Basic Information

China

ChinaScore

China

|

5-10 years

|

China

|

5-10 years

| http://www.cdfco.com.cn

Website

Rating Index

Influence

D

Influence index NO.1

Taiwan 2.37

Taiwan 2.37 Licenses

LicensesLicensed Entity:中衍期货有限公司

License No. 0197

China

China cdfco.com.cn

cdfco.com.cn China

China

| China-Derivatives FuturesReview Summary | |

| Founded | 1996 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Products & Services | Futures, Brokerage, Investment, Consulting, Asset Management, Fund |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

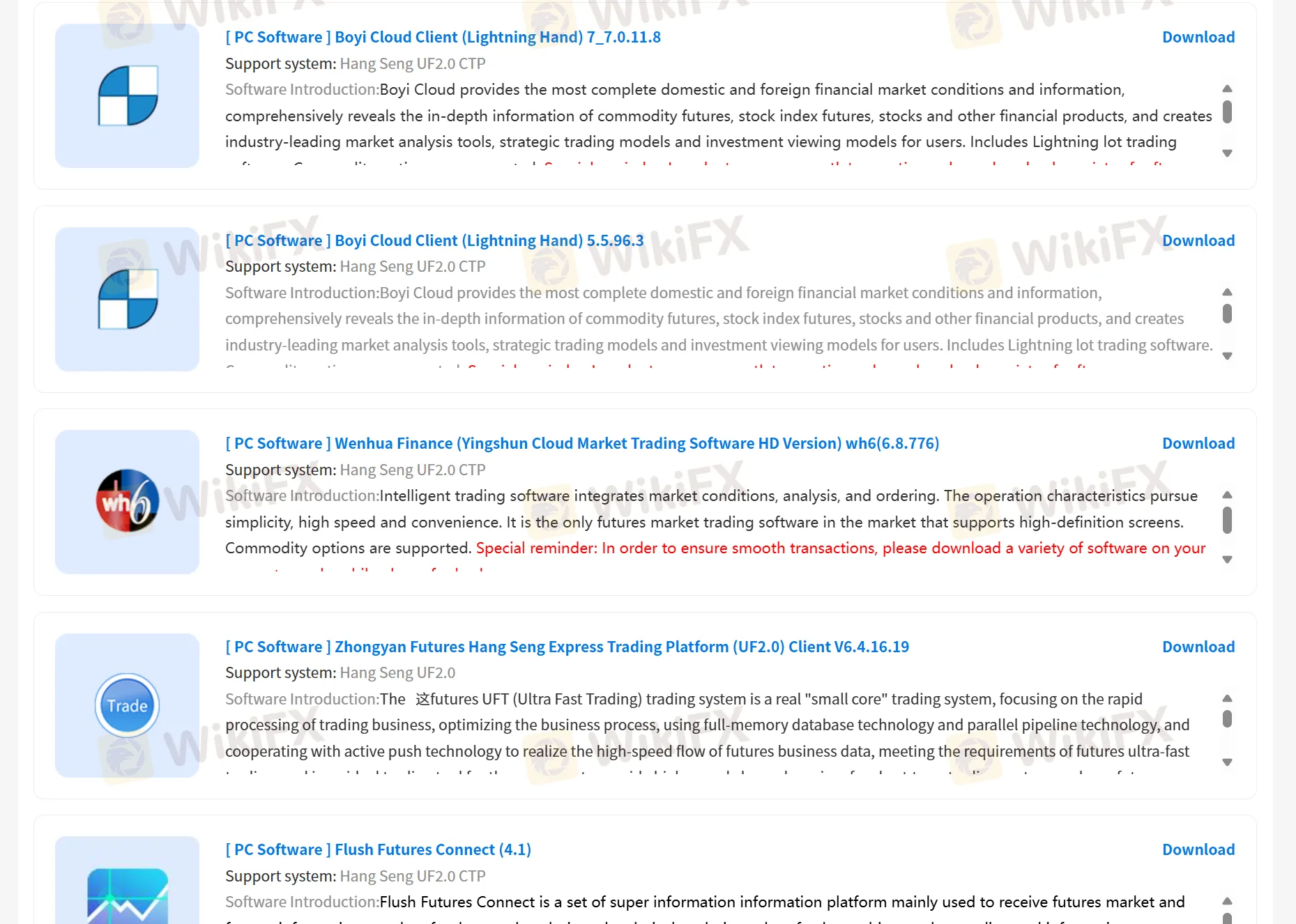

| Trading Platform | China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, and TradeBlazer |

| Minimum Deposit | / |

| Customer Support | Live Chat |

| Email: office@cdfco.com.cn | |

| Phone: 400-688-1117 | |

| Address: Zhongyan Futures Co., Ltd., 7th Floor, Building B, Jinchang'an Building, No. 82 Dongsi Fourth Ring Road, Chaoyang District, Beijing | |

Founded in 1996, China-Derivatives Futures Co., Ltd. is a regulated entity under the supervision of the China Financial Futures Exchange (CFFEX). However, it only serves clients within China and is a prominent player in the domestic derivatives market. It is a comprehensive financial company approved by the China Securities Regulatory Commission (CSRC) that specializes in domestic commodity futures brokerage, financial futures brokerage, futures trading consulting, asset management, and public offering of securities investment fund sales.

| Pros | Cons |

| Regulated by CFFEX | Lack of transparency |

| Specialized in futures trading | |

| Demo trading supported | |

| Various trading platforms | |

| Long operation history |

China-Derivatives Futures is regulated by CFFEX under license numbers 0197.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| China | China Financial Futures Exchange (CFFEX) | Regulated | China Commodity Futures Co., Ltd. | Futures License | 0197 |

China-Derivatives Futures mainly focuses on futures trading, and it also offers a comprehensive range of investment services, such as brokerage, investment, consulting, asset management, and funds.

| Products & Services | Supported |

| Futures | ✔ |

| Funds | ✔ |

| Brokerage | ✔ |

| Investment | ✔ |

| Consulting | ✔ |

| Asset Management | ✔ |

China Derivatives Futures supports trading through proprietary platforms, China-Derivatives Futures App, and Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, and TradeBlazer. Besides, it also provides opportunities for customers to simulate trade.

| Trading Platform | Supported | Available Devices | Suitable for |

| China-Derivatives Futures App | ✔ | PC, Mobile | / |

| Boyi Client Cloud | ✔ | PC | / |

| Wenhua Finance | ✔ | PC | / |

| Yisheng Polar Star | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

Based on my experience as a trader and after reviewing the details about China-Derivatives Futures, I believe it's essential to approach this broker with a cautious mindset. While it is regulated in China by the CFFEX and has a long business history, I noticed some important factors that warrant attention. First, there is mention of a "suspicious scope of business," which, for me, raises concerns about full regulatory coverage and the broker’s activities outside its core offerings. Clarity about exactly what is regulated versus what is not is vital, as unregulated operations may expose clients to unexpected risks. Additionally, customer experiences appear mixed, with one significant exposure highlighting issues such as withdrawal delays and vague explanations from support staff. While some clients report positive experiences and transparent fees, the negative report regarding withdrawal difficulty cannot be disregarded. In my view, consistently reliable fund withdrawals are non-negotiable for trust in any broker. Another point I weigh heavily is that China-Derivatives Futures predominantly serves domestic Chinese clients. For non-residents, access to customer support, regulatory recourse, and platform familiarity could be limited or challenging. Furthermore, as the platforms offered are proprietary or locally focused, traders who are used to international standards like MT4/MT5 may find adaptation difficult. Ultimately, while regulation and long operational history are positives, I only proceed with brokers after thorough due diligence, an understanding of all withdrawal policies, and confirmation that all activities are properly licensed. Personal vigilance is key in safeguarding my capital.

As an independent trader with a strong focus on due diligence, I always prioritize transparency when evaluating brokers. In my detailed review of China-Derivatives Futures, I found that while the company has a long operating history and is officially regulated in China under CFFEX, specific trading conditions for standard forex pairs like EUR/USD, such as spreads, are not explicitly disclosed in available materials. My experience tells me that any reputable broker should clearly publish critical metrics like average spreads, especially since these costs significantly impact trading outcomes. For China-Derivatives Futures, the emphasis is primarily on futures trading and related financial instruments rather than traditional spot forex products. Their product range and platforms appear tailored for domestic futures markets, not global forex, with no direct mention of specific spreads or leverage on major currency pairs. Whenever I encounter this kind of information gap, particularly for something as fundamental as the EUR/USD spread, I prefer a cautious approach and recommend that potential clients contact the broker directly for precise trading details. This lack of transparency makes it difficult for me to properly assess trading costs and risk, which, from a risk management perspective, is essential before committing any funds. If transparency on standard spreads is lacking, I always consider it a significant limitation.

In my experience with China-Derivatives Futures, I found that their primary focus is on futures trading rather than the broad array of instruments commonly offered by offshore forex brokers. As someone always seeking transparency and regulatory clarity, I note that China-Derivatives Futures operates under a CFFEX futures license and is supervised by Chinese authorities, strictly serving mainland clients. Their specialty lies in domestic commodity futures and financial futures, so for traders like me aiming for exposure to global spot forex, international stocks, or cryptocurrencies, this broker does not meet those needs. Through their proprietary platforms, including their own app and several desktop solutions such as Boyi Client Cloud and Wenhua Finance, I was able to access instruments tied to China’s futures markets. Besides futures, they advertise additional services like investment consulting, asset management, and brokerage for funds, but I did not see access to individual stocks, spot forex pairs, indices, or digital assets. For me, the appeal of China-Derivatives Futures is their established presence and their clear regulatory status in China, but I have to stress this broker’s product offering is highly specialized. Anyone considering them should be seeking exposure to mainland China’s futures and perhaps fund products, not broader global markets. As always, I view specialization as a double-edged sword; it brings depth in one area, but also limits diversification opportunities for a trader’s portfolio.

As someone who values the ability to evaluate a broker before committing real funds, the availability of a demo account is a significant factor in my decision-making process. With China-Derivatives Futures, I found that they do indeed offer demo trading—an important resource for both beginners and experienced traders seeking to familiarize themselves with the broker’s proprietary platforms and functionalities, such as the China-Derivatives Futures App and several desktop solutions. This demo access allowed me to simulate trades and understand the user interface, which I believe helps minimize initial trading errors and builds confidence before moving to live markets. However, while the context confirms that demo trading is supported, I was unable to find any specific mention regarding restrictions like a time limit or capped virtual funds. In my experience, prudent traders should always clarify such terms directly with the broker, as some platforms may introduce limitations on demo accounts that can affect the learning experience. For me, this cautious approach is essential, especially when dealing with derivatives trading, where risk management and platform familiarity are critical. Overall, having demo access influenced my perception positively, allowing for safer skill development, but I would advise anyone to verify any potential demo account restrictions through official channels before relying on this feature extensively.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

扶众法援

China

In this March, I received a friend request, which I thought it might be stock friend. Then I was pulled into a preparation group, in which members showed profits screenshots. I was moved and observed for awhile. Later, I also got registered and followed the teacher’s instruction. The teacher asked me to bring the deposit to 500 thousand as a threshold, claiming that professional teachers could operate for me. There were gains and losses. When there was only 100 thousand left, I tried to apply for the withdrawal. But the funding channel was unavailable on ground of risk existence. The teacher kept fending off and noticed me that the deposit/withdrawal might be deferred. The withdrawal is unavailable for one week.

Exposure

Cris Men

Ecuador

I have never had any problems with withdrawals or anything like that

Positive

Maximilian 111

Nigeria

I trade commodities here all the time. It offers transparent fees, and great customer service, which is always my solid choice.

Positive

Vegas

Colombia

China-Derivatives Futures co,.LTD. Provide a variety of trading apps, in case of trading mistakes, very intimate. And the company has a formal regulatory body, trading information is open and transparent, I am very reassured.

Positive