Présentation de l'entreprise

| AMTD Résumé de l'examen | |

| Fondé | 1997 |

| Pays/Région Enregistré | Hong Kong |

| Régulation | SFC (Non vérifié) |

| Services | Solutions numériques, médias et culture, éducation et formation, actifs premium |

| Plateforme/APPLI | airstar APP |

| Support Client | Email : enquiry@amtdinc.com |

| Réseaux sociaux : Facebook, LinkedIn, YouTube, X | |

Informations sur AMTD

AMTD a été fondé en 1997 et est enregistré à Hong Kong, réglementé par la Commission des valeurs mobilières et des contrats à terme de Hong Kong (SFC). Il propose divers services, notamment des solutions numériques, des services commerciaux tout-en-un, des médias et du divertissement, ainsi que de l'éducation et de la formation. Cependant, son statut réglementaire est actuellement non vérifié.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Longue histoire | Régulation SFC non vérifiée |

| Divers services proposés | Structure tarifaire peu claire |

| Pas de canal de contact direct | |

| Pas d'adresse physique |

AMTD Est-il Légitime ?

AMTD est réglementé par la Commission des valeurs mobilières et des contrats à terme de Hong Kong (SFC), mais son statut réglementaire actuel est non vérifié. L'entité titulaire de la licence est oOo Securities (HK) Group Limited, détenant une licence de négociation de titres avec le numéro de licence AJH488.

Enquête sur le Terrain WikiFX

L'équipe d'enquête sur le terrain de WikiFX a visité l'adresse de AMTD à Hong Kong, et nous avons constaté que AMTD n'a pas de présence physique à l'adresse indiquée ci-dessus.

Services

AMTD propose quatre services, notamment des services de solutions numériques, des services commerciaux tout-en-un, des médias et du divertissement, ainsi que de l'éducation, de la formation, des actifs premium et de l'hospitalité.

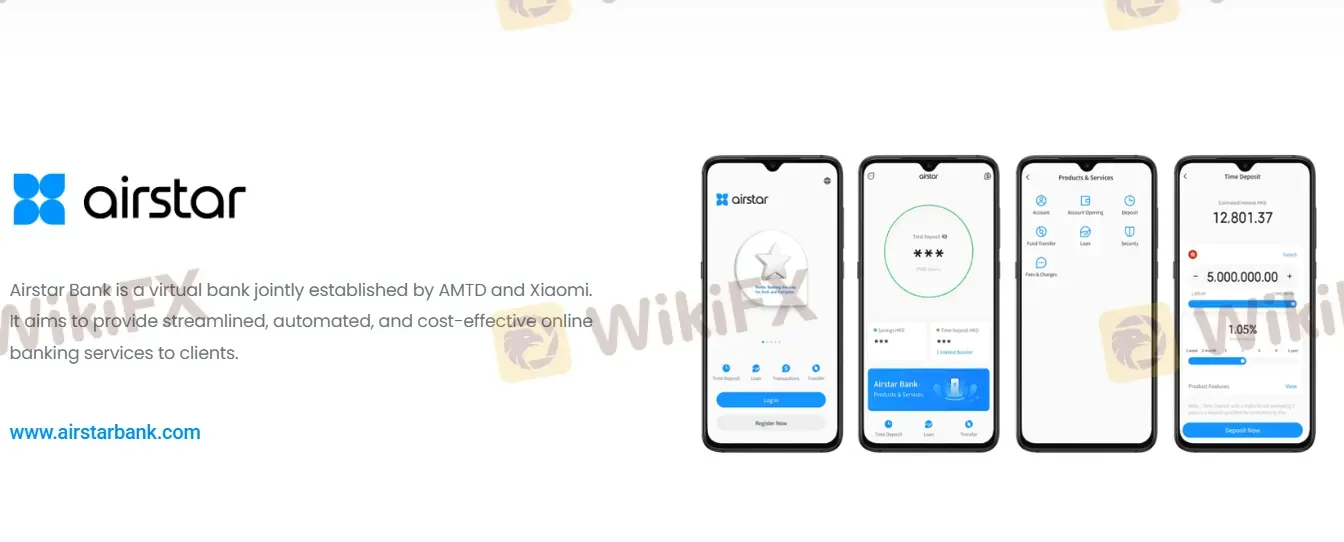

Plateforme/APPLI

| Plateforme/APPLI | Pris en Charge | Appareils Disponibles |

| airstar App | ✔ | iOS, Android |