Şirket özeti

| DGCX İnceleme Özeti | |

| Kuruluş Yılı | 2005 |

| Kayıtlı Ülke/Bölge | Birleşik Arap Emirlikleri |

| Düzenleme | Düzenleme yok |

| Piyasa Araçları | Para Birimleri, Hisse Senetleri, Hidrokarbonlar, Metaller |

| Deneme Hesabı | / |

| Kaldıraç | / |

| Spread | / |

| İşlem Platformu | Cinnober (Nasdaq tarafından) FIX API aracılığıyla |

| Minimum Yatırım | / |

| Müşteri Desteği | Tel: +971 4361 1600 |

| E-posta: info@dgcx.ae | |

DGCX Bilgileri

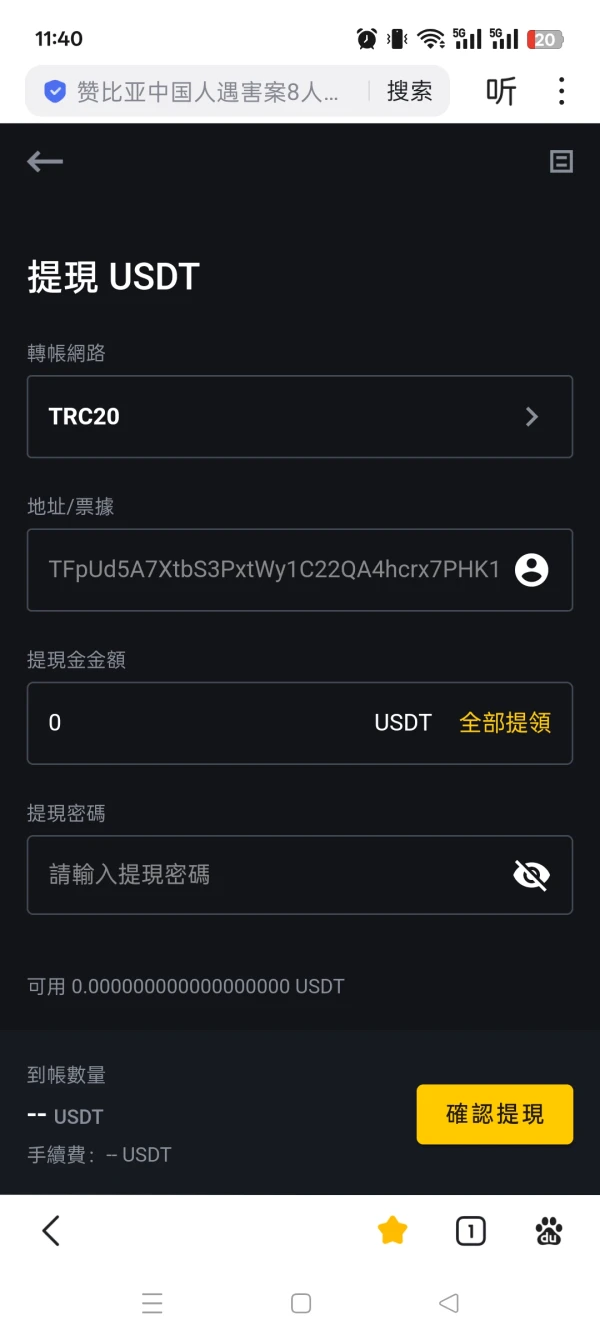

DGCX, 2005 yılında kurulan Birleşik Arap Emirlikleri merkezli bir türevler borsası olup para birimleri, metaller, hidrokarbonlar ve hisse senetleri üzerine vadeli işlem sözleşmelerinde işlem yapmaktadır. Güçlü bir kurumsal platformda (Nasdaq tarafından Cinnober) faaliyet göstermektedir ancak genellikle üyelere yöneliktir ve perakende yatırımcı dostu değildir.

Artıları ve Eksileri

| Artılar | Eksiler |

| Geniş vadeli enstrüman yelpazesi | Düzenleme yok |

| Şeffaf ücret tarifesi | Yüksek işlem ve üyelik ücretleri |

| Orta Doğu pazarlarında güçlü bir varlık | İşlem koşulları hakkında sınırlı bilgi |

DGCX Güvenilir mi?

DGCX (Dubai Gold & Commodities Exchange), Dubai merkezli olup Dubai Multi Commodities Centre (DMCC) denetimi altında faaliyet göstermektedir. Bununla birlikte, FCA (İngiltere), ASIC (Avustralya) veya NFA (ABD) gibi önemli uluslararası finansal düzenleyicilerden herhangi bir lisansa sahip değildir.

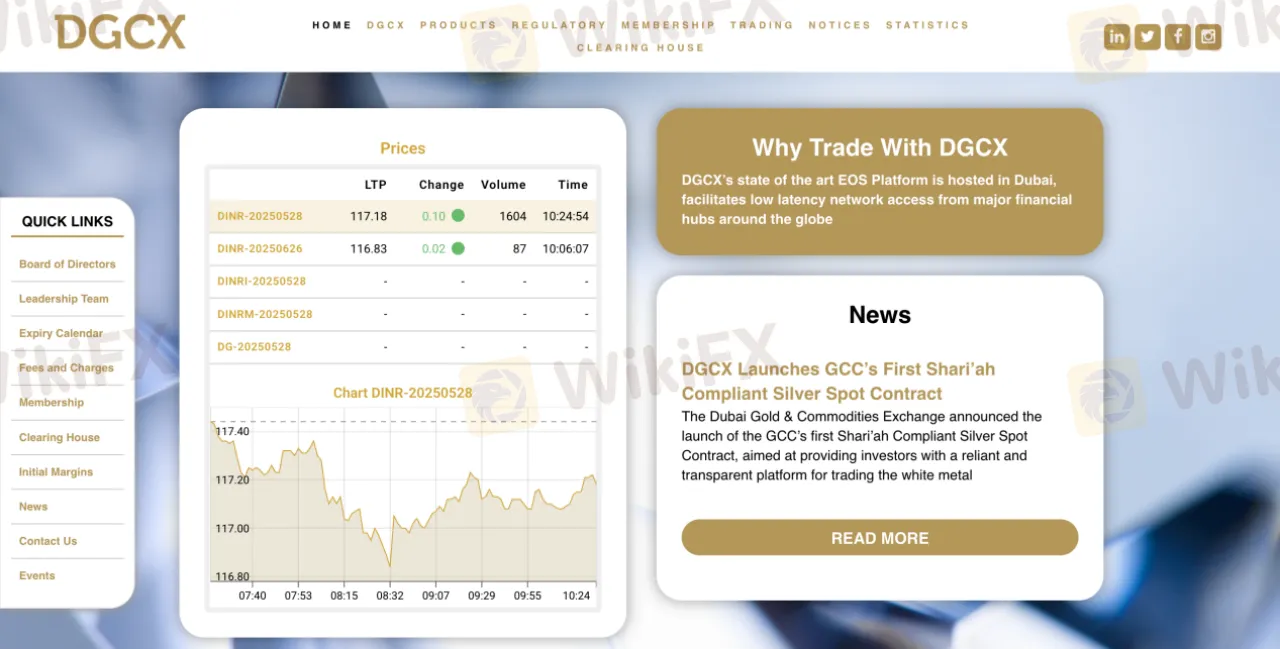

Alan adı dgcx.com, 18 Ocak 2002 tarihinde kaydedildi ve 18 Ocak 2027 tarihinde sona erecektir. Son olarak 30 Ağustos 2024 tarihinde güncellendi. Alan adı şu anda silmeyi, yenilemeyi, transfer etmeyi veya güncellemeyi engelleyen kilitli bir durumdadır. Ad sunucuları Bodis altında listelenmiştir, bu da sitenin park edilmiş veya etkin olmadığını düşündürebilir.

DGCX Üzerinde Ne İşlem Yapabilirim?

DGCX toplamda 4 tür ürün sunmaktadır, bunlar çeşitli döviz çiftleri, metal vadeli işlemler, hidrokarbon sözleşmeleri ve hisse senediyle ilgili enstrümanları içermektedir.

| İşlem Yapılabilir Enstrümanlar | Desteklenen |

| Dövizler | ✔ |

| Hisse Senetleri | ✔ |

| Hidrokarbonlar | ✔ |

| Metaller | ✔ |

| Forex | ❌ |

| Emtialar | ❌ |

| Endeksler | ❌ |

| Hisse Senetleri | ❌ |

| Kripto Paralar | ❌ |

| Bono ve Tahviller | ❌ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |

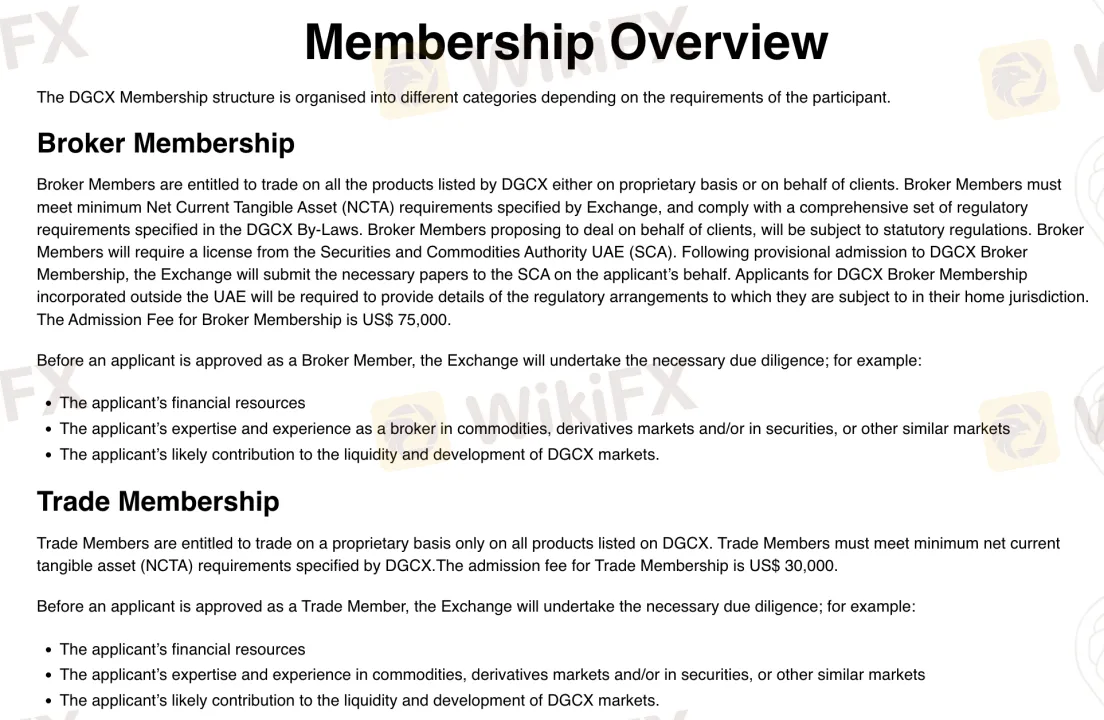

Üyelik

| Üyelik | Başvuru Ücreti | Özellik | Uygun Kullanıcılar |

| Aracı Üyelik | $75,000 | Müşteriler adına ticaret yapma; SCA lisansı gerektirir | Lisanslı aracılar, finansal kurumlar |

| Ticaret Üyeliği | $30,000 | Sadece kendi hesabına ticaret yapma | Kurumsal veya özel yatırımcılar |

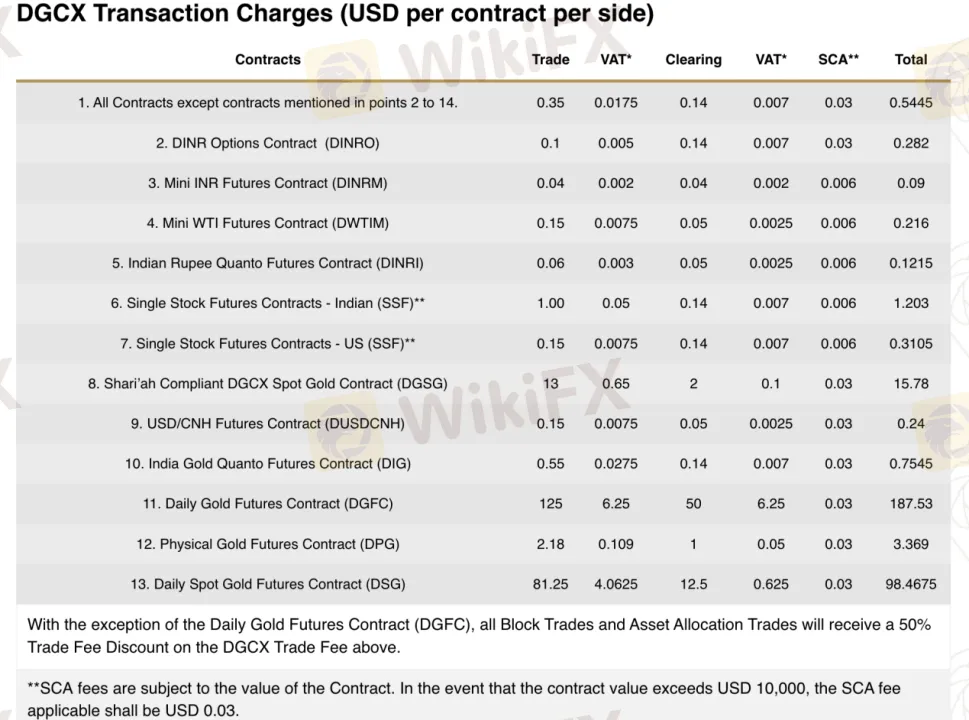

DGCX Ücretleri

DGCXün ticaret ücretleri, özellikle kıymetli metaller için tipik perakende komisyonculara kıyasla yüksektir. Bu, DGCXün perakende CFD komisyoncusu yerine kurumsal düzeyde bir vadeli işlem borsası olarak faaliyet göstermesi nedeniyle beklenmektedir. DGCX, sözleşme başına sabit ücretler talep etmektedir. Bu ücretler ürüne göre değişmektedir.

| Sözleşme | Ticaret Ücreti | Takas Ücreti | Toplam (KDV/SCA Hariç) |

| Günlük Altın Vadeli İşlem Sözleşmesi (DGFC) | $125.00 | $50.00 | $175.00 |

| Mini INR Vadeli İşlem Sözleşmesi (DINRM) | $0.04 | $0.04 | $0.08 |

| USD/CNH Vadeli İşlem Sözleşmesi (DUSDCNH) | $0.15 | $0.05 | $0.20 |

| Tek Hisse Senedi Vadeli İşlemleri - Hint (SSF) | $1.00 | $0.14 | $1.14 |

| Şeriat Altın Spot Sözleşmesi (DGSG) | $13.00 | $2.00 | $15.00 |

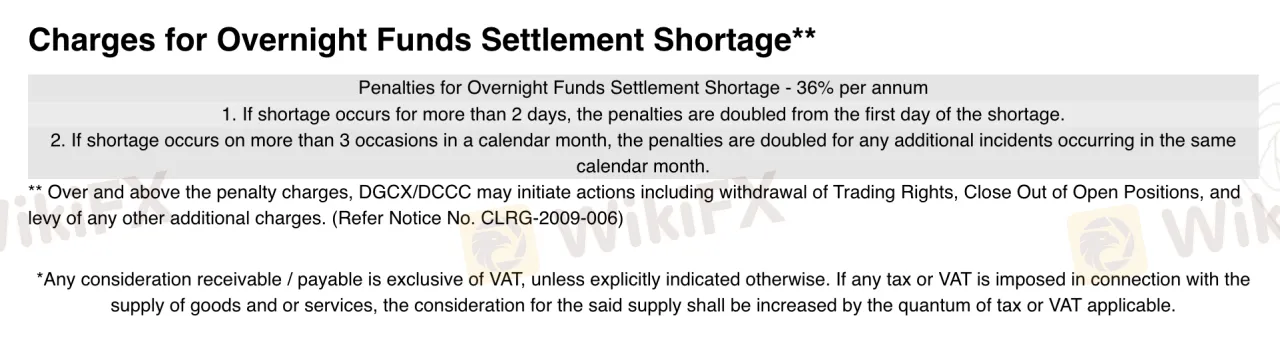

Swap Oranları

DGCX perakende CFD komisyoncuları tarafından kullanılan geleneksel swap oranlarını uygulamaz. Bunun yerine, gecelik fon yerleşim eksiklikleri için yıllık %36 oranında bir ceza uygular.

| Koşul | Ceza |

| Standart ceza oranı | Yıllık %36 |

| Eksiklik 2 günden fazla sürerse | Cezalar 1. günden itibaren ikiye katlanır |

| Bir takvim ayında 3'ten fazla eksiklik | Gelecekte cezalar ikiye katlanır |

| Ek sonuçlar | İşlem hakkının kaybı, zorunlu pozisyon kapatma |

İşlem Platformu

| İşlem Platformu | Desteklenen | Mevcut Cihazlar | Uygun |

| Cinnober (Nasdaq tarafından) | ✔ | Masaüstü / Kurumsal Sistemler (FIX API aracılığıyla) | Doğrudan piyasa erişimi gerektiren kurumsal ve profesyonel işlemciler |