Informasi Dasar

Uni Emirat Arab

Uni Emirat Arab

Skor

Uni Emirat Arab

|

5-10 tahun

|

Uni Emirat Arab

|

5-10 tahun

| https://www.dgcx.ae/

Website

Peringkat indeks

Pengaruh

C

Indeks pengaruh NO.1

Zimbabwe 3.11

Zimbabwe 3.11 Lisensi

LisensiTidak ada informasi regulasi yang valid, harap waspada!

Uni Emirat Arab

Uni Emirat Arab dgcx.ae

dgcx.ae Amerika Serikat

Amerika Serikat

| DGCX Ringkasan Ulasan | |

| Dibentuk | 2005 |

| Negara/Daerah Terdaftar | Uni Emirat Arab |

| Regulasi | Tidak diatur |

| Instrumen Pasar | Mata Uang, Saham, Hidrokarbon, Logam |

| Akun Demo | / |

| Daya Ungkit | / |

| Spread | / |

| Platform Perdagangan | Cinnober (oleh Nasdaq) melalui API FIX |

| Deposit Minimum | / |

| Dukungan Pelanggan | Tel: +971 4361 1600 |

| Email: info@dgcx.ae | |

DGCX adalah bursa derivatif berbasis Uni Emirat Arab yang didirikan pada tahun 2005, menawarkan perdagangan kontrak berjangka di berbagai mata uang, logam, hidrokarbon, dan saham. Operasinya dilakukan pada platform institusional yang kuat (Cinnober oleh Nasdaq) tetapi lebih banyak diakses oleh anggota dan kurang ramah bagi ritel.

| Kelebihan | Kekurangan |

| Beragam instrumen berjangka | Tidak diatur |

| Jadwal biaya transparan | Biaya perdagangan dan keanggotaan tinggi |

| Kehadiran regional yang kuat di pasar Timur Tengah | Informasi terbatas mengenai kondisi perdagangan |

DGCX (Dubai Gold & Commodities Exchange) berbasis di Dubai dan beroperasi di bawah pengawasan Dubai Multi Commodities Centre (DMCC). Namun, tidak memiliki lisensi dari regulator keuangan internasional utama seperti FCA (Inggris), ASIC (Australia), atau NFA (AS).

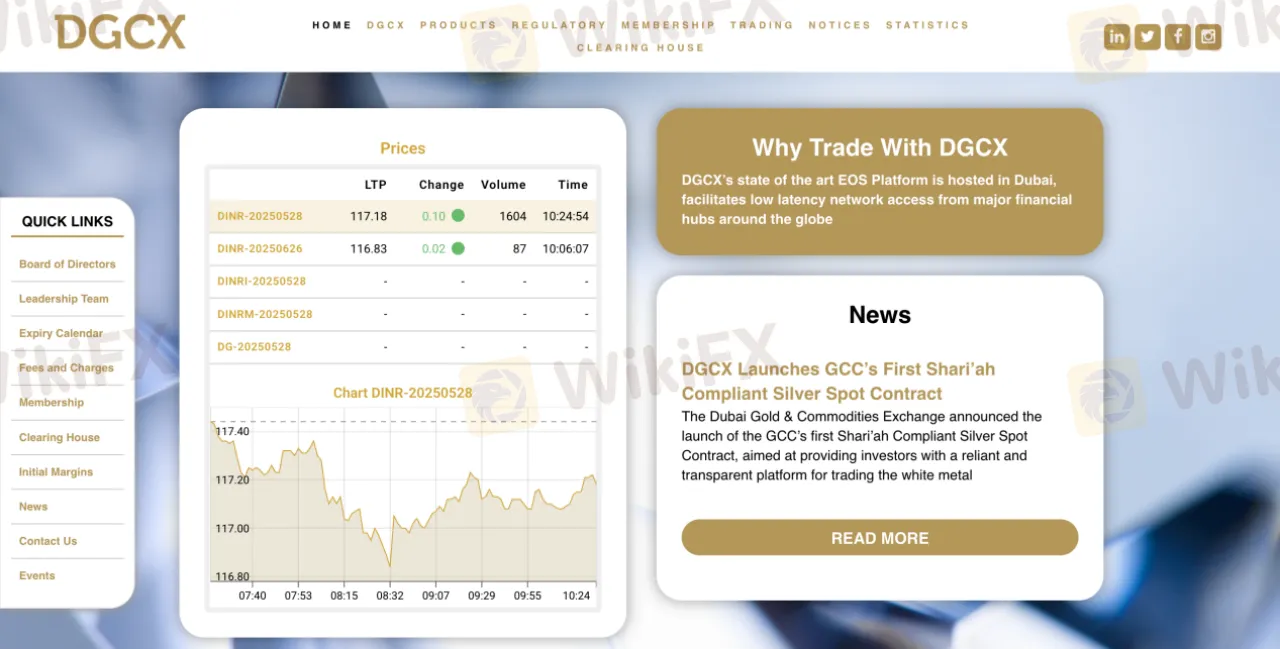

Domain dgcx.com didaftarkan pada 18 Januari 2002, dan akan kedaluwarsa pada 18 Januari 2027. Terakhir diperbarui pada 30 Agustus 2024. Domain saat ini berada dalam status terkunci yang mencegah penghapusan, perpanjangan, transfer, atau pembaruan. Server nama yang terdaftar di bawah Bodis, yang menunjukkan bahwa situs tersebut mungkin diparkir atau tidak aktif.

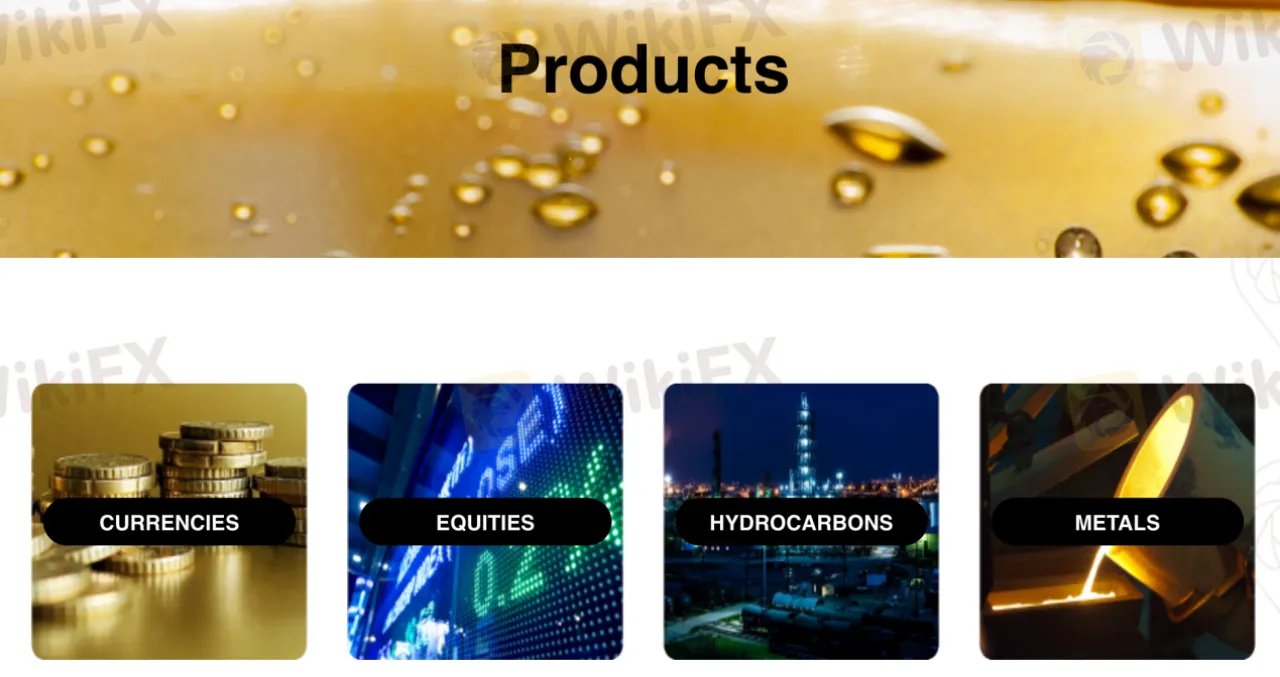

DGCX menawarkan total 4 jenis produk, yang mencakup berbagai pasangan mata uang, kontrak logam berjangka, kontrak hidrokarbon, dan instrumen terkait ekuitas.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Mata Uang | ✔ |

| Ekuitas | ✔ |

| Hidrokarbon | ✔ |

| Logam | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

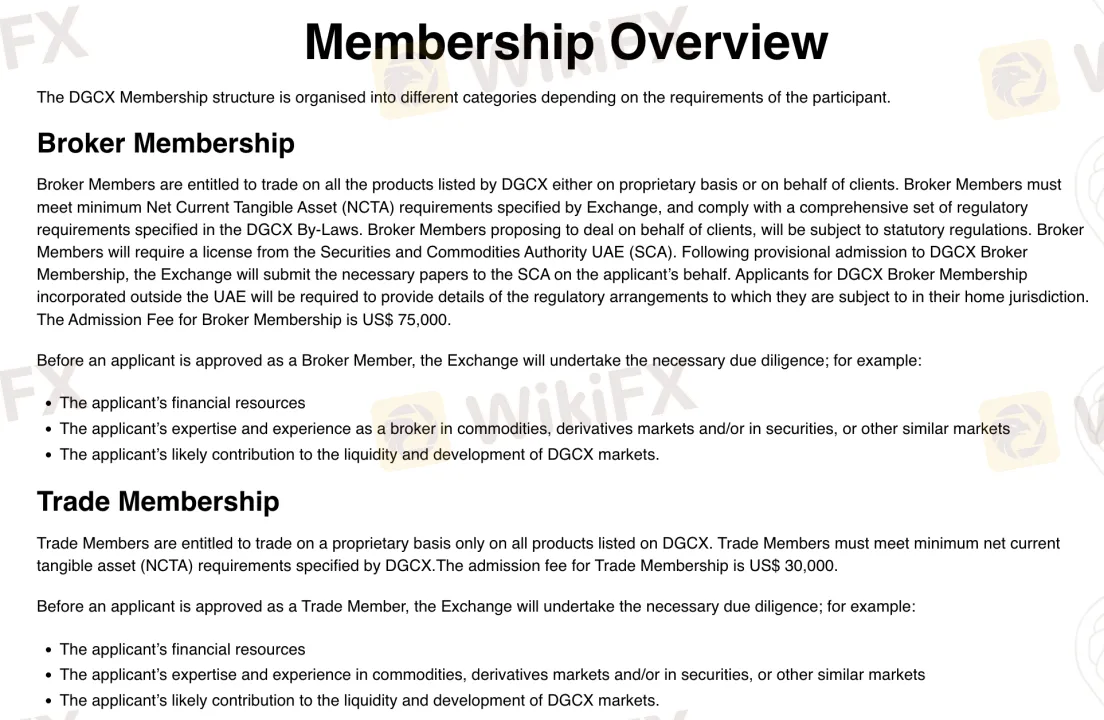

| Keanggotaan | Biaya Pendaftaran | Fitur | Cocok untuk |

| Keanggotaan Broker | $75,000 | Bertransaksi atas nama klien; memerlukan lisensi SCA | Broker berlisensi, perusahaan keuangan |

| Keanggotaan Trading | $30,000 | Bertransaksi hanya untuk akun sendiri | Trader institusional atau propietary |

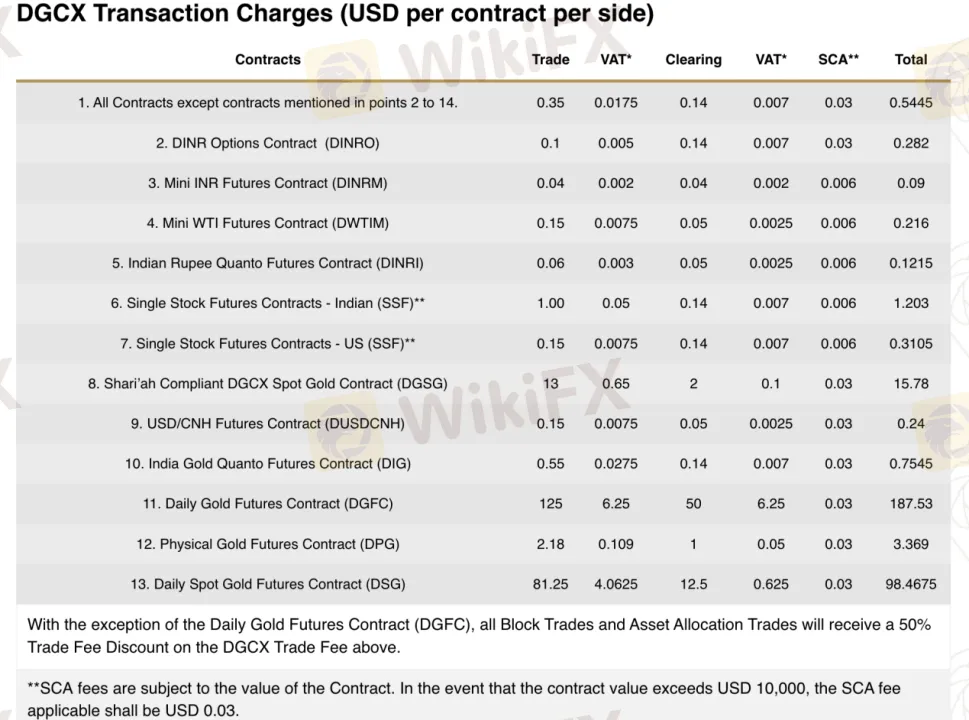

Biaya perdagangan DGCX tinggi dibandingkan dengan pialang ritel biasa, terutama untuk logam mulia. Hal ini diharapkan karena DGCX beroperasi sebagai bursa berjangka tingkat institusi daripada pialang CFD ritel. DGCX mengenakan biaya tetap per kontrak. Biaya ini bervariasi berdasarkan produk.

| Kontrak | Biaya Perdagangan | Biaya Kliring | Total (Tidak Termasuk PPN/SCA) |

| Kontrak Berjangka Emas Harian (DGFC) | $125.00 | $50.00 | $175.00 |

| Kontrak Berjangka Mini INR (DINRM) | $0.04 | $0.04 | $0.08 |

| Kontrak Berjangka USD/CNH (DUSDCNH) | $0.15 | $0.05 | $0.20 |

| Kontrak Berjangka Saham Tunggal - India (SSF) | $1.00 | $0.14 | $1.14 |

| Kontrak Emas Spot Syariah (DGSG) | $13.00 | $2.00 | $15.00 |

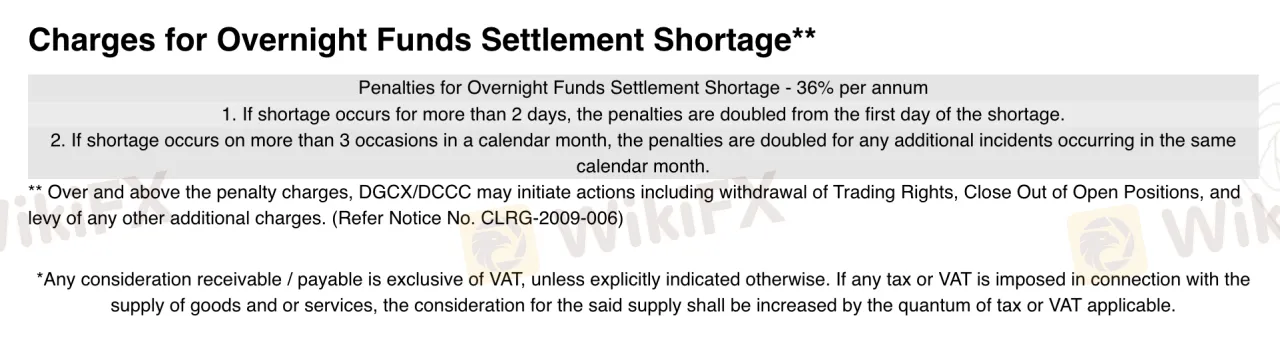

DGCX tidak menerapkan tarif swap tradisional seperti yang digunakan oleh pialang CFD ritel. Sebagai gantinya, dikenakan denda untuk kekurangan penyelesaian dana semalam dengan tingkat 36% per tahun.

| Kondisi | Denda |

| Tarif denda standar | 36% per tahun |

| Kekurangan berlangsung lebih dari 2 hari | Denda digandakan sejak hari pertama |

| Lebih dari 3 kekurangan dalam sebulan kalender | Denda masa depan digandakan |

| Konsekuensi tambahan | Kehilangan hak trading, penutupan posisi paksa |

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Cinnober (oleh Nasdaq) | ✔ | Desktop / Sistem Institusional (melalui API FIX) | Pedagang institusional dan profesional yang memerlukan akses pasar langsung |

Reflecting on my own experience as a trader, I approach DGCX with a great deal of caution, but I can outline some particular features it brings. The main advantage I have observed is the sheer breadth of futures contracts on offer; DGCX provides access to currencies, equity-related instruments, hydrocarbons, and metals—each as exchange-traded futures. For anyone focusing on Middle East markets or seeking exposure to these particular asset classes via regulated exchange products (as opposed to retail trading platforms), that diversity is notable. However, it’s vital to recognize that DGCX is not structured like a retail forex broker. Instead, it is an institutional-level exchange targeted at professional firms, with access typically limited to members rather than individual retail traders. The trading platform, Cinnober by Nasdaq, supports robust and direct market access, yet it isn’t optimized for casual or low-volume market participants. One recurring issue for me has been DGCX’s high trading and membership fees. For example, trading a single standard gold futures contract costs $175 per side in exchange and clearing fees—substantially higher than typical retail market alternatives. Membership fees are significant as well, with broker memberships running to $75,000. While the fee schedule is relatively transparent and fixed per contract, it makes participation prohibitively expensive for many. Given DGCX's lack of recognized international regulation and high barrier to entry, I urge careful due diligence and a conservative approach before engaging with this exchange.

Having evaluated DGCX as an independent trader with a cautious approach, I found its structure dramatically different from retail forex and CFD brokers. In my experience, one of the notable strengths is its comprehensive range of futures instruments, including contracts on currencies, metals, hydrocarbons, and equities. For me, the underlying institutional platform, Cinnober by Nasdaq, provides robust infrastructure and direct market access—features typically sought by professional or proprietary traders who require efficiency and transparency at scale. However, substantial drawbacks outweigh these benefits for individuals like myself. The most significant concern is the absence of oversight from recognized international regulators such as the FCA or ASIC. DGCX is supervised by the Dubai Multi Commodities Centre (DMCC), yet it does not possess licenses accepted by major regulatory authorities. This regulatory gap creates inherent risk, especially with the red flags highlighted: suspicious license status, high-risk warnings, and reports of withdrawal difficulties from some users. The high barriers to entry—such as steep membership application fees and notably expensive per-contract trading costs—make it impractical for most retail traders. Information on basic trading conditions and client protections is limited as well. Given the specialized nature of the platform and the uncertainty regarding fund safety, I personally would only consider DGCX if I were operating as a well-capitalized institutional participant with a comprehensive understanding of the risks specific to unregulated exchanges. For most traders, especially those valuing statutory protection and transparent dispute resolution, DGCX's drawbacks carry considerable weight.

Drawing on my experience as a forex trader, I approached DGCX with the expectation of industry-standard convenience, especially for withdrawals. However, based on the comprehensive information available, I found no clear details about retail payment methods or any provision for immediate withdrawals on DGCX. In fact, DGCX primarily positions itself as an institutional exchange and not as a typical retail broker. This distinction is crucial because it means account interactions, including deposits and withdrawals, are generally managed at the member or institutional level, rather than through retail-facing online methods. My research also highlighted some worrying red flags. There are recent user reports that withdrawals have been delayed or rendered inaccessible, and the platform currently operates without recognized international regulation. This absence of oversight adds a layer of risk, particularly around fund safety and dispute resolution. For me, the lack of transparency regarding withdrawal procedures and options, combined with warnings about fund accessibility, signals a need for considerable caution. In my opinion, unless you are an established financial institution with direct membership and a clear understanding of the operational framework, DGCX does not provide the swift or direct withdrawal solutions that retail traders might expect. I strongly advise prioritizing brokers with proven, regulated, and transparent withdrawal processes.

Speaking as someone who has spent years assessing exchanges and brokers, I approach DGCX with particular caution given several material risks. First and most critically for me, DGCX is not regulated by any of the major global financial authorities. While it operates under the Dubai Multi Commodities Centre, this lacks the rigorous investor safeguards provided by bodies like the FCA in the UK or ASIC in Australia. For a trader, the absence of this oversight translates to greater counterparty and operational risks — simply put, if something goes wrong, avenues for formal recourse are limited. Additionally, my experience with institutional-grade exchanges like DGCX has taught me that they are simply not designed for the typical retail participant. DGCX’s model requires significant upfront costs just to gain access: membership fees start at $30,000 for proprietary accounts and rise to $75,000 if you intend to act as a broker. Alongside these high entry barriers are transaction fees that far exceed what is standard at most retail brokers, especially in precious metals contracts. This pricing structure renders DGCX impractical for most individual traders and magnifies the financial exposure per trade. I also notice considerable transparency gaps. Unlike retail brokers, DGCX does not disclose common retail trading conditions such as leverage, spreads, or account minimums, leaving me uncertain about the true trading environment. Trading is restricted to a narrow but institutional-grade set of futures — not CFDs or spot forex — meaning you must be comfortable with futures products and their risks. Complicating matters are troubling user reports of withdrawal difficulties, which, combined with the lack of regulatory clarity and severe penalties for settlement issues, heighten my concerns about operational reliability and liquidity. All considered, my personal view is that DGCX’s risk profile is elevated, and only very experienced professional or institutional traders with a deep understanding of exchange-traded derivatives — and a high tolerance for both cost and counterparty risk — should consider participation. For the vast majority of traders, I believe the downsides outweigh potential benefits.

Silakan masukan...

TOP

TOP

Chrome

Plugin Chrome

Pertanyaan Regulasi Pialang Forex Global

Jelajahi situs web broker forex dan kenali broker resmi dan penipu secara akurat

Pasang sekarang