disso, cobra uma penalidade por falta de liquidação de fundos durante a noite a uma taxa de 36% ao ano.

| Condição | Penalidade |

| Taxa de penalidade padrão | 36% ao ano |

| Falta dura mais de 2 dias | Penalidade dobrada a partir do dia 1 |

| Mais de 3 faltas em um mês calendário | Penalidades futuras dobradas |

| Consequências adicionais | Perda de direitos de negociação, fechamento forçado de posições |

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Cinnober (by Nasdaq) | ✔ | Desktop / Sistemas Institucionais (via FIX API) | Traders institucionais e profissionais que necessitam de acesso direto ao mercado |