Présentation de l'entreprise

| PGM Résumé de l'examen | |

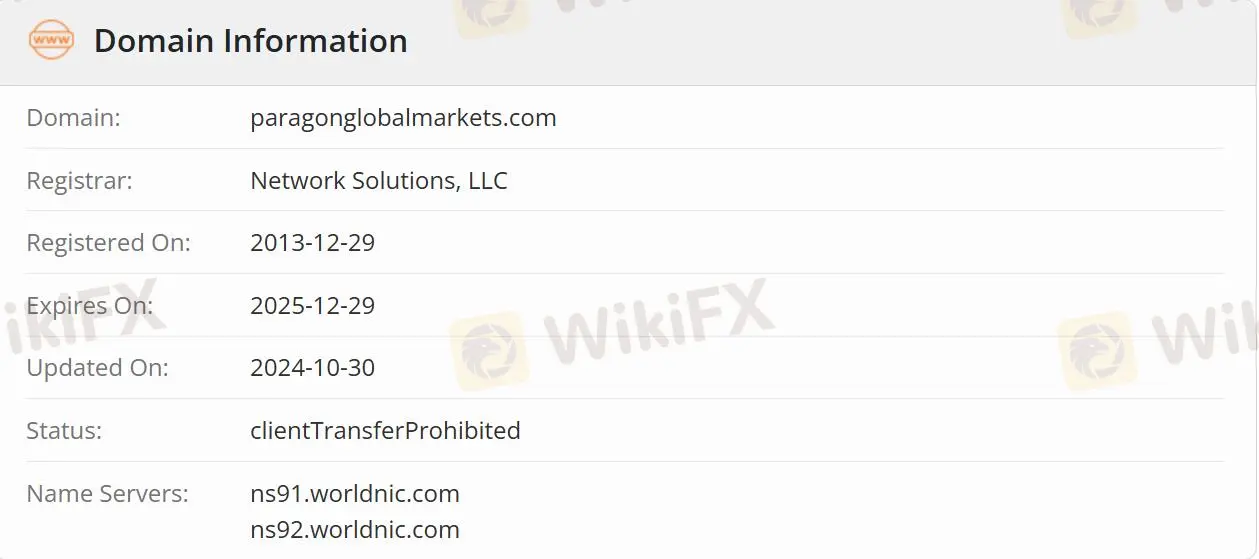

| Fondé | 2013-12-29 |

| Pays/Région enregistré(e) | États-Unis |

| Réglementation | Non réglementé |

| Produits et services | Produits/Futures gérés/Solutions client. |

| Plateforme de trading | CQG/CTS/Trading Technology/QST/Bloomberg/FFastFil/InfoReach/CME Group/Ice |

| Assistance client | Téléphone : +1 (212) 590-1900 |

| Email : info@paragonglobalmarkets.com | |

PGM Information

Paragon Global Markets (PGM) est un courtier introducteur indépendant qui propose ses services à une clientèle diversifiée de traders en contrats à terme, en devises étrangères, en exécution et en compensation sur les marchés mondiaux des dérivés.

PGM est-il légitime ?

PGM n'est pas réglementé, ce qui le rend moins sûr que les courtiers réglementés.

Quels produits et services PGM propose-t-il ?

Les produits et services se répartissent en trois catégories : produits, futures gérés et solutions client.

Produits : Fournir aux clients des services d'exécution de contrats à terme négociés en bourse et de change, y compris des plateformes d'exécution électronique de premier plan sur toutes les principales bourses à terme mondiales, des algorithmes, une expertise LME, une gestion des ordres de bloc, des ordres de soins infirmiers et une gestion des stratégies d'options.

Futures gérés : Une classe d'actifs unique dans le monde des investissements alternatifs, distincte des investissements traditionnels tels que les actions et les obligations. Les gestionnaires de portefeuille, connus sous le nom de conseillers en trading de matières premières (CTA), utilisent des contrats à terme dans le cadre de leurs stratégies d'investissement et réalisent des bénéfices en prenant des positions longues et/ou courtes sur des instruments financiers, des devises et des matières premières.

Solutions client : Comprenant les positions, les achats et les ventes, les activités de trésorerie, les soldes, la marge, les transactions, etc.

Plateforme de trading

PGM offre un accès à diverses plateformes de trading, en ligne et téléchargeables, telles que Trading Technology, Bloomberg, FFastFill, et plus encore.

| Plateforme de trading | Pris en charge |

| CQG | ✔ |

| CTS | ✔ |

| Trading Technology | ✔ |

| QST | ✔ |

| Bloomberg | ✔ |

| FFastFill | ✔ |

| InfoReach | ✔ |

| CME Group | ✔ |

| Ice | ✔ |