Resumo da empresa

| China-Derivatives FuturesResumo da Revisão | |

| Fundação | 1996 |

| País/Região Registrada | China |

| Regulação | CFFEX |

| Produtos e Serviços | Futuros, Corretagem, Investimento, Consultoria, Gestão de Ativos, Fundo |

| Conta Demonstrativa | ✅ |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star e TradeBlazer |

| Depósito Mínimo | / |

| Suporte ao Cliente | Chat ao Vivo |

| Email: office@cdfco.com.cn | |

| Telefone: 400-688-1117 | |

| Endereço: Zhongyan Futures Co., Ltd., 7th Floor, Building B, Jinchang'an Building, No. 82 Dongsi Fourth Ring Road, Distrito de Chaoyang, Pequim | |

China-Derivatives Futures Informação

Fundada em 1996, China-Derivatives Futures Co., Ltd. é uma entidade regulamentada sob a supervisão da China Financial Futures Exchange (CFFEX). No entanto, atende apenas clientes dentro da China e é um importante player no mercado doméstico de derivativos. É uma empresa financeira abrangente aprovada pela Comissão Reguladora de Valores Mobiliários da China (CSRC) que se especializa em corretagem de futuros de commodities domésticas, corretagem de futuros financeiros, consultoria em negociação de futuros, gestão de ativos e oferta pública de vendas de fundos de investimento em títulos.

Prós e Contras

| Prós | Contras |

| Regulado pela CFFEX | Falta de transparência |

| Especializado em negociação de futuros | |

| Suporte para negociação de demonstração | |

| Diversas plataformas de negociação | |

| Histórico operacional longo |

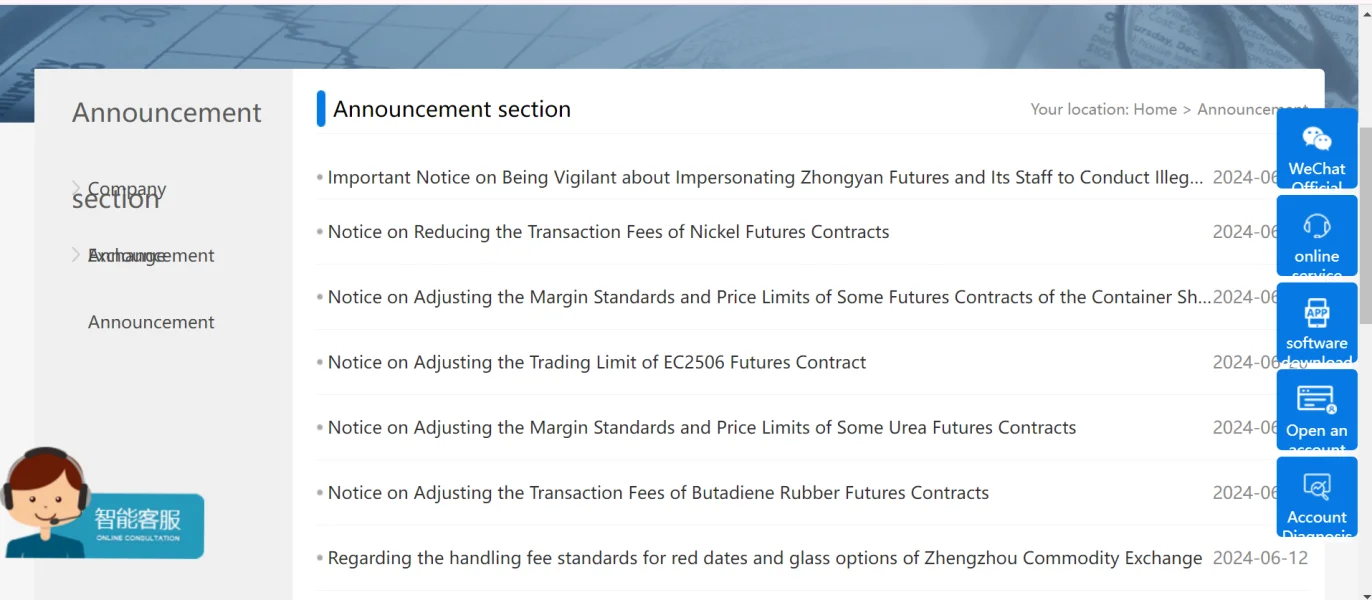

China-Derivatives Futures é Legítimo?

China-Derivatives Futures é regulado pela CFFEX sob o número de licença 0197.

| País Regulamentado | Autoridade Reguladora | Status Regulamentar | Entidade Regulamentada | Tipo de Licença | Número de Licença |

| China | China Financial Futures Exchange (CFFEX) | Regulado | China Commodity Futures Co., Ltd. | Licença de Futuros | 0197 |

Produtos & Serviços

China-Derivatives Futures foca principalmente na negociação de futuros e também oferece uma ampla gama de serviços de investimento, como corretagem, investimento, consultoria, gestão de ativos e fundos.

| Produtos e Serviços | Suportado |

| Futuros | ✔ |

| Fundos | ✔ |

| Corretagem | ✔ |

| Investimento | ✔ |

| Consultoria | ✔ |

| Gestão de Ativos | ✔ |

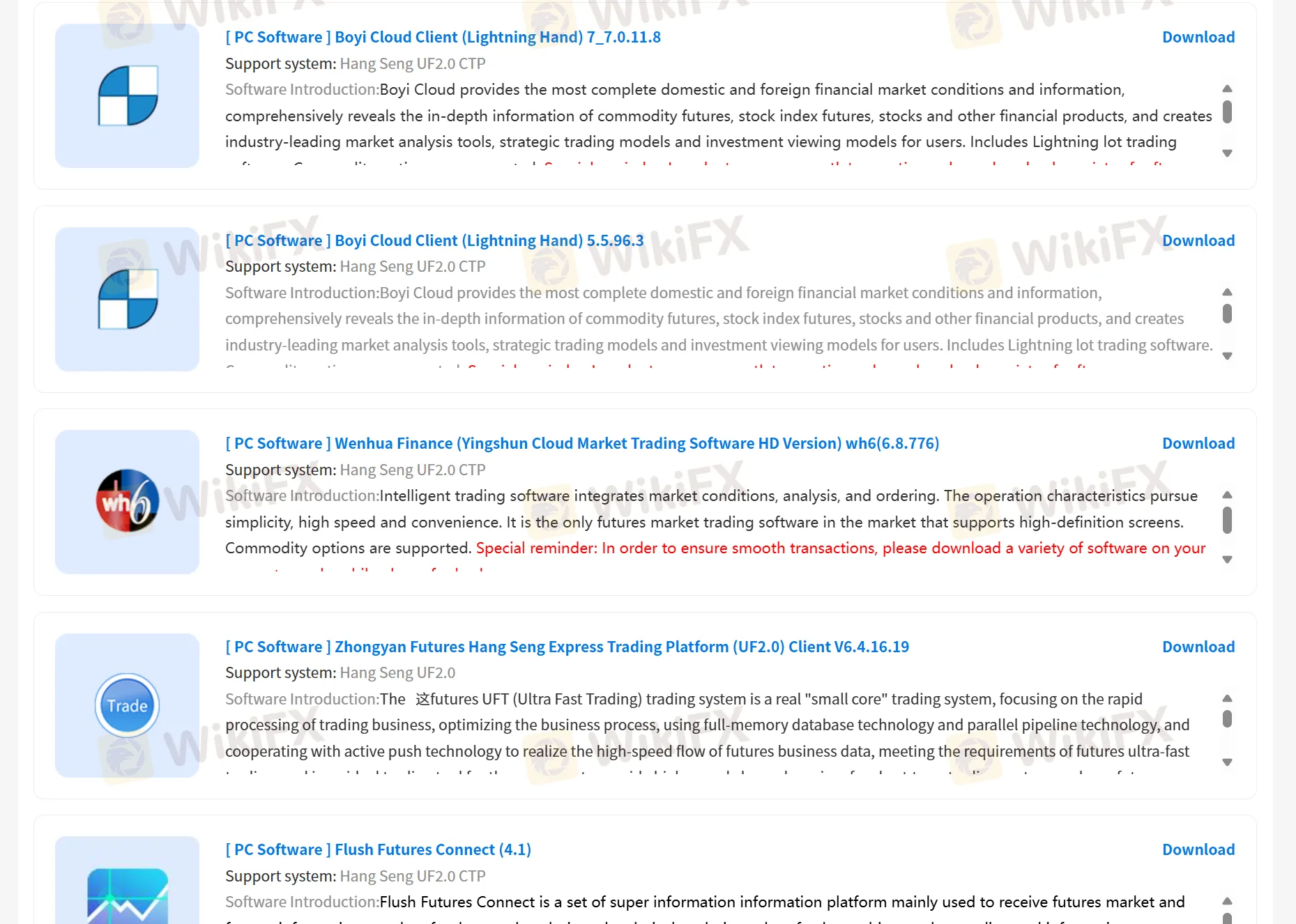

Plataforma de Negociação

China Derivatives Futures oferece suporte à negociação por meio de plataformas proprietárias, China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star e TradeBlazer. Além disso, também oferece oportunidades para os clientes simularem negociações.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| China-Derivatives Futures App | ✔ | PC, Celular | / |

| Boyi Client Cloud | ✔ | PC | / |

| Wenhua Finance | ✔ | PC | / |

| Yisheng Polar Star | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

扶众法援

Hong Kong

Em março deste ano, recebi um pedido de amizade, que pensei que fosse amigo de estoque. Depois fui puxado para um grupo de preparação, no qual os membros mostravam capturas de tela dos lucros. Fiquei comovido e observado por um tempo. Mais tarde, também me registrei e segui as instruções do professor. O professor me pediu para trazer o depósito para 500 mil como um limite, alegando que professores profissionais poderiam operar para mim. Houve ganhos e perdas. Quando restavam apenas 100 mil, tentei solicitar a retirada. Mas o canal de financiamento não estava disponível em razão da existência de risco. O professor continuou se afastando e me notou que o depósito / retirada poderia ser adiado. A retirada não está disponível por uma semana.

Exposição

Cris Men

Equador

nunca tive problemas com saques nem nada desse tipo

Positivos

Maximilian 111

Nigéria

Eu negocio commodities aqui o tempo todo. Ele oferece taxas transparentes e um ótimo atendimento ao cliente, o que sempre é minha escolha sólida.

Positivos

Vegas

Colômbia

China-Derivatives Futures co,.LTD. fornece uma variedade de aplicativos de negociação, no caso de erros de negociação, muito íntimo. E a empresa possui um órgão regulador formal, as informações de negociação são abertas e transparentes, estou muito tranquilo.

Positivos